How the BitcoinSV, Bitcoin Cash Forks Affected Hashprice

BitcoinSV's and Bitcoin Cash's hardforks greatly affected hashprice for both coins.

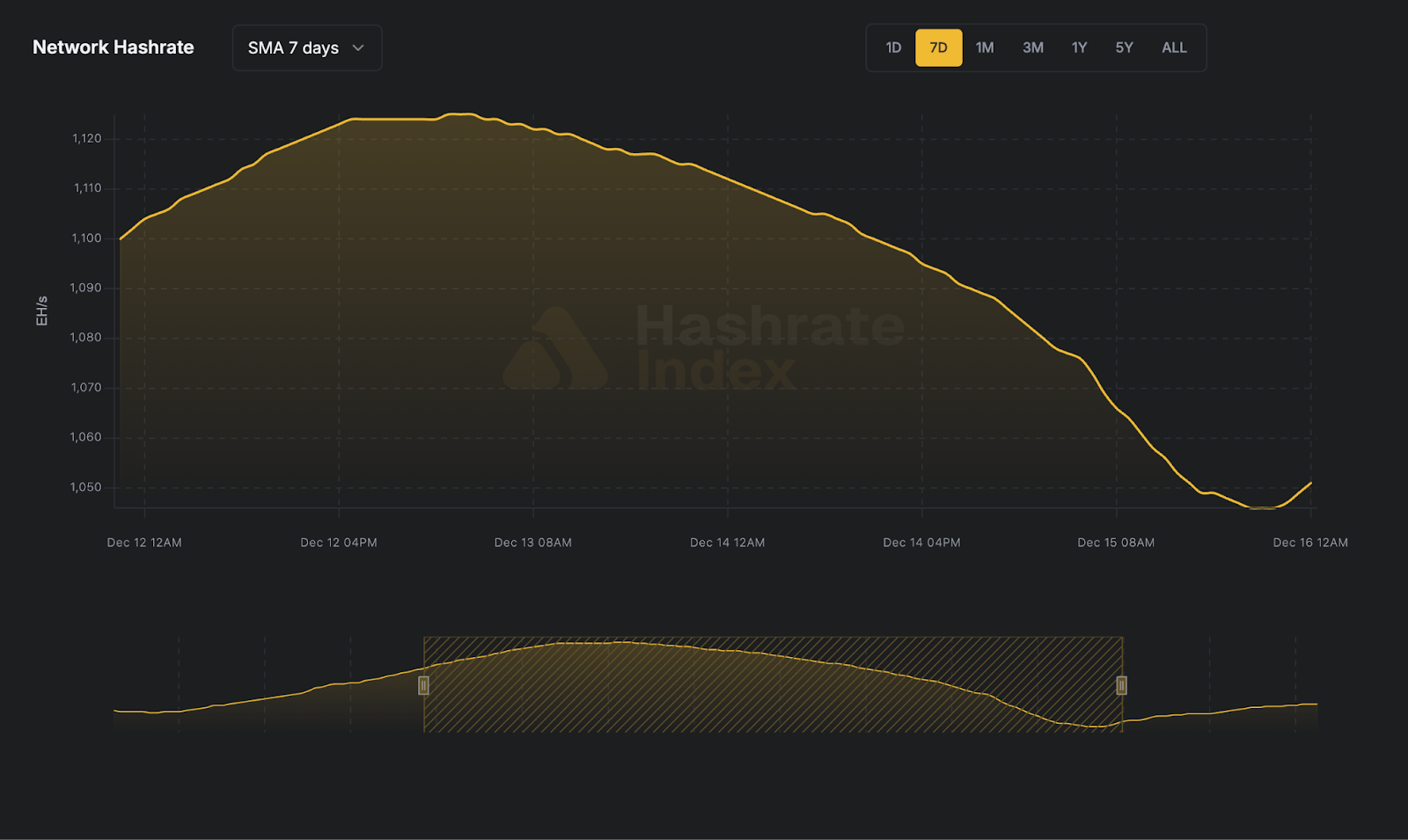

We think hashrate is one of the most interesting commodities, as its value is heavily impacted by macro-economic events and technical innovations. We think the value is more fundamentally driven and less speculative than the cryptocurrency prices themselves.

One interesting technical event that can significantly impact the price of hashrate is a hard fork of the network. We wanted to dive deeper into this topic and do a case study on the Bitcoin Cash Fork and the Bitcoin SV Fork.

This case study will walk through some key terms, go into the forks and conclude with our view on valuing hashrate ahead of a fork.

Definitions

Hashprice

Hashprice is a new term that we just invented, so please pretend it exists :)

It is simply the price of hashrate.

In today’s market, hashprice is the revenue in which you can generate for your hashrate over a certain time period. This is usually thought of as BTC/TH/Day but can also be on a USD basis.

The most accurate way to calculate a miner’s revenue on a PPS pool varies per coin and uses some combination of network difficulty, bDiff, pool difficulty, block reward and hashrate. However, conceptually you can think of long term mining reward as:

(User Hashrate / Network Hashrate) _ (Block Reward _ Block Time) From there you can divide by the user’s hashrate to get the hashprice.

Hard Fork

The technical definition of a hard fork, is a change to a network’s protocol that isn’t backwards compatible. After a hard fork has occured, the previous version of the network and the new one are completely split. There is no longer communication between the networks and from the change onwards, each version will have its own transaction history.

The simplest way to understand this, is that a new cryptocurrency is created with a new set of rules.

Case study: Bitcoin Cash Fork

On August 1st 2017, Bitcoin went through the largest fork in history. A group of then Bitcoiners and Miners wanted to make changes to the Bitcoin network, specifically relating to scalability and higher transaction speed. After the hard fork, Bitcoin Cash became a new currency with different rules. Everyone who held Bitcoin at the time of the fork received the equivalent amount in Bitcoin Cash.

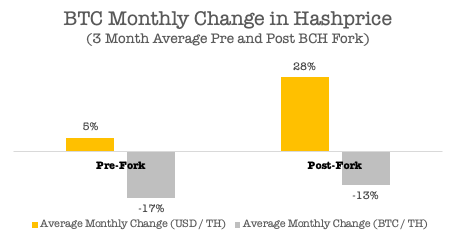

In the three months leading up to the Bitcoin Cash Fork, the hashprice of BTC increased by a monthly average of 5% on a USD basis and -17% on a BTC basis. Post-fork, the hashprice performed significantly better, increasing 28% on a USD basis and -13% on a BTC basis. In short, the fork had a positive effect on the BTC hashprice on both a USD and BTC basis.

BCH forked at block 478558, 1 August 2017On a USD basis, the price performed well following the fork, driving most of the returns. However on a BTC basis, the hashprice still performed better post-fork mainly due to network hashrate not increasing as fast as pre-fork. The key takeaway here is that the fork had a positive effect on price, it also had a negative impact on hashrate growth, likely because some of the hashrate went to mine BCH.

Case study: Bitcoin SV Fork

On November 5th 2018, Bitcoin Cash went through a fork. One side promoted the software, Bitcoin ABC (Adjustable Blocksize Cap) which would maintain the block size at 32MB. The other side promoted Bitcoin SV that would increase the block size limit to 128MB. The result was a fork of the network.

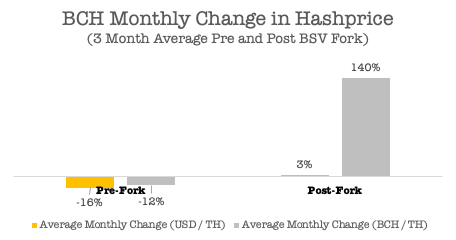

In the three months leading up to the Bitcoin SV Fork, the hashprice of BCH decreased by a monthly average of 16% on a USD basis and -12% on a BCH basis. Post-fork, the hashprice performed significantly better, increasing 3% on a USD basis and 140% on a BCH basis. The fork had a positive effect on the BCH hashprice on both a USD and BCH basis.

BSV forked at block 556766, 15 November 2018The hardfork had a very negative impact on the price of BCH. But the existing hashrate on the market split, with some of it going to mine BSV, and some potentially fleeing the war to another SHA-256 coin. This means that on a BCH basis the hashprice increased significantly.

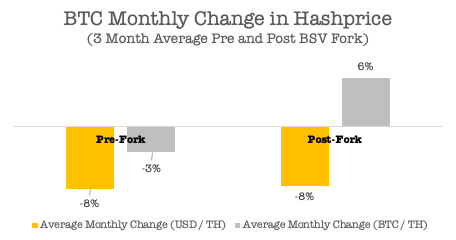

Now looking at the BTC hashprice (even though it wasn’t directly involved in the fork). In the three months leading up to the Bitcoin SV Fork, the hashprice of BTC decreased by a monthly average of -8% on a USD basis and -3% on a BTC basis. Post-fork, the hashprice performed roughly the same at -8% on a USD basis but alot stronger at 6% on a BTC basis. The fork had a neutral effect on the BTC hashprice on a USD basis and positive on a BTC basis.

BSV forked at block 556766, 15 November 2018What happened here was the BCH-BSV war had a negative impact on the price of BTC. However, the hashrate war drew some hashrate away from the Bitcoin network, meaning that on a BTC basis the hashprice saw a significant increase.

Our Takeaways

When a fork occurs, we expect to see an increase in hashprice. This is only for forks that keep the same algorithm (i.e. Bitcoin Cash Fork that stayed as SHA-256 and not Bitcoin Gold which went to Equihash-BTG). The reason being is the total emission rate (block reward + transaction fees) for that algorithm increases, while the amount of hashrate stays the same.

The analysis above is rather simplistic in nature, we took a high level approach to looking at the causes of changes in hashprice. However, we think that you could build a much more sophisticated model that takes more variables into consideration. Some additional variables to look at would be new hardware shipping, what season it was in the Sichuan province, more adoption creating larger transaction fees etc….

We are excited about hashrate as a global commodity. If you have any suggestions of other macro events for us to look into please ping the team!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.