The Bitcoin ASIC market is (mostly) recovering: Luxor RFQ April Insights

New-gen rigs are rising, but Antminer S19 XP prices have fallen 42% year-to-date.

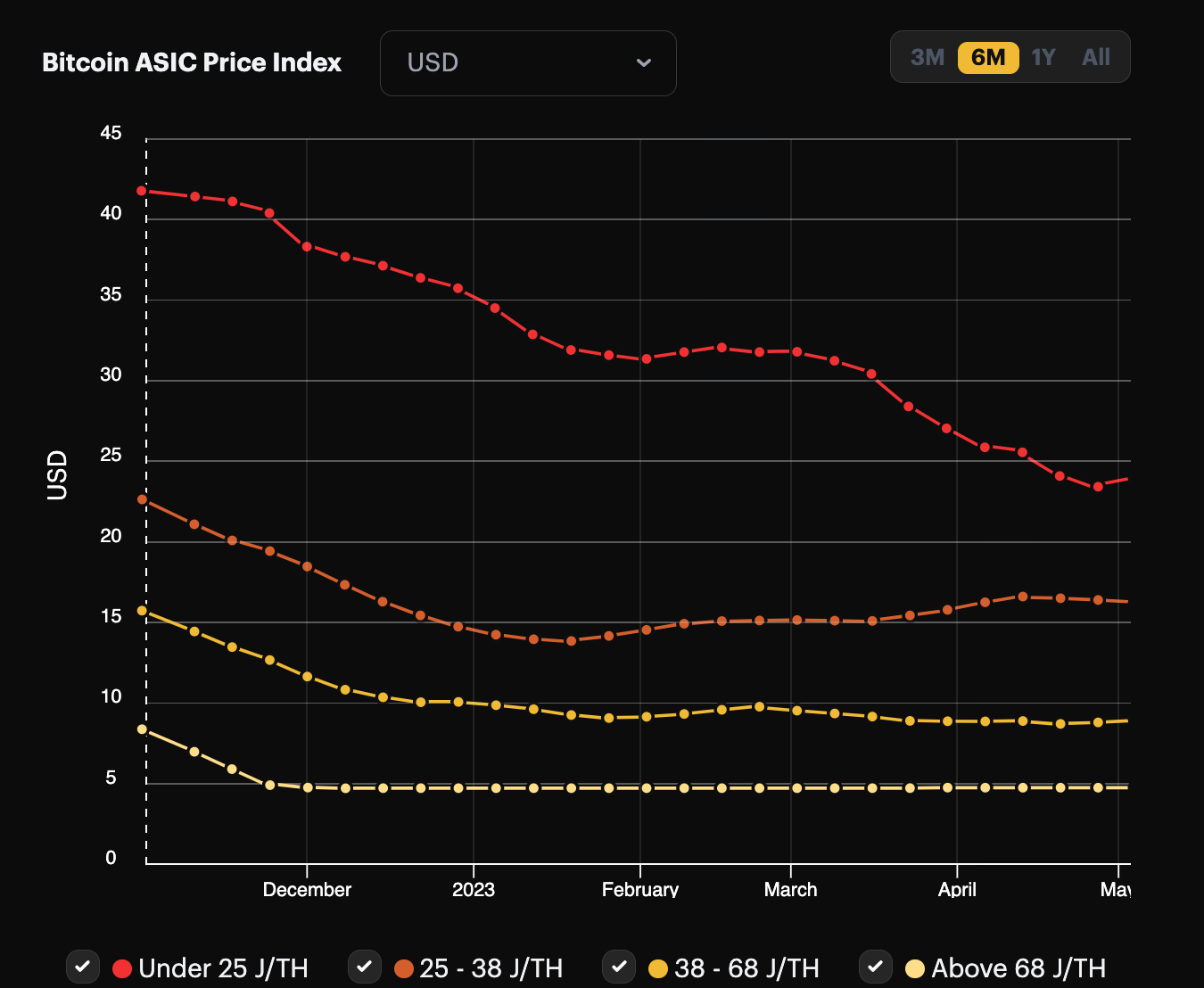

2022’s bear market bloodied every aspect of the Bitcoin mining sector, and nowhere was the bloodletting more clearly demonstrated than Bitcoin mining ASIC prices.

But after over a year of plunging valuations, ASIC miners have stabilized and prices bounced in Q1 of this year.

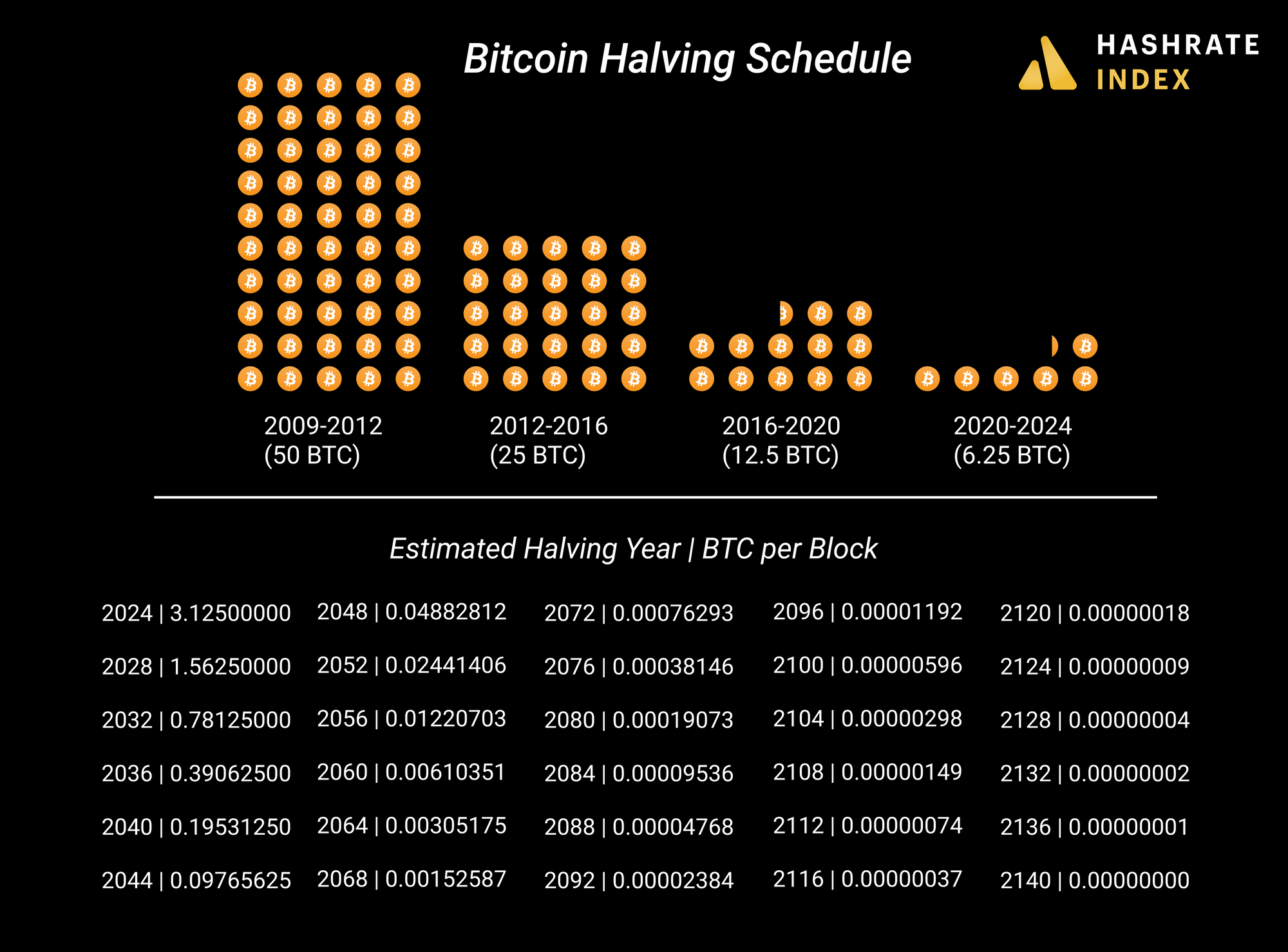

With Q1 setting the pace, miners were off to the races in the first month of Q2, with 2024’s halving less than a year away as their finish line. As legendary auto racer, Bobby Unser once said, “Success is where preparation and opportunity meet.”

For Bitcoin miners, the opportunity now is in yearly-low ASIC prices and the fact that hashprice is hovering around $80/PH/day. To set themselves up for success when the next halving hits, miners are taking advantage of yearly-low ASIC prices and this year’s more favorable hashprice to reinvest their profits into new hashrate.

Earlier this year, Luxor launched an auction-style ASIC marketplace called Luxor RFQ. With this one-of-a-kind, open auction ASIC marketplace, Luxor's ASIC Trading Desk team has clear insights into the current state of the mining market – from pricing trends to shipping flows, and everything in-between. This request-for-quote platform is designed to give buyers and sellers the most competitive deals in an open and transparent marketplace. Since launch, over 2.56 EH of hardware has been traded through the platform, with 1.18 EH of machines purchased in April alone.

For the rest of this article, we’ll be focusing on some takeaways from Luxor RFQ’s April operations.

The Antminer S19j Pro+ is here and it’s cutting into the Antminer S19 XP’s price premium

Bitmain unveiled the Antminer S19 XP in November 2021, and the first shipments of the model first came to market in June 2022. Given 2022’s bear market mining economics, the Antminer S19 XP carried a BIG premium over new-gen machines like the Antminer S19j Pro, leading to the model being overpriced for much of 2022 relative to its earning power.

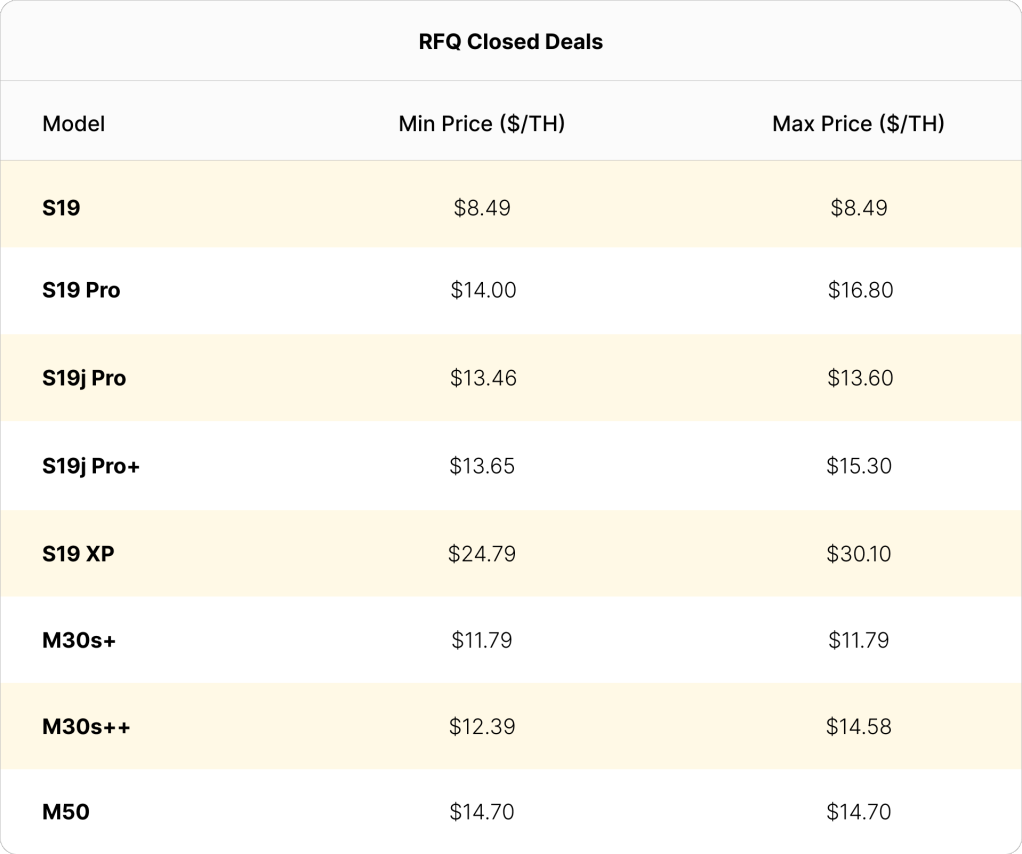

Now, Luxor’s ASIC Trading Desk is seeing excitement around the newly shipped Antminer S19J Pro+ model from Bitmain. These machines produce 20% more hashrate than the original J Pro and have an efficiency of 27.5 J/TH, which isn’t quite as good as the Antminer S19 XP, but it’s better than the S19j Pro. Despite its efficiency and hashrate boosts, the S19j Pro+'s price premium to the Antminer S19j Pro is much smaller than the S19 XP's premium to it.

As we can see in the chart above, which includes April price data for Luxor’s RFQ, the price spread for the S19 XP is the largest on both a dollar and percentage basis. This demonstrates how drastically S19 XP prices and premiums have fallen as new rigs like the Antminer S19 Pro+, Antminer S19e Pro, and Antminer S19K Pro come to market with more competitive pricing out-the-gate from Bitmain.

To highlight the Antminer S19 XP’s premium further: Assuming a power rate of $0.07/kwh and an average hashprice of $75/PH, an Antminer S19j Pro+ should have ROI in less than a year and half. Compare that to an S19 XP, which has a 30% longer ROI time period due to the current price premium. This indicates that S19 XP prices could continue to fall from their current levels.

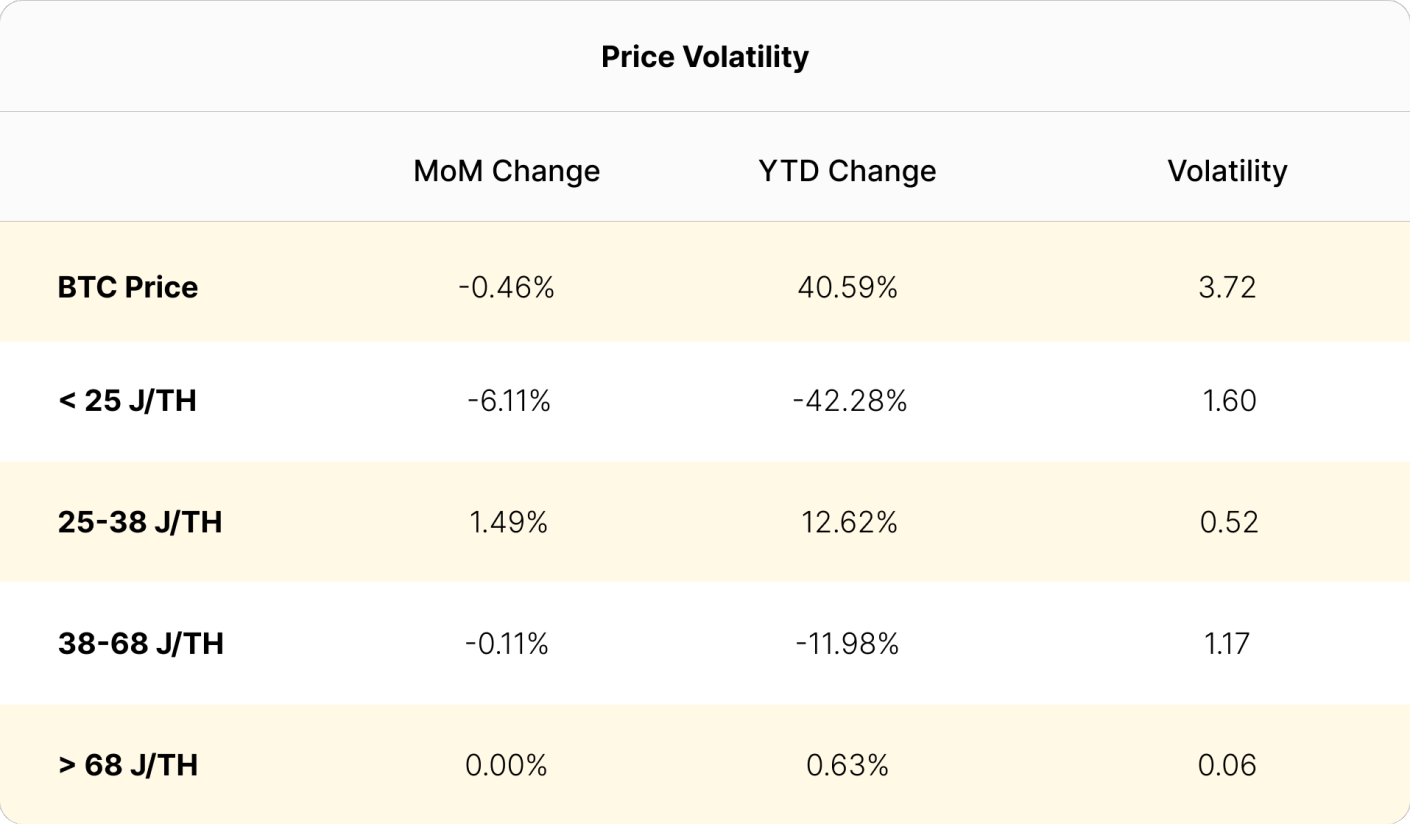

The data set above shows how Bitcoin's price rise this year has out paced machines of all efficiency tiers, but most notably, next gen machines like the S19 XP have fallen dramatically year-to-date, while new-gen rigs have risen slightly. We tackle the relationship of these conflicting price trends in this article on ASIC price premiums for those who want to learn more.

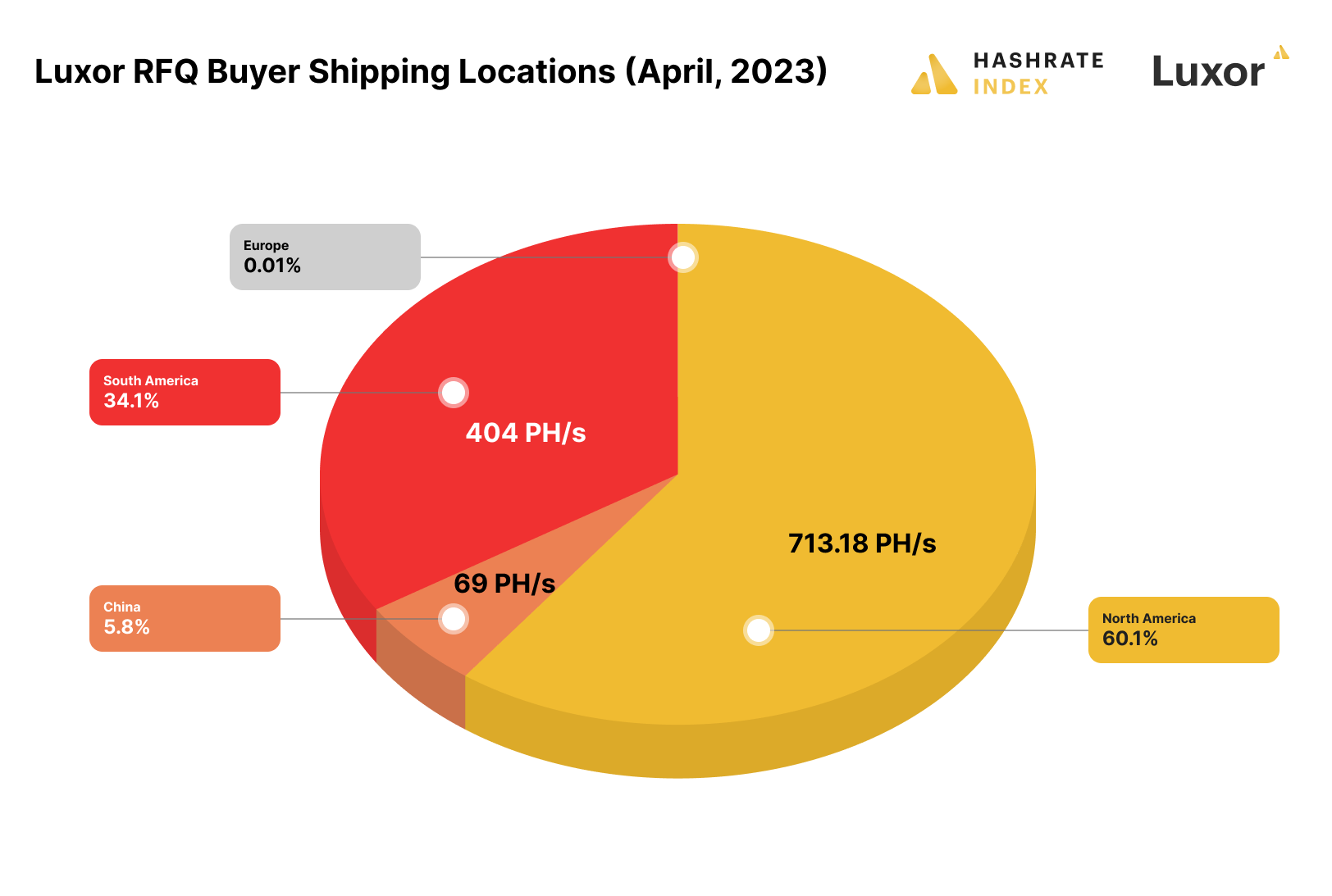

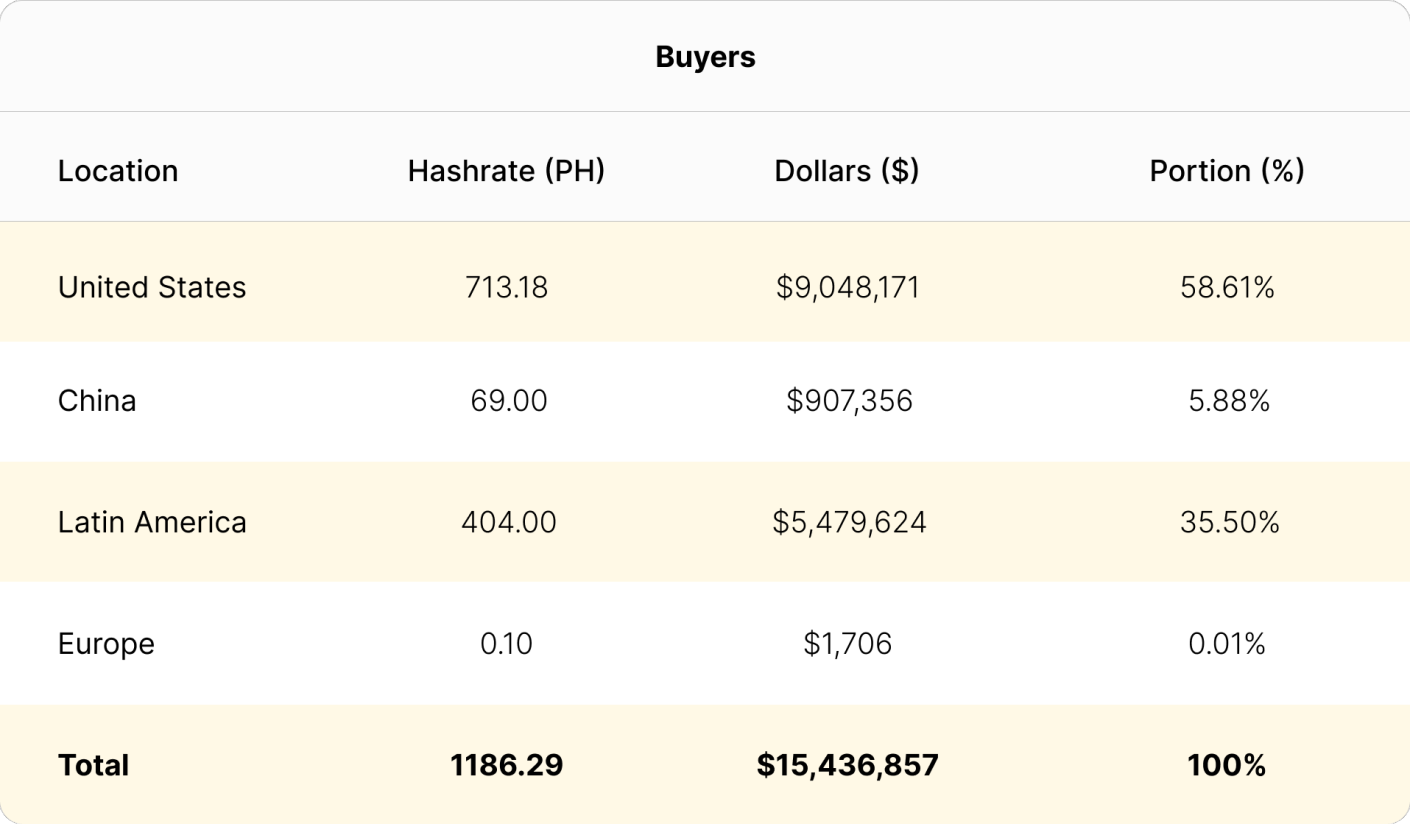

North and South America Bitcoin miners make up bulk of buyers in April 2023

The majority of shipments from Luxor’s RFQ marketplace went to North America. But South America purchased its fair share, too. Due to the ongoing regulatory headwinds in North America, many operators have begun diversifying into Latin America - namely Paraguay.

We also saw notable shipments to China as the Bitcoin mining industry continues to rebuild in the region following (and despite) the government's 2021 Bitcoin/crypto mining ban.

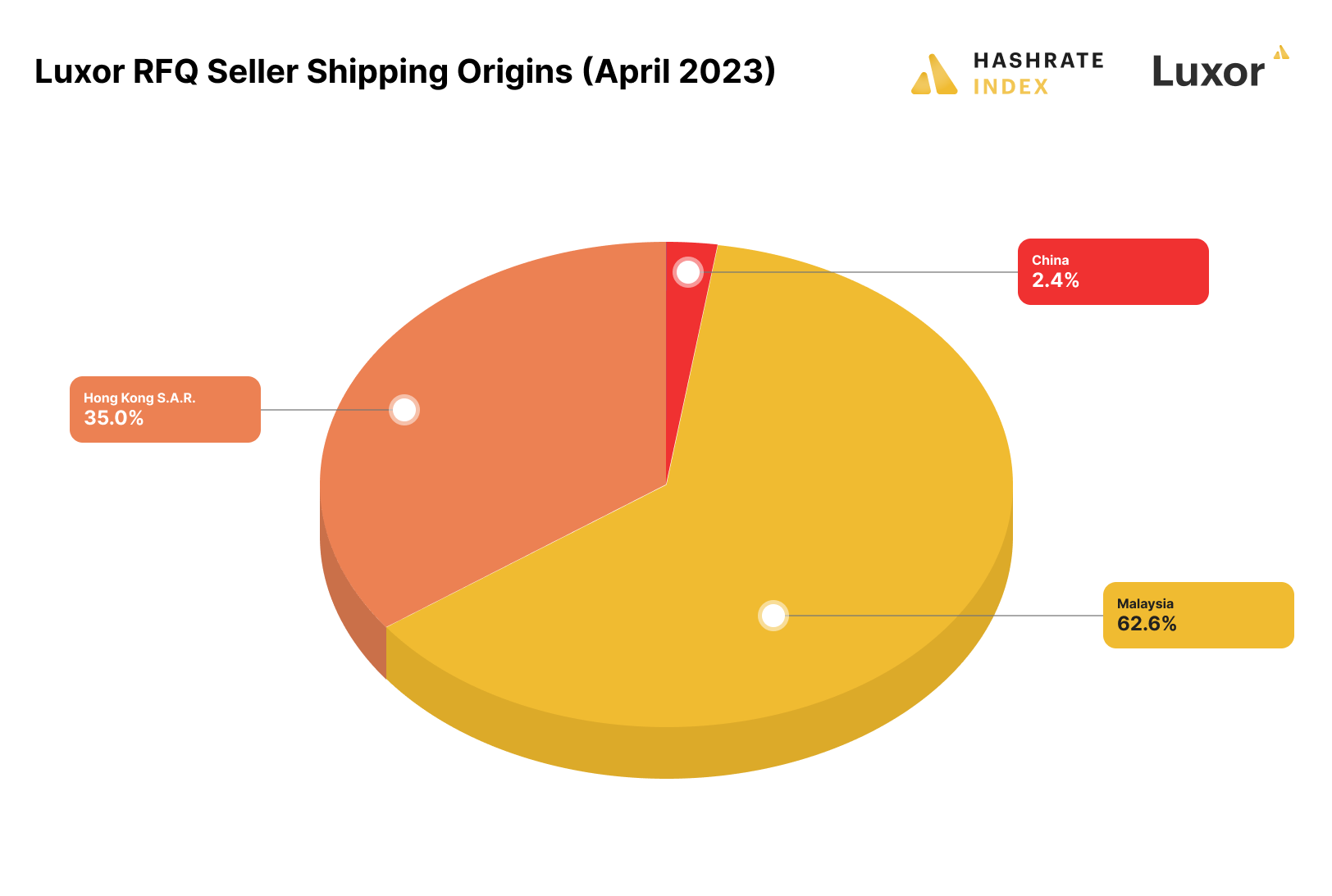

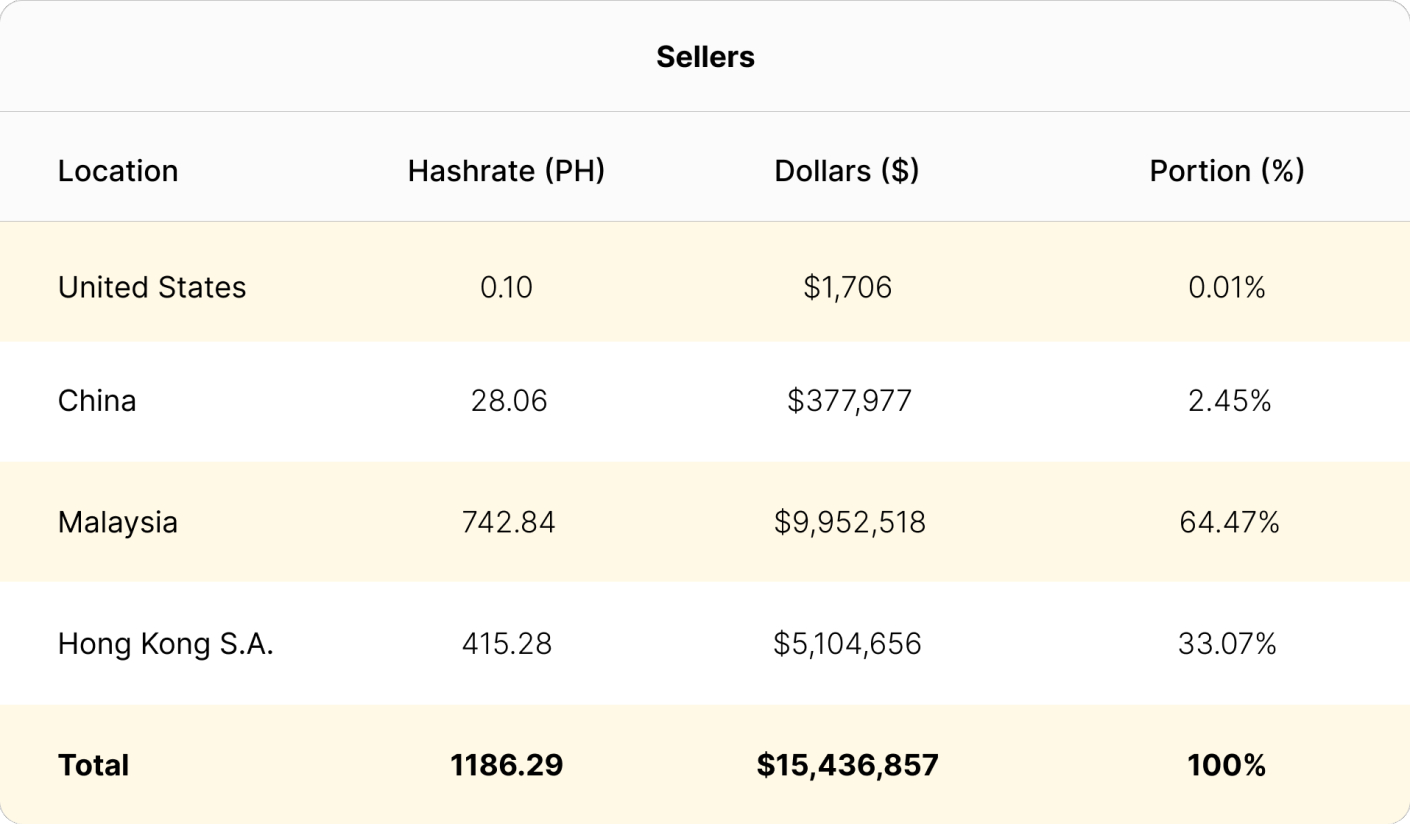

Supply remains consistently strong out of Asia, with the majority of exports coming from Hong Kong and Malaysia. Bitmain relocated a lot of its manufacturing capabilities to Malaysia following the 2021 China Mining Ban, and we can see this reflected in April’s numbers.

Will Antminer S19 XP prices rise or fall for the rest of 2023?

The 42% year-to-date price decline of next generation ASIC miners like the Antminer S19 XP is one of the most notable datapoints from our April update. Whether or not the Antminer S19 XP falls or rises from here depends on if Bitmain runs another promotional price campaign to stimulate XP purchases.

It also depends on the flow of new hardware from Bitmain to resellers. Bitmain currently has no plans to release anything that is more efficient than the S19 XP this year, but if it receives enough interest, it could start shipping its newest model, the Antminer S19K Pro, in Q2, which has next-gen efficiency but isn't as efficient as the S19 XP.

With all of that in mind, we'll be watching closely to see if next-gen premiums continue to fall or if they rise in the months leading up to the 2024 Bitcoin Halving.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.