Highlights from Hut 8’s Q3 Report

Hut 8 just revealed the state of its finances and operations in its latest quarterly report. How is it going with this Canadian bitcoin miner and data center operator? Find out in this article.

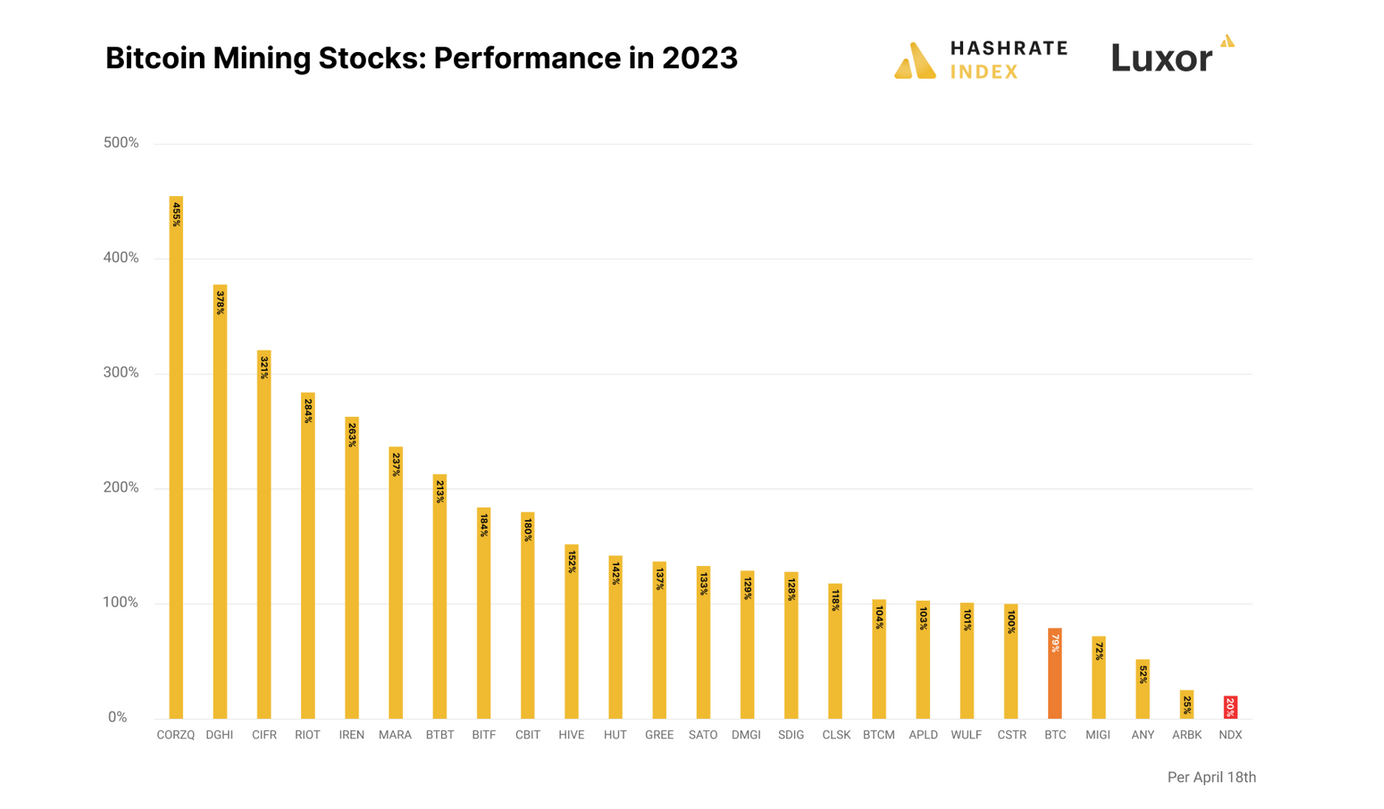

The bitcoin mining industry is currently in crisis mode. The share prices of most public mining companies have plummeted by more than 90% from their all-time highs, and the latest icing on the cake is that several of these companies are warning that they might run out of cash soon.

After the FTX situation pushed the bitcoin price down to $17k, things have gotten so bad that many are wondering which bitcoin miners will go bust. The more optimistic of us are framing the question the opposite way: "Which bitcoin miners are so strong that they will not only survive the bear market but could capitalize on it?"

To answer such questions, we must dive deep into the public bitcoin miners' financial reports. After having looked into the finances of Riot and Core Scientific, I now analyze Hut 8’s latest quarterly report.

Hut 8 has a solid balance sheet with little debt and enormous bitcoin holdings

One thing that has become apparent in this bear market is that having a solid balance sheet is currently the most crucial factor for bitcoin mining companies. Those with weak, debt-filled balance sheets are vulnerable as they have large debt payments to make while their operating cash flows are shrinking due to deteriorating mining economics. We are currently seeing public bitcoin miners like Core Scientific, Argo, Stronghold, and Iris Energy being under heavy pressure due to their high debt positions.

Hut 8 is definitely not in the group of miners with weak balance sheets as it has little debt relative to equity and very high liquidity compared to its current liabilities. Let’s first look at the solidity of its balance sheet before determining its liquidity.

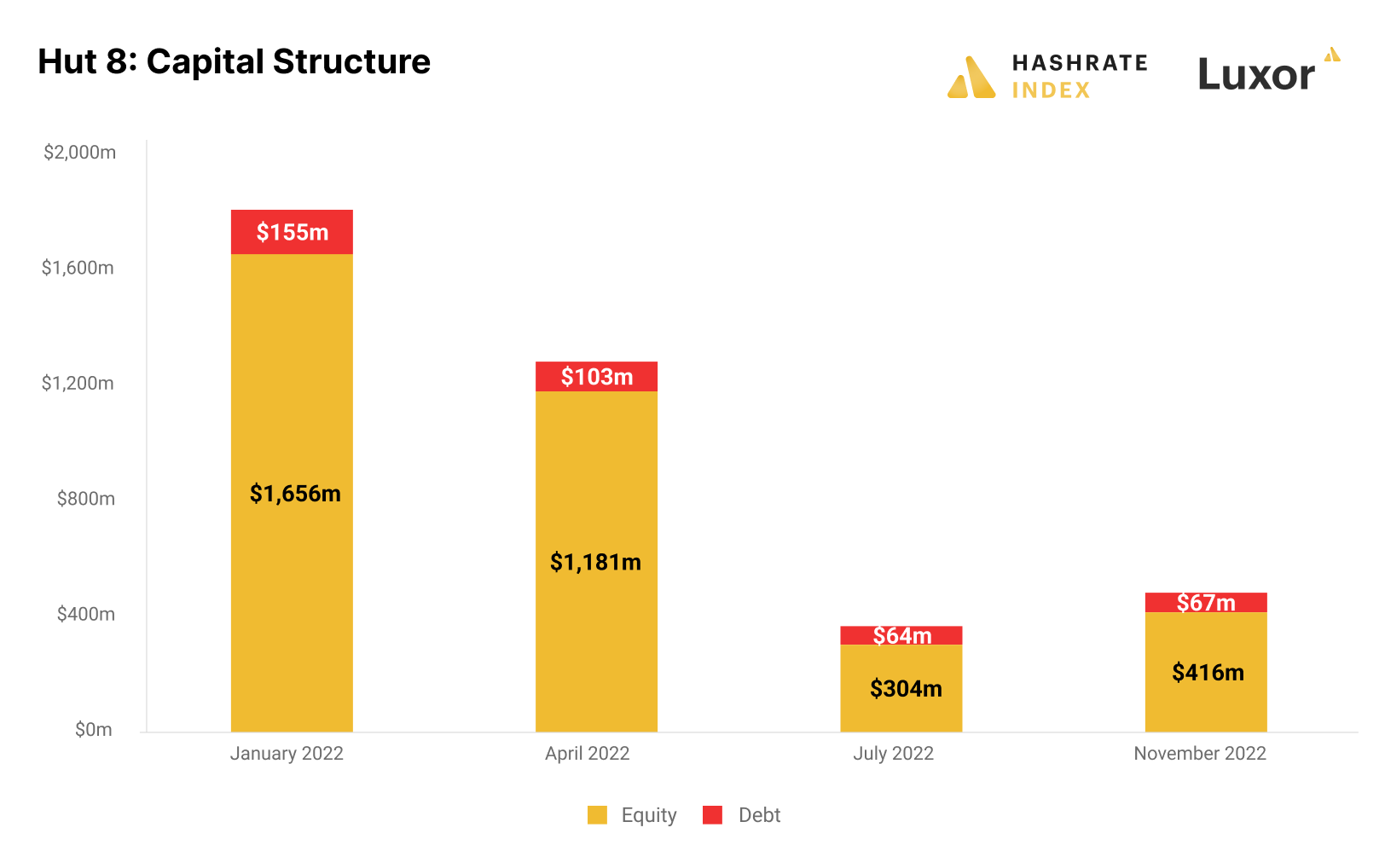

Hut 8 only has $67 million in liabilities, while its equity has a market value of $416 million. This capital structure gives the company a debt-to-equity ratio of only 0.16, among the lowest of the public bitcoin miners.

As you can see on the chart above, Hut 8 had more than twice as large a debt position in January as it has now. The company’s equity value has naturally fallen due to the bear market, but it’s still enormous relative to its small debt. Hut 8’s high equity value compared to the debt means the company could easily take on additional debt if needed. Still, as I will explain later in the article, the company will likely keep favoring equity over debt.

Not only doesn’t Hut 8 have significant outstanding debt, but it has very little machine-collateralized debt. This type of debt has been the most precarious for several public bitcoin miners, as it makes companies vulnerable to bitcoin and machine price declines. Hut 8 has only one machine collateralized loan with Trinity outstanding of $30.2 million. The loan only bears an interest rate of 9.5%, significantly lower than most other public mining companies pay on similar loans.

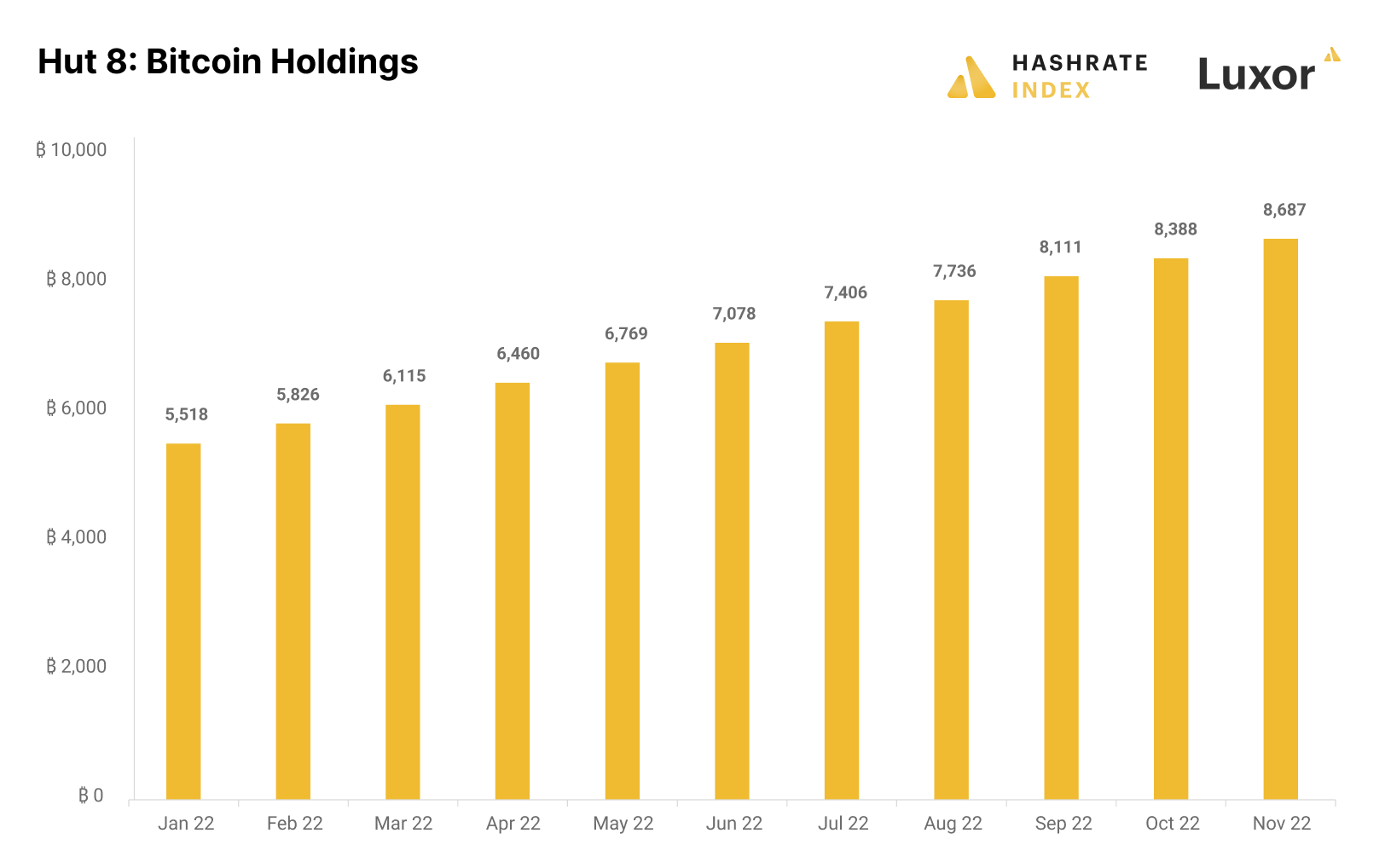

In addition to having a solid balance sheet primarily funded by equity, Hut 8 also has tremendous liquidity. The company holds $33 million of cash and 8,676 bitcoin, giving it a total liquidity of $227 million. This is among the biggest liquidity positions among public mining companies, which is interesting since Hut 8 is only the seventh biggest public bitcoin mining company by hashrate. Compared to total assets held, Hut 8 definitely has the most liquid balance sheet.

The company’s liquidity is particularly impressive when we compare it to its current liabilities, a financial ratio known as the quick ratio. This indicator measures the company’s ability to meet its short-term obligations with its most liquid assets. Generally, a quick ratio above 1 is considered good. Hut 8 has a quick ratio of 9.2. The company undoubtedly has enough liquid assets to pay its future obligations.

Hut 8 has such a massive liquidity position because of its enormous bitcoin holdings. It's the only public bitcoin mining company except for Marathon, which has never sold a single bitcoin. The company has steadily added to its bitcoin holdings, growing them from 5,518 in January to 8,687 currently.

Hut 8’s bitcoin holdings make up 85% of its total liquidity. This makes the company’s liquidity position highly vulnerable to bitcoin price volatility. The company has already booked enormous losses this year by holding all its bitcoin down during the bear market instead of selling. Still, anyone who has been investing in bitcoin for a significant period knows it’s difficult to time the market. Hut 8 could just as well have benefitted massively from its hodl strategy this year if the market had gone in the opposite direction. The company is taking a long-term approach, and I respect that.

Still, I question the necessity of holding so much bitcoin relative to total assets. While I appreciate that the company has enough liquidity to weather the bear market, it would be wise to invest some of it into increased bitcoin production capabilities.

Hut 8 loves raising equity – dilution may be incoming

You may wonder how Hut 8 has been able to pay its operating costs and infrastructure investments without selling a single bitcoin. The only way for a miner to pursue a 100% hodl strategy is to finance its operations with external capital in the form of equity or debt. As I showed in the previous section, Hut 8 barely has any debt, meaning that the company has used equity to finance its enterprise.

Hut 8 has raised enormous amounts of equity in its lifetime as a company. Since 2021, the company has raised $398 million, consisting of $315 million in 2021 and $83 million in 2022. While equity is a less risky form of capital than debt, it has one downside: dilution. Hut 8 diluted its shareholders by 45% in 2022 alone.

Like most public bitcoin miners, the company has primarily raised equity through at-the-market offerings, in which the company gradually sells its stock on the open market through a broker. The company currently has an open at-the-market equity program initiated in August, allowing the company to sell up to $274 million worth of shares. Hut 8 has only raised $3 million from this program, meaning that there is a potential $271 million of equity dilution incoming.

I appreciate that the company could raise equity, but I don’t understand why it would need to when it already has such a massive liquidity position. I know that the company pursues a 100% hodl strategy, and if it hasn’t sold any bitcoin yet, it's doubtful that it will throw in the towel now and sell at the current depressed bear market prices. Therefore, I believe the company will raise additional equity to pay for operating costs and expansions in the coming months, meaning that shareholders will likely be significantly diluted.

Hut 8 is diversifying into high-performance computing

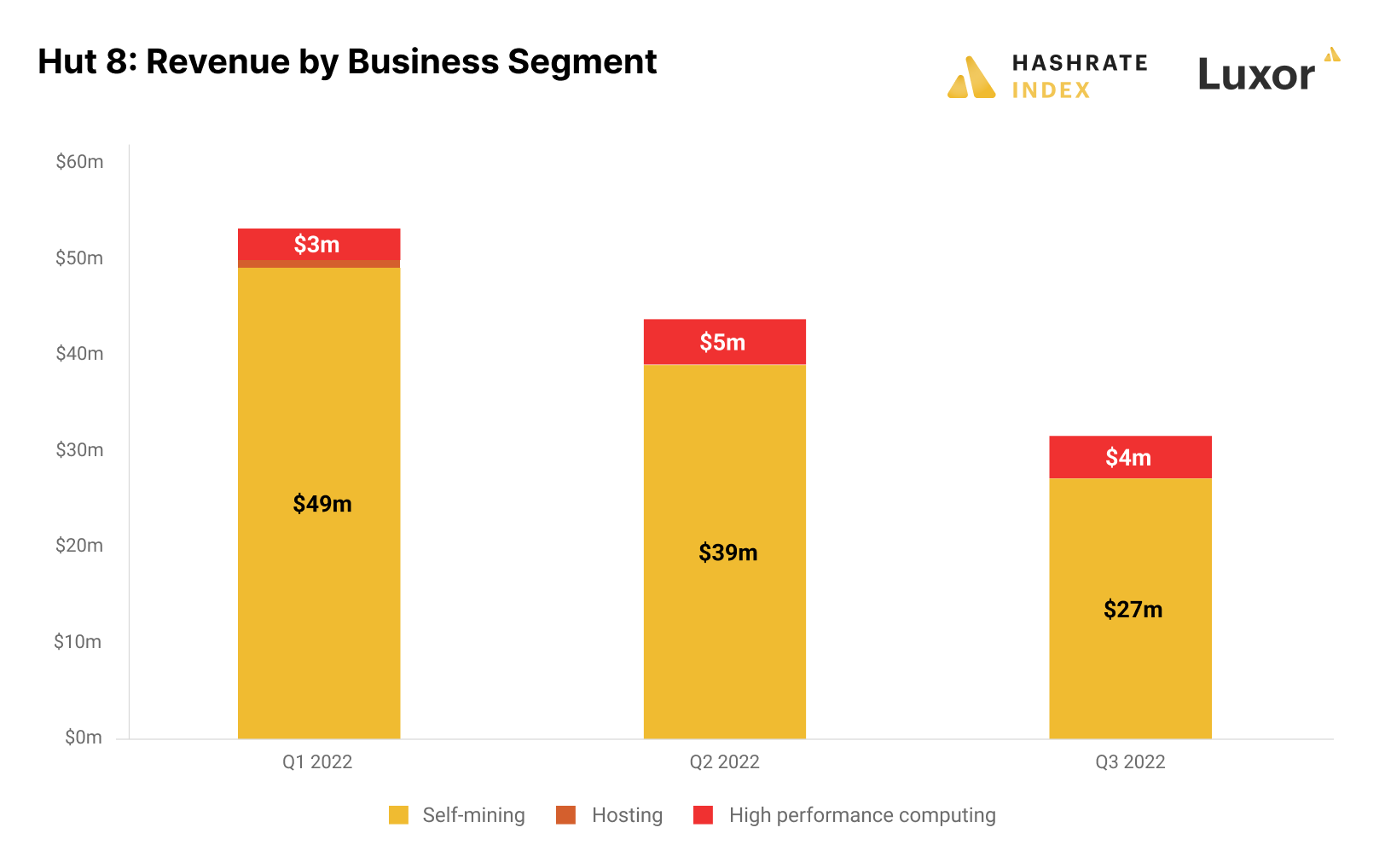

Hut 8 operates in two business segments: Bitcoin self-mining and high-performance computing (HPC). The company has focused on building up its HPC segment over the past year after it acquired five data centers from TerraGo in January 2022 for $30 million. Self-mining is still the company’s most important business segment, but the HPC division has gradually become a larger share of total revenues.

Hut 8 has seen a 40% growth in HPC revenues from $3.3 million in Q1 to $4.4 million in Q3. Meanwhile, the company’s self-mining revenue fell from $49.3 million in Q1 to $27.3 million in Q3. Due to the growth of HPC and the decline of self-mining revenues, HPC’s share of total revenues increased from 6% in Q1 to 14% in Q3.

High-performance computing is a more stable business than bitcoin mining, allowing Hut 8 to de-risk part of its revenue base. Due to low entry barriers, bitcoin mining will likely become an extremely low-margin business far into the future, while HPC data centers will book significantly higher margins. I’m therefore optimistic about Hut 8 diversifying into HPC.

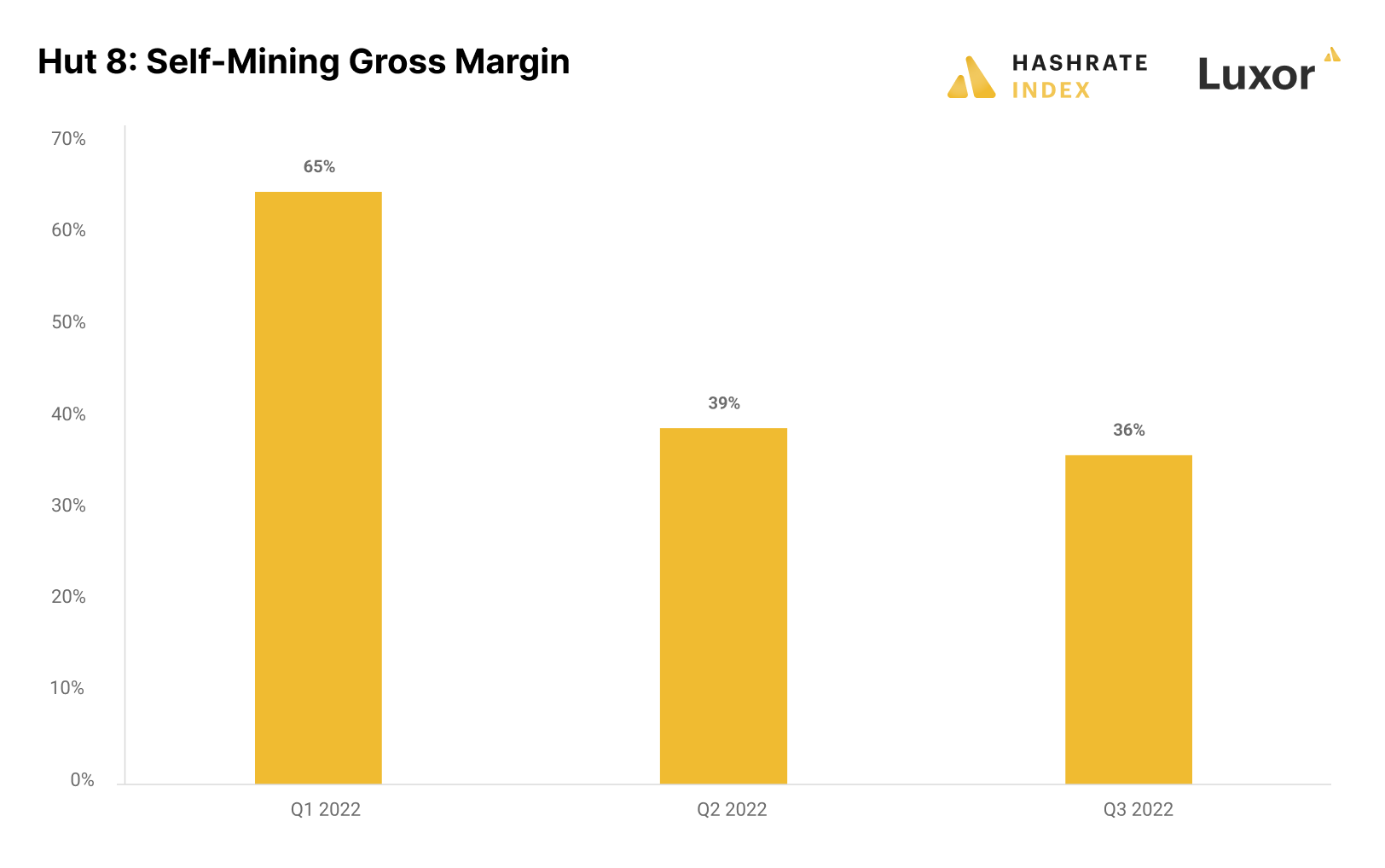

Hut 8 doesn’t have the best self-mining gross margin

Hut 8’s self-mining gross margin was 65% in Q1 but fell to 36% in Q3. This gross margin is not very good compared to its competitors.

The average bitcoin price in Q3 was $21,200, meaning that the company spent $13,600 to produce one bitcoin. Since then, the bitcoin price has fallen to $17k, further contracting the company’s gross margin. The bitcoin price doesn't have to fall much higher before the company's self-mining gross margin completely evaporates.

Conclusion

Hut 8 has the strongest balance sheet of all the public bitcoin miners. The company’s equity-financed balance sheet is overflowing with liquidity mostly consisting of bitcoin. Due to the company’s stated 100% hodl strategy, it will likely have to raise equity to pay for operating expenses and capacity investments in the coming months.

Hut 8 is not a pure-play bitcoin miner, as it increasingly diversifies into high-performance computing. This business segment is less risky than bitcoin mining and allows the company to de-risk and diversify its revenue base, which could come in handy as bitcoin mining revenues are highly volatile. With its bitcoin mining margins weakening due to the bear market, it will be important for the company to have the high-performance computing business segment to lean on.

Although I appreciate that Hut 8 has an extremely solid and liquid balance sheet, it should put some of that liquidity to work by transforming it into income-generating assets like increased bitcoin mining capacity. The company currently has too much liquidity, making its capital base inefficient. The company now has the choice between holding onto its precious bitcoin or selling some of it so that it can exploit the bear market by picking up some cheap distressed mining infrastructure.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.