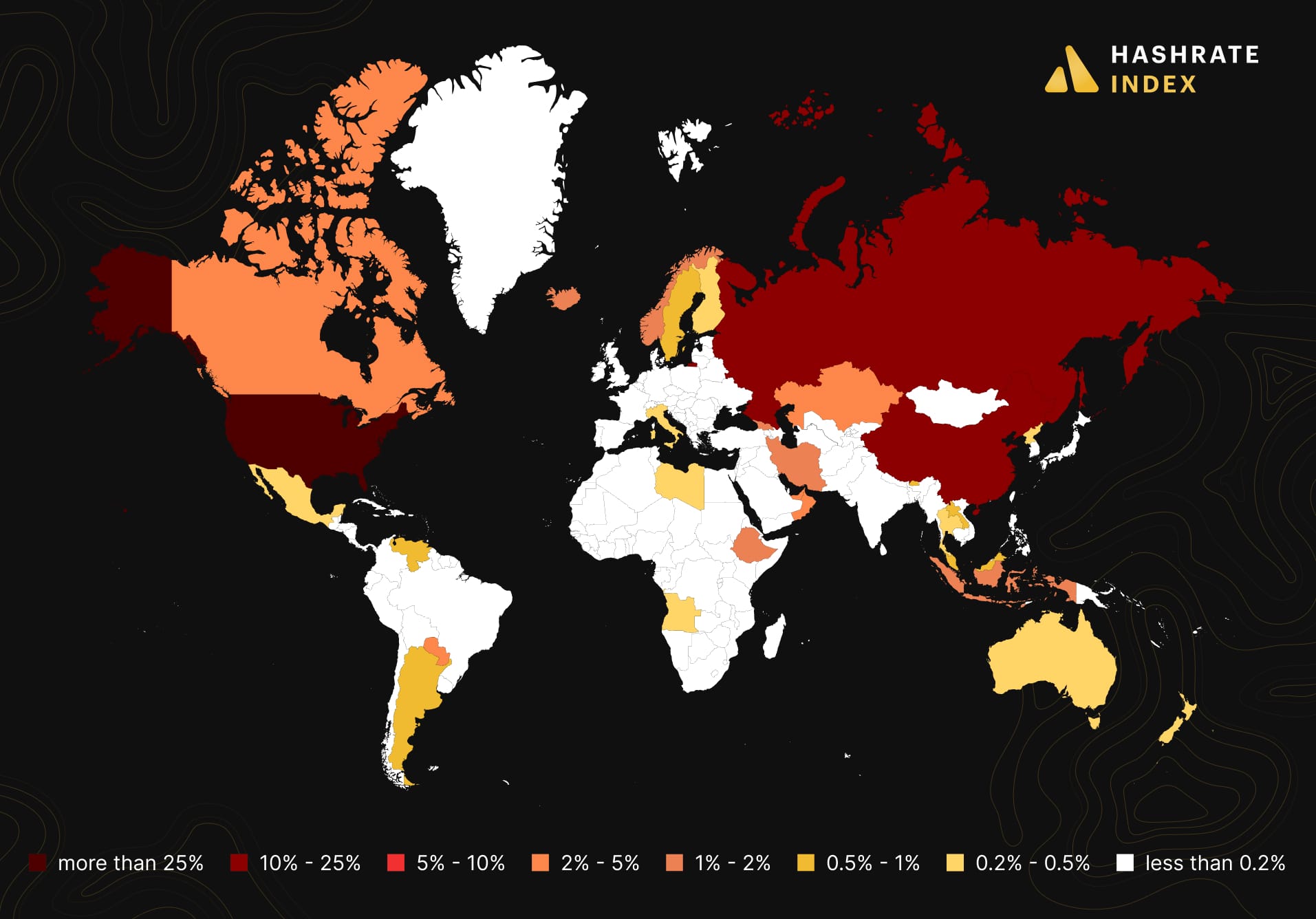

Top 10 Bitcoin Mining Countries of 2025

Hashrate Index’s list for the top Bitcoin mining countries in 2025.

We started our Bitcoin Mining Around The World Series as a way to bring more coverage to the less-covered countries that could present unique opportunities for investors, miners, energy companies and researchers.

Throughout 2024, the continued adoption of Bitcoin has attracted interest from jurisdictions. Geopolitical issues, environmental concerns, regulatory changes and more have made for consistently evolving landscape in the distribution of hashrate around the world.

Some countries have taken an exceptional interest in the sector, moving past the noise and focusing on the signal.

Here is Hashrate Index’s list for the top Bitcoin mining countries in 2025.

- The United States of America

The United States remains the top Bitcoin mining market, offering the most institutional involvement and best risk-adjusted returns. The regulatory environment varies by state but is generally favorable, with regions like Texas and Wyoming emerging as mining hub due to their business-friendly policies and abundant cheap energy. Renewable energy initiatives have also gained traction, with a significant portion of mining operations leveraging hydroelectric, wind, and solar power. The country's robust infrastructure and access to capital make it a preferred destination for institutional miners.

- Russia

Russia presents a significant opportunity due to its vast energy resources, particularly in natural gas and hydropower. Domestic companies have tapped into these resources to fuel mining operations, especially in Siberia, where the cold climate reduces cooling costs. However, for foreign companies, the country poses a considerable regulatory risk, exacerbated by ongoing international sanctions and geopolitical tensions. Russia’s energy policy, which prioritizes domestic energy utilization, further complicates the landscape for external investors.

- China

Despite an official ban on cryptocurrency mining, China continues to play a substantial role in global Bitcoin mining through underground operations. The country benefits from a wealth of cheap electricity, particularly from hydropower in provinces like Sichuan during the rainy season. Additionally, China's historical expertise in hardware manufacturing and mining operations gives it an edge. Regulatory risks remain high, but the sheer scale of resources and expertise keeps it relevant in the mining ecosystem.

- Norway

Norway is emerging as a promising Bitcoin mining destination due to its cool climate and abundant renewable energy sources, particularly hydropower. Northern regions are particularly attractive, offering consistent access to cheap and sustainable energy. However, the regulatory environment remains uncertain, with ongoing debates around the environmental impact of mining and how it fits into the country's broader energy transition goals.

Check out our Bitcoin Mining Around the World series article on Norway here.

- Canada

Canada's vast energy resources make it an appealing location for Bitcoin miners. Provinces like Quebec and British Columbia offer surplus hydropower, making them hotspots for mining operations. However, the regulatory landscape is fragmented, with some provinces imposing restrictions or outright bans on mining, while others actively encourage it. This diversity creates both opportunities and challenges, requiring miners to navigate complex regional policies.

- Paraguay

Paraguay boasts one of the largest surpluses of hydroelectric power in the world, thanks to the Itaipú Dam. This makes it an attractive destination for Bitcoin mining, with energy costs significantly lower than global averages. However, the country’s regulatory environment remains volatile, with inconsistent policies and a lack of long-term clarity posing risks for miners and investors.

Check out our Bitcoin Mining Around the World series article on Paraguay here.

- Argentina

Argentina is rapidly becoming a key player in Bitcoin mining, leveraging its abundant stranded natural gas resources and the need to alleviate flaring. Under a new, more business-friendly regime, the country has made strides in attracting foreign investment to its energy sector. While inflation and economic instability are ongoing concerns, the low cost of energy and improving regulatory framework present significant opportunities for growth.

- The United Arab Emirates (UAE)

The United Arab Emirates has emerged as a strategic player in Bitcoin mining, driven by government involvement and access to vast energy resources. The country’s energy policy focuses on diversification, leveraging both fossil fuels and renewables. While the hot climate necessitates the use of advanced cooling systems like immersion tanks, the availability of capital and infrastructure support makes it a promising location for innovative mining setups.

Check out our Bitcoin Mining Around the World series article on the UAE here.

- Ethiopia

Ethiopia is one of the fastest-growing Bitcoin mining markets, capitalizing on its abundant hydroelectric power. The government has been supportive of the sector, recognizing its potential to drive economic development. However, the country faces challenges from political instability and intermittent civil conflict, which pose risks to the long-term viability of large-scale operations.

Check out our Bitcoin Mining Around the World series article on the continent of Africa, covering Ethiopia, here.

- Kazakhstan

Kazakhstan emerged as a major Bitcoin mining hub after China’s mining ban, leveraging its coal-based energy resources and proximity to key mining hardware manufacturers. However, the country is rapidly losing market share due to increased regulatory scrutiny and limitations on energy consumption for miners. The government’s recent measures to control energy usage and environmental impact have added uncertainty to the country’s mining future.

Check out our Bitcoin Mining Around the World series article on Kazakhstan here.

Each of these countries offers unique opportunities and challenges for Bitcoin mining. Understanding their regulatory environments, energy policies, and natural resource availability is crucial for investors and miners looking to navigate this dynamic industry.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.