Hashrate Index Roundup (February 26, 2024)

Even with bitcoin's price surging, ASIC miner prices are falling with the Halving less than two months out.

Happy Monday, y'all!

As the 2024 Bitcoin Halving draws closer, ASIC miner market participants are playing a game of wait-and-see for rig pricing.

Despite Bitcoin's price continuing its run and hashprice remaining healthy, ASIC prices on the secondary market are coming down. The looming uncertainty of the Halving's full impact on mining revenue has reduced demand, so vendors have a glut of supply and have been forced to drop their prices to move inventory – even production of the vaunted S21, Bitmain's most powerful and efficient model, is greater than demand.

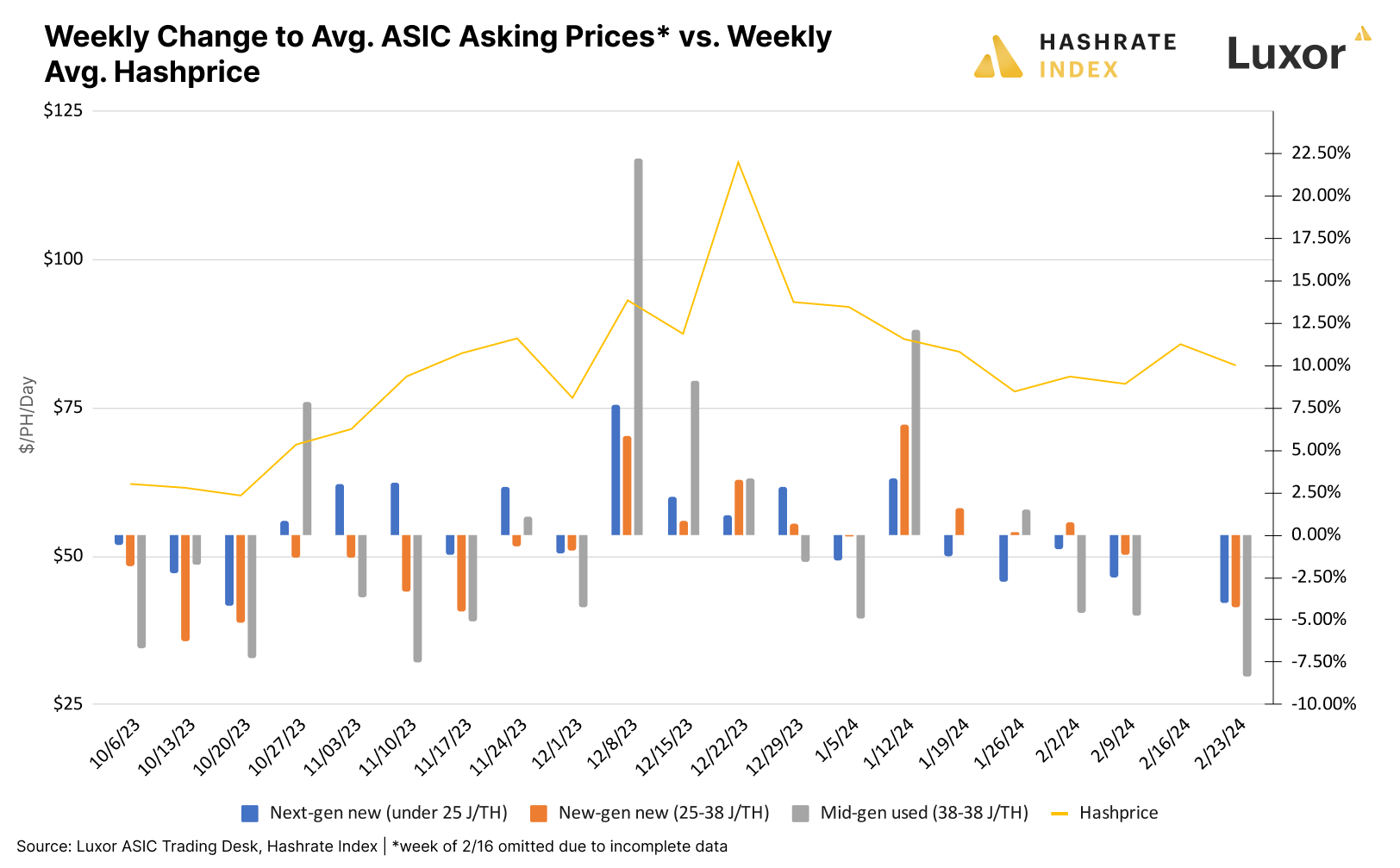

As the chart below shows, even though hashprice has trended up in February, ASIC prices dropped over the month, and they posted their largest decreases of the month over this past week. New-gen and mid-gen models have taken the biggest hits. Vendors who are selling the S21 and T21 have price protections built into their contracts with Bitmain, so they aren't willing to drop prices drastically just yet.

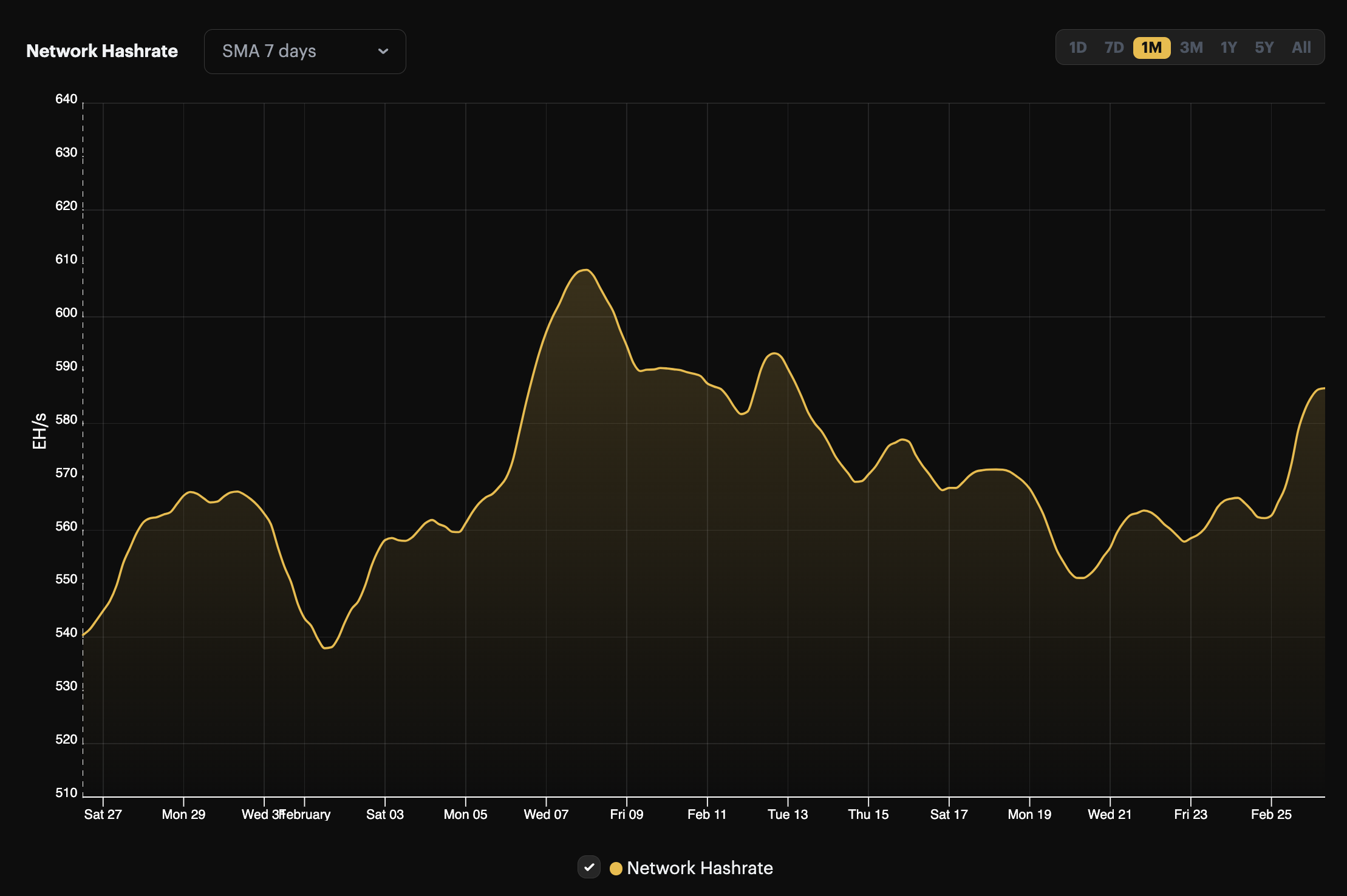

Hashprice continues to perform well thanks to bitcoin's rise to $54,000, and this week, it may also receive yet another boost in the form of a negative difficulty adjustment. With blocks coming in every 10 minutes and 17 seconds on average, our estimator is forecasting a -2.76% difficulty decrease in three days. But a drop in mining difficulty is not guaranteed, especially considering Bitcoin's 7-day average hashrate has increased by 4.3% this week.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

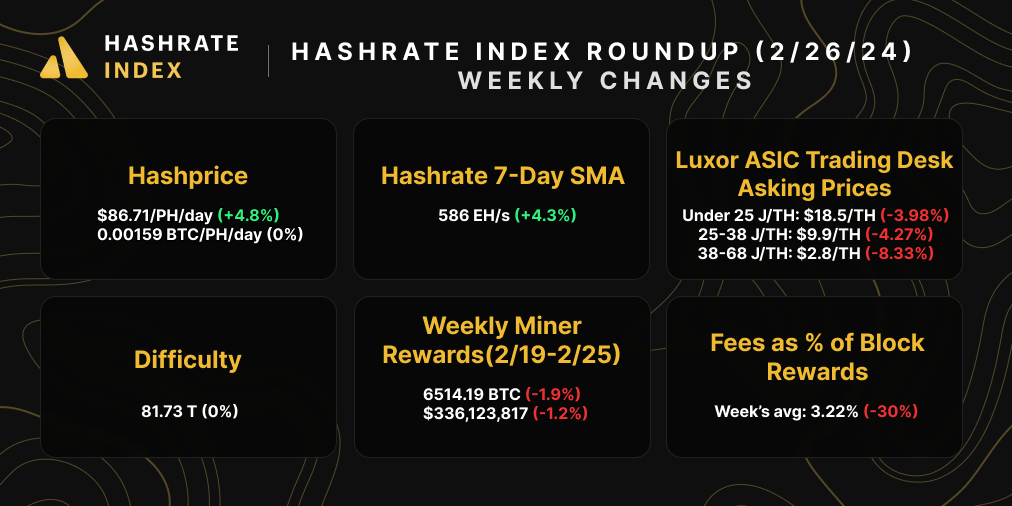

We've got mixed returns for the data points in this week's market update. As we discussed earlier, ASIC prices saw their worst week in a while, and transaction fees have fallen for the third week in a row. Hashprice and hashrate are up, and despite this, weekly miner rewards are down because block times have been slower than the 10 minute average so far this difficulty epoch.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- US energy data agency to temporarily suspend bitcoin miner survey after lawsuit

- Ethiopia To Become The First African Country To Start Bitcoin Mining

- Marathon Launches Slipstream Service to Optimize Non-Standard Bitcoin Transactions

Bitcoin Mining Stocks Update

Week-over-week, Bitcoin mining stocks have had mixed returns, with many falling and only a handful seeing positive returns over the week. That said, with Bitcoin's price on the up and up, these stocks are roaring to start the week, and many miners have seen double digit gains today. Our Crypto Mining Stock Index rose 4.1% over the week.

Weekly changes to Bitcoin mining stocks:

- RIOT: $17.37 (+5.15%)

- HUT: $9.21 (-7.53%)

- BITF: $3.61 (-0.28%)

- HIVE: $4.28 (-1.72%)

- MARA: $29.19 (+9.24%)

- CLSK: $20.35 (+13.28%)

- IREN: $6.91 (-3.02%)

- CORZ: $3.31 (-12.66%)

- WULF: $2.33 (-5.67%)

- CIFR: $3.40 (-6.08%)

- BTDR: $8.00 (+10.19%)

- SDIG: $4.98 (-13.54%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.