Highlights from Bitfarms’ Q3 Report

Bitfarms just revealed the state of its finances and operations in its latest quarterly report. How is it going with this international bitcoin mining company? Find out in this article.

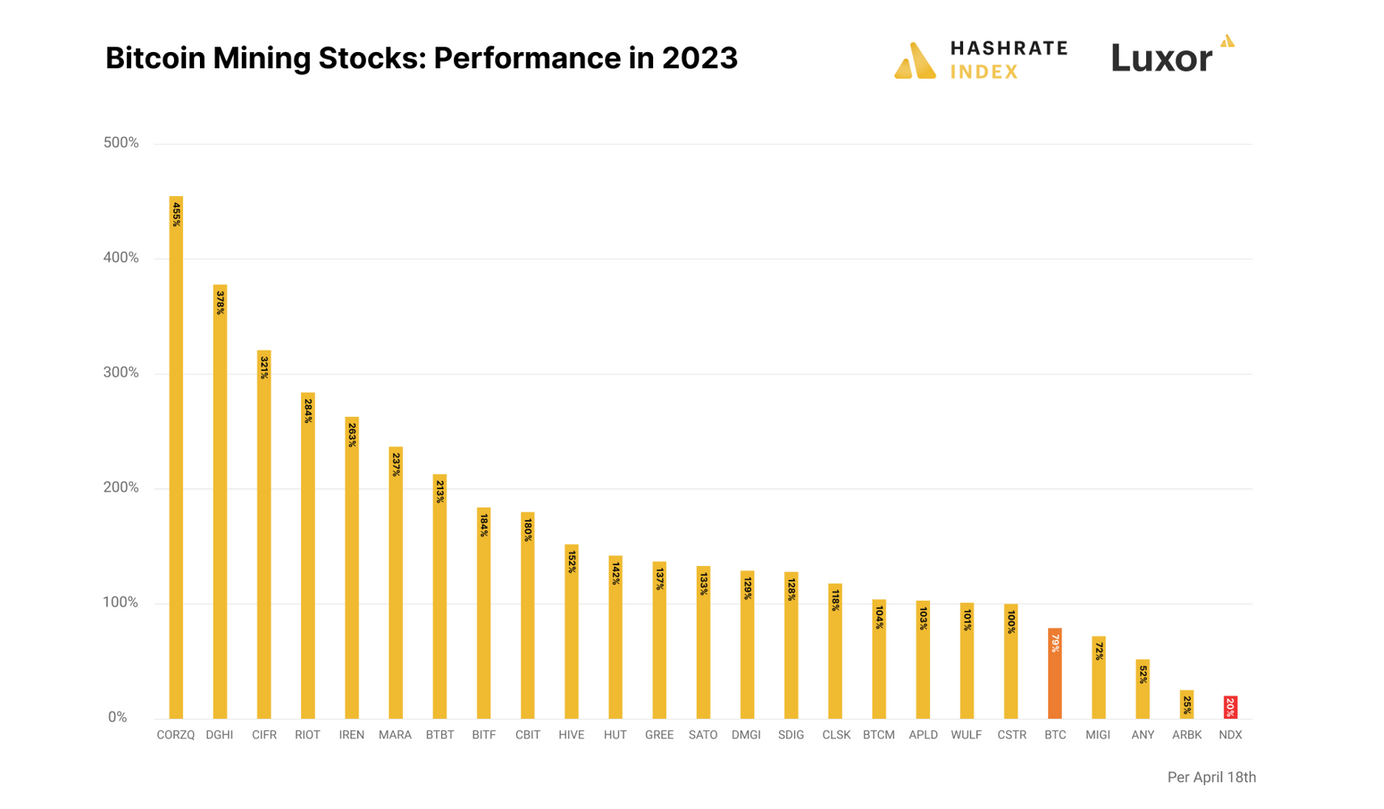

The bitcoin mining industry is currently in crisis mode. The share prices of most public mining companies have plummeted by more than 90% from their all-time highs, and the latest icing on the cake is that several of these companies are warning that they might run out of cash soon.

After the FTX situation pushed the bitcoin price down to $17k, things have gotten so bad that many are wondering which bitcoin miners will go bust. The more optimistic of us are framing the question the opposite way: "Which bitcoin miners are so strong that they will not only survive the bear market but could capitalize on it?"

To answer such questions, we must dive deep into the public bitcoin miners' financial reports. After having looked into the finances of Core Scientific, Riot, and Hut 8, I now analyze Bitfarms’ latest quarterly report.

Bitfarms has significant bitcoin and machine-collateralized debt

The bear market has gotten so bad that it’s only about survival for the public mining companies. Therefore, I start my analysis by looking at Bitfarms’ balance sheet, which will determine if the company is strong enough to get through this rough period.

With a debt-to-equity ratio of 0.7, my first impression is that Bitfarms’ balance sheet is neither particularly strong nor particularly weak. We must dig deeper into the company’s assets and debt positions to determine its strength.

Let's analyze the company's debt. Bitfarms has been a dedicated user of bitcoin- and machine-collateralized debt, the same type of debt that has nearly killed other public bitcoin miners like Core Scientific and Argo. Taking on dollar-denominated debt positions collateralized by bitcoin-correlated assets makes bitcoin mining companies vulnerable to bitcoin price declines. We have seen these dynamics play out during this bear market, as these loans have been, and still are, a source of headache for Bitfarms.

The company has $55 million outstanding in machine-collateralized loans, of which it owes $31.3 million to NYDIG, $22.2 million to BlockFi, and $1.7 million to Foundry. It also has a bitcoin-collateralized loan of $23 million with Galaxy Digital. As I will soon explain, the company’s bitcoin-collateralized loan is at this depressed bitcoin price dangerously close to liquidation.

Bitfarms learned some lessons this summer when it was forced to dump thousands of bitcoin as the price of bitcoin fell from $30k to $20k. In Q3, the company focused on strengthening its balance sheet and reduced its debt by $24 million, of which most came from the company paying down some of its bitcoin-collateralized debt. The company achieved that by selling significantly more bitcoin than it produced in Q3, as it generated 1,515 and sold 2,595.

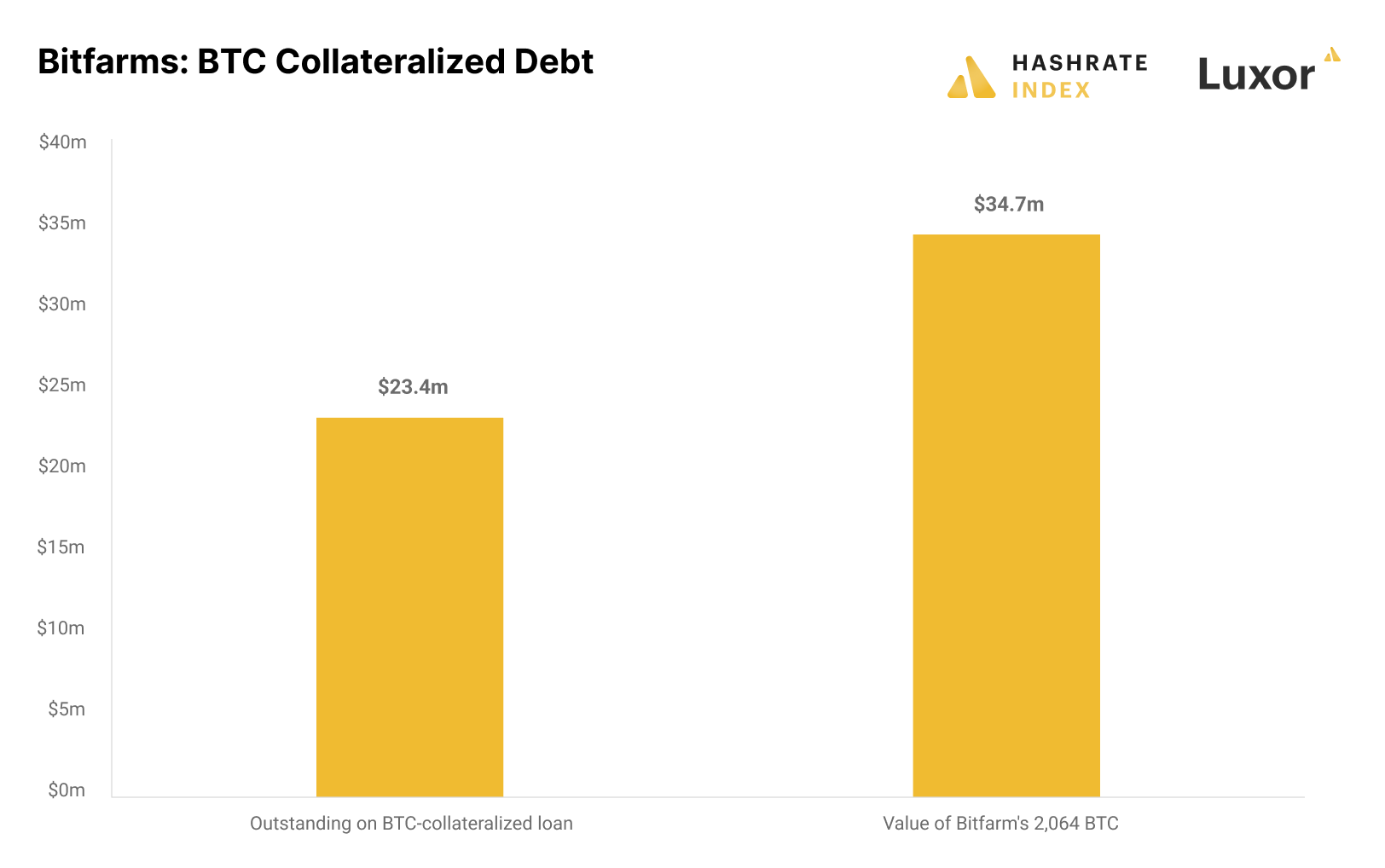

Let’s analyze the company’s liquidity. It holds $38 million of cash and 2,064 bitcoin. So far, so good. The problem is that 1,724 of these bitcoin are pledged as collateral in its Galaxy Digital loan, giving the company a total unpledged liquidity of only $44 million. As I will explain later in this article, the company’s liquidity is insufficient to fund its planned expansions.

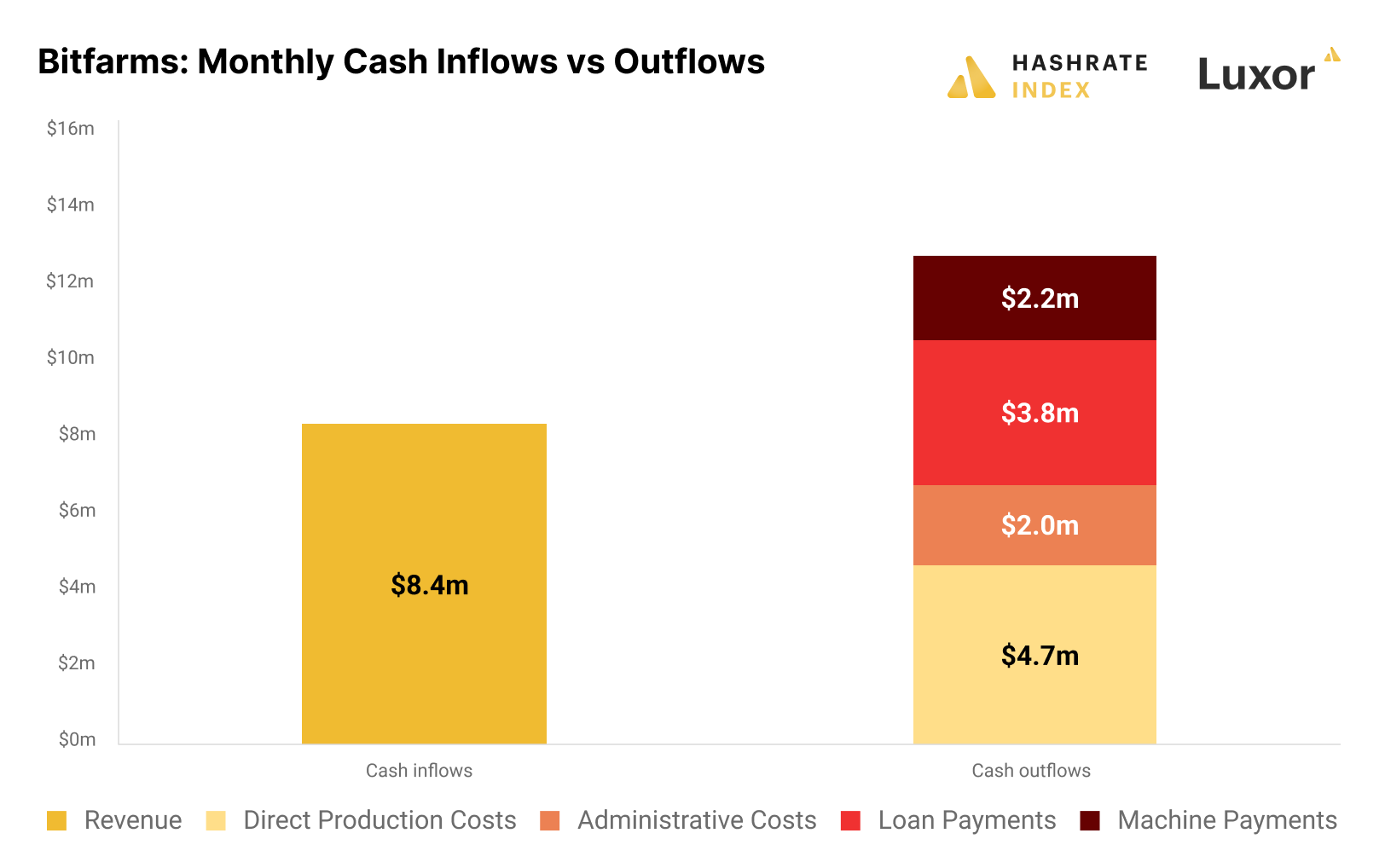

But why does liquidity matter, you may ask? Isn’t Bitfarms’ cash flow from operations sufficient to service debt and make the necessary machine payments? Let’s find out. Bitfarms currently produces around 500 bitcoin monthly at a direct production cost of $9,400 per bitcoin. At the current bitcoin price of $16,800, the company books a monthly revenue of $8.4 million and direct production costs of $4.7 million, leaving us with a monthly gross profit of $3.7 million. This gross profit should also cover administrative expenses of $2 million, giving the company a meager $1.7 million monthly cash flow from operations.

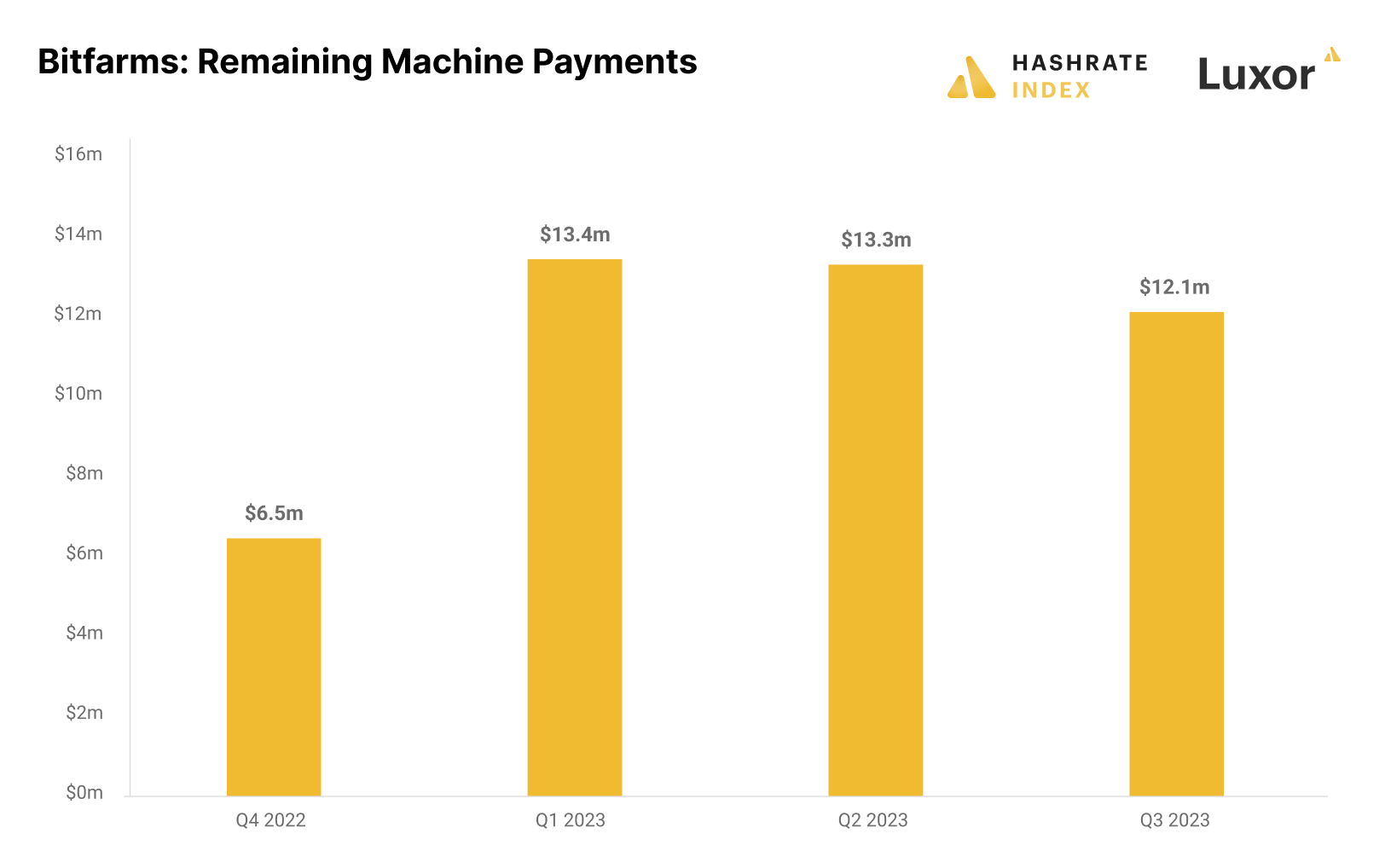

With $3.8 million in monthly loan payments and only $1.7 million in cash flow from operations, the company will have to burn through its saved-up liquidity to service debt. In addition, the company has $2.2 million in monthly machine payments to make, meaning that it will drain its liquidity by approximately $4.3 million per month. Its unpledged liquidity of $44 million will quickly fall to a dangerously low level, forcing the company to raise external capital. Still, the company will soon receive $3.5 million from the sale of a mining facility, which will somewhat help.

Negative cash flows from operations and little liquidity are not Bitfarms’ only problems. The company’s bitcoin-collateralized credit facility has plagued its finances as the bitcoin price has plummeted. The facility has $23.4 million outstanding and is secured by 1,724 bitcoin, requiring the company to keep the value of the bitcoin collateral at a minimum of 125% of the outstanding loan. Bitfarms’ current debt of $23.4 million means it must hold a minimum of $29.2 million worth of bitcoin as collateral, which at the current bitcoin price of $16,800 equals 1,738 bitcoin. Due to bitcoin's decline, the company has been forced to pledge an additional minimum of 14 bitcoin as collateral since the end of Q3.

The company’s entire bitcoin stack of 2,064 equals 141% of the bitcoin collateralized loan. If the bitcoin price were to fall by a further 16% to $14,200, Bitfarms would not be able to contribute more collateral, forcing Galaxy Digital to liquidate the loan. Things are looking bleak for Bitfarms’ bitcoin stack, as basically all of it is locked up as collateral and is close to liquidation territory.

While other public bitcoin miners like Core Scientific and Argo are in much bigger financial trouble than Bitfarms, the Canadian miner is balancing on a knife edge. If anyone is praying for the bitcoin price to increase, it’s Bitfarms.

Bitfarms has been keeping its costs down during this bear market

Bitfarms might be struggling financially due to its large bitcoin and machine-collateralized debt positions, but the company keeps delivering on the operational front. The company made a great decision in building its operations in electric grids predominantly powered by hydro, as it hasn’t been as exposed to energy price inflation as many of the other public bitcoin miners operating in grids with a higher share of expensive natural gas.

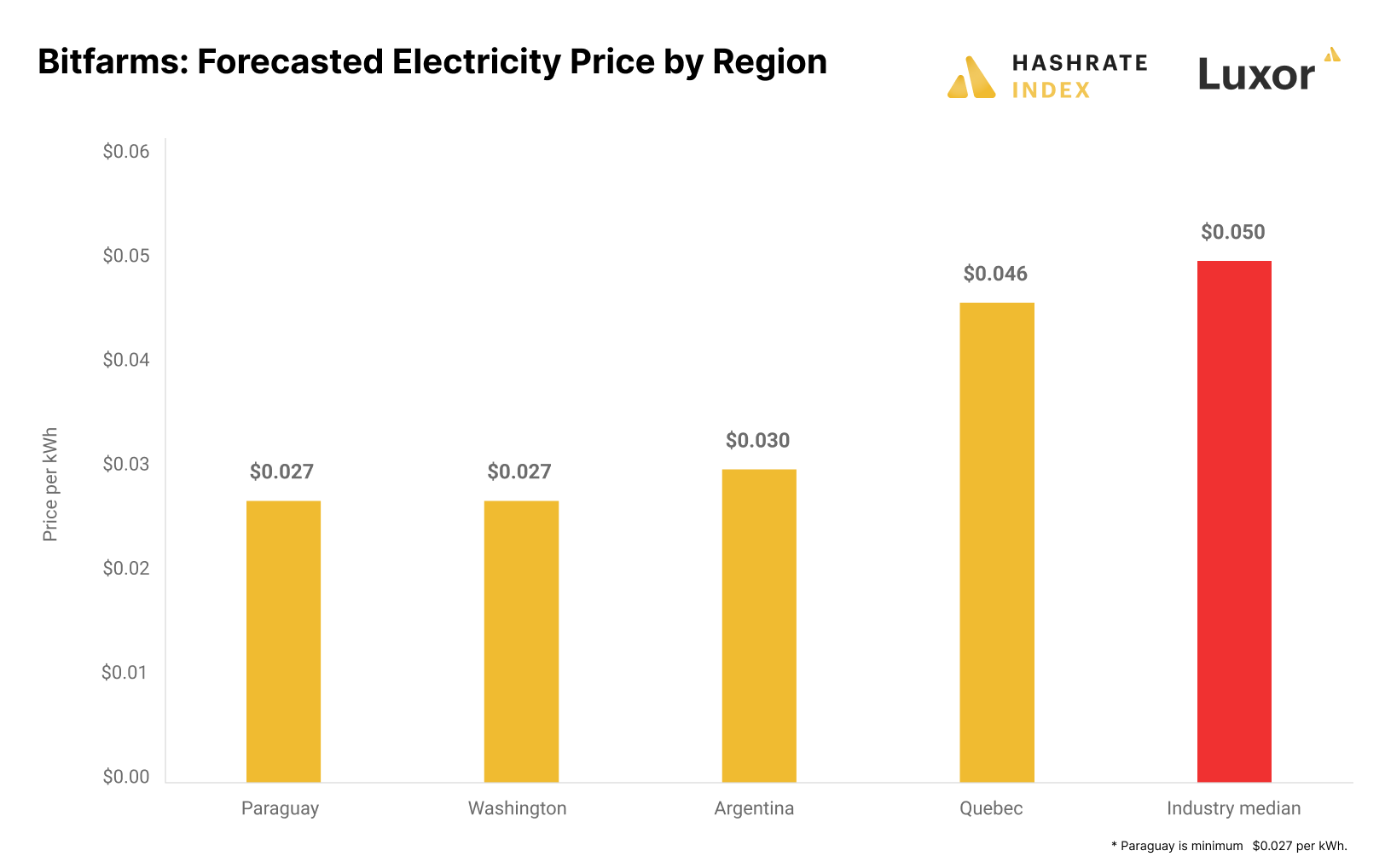

In its Q3 report, Bitfarms broke down its forecasted long-term electricity prices by sites. The company expects to pay $0.027 per kWh in Washington, $0.03 per kWh in Argentina, and $0.046 per kWh in Quebec. It also has a smaller site in Paraguay, which it states is its “lowest cost” facility, meaning it must have access to electricity priced lower than $0.027 per kWh.

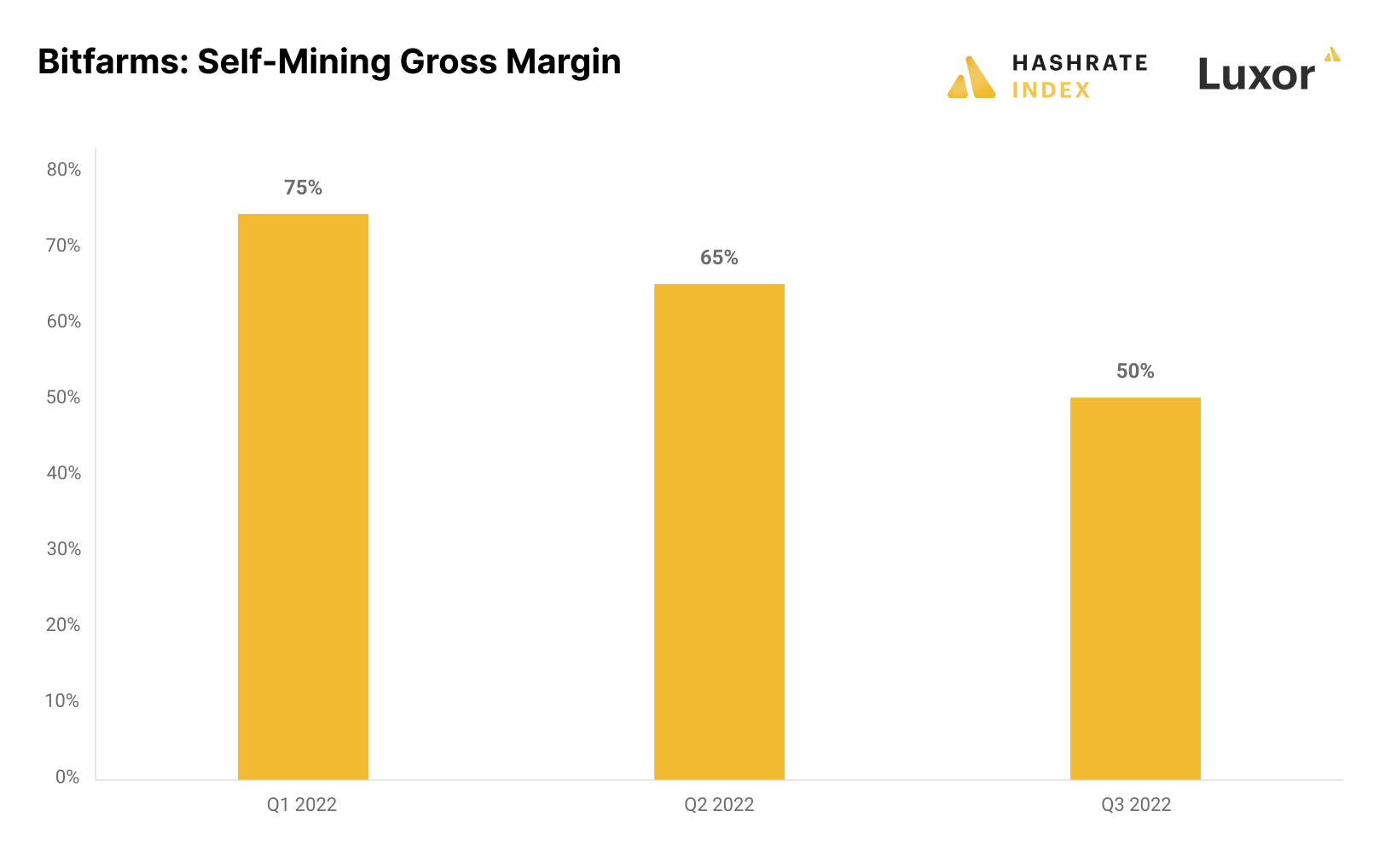

These electricity rates are significantly lower than the industry median, around $0.05 per kWh, giving the company a relatively low direct bitcoin production cost. Its gross margin was 50% in Q3, which is better than most competitors. Still, the average bitcoin price in Q3 was $21k, significantly above the current price of $16,800. Therefore, Bitfarms’ gross margin has fallen considerably since it published its report and is now likely closer to 40%.

Not only has Bitfarms been good at minimizing its production costs, but it has also managed to keep its administrative costs relatively low compared to competitors. The company cut its administrative costs from $15.4 million in Q2 to $10.3 million in Q3, of which only $6 million was cash costs. Keeping its production costs and administrative costs low is essential for the company in the future, as it must maximize operating cash flows to keep servicing its debt.

Bitfarms is expanding internationally but will have to raise capital to fund the expansion

As I explained in the previous section, Bitfarms has historically been a great operator. The company has nearly doubled its hashrate in 2022 to 4.2 EH/s from 2.2 EH/s at the start of the year. It expects to keep growing its hashrate to 5 EH/s by year-end.

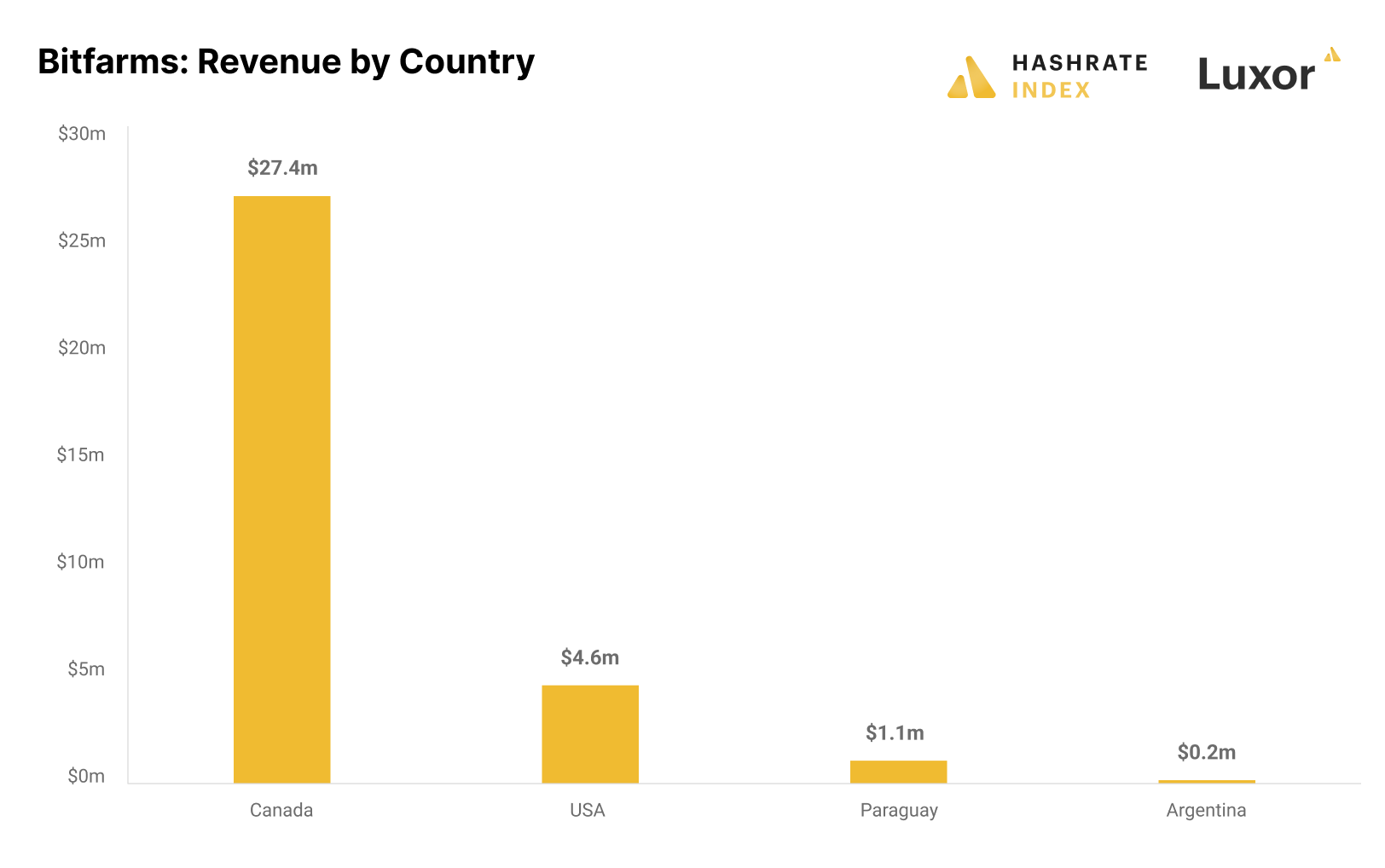

In contrast to many public bitcoin miners who prefer to stick to their home turf, Bitfarms has been expanding internationally, operating facilities in Canada, the US, Paraguay, and Argentina.

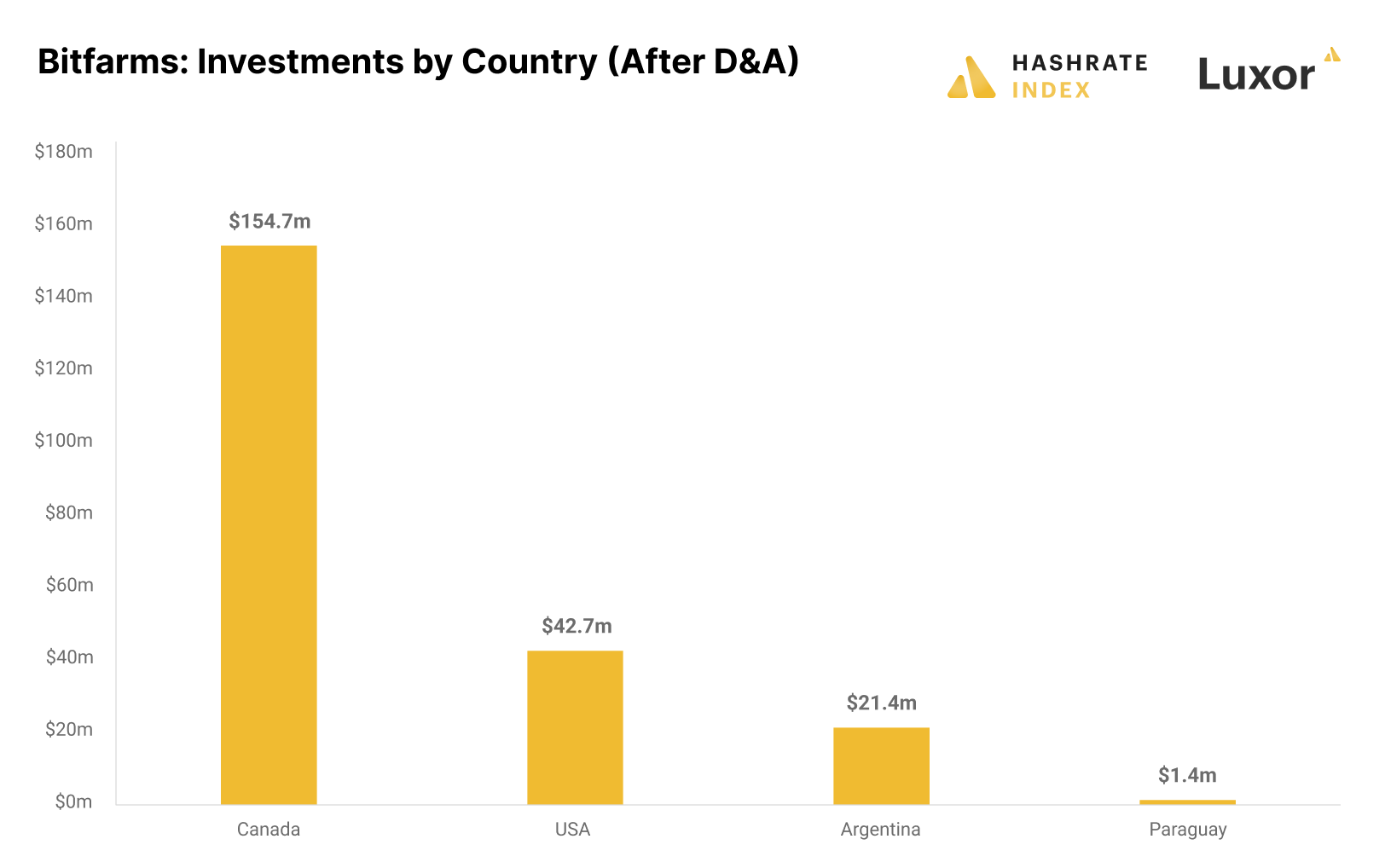

The company plans most of its hashrate growth to come from Argentina, where it develops a facility behind the meter at a stranded natural gas asset. The Argentine facility currently operates at 10 MW, and Bitfarms plans to scale it to 50 MW by the end of the year.

Although Bitfarms is expanding into South America, its Quebec facilities are still the company’s bread and butter, providing more than 80% of its revenue.

The company has invested significant money into its Argentine facility, but it will have to invest materially more to increase the facility’s capacity towards its target. Doing business in Argentina hasn’t proved to be an easy task. The company has faced problems getting machines into the country as it needs to secure trade approval for the importation of the machines due to the Argentina Central Bank attempting to protect its foreign currency reserves as the nation wrestles with inflation. The company’s growth depends on the Argentine development’s success, and things are moving slower there than initially expected.

Also, Bitfarms’ private power producer in Argentina is still awaiting approval of its final operating permit, forcing the company to purchase electricity from an electrical utility at a higher cost. It will be necessary for the company to overcome these obstacles in Argentina as soon as possible to get its idle machines online to produce much-needed bitcoin.

To fill up its Argentine facility, Bitfarms is awaiting significant machine deliveries and will have to make substantial machine payments in the coming months.

As I explained earlier in this article, Bitfarms cannot service its debt based on operating cash flows alone and will have to spend its saved-up liquidity. Adding machine payments on top of that, it becomes clear that the company will drain its liquidity in the coming months if it doesn’t raise external capital. Bitfarms even warns about this in its Q3 report, stating that it might have to scrap some growth plans if it cannot obtain this financing. And if it is able to raise capital, it will likely come in the form of equity, which will significantly dilute existing shareholders.

Conclusion

Bitfarms is currently in a tight spot due to its high bitcoin- and machine-collateralized debt positions. This type of debt has plagued the company as the bear market pushed the bitcoin price from $69k to $17k. The company is praying that the bitcoin price will not fall further, as it could force its bitcoin stack into liquidation and make it even more difficult for the company to raise external capital.

Although the company struggles financially, it’s still a great operator with low production costs. It also managed to lower its administrative expenses in Q3, which has given a much-needed boost to its cash flow from operations. The company spent Q3 well, focusing on paying off debt and minimizing its costs.

The company is aggressively expanding in several countries. Its expansion requires significant funding, forcing the company to raise external capital. If it’s unable to obtain such financing, things are not looking good for the company. In the best case, it will need to scrap expansion plans. In the worst case, if the situation coincides with a further fall in the bitcoin price, the company might have to sell some of its assets.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.