Bitcoin Mining Around the World: Norway

Norway is the biggest bitcoin mining hub in Europe thanks to its cheap energy. But what else defines the bitcoin mining industry in this Arctic outpost?

Thanks to its stranded hydropower, Norway has become Europe’s largest bitcoin mining hub. But what else defines the bitcoin mining industry in this Arctic outpost?

After publishing an article on bitcoin mining in Sweden, we continue our research series on bitcoin mining around the world. Why do bitcoin miners flock to specific countries while avoiding others? Which countries have the most potential for developing new operations? These are the types of questions we will answer in this article series.

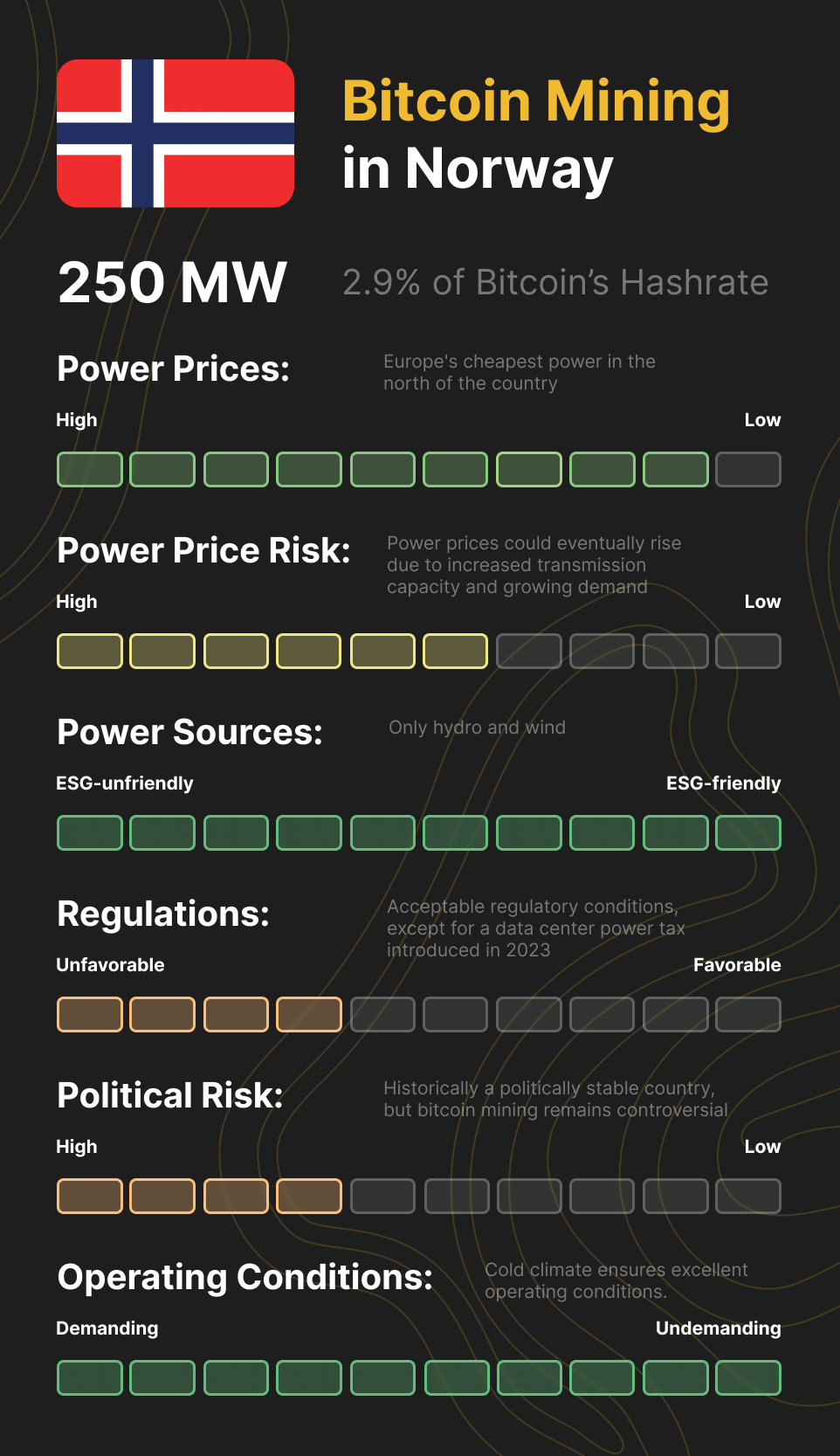

In this article, I explain why Norway, my home country, has attracted the largest bitcoin mining industry in Europe. At the end of the article, I give the country a bitcoin mining score based on several factors, including power prices, power price risk, regulatory environment, political risk, and operating conditions.

This article is an update of a similar analysis I published for Arcane Research last year.

An Arctic outpost of bitcoin miners

Let’s establish the size of Norway’s bitcoin mining industry. As usual, I will provide an existing estimate before coming up with my own number.

Cambridge University periodically publishes its Bitcoin Mining Map estimating the percentage of hashrate originating in different countries. According to the latest version from January 2022, Norwegian miners generate 0.74% of Bitcoin’s hashrate. Multiplying this percentage by Bitcoin’s electricity consumption at the time gives us a Norwegian bitcoin mining power consumption of 69 MW.

Cambridge’s estimate is more than a year old and is based on a top-down methodology using data from only four mining pools. I will now provide an updated estimate based on identifying as many Norwegian bitcoin mining facilities as possible and getting power consumption approximations from industry insiders.

I estimate the Norwegian bitcoin mining industry to consume around 250 MW. This power consumption should equal a Norwegian share of the global hashrate production of 2.9%, based on Hashrate Index’s Bitcoin Mining Energy Consumption Index, which currently sits at 8.5 GW. This estimate is significantly higher than Cambridge’s and illustrates the growth of the Norwegian bitcoin mining industry in 2022.

Who mines bitcoin in Norway?

Generating just below 3% of Bitcoin’s hashrate, Norwegian miners are not the biggest but still important contributors in securing the Bitcoin network. Who are they, and where do they operate?

The most prominent multinational companies are Bitfury, COWA, Bitzero, and Bitdeer, while locals include Kryptovault and Arcane Green Data.

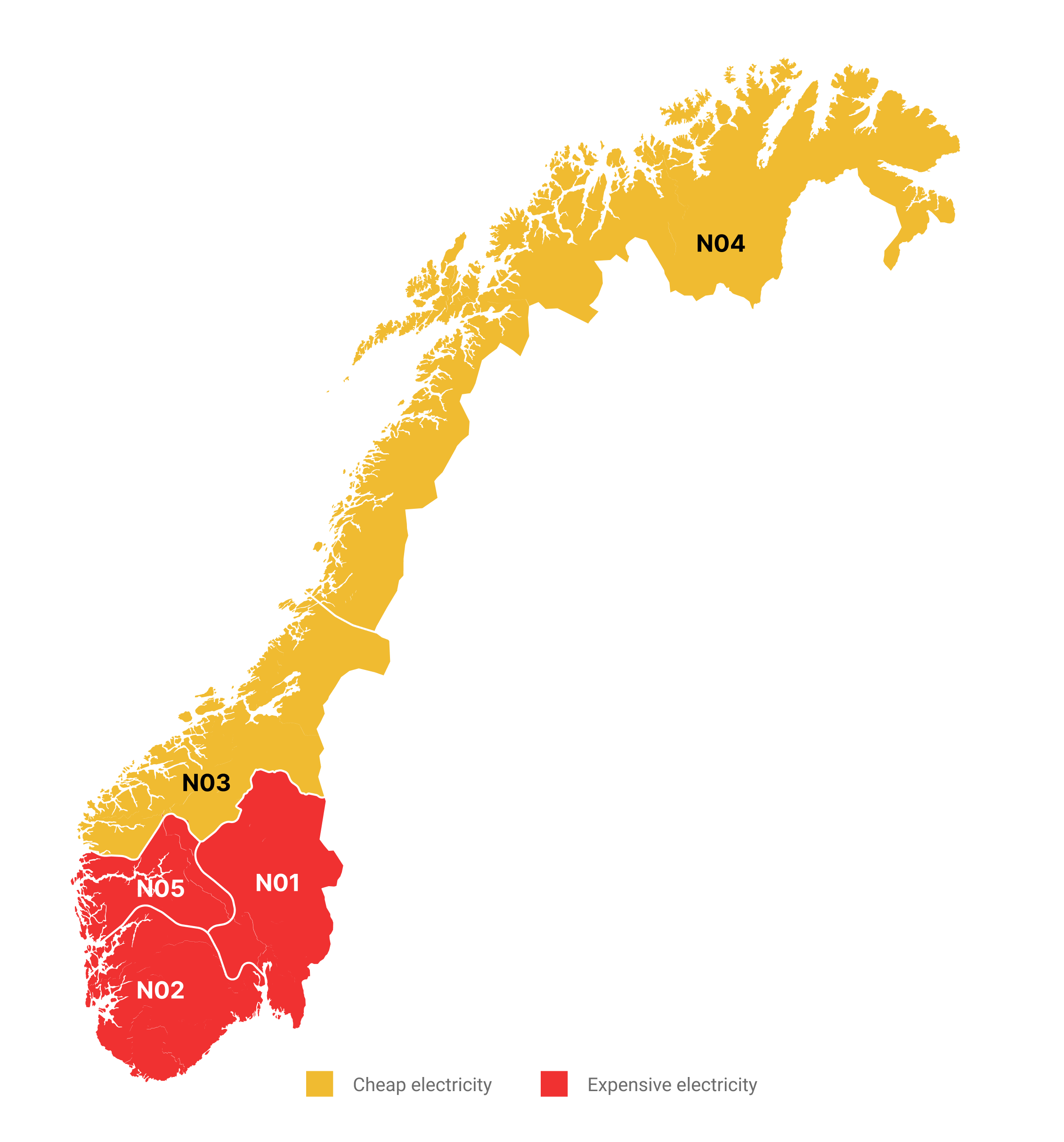

Due to colossal power price differences between regions, all bitcoin miners in Norway operate in the middle and northern parts of the country, enjoying abundant stranded hydropower. Before Europe’s energy crisis kicked off in late 2021, many miners operated in southern Norway but eventually relocated further north in response to a sudden surge in power prices. More on that later in the article.

Europe’s largest hydropower producer

The main reason Norway has attracted a sizeable bitcoin mining industry is its abundance of renewable energy. Norway is an electricity powerhouse, generating the second-most electricity per capita globally in 2021.

Norway is blessed with a mountainous geography and wet climate that provides excellent opportunities for hydropower. In the 20th century, the Norwegians exploited this opportunity by developing hundreds of hydropower plants all around the country. As a result, Norway is among the few countries in the world where hydro generates almost all the electricity.

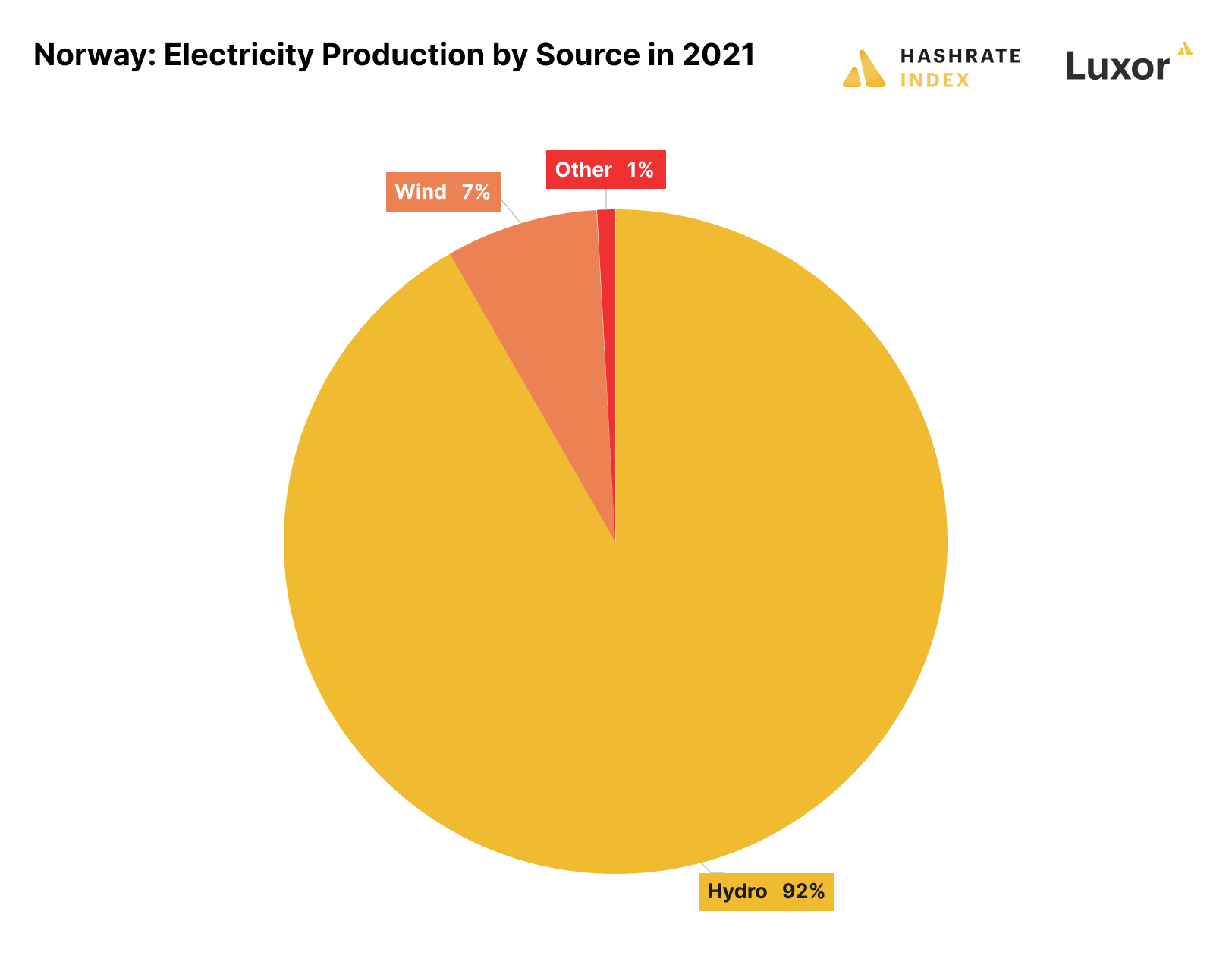

In 2021, hydropower generated 92% of the country’s electricity, while 7% came from wind. Norway developed most of its hydro capacity during the post-war industrialization, and the buildout slowed down from the 1990s. Since then, most of the capacity increase has come from wind power.

Norway’s 100% share of renewables makes it an attractive location for bitcoin miners who want to claim carbon neutrality. The other advantage is low electricity prices, as I will explain in the following section.

Parts of Norway enjoy among the cheapest electricity globally

Fjords and mountains dominate Norway’s geography. Under such geographical conditions, building transmission lines is highly challenging and expensive. As a result, significant transmission constraints exist within the country, particularly between the middle and the southern parts.

Due to these transmission constraints, Norway has split its electricity market into five price zones, as illustrated on the map above. In this article, I refer to NO4 as “northern Norway”, NO3 as “middle Norway”, and the three southernmost price zones as “southern Norway”. These areas' electricity prices were historically similar, but colossal differences suddenly emerged in late 2021.

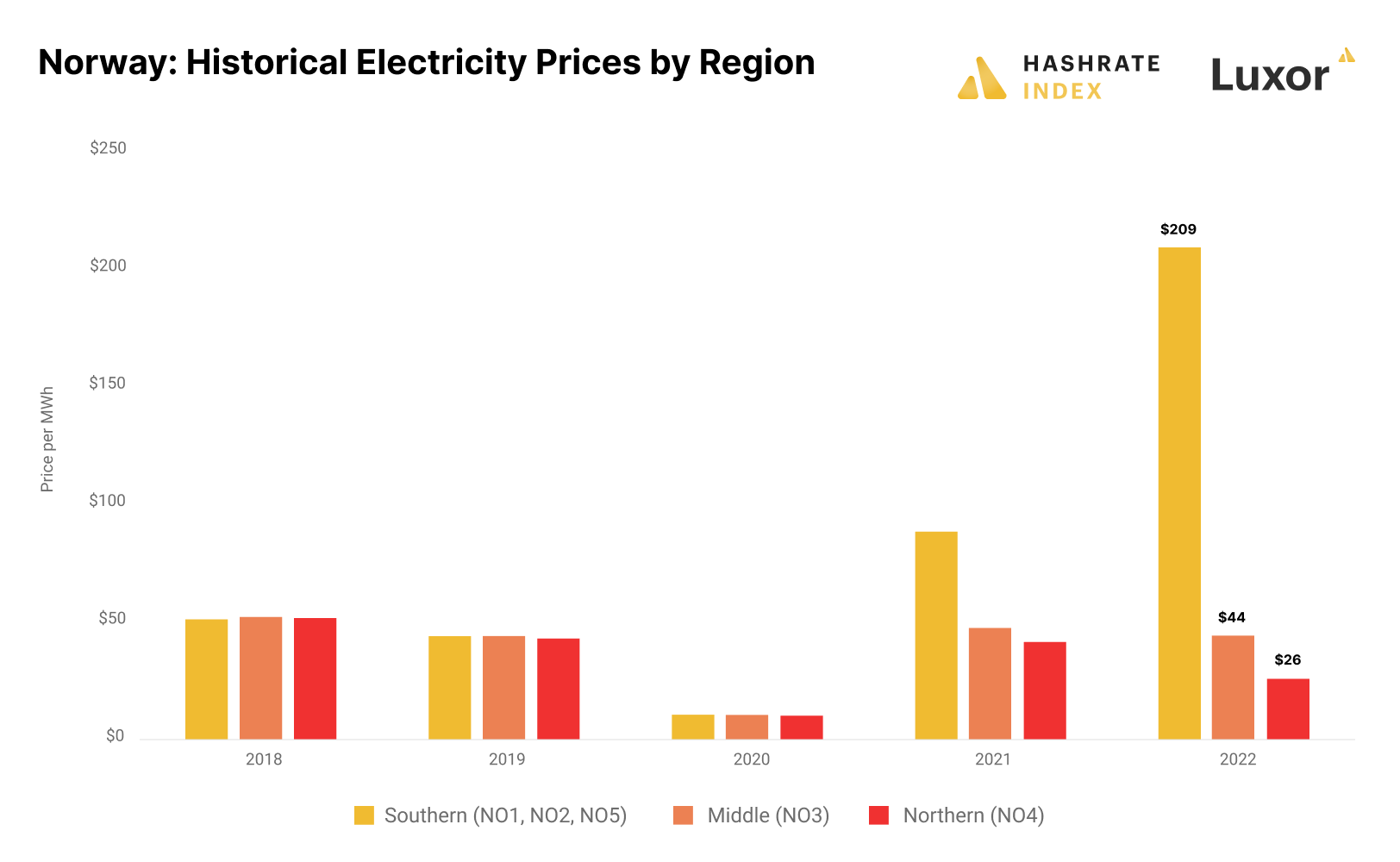

As you can see in the chart above, electricity prices were historically similar in all the regions of Norway, with the yearly average electricity price in all the price zones staying between $10 and $50 per MWh from 2013 to 2020. Electricity prices have historically been low in Norway, albeit with some yearly volatility due to differences in precipitation.

In late 2021, electricity consumers in southern Norway suddenly saw their power bills explode to unimaginable heights. Southern Norway is relatively well-connected to the European power markets through several submarine power cables. Therefore, surging electricity prices on the continent quickly spread to southern Norway. As we all know, Europe’s energy crisis escalated further in 2022 when Russia cut natural gas exports after it invaded Ukraine.

In 2022, the average power price in southern Norway reached a whopping $209 per MWh, rendering bitcoin mining prohibitively expensive. Meanwhile, prices in middle and northern Norway stayed low at $44 and $26 per MWh. All the miners who operated in southern Norway have now shut down operations or moved up north.

The transmission constraints between middle and southern Norway prevent the southward flow of cheap electricity and have protected consumers in these regions from Europe’s electricity price inflation.

Will electricity stay cheap in northern Norway?

Even in the middle of Europe’s energy crisis, the northern parts of Norway still enjoy some of the cheapest electricity in the world. But will these good times last? Let’s find out.

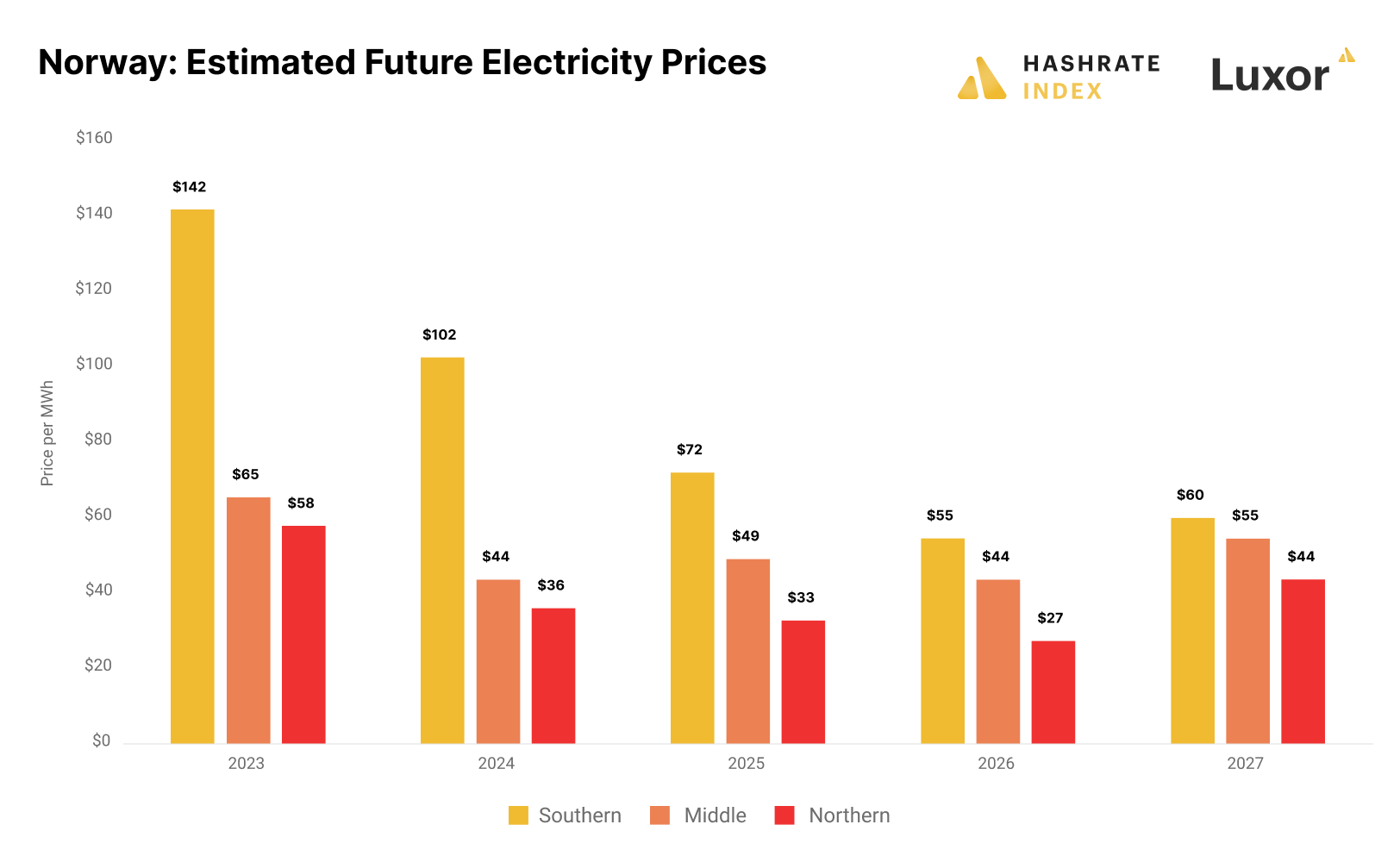

Statnett, the Norwegian transmission system operator, estimates that the electricity prices in middle and northern Norway will increase in 2023 to $65 and $58 per MWh. This price increase reflects the expected normalization of weather conditions, as precipitation was unusually high in 2022, leading to abnormally low electricity prices.

Statnett expects electricity prices in the middle and northern parts to fall between 2023 and 2026, to reach $44 and $27 per MWh in 2026. In 2027, Statnett estimates prices to increase significantly (but still stay relatively low) due to the opening of new transmission capacity.

According to Statnett’s estimates, middle and northern Norway will continue to be hospitable locations for bitcoin miners from an electricity price perspective. It’s important to note that Statnett’s calculations assume a diminishing of the conflict between Russia and the west and a general avoidance of any additional black swan events. Therefore, I will now explain some of the Norwegian electricity market trends so we can better understand any electricity price risks.

Three factors can influence the development of electricity prices in middle and northern Norway: the development of the local electricity generation capacity, changes in the local electricity demand, and expansion of the transmission capacity between middle and southern Norway. Let’s evaluate these three factors one after the other.

There are few plans to increase the electricity generation capacity in middle and northern Norway. At the same time, electricity consumption will likely significantly increase toward 2030. Northern Norway is a relatively attractive location for specific government-approved electricity-intensive industries due to its low electricity prices. Also, the electricity demand in northern Sweden is growing rapidly, which could affect electricity prices in northern Norway since these two markets are relatively well-connected. Still, it will likely take several years for this industrial electricity demand to grow to a meaningful level.

What about the development of the transmission capacity? Here it’s essential to understand that electricity in the Nordics generally flows from north to south, using both Norwegian and Swedish transmission lines. Since the electricity markets of the northern parts of these countries are well-connected, the elimination of transmission constraints between northern and southern Sweden would likely lead to rising electricity prices also in northern Norway. Norway and Sweden plan to increase the north-south transmission capacity, but this process will take many years, and the substantial north-south transmission constraints will persist at least until 2030.

It is highly uncertain what will happen to electricity prices in northern Norway. The TSO projects prices to stay low for at least until 2027. Still, in the long term, prices in the northern and southern parts of Norway will likely converge due to improved transmission capacity and increased electricity demand in the north. Therefore, I believe miners will enjoy an additional five years of low power prices in northern Norway before they rise. This projection is supported by the fact that power purchase agreements suddenly get way more expensive with a time horizon of more than five years.

Cold weather ensures excellent operating conditions

There are few countries where operating a mining farm is easier than in Norway. This Arctic country's cold climate provides natural cooling to heat-producing mining operations. The average monthly temperatures in northern Norway range from -4C (+26F) to +13C (+56F) between the coldest and warmest months. The air is also clean. The climate barely gets any better for bitcoin mining.

The benign climate means maintaining and running a mining operation is more straightforward than in hotter bitcoin mining hubs like West Texas. Miners can easily run air-cooled operations and don’t need to worry about building additional cooling infrastructure. In addition, machines could last longer.

The low failure rate due to the cold climate also means lower maintenance requirements, which could reduce operating costs. I have heard about some smaller miners in the region who sometimes leave their facility running for several weeks without any employees present except for periodic security checks. Try to do that in West Texas during the scorching summer heat.

A politically stable country, but bitcoin mining remains controversial

Norway has historically been a stable and business-friendly country with acceptable regulatory conditions for most businesses. Corruption is virtually nonexistent, and transparent processes ensure everyone is treated equally according to the law. An example is the energy act, which prevents the transmission system operator from discriminating against different industries when allocating electricity supply. Thanks to its stable and transparent business environment, Norway ranked nine on The World Bank’s Ease of Doing Business Index in 2019.

Let’s talk about taxes, a boring but important topic. The corporate tax level for most industries in Norway is 22%, a relatively low level compared to most European countries. Meanwhile, the VAT is 25%, which applies to imported products, including hardware. Still, miners can avoid the import VAT by registering their companies in the Norwegian VAT registry.

Until 2023, Norwegian miners were eligible for a reduced power tax as part of the broader data center industry. They will now have to pay NOK 0.0916 ($0.0093) per kWh from January to March and NOK 0.1584 ($0.016) per kWh from April to December, equal to a yearly average power tax of NOK 0.1417 ($0.014) per kWh. Comparatively, miners previously only paid NOK 0.00546 ($0.00055) per kWh. This drastically higher power tax will significantly increase Norwegian miners’ all-in electricity prices.

Why did the Government suddenly raise power taxes for miners and other data centers? Short answer - they want to smoke them out. Many Norwegian politicians, both on the national and local levels, have a complicated relationship with bitcoin mining. Some politicians, mainly from the left wing, have persistently expressed their desire to ban the activity but haven’t been successful. After one such unsuccessful ban attempt, they seem to have realized that increasing the power tax is the only way to curb the industry.

This is not the first time the Norwegian government has tried to make life hard for miners by increasing the power tax. In 2019, the government attempted to increase the power tax specifically for miners but suddenly scrapped the idea one year later. They may have realized that such a granular selectivity in their decision-making for who is eligible for a reduced power tax is most likely against several Norwegian and international laws.

The difference this time is that this power tax hike affects the entire data center industry and not only miners. Yes, you read that right. The Norwegian government is willing to throw the entire data center industry under the bus to limit the bitcoin mining industry. This is surprising, giving the Norwegian government introduced a national data center strategy in 2016, aiming to create a data center hub in Norway.

After reading about this power tax saga, you may not understand how I could brag about the political stability of Norway in the introduction of this section. Norway may have the history on its side but is, together with most western countries, moving toward a governing structure characterized by increasing central planning. In such a top-down environment, having the government’s support is invaluable. Unfortunately, the Norwegian government doesn’t support bitcoin mining and would instead want to reserve the electricity capacity for other electricity-intensive industries like battery production that better align with Norway’s and the EU’s ambitions for the energy transition.

Still, bitcoin mining is by no means regularly infeasible in Norway. As mentioned, Norway is still a law-based country, and politicians face many legal and procedural obstacles when trying to eliminate the industry. Compare that to some of the growing bitcoin mining countries in Latin America, where the governments might seem more pro-bitcoin but where a single politician could shut down your bitcoin mine at a whim.

Conclusion

Thanks to its cheap renewable energy, cold climate, and historical political stability, Norway has attracted a significant mining sector generating almost 3% of Bitcoin’s hashrate.

Stranded hydropower has spared northern Norway from the energy price inflation that has ravaged Europe since late 2021, making it the biggest bitcoin mining hub of Europe. It’s important to note that electricity is only cheap in northern Norway - not in the southern part of the country.

Norway has historically been a politically stable country with an acceptable regulatory environment for most businesses. Still, bitcoin mining remains controversial. Norwegian regulators are eager to reduce the industry's size to make room for other electricity-intensive industries that align with Norway’s and the EU’s ambitions. Therefore, they recently substantially increased power taxes for all data centers, including miners.

The competition for electricity with these government-approved industries gives the Norwegian bitcoin mining industry little additional room to grow. In addition to the increasing political opposition, there is also some electricity price risk. There is little new electricity supply coming online in the next few years, at the same time as the demand could substantially increase. In addition, the government plans to increase the transmission capacity between the northern and southern parts.

Still, bitcoin miners likely have at least five good years left in a stable country with low power prices and excellent operating conditions.

Are you scaling a Bitcoin mining operation and in need of mining software, services, or hardware? We can help. You can reach us here.

Thanks to Frank Arild Aadnevik (Exakraft) for giving me insights for the article.

If you have any questions about mining, please DM me on Twitter @jmellerud. I can help you with your mining operation.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.