Hashrate Index Roundup (February 5, 2024)

Bitcoin's hashrate is back with a vengeance after January's winter storms, and difficulty is at an all-time high as a result.

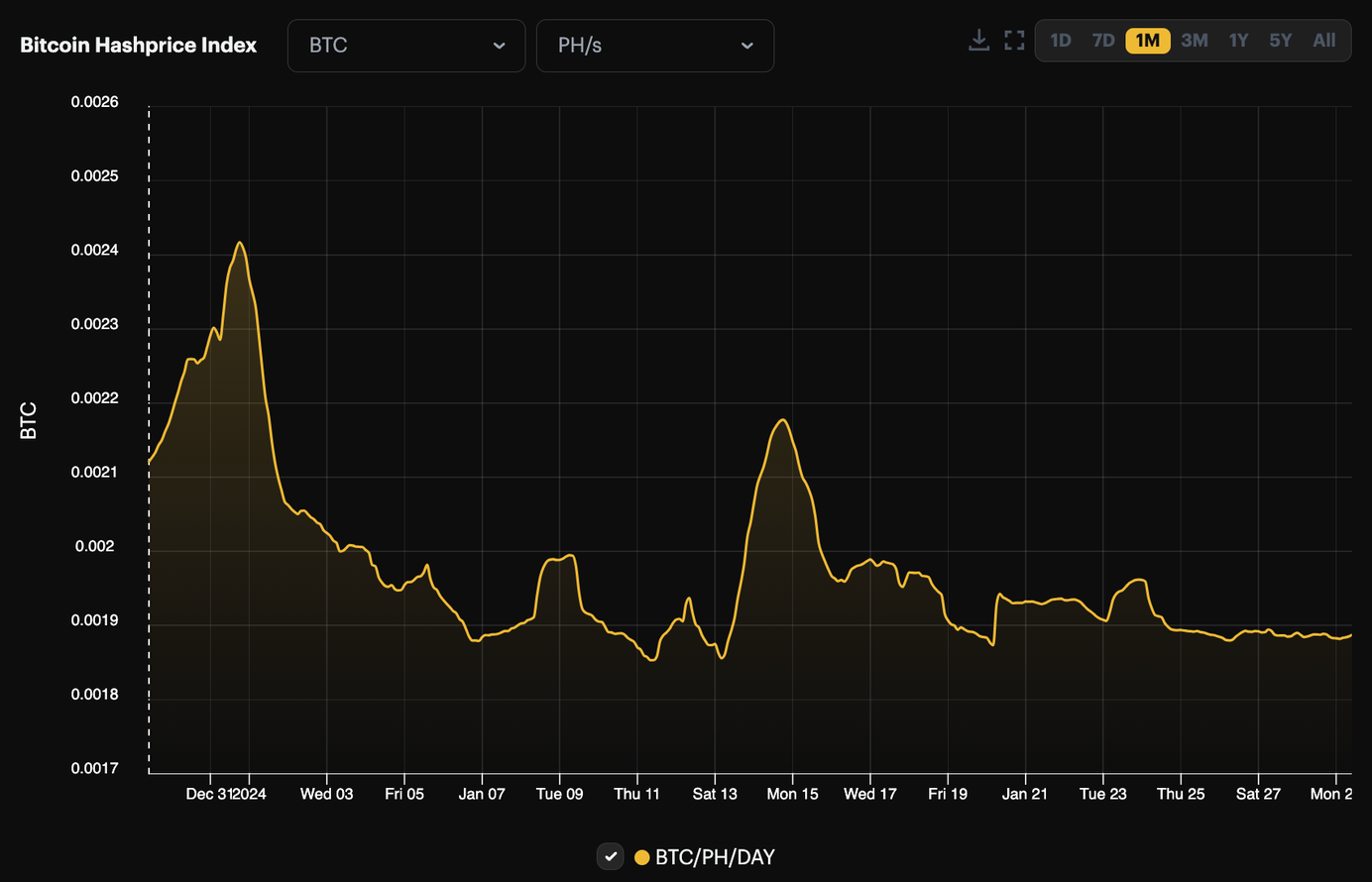

Hashrate Index Roundup (January 29, 2024)

Bitcoin's hashrate hits an all-time high, and hashprice is back above $80/PH/day.

Bitcoin Mining Predictions for 2024

Here are a few predictions for the Bitcoin mining industry in 2024.

Hashrate Index Roundup (January 21, 2024)

Gobs of hashrate came offline last week, and mining difficulty fell by its largest percentage since December 2022.

Hashrate Index 2023 Bitcoin Mining Year in Review: In the Shadow of the Halving

2023 was a comeback year for a beleaguered Bitcoin Mining industry. We cover the highlights in our 2023 Bitcoin Mining Year in Review.

Bitcoin Mining in Canada: 2023 Recap and Looking Ahead to 2024

Bitcoin miners in Canada faced policy challenges in 2023, but they also adapted to this adversity.

Hashrate Index Roundup (January 7, 2024)

We're ringing in the new year with all-time highs for Bitcoin's hashrate and difficulty.

Luxor’s 2023 Year in Review: All Markets are for Building

We had a blockbuster 2023 at Luxor, and we're gearing up for an even better 2024.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.