Using the Price-to-ASIC-Value Ratio for Bitcoin Mining Stocks

In this article, we introduce the price-to-ASIC-value ratio, a metric for ranking and valuing Bitcoin mining stocks based on their active bitcoin mining ASIC portfolios.

Given recent deployment delays in the post-China ban bitcoin mining world, investors need key operational metrics to find true values for the largest Bitcoin mining companies. By understanding the value of plugged-in hashrate owned by the largest publicly traded miners (and how efficiently these miners manage this hashrate), investors can see which bitcoin mining stocks are relatively overvalued or undervalued.

Using what we call the price-to-ASIC-value ratio, investors can gauge the total value of a Bitcoin miner’s active ASIC fleet. Investors can use the price-to-ASIC-value ratio alongside the price-to-hodl ratio, the price-to-mined revenue-ratio, and the price-to-hashrate ratio to evaluate whether or not a public bitcoin miner is overpriced or underpriced relative to its peers.

Calculating Price-to-ASIC-Value Ratio Using a Bitcoin Miner’s Active Hashrate

Active mining hashrate is king for every bitcoin miner; a miner is only making money if it is plugged in. Bitcoin miners must carefully expand their operations with a strategic cadence in mind to keep pace with newer, better, faster, and more efficient mining rigs. Bitcoin miners strive to scale operations to be as large, efficient, and low cost as possible, as these features are critical to the longevity and profitability of successful Bitcoin mining business.

Below, we’ll take a look at publicly-released metrics from public miners to determine fleet efficiency, which will allow us to estimate the value of their active ASIC fleets.

Methodology for Calculating Price-to-ASIC-Value Ratio for Bitcoin Miners

Before we reveal ratios for multiple public Bitcoin miners, we’ll use Bitfarms as our guinea pig to show how you can calculate this metric.

Bitfarms has disclosed they have access to 116 MW of power with a current hashrate capacity of 2.3 EH.

Given this information, we can calculate the value of Bitfarm’s active ASIC fleet:

Step 1: Estimate joules per TH of Bitfarms’ fleet

- Bitfarms’ total watts capacity / hashrate capacity (in TH/s) = ASIC fleet efficiency

- 116,000,000 watts / 2,300,000 TH = 50.4 J/TH efficiency

*Joules is interchangeable with watts

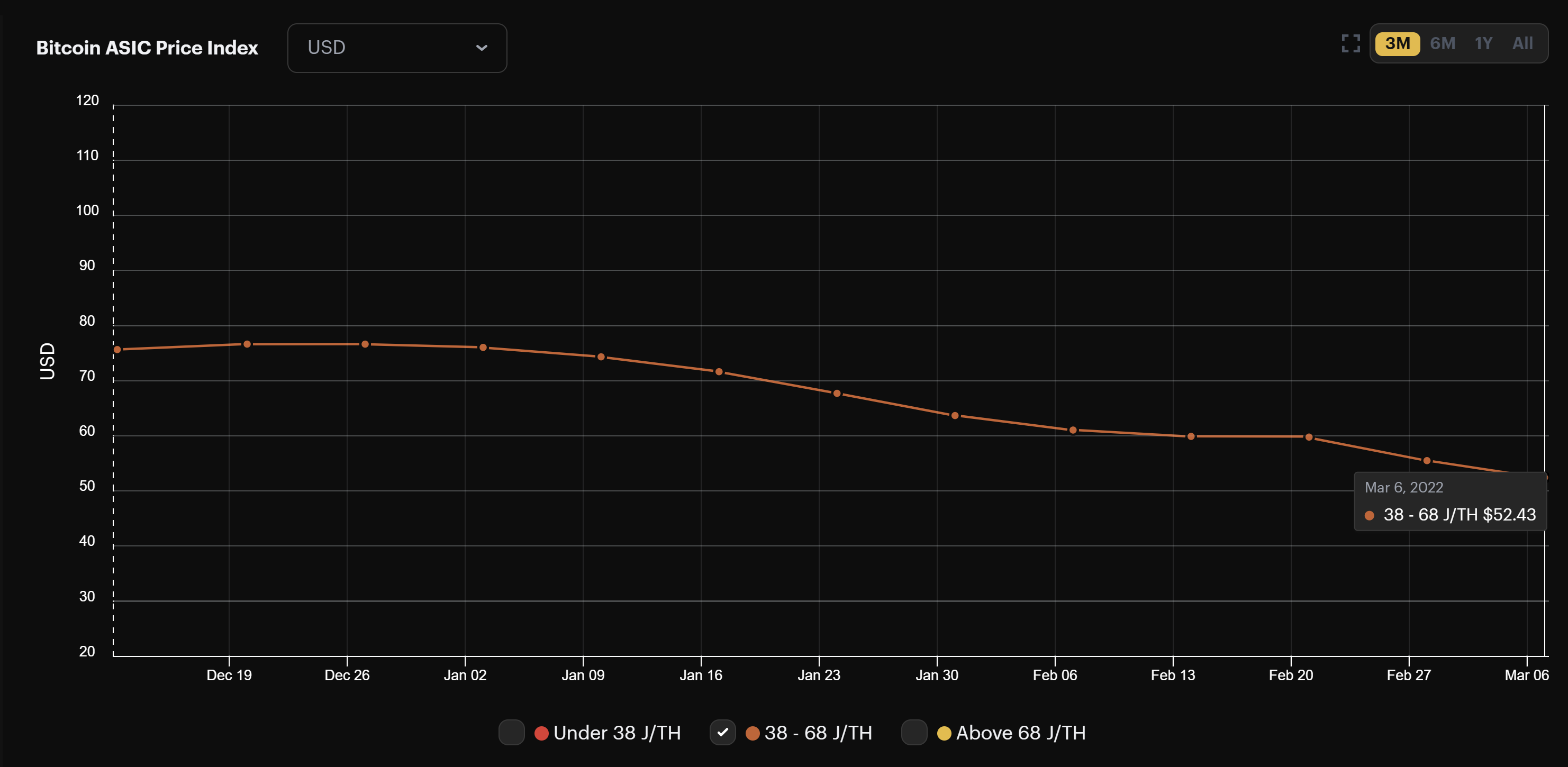

Based on this efficiency estimate, we’d use a mid-gen Hashrate Index Multiplier for the value of Bitfarm’s ASIC fleet (see pic below).

Step 2: Calculate current hashrate capacity to total ASIC spot price unit value

- Value of Bitfarm’s ASIC fleet efficiency tier ($ per TH) * Bitfarms total current hashrate capacity

- $52.43 $/TH * 2,300,000 TH = $120,589,000 total ASIC value

Step 3: Calculate price-to-total-ASIC value

- Bitfarms market cap / total ASIC value

- $762 MM / $141.6 = 5.5 price-to-ASIC-value ratio

A low price to total ASIC value is preferred, as investors are getting more active bitcoin mining hashrate at a discount. If the ratio is high, investors are paying a premium for racked mining hashrate and future expansion.

Looking at the table below, we can see that Cleanspark and Core Scientific have the lowest ratios among their peers. Marathon Digital, Riot Blockchain, and Hut 8 rank highest among their peers. The higher ratio indicates that investors are likely willing to pay higher average prices to own exposure to the hashrate expansions these companies have planned for the near future.

Evaluating Price-to-ASIC-Value Ratio vs. ASIC Values in Storage

The price-to-ASIC-value ratio reveals the relative value of a Bitcoin miner's actively hashing fleet, but currently, many public Bitcoin miners have more ASICs on preorder or in storage in their portfolios than ASICs that are operational.

Indeed, Rack space is scarce for Bitcoin miners in 2022, and many ASICs are on the sidelines as miners build out additional capacity. Many mining firms are experiencing delays due to supply chain constraints, blown-out infrastructure timelines and, more recently, geopolitical conflicts creating uncertainty in global markets.

It takes a tremendous amount of work to build out large power capacity for North American Bitcoin miners. The China mining ban created a greater sense of urgency for the public bitcoin miners to aggressively expand power capacity. Already this year, many large bitcoin miners have experienced delays in their hashrate expansion.

Marathon Digital Holdings, to provide one example, recently indicated in their public filings that they have over 51,000 Bitmain S19 ASIC miners waiting to be deployed in early 2022. Based on ASIC prices from HashrateIndex, these S19 rigs are worth $8,800 per unit. As of Jan 2nd, 2022 Marathons’ existing mining fleet consists of 32,350 active miners capable of producing approximately 3.5 EH/s. The remaining undeployed S19 miners represent 5.1 EH/s of mining capacity, valued at $449 million USD. That represents roughly $1,000,000 in daily lost revenue based on current hashprice levels.

Marathon Digital is not alone; other Bitcoin miners have troves of machinery waiting in storage as they build out additional rack space. Since bitcoin miners do not make money sitting in warehouses, bitcoin mining operators are hustling to expand capacity as quickly as possible, particularly with Bitcoin’s fourth halving nearly two years away.

What does the Total ASIC Value to Market Cap Tell Us?

Investors can rank the best undervalued active mining fleets within the North American bitcoin mining universe by reviewing the efficiency, power capacity, and active hashrate of the largest Bitcoin miners. Arguably, by using this operational value metric, investors can immediately identify market mispricing of hashrate.

For example, Cleanspark is nearly 2-3 times cheaper in market value than most of the miners analyzed. The company is still actively growing capacity, and its future contracted capacity is not yet fully deployed. Many of the larger miners will add new, active hashrate in the coming months, and this will affect their ratios. With new gen bitcoin miners coming online in March, Bitfarms, Riot Blockchain,and Hut 8 should all see significant efficiency gains by the end of the month.

Bottom line: Every Bitcoin investor needs to monitor the real intrinsic value of active hashrate. Bitcoin miners sitting in warehouses waiting to be electrified add no earnings power to a business. Investors should seek out miners that are executing their expansions well, even with the current constraints in the supply chain.

Disclosure: The author is long Hut 8, Bitfarms, Cleanspark, Core Scientific

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.