Bitcoin Mining Around the World: Finland

Finnish bitcoin miners are uniquely positioned to become world leaders in heat recovery.

Finland is becoming an increasingly attractive location for bitcoin miners due to its growing electricity generation capacity and miners’ possibilities of selling their waste heat to the country’s sophisticated district heating network.

As the bitcoin mining industry faces obstacles in neighboring Sweden and Norway, it's refreshing for a Nordic mining viking like me to see growth opportunities in nearby Finland. To make the world aware of this growth potential, I decided to write this article.

This article is the latest in our Bitcoin Mining Around the World series. Our previous articles cover Sweden, Norway, Iceland, Paraguay, Kyrgyzstan, and Kazakhstan.

Europe’s unexplored bitcoin mining frontier

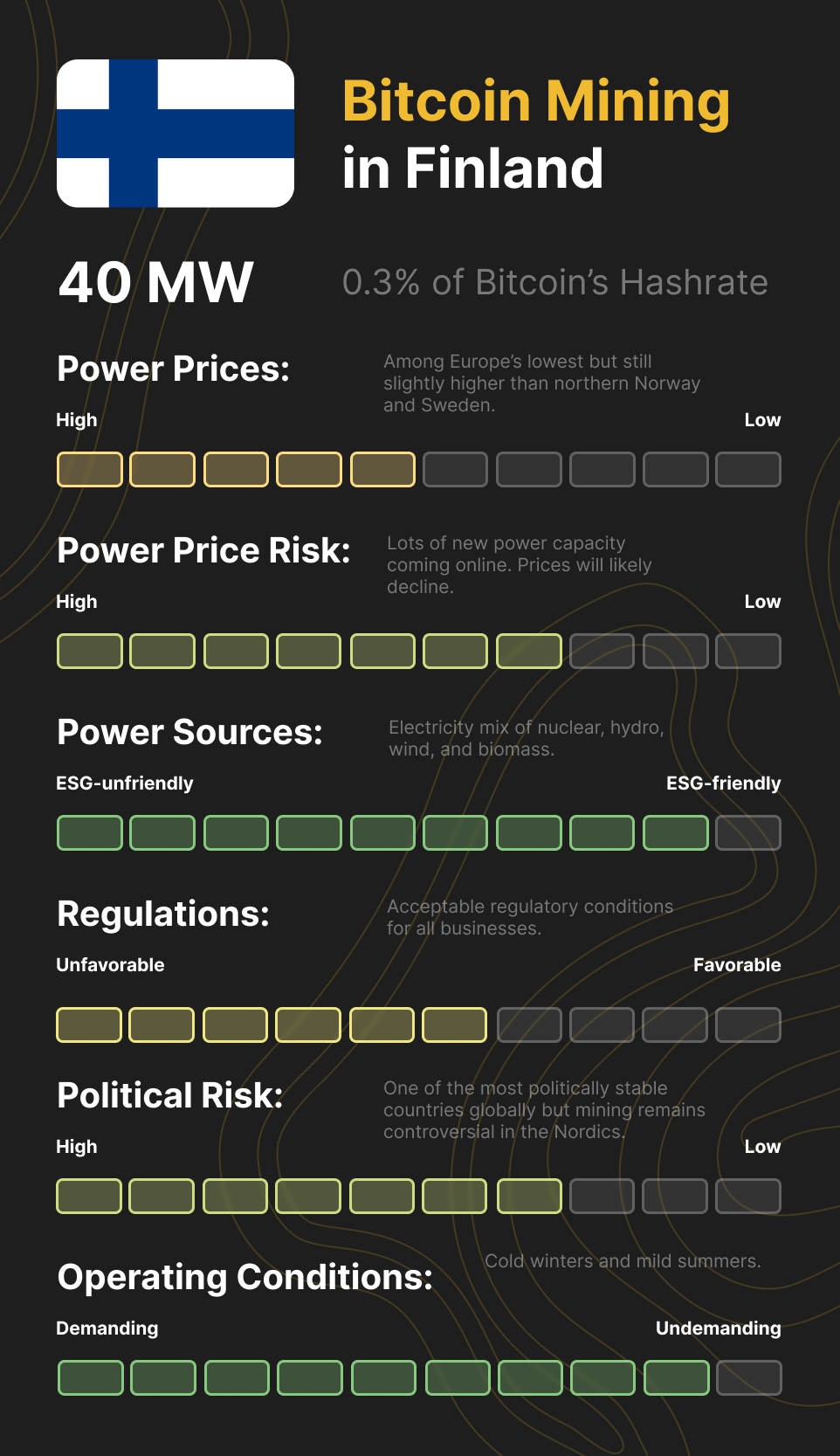

Finland has historically fallen behind its Nordic neighbors regarding bitcoin mining. While miners flocked to Norway, Sweden, and Iceland to tap into these countries' stranded hydropower, Finland didn’t get much attention due to its more expensive electricity. Currently, Finland only has a bitcoin mining capacity of 40 MW, generating a meager 0.3% of Bitcoin’s hashrate.

As I will explain in this article, Finland will likely see more bitcoin mining growth in the coming years than its Nordic neighbors. While the industry faces growth barriers in Norway, Sweden, and Iceland, there is massive potential in Finland as the industry is undeveloped with a substantial untapped power capacity. Finland is Europe’s unexplored bitcoin mining frontier.

Although the Finnish mining industry is currently microscopic, it could grow to a similar size as those of its neighboring countries. I wouldn’t be surprised if Finland sees 300 MW of bitcoin mining capacity within the next two years, similar to Norway.

The Nordic nuclear haven

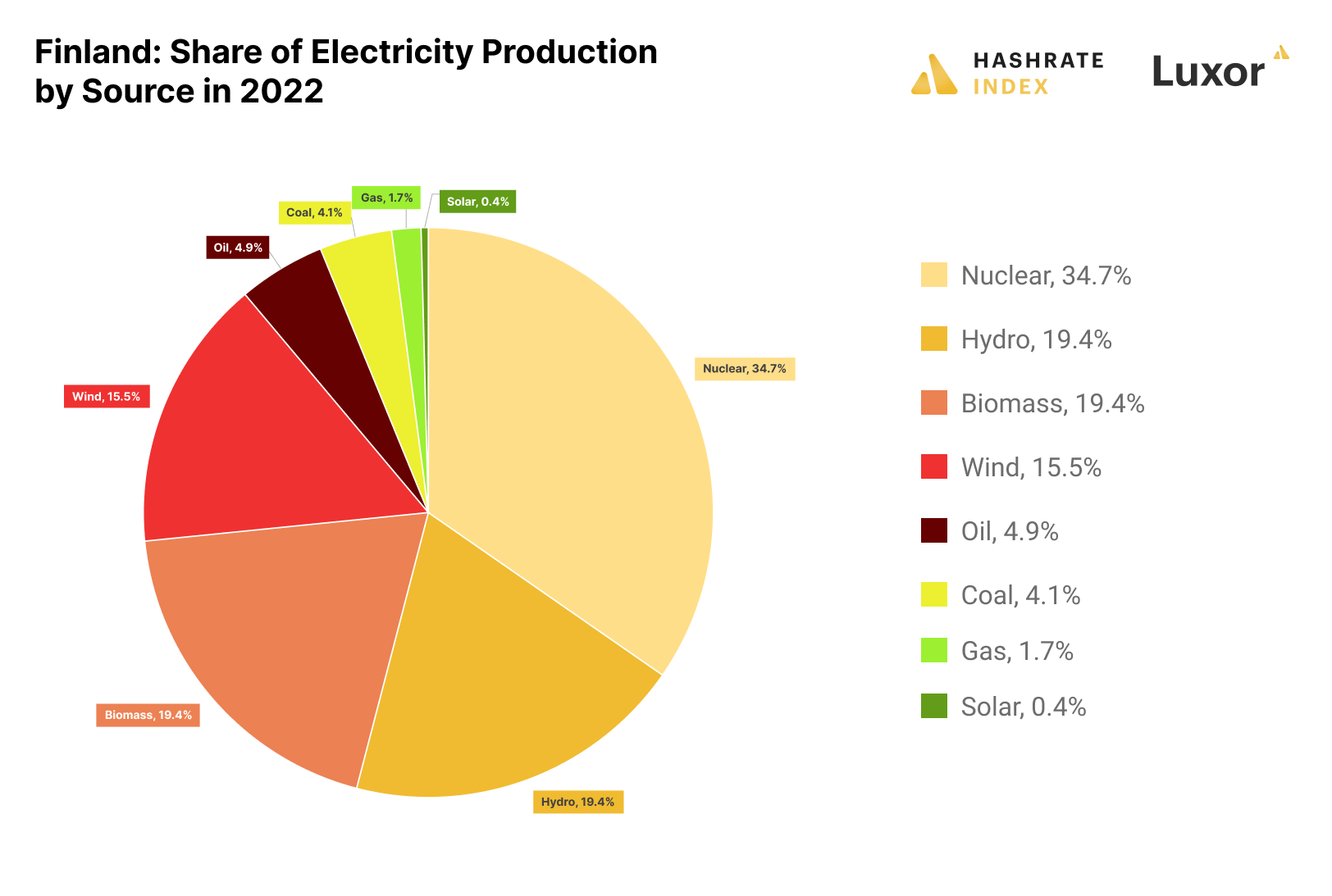

Finland has a diverse electricity mix powered 89% by non-fossil sources, making it an attractive destination for ESG-focused miners. Nuclear is the system's backbone and generated 35% of the electricity in 2022, while 19% came from hydro, 19% from biomass, 16% from wind, and the remaining 11% from oil, coal, gas, and solar.

The Finns have never been afraid of going against the mainstream. While other European countries strongly opposed nuclear energy and even started phasing out reactors in the 2000s, the Finns thought:” F*ck it, we are just going to build the biggest nuclear reactor in Europe”.

The Finnish pragmatism paid off. In April 2023, while nuclear-opposing Germans struggled to keep their lights on, the Finns launched their new Olkiluoto III reactor. With a nameplate capacity of 1,600 MW and an expected capacity factor of 90%, it could generate 12.6 TWh of electricity annually. Thus, 55% of Finland's electricity is expected to currently come from nuclear, up from 35% in 2022. This gives Finland the second-highest share of nuclear globally, only behind nuclear OG France.

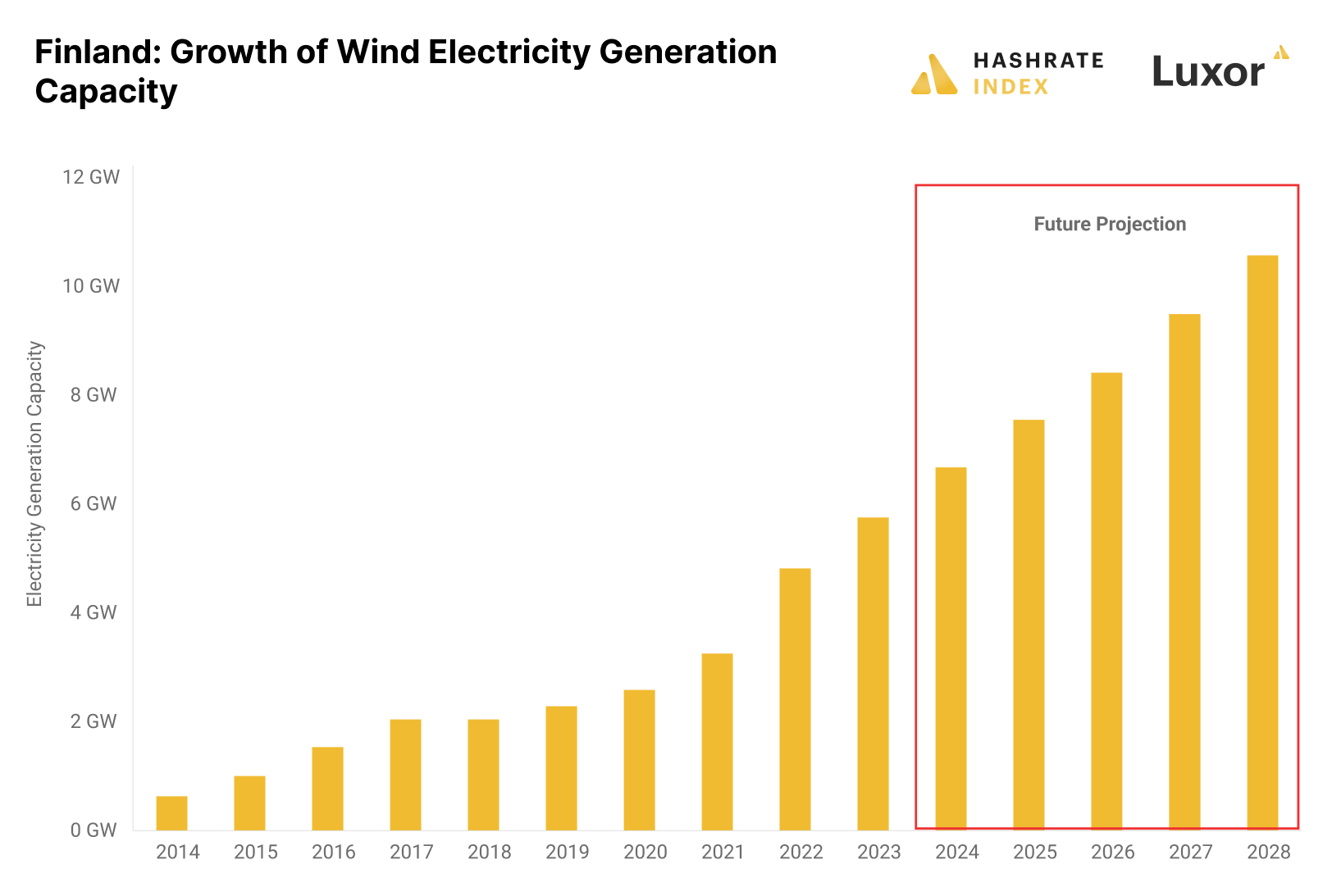

The industrious Finns are not resting on their nuclear laurels and are also heavily expanding wind capacity along its western coast. In 2022, 4.8 GW of wind capacity generated 16% of the country’s electricity after massive wind buildout during the past 10 years. Finland plans to more than double its wind capacity by 2028.

As if that wasn't enough, Finland plans to build 7 GW of solar by 2030. Still, these solar farms will likely achieve a very low capacity factor due to the poor solar conditions in Finland and will, therefore, not contribute as much to the country's electricity production as the new wind and nuclear capacity. However, it could still lead to exceptionally low electricity prices on sunny days.

The influx of nuclear, wind, and solar capacity is critical for Finland, as it could achieve a yearly electricity surplus and decrease its reliance on imports. The country has historically suffered a significant electricity deficit which it covered by imports from its good neighbors Russia, Sweden, and Norway. As part of the EU’s sanction package, Finland stopped importing electricity from Russia in 2022. With its increased generation capacity, Finland will be self-reliant on electricity and could even become a net exporter. That is great news for bitcoin miners, which export electricity through the Bitcoin network.

Another consequence of the rapid growth in nuclear, wind, and solar capacity is the increased need for demand flexibility in the Finnish grid. Nuclear provides a base load and cannot easily be regulated, while wind and solar power are weather-dependent and thus highly volatile and uncontrollable. As the supply side becomes increasingly inflexible, the Finnish grid will have to rely more on the demand side to provide flexibility in the form of demand response.

Finnish miners can secure annual revenues of $70k per MW by providing demand response capacity, and I estimate this market to grow substantially. During certain months, miners in West Texas have earned more by shutting down their production than by mining bitcoin. This could happen in Finland as well.

Electricity prices will fall in Finland

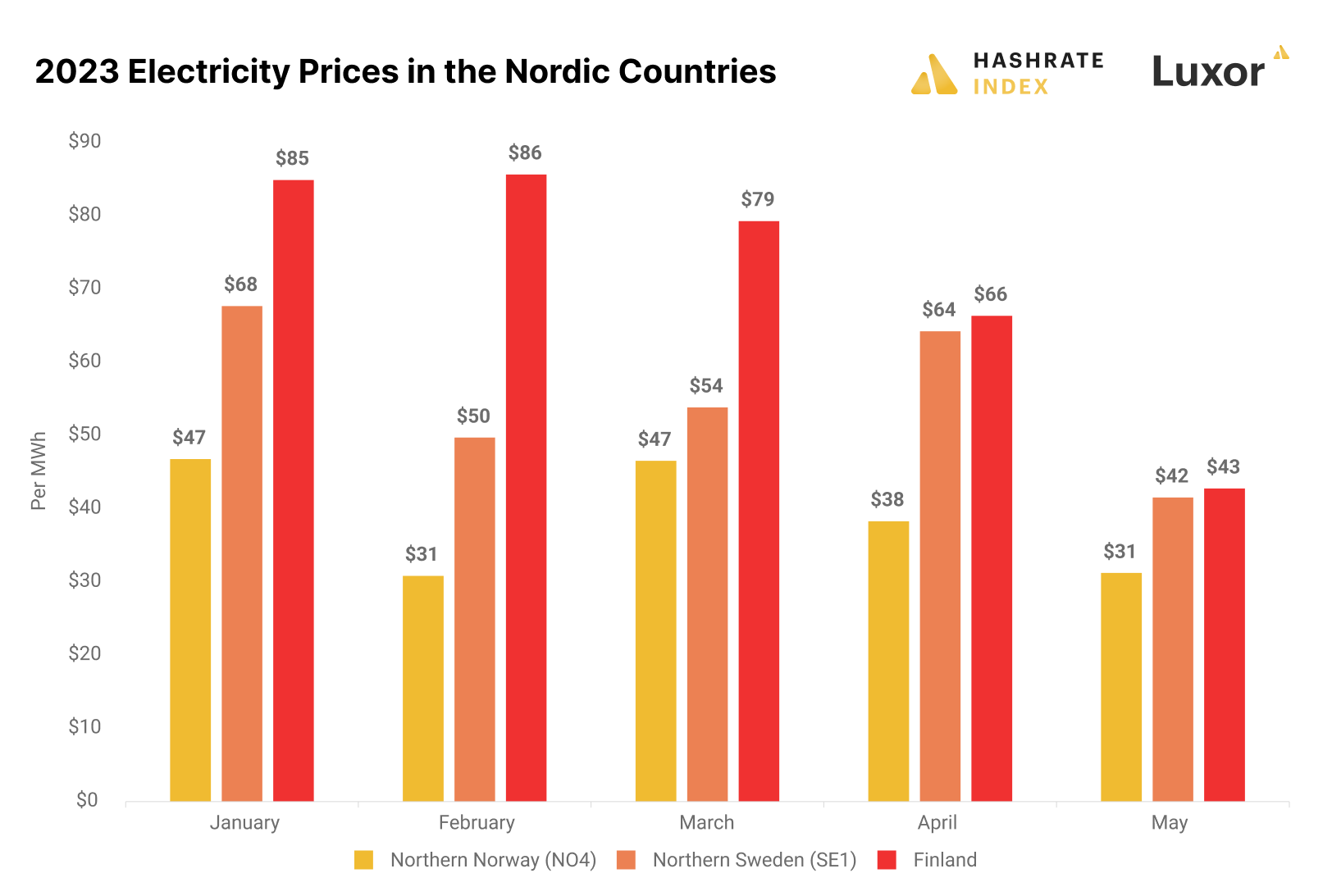

Finland has historically had slightly higher electricity prices than neighboring Norway and Sweden, but with the influx of nuclear and wind, prices are destined to fall. I expect the Finnish electricity prices to converge toward those in northern Sweden and potentially become even lower.

As you can see on the chart below, electricity prices dropped substantially from April. Prices in Northern Sweden also dropped, as they are significantly correlated with the Finnish prices due to substantial transmission capacity between the two countries.

With electricity prices converging toward those in Northern Sweden, Finland looks like an increasingly attractive bitcoin mining location from a pure cost perspective. I expect prices to keep dropping as more wind and solar capacity comes online in the coming years.

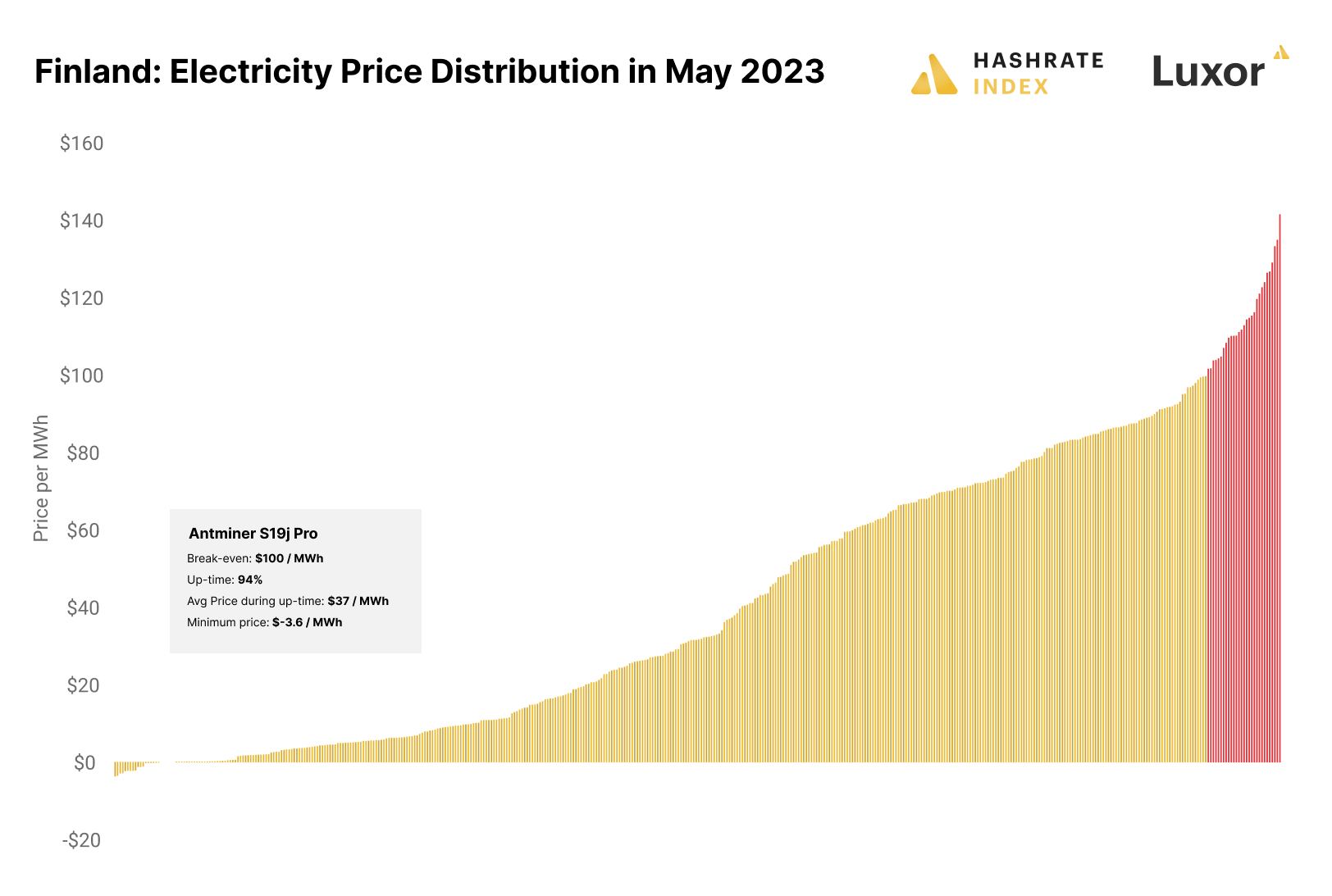

May was the first full month with the new 1,600 MW nuclear reactor online. Let’s look at the price distribution during this month. A Finnish miner with the Antminer S19j Pro buying electricity at the spot market would achieve a total up-time of 94% in May at an average electricity price of $37 per MWh. These are decent results.

We also see that some hours in May were even negatively priced due to massive wind and hydro production. Such negative prices rarely happened before the nuclear reactor came online, and their prevalence is expected to increase as more wind and solar capacity comes online in the coming years. Such volatile prices favor bitcoin miners playing the electricity market by buying spot and registering in demand response programs.

Finland has also historically had significant seasonal differences in electricity prices due to heating requirements in the winter. While May has historically been among the cheaper months, electricity could, even with all this new nuclear and wind capacity, become relatively expensive from December to March. Miners buying spot would thus achieve a slightly lower up-time during the winter than in the summer.

Bitcoin miners are heating Finnish homes

Finnish winters can be harsh, so the Finns have built among the world's most sophisticated district heating systems. These systems currently heat about 50% of the country’s homes and are growing year after year.

The district heating providers are currently burning wood bark, coal, oil, gas, or peat to generate heat and are in a hurry to switch to less polluting fuel sources due to EU directives, demands from customers, and because most of the wood bark is imported from Russia.

Luckily, Finnish bitcoin miners provide a solution to this problem. By delivering their waste heat to the district heating companies, bitcoin miners are helping them decarbonize their heating systems and lowering their imports from Russia.

The advantages are clear for the district heating companies, but what do bitcoin miners get in return? There are two main advantages for the bitcoin miners. Firstly, the district heating companies pay them between $15 and $30 per MWh of heat supplied. Thus, the miner gets an additional income source that effectively lowers its electricity costs by a substantial amount. The second advantage comes from a vastly improved political positioning. If miners become integrated into the Finnish district heating system, it will be extremely hard for Finnish regulators to curb the industry. It also gives public relations benefits.

Finnish miners are uniquely positioned to become the world leaders in heat recovery. The future of the Nordic bitcoin mining industry consists of smaller facilities reusing their heat, and Finland, with its extensive district heating system, will lead the way.

A politically stable country with acceptable regulatory conditions

During the past few years, miners in many locations have encountered political or regulatory opposition in the form of rising electricity taxes, moratoriums, or even mining bans. Thus, bitcoin miners worldwide are becoming increasingly aware of the importance of operating in a politically stable jurisdiction.

Finland is widely regarded as one of the safest and most politically stable countries globally. It is the type of country where just not much is happening. Things just stay the same year after year. You could definitely find more “Bitcoin-friendly” countries, but you have to remember that these are usually politically unstable countries where miners live at the mercy of only one group of people in power. The situation might completely change if other people get to power, as they could throw out the entire bitcoin mining industry. Finland is no such country, so I would feel very safe operating there.

Still, as in most countries, Bitcoin is politically incorrect in Finland. Finland’s neighbors - Sweden and Norway, recently removed all data centers’ eligibility for a reduced power tax, and miners’ power tax thus increased by a substantial amount overnight. Finnish miners currently pay $0.00068 per kWh in power tax, and I believe it will stay that way for the foreseeable future.

Finland’s bitcoin mining industry is so small that it is not of a political substance. Finland’s politicians have more important concerns than a 40 MW bitcoin mining industry. Still, as I explained in this article, Finland’s bitcoin mining industry could grow toward several hundred megawatts, and it would then become so substantial that the Finnish politicians might start to care.

Let’s say Finnish politicians started opposing the mining industry and wanted to increase its taxes. It would be very difficult for them to do that, as Finland doesn’t have its own tax code for data centers. Miners in Finland simply go under the broad category “industry”. For Finland to specifically increase power taxes for miners, they will have to create a new tax code and an entirely new tax bracket. This is a much more challenging task than increasing the power tax for data centers in Norway and Sweden.

Overall, Finland is a politically stable country with acceptable regulatory conditions for miners. I expect it to stay that way.

Cold weather ensures excellent operating conditions

Climate conditions is a critical but often downplayed consideration in bitcoin mining. Miners operating in cool environments can overclock using firmware like LuxOS, enhance up-time, minimize cooling infrastructure needs, increase machine lifespan, and reduce maintenance requirements. Combined advantages can give a colossal efficiency boost to a mining operation.

Finland has a bitcoin mining-friendly climate. In the capital Helsinki, daily mean temperatures range from -4°C (25°F) to 18°C (65°F) between the coldest and warmest months. It is worth noting that Helsinki is in the south of the country, so most viable bitcoin mining locations in Finland will be even colder.

The air is also very clean in Finland. Pollution is virtually non-existent, and there are minimal amounts of dust and pollen in the air. This reduces filtration requirements and can increase the lifespan and performance of the machines.

This cool climate and clean air are some of the major advantages of mining in Finland.

Conclusion

Finland is Europe’s unexplored bitcoin mining frontier. Historically, its Nordic neighbors Norway, Sweden, and Iceland have absorbed most of the European bitcoin mining demand, but with these locations becoming increasingly crowded, the massive available capacity in Finland is looking increasingly tempting.

Electricity prices in Finland will also substantially decline with Europe's largest nuclear reactor in full production, along with several gigawatts of planned wind and solar capacity in the next few years. These lower prices alone could attract a substantial bitcoin mining sector.

In addition, bitcoin miners can play a critical role in heating Finnish homes through the country’s district heating system. Finnish district heating providers are eager to move away from traditional district heating fuel sources like oil and coal, and bitcoin miners can help them by supplying waste heat. Finnish bitcoin miners are uniquely positioned to become world leaders in heat recovery.

Finnish miners have revenue potential from three sources; mining, demand response, and heat sales. This, along with the fact that Finnish electricity prices are likely to decline, will make Finnish bitcoin miners highly competitive globally. I see Finland as the last bitcoin mining frontier of Europe and believe the industry will grow to several hundred megawatts in the next couple of years.

Thanks to Lauri Pispa (Coinseeker), Jaakko Kaijala (Nordblock), Kasimir Kaitue (Nordblock), Anti Jalomäki (Nevaberry), and Thomas Brand (Coinmotion) for their invaluable Finnish insights that helped me write this article.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.