Bitcoin Mining Around the World: United Arab Emirates

The United Arab Emirates is the fastest-growing bitcoin mining hub in the Middle East.

With its political stability, business friendliness, strong capital markets, and abundant energy resources, the UAE is emerging as the prime destination for bitcoin miners in the Middle East.

The Luxor team recently spent some weeks in the UAE and met with local players. In this article, we explain what characterizes bitcoin mining in the UAE and analyze what its future could look like.

This article is the latest in our Bitcoin Mining Around the World series. Our previous articles cover Sweden, Norway, Finland, Iceland, Paraguay, Kyrgyzstan, and Kazakhstan.

Leading the way in Middle East bitcoin mining

The United Arab Emirates is a country adjacent to the Persian Gulf in the Middle East. It comprises seven emirates, the most famous being Abu Dhabi and Dubai.

The UAE is a business-friendly and entrepreneurial country where the population is curious about new technologies. Due to this innovative spirit, as well as heavily subsidized electricity tariffs for specific sectors, home mining and other small-scale amateur mining setups have been widespread in the country for several years.

However, during the past year and a half, a push from a local sovereign wealth fund led to the emergence of two giga projects that put the UAE on the global bitcoin mining map as a serious and ambitious player.

In late 2021, the digital asset arm of Abu Dhabi’s sovereign wealth fund, Zero Two (then under the name FS Innovation), partnered with local bitcoin mining company Phoenix Technology to build a 200 MW hydro-cooled mining farm in Abu Dhabi.

In February 2023, Zero Two launched its second bitcoin mining partnership, this time with the US public miner Marathon. Per this partnership, Zero Two and Marathon will build and operate two immersion-cooled Abu Dhabi facilities totaling 250 MW, of which Zero Two will own 200 MW and Marathon 50 MW.

Thus, all large-scale projects in the UAE have been led by Abu Dhabi’s sovereign wealth fund in partnership with established industry players. Also, virtually all mining activity in the country occurs in Abu Dhabi, the biggest and most energy-rich of the seven emirates.

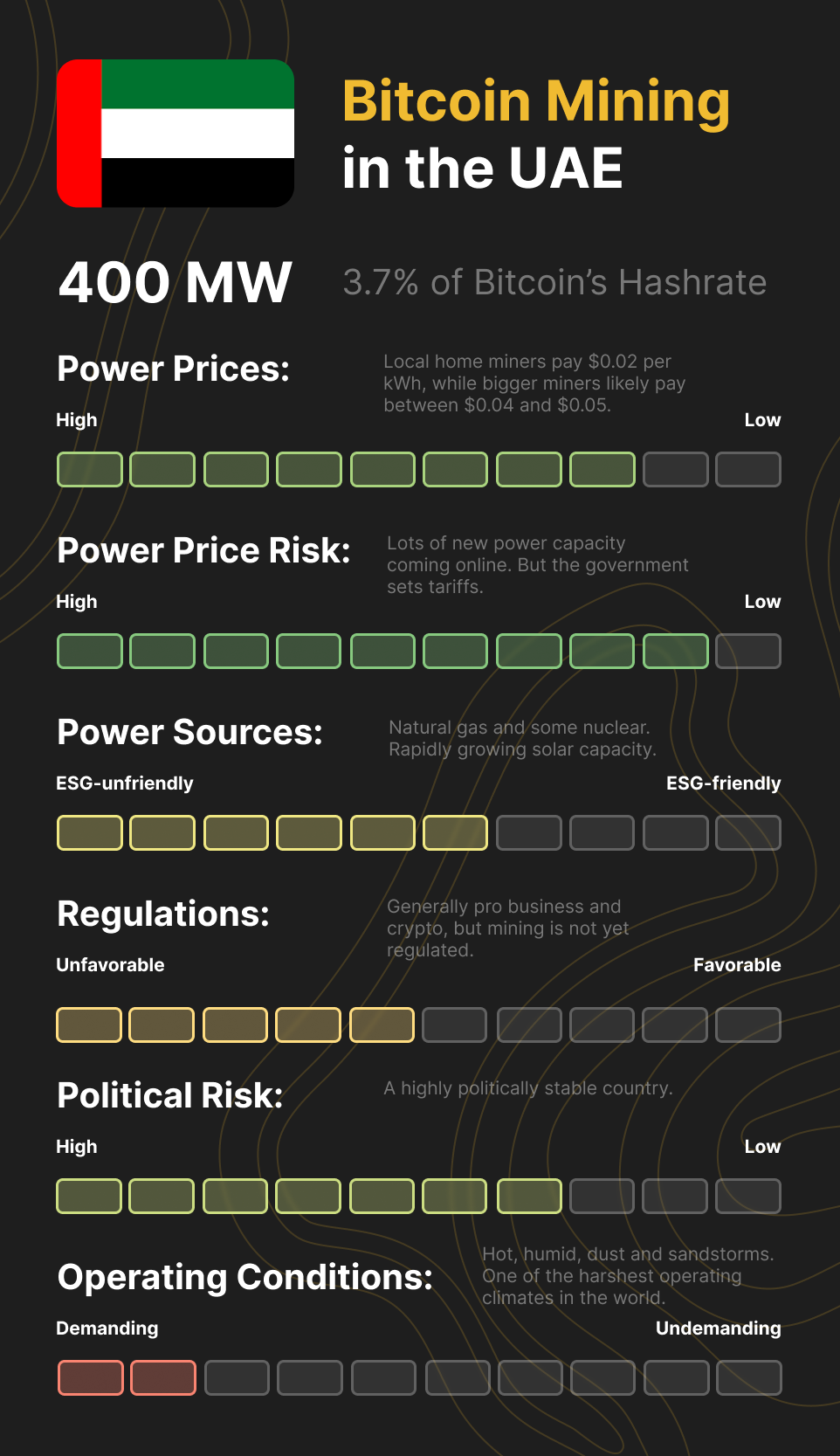

Split between the mentioned semi-governmental projects and countless small-scale amateur deployments, the UAE’s operational bitcoin mining capacity is likely around 400 MW. This capacity will likely surpass 600 MW by the end of this year as the semi-governmental projects expand.

At an assumed average energy efficiency of 30 J/TH, bitcoin miners in the UAE should generate about 13 EH/s, corresponding to 3.7% of the Bitcoin hashrate. This hashrate share makes the UAE the leading bitcoin mining nation in the Middle East, ahead of its neighbors Oman, Kuwait, Saudi Arabia, Bahrain, and Qatar. All these energy-rich countries may have enormous bitcoin mining potential, but the innovative UAE is leading the way.

The UAE keeps expanding its electricity supply

As an OPEC member and the seventh-biggest oil producer globally, the UAE is a major player in the global energy markets.

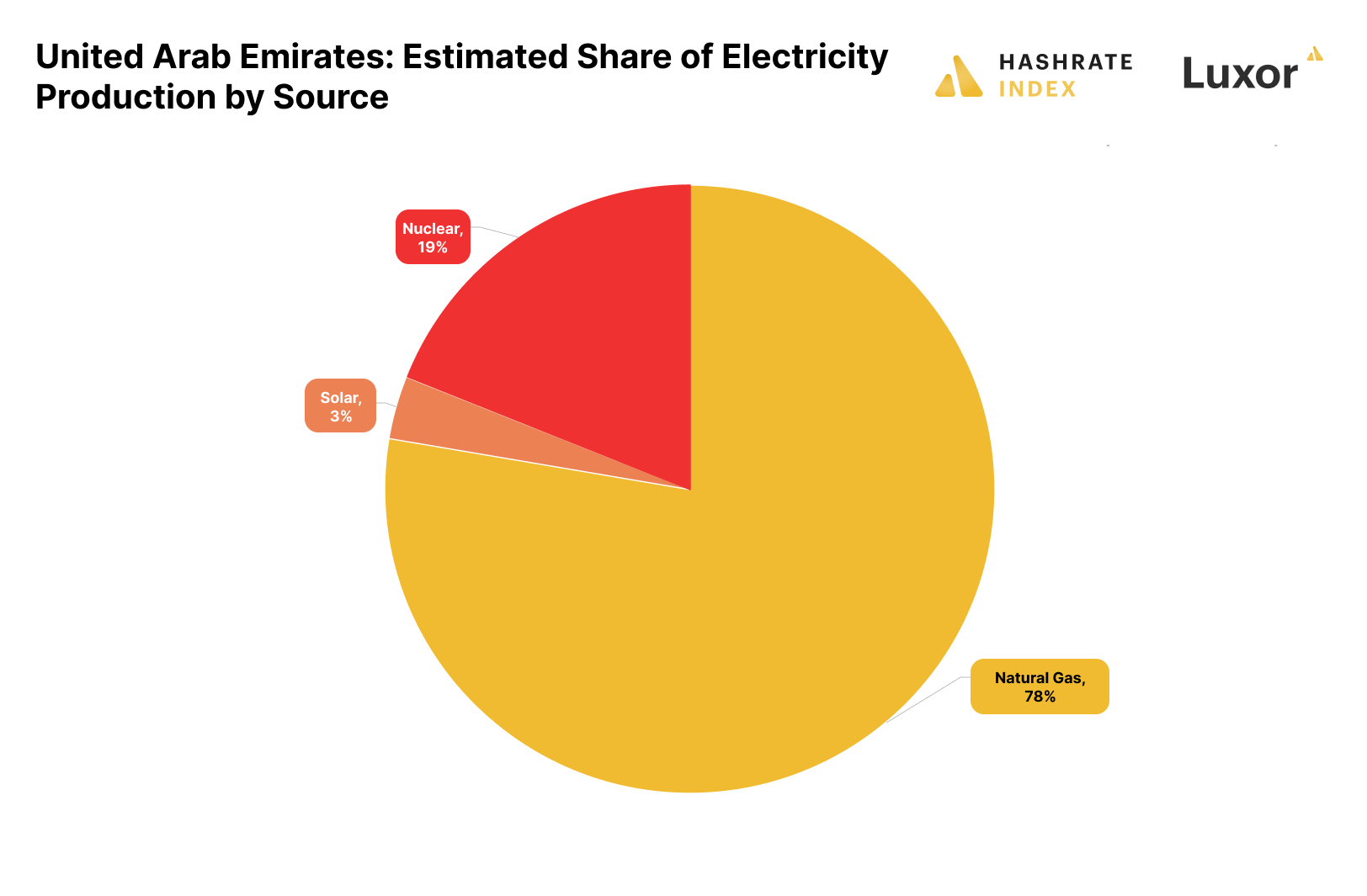

Like most countries with vast oil and gas resources, the UAE exports most of its oil while using gas for internal electricity generation. Historically, virtually all of the country’s electricity has been generated by natural gas.

As part of its push to grow alternative electricity sources, the UAE recently opened Barakah, the largest nuclear power plant in the Arab world. The three commissioned reactors have a total capacity of 4 GW, generating an estimated 19% of the country’s electricity. The final reactor will come online later this year, bringing the total capacity up to 5.4 GW.

Not only does this nuclear expansion provide bitcoin miners with an ample supply of cheaply generated electricity, but it will also increase the need for demand flexibility since nuclear power production cannot easily be adjusted according to the demand. As Jaran Mellerud explained in Bitcoin Magazine, bitcoin miners are uniquely flexible electricity consumers and can thus provide much-needed demand flexibility to inflexible nuclear-powered grids.

Furthermore, the new nuclear power plant is located in the extreme south of the UAE, hundreds of kilometers from the population centers in Abu Dhabi and Dubai. Given these distances, bitcoin miners could minimize power losses by establishing operations directly at this power plant, similar to Talen Energy in the United States.

Still, given the security sensitivities of the nuclear project and the early stage of bitcoin mining in the country, behind-the-meter nuclear-powered bitcoin mining will likely remain a utopia. As Reza Dabiralaei from Minestack explained, establishing a special bitcoin mining zone less than 100 kilometers from the power plant is a more realistic solution.

In addition to its nuclear project, the UAE plans a massive solar buildout in its vast, sunny deserts. The country’s biggest solar project has an operational capacity of 1.6 GW and will become one of the world’s largest at 5 GW by 2030. Solar currently generates about 3% of the UAE’s electricity, but this share will likely grow considerably over the next few years.

Solar projects at this massive scale will undoubtedly periodically generate vast amounts of excess electricity. Being location-agnostic and interruptible electricity consumers, bitcoin miners can set up operations directly at these solar farms to offtake and monetize this otherwise wasted electricity. We have seen numerous projects in the United States with such synergistic cooperation between solar farms and bitcoin miners.

Overall, the UAE keeps expanding its electricity supply at a pace North American and European consumers can only dream of. With its steady growth of nuclear and solar, the UAE will have more than enough electricity to spare for its rapidly growing bitcoin mining industry.

Electricity demand fluctuates tremendously across seasons

A thriving economy in the desert requires two critical components that people in more northern parts of the world take for granted: freshwater and cooling. The production of these components accounts for 70% of the energy consumption in the UAE. As we will now explain, this high share of energy consumption related to freshwater production and cooling has significant implications for the electricity supply and demand patterns.

Let’s first analyze the demand side. Temperatures in the UAE vary tremendously between the hottest and coolest months, leading to enormous seasonal changes in electricity consumption by the country’s hundreds of thousands of air conditioners. Due to this consumption pattern, the base demand in the winter is approximately half of the peak summer demand.

Such seasonal differences naturally put strains on the electricity system. To make the situation even more challenging, UAE’s power plants cannot reduce their output during the winter to accommodate the lower demand. We will now explain why.

Having limited freshwater resources, the UAE uses combined power and desalination plants to desalinate seawater. Due to the critical necessity of delivering freshwater, these plants must run at a relatively continuous capacity throughout the entire year, even though the electricity demand fluctuates tremendously between the hottest and coolest months. This leads to enormous amounts of wasted electricity.

In 2021, the UAE produced 149 TWh while consuming only 129 TWh, corresponding to a wasted surplus of 20 TWh. If we assume an alternative cost of $0.03 per kWh, this wasted electricity costs the utilities approximately $600 million in lost annual revenues.

Bitcoin mining fixes this. As Marathon’s CEO Fred Thiel explained on The Mining Pod, bitcoin miners can increase the utilities' revenues by monetizing this previously wasted electricity. The utilities can then invest this increased revenue in further improvements of the electricity system or by lowering electricity tariffs for residential, commercial, or industrial consumers.

Reza Dabiralaei explains it similarly but emphasizes the demand flexibility bitcoin mining provides to the electricity system. The UAE currently has no baseload electricity consumers with an even demand profile throughout the year. By adding a steady and flexible bitcoin mining component to the grid, the UAE’s electricity system can reduce its high share of seasonal-dependent demand, making the system more efficient and resilient.

Electricity tariffs are sector dependent

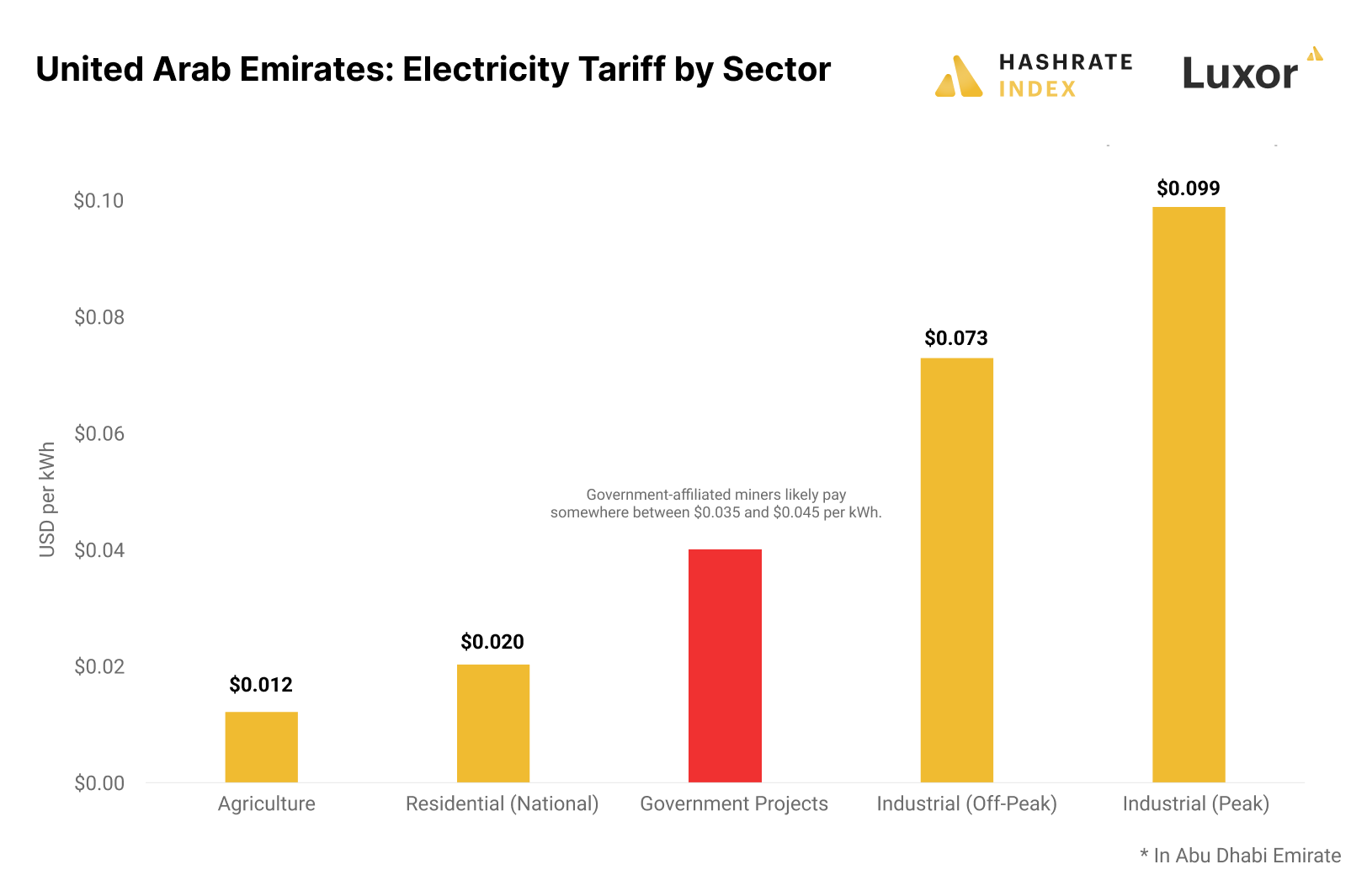

The UAE operates a utility-structured electricity market, where the government controls the utilities. Electricity tariffs set by the utilities vary depending on the sector of the end-consumer, with significant tariff differences.

For example, the government subsidizes electricity for agricultural consumers at $0.012 per kWh. This subsidy has inadvertently created an opportunity for operators to establish small bitcoin mining farms on agricultural land, benefitting from the subsidized electricity rates. Dozens of such small mining farms have sprouted across the countryside.

However, this strategy of taking advantage of government subsidies is not sustainable in the long term, as happenings in Kazakhstan and Kyrgyzstan have proved that governments are not inclined to tolerate such exploitation.

A unique aspect of the UAE’s electricity system is that citizens of the country pay considerably less for electricity than expatriates. Many UAE citizens have installed small bitcoin mining farms in their backyards and basements to arbitrage their heavily subsidized electricity rate of $0.02 per kWh.

We see the same story everywhere - electricity subsidies attract bitcoin miners.

While UAE nationals and farmers feast on cheap electricity, industrial consumers pay relatively high rates of between $0.073 and $0.099 per kWh. These rates are prohibitively high for bitcoin mining, which brings us to the question: How much do the semi-governmental mining projects pay for electricity?

Even though we have no definite sources, we believe the semi-governmental bitcoin mining projects pay between $0.035 and $0.045 per kWh. This price is fair given the cost of generation in the UAE, and also, we assume Marathon would never have entered the UAE if it paid more than $0.045 per kWh.

In the current electricity tariff regime, there are only three ways of operating as a bitcoin miner in the UAE. First, you can exploit subsidies by running small bitcoin mining farms on agricultural land, but this is neither a scalable nor sustainable strategy. Second, if you are a UAE national, you can install a small mining shed in your backyard - also not remarkably scalable.

Thus, the only way for bitcoin miners to obtain a reasonable electricity rate in a scalable and sustainable manner in the UAE is to partner with a government entity, as Marathon has done.

Access to capital is excellent in the UAE

The UAE is exceptionally wealthy due to its oil and gas resources. Furthermore, in recent years, Dubai and Abu Dhabi have transformed into international centers of commerce and attracted enormous amounts of foreign direct investment. These cities are filled with wealthy sovereign wealth funds, government affiliates, family offices, and other investors that want to get a piece of the scarce bitcoin pie.

To maximize control of their investments, many of these investors want to mine the bitcoin themselves, ideally within the borders of the UAE. An example is Zero Two’s projects in Abu Dhabi.

During our stay in the country, we met many mining-as-a-service companies like Phoenix Store and Blockfarms, which help offtake some of the never-ending local investment demand for bitcoin mining. Notably, these companies don’t offer hosting solutions within the country but abroad in places like Canada, the United States, Russia, and Paraguay. There are currently limited hosting options in the UAE for smaller-scale miners, as the big semi-governmental projects focus on self-mining.

It’s critical to remember that one of the primary reasons the United States quickly grew into the world’s number one country for bitcoin mining was its strong capital markets. Like the US, bitcoin mining projects in the UAE will have excellent access to capital and can much easier raise money than projects in other mining hubs like Russia and Paraguay.

A politically stable and business-friendly country

An absolute monarchy split into seven emirates, each led by a local ruling family, the UAE has enjoyed unprecedented political stability since its inception in 1971. Building on this stable foundation, the country has followed a doctrine of business friendliness that has transformed the cities of Dubai and Abu Dhabi from tiny fishing villages in the 1970s into international metropolises of commerce.

The UAE is not resting on its laurels and keeps pushing to diversify its economy further and build new industries. The country is eager to develop its IT sector and wants to have vital data center infrastructure within its borders. As we know, bitcoin mining is a great way to build multipurpose electrical and data center infrastructure quickly.

Furthermore, the UAE has been highly open to the crypto sector. Crypto friendliness is positive for bitcoin miners, as it could bring advantages in relations with government organizations, banks, and other service providers. We particularly see this as an advantage in light of the recent tightenings in access to banking for crypto companies and bitcoin miners in the United States and Canada.

One of the reasons the UAE has attracted vast amounts of foreign direct investment is its tax advantages. Certain export-oriented companies, including bitcoin miners, can register in one of the country’s more than 30 free trade zones and avoid corporate tax, VAT, and import duties. This is an enormous advantage in a global, cut-throat competitive industry like bitcoin mining.

An example of such a free zone is the Abu Dhabi Global Market (ADGM), which is where Marathon and Zero Two set up their Abu Dhabi bitcoin mining entity. This free zone specifically has been highly focused on attracting digital asset businesses.

Still, it’s critical to be aware that the UAE is an absolute monarchy where the government prefers to be heavily involved in sectors it deems vital. Given bitcoin mining’s close relationship with the energy sector, the UAE government will likely seek control over the industry. We already see this happening.

Currently, there is no specific regulation in place for bitcoin mining. Thus, all miners, except for the semi-governmental projects, currently operate in a legal gray zone. The sector will likely be regulated soon, with the government creating a licensing scheme where private companies can apply for a mining license and must operate in a specific government-approved way. This is similar to how the country regulated its oil and gas sector.

Among the harshest operating conditions globally for mining

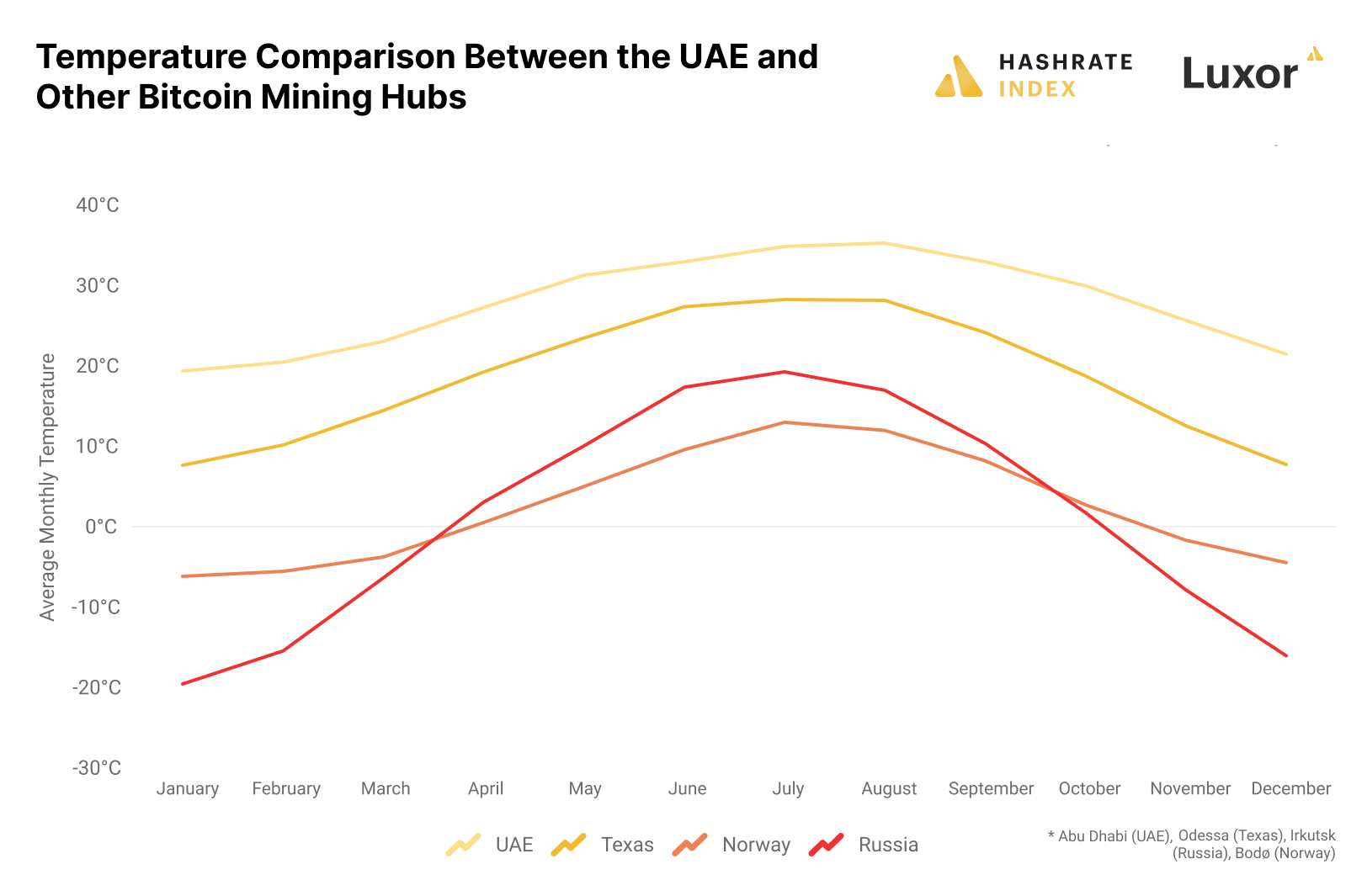

The UAE might have a lot going for it for mining when it comes to its political stability, business friendliness, strong capital markets, and abundant energy resources, but it has among the most mining unfriendly climate on the planet. A monstrous combination of burning heat, high humidity, salty air, dust, and periodic sandstorms makes for a challenging existence for the country’s bitcoin mining operations.

The heat is the biggest issue. Located in the desert, average day temperatures in the UAE range between 24°C in January to 42°C in August. During the summer, it is not unusual for temperatures to surpass 50°C.

Meanwhile, as shown on the chart above, average monthly temperatures in the bitcoin mining hub of West Texas range between 14°C and 35°C, substantially cooler than in the UAE. Interestingly, even in West Texas, miners periodically curtail during the summer due to hot weather.

During our UAE trip, we have seen facilities run with air cooling during outside temperatures of around 45°C. The operator used water curtains to cool the air entering the facility. As a result, the ambient temperature close to the racks sat at an acceptable 26°C. Still, water is an expensive resource in the UAE, and we doubt this water curtain setup will work as well on the hotter summer days when the temperature regularly surpasses 50°C. We also question how operating in this hot environment impacts the machines’ lifespan.

One thing is sure, miners in the UAE should, on the hot summer days, underclock with the LuxOS firmware to reduce chip temperature, improve efficiency and increase the machines’ lifespan.

The heat is not the only climatic factor plaguing UAE miners, as vast amounts of dust and periodic sandstorms also pose considerable problems. Air-cooled facilities can utilize dust filters, but it is still impossible to entirely prevent dust from entering the machines and shorten their lifespan.

Hydro or immersion cooling dampens the effects of heat and dust, making them preferable cooling solutions in the region. Hydro cooling poses more challenges than immersion since the UAE lacks freshwater, and it is still being determined how well the desalinated water works in the hydro cooling setups.

To provide the maximum benefits to the electrical grid, bigger mining projects in the UAE will need to guarantee their electricity consumption at all times. Therefore, they must have sufficient cooling infrastructure to avoid frantic curtailing during the summer heat. Only immersion-cooling offers that reliability right now, which is undoubtedly part of the reason why Zero Two and Marathon are implementing that solution in their new facilities.

Still, the immersion fluid must also be cooled, a challenging feat when the outside temperature surpasses 50°C. Therefore, immersion-cooled facilities in the UAE will likely have to use heat pumps or similar technologies to cool the fluid, leading to a considerable cooling electricity consumption on top of what the machines already consume.

Operating large-scale bitcoin mining facilities is still an experiment in the UAE when it comes to cooling solutions. Even though the climate conditions here are among the harshest in the world, we still have no doubts operators will figure out an optimal solution that will allow them to operate even during the hottest summer months. Still, no matter how efficient their systems, miners in the UAE will always suffer higher cooling costs than miners in cooler environments, like Norway.

Conclusion

Blessed with abundant energy resources, the Middle East is one of the most promising regions for bitcoin mining. And as the most open and business-friendly country in the region, the UAE is unsurprisingly leading the way.

The UAE has a considerable electricity surplus that only will grow bigger in the coming years as it adds more nuclear and solar to its grid. Bitcoin miners could provide significant benefits to the electricity system in the form of monetization of previously wasted electricity and much-needed demand flexibility.

Although the country holds massive bitcoin mining potential, the industry is still in its early stages and not yet regulated. Currently, the only way to mine bitcoin in a scalable and legally sustainable way is by partnering with a government entity. This is how Marathon entered the country.

Marathon might have been the first North American miner to move into the UAE, but it will not be the last. Geographic diversification is becoming an increasingly important consideration for North American bitcoin miners, and few places outside North America and Europe offer such high levels of political stability and business friendliness as the UAE. Growth in the country will likely be led by local semi-governmental players in collaboration with established players like Marathon.

While there are many advantages of operating in the UAE, we can’t get around the biggest challenge of them all: the hostile climate. Bitcoin miners can handle this challenge by utilizing immersion cooling and firmware.

Overall, the UAE will become an increasingly important bitcoin mining country over the next couple of years and could provide a case study for other Middle East countries to follow.

Are you scaling a Bitcoin mining operation and in need of mining software, services, or hardware? We can help. You can reach us here.

Thanks to Reza Dabiralaei (Minestack), Adam Swick (Marathon), Charlie Schumacher (Marathon), Omar Rashid (Blockfarms), and Jose Farrona (ALEC Data Center Solutions) for their invaluable insights that helped us write this article.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.