Bitcoin Mining Stocks October 2022 Updates

Hashrate expansion continues during the bear market.

Public bitcoin miners are feeling the harsh realities of increasing network hashrate, and a weak Bitcoin market.

All major public miners continue to experience significant downward pressure on their stocks as investors realize mining economics have deteriorated expeditiously. There is a tremendous amount of uncertainty around some mining operators that carry large debt loads. Even with all the risk and downside, the trend in October is more expansion of hashrate and mined rewards.

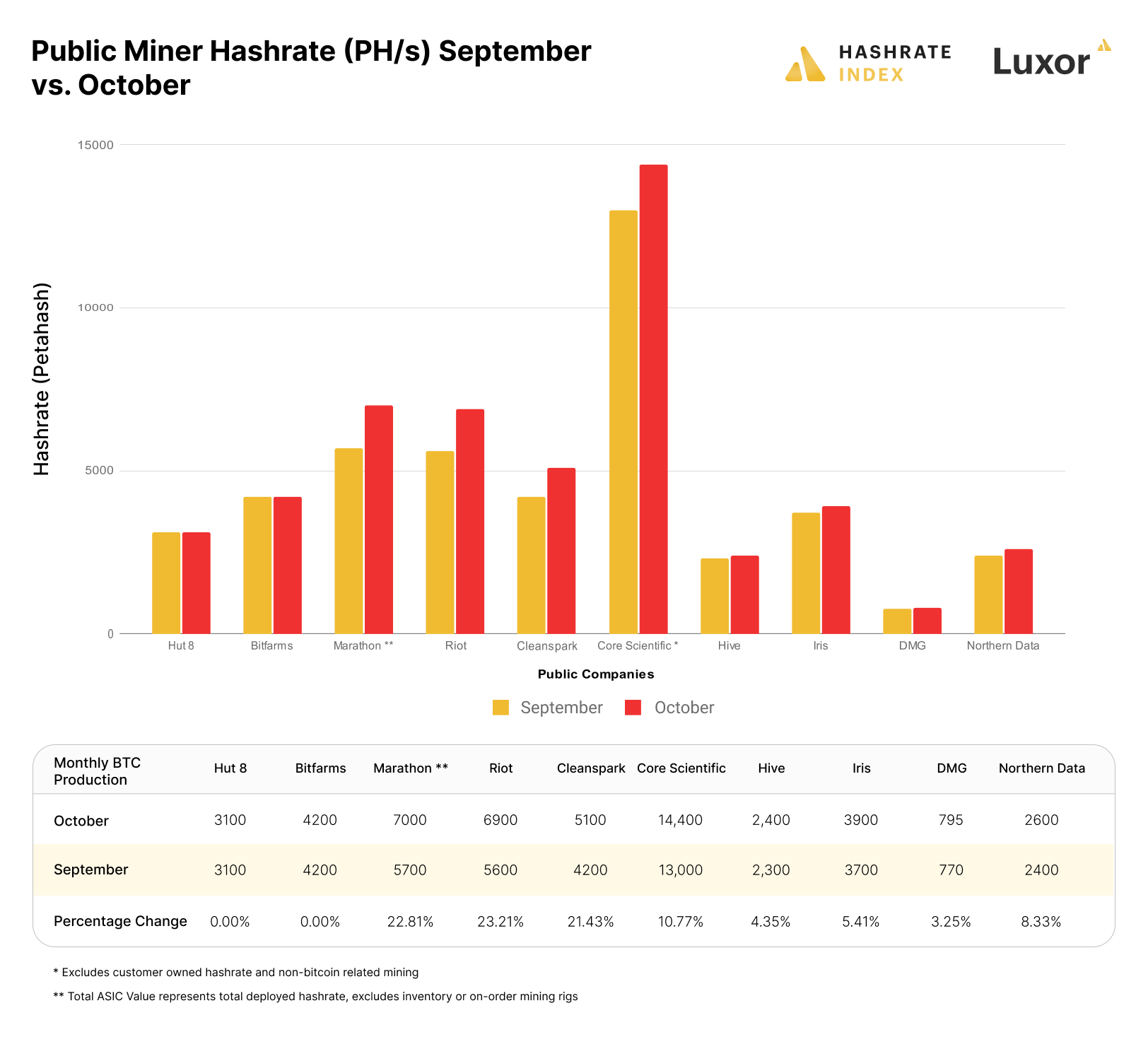

Bitcoin Miner Stock October Hashrate Growth

In terms of adding new hashrate capacity, Marathon Digital, Cleanspark and Riot Blockchain were the clear leaders in October, growing their fleets’ hashrate by 22.8%, 21.2%, and 23.2% respectively. Notable observations in October, Hut 8 and Bitfarms did not see any real increases in their mining fleet capacities.

Marathon Digital saw more growth again month-over-month, as their Texas mining sites continue to be energized throughout October. Marathon worked through the summer to prepare all their mining containers for energization the later half of this year.

Cleanspark continued their high paced fleet growth with their recent acquisitions, and purchasing heavily discounted Bitcoin miners on the open market. Riot Blockchain continues to expand capacity at their Rockdale Texas mining facilities.

Most of the other miners grew their hashrate noticeably higher in October compared to previous months. Even with a full on bear market, miners continue to focus on their mining fleet hashrate expansion.

As miners grew hashrate higher, this additional capacity meant a growth in rewards. Marathon Digital saw a large 70% increase in their mined Bitcoin as significant capacity from West Texas came online. Investors should expect more expansion until the remainder for the year for Marathon Digital.

Bitfarms only grew mining rewards by one percent as their Argentina expansion slowed with import restrictions of new miners.

“Argentina is wrestling with high inflation, currency devaluation and a significant debt burden. To alleviate concerns about a drain on the Argentina Central Bank’s foreign currency reserves, trade approval for the importation of most goods, including mining and IT equipment, is being delayed, which has been adversely affecting our ability to bring in the additional 12,000 miners we need to operate the first warehouse at its full capacity of 50 MW.“

Iris Energy grew their mined Bitcoin significantly in October, as their mined coins increased by about 38 percent from September. Most of the increase was due to continued expansion and electrification of their new mining facilities. Expect downward pressure on their mining output, as Iris announced recently that due to mining economics they may return a large portion of their mining rigs to NYDIG to pay back equipment loans. Their equipment loans are non-recourse, which means they still have control and ownership of their mining data centers.

Bitcoin Sales in October

With the bear market in full swing, the majority of public miners sold their mined coins to pay operating costs, and debt repayments. Hut 8 mining and Marathon Digital continued to hold the line in October, their newly minted coins were immediately placed into treasury. By holding Bitcoin, both companies have shown their balance sheet strength, and operational abilities in the bear market.

Core Scientific experienced the highest rate of sales, as they needed to sell every mined Bitcoin to pay their debt obligations. The company has indicated they might not be able to pay for their ongoing debt obligations by the end of the year. Bitfarms continues to sell all of their monthly mining rewards to pay down their equipment loans and other debts.

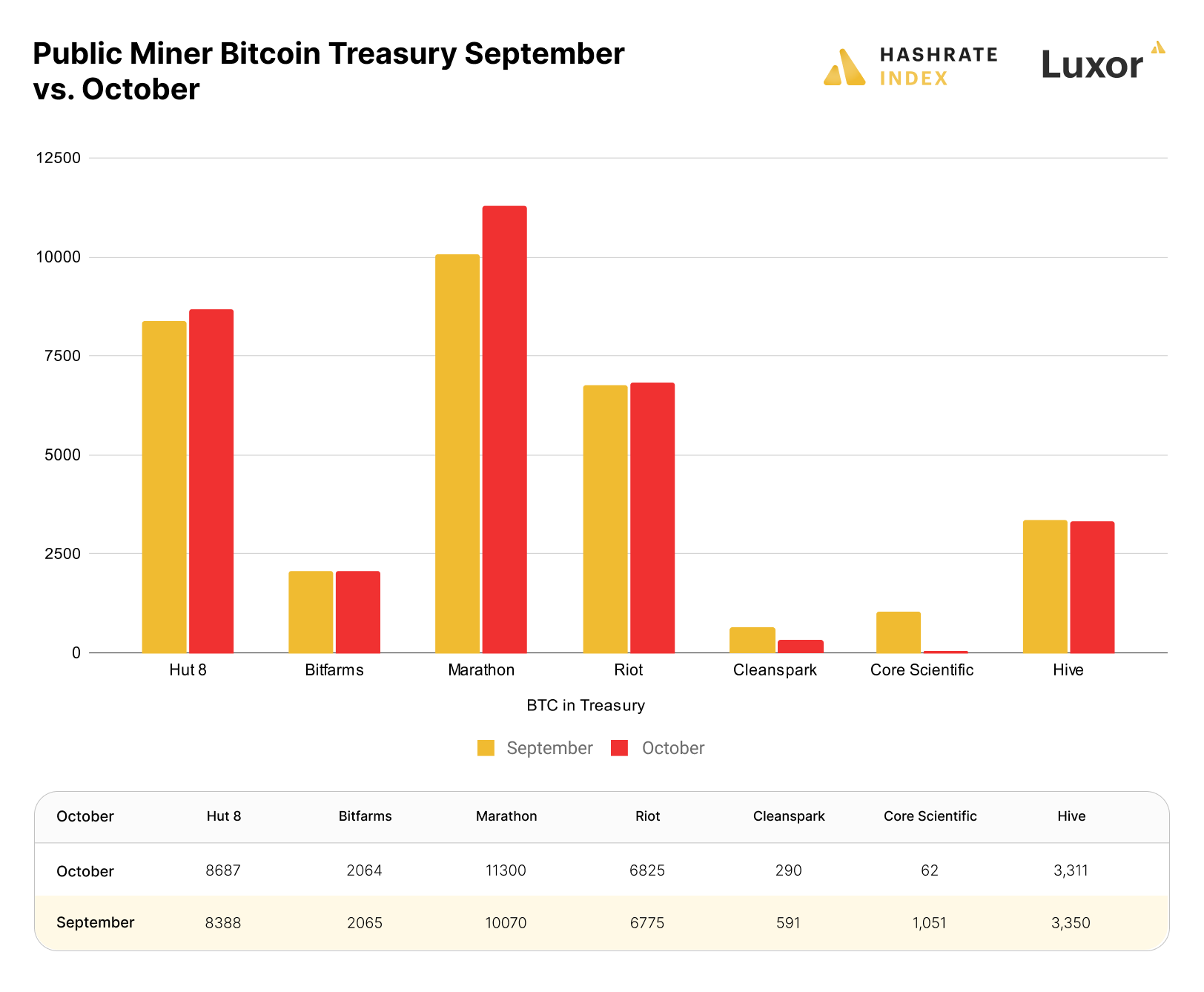

Bitcoin Mining Stock Treasury Trends in October

As market continues downward trend, public miner bitcoin treasuries are starting to dwindle in size.

Core Scientific reported the largest drop in Bitcoin treasury as compared to the rest of their peers. With a high debt load, Core Scientific has been a forced seller of their Bitcoin treasury. Hut 8 and Marathon Digital continue to HODL their BTC stacks through the bear market.

How Will Things Shake Out for the Remainder of the Year?

As we progress towards the end of the year, expect continued market volatility as the Federal Reserve continues towards terminal peak interest rate tightening. As mentioned in our August update, Bitcoin mining stocks will continue to experience a lot of pain. The recent FTX events have raised more doubts over the entire blockchain ecosystem, and have created greater regulatory uncertainty in Washington.

With many highly indebted Bitcoin miners at risk of filing for Chapter 11 bankruptcy, investors should seek out low debt-to-equity mining operators that can weather a long-term bear market. Be careful out there, as the dust settles, and the market capitulates, there is a lot of potential upside owning the right Bitcoin mining operators.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.