Highlights from Marathon Digital's Q3 2022 Earnings

After a tough Q3, Marathon Digital is in search for liquidity via market offerings and BTC-collateralized loans.

Marathon Digital, one of the largest publicly traded bitcoin miners, has struggled to keep their mining fleet operational for the majority of 2022. Marathon turned the tide in Q3, though, and the company now reports an operational hashrate of 7 EH/s (though on-chain data puts this number closer to 4 EH/s).

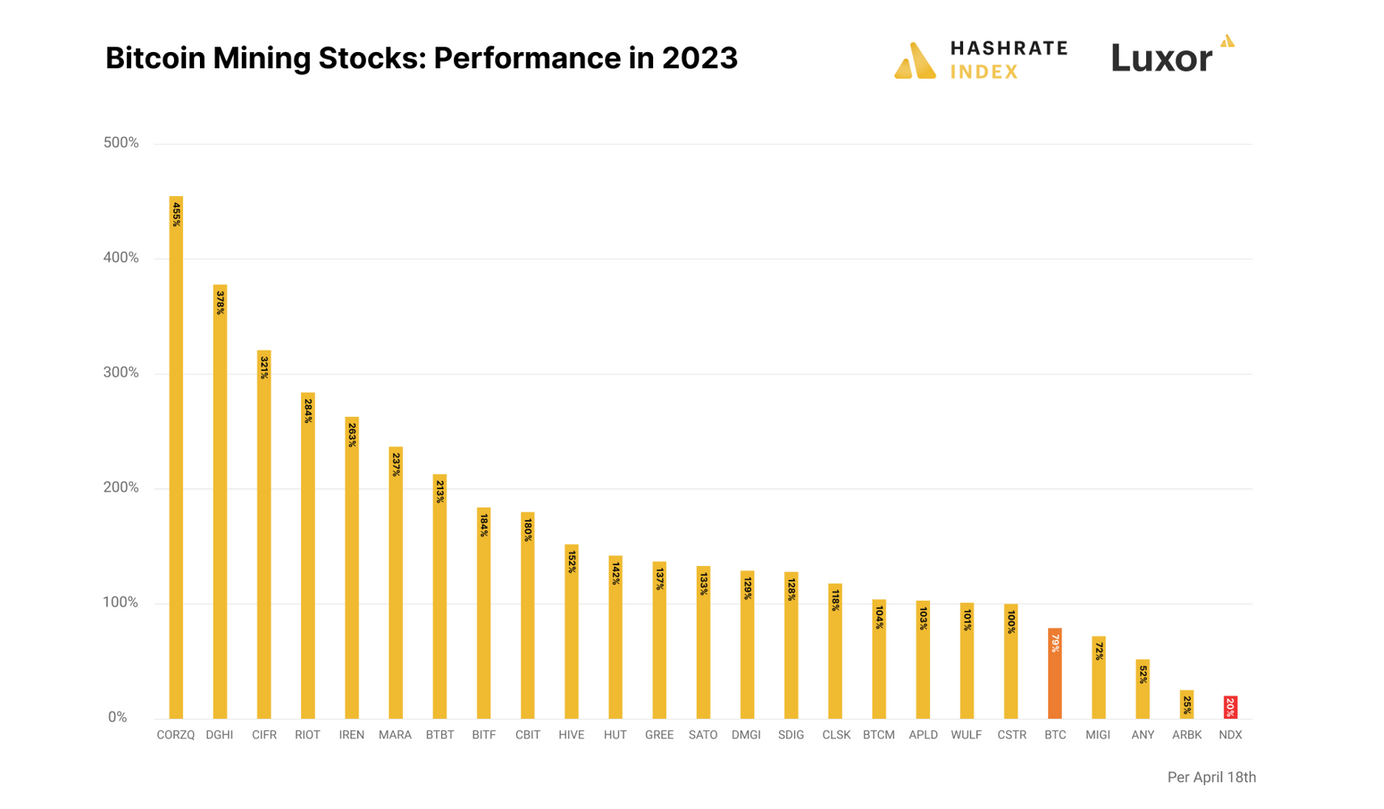

The entire Bitcoin mining sector is taking a beating, as well-established cryptocurrency platforms halt withdrawals after the FTX failure. Most investors are taking their money off the table and selling away Bitcoin mining stocks. Very few investors have the stomach to see their capital evaporate in the depths of the panic.

Let's take a look at Marathon Digital's Q3 earnings report.

Marathon's Balance Sheet Softens in Q3

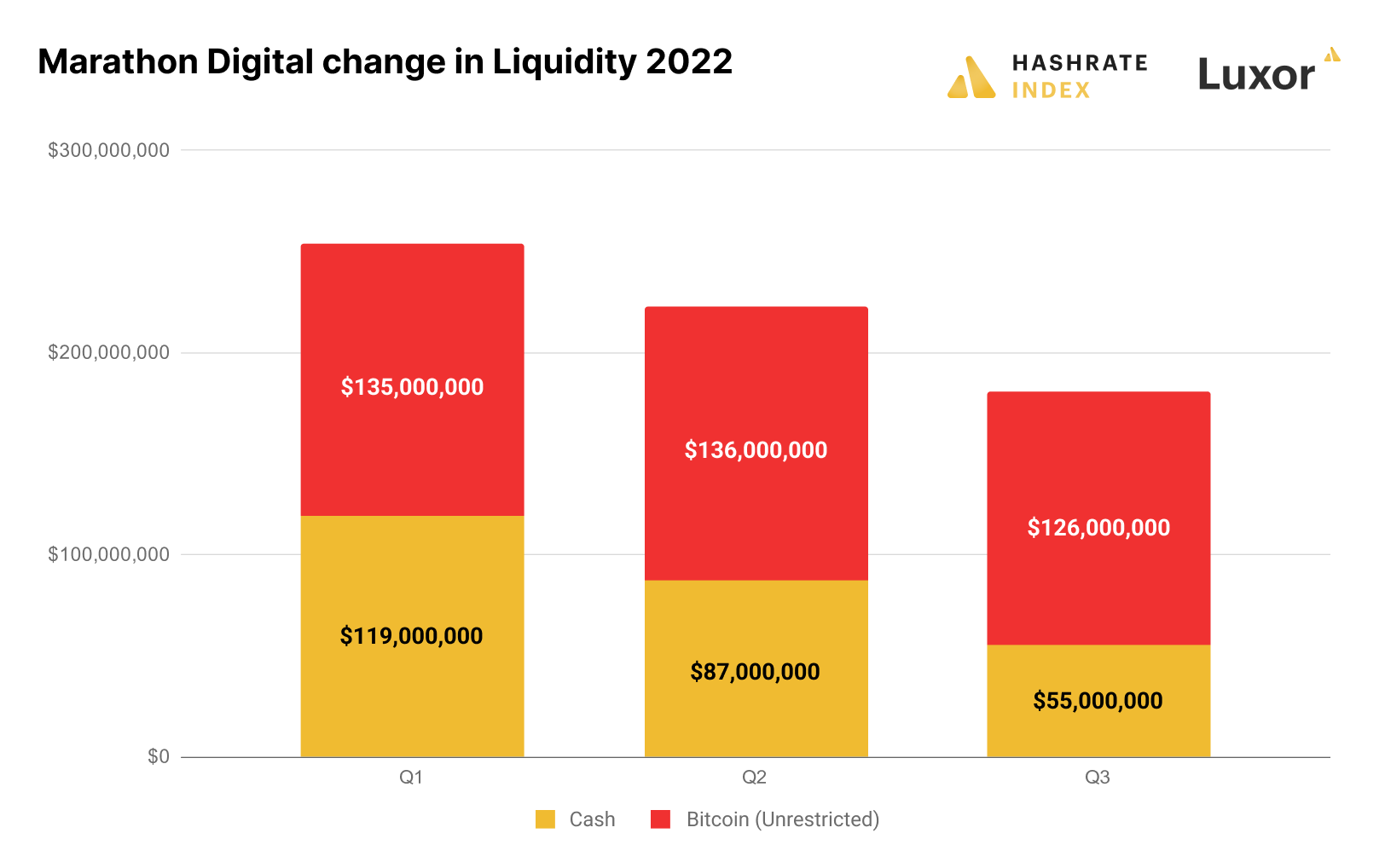

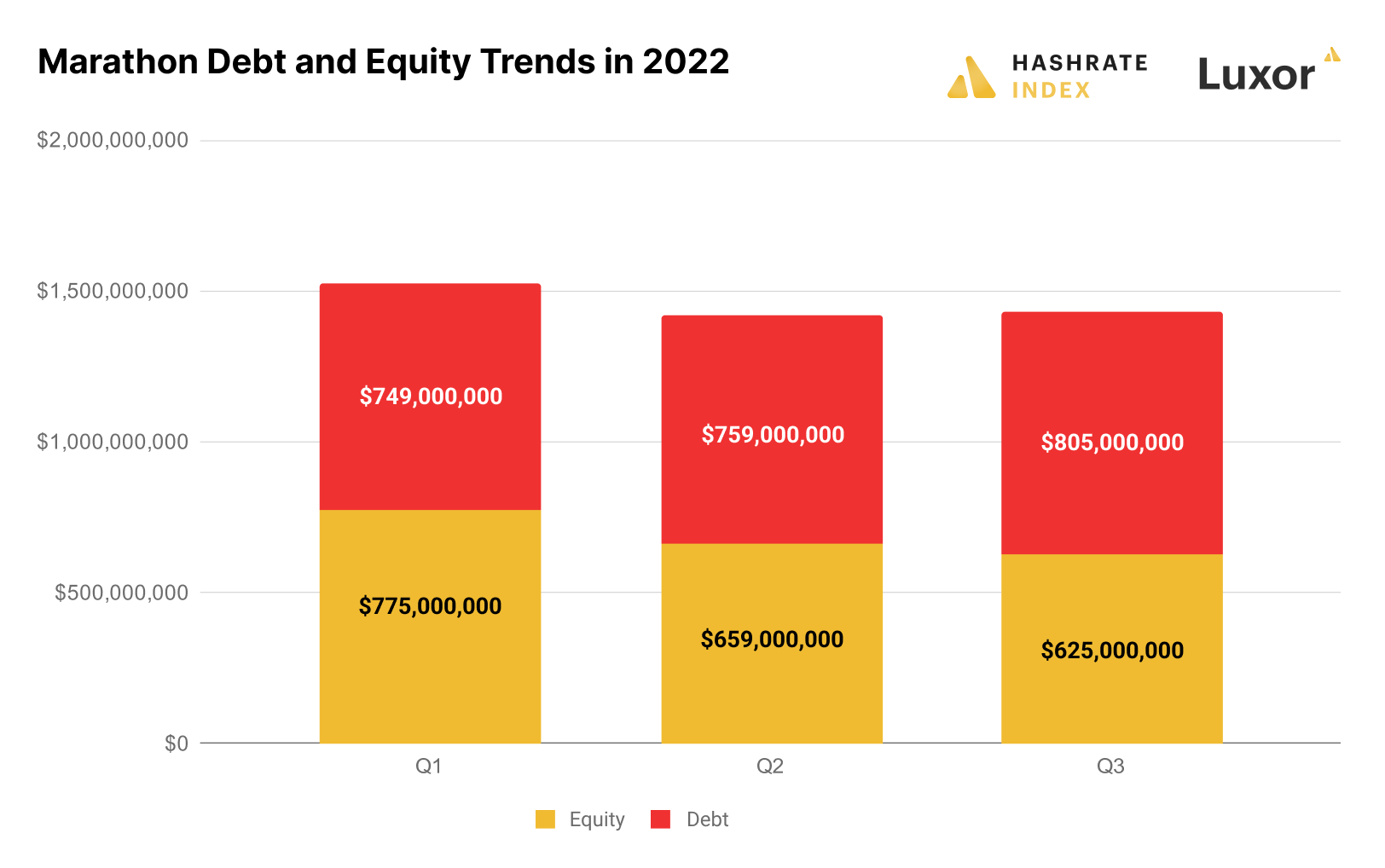

As the crypto contagion takes hold of the markets, investors want the peace of mind that they own miners with strong balance sheets. In the early days of the bull market, Marathon Digital raised most of their capital through debt and equity. Now, with limited options for raising capital, Marathon is using its Bitcoin as collateral for loans to shore up cash liquidity.

The chart above shows cash and unencumbered Bitcoin available to fund their ongoing operations and growth. As you can see, cash available for their business is treading down quarter over quarter. With cash on hand moving lower, Marathon Digital has started to collateralize their full Bitcoin stack for greater liquidity via a revolving creditline with Silvergate (which we discuss in detail in the following section).

Besides using their Bitcoin stack for ongoing working capital needs, Marathon has raised capital through their $750 MM at-the-market offering. In their Q3 earnings release, Marathon indicated they raised about $198.7 million through the ATM facility.

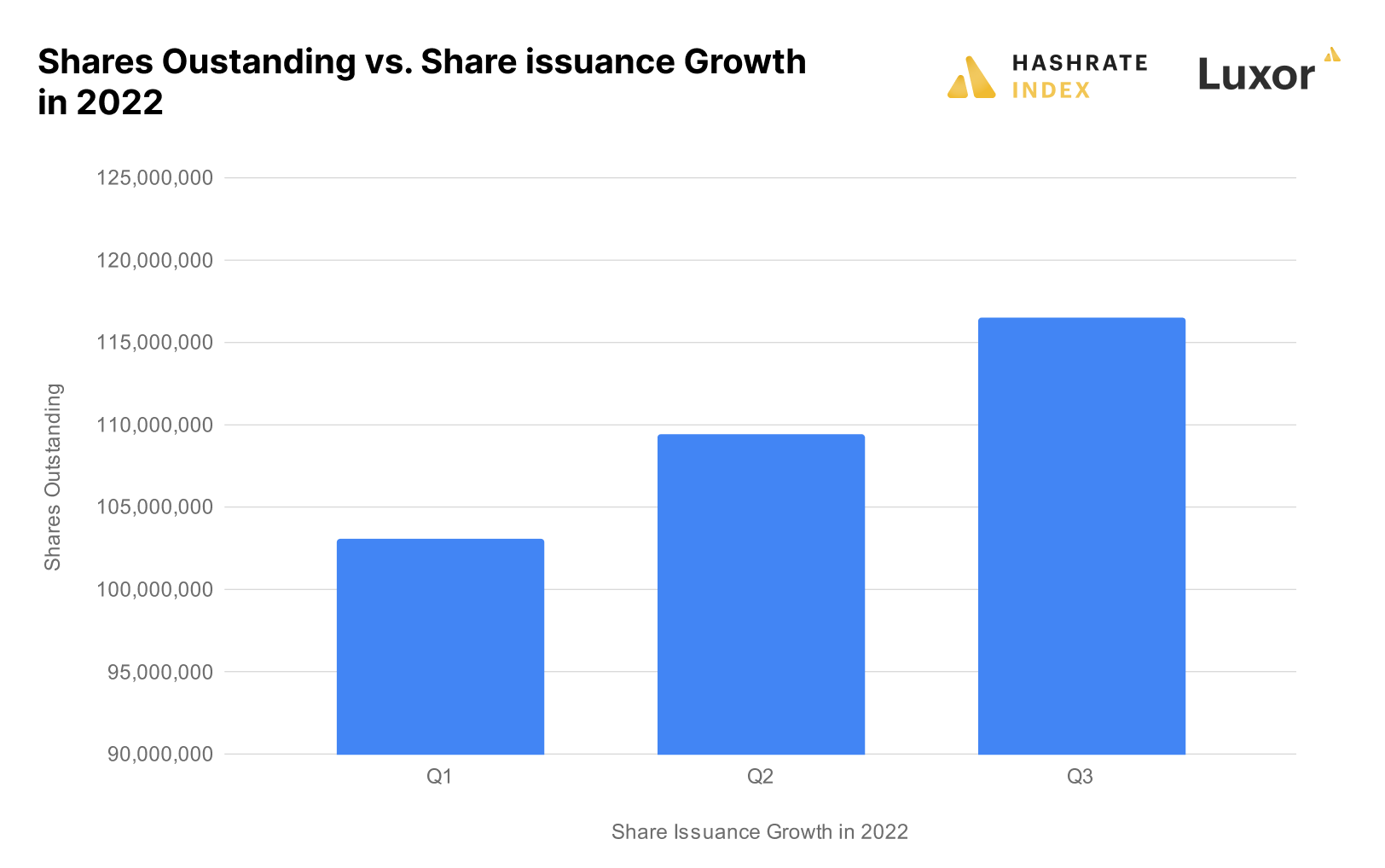

Indeed, as you can see from the chart below, share issuance is trending higher.

Marathon's BTC Collateralized Loan With Silvergate

Marathon Digital established a new $100 million dollar revolving line of credit with Silvergate Bank in the summer. Under the terms of the agreement, Marathon Digital is securing working capital by collateralizing their Bitcoin stack for the $100 MM loan facility. As you can see from the chart below, the increase in debt is mainly attributable to drawing $50 million from the revolving credit line.

With the recent revelations about FTX bankruptcy, many investors are concerned about potential risk securing a Bitcoin loan with third-party custodians or banks. Marathon Digital has partnered with Silvergate Bank for their revolving credit line. Under the terms of the loan, they must maintain a certain level of Bitcoin to keep current with conditions of the credit facility.

Here are two key pieces of information for their revolving line.

At origination, the Company must ensure the Collateral Account balance has sufficient bitcoin to cause the LTV ratio to equal 65% (or less) (“Minimum Advance Rate”) on the unpaid principal balance of the facilities. If at any time the LTV ratio exceeds 75%, the Company must bring the rate of advance to the Minimum Advance Rate.

Covenants: The Company must maintain a minimum adjusted net worth of $350 million. The Company must maintain a minimum liquidity of $25 million

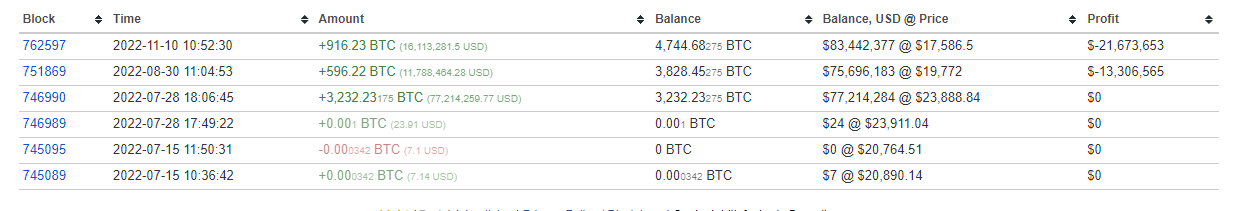

In their earnings release, Marathon Digital disclosed they have had to increase Bitcoin collateral to support the loan. Contained within the earnings report, Marathon Digital indicated on November 9th, 2022 they owned a total Bitcoin stack of 11,440. Of that total amount of Bitcoin, 9,490 was fully committed to the credit facility. About 82% of their entire Bitcoin stack is committed to the $100 MM loan. The total market value of Bitcoin collateral at the time of their earnings release was approximately $153 million.

On-Chain data confirms the company has had to increase their collateral to support the loan arrangement. Marathon Digital has $50 Million on bitcoin address 17mnsnn and $50 million on block address 13CnBQc. If Bitcoin were to decline below $14,000, Marathon would need committed nearly all of their 11,440 BTC to secure the loan.

Marathon Digital - Mining Fleet Performance

Every Bitcoin miner is battling tooth and nail for every Bitcoin block reward. The entire Bitcoin network hashrate has experienced significant growth in overall difficulty. With Bitcoin prices moving lower, every miner is experiencing compression in mining margins.

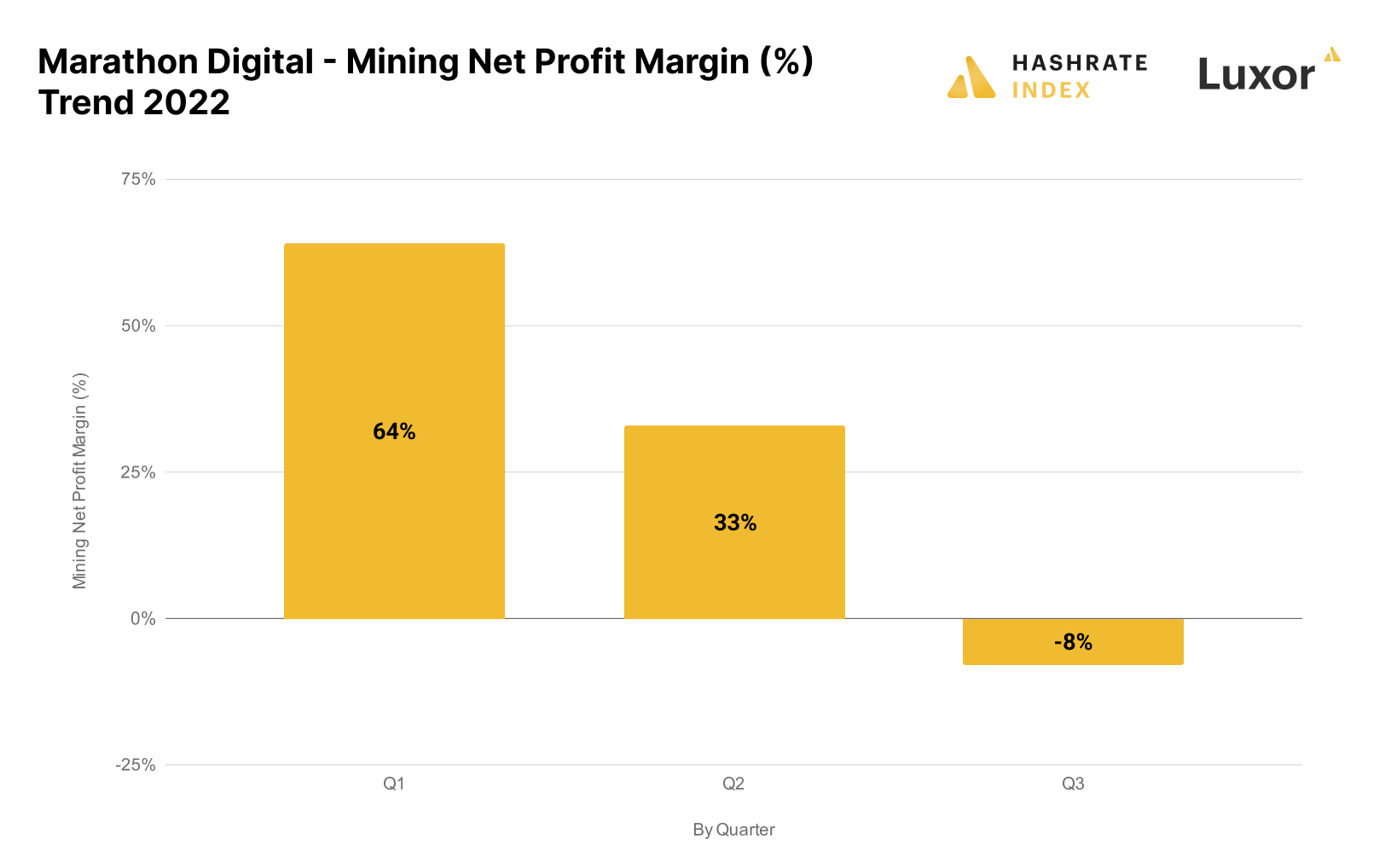

Perhaps even more damaging than thinning margins from increased network difficulty, though, was Marathon Digital's winding down of its Hardin, Montana facility. For most of this year, Marathon's mining margins were directly impacted by the shutdown in Montana and the delay in energization of their West Texas facility. As you can see in the chart below, with a fully operational mining fleet, their mining net profit margin was 64% versus -8% net mining margin with the Hardin facility shutdown and delays in West Texas.

The main reason for the lower mining margin is the direct costs related to winding down the value of the remaining service agreements under the facility partnership in Montana. As shown below, Marathon Digital discloses the impacts of the facility shutdown.

The company completed its previously disclosed exit from the Hardin, MT facility (“Hardin”) in September. The Company had deployed approximately 30,000 mining servers at Hardin. In conjunction with this exit, the Company sold approximately 22,000 bitcoin mining servers for cash proceeds of $46.5 million, recording a gain on sale of $3.2 million. The company also recorded additional depreciation of $4.1 million in the period related to approximately 1,800 bitcoin mining servers that were previously deployed at Hardin that are no longer in operating condition based on inspections of the assets at the facility and experience with the assets formerly deployed at Hardin in the weeks following redeployment.

Compute North Bankruptcy Impact to their Business

In September, news broke that Bitcoin mining host Compute North was filing for bankruptcy. Not only did Marathon Digital have their entire fleet with Compute North at the time of the bankruptcy, but they also invested in the company too.

Marathon Digital has taken a $39 million impairment charge on their investment stake in Compute North. Compute North's primary lender, Generate Capital, has taken over the Wolf Hollow and Nebraska mining sites from the bankruptcy process. Marathon has disclosed some of the potential impacts to their Wolf Hollow operations.

In early July 2022, the Company expanded certain hosting arrangements with Compute North in Granbury, TX (“Wolf Hollow”). As of November 9, the Company has approximately 6,000 mining servers in operation. The Company’s understanding is that plans for additional deployments have been delayed due to uncertainties associated with the Compute North Bankruptcy.

During the quarter, Marathon Digital announced a significant partnership with Applied Blockchain to continue growing their fleet capacity. With the loss of Hardin Montana and Compute North's bankruptcy, the company needed a new facility partner to energize their new leading-edge S19 XP Antminer mining rigs.

On July 12, 2022, the Company entered into an agreement to secure approximately 200 megawatts of hosting capacity for the Company’s previously purchased miners, including 90 megawatts of hosting capacity in Texas and at least 110 megawatts of hosting capacity in North Dakota. The Company expects to have 66,000 miners, representing approximately 9.2 EH/s, hosted across these facilities. Based on current construction schedules, installations of the Company’s miners are expected to begin at these facilities during the fourth quarter of 2022 with all miners installed by approximately mid-year 2023

Conclusion

Marathon Digital is an industry titan, as they own one of the largest Bitmain Antminer fleets in the world. With the recent Applied Blockchain partnership, investors should hopefully see significant fleet capacity growth in 2023. There are some unknowns with Compute North bankruptcy – namely, will they be able to retain all of their current and future capacity at Wolf Hollow?

With the volatility and market contagion spreading throughout the entire crypto ecosystem, there is a real possibility Marathon sells away their entire Bitcoin stack to Silvergate Bank. Bitfarms experienced the same force selling with their Bitcoin collateral loans this past summer. With a full hodl stack gone, Marathon would need to rely on their at-the-Market offering to support cash needs going forward. Investors should expect share dilution across the entire universe of Bitcoin mining stocks as mining margins are under pressure.

With the broader economy slowing down and interest rate hikes nearing terminal levels, Bitcoin mining stocks will continue to see high volatility. Across the entire Bitcoin mining complex, trading volumes are in full decline as the crypto winter arrives in force.

Disclaimer: This author is long Hut 8, Cleanspark, Bitfarms, Sato

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.