Bitcoin Mining Around the World: Venezuela

Venezuela has the energy reserves to become a Bitcoin mining powerhouse once again, but it remains a sleeping giant waking from a regulatory nightmare.

In this article, I try to explain the complex reality for Bitcoin mining in Venezuela and analyze whether its massive energy potential can finally be unlocked.

This article is the latest in our Bitcoin Mining Around the World series. Our previous articles cover Oman, Sweden, Norway, Finland, Iceland, Paraguay, Kyrgyzstan, Kazakhstan, and the United Arab Emirates.

Venezuela recently captured attention again amidst political shifts between the United States and itself. However, the real story is the unprecedented opening of the Western Hemisphere's largest energy reserve to private capital. Could this bode a future where our energy-rich nation reclaims its lost crown as Latin America’s Bitcoin mining capital?

As the dust settles in Caracas, a new industrial logic is emerging for Venezuela’s energy sector. The U.S. Department of Energy (DOE) made claims recently that the United States will work to improve the electrical grid, which is essential for increasing oil production, economic opportunities, and the daily quality of life for the Venezuelan people.

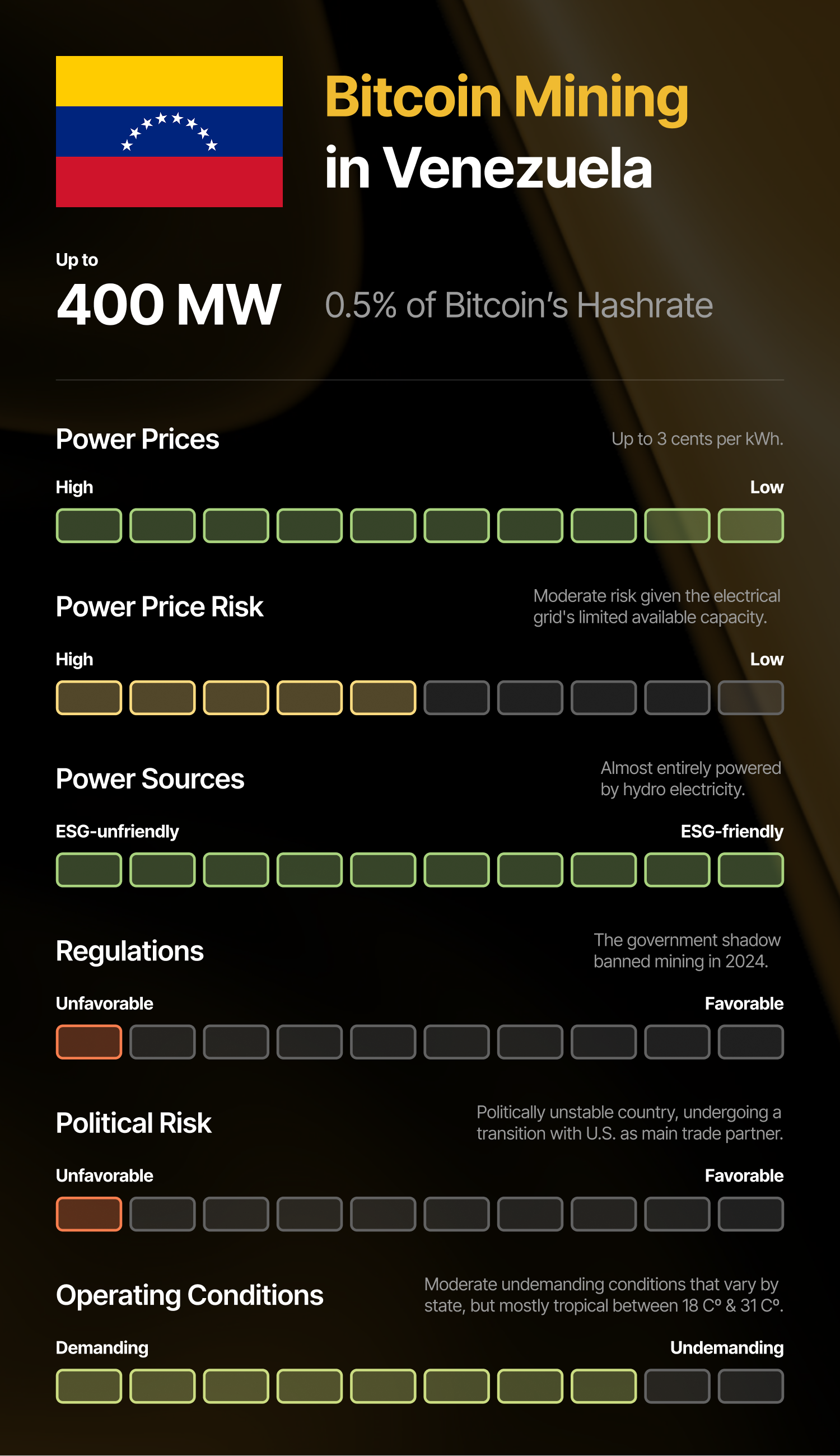

This infrastructure gap could represent one of the largest arbitrage opportunities in the history of Bitcoin mining. Some U.S.-based mining fleets are being squeezed by decreasing Hashprice, forcing them to look south for cheaper energy, or unplug a part of their Bitcoin mining fleet, and have the miners sit in warehouses. But U.S. miners could bring what Venezuela desperately needs: cash and immediate infrastructure investment. In return, Venezuela could offer attractive energy costs, below $0.02 per kWh in some cases, which few other jurisdictions can.

The Sleeping Latin American Bitcoin Mining Giant

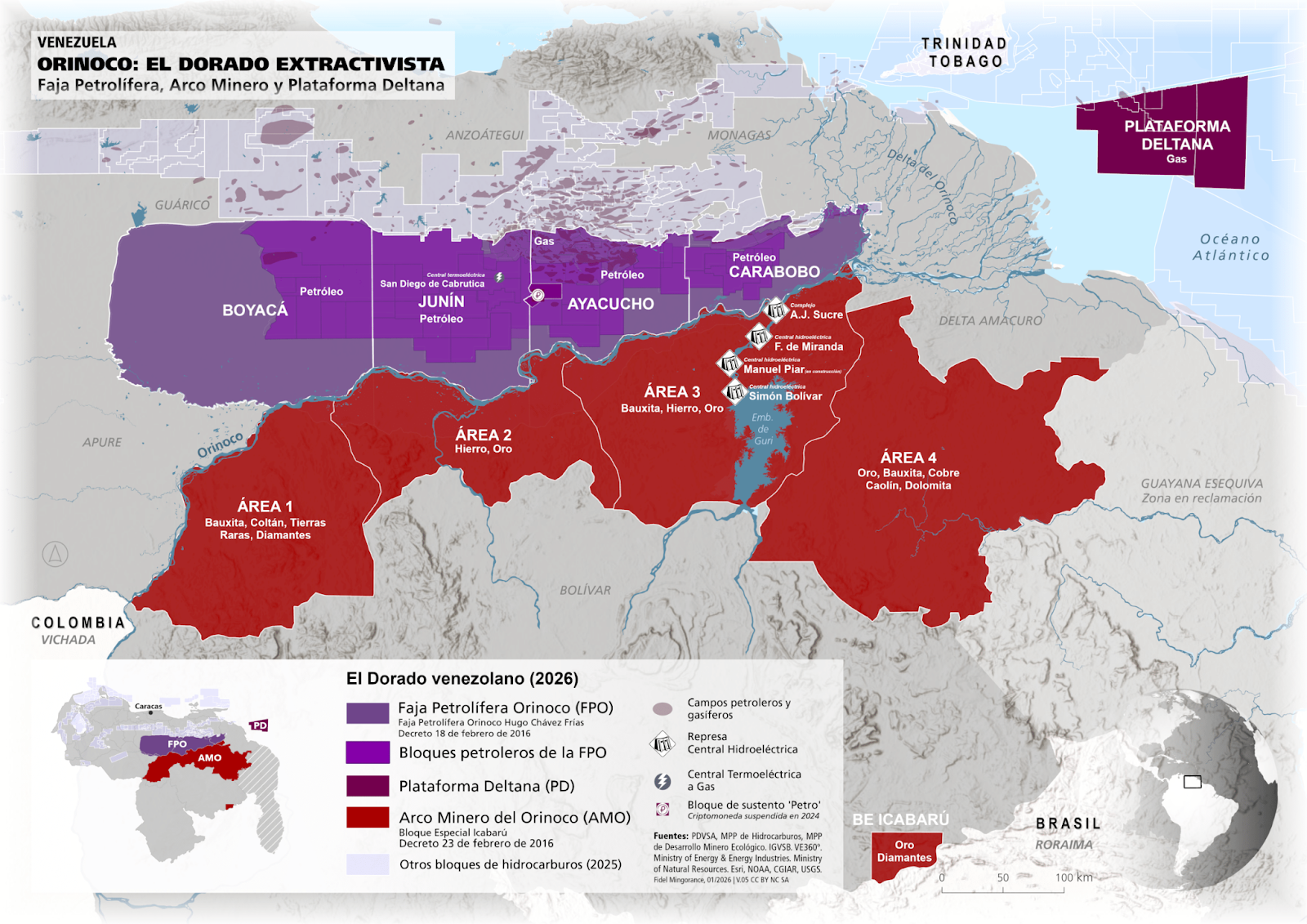

Venezuela is located on the northern coast of South America, sitting atop the world's largest proven oil reserves: over 300 billion barrels valued north of $17 trillion dollars (as of February 2026).

Although historical hashrate data specific to Venezuela is hard to track, some argue that the country had established itself among the Top 10 for Global Hashrate at some point.

The period around 2015-2017 is often referred to as a "golden age for mining", as Venezuelan citizens sought alternatives to hyperinflation, and residential electrical costs were almost fully subsidized.

By late 2017 — due to the imposition of the first U.S. sanctions — the industry started facing government seizures of mostly Antminer S7 and S9 models (obsolete Bitcoin mining equipment today), as the government looked for new financing venues outside of the traditional financial system. Further, a new regulator that would authorize and supervise all mining activity in the country — Superintendencia Nacional de Criptoactivos (SUNACRIP) — was created. These events resulted in a catastrophic "regulatory winter" for Bitcoin mining in the country that began around 2023, and turned into a total ban in mid-2024 when miners were asked to shut down operations nation-wide.

Today, there continues to exist a regulatory framework which requires soliciting a mining license with SUNACRIP to legally mine in the country. But the question remains if the rule of law will be reestablished, so that foreign investors and mining companies can import miners without the risk of future seizures, and lock in favourable long-term electricity rates to avoid shutting down their old mining rigs.

One thing is for sure: the "wild west" era of home mining in Venezuela is gone. As a nation, we have a unique shot at replacing it with a more strategic, industrial-scale approach focused on grid stabilization and co-location at power generation sources, with the support of foreign capital.

Venezuela’s Bitcoin Mining Capacity: Recovering The Lost Hashrate

As of February 2026, we estimate approximately 5 EH/s of legitimate or semi-legitimate mining capacity operating in Venezuela. This is a shadow of its 2021 peak. At an average efficiency of 80 J/TH (reflecting a mix of older S9s), this power consumption equals up to 400 MW, giving Venezuela a little less than 0.5% share of the global hashrate.

If we upgrade that same 400 MW power envelope from obsolete Antminer S9s to the old-standard Antminer S19j Pro, the hashrate would nearly triple to 13.6 EH/s. By simply swapping out older machines (without consuming a single extra watt of power), Venezuela's contribution to the global network would jump from ~0.47% to roughly ~1.27%.

This highlights why foreign investment is so critical: the bottleneck isn't power generation, it's capital expenditure (CapEx) for modern hardware and site retrofitting. Replacing 400 MW of S9's with S19j Pros is not a 1-to-1 swap; it requires managing a massive increase in power density. With an S19j Pro pulling ~3kW versus the S9’s ~1.4 kW, existing infrastructure (buildings, containers, and electrical racks) would require significant upgrades to handle the higher load per slot, not to mention the logistics involved in shipping approximately 130,000 units.

The Guri Dam: A Renewable Behemoth

In Venezuela, the story for miners is also about the chasm between Installed Capacity and Available Reality.

The Venezuelan grid relies on the Simón Bolívar Hydroelectric Plant (Guri Dam). On paper, this is a monster with an installed capacity of 10.2 GW, the backbone of a national system that theoretically boasts 30 to 36 GW of total generation.

However, data shared by experts at Universidad Metropolitana (Unimet) in Caracas reveals a starkly different picture of a system in deficit rather than surplus. The "Installed Capacity" is largely a ghost, composed of thermal plants that have been stripped for parts and turbines that haven't spun in a decade.

The national demand is hovering around a maximum of 13 GW and the Guri Dam's current production is estimated to be only ~8 GW. The country faces a severe structural shortage that dismantles the popular narrative of an “abundance of free energy” waiting to be tapped. This gap means there is no "national surplus" to easily exploit. Simply plugging a 100 MW mining facility into the central grid is not a victimless act of efficiency, but a strain that would likely require turning off the lights in a city to sustain.

The Opportunity: Fixing the Nervous System

So, where is the opportunity for Bitcoin miners? It lies in the transmission bottlenecks and the modernization of the grid’s nervous system.

While the parts of the country starve for power, the south (Bolívar State) often faces localized surpluses because the grid is physically incapable of transmitting the Guri's full output. The high-voltage lines have deteriorated, and the SCADA (Supervisory Control and Data Acquisition) systems, the "brain" of the grid, are obsolete, leaving operators blind to real-time conditions.

Miners here act not just as consumers, but as financing vehicles. The play in 2026 is for international mining groups to fund the repair of these SCADA systems and high-voltage interconnects in exchange for access to the "Trapped Energy" in the south. It is a swap: capital for infrastructure, unlocking the electrons that are currently stuck at the dam.

The Flared Gas Frontier: The True “Energy Surplus”

Given tight conditions on the hydroelectric grid (8 GW supply vs 13 GW demand), the most ethical and scalable frontier for Bitcoin mining in Venezuela is flared gas.

Turning 1.5 Billion Cubic Feet of Waste into Revenue

Venezuela currently faces a massive infrastructure bottleneck: it produces oil, but lacks the pipelines and processing plants to handle the associated gas. As a result, the country flares (burns off) an estimated 1.2 to 1.5 billion cubic feet of gas per day.

To monetize this gas via traditional means would require billions of dollars in pipeline infrastructure and years of construction. Bitcoin mining offers a "digital pipeline" as an alternative. By deploying containerized gas generators and mining hardware directly to the wellheads in Monagas and Anzoátegui, Venezuela could convert this waste gas into electricity and hashrate on-site.

Converting 1.5 billion cubic feet of gas could theoretically generate over 2,000 MW of off-grid power, more than the entire current power consumption of the Bitcoin network in the United States. What is missing is not the resource, but a legal framework that guarantees the security of private property to attract foreign capital into our country.

The Role of International Giants: Shell and BP

A fascinating development is the return of Western majors. Shell, Chevron, and BP have been soliciting and receiving licenses from the U.S. and Venezuelan governments to extract gas from the Dragon Field and cross-border reservoirs with Trinidad and Tobago. Could there be space for Bitcoin mining here?

Yes, primarily driven by Environmental, Social, and Governance (ESG) mandates. Global oil majors are under immense pressure to reduce methane emissions. Venting or flaring gas is increasingly penalized around the world. Bitcoin mining creates an economic incentive to capture that gas and divert it to onsite gas generators, a crucial part of flared gas mining. These generators convert raw gas into electricity for powering servers. While these companies are unlikely to hold BTC on their balance sheets due to compliance, we could see "mitigation partnerships" where they sell excess gas to third-party, OFAC-compliant mining operators on-site to achieve zero-flare certifications.

The Strategic Advantage of Reserves

Venezuela holds the 8th largest proven gas reserves in the world (and the largest in Latin America). For the Bitcoin network, this is a net positive. Unlike renewable grids that fluctuate with weather, or grids that compete with civilian demand, Venezuela’s gas reserves offer a potential century-long supply of stranded energy that is decoupled from residential consumption. This "baseload" capability could make Venezuela one of the most stable mining jurisdictions energetically, provided the political risk can be managed.

However, operational success will depend on managing the country's year-round heat and humidity. Following current infrastructure upgrades, the future of the sector in Venezuela likely lies in hydro-cooling technologies to ensure hardware longevity and efficiency in a tropical climate.

Conclusion

Venezuela remains a high-risk, high-reward frontier for the Bitcoin mining world.

It has massive stranded renewable energy and established electrical infrastructure, but to become a "Holy Trinity" of mining, it’s missing the rule of law to attract foreign investment. The potential to monetize 1.5 billion cubic feet of wasted daily gas by placing gas generators on-site could revolutionize the country's energy sector.

If Venezuela can offer a stable framework for "off-grid" gas mining and "generation-side" hydro mining, it will not just recover its previous standing, it will rival the largest mining hubs in the world.

However, the path forward is not for the faint of heart. Success here will require multiple engagements between industry participants and the regulator for the private property rights and capital of miners to be respected.

As of 2026, the giant is still stirring, and without foreign investment in infrastructure, it will hardly get back to hashing in the major leagues.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.