The Summer Slowdown: How Seasons Shape Hashrate Markets

Uncover the impacts of seasonality on Bitcoin mining.

Energy Markets for Bitcoin Miners: Fixed Price Power with Short Calls & Fixed Pool Payouts

How Bitcoin miners refine price volatility into predictable margins.

Luxor Hashrate Lookback Series - May 2025

May 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor Hashrate Lookback Series - April 2025

April 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Energy Markets for Bitcoin Miners: Spot vs. Fixed Power Prices

Understand how Bitcoin miners participate in power markets.

The Evolution of Bitcoin Mining Pool Rewards: Fixed & Upfront Payouts

Understand the past, present, and future of mining pool payouts.

Luxor Hashrate Lookback Series - March 2025

March 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

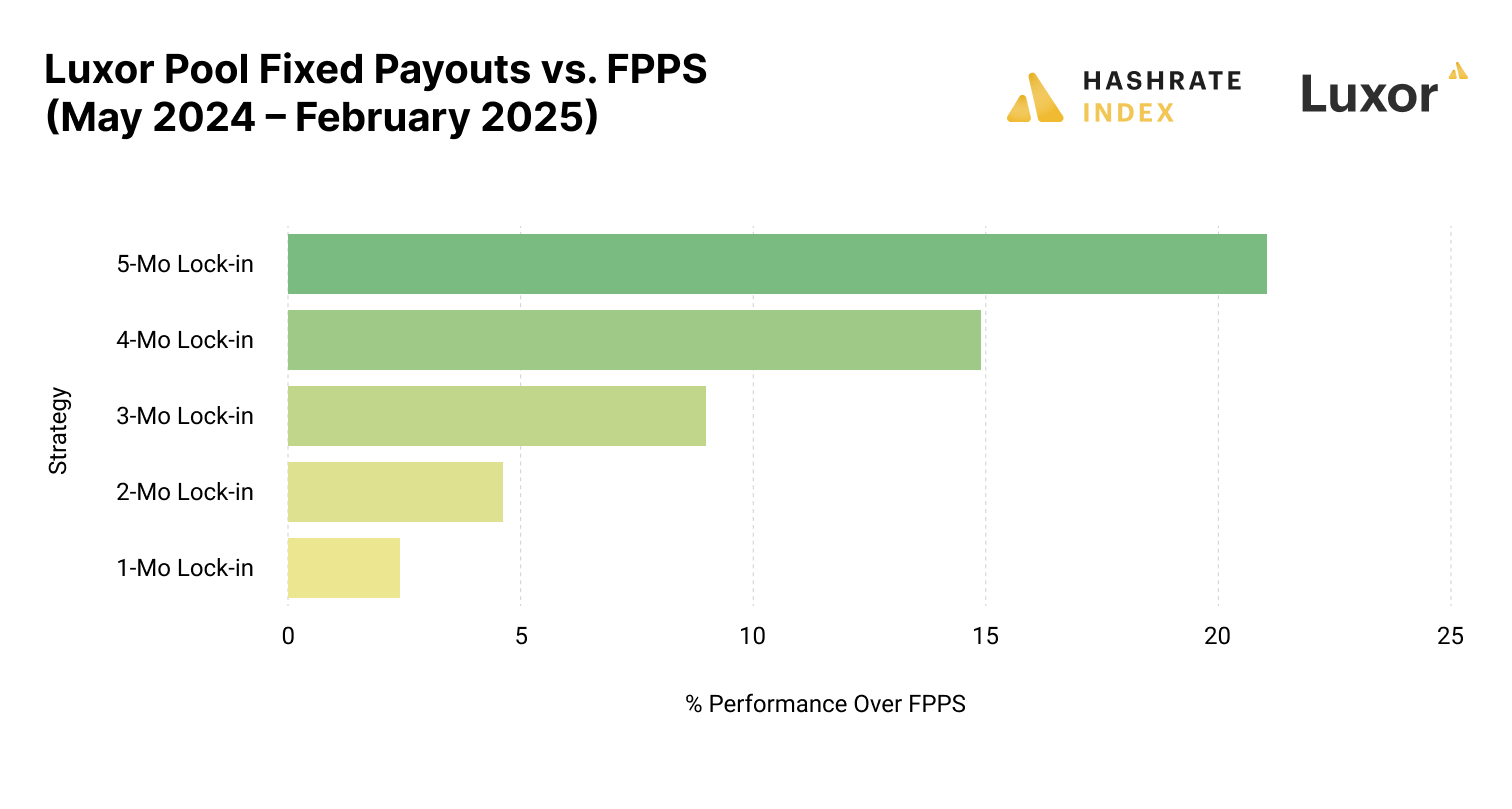

Up to 20% More Bitcoin: Luxor Pool’s Fixed Payouts Outperform FPPS After Halving

Understand the relative performance of post-halving hedging strategies.