Hashrate Index 2025 Bitcoin Mining Year in Review: Standing on Soft Ground

2025 was a significant challenge for the mining industry.

Hello world!

Today, we're thrilled to announce that we've published our 2025 Bitcoin Mining Year in Review.

You can download the report here:

If you have any feedback or questions, please don't hesitate to drop a line to [email protected].

- Hashrate Index Team

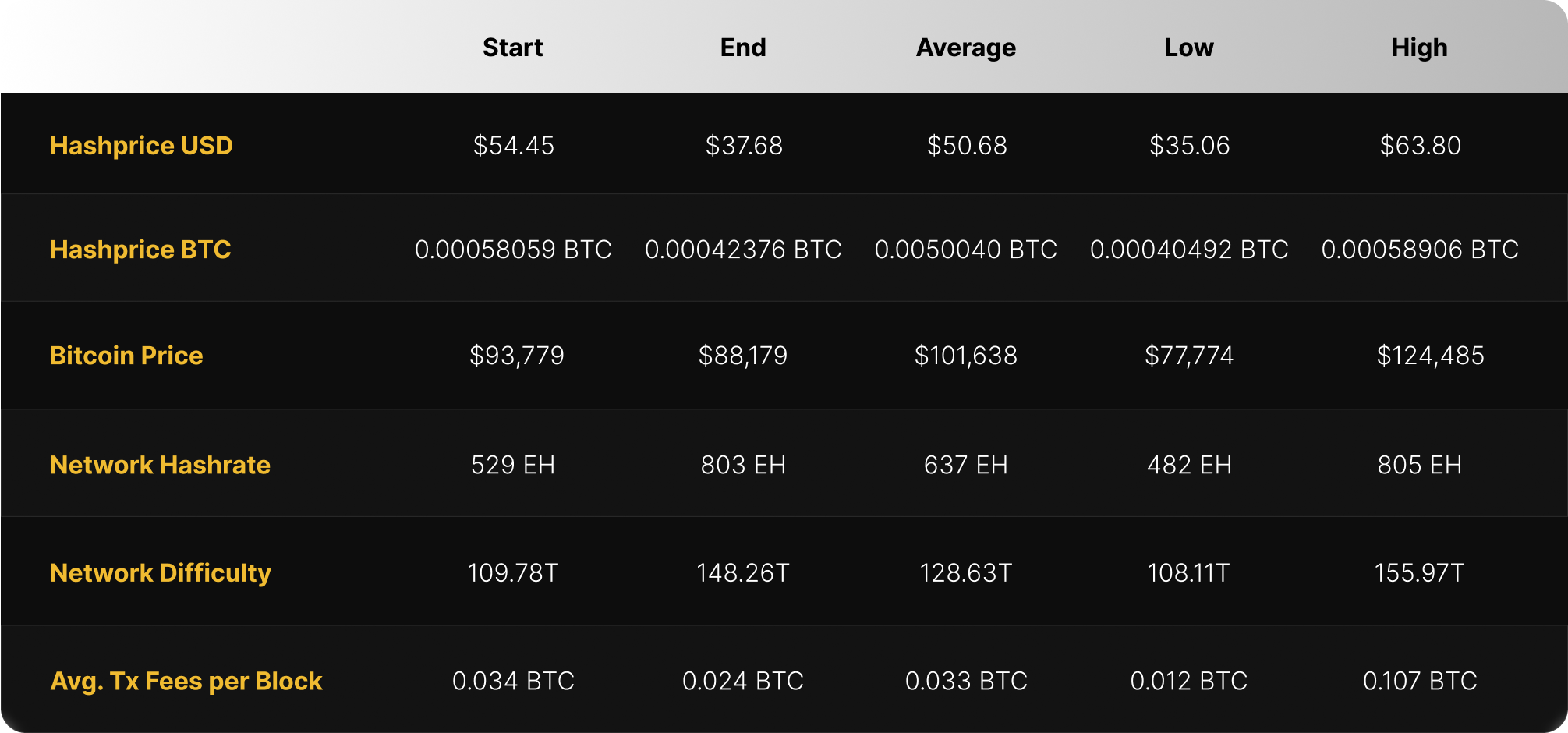

Hashrate Markets

The network entered the zettahash era in September, pushing difficulty above 139.7T and driving hashprice to record lows, even as bitcoin hit a new all-time high of $124,485.

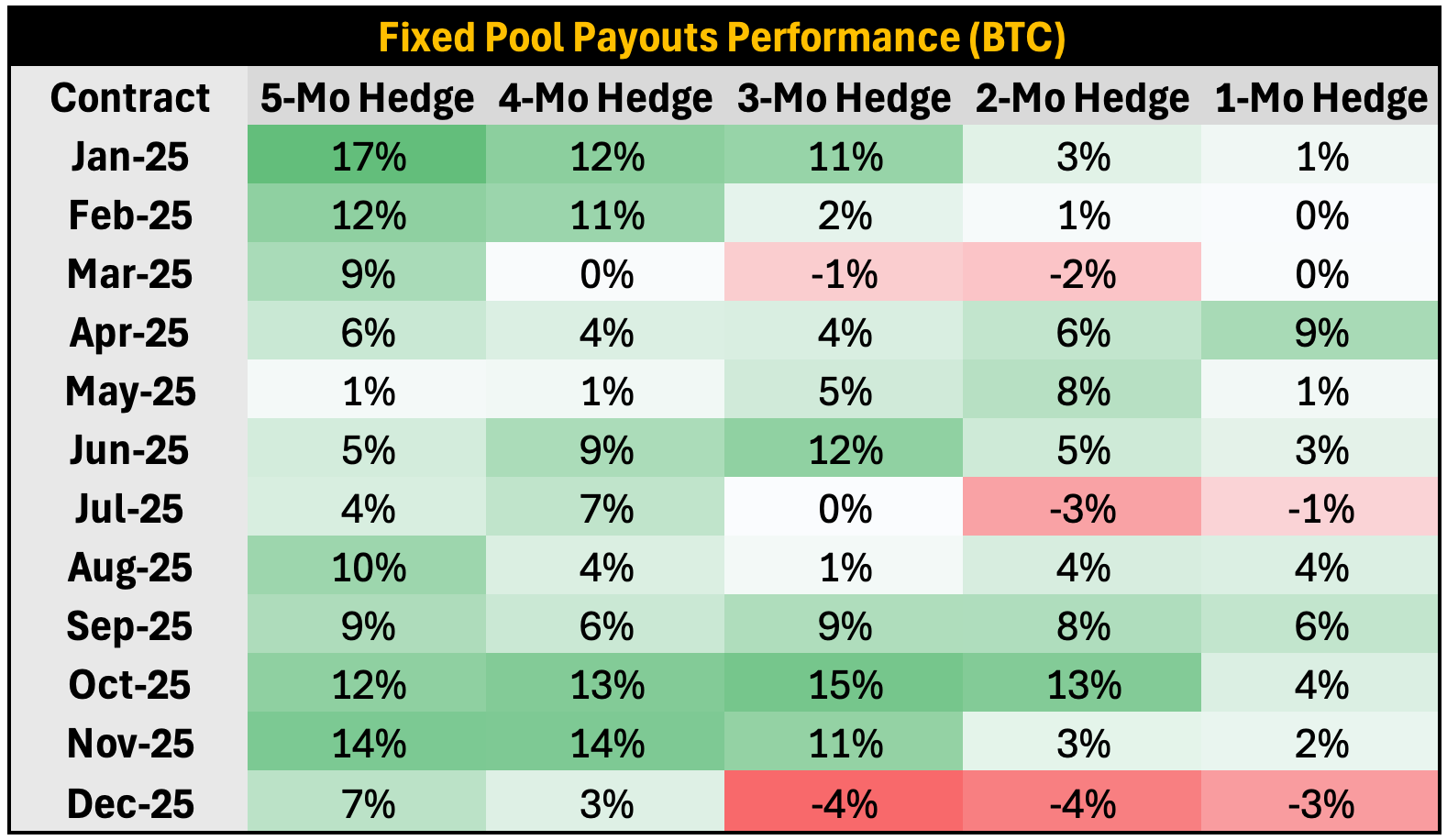

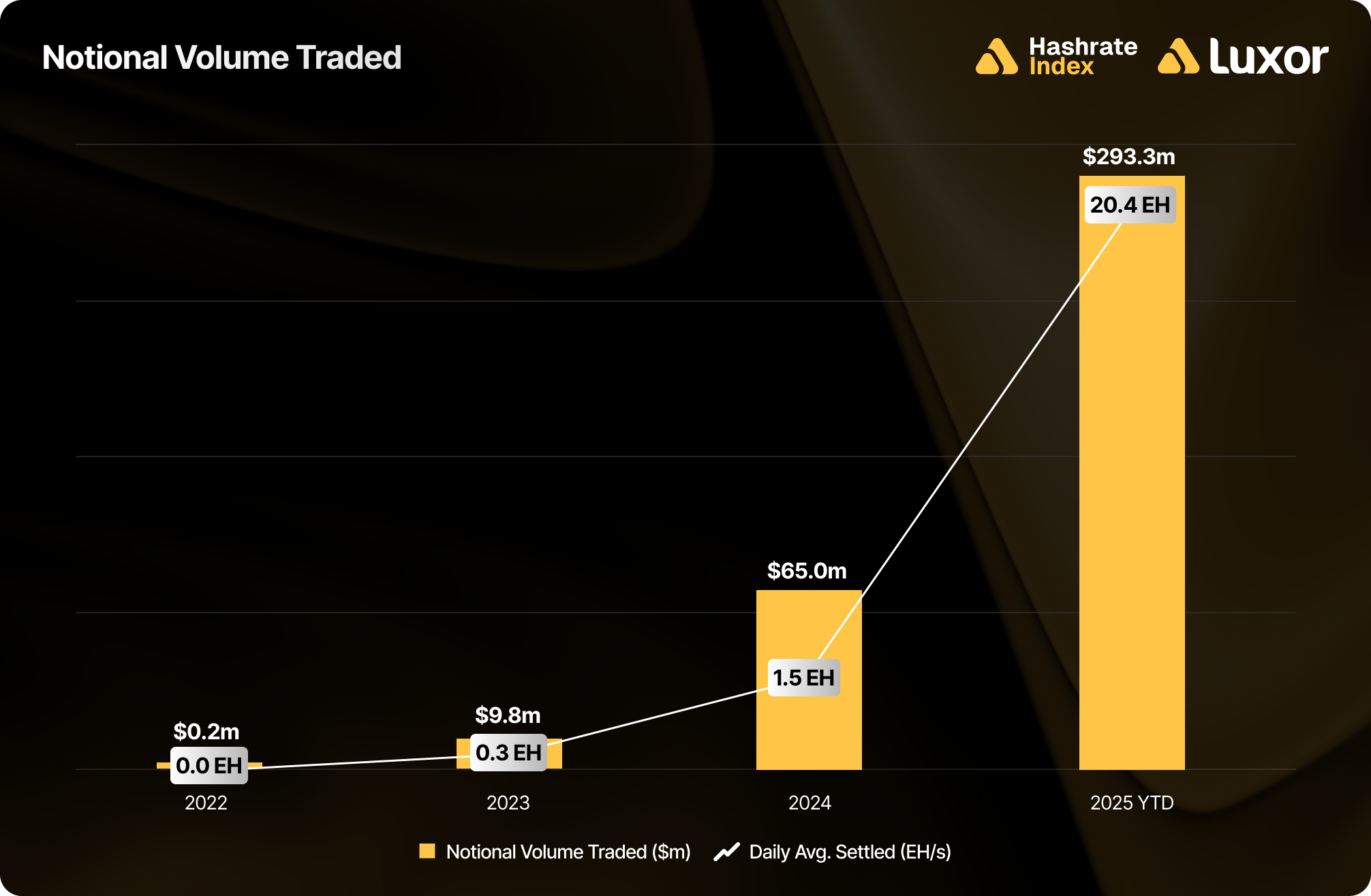

This margin squeeze accelerated adoption of forward hashrate markets. The takeaway was clear: miners that secured fixed pool payouts — especially in BTC terms — consistently outperformed spot FPPS mining, cementing hashprice risk management as critical to fleet survival.

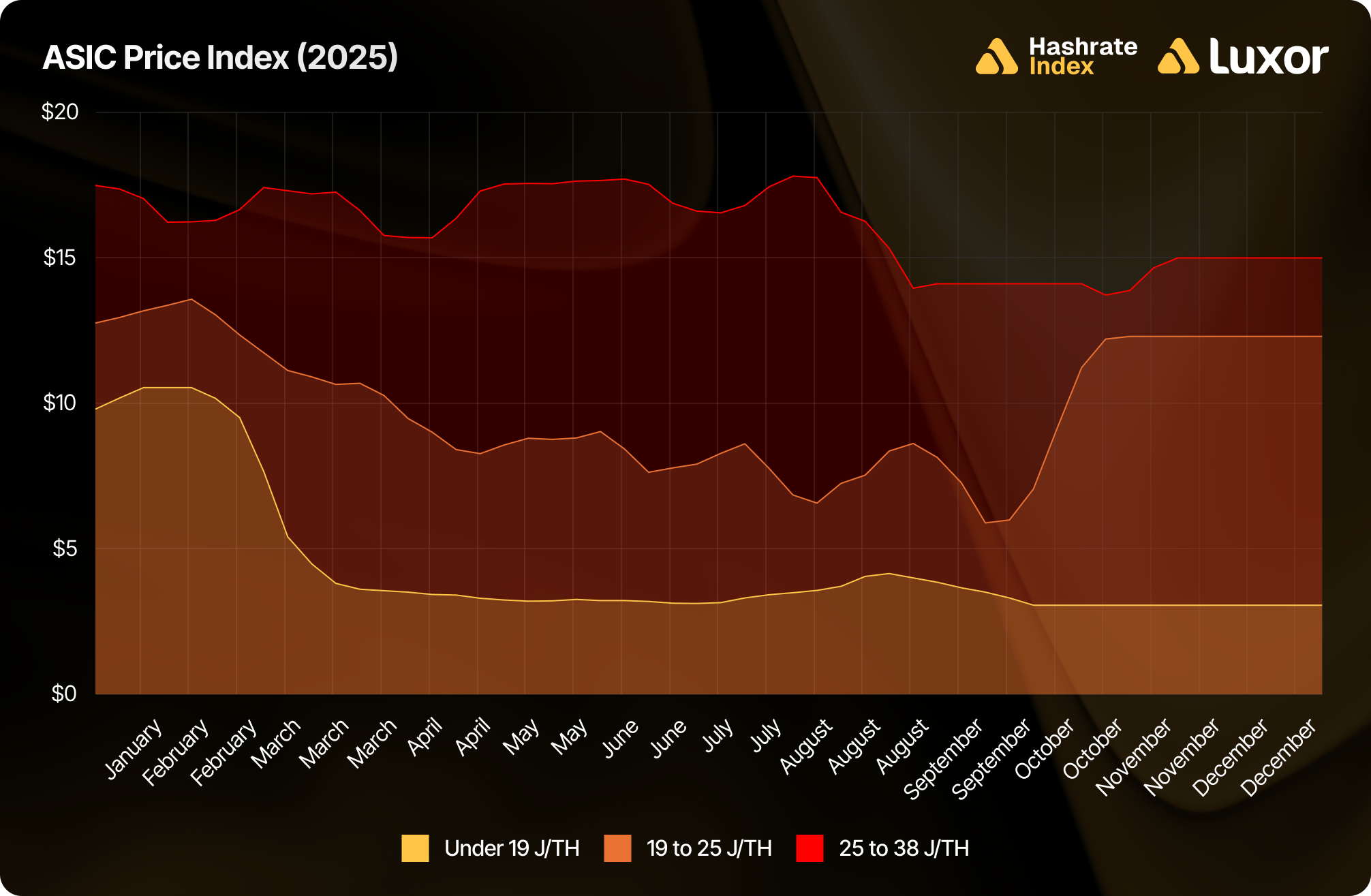

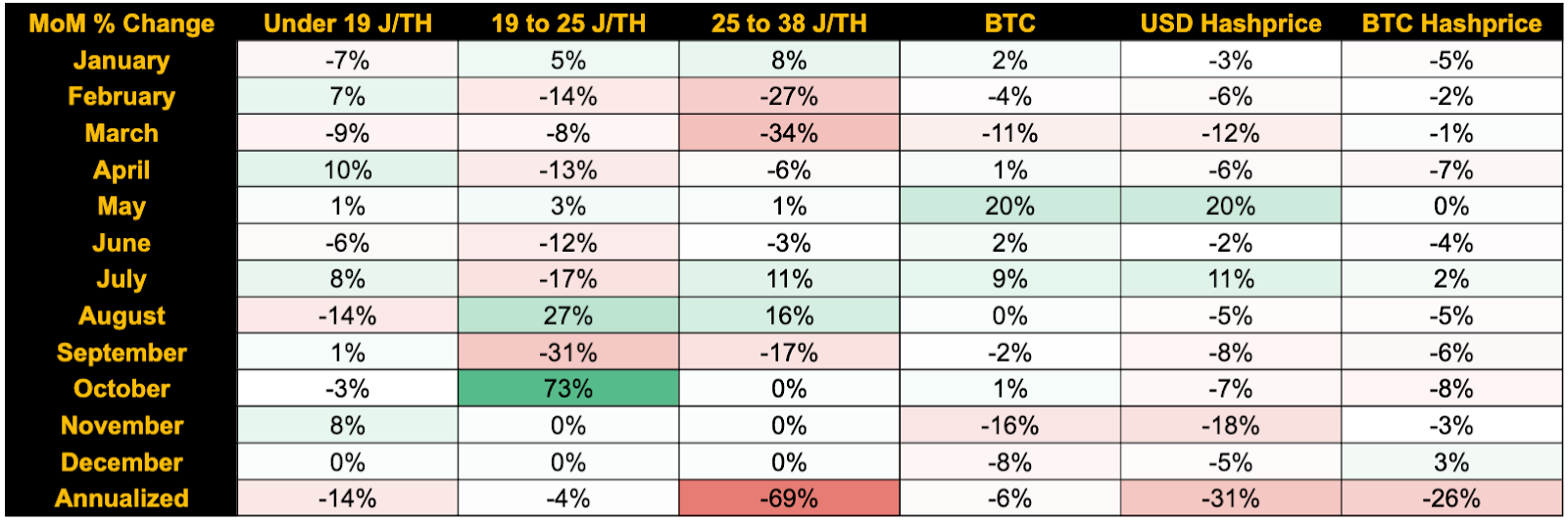

Hardware Markets

In 2025, Hashrate Index’s ASIC Price Index observed a significant price decline for old-generation machines, indicating a gradual phase-out of relatively outdated (25–38 J/TH) hardware. In contrast, newer-generation (under 19 J/TH) and mid-generation machines (19–25 J/TH) suffered from a relatively lighter decline, maintaining demand.

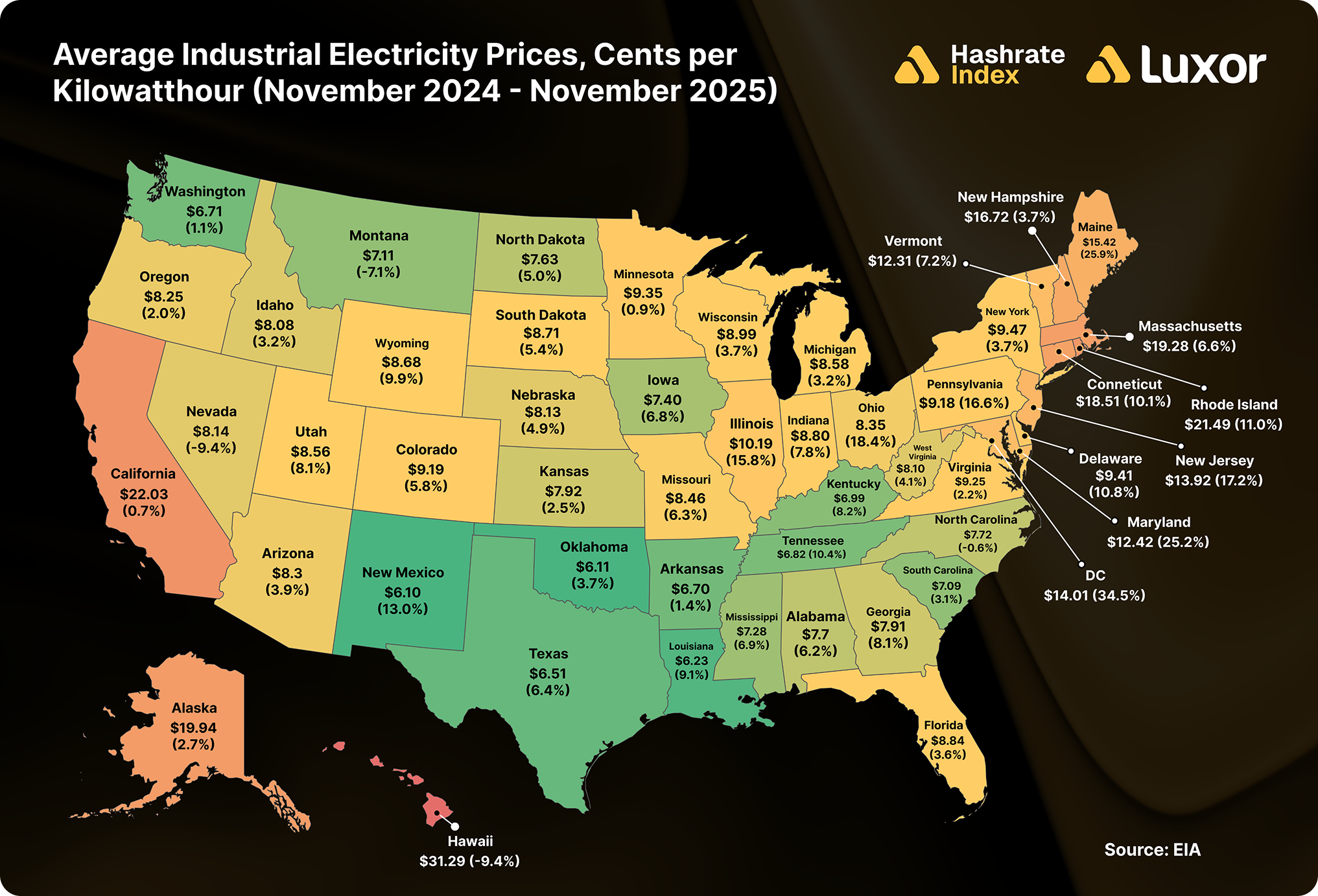

Energy Markets

Electricity prices in the U.S. were rose year over year, but there was a mixed bag of power price changes in popular mining states.

Public Markets

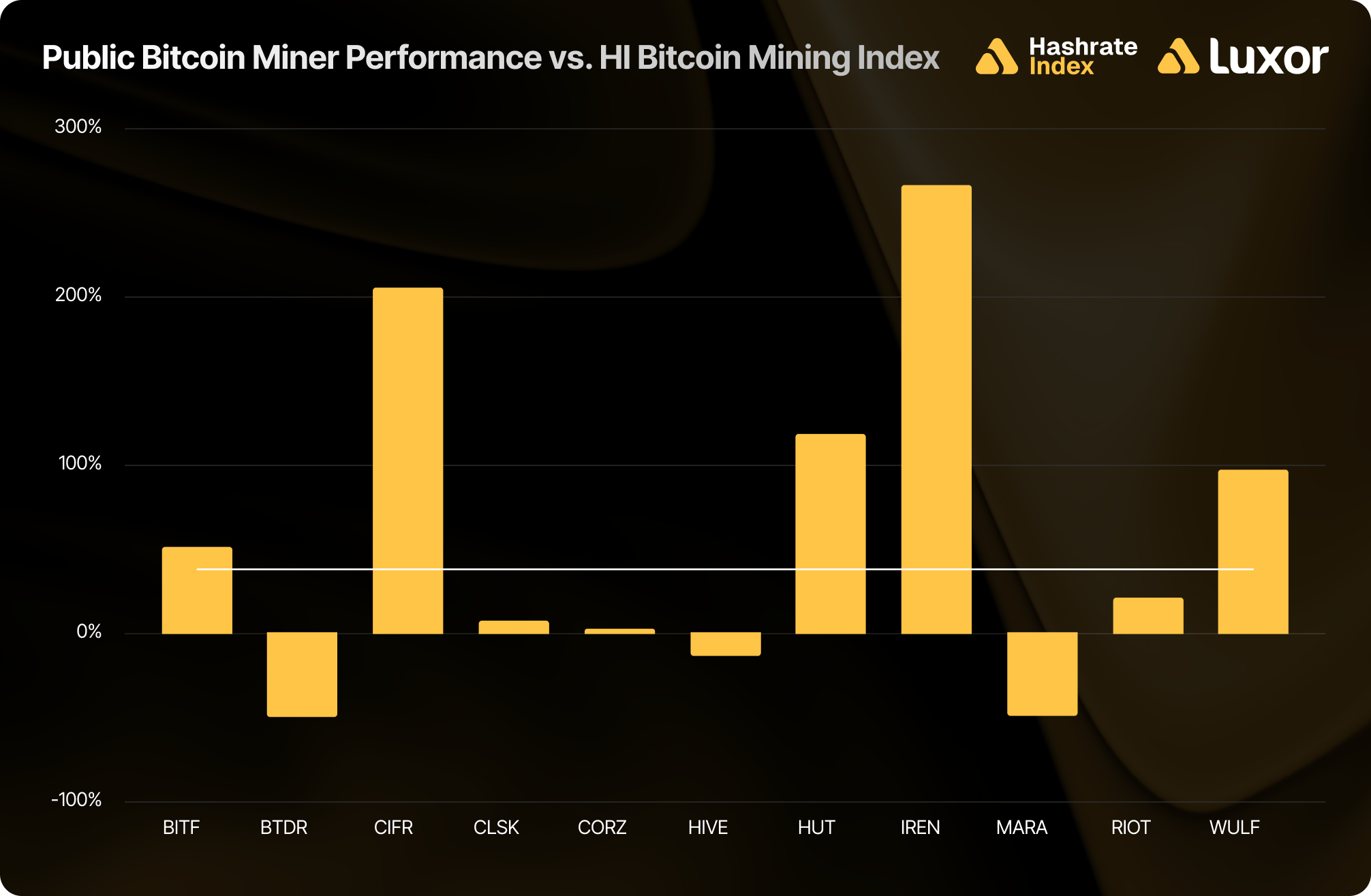

Generally speaking, public Bitcoin miners experienced divergent fortunes in 2025: AI/HPC pivots won, whereas pure-play miners suffered.

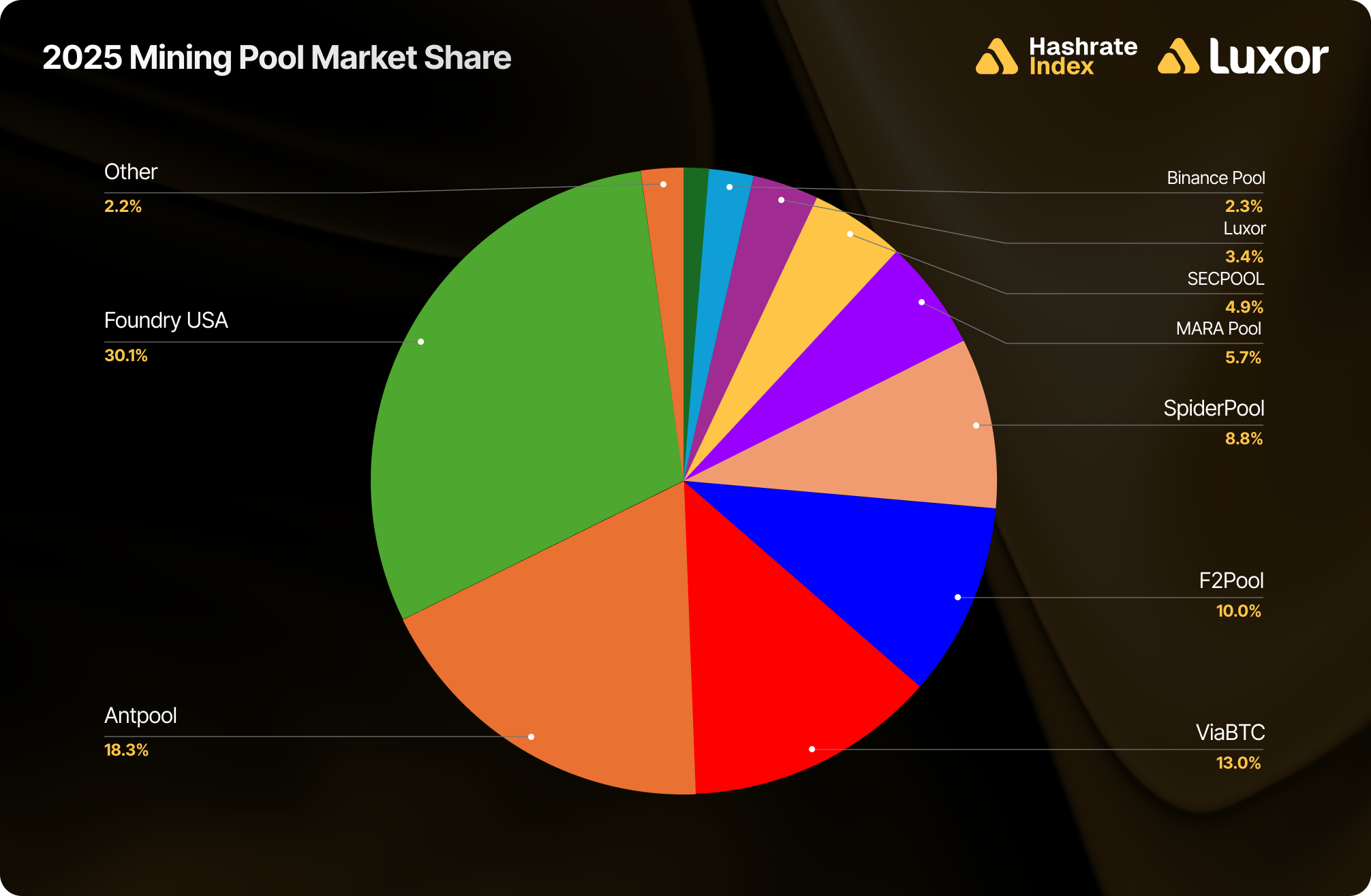

Pools and Firmware

In 2025, the competitive frontier moved further up the mining stack. The pools that matter today are much more than just endpoints for hashrate. The best pools now integrate firmware, fleet management, energy, and finance. SHA-256 hashes are increasingly being treated as a risk-managed compute commodity, and the best miners are continuously optimizing operations based on real-time markets in bitcoin mining and electricity.

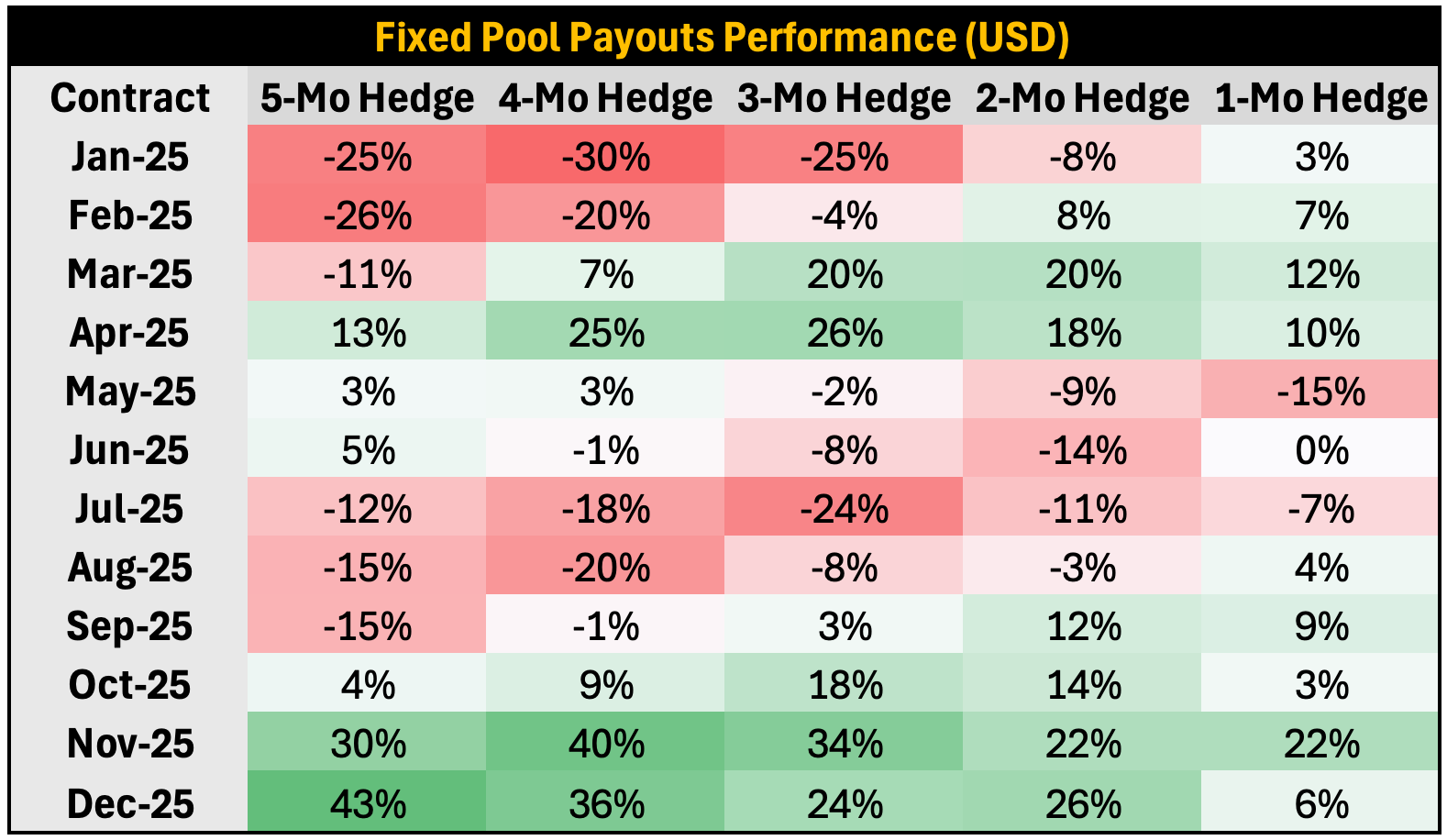

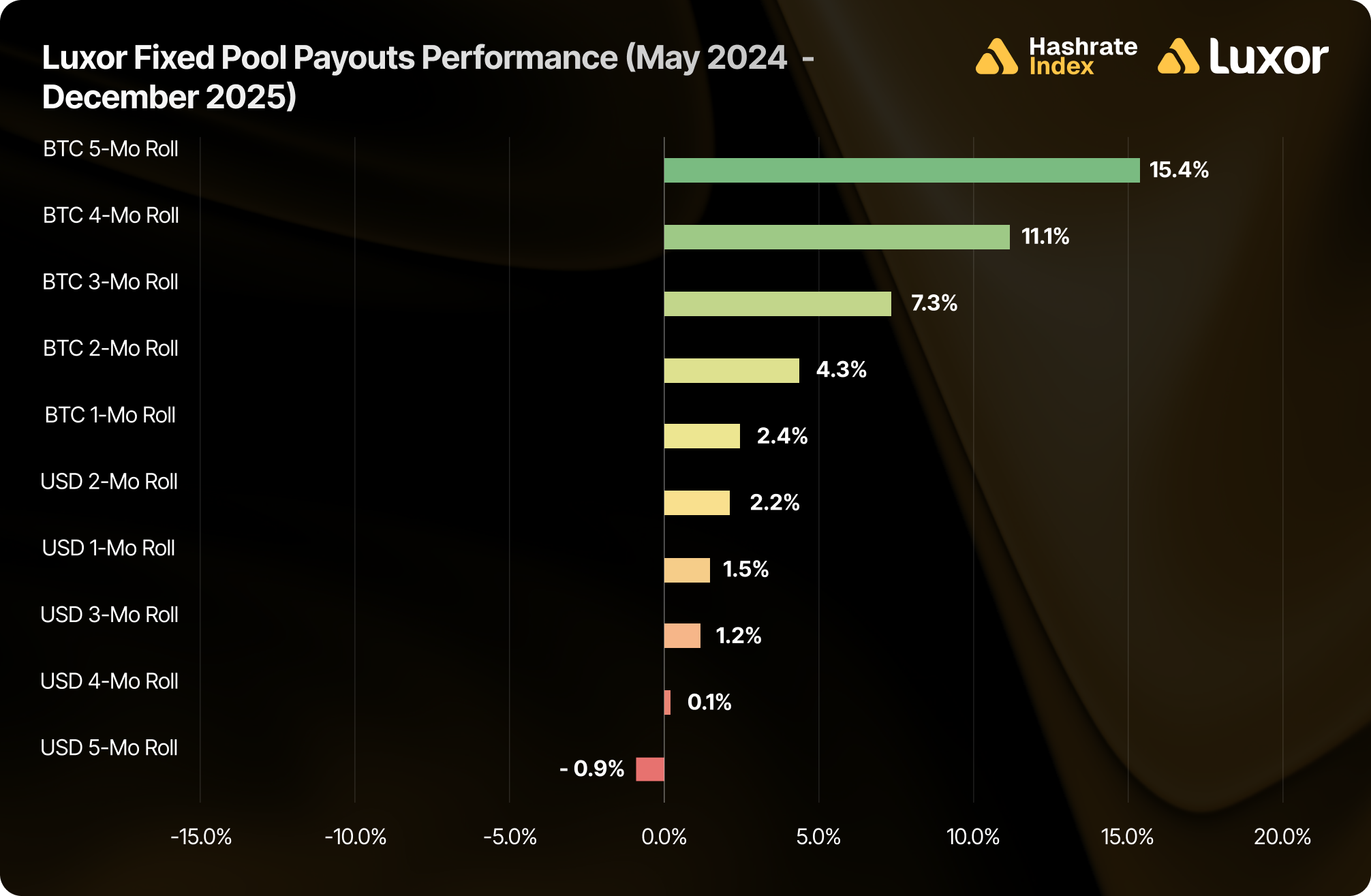

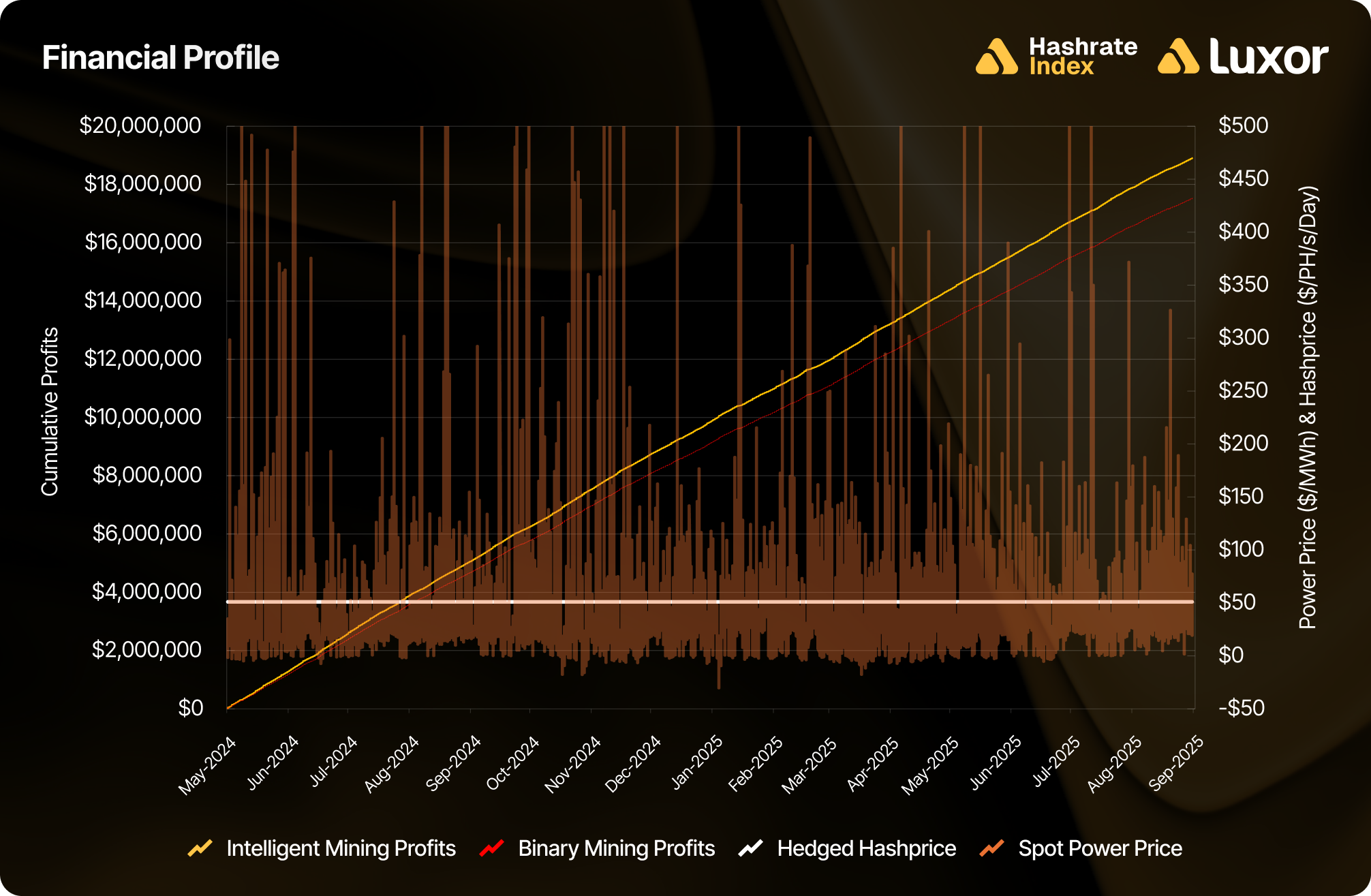

The 2024 halving set off a period of sustained margin compression for miners. However, not all miners were impacted equally. Those who hedged hashprice via fixed pool payouts won.

rolling BTC-denominated fixed pool payout strategies outperformed since the 2024 halving, with the strongest results coming from 5-months (+15.4%) and 4-months (+11.1%). These longer-duration hedges generally benefited from locking in a higher hashprice ahead of rising network difficulty and low fee environments.

In contrast, USD-denominated fixed pool payouts outperformed spot mining by a small margin, 0.8% on average, because of an overall rise in bitcoin price since May 2024.

With over $290 million dollars of notional volume traded in 2025, the trend is clear: fixed and upfront pool payouts are the next evolutionary step for modern mining operations.

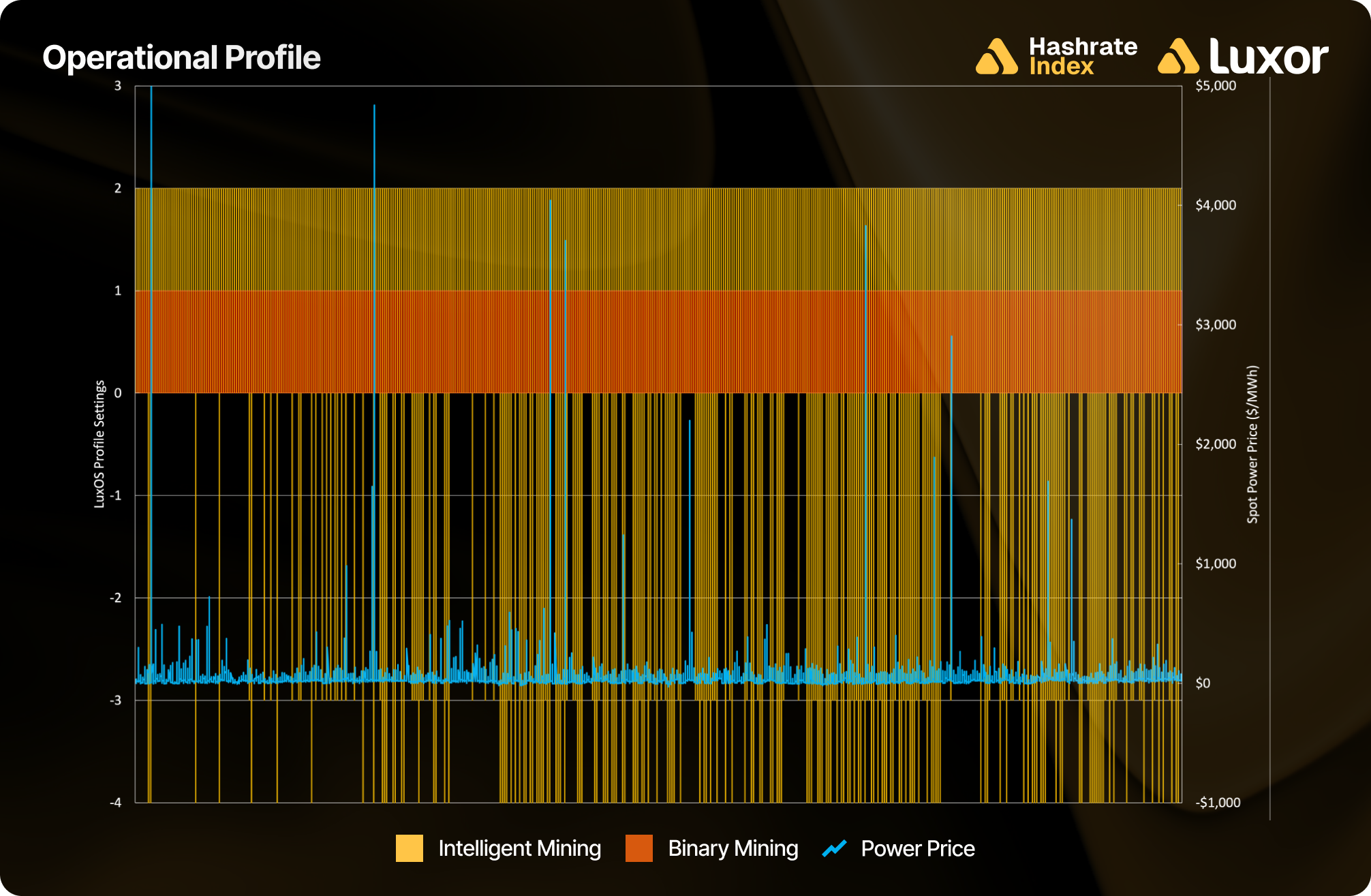

In order to showcase the power of flexible firmware, we performed a simulation backtest using operational data captured through Luxor’s R&D mining fleet.

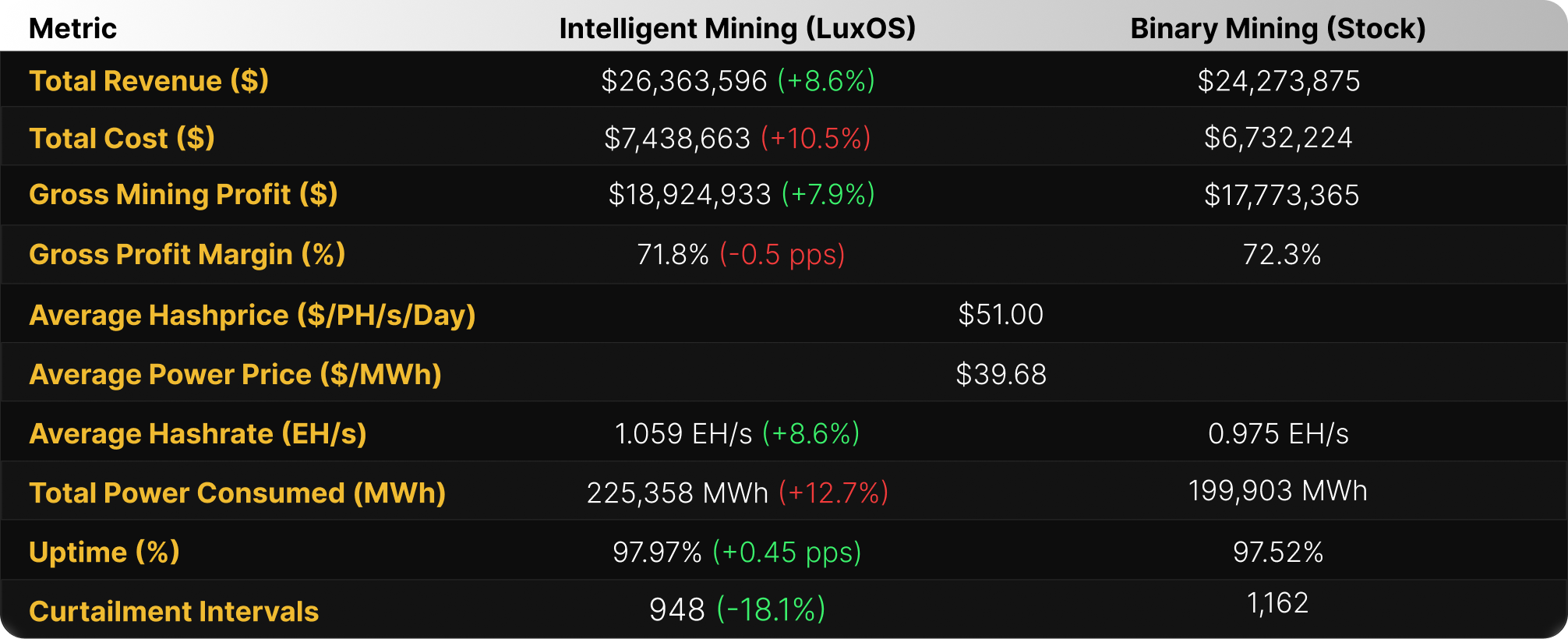

The results speak for themselves:

- Cost control through curtailment: LuxOS encountered ~18% fewer curtailment intervals (948 vs. 1,162) by underclocking and improving efficiency instead of total shutdown, avoiding unnecessary downtime as a result while still responding to unprofitable power prices.

- Capitalizing on cheap: There were 2,769 intervals when prices fell to zero or below. LuxOS exploited these windows by overclocking, squeezing out extra hashrate, and generating $2.1 million (+8.6%) in additional revenue.

Flexible firmware delivered higher uptime, more hashrate, and nearly 8% more profit than stock operations. Real-time fleet optimization turned power price volatility into an opportunity.

2025 was a productive year for Bitcoin, with both institutional adoption and regulatory clarity continuing to improve, but a significant challenge for the mining industry.

Looking ahead into 2026, we (loosely) predict the following:

- Global hashrate continues to move: Venezuela will gain, and the U.S. will decline.

- New hardware launches boast ASIC efficiencies at around ~7 J/TH.

- Competition in hardware heats up, and hydro-cooled model deployments increase.

- Bitcoin treasury companies consolidate.

Here’s to another year in the beautiful game.

— Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.