Ordinal Inscriptions Give $1.35M Nudge to BTC Transaction Fees in February

Inscriptions are driving a slight increase in fees, but how long will it last?

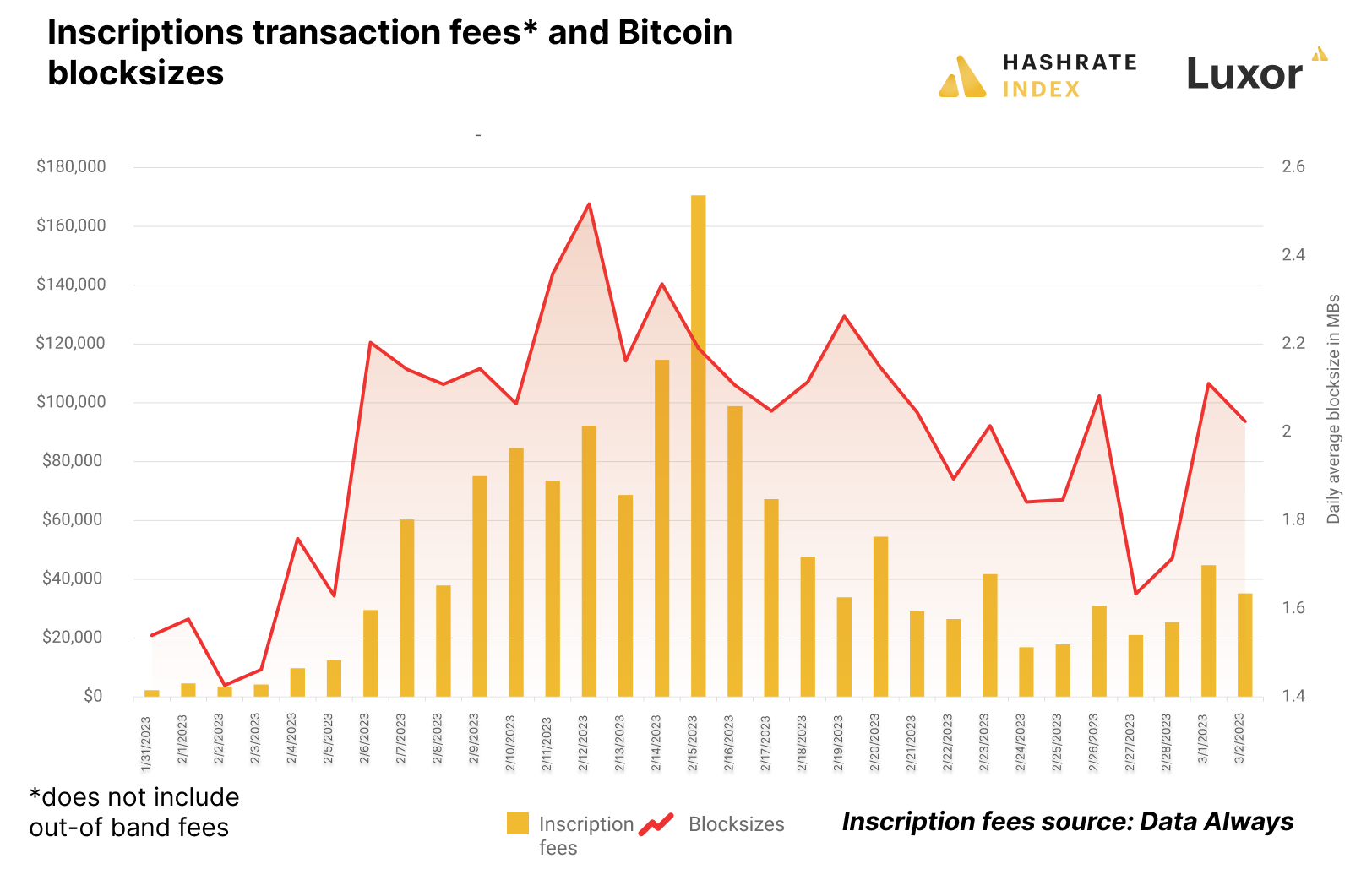

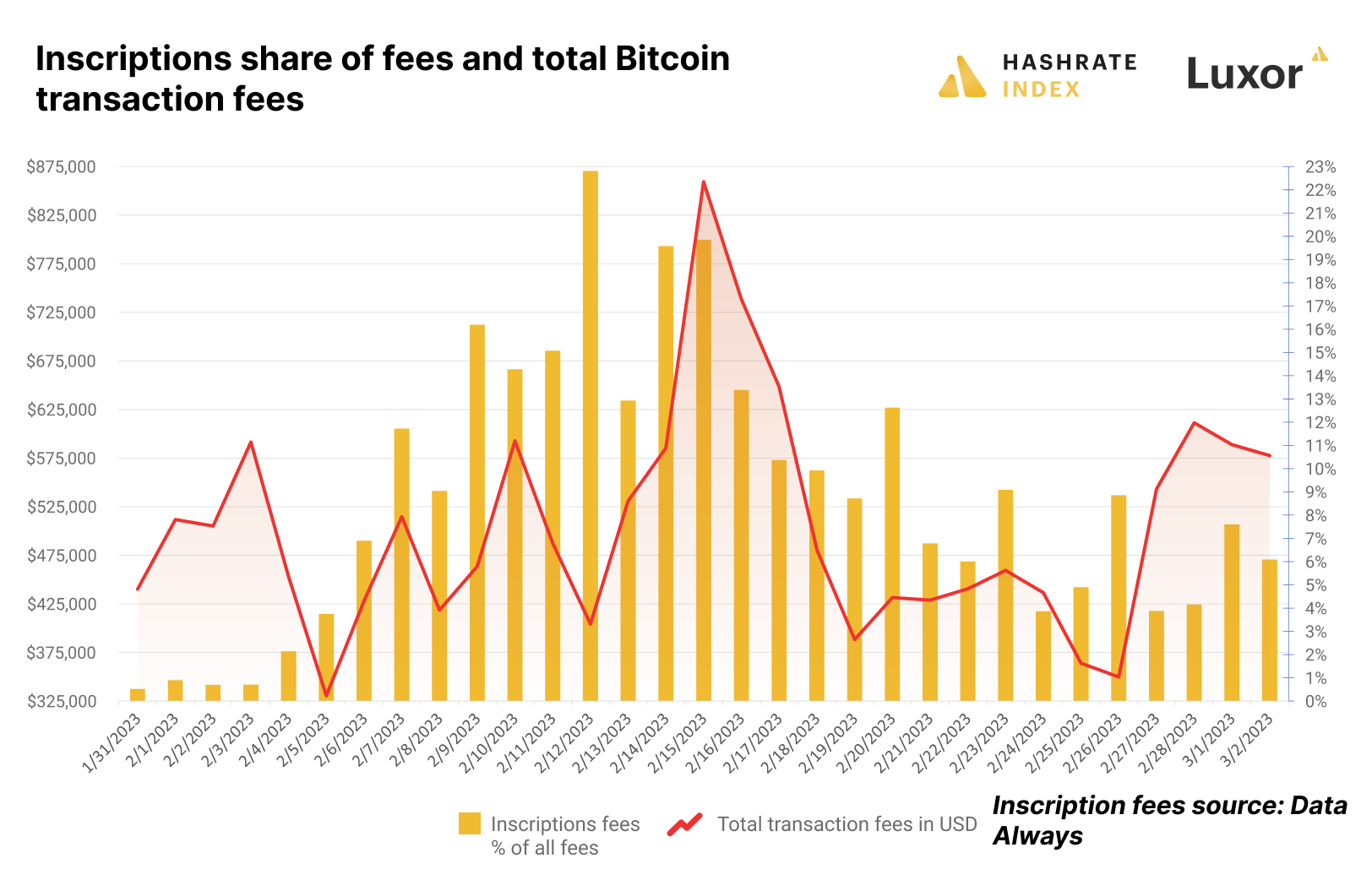

February was a breakout month for ordinal inscriptions. After minimal activity in January, over 200,000 inscriptions were inscribed in February, earning miners $1.35 million in transaction fees (and those are just the in-band fees we know about, but more on that later).

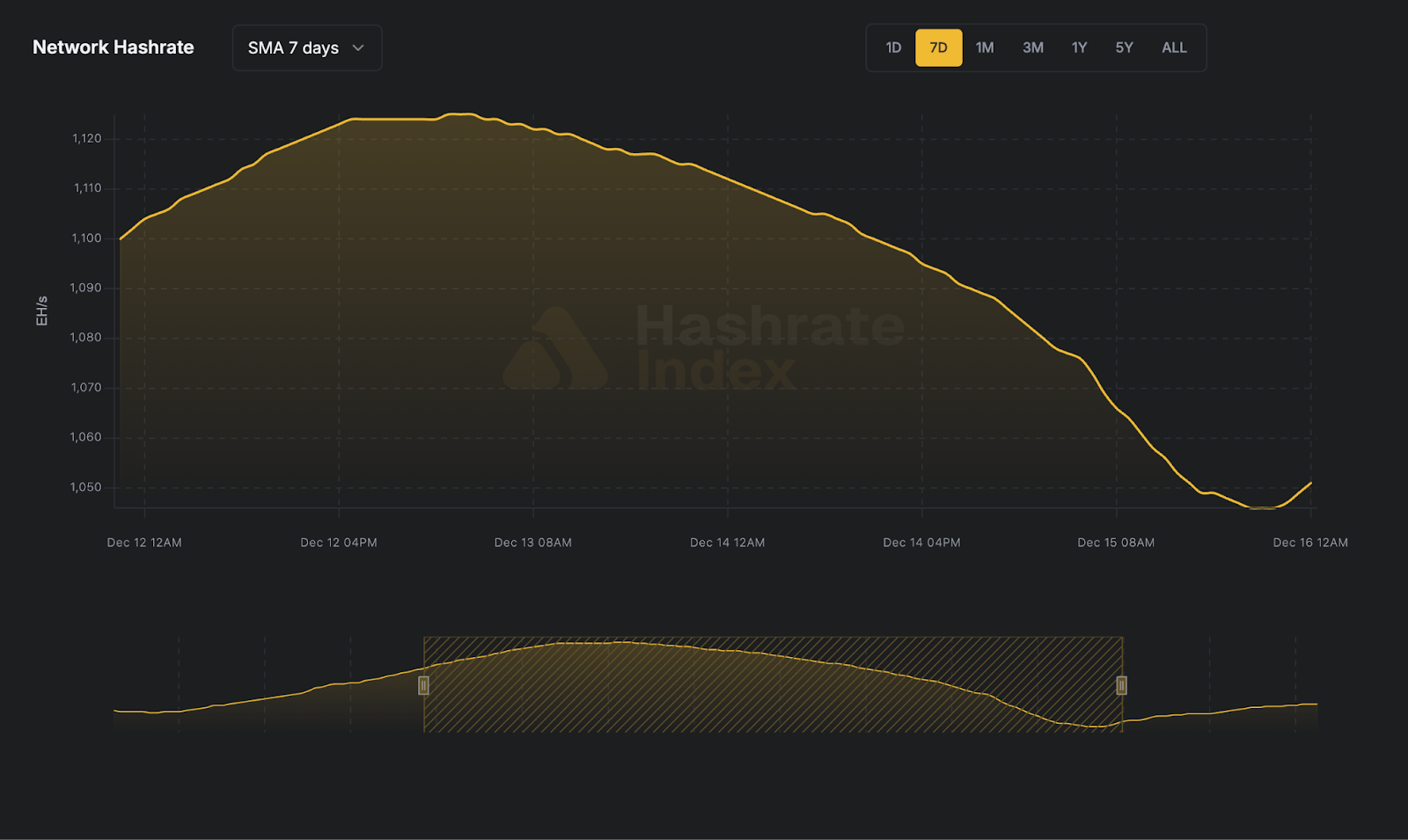

The inscription fever cooled by the close of February. Courtesy of data from Data Always’ Ordinals Dune dashboard (which has since been made private), we can observe that the inscription spree peaked in mid-February and tapered by the final week of the month.

The data presented above does not include out-of-band fees for inscriptions. An inscriber or collection curator may directly contact a mining pool or miner to mine their inscription (or a collection of inscriptions, like in the tweet below) in a custom block, and they pay the miner directly for this service in a separate transaction.

535 DeGods. 3.53 MBs. 1 block. pic.twitter.com/pbCsvaMvoV

— DeGods III (@DeGodsNFT) February 17, 2023

Out-of-band ordinal inscriptions account for a sizable portion of inscription transaction fees. On certain days, it could be as high as 100% of in-band ordinal fees. You'd want to factor these in for a more comprehensive analysis of the impact of inscriptions on transaction fees, but there’s no way to reliably trace out-of-band payments.

Even without out-of-band payment data, we have a month of in-bound data we can use to observe how inscriptions are impacting Bitcoin’s blockspace market. February showed us that inscriptions are driving demand for blockspace and increasing on-chain fees marginally. Out-of band payments for inscriptions are the real honeypot for miners though. If inscriptions stick around, they could have significant implications for Bitcoin-native MEV for miners.

How ordinal inscriptions are impacting transaction fees, blocksizes

Transaction fees would be much lower without the blockspace demand from inscribers.

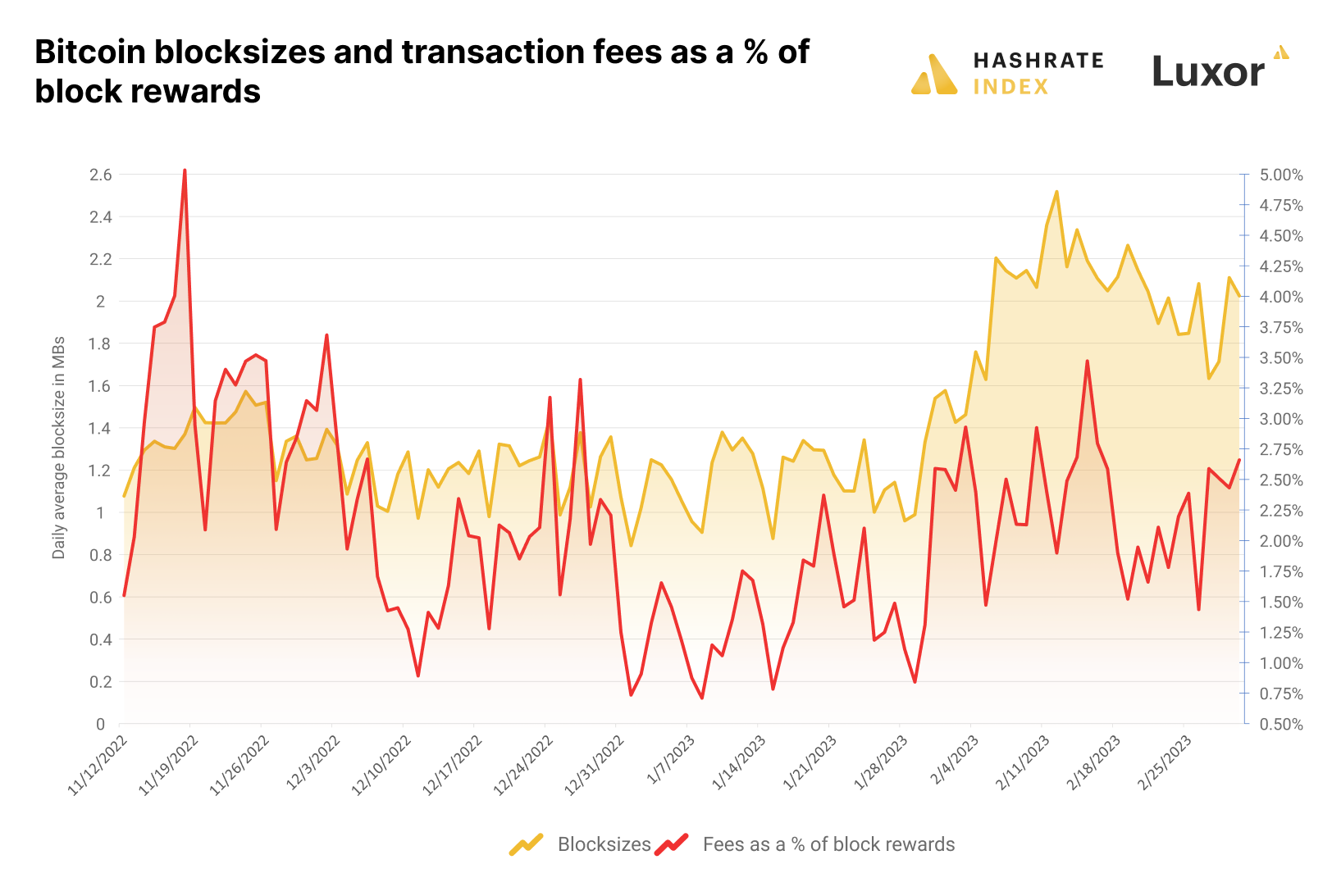

In USD terms, fees from February’s inscription fervor were higher than the fees miners earned in November 2022, the month of FTX’s collapse and the most active Bitcoin’s fee market has been since China’s mining ban ($14 million vs $12.3 million).

Bitcoin's price increase from November to now is doing a lot of the work for th increased fee revenue there, as evidenced by how much BTC miners netted from transaction fees in Novmber and February. (Miners earned 601 BTC in in-bound transaction fees in February vs 712 in November).

Inscriptions have been controversial for a number of reasons, not least of which because they benefit from SegWit’s data discount. The data for the inscription lives in the transaction witness section of a block that was introduced with 2017’s Segregated Witness (SegWit) upgrade. Witness data is cheaper to transact per byte than data included elsewhere in the transaction, so inscriptions cost fewer satoshis per byte of data than a normal, economic transaction.

We can observe the SegWit discount in full effect in the charts above and below with the window to the right of either chart. The chart above shows blocksizes swelling from inscriptions in February while transaction fees rise only slightly.

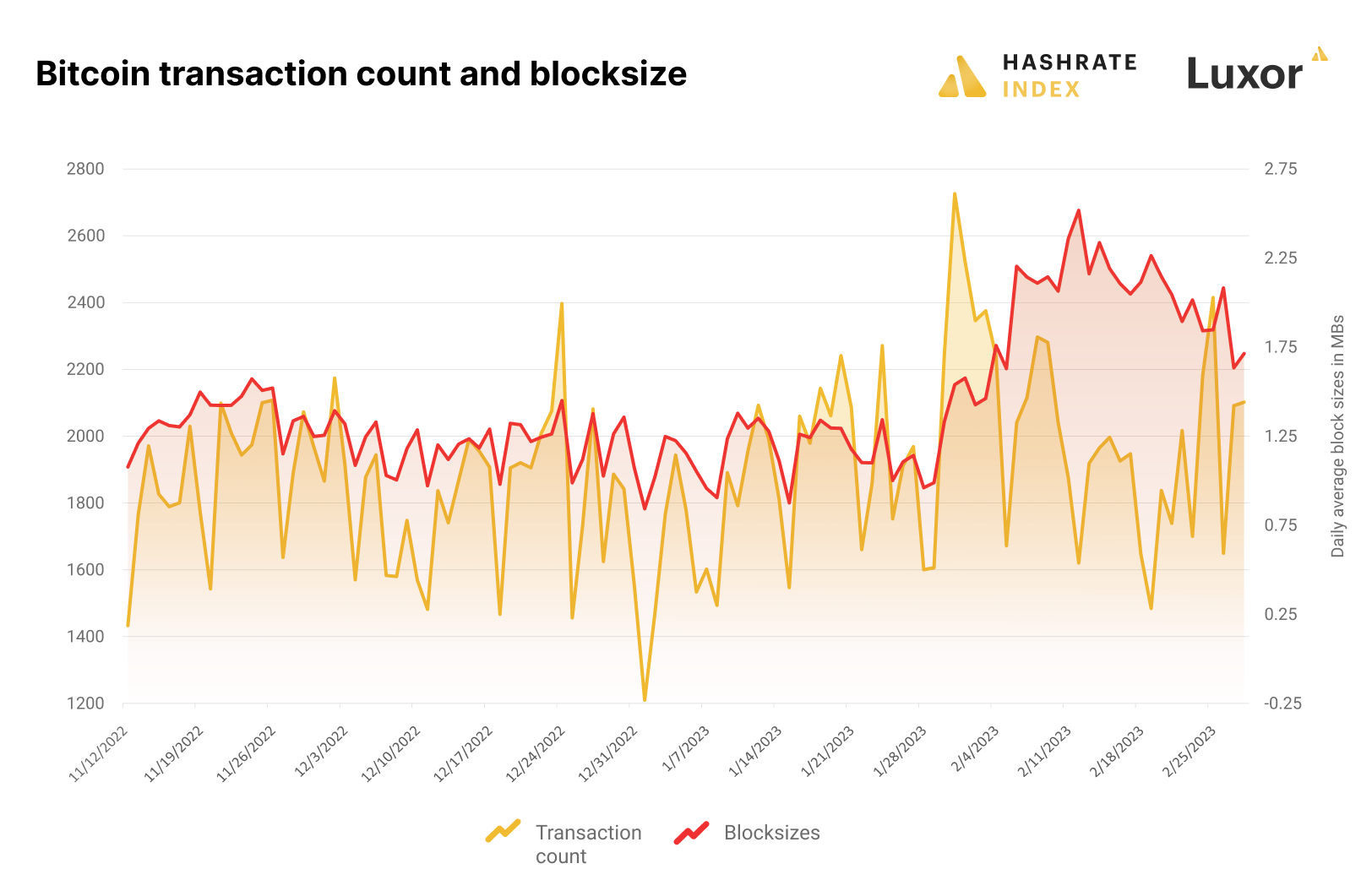

In the chart below, we can see that total transactions per block fell substantially at the peak of February’s inscription fever (February 9 -20). Unsurprisingly, as ordinals flooded the mempool, miners included fewer total transactions per byte of blocksize. Even so, total transactions included in each block trended upward from November 12, 2022 through February 2023.

All things being equal, inscriptions are netting miners more fees than they otherwise would earn. They have driven demand for blockspace and created direct pressure on transaction fees with their own fees and indirect pressure by raising the floor for average fees for other transactions. If all of the blockspace demand were economic transactions without the SegWit discount, then the fees miners are earning would be much higher.

But that demand doesn’t exist right now and demand for inscriptions does, so miners will welcome the increased fee revenues they earn from these inscriptions even if it isn't a fortune right now.

Inscriptions are promising for Bitcoin miners, but it's early

It’s too early to tell what the substantive, long-term impact of inscriptions will be.

If demand for blockspace increases substantially in 10 years, it’s possible that inscriptions could place serious pressure on transaction fees. The long-term viability of NFTs on any chain, though, is still in the air.

For right now at least, inscriptions are giving miners a modest boost to in-band transaction fees, but miners are also earning fees for custom mints in the form of out-of-band transactions. This is a sort of proto-MEV for bitcoin and is worth examining to see if other monetizing strategies develop from inscriptions.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.