Highlights from Hive's Q3 Report

Hive Blockchain just lost its cash cow as Ethereum transitioned to proof-of-stake. This article analyzes the company's financial strength and discusses how impacted it was by "the merge".

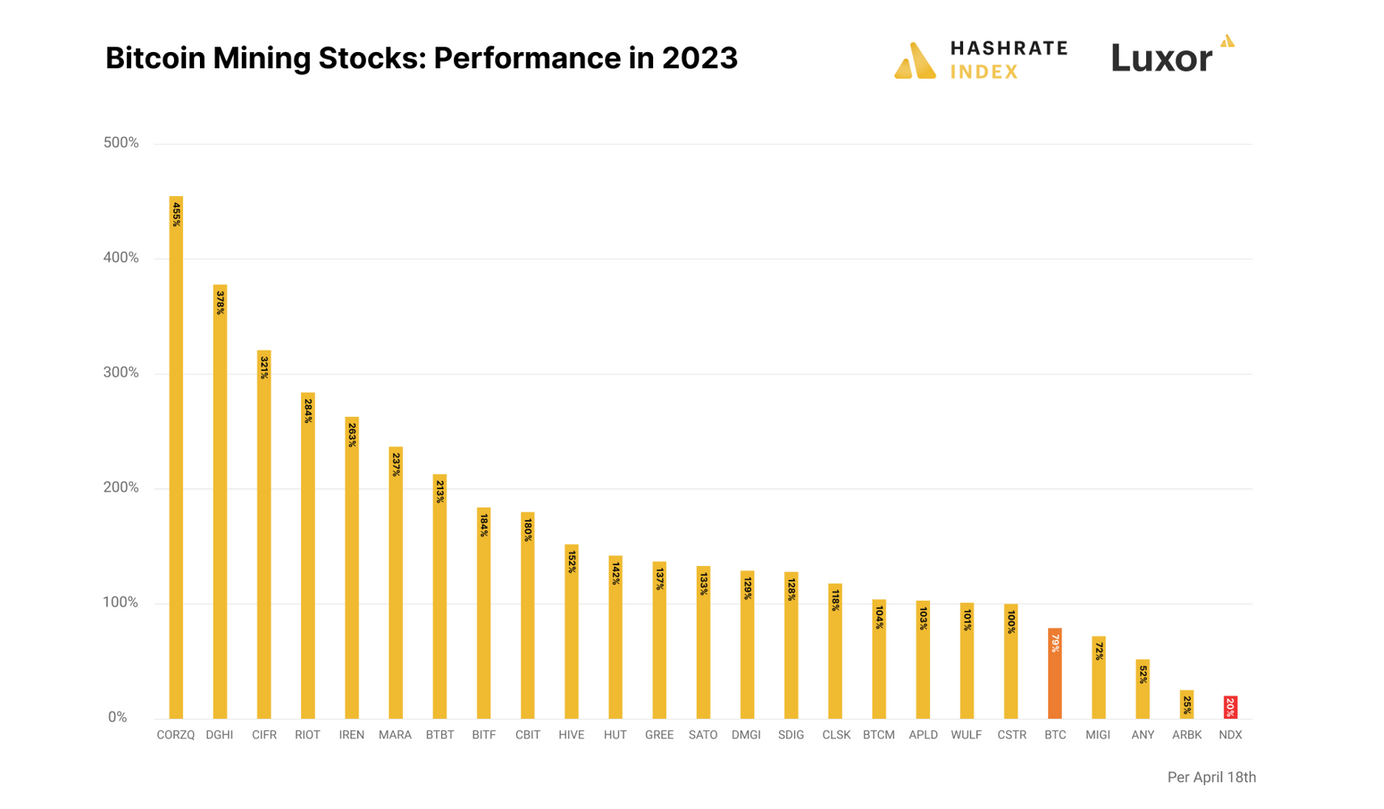

The bitcoin mining industry is going through a crisis. Most stocks have plummeted by more than 90%, and some have even warned they are on the brink of bankruptcy. While everyone agrees that bull markets are more comfortable, it's essential to remember that the depths of the bear market will provide the best investment opportunities.

While some of the public bitcoin miners are just waiting to die, others are so strong that they could not only survive the bear market, but potentially capitalize on it. To separate the weak from the strong, we have already looked into the finances of Core Scientific, Riot, Bitfarms, Hut 8, and Marathon, and now we analyze Hive's last quarterly report.

A little background on Hive: Hive was the first cryptocurrency mining company to go public in 2017. Its 100% hydro- and geothermal-powered operations are located in Canada, Sweden, and Iceland. The company was a prominent ether miner before Ethereum transitioned to proof-of-stake and is now expanding its bitcoin mining capacity to compensate for the lost ether mining revenues.

Hive has a solid and liquid balance sheet

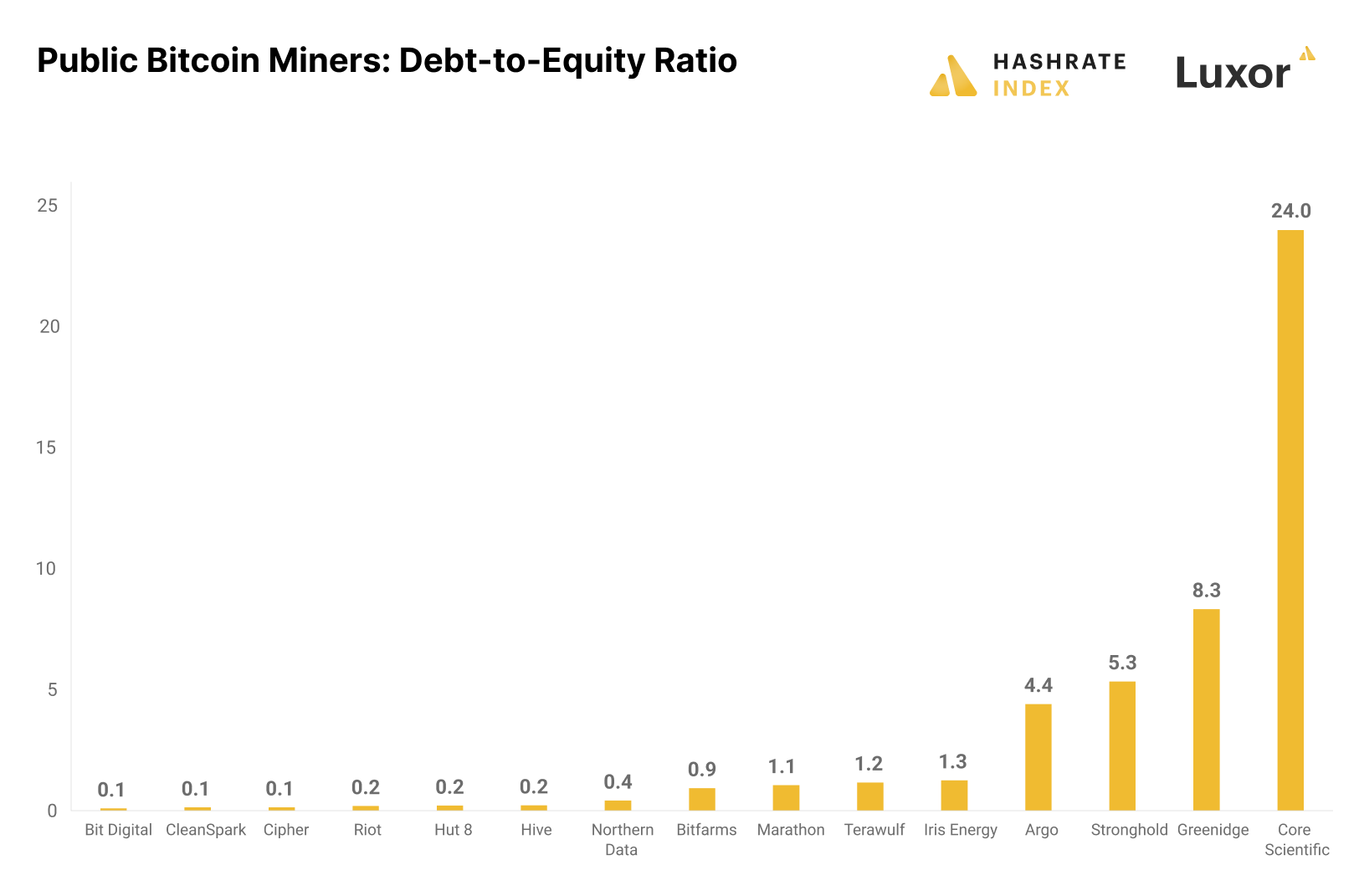

Nothing is more critical during the bear market than having a solid balance sheet. Those with weak, debt-filled balance sheets are currently sitting in precarious positions as they struggle with significant debt service payments at the same time as their cash flows from operations are shrinking due to the deteriorating mining economics. A common trait among all the struggling public bitcoin miners is high debt loads, particularly machine-and-bitcoin collateralized debt.

With little debt and excellent liquidity, Hive is definitely not among these struggling companies. Let's first inspect the solidity of its balance sheet before analyzing its liquidity.

The chart above shows the debt-to-equity ratios of the 15 biggest bitcoin mining companies by enterprise value. Hive's debt-to-equity ratio is only 0.2, making it among the least indebted public bitcoin miners. The company's long history means it has experienced the cyclicality of bitcoin mining before, which might have played a role in making the company conservative with debt.

Like some of its competitors, Hive spent the third quarter strengthening its balance sheet by paying down debt, reducing its total liabilities to $50 million from $59 million on June 30th. Its interest-bearing debt is only $26 million, sparing it from the massive debt service payments that currently plague many of its competitors. Hive's insignificant debt service payments let it preserve most of its cash flow from operations, which is of tremendous help to the company's liquidity.

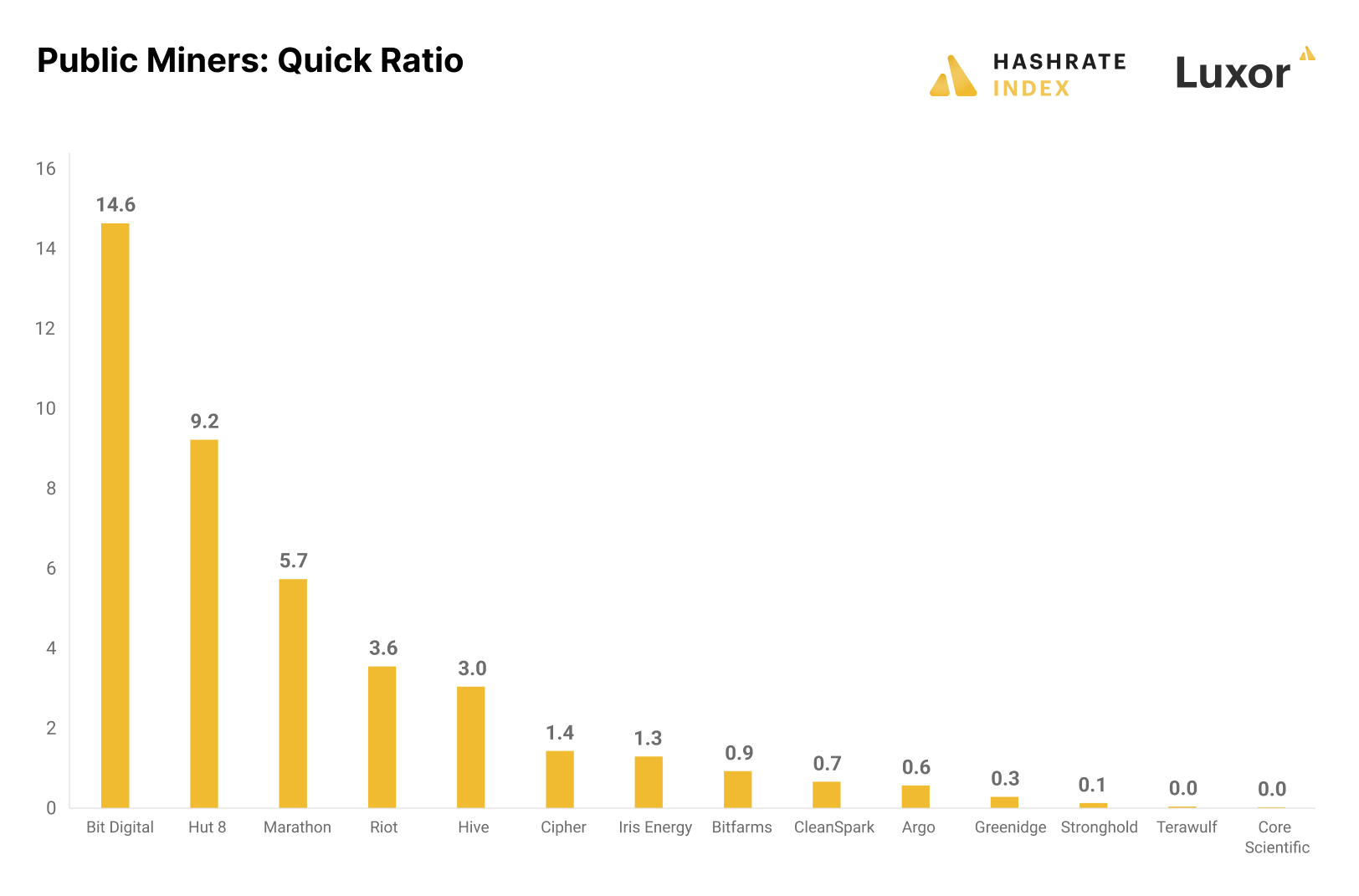

Not only does Hive have a solid balance sheet with little debt relative to equity. Its balance sheet is also highly liquid, proven by its quick ratio of 3. Only four top 15 public bitcoin miners by enterprise value have more liquid balance sheets.

Hive's liquidity primarily consists of its bitcoin holdings. The company only has $8 million in cash but holds 3,311 bitcoin, making it the fourth-biggest hodler of the public miners. Its bitcoin holdings are worth $57 million, making up 88% of the company's liquidity.

The company generates positive cash flows from operations and doesn't have significant debt service payments. Still, if market conditions worsen, the company must likely tap into its bitcoin holdings for fiat liquidity to pay for operating expenses. Hive follows a flexible treasury model, as it neither pursues a 100% hodl strategy nor sells everything it mines. The company previously had significant ether holdings but dumped it all in Q2 and Q3.

Hive is keeping its costs down

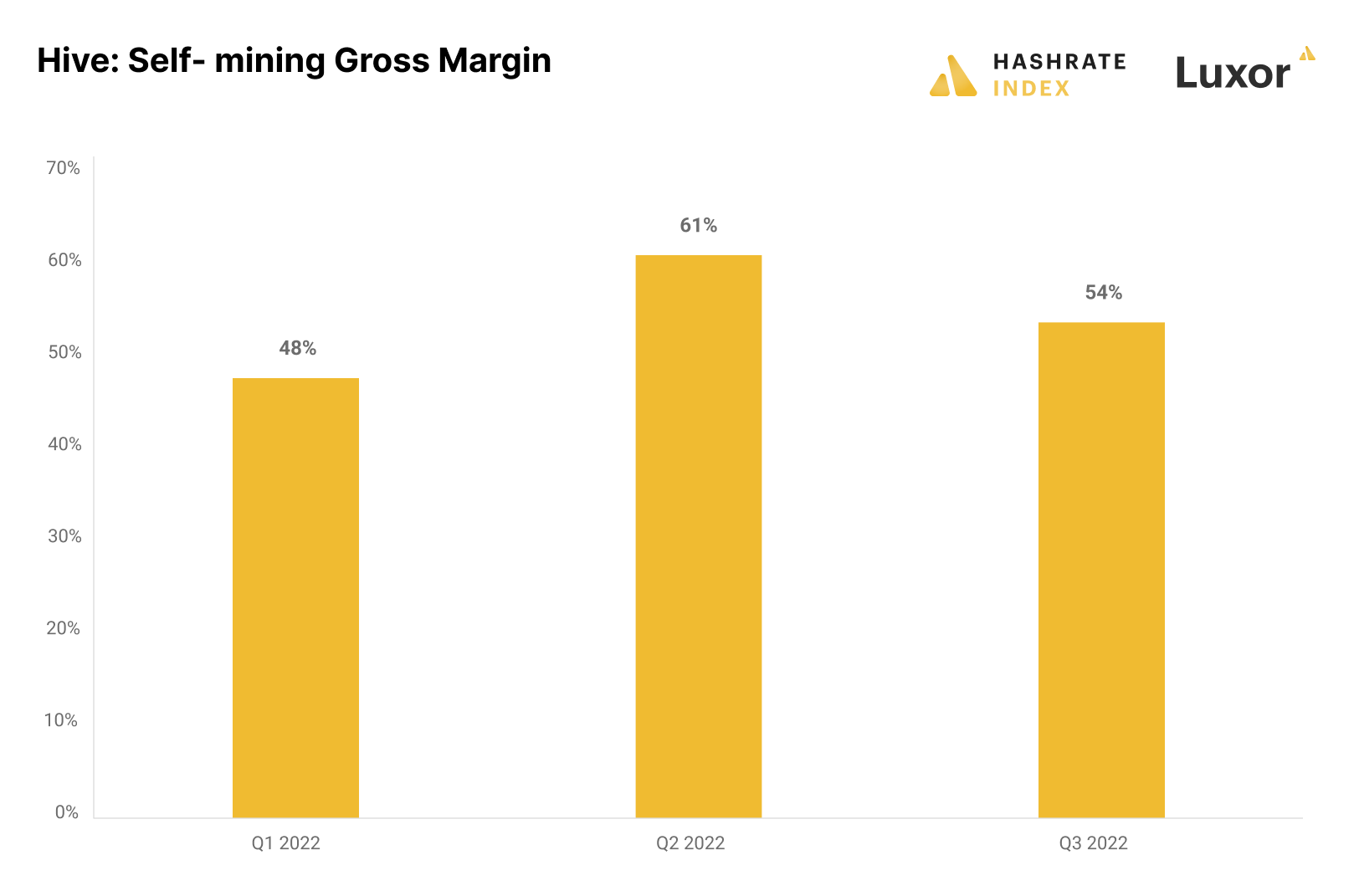

Let's look at Hive's income statement. The company has historically been among the miners with the highest gross margins due to its tremendously profitable ether mining business. In the previous quarter, its gross margins were 54%. This gross margin is decent, considering the current market environment, but still a massive decline from the more than 90% ether mining gross margins the company once enjoyed.

There are two main reasons why Hive has relatively strong mining margins. Firstly, it enjoys low electricity prices. The company only operates in hydro- or geothermal-powered grids in Quebec, New Brunswick, Sweden, and Iceland. Grids powered by these energy sources don't require the backup of natural gas and have seen considerably lower electricity price increases than wind- and solar-powered grids like Texas. Therefore, Hive has been spared from most of the energy price inflation that has plagued many of its competitors this year.

The second reason why Hive has been able to produce bitcoin cheaper than many competitors is its higher operating efficiency. The company has historically been one of the most efficient public miners judged by bitcoin produced per EH/s of capacity. Hive has historically been able to squeeze out between 5% and 30% more bitcoin for its mining capacity than most competitors. This could be due to the company achieving a higher up-time due to consistent hydropower supply. This hypothesis is further strengthened by seeing that the other hydro-powered miners, Iris Energy and Bitfarms, are second and third on the efficiency list.

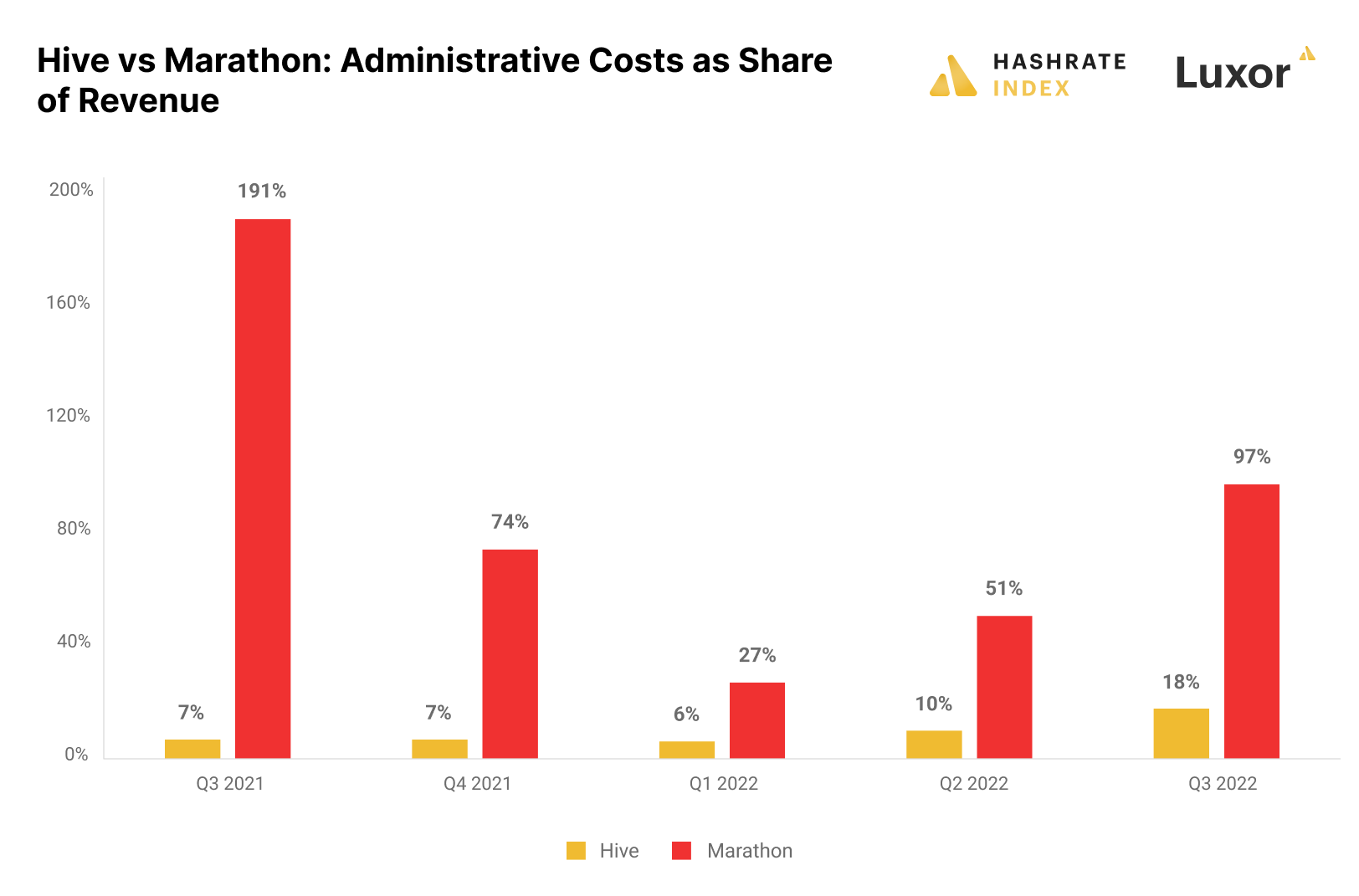

There are several public miners with similar gross margins as Hive, but many have high administrative costs that eat up their cash flow from operations. Hive has historically spent significantly less on administration than most competitors. Its administrative costs have historically stayed between $3 million and $5 million quarterly.

To gain perspective on Hive's low administrative costs relative to competitors, let's compare it to Marathon – the biggest administrative spender of the public bitcoin miners. During the previous five quarters, Marathon's administrative costs comprised between 27% and 191% of its revenues. Meanwhile, Hive's administrative costs have stayed in the more reasonable area of between 6% and 18% of revenues. The company's low administrative costs are a breath of fresh air in an industry with a bad reputation for massive overspending on executive compensation and other administration.

Hive just lost its ether mining cash cow

Hive was a prominent ether miner until September 15th, when Ethereum transitioned from proof-of-work to proof-of-stake. The company had spent years building up one of the world's most profitable GPU fleets, which is now rendered almost worthless.

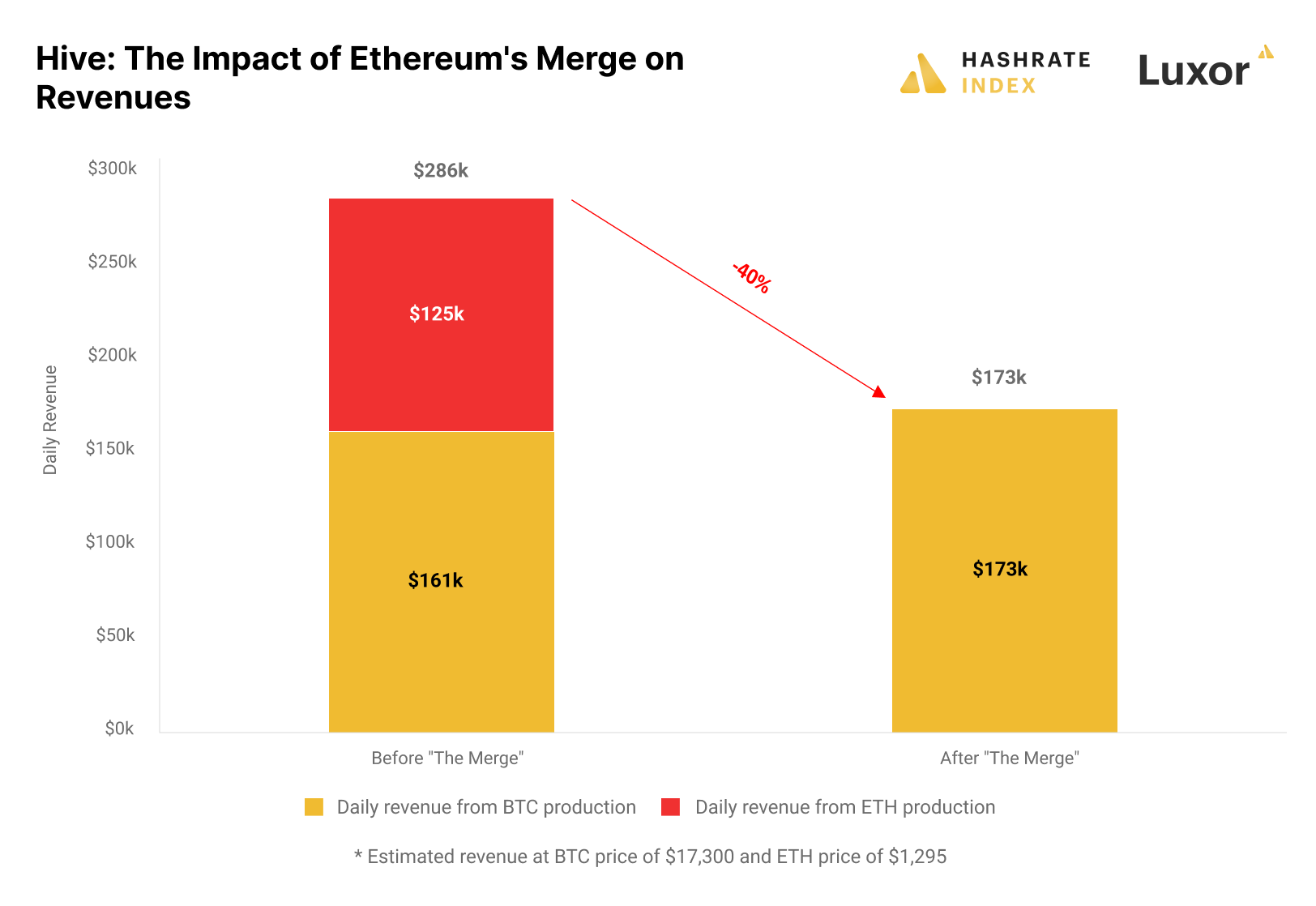

I estimate Hive's daily revenues to have fallen by 40% from $286k to $173k due to "the merge". Such a revenue decline is bad enough by itself. What makes it worse is that Hive's defunct ether mining business was much more profitable than its remaining bitcoin mining business, meaning that the actual loss to the company's cash flow from operations is likely in the 60% area.

How does Hive deal with losing its possibilities for mining ether? While the company uses some GPUs for mining Ethereum Classic, its most important focus is repurposing its ether mining facilities to bitcoin mining. The company currently has 2.8 EH/s of bitcoin mining capacity, which it aims to grow to 3.33 by February 2023.

I have no doubts that the company will be able to significantly increase its bitcoin mining capabilities over the next few months, as it already has significant data center infrastructure available. In addition, with machine prices depressed, the company almost couldn't have asked for a more favorable time to invest.

Conclusion

Hive has been through a tough quarter where it lost its precious ether mining cash cow as Ethereum transitioned to proof-of-stake. The company is now forced to do without its high-margin ether mining business and focuses on replacing this capacity with bitcoin mining.

The company has a solid balance sheet with little debt and massive bitcoin holdings it could tap into for liquidity if needed. Its financial strength makes it well-positioned to make the necessary investments to transform itself from a hybrid ether and bitcoin miner to a fully dedicated bitcoin mining company.

The veteran miner Hive has historically been good at keeping its costs low. The company has access to cheap hydro- and geothermal power and consistently operates its fleet more efficiently than most competitors. Keeping the costs down and efficiency high will be vital for Hive to transform its business during this bear market.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.