Bitcoin Mining Around the World: Africa

From Ethiopia, to Kenya, to Nigeria, and beyond, Africa is quietly emerging as a Bitcoin mining hub.

Africa is the next big frontier in Bitcoin mining.

The continent has largely been underserved in the global hash race for understandable reasons. Many African countries have aging or underdeveloped infrastructure, which creates difficulties with transmitting power from electricity generating assets to end consumers; some African countries have political concerns that stem from corruption or general socio-political instability; and others still come with cultural, commercial, and linguistic barriers that miners may find difficult to clear.

But in these weaknesses lie the strengths that will make Africa a prime destination for Bitcoin miners in the years to come. Because it is so under explored, there are plenty of opportunities for miners looking to tap new markets. Because many countries have difficulties transmitting power, there are plenty of energy generating assets that are underutilized. Miners can consume electricity close to power sources, which can fund utility companies and governments to build transmission and distribution for other consumers. Additionally, many African countries employ so-called minigrids to provide electricity to underdeveloped, mostly rural areas, and Bitcoin mining is emerging as a promising method for making these minigrids financially sustainable, while also generating revenues to invest further in these underserved regions.

Thus, we believe that Africa could be one of the biggest regions for hashrate growth in the coming decade. In this article, we provide an overview of some of the leading countries in Africa’s Bitcoin mining sector and explore areas that are promising for future growth.

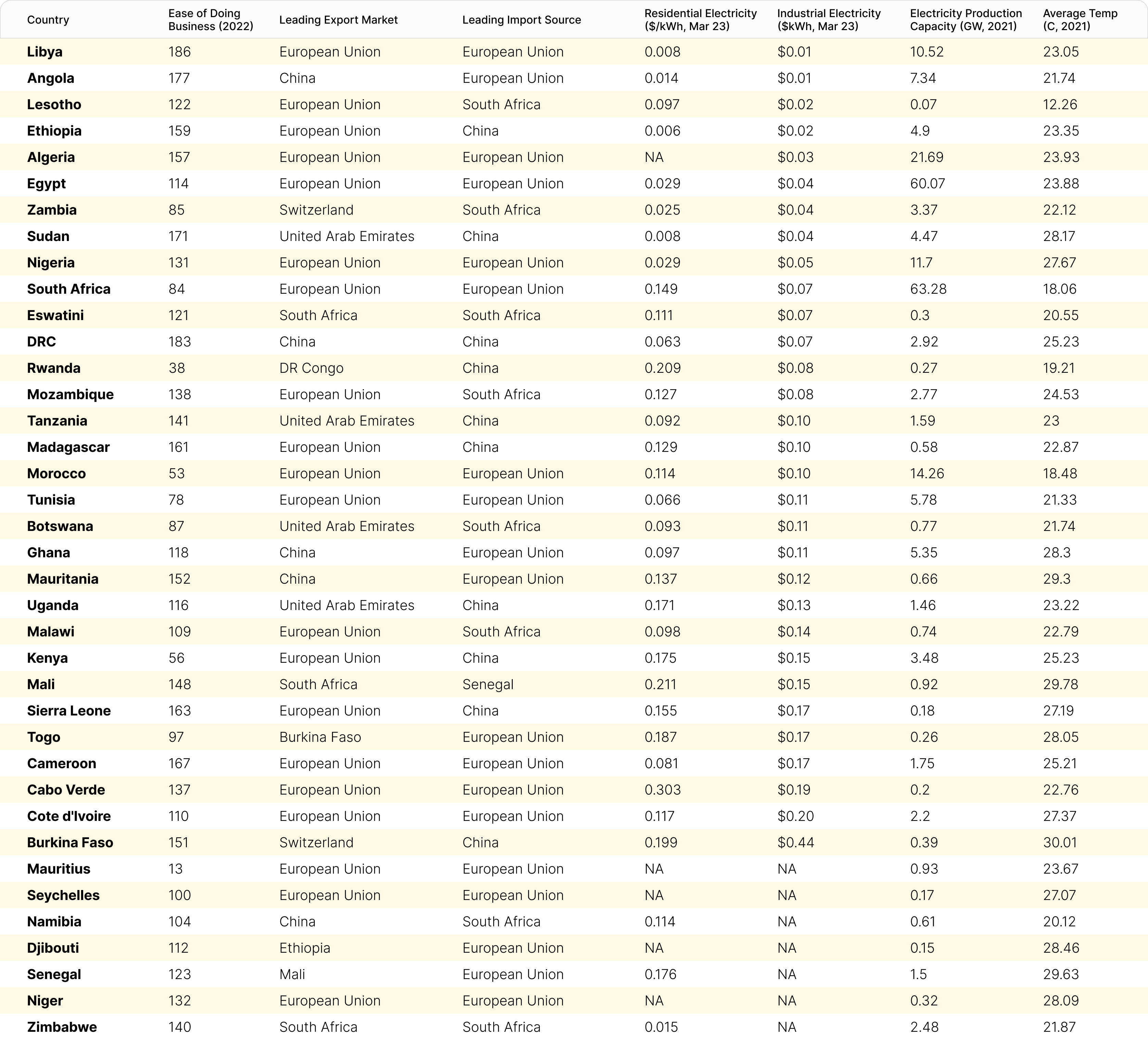

African Countries by the Numbers

In addition to assessing testimonies from entrepreneurs in the region, when examining African countries for mining potential, we’ve taken a high-level view on metrics such as ease of doing business, power prices, power capacity, average annual temperature, and other factors. In the table below, we lay these metrics out for a majority of the countries on the continent, and we’ve excluded some for lack of comprehensive data.

In the final section of this article, we factor some of these metrics into a ranking system for countries that we believe to be the most promising for Bitcoin mining in Africa. In the following sections, we highlight countries which contain notable Bitcoin mining activity or which hold the greatest potential for becoming major African mining hubs in the near future.

Bitcoin Mining in Ethiopia

Ethiopia has promise to become the largest Bitcoin mining hub in Africa – if miners can navigate a slow moving regulatory process.

With an average industrial power cost of $0.022/kWh, the country is flush with hydroelectric power that has nowhere to go. In 2021, for example, Ethiopia generated 4.9 GW of power, 95% of which came from hydroelectric dams. Incredibly, the country only taps ~5% of this hydroelectric power since only 51% of the population has access to electricity. Ethiopia Electric Power (EEP), the country’s state-run power authority, hasn’t built enough high voltage transmission infrastructure to deliver more hydroelectric power to market.

To give an idea of the cost to construct high voltage transmission, in 2022, the 1,045 kilometer Ethiopia-Kenya Transmission Interconnection Line went live at a cost of $334.5 million (or $320,000 per kilometer). The cost of expanding high voltage transmission varies per region. To provide another example, Kenya is seeking out as much as $6 billion to finance 12,672 kilometers of high voltage transmission infrastructure – that’s $473,484 per kilometer.

Power companies can have trouble sourcing investment for often-expensive transmission infrastructure. Bitcoin mining can help fix this.

In fact, framing Bitcoin mining as a solution was the approach of Ethiopian Bitcoin mining company QRB Labs when it pitched its services two years ago to government officials and regulators. One of the first (if not the first) Bitcoin mining companies in the country, QRB Labs billed their services as a way for EEP to generate revenue from otherwise stranded energy, which could then be used to invest in infrastructure to improve the Ethiopian grid.

QRB eventually sold officials on the process. But it's taken two years of painstaking negotiations and discussions to clear the red tape. The Ethiopian Information and Network Security Administration (INSA), which is in charge of improving imports of computer hardware into the country (in this case, that means approving shipments of ASIC miners), has been particularly difficult to work with, but QRB Labs is nearing approval from this agency as well. QRB Labs focuses a substantial amount of their business on hosting services in order to scale quickly and fund expansions.

Zooming out to Ethiopian mining more broadly, based on conversations with miners in the area, there could be just over 200 MW of Bitcoin mining operations that are on the cusp of approval and ready to come online in Ethiopia. Some of these operators, like QRB Labs, are going by the book and making sure they have clear regulatory approval. Others are playing it fast-and-loose, particularly some Chinese and Russian foreigners who aren’t afraid to bribe their way into the market and skirt regulations (not every Chinese and Russian miner in Ethiopia is gaining favor through bribery, but some no doubt have). Such tactics might conflict with Western or local entrepreneurs who operate in more legitimate fashions.

Overall though, with an abundance of stranded hydro and government plans to add 1.7 GW of generation to the grid over the next 10 years, Ethiopia will likely emerge as one of Africa’s biggest bitcoin mining hubs in the near future.

One knock in Ethiopia’s disfavor, though, is budding civil unrest that some commentators believe could bloom into serious civil conflict and potentially war.

Bitcoin Mining in Angola

Angola was Africa’s rising star for Bitcoin mining ever since miners started moving into the country two years ago, particularly Chinese miners looking for a new home after China’s mining ban. But then miners moved too fast and rubbed officials the wrong way, so now most miners have vacated the country.

The government moved to ban Bitcoin mining in August 2023, although no legislation has been passed into law yet. The legislation proposal came after officials cracked down on illicit, covert mining operations, such as this one where Chinese foreigners were drawing power without permission in an operation disguised as a brick factory.

Many miners have fled the country amid the government’s crackdown, although as much as 50 MW could still be active in Angola’s borders. For the operations that are still left in the country, we were told they amount to small farms of 1-2 MW.

Near-term hashrate expansion in Angola is limited, which is a shame given that the country has one of the largest hydroelectric production capacities of any country in Africa (Angola’s hydroelectricity production capacity was 5.14 GW in 2021, accounting for 70% of total electricity produced).

Bitcoin Mining in Nigeria

Nigeria has emerged as a promising hub for Bitcoin mining thanks to its underutilized hydro-electric power and its abundance of stranded natural gas on the country’s many oil fields

Nigerian officials have actively encouraged Bitcoin miners to come to the country to soak up otherwise flared/vented natural gas (the country produces a little over one million barrels of oil per day and is the ninth biggest natural gas flaring country as of 2022). Further, the government has taken a step to establish formal regulation for Bitcoin businesses via the Nigeria Blockchain Policy Bill. Additionally, Nigeria’s June 2023 Electricity Act allows for state-by-state management and distribution of electricity and energy resources, so state governments can now make decisions for their energy producing assets that are independent of the national grid. This decentralization has been a positive development for Bitcoin miners, as state electricity authorities now have the leeway to sell power at their discretion.

A few local entrepreneurs are building small scale sites and utilizing under-tapped hydropower in Eastern Nigeria, the foremost of which is Trojan Mining. Other miners have accepted the government’s call and are making use of otherwise-flared/vented natural gas.

One of the biggest question marks for miners in Nigeria comes from the country’s political risks. The country’s political stability has improved over the last decade, but it’s still low compared to other countries on this list (like Kenya, for example). The jury is still out regarding the government’s acceptance for Bitcoin; while they may be taking steps to regulate Bitcoin businesses, this doesn’t guarantee that they will take a favorable stance, even as crypto and Bitcoin adoption among Nigerians is relatively high.

Ultimately, with 11.7 GW of electricity produced in 2021 and over 5,000 bcm of flared gas volume in 2022, Nigeria holds great promise to become one of Africa’s biggest Bitcoin mining hubs, but there are still gray areas to clear up before it achieves its full potential.

Bitcoin Mining in Kenya

Kenya has a very small Bitcoin mining footprint, but it is home to arguably one of the most interesting African Bitcoin mining companies.

Founded in 2022, Gridless powers small scale, off-grid Bitcoin mining sites in Kenya (and in 3 other countries, which we’ll touch on later) in a partnership with HydroBox, an African hydroelectric power company. Gridless’ Kenya sites capture hydroelectricity from rural minigrids that would otherwise be wasted, giving the power operators the unprecedented ability to monetize excess energy. As with other sites in Africa, this will allow the power operators to invest in additional generation capacity and transmission. The company raised $2 million at the end of last year, led by Stillmark and Jack Dorsey’s Block.

In its June 2023 report Energy and Bitcoin in Africa, the Green Africa Mining Alliance explains why Bitcoin mining is particularly well suited for minigrid projects:

The problem with minigrids is that "the risks perceived to be associated with minigrid projects are not aligned with the risk/return expectations of commercial financiers", according to the Mini-Grids Partnership’s Global Mini-grids Market Report 2020 published by Bloomberg NEF and Sustainable Energy for All (SEforALL). In other words, the financial effort required to set up a minigrid is not worth the result as virtually all minigrids projects so far have not been economically sustainable – and if they are not economically sustainable, especially in the initial phase after commissioning when demand is still very low, it’s hard to expect them to help reduce the electricity access gap in Africa and other regions.

This financing problem is exacerbated by the fact that minigrid operators often have to overbuild capacity to compensate for variability of the natural forces that generate the electricity (sun, wind, and water). Bitcoin mining provides a panacea for these issues. It provides operators with a flexible load source that allows them to monetize their excess electricity production, which in turn provides financial stability for these projects while also eliminating energy waste.

One of the key costs that Bitcoin miners in Kenya need to account for is importation tax. The ASIC miners themselves are not subject to an importation duty, but certain electrical equipment, (like power distribution units) and shipping containers are subject to tax. As such, it may be more economical in some cases for miners to purchase equipment in-country if they can find it. In Gridless’ case, the team designed and built their own mining containers in Kenya to avoid an otherwise exorbitant tax on importing shipping containers.

Looking beyond Gridless, Kenya has offered one of the more favorable business and political environments for Bitcoin mining in Africa. In the summer of 2022, the country’s largest electricity company issued an open invite to Bitcoin miners to make use of its abundant geothermal energy. Also playing in its favor, Kenya has a higher degree of political stability than other African mining hotspot-hopefuls like Ethiopia and Nigeria.

Bitcoin Mining in Uganda

Uganda is a smaller player in Africa’s Bitcoin mining scene with minimal hashrate, but there are promising opportunities for miners in the country to make use of stranded hydroelectric power, particularly from microgrids. Uganda hydroelectric capacity was 1.31 GW in 2021, and hydroelectricity accounted for 90.91% of its electricity production in the same year. Like many African countries, Ugandan power companies have difficulties bringing all of this electricity to market, as only 42% of Ugandans had access to electricity in 2021.

Some miners – particularly, Chinese ones – have taken advantage of the country’s gushes of stranded hydroelectric power. Most of this mining, however, is small-scale mining and mostly on microgrids. Uganda is likely to have a smaller mining footprint than other hydro-rich nations like Ethiopia for the simple fact that the country has less hydroelectricity to offer.

The Ugandan Central Bank and government have at times taken harsh or ambiguous stances toward cryptocurrency in general, but this has changed in recent years as officials have opened up pathways to regulation for Bitcoin and cryptocurrency businesses.

Bitcoin Mining in Zambia

Zambia has a relatively small mining footprint, but the country holds a lot of promise thanks to its cheap electricity rates, high ease of doing business, and political stability relative to other African nations.

Gridless has set up shop in Zambia on minigrid sites similar to its operations in Kenya and Malawi. Typically, smaller mining operations, similar to those found in Uganda, are the most common representation of mining in the country

Zambia has the highest political stability rating of any country detailed in this article, and the current government is starting to favor American entrepreneurs and business over Chinese ones, something that sets it apart from most other African countries. With regards to cryptocurrency, the government seems open-minded to adoption, evidenced by the fact that has conducted studies in 2023 to test its integration and use in the local economy.

Bitcoin Mining in Malawi

Malawi is another smaller player in the African Bitcoin mining field. But with only 14.87% of the population having access to electricity in 2020, there is great potential for minigrids to provide electricity access to the Malawi population, hence why Gridless operates Bitcoin mines on renewable minigrids in the country.

1600 families connected to this remote hydro minigrid in the mountains of southern Malawi. They have 50kW of stranded energy that we are testing out as a new Bitcoin mining site.

— Gridless (@GridlessCompute) January 21, 2023

Videos for context.

Still working on venting, wiring, etc. pic.twitter.com/Sxf8ABGPWH

Malawi generates the least amount of electricity of all the countries detailed in this article; in 2021, for instance, the country’s total power capacity was 0.74 GW, of which 75% came from hydroelectric sources.

Unlike Kenya, Malawi has an importation tax on computing hardware, and Bitcoin ASIC miners clearly fall under this category, which makes importing rigs into the country expensive. A point in its favor, Malawi has the second highest degree of political stability of the countries in this article.

The future of Bitcoin mining in Malawi will likely come from minigrid colocated mines, as bitcoin mining provides a unique use case for monetizing these power sources.

Bitcoin Mining in the Democratic Republic of the Congo

The Democratic Republic of the Congo (DRC) is perhaps one of the better examples of a place where Bitcoin mining can help bootstrap energy infrastructure. The country generates 99.64% of all its power from hydroelectric sources. In 2021, the country generated 39 TWh of power from its hydroelectric dams, but only 11.04 TWh of this generation was put to use because only 19.10% of the country’s population has access to electricity. Bitcoin mininers are the ideal first-and-last resort buyer of this energy.

Big Block Green Services operates out of the country, making use of surplus hydroelectric; in neighboring Congo, Big Block Green Services also partnered with the park services for Virunga national park to set up a Bitcoin mine that runs on excess hydro power, a project which allowed Virunga to stay financially afloat during COVID.

We anticipate that the DRC will become one of the bigger Bitcoin mining sectors in Africa in the coming decade so long as the government does not hinder the growth of the industry.

Regulatory and General Concerns for Bitcoin Miners in Africa

The biggest challenge for miners in Africa comes from the shifty regulatory and political landscapes inherent to most African countries.

Unfortunately, political corruption is high in many African countries, including the ones featured on this list. And even for countries with relatively high political stability compared to their neighbors, like Angola, government attitudes can pivot from tolerance to hostility toward industries that get on the government’s bad side or which receive push back from special interest groups.

As a result of the relatively high levels of corruption, pay-for-play and bribery dictates business practices in most African countries. Investors and miners in Western economies may find it difficult to operate in the region due to differences in business ethics and the general business climate. Even so, there are plenty of opportunities for reputable businesses, particularly local ones whose entrepreneurs understand the culture and business climates, and these legitimate opportunities will only become more prevalent over time as the industry gains a foothold and common practices are established.

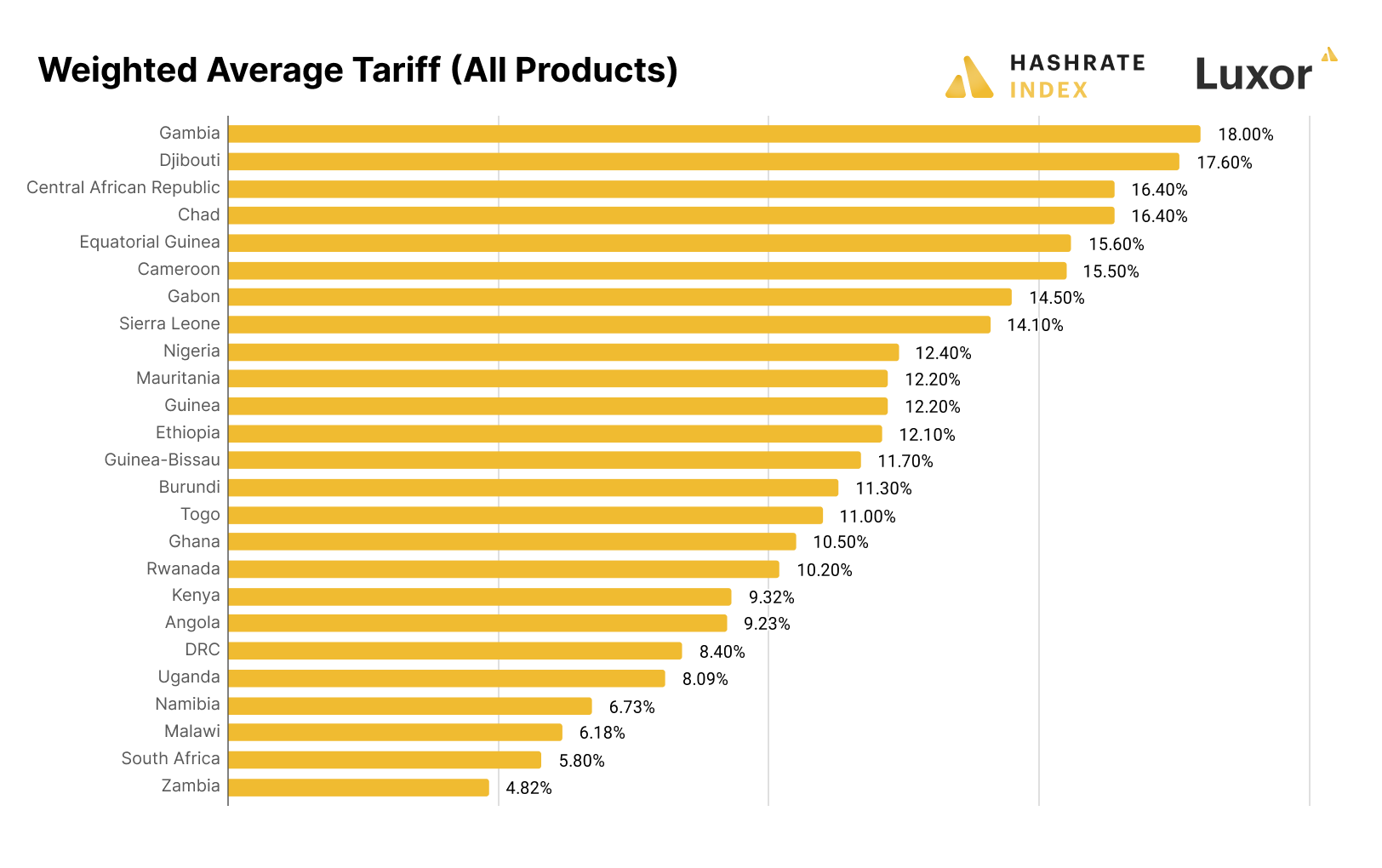

Bitcoin Mining Importation Challenges in Africa

Importation is another key hurdle for miners to clear. As we discussed with Malawi, many African countries levy high importation tariffs, which can make it prohibitively expensive for miners to import rigs and necessary infrastructure.

For certain items like containers, there are ways to work around this by sourcing materials and building in-country, but for the mining rigs themselves – of which there is a dearth of sell-side supply in Africa – this can cause major problems for bootstrapping an operation.

In addition to cutting costs by sourcing materials in-country, miners may also be able to find loop-holes, tax holidays, and gray areas in a country’s tax code to save money on importation, as well.

One Belt, One Road Implications

Chinese private and public entities have poured capital into Africa over the last four decades to build critical infrastructure like shipping ports, airports, roads, and power generating assets, with investments particularly ramping up in the 2000s. As such, it seems fitting that Chinese miners are flocking to the continent as well.

But wider Chinese government interest in these regions could be at odds with the interest of Chinese miners. The strategic investments made in African countries are part of China’s “one belt, one road” initiative which seeks to create a global, interconnected trading network that benefits Chinese interest. As this article describes, the goal is "to construct a unified large market and make full use of both international and domestic markets, through cultural exchange and integration … resulting in an innovative pattern of capital inflows, talent pools, and technology databases."

It remains to be seen just to what extent Chinese ownership of African infrastructure could affect Bitcoin miners. But challenges could surface if a Chinese-owned power plant decides to cut off power allotments to Bitcoin miners, for example, or if the CCP exerts pressure to influence local laws in Africa regarding Bitcoin and Bitcoin mining. Alternatively, it could work in their favor since some African governments will not want to interfere with Chinese Bitcoin miners for fear that it will disrupt other Chinese investments in their country.

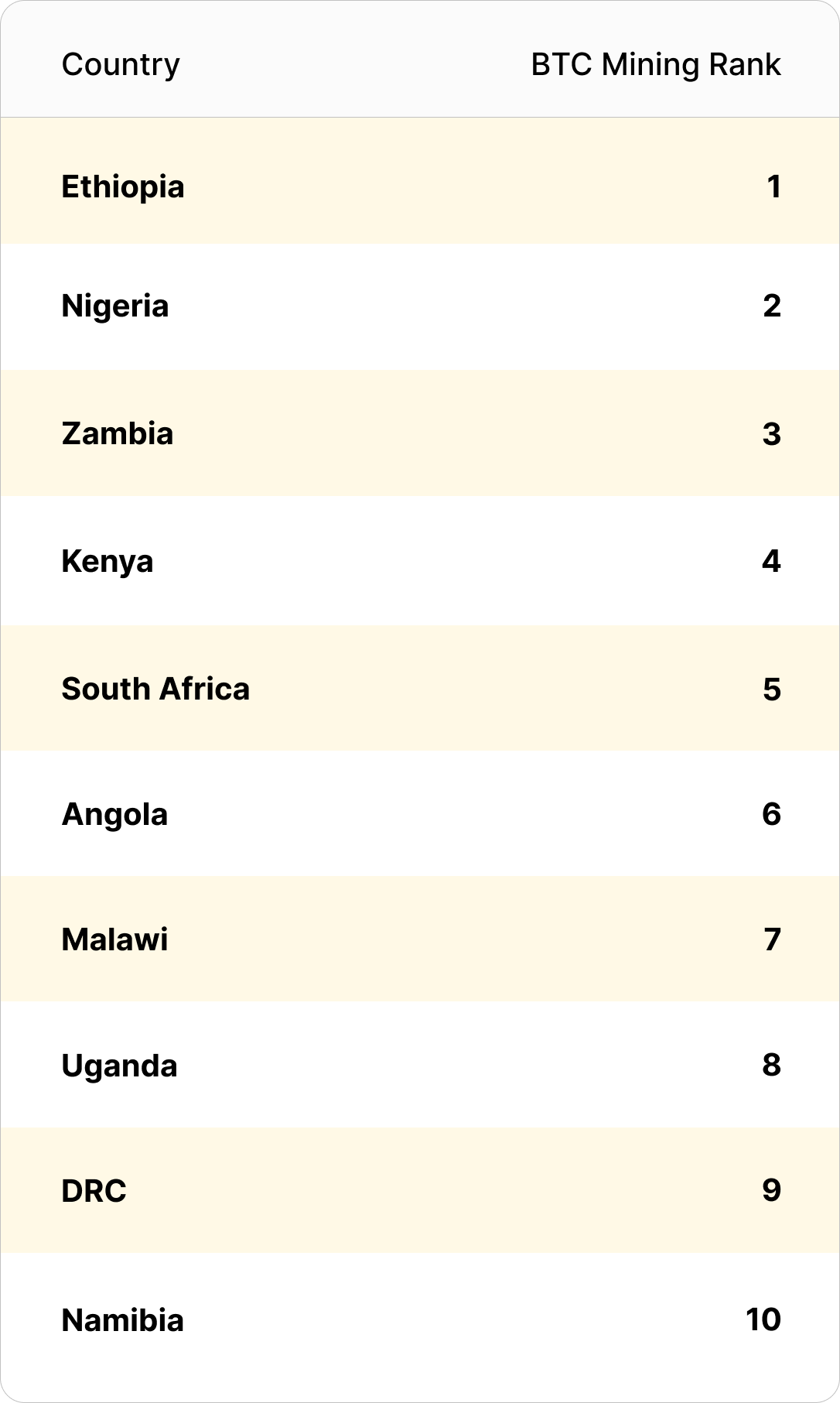

Ranking of African Countries by Mining Potential

In the table below, we present a ranking of African countries by their potential as future Bitcoin mining hotspots based on their ease of doing business scores, electricity generating capacity, industrial power prices, and import tariffs. The list consists primarily of countries that we covered in this article, but it also includes Namibia and South Africa, both of which have burgeoning Bitcoin mining scenes but which we didn’t cover in this article due to insufficient data and commentary. In the case of Angola, which ranks very highly when we consider power capacity and power price, we discounted it considering the government’s restrictions on Bitcoin mining currently.

We believe that the countries detailed in this chart provide Bitcoin miners with the greatest opportunities and potentials for future growth. As the 2024 Bitcoin halving comes to pass and miners increasingly look to under-explored countries, Africa’s abundance of under-tapped hydroelectric energy and its minigrid infrastructure could present attractive opportunities for hashrate expansion on the continent in the years to come.

Special thanks to Erik Hersman and Nemo Semret for their insights and commentary for this article.

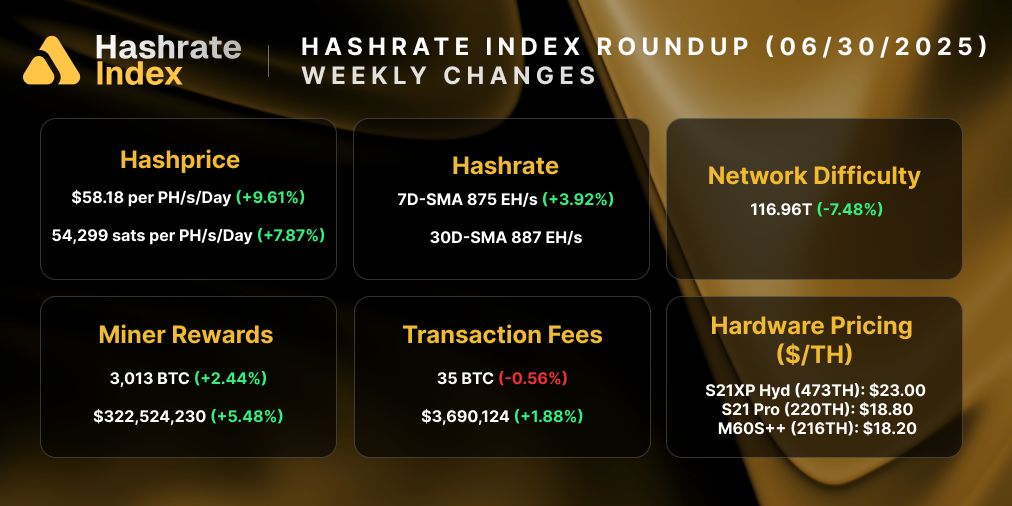

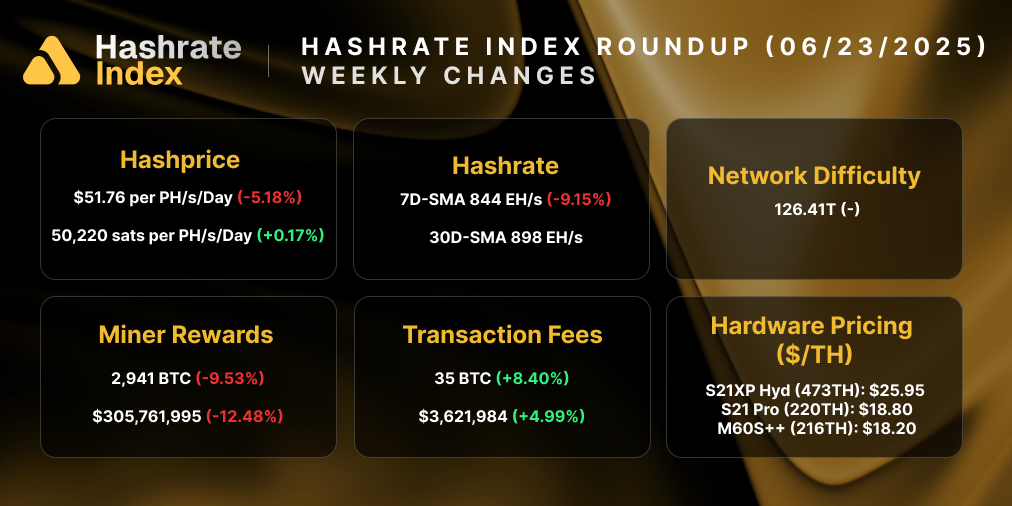

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.