Buying and Selling Bitcoin Mining ASICs and Automating Trade With RFQ

A 101 for buying and selling Bitcoin mining ASICs and how an RFQ marketplace can automate the process.

Since their introduction in 2012, Bitcoin mining ASICs have been the core hardware component of Bitcoin mining, so every production change and technological advancement in the ASIC industry significantly impacts the entire Bitcoin mining landscape.

Bitcoin miners want to know 1) the price of equipment when buying direct from manufacturers or via the secondary market and 2) the location of the hardware.

This article will cover how ASICs have been traded in the past and how miners and ASIC traders can utilize Request-for-Quotation (RFQ), open-auction marketplaces like Luxor's RFQ to increase price discovery for Bitcoin mining ASIC trading.

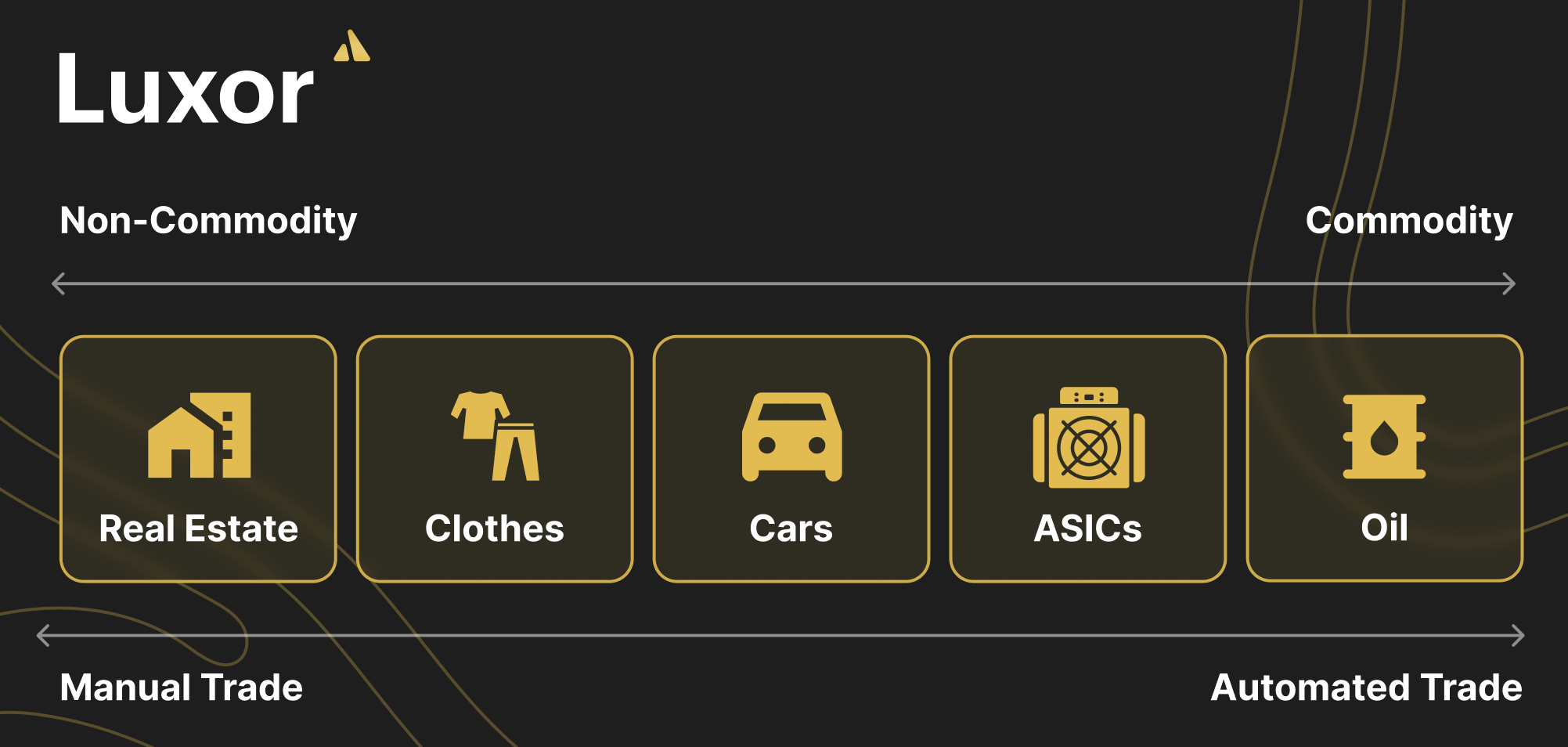

Commodity Trades Trend Toward Automation

The trade of certain goods and commodities trends towards automated.

Automation replaces human input and effort with technology and standardization. In the context of goods and commodities trading, the automation via marketplaces has several advantages.

Automated marketplaces:

- Reduce the labor cost required to sell goods

- Lower trade friction through standardization

- Minimize the possibility of human error.

These incentives have pushed the trading of most goods toward automation over time.

The trade of some goods still relies primarily on human labor. The degree to which we can automate trade depends primarily on two characteristics of the traded good: ease of standardization and ease of transportation.

If you can provide trading standards (e.g. quality and quantity) for a good, it will be easier to automate the trading process. Because they are (typically) fungible, commodities are the most standardizable goods and their trade tends to be highly automated through exchanges like CME or NYMEX. Examples of commodities include electricity, coal, oil, and copper.

A good’s ease of transport is the second most important characteristic when determining the prospect of trade automation. Goods that are easy and cheap to transport can be traded over a larger geographical area, increasing the potential market size and liquidity. Transportable commodities like oil and coal are traded on global markets, while those that are harder to transport, like electricity and natural gas, are traded on more fragmented, localized markets.

ASICs possess commodity-like characteristics and are highly suitable to being sold on automated marketplaces. One unit of hashrate from a mining rig is interchangeable with an equal unit of hashrate from different rig of the same model. This makes it easier to standardize the exchange process. As the ASIC market continues to commoditize, the same machine models will trade at a uniform price per TH across different markets.

Used ASICs are less fungible than new ones, as buyers can’t be 100% confident in the condition of the rigs. Buyers typically want some proof that the ASICs work as advertised, which requires more manual labor as well as trust. New ASICs, on the other hand, are more fungible as the buyer can be relatively more certain of the condition of the rigs, particularly if purchasing them through a reputable seller.

When traded on an exchange, commodities must meet specified minimum standards, also known as basis grades. A basis grade on an ASIC exchange could stipulate that all listed rigs must be new in their original packaging and come with a warranty. The disadvantage of having such a basis grade is that it excludes used ASICs, but these can be traded on another market.

The commodity-like nature of hashrate and Bitcoin mining rigs almost guarantees that ASIC trading will evolve into automated marketplaces with basis grade standards.

The History and Current Channels of ASIC trading

The ASIC sales and trade began with the original equipment manufacturer (OEM) market back in 2012 when Bitcoin ASIC technology for Bitcoin mining was first introduced.

The race began with three players – Canaan, ASICMiner, and Butterfly Labs. Canaan won the race in January 2013 by successfully shipping the Avalon miner as the first commercially functional ASIC delivered to the market. Since then, the OEM market has dominated the ASIC sales funnel as more manufacturers (namely Bitmain and MicroBT) have emerged.

In the early days of ASIC mining, when there were no official online stores, miners would usually learn about new machines via press conferences hosted by manufacturers and then contact their account managers to place orders. Miners also relied on word of mouth to resell their inventory since the industry was relatively small. Later on, the channels for buying and selling ASICs were expanded when official OEM websites, third-party online forums, third-party distributors, and online stores for ASIC trading became available.

The current ASIC trading landscape is still a highly fragmented market that has seen little development in the past 10 years. In the secondary market (that is, trading that occurs between miners outside of the OEM market), sellers and buyers spread trade across multiple chat apps, online forums, and marketplaces. A handful of startups from different regions have tried to capitalize on this fragmentation to create a marketplace / software that would replace this patchwork ASIC trading.

Unfortunately, those attempts only had limited success due to the intricacy of ASIC market. To be more specific, there are a few primary vending channels for of ASIC sales that miners widely use, and a unified ASIC marketplace needs to factor in both when catering to ASIC traders.

- Manufacturers: ASIC manufacturing is currently an oligopoly controlled by Bitmain, MicroBT, and Canaan, which gives these three the position to decide how many ASICs will be available for purchase in the market each year and for what price. As a purchaser, buying directly from OEM minimizes the counterparty risk and at the same time allows buyers to get the most accurate information for technical support. However, compared to the secondary market, OEM markets don’t always have the best pricing (especially during a bear market). Meanwhile, the purchasing terms with OEMs are usually less flexible and have much less room available for negotiation.

- Professional Resellers: Professional resellers are vendors who trade ASICs as a primary business, and they can serve as a bridge between the OEM and the secondary market. This category includes a manufacturer’s official distributor of manufacturers and third-party non-official distributors. For new equipment and particularly futures, many resellers will place bulk orders directly from manufacturers and then resell them on communication apps like WeChat, Telegram, WhatsApp, and other platforms such as LinkedIn. Resellers may also pool funds together with partner vendors or raise funds from investors to obtain bulk order discounts with manufacturers, thus making their pricing in the secondary market more attractive. For used equipment, resellers usually source the supplies from the secondary market or directly from miners and will promote the inventory through the same platforms. As major suppliers on the secondary market, professional resellers can provide buyers more flexibility with payment terms, minimum order quantities (MOQs), payment methods, and vendor financing terms. A word of caution however, the secondary market also carries the potential for fraud (e.g., false vendor/buyer identity or falsified contract), pricing volatility, tortious interference of a purchase agreement, etc. ASIC market buyers have long struggled to find trustworthy vendors who also have competitive pricing.

- Hosting Providers: Many hosting companies may also sell equipment through their mining-as-a-service offerings. For example, hosting providers usually sell equipment to hosting clients as part of their turnkey mining solution. This channel is the most convenient for buyers to begin mining as-soon-as-possible, because it eliminates the hassles of sourcing hardware, shipping and handling, and installing the rig. Of course, this convenience comes at a cost — hosts typically sell plug-in-play rigs at a premium.

- Other Miners: Direct-from-miners deals are more common in the used equipment market. This channel first requires buyers and sellers to acquire information on their trading counterparties and on non-publicly available deals to gauge fair pricing. Trading used equipment is almost always a guessing game where the buyer and seller need to be experienced with mining equipment to reduce friction in deal-making. Additionally, it’s rare to find a very attractive deal directly from miners, so buyers and investors need to keep a lookout constantly to source such opportunities.

In addition to the channels above, an emerging way to procure miners at a discount is participating in open-bid or closed-bid auctions of distressed assets, default loans, or bankruptcy cases. According to Luxor ASIC Trading Desk’s experience in hosting, conducting, or participating in 10+ bulk ASIC auctions and the first in-person Bitcoin ASIC auction in history, we found auctioning to be a unique and effective method for both price discovery and closing a deal.

We believe as the industry grows and matures, the future of ASIC trading can utilize more auction mechanisms and technology to enhance automation and efficiency.

Luxor RFQ (Request-for-Quote), A More Effective Way of ASIC Trading

The current fragmented ASIC market has a few major disadvantages:

- Fragmented trading creates inefficiency when manually collecting bids/asks and when doing diligence on counterparties

- Trading channels are spread out, resulting in lower liquidity across various channels rather than concentrated liquidity in one trading hub

- Low level of transparency. This remains difficult for experienced miners and it is especially challenging for new players to the industry. Even with all the trading channels available, a tremendous amount of time and knowledge is needed to effectively navigate the ASIC market.

- Trading is largely done on the fly. There are few standards that dictate trading terms and processes, which can cause confuse for investors.

To tackle these pain points, Luxor’s RFQ includes some notable features which separate itself from other trading channels:

- Automation: users can easily create a sell/buy RFQ to automate the process of price discovery, and they can compare and manage all their bids/asks in one place.

- Liquidity: The platform opens up Luxor’s global ASIC buyer/seller network to all users, increasing liquidity and visibility into deal flow.

- Transparency: All users are provided with detailed information such as a users’ transaction fees, bids/asks, and opened/closed RFQs.

- Standardization: Users can market purchase/sales opportunities with standardized information and listings.

- Controlled Risks: Luxor acts as the transaction counterparty to lower the risks of dealing with unknown counterparties.

The Luxor RFQ platform will help accelerate the move of ASIC trading away from Telegram, just like the internet led to the disappearance of the pit traders in the stock market.

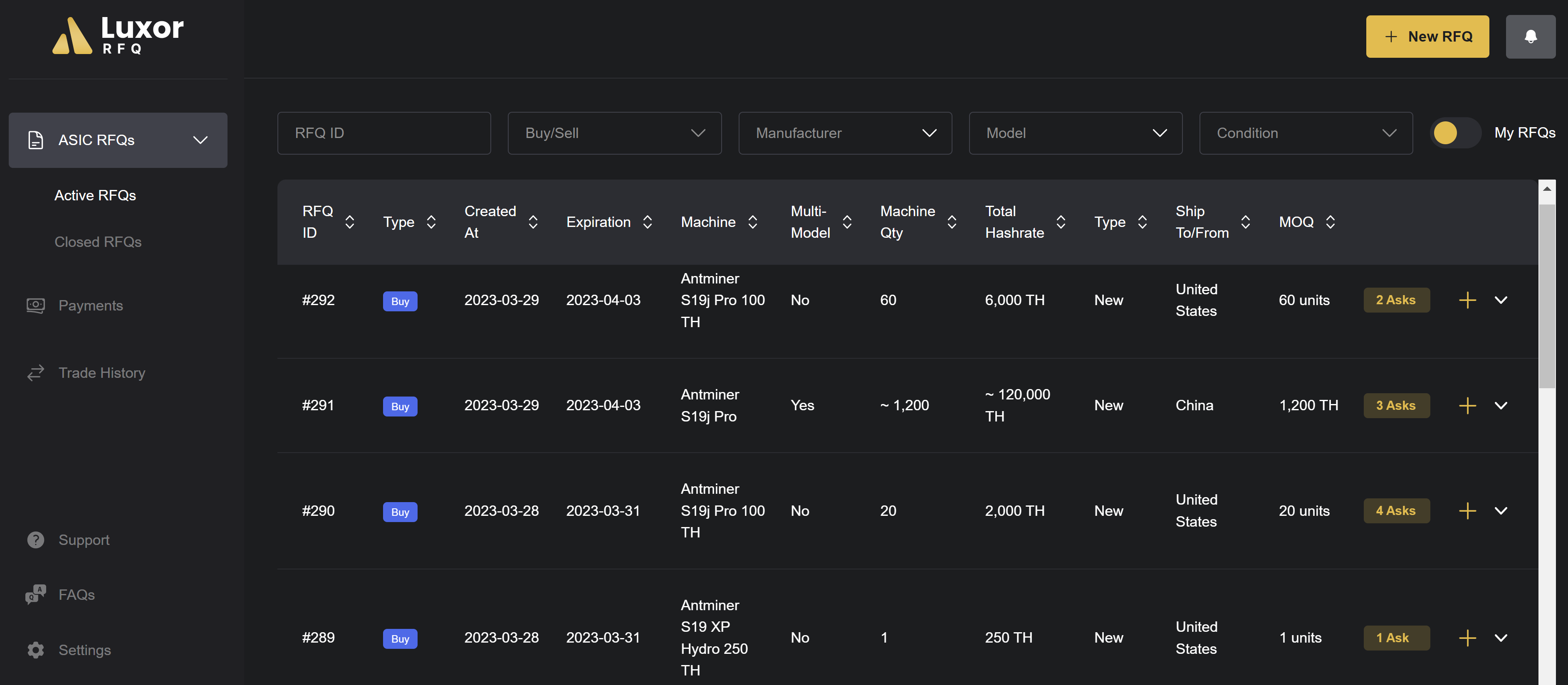

How does the Luxor RFQ Platform work?

Since its launch in late January 2023, Luxor RFQ has closed and executed ~$16mm worth of Bitcoin mining ASIC deals which represent over 1 EH/s of hashrate.

Buyers can create a buy RFQ and specifying information such as machine models, quantity, and ship-to location. Luxor will then invite over 40 ASIC vendors from different countries and regions to respond to the RFQ with ask prices of available inventory. All the ask prices are visible to the RFQ creator and other vendors who participated in this RFQ, but only the best ask price is visible to other RFQ users. Once the first ask price is provided by one of the verified vendors, the Buy RFQ becomes an open-bid auction which allows other vendors to try to outbid the best ask submitted.

And vice versa: if a seller creates a Sell RFQ with details of their inventory available for sale, Luxor will notify buyers to submit bids for the inventory. Before the RFQ expires, the seller can choose to accept the highest bid or reject bids with feedback. Given the competitive nature of price discovery for these Sell RFQs, both buyers and sellers will have a higher chance of getting the best deal available.

Users can easily move between buying and selling on Luxor RFQ. For example, a frequent buyer can liquidate their existing inventory through the RFQ platform (they’ll need to verify themselves before listing), and professional sellers can use Luxor RFQ to source their supply.

In addition to an automated price discovery, Luxor RFQ offers other benefits, including a transparent and tiered fee schedule, streamlined purchase order execution, a one-stop solution for logistics and technical support, public market insight, and more.

If you are selling or buying Bitcoin mining ASICs and want to learn more about how Luxor RFQ can help you grow your business, feel free to contact us for onboarding and join our Telegram channel for automated updates of open/closed RFQs.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.