Bitcoin Mining Stocks August 2022 Updates

As the summer heat subsides, public bitcoin miner hashrate is heating up.

As the scorching summer heat abates, Bitcoin miners continue to expand their operational hashrate in the depths of the Bitcoin bear market.

All the major public miners are diligently expanding their hashrate and have plans to do so until year-end. Top public miners plan on deploying nearly 17 EH/s of hashrate for the remainder of the year. In August, we noted an uptrend in hashrate growth as new leading edge Antminer S19 XP and S19J miners were turned on.

Investors should not be surprised if the Bitcoin network hashrate hits or exceeds 270-280 EH/s by year-end.

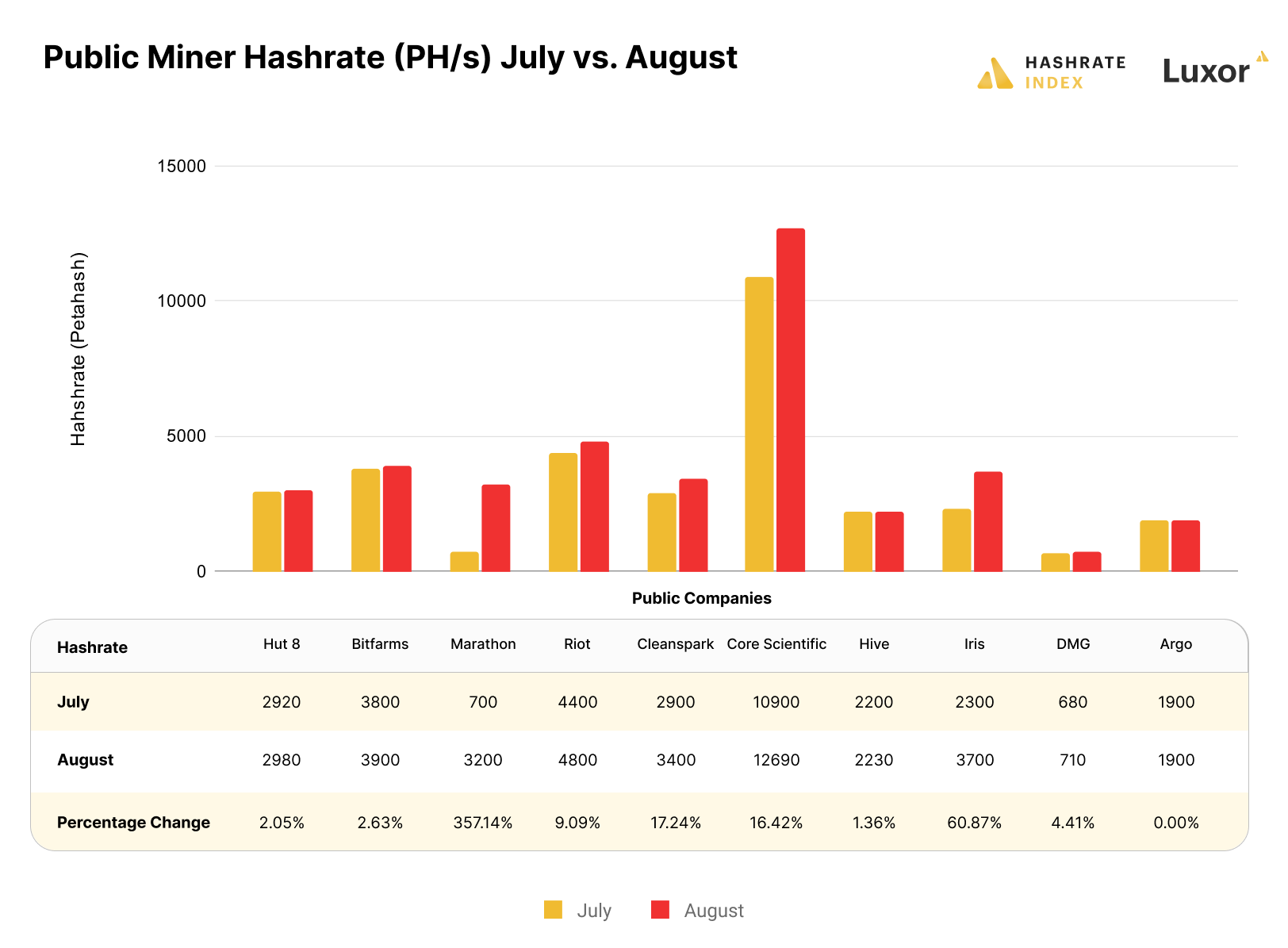

Bitcoin Mining Stock August Hashrate Growth

In terms of adding on new hashrate capacity, Cleanspark and Core Scientific were the clear winners in August, growing their fleets’ hashrate by 17.25%, and 16.42%, respectively.

While Marathon saw more growth month-over-month, this was something of an anomaly. The sizeable 357% growth in hashrate was largely a result of Marathon migrating machines to West Texas after taking them offline in Montana.

Most of the other miners in our analysis grew their mining fleet capacities by 1% to 4%.

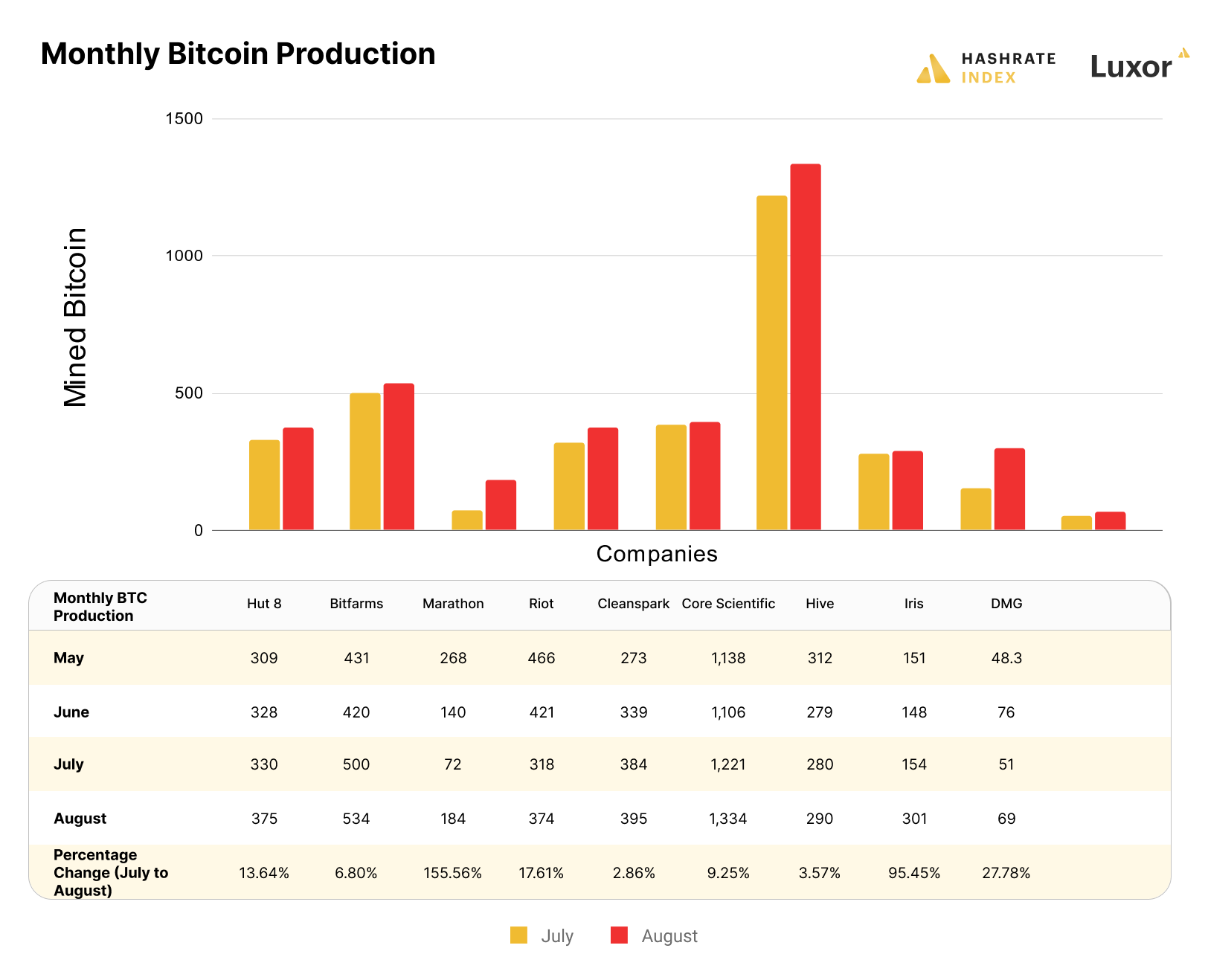

In every case for the miners in our analysis, this additional hashrate meant a growth in rewards. Iris energy saw a 95% increase in their mined Bitcoin as their new facilities came online earlier than expected. Hut 8, Bitfarms, Riot, Core Scientific, and DMG all saw quality gains in their Bitcoin production.

Marathon Digital had the largest spike in mined production with a 155% increase, once again the result of their migration from Montana to Texas. Marathon expects to add plenty of additional hashrate for the remainder of the year.

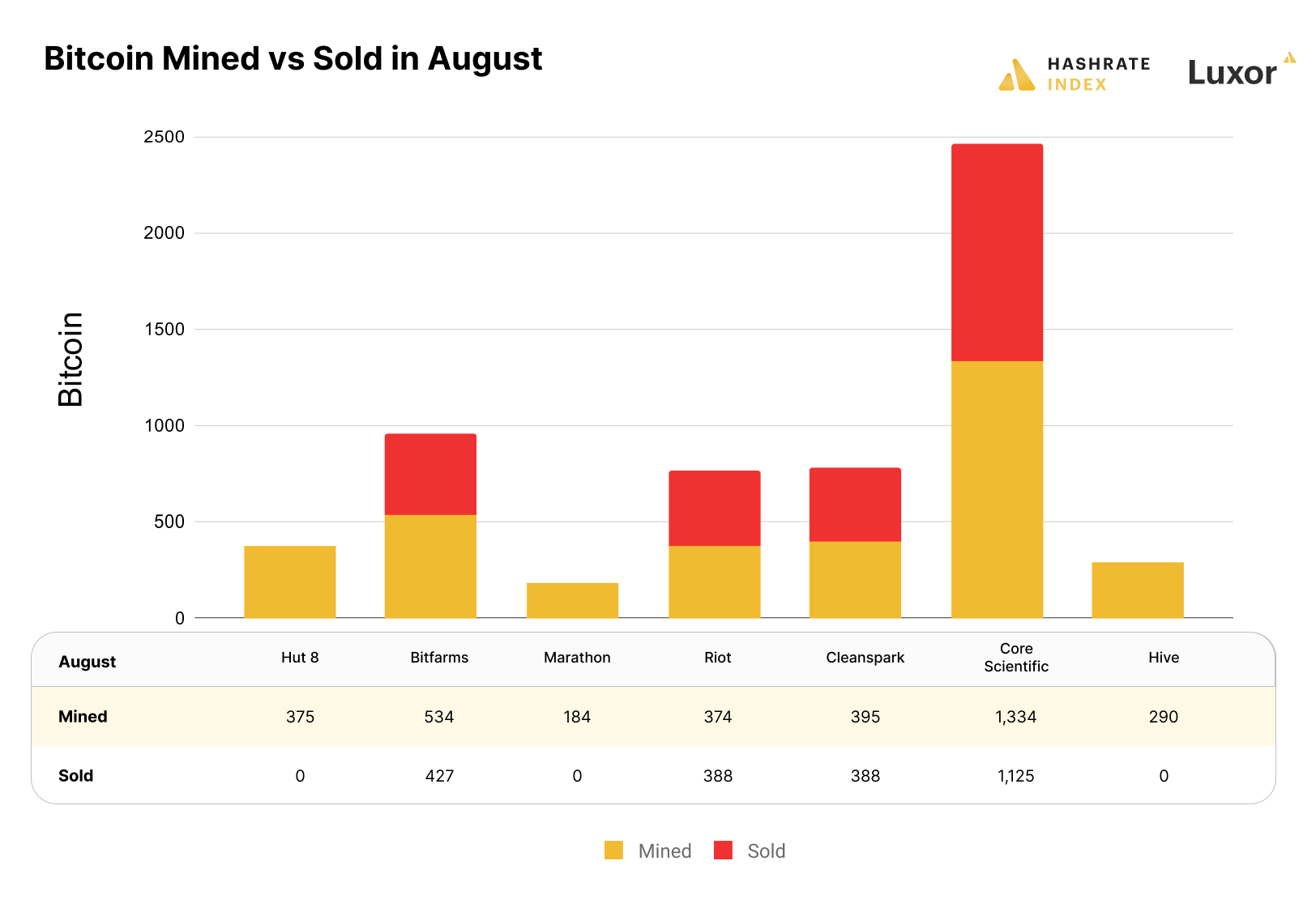

Additionally, these miners collectively sold fewer coins in August than they did in July, the latter month marking the fever-pitch of summer liquidations from the Bitcoin mining sector.

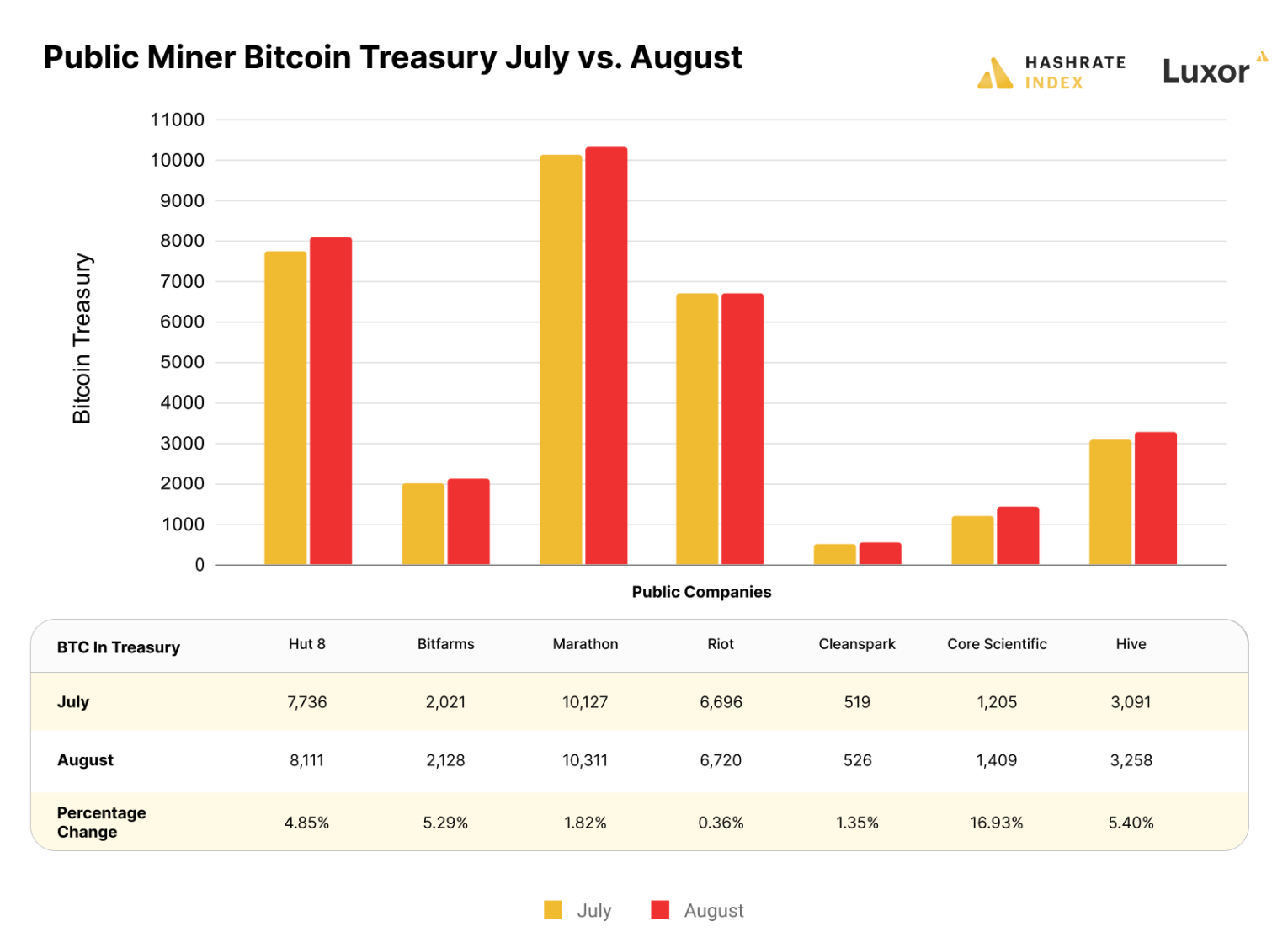

Bitcoin Mining Stock Treasury Trends in August

As selling subsides, public miner bitcoin treasuries are growing once again.

Core Scientific reported the largest percentage increase of held Bitcoin as their self-mining hashrate grew during the month and they sold fewer BTC than prior summer months. Every other miner saw smaller increases in their Bitcoin treasury. Hut 8 continues to HODL its full BTC stack through the bear market, while Hive Blockchain and Marathon Digital have sold relatively little of their treasuries when compared to other miners.

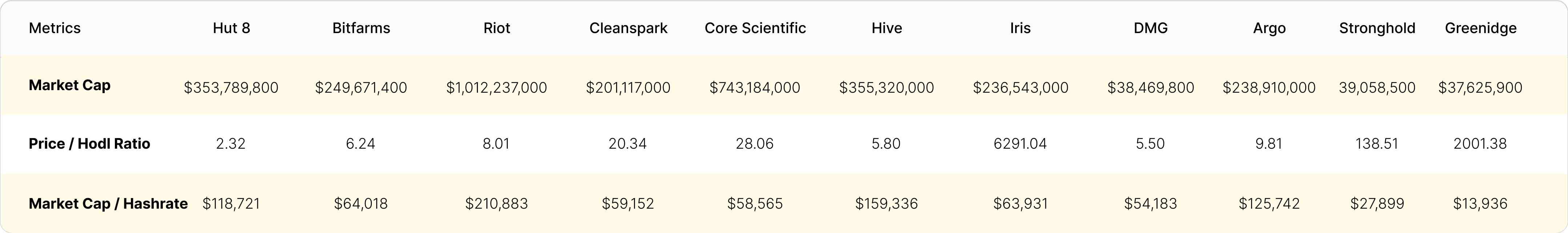

Bitcoin Mining Stock Marketcaps and Price-to-Hodl Ratios

Below is a table that includes marketcaps for the Bitcoin mining stocks in our analysis, as well as their price / hodl ratios and marketcap / hashrate ratios.

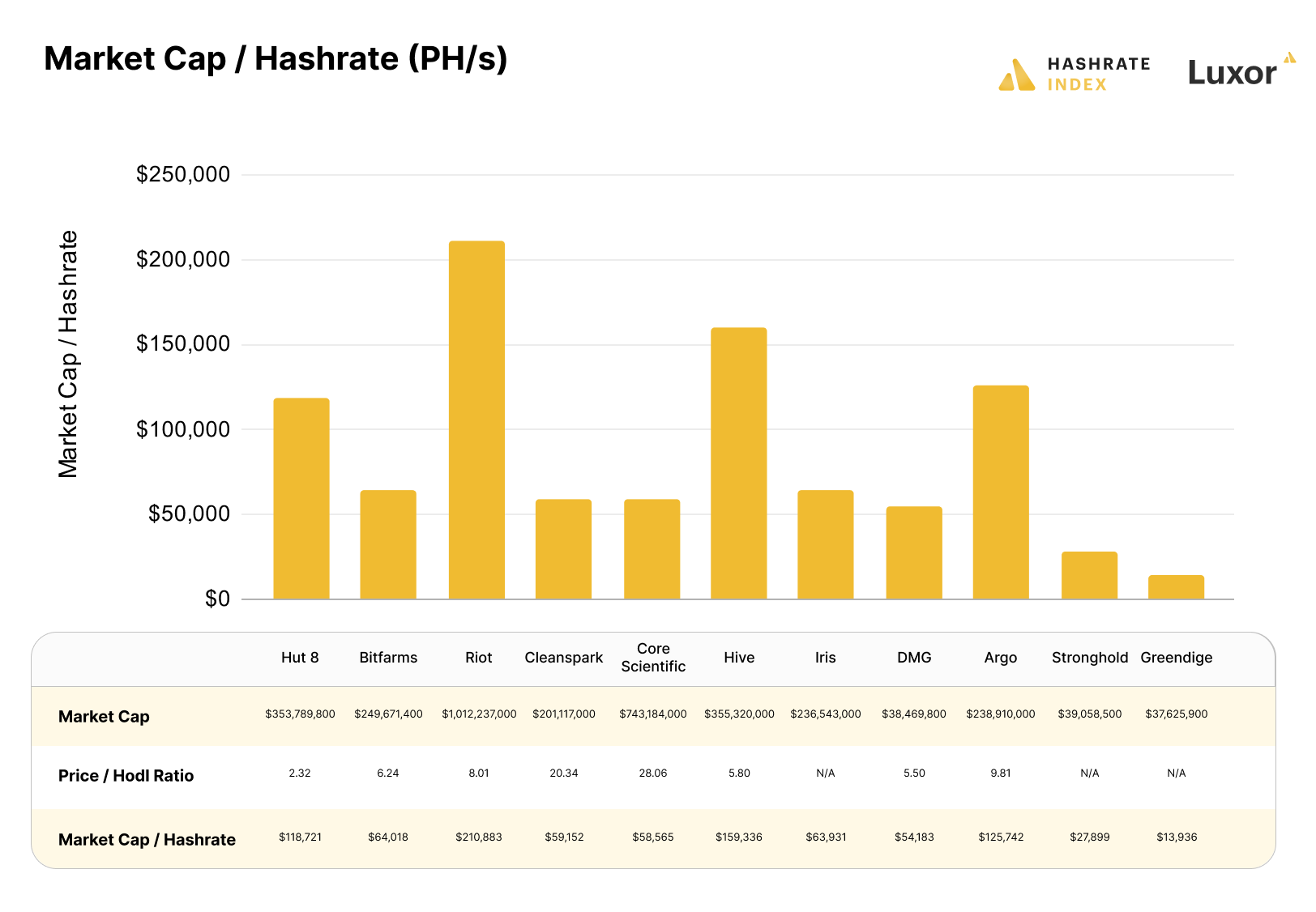

Let’s look at some interesting valuations on the below market cap / hashrate ratio chart.

The marketcap / hashrate ratio shows investors how much they are paying for exposure to a company’s active hashrate capacity. A low ratio means an investor is paying a low price per share for a company's current hashrate, whereas a higher ratio means an investor is paying much higher cost per share to own an equivalent amount of hashrate. (Additionally, certain miners may have a higher marketcap / hashrate ratio because they own infrastructure, like a mining facility itself or an energy source, which investors bake into overall valuation).

As you can see from the chart below, Marathon and Riot continue to hold large premiums to hashrate values relative to their peers.

What does this mean? Investors are willing to purchase and own shares of these companies as they expect large hashrate increases in the future; additionally, these bitcoin mining stocks are two of the oldest publicly traded miners, and their history and brand recognition may give them a certain level of “blue chip” status among investors. That said, based on delivery schedules for the rest of the year, it does make sense to see the market pricing higher premiums for potentially explosive hashrate growth.

Greenidge and Stronghold are showing low market cap to hashrate values. Do not read much into these low values, as these companies carry higher debt levels, so the market is likely pricing in that risk.

In this author's view, Bitfarms and Cleanspark hold the most potential value in hashrate as their stock prices are not reflecting large increases in operational mining capacity.

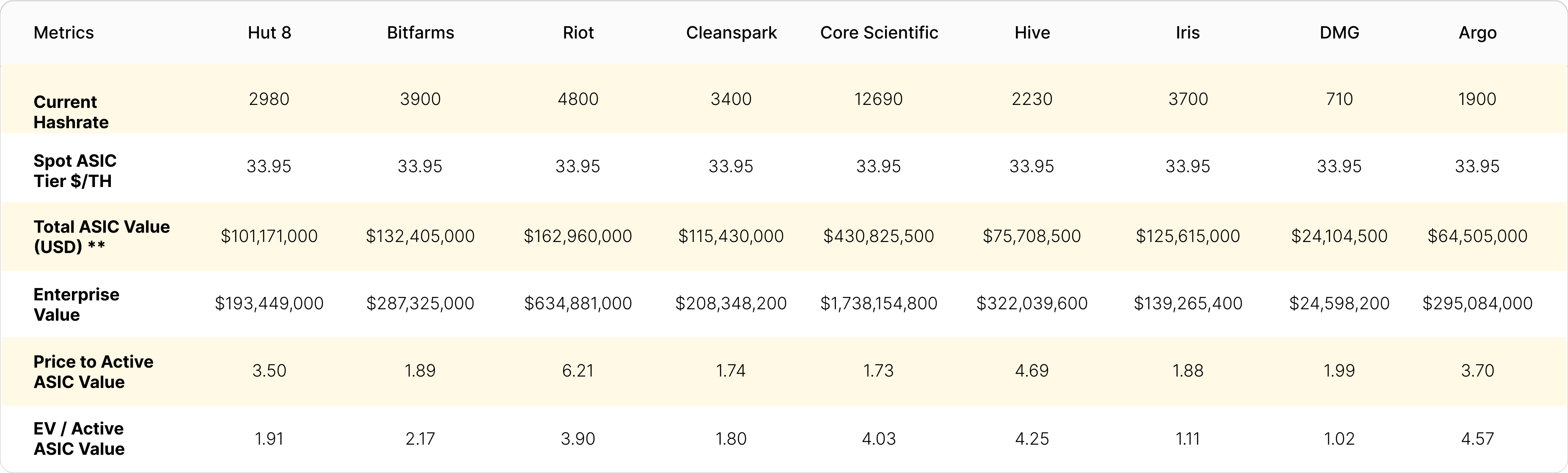

Bitcoin Mining Stock ASIC Info and EV-to-ASIC-Value Ratio

Active fleet spot values decreased across the board in August, leading to lower total ASIC values for all mining companies.

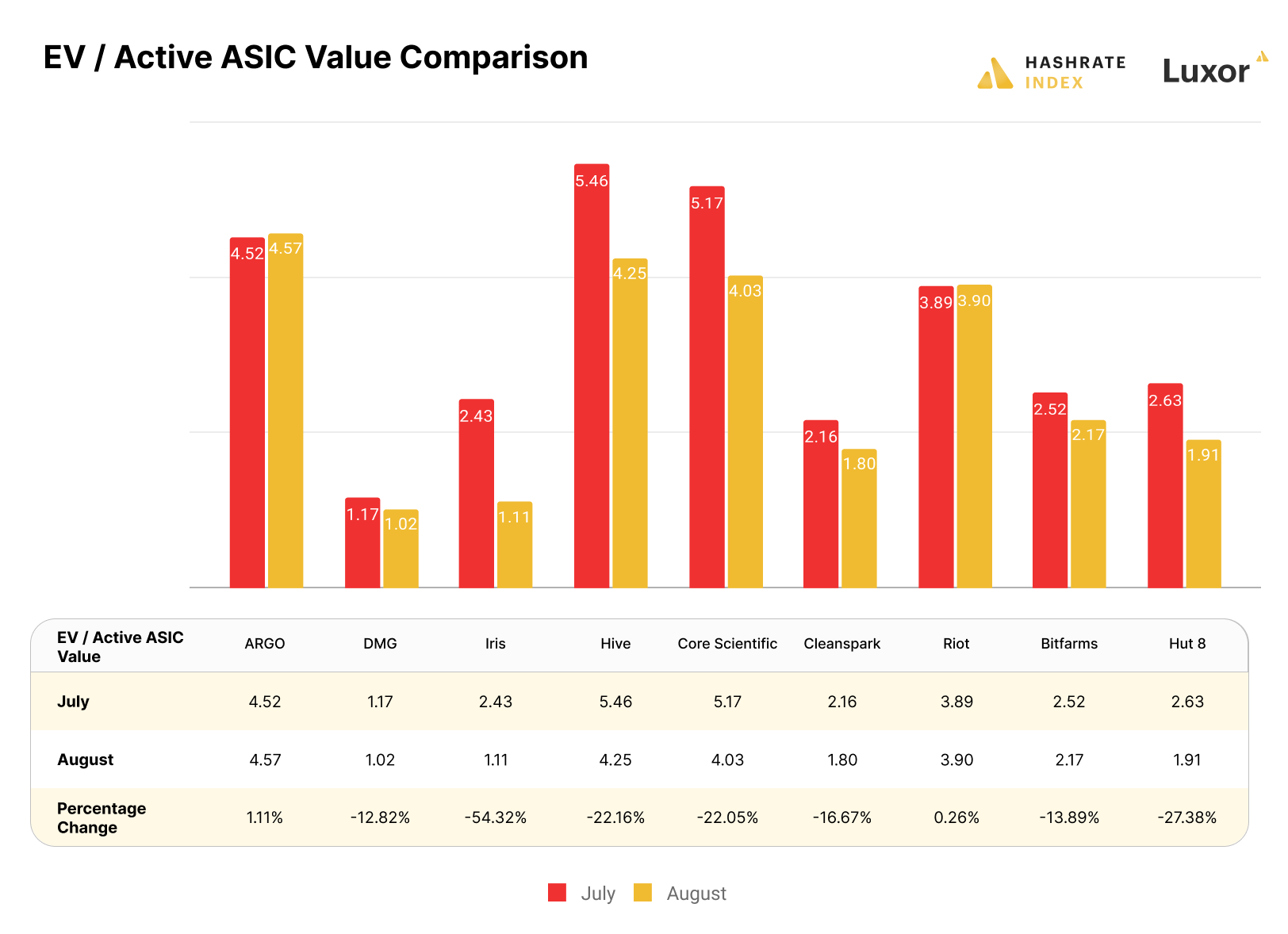

The EV / Total ASIC Value ratio is a multiple we pioneered on Hashrate Index to show how much larger a company’s enterprise value is relative to its productive assets (bitcoin mining ASICs).

As with other similar multiples, a larger ratio is less favorable than a smaller ratio.

With the bear market in full swing, enterprise values were impacted by both the decrease in Bitcoin and the value of active bitcoin mining hashrate (we included BTC holdings into our EVs for these miners).The market continues to de-risk portfolios as most investors sell away higher volatility stocks (Bitcoin miners).

Astute investors will continue to see the compression in enterprise valuations and position themselves accordingly in the bear market.

Reviewing the EV / Total Active ASIC ratio, we can see the lower valuations the market is placing on active hashrate. Iris Energy has the second lowest ratio in August, as their ratio compressed by 54% from July. This means investors are selling down the stock, while Iris continues expanding and growing revenues through its active Bitcoin mining ASIC fleet.

In our analysis, we did not include Marathon as their low active fleet hashrate skews the rest of the chart. If the company can execute, Marathon can dramatically increase its active fleet hashrate throughout the rest of the year.

What Does the Bear Market Mean for Bitcoin Mining Stocks in the Future?

As we enter the autumn, markets continue to deflate as the Federal Reserve continues to tighten interest rates. With the broader bond and equity markets on edge, Bitcoin mining stocks are being sold off indiscriminately.

With this week's surging stock market volatility, bitcoin mining companies have seen big dips and huge rebounds. With potential credit contagion on the table globally, expect Bitcoin mining stocks to underperform the broader equity market. Once interest rate tightening slows in the coming months, Bitcoin mining stocks will likely trade flat to find a bear market trading channel As mining stocks sink into their bear channel, expect significant reflexivity upward as the Bitcoin bull rally develops in time.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.