What is the Bitcoin Mining Block Reward?

Bitcoin's block reward pays bitcoin miners for their work, and this reward is reduced every four years from the Bitcoin halving.

A bitcoin block reward is the prize bitcoin miners earn for successfully mining a new block. The bitcoin block reward consists of two components: the bitcoin block subsidy and bitcoin transaction fees.

Known as a coinbase transaction, each block reward is paid out in the first transaction of each newly mined block. The output of this coinbase transaction cannot be spent for 100 blocks, preventing miners from immediately spending newly discovered block reward for roughly 15 hours after mining them.

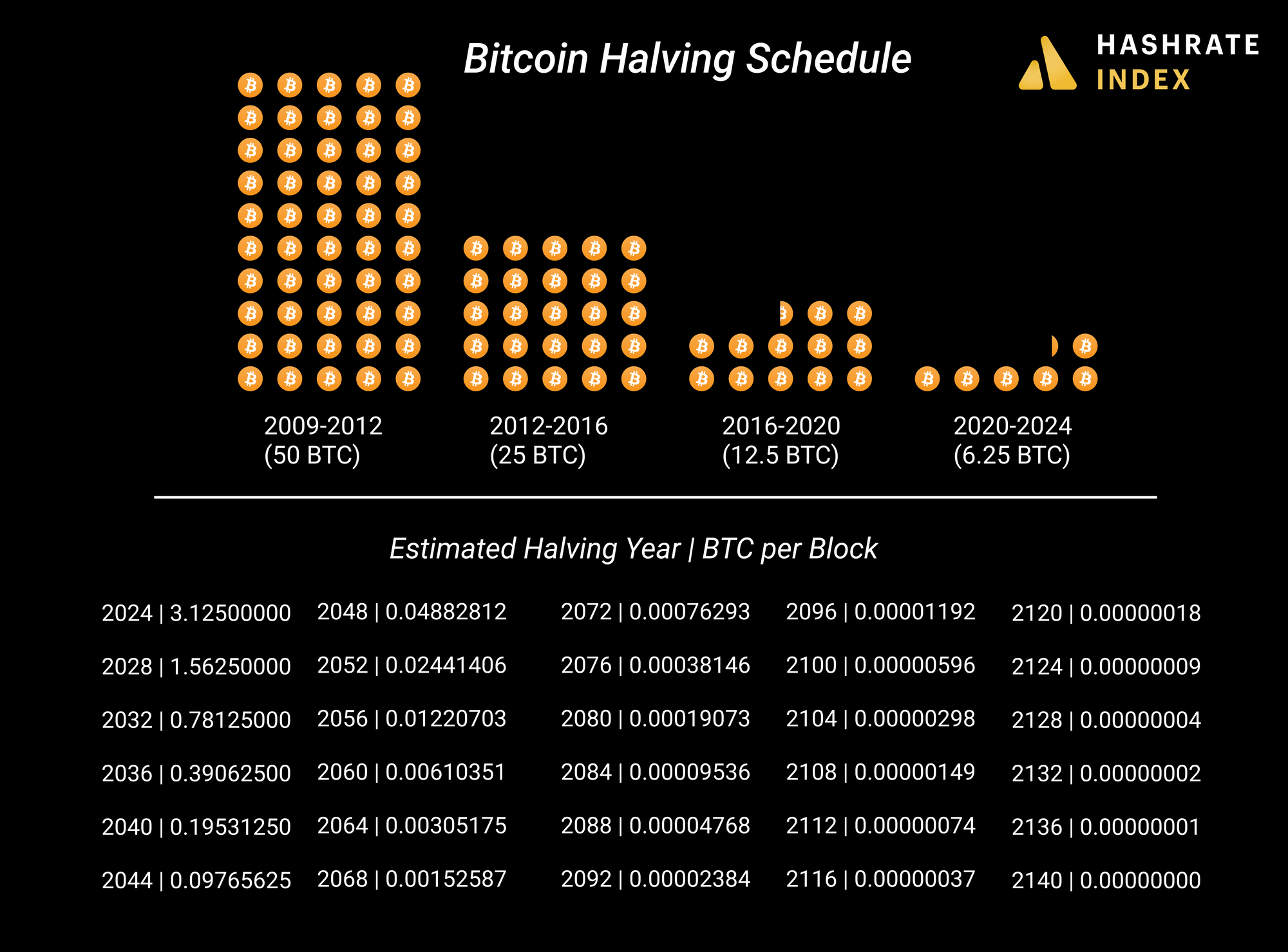

The batch of newly minted coins bitcoin miners earn from mining blocks (sans transaction fees) is called a block subsidy. Bitcoin’s current block subsidy is 6.25 BTC, but this will be cut in half soon in an event known as the halving. This self-executing, programmatic event occurs every 210,000 blocks (~4 years). As seen in the image below the block subsidy trends towards zero, and it will eventually reach zero around the year 2140, giving Bitcoin an inflation rate of zero.

Along with the block subsidy, block rewards include the fees bitcoin users include in the transactions they broadcast to the network. Once users send a transaction with its associated fee, the transaction goes into a waiting list called the mempool. Bitcoin miners and mining pools examine the transactions in the mempool and decide which to include in the blocks they mine, and they typically try to include transactions with the highest fees.

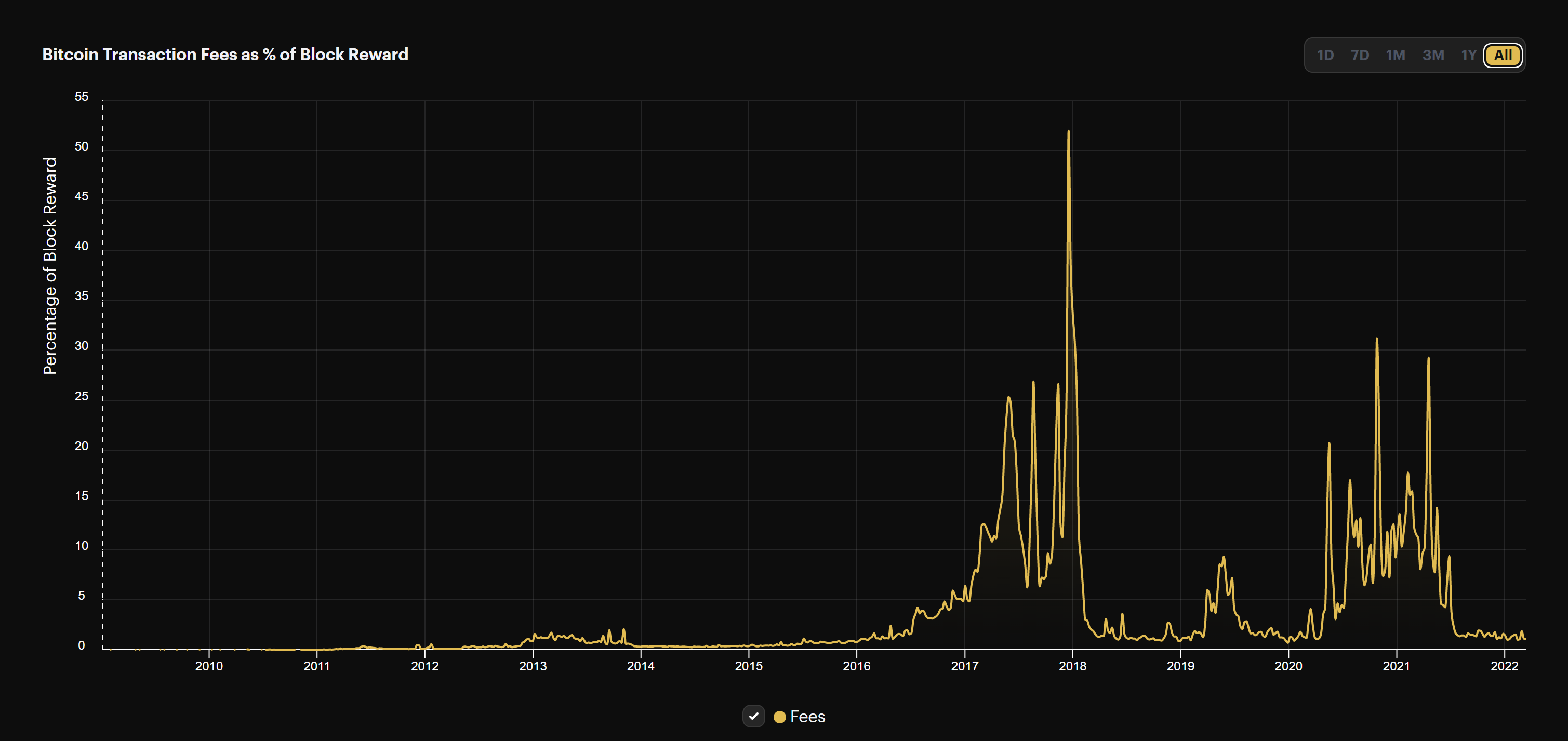

At the time of publication, bitcoin transaction fees account for a small proportion of each overall Bitcoin block reward, but will most likely continue to increase as the subsidy decreases and overall users increase.

How Bitcoin Mining Transaction Fees Affect Hashprice and Miner Profitability

Since the block reward is the only Bitcoin network-endogenous source of revenue for bitcoin miners, transaction fees play an important role in determining the total value of a block reward and therefore mining profitability.

Transaction fee volume and hashprice (miner revenue) are positively correlated. When fees constitute a larger percentage of the block rewards, hashprice increases, and the inverse is true if fees constitute a smaller percentage of the overall reward.

Currently, Bitcoin transactions fees constitute a very small percentage of block rewards, ranging from 1-2% for a majority of the last 3 months.

What Happens When the Block Subsidy is Zero?

A common criticism of the bitcoin network is that the security of the Bitcoin network will weaken once the block subsidy reaches zero, as miners will have little incentive from fees to continue mining and securing the network.

Though this is a valid concern considering the current fee market, the continual adoption and utility of the bitcoin network will continue to increase over time, bringing the potential of an adequate fee market to the realm of possibility. Once the block subsidy is inevitably zero around 2140 the maturation of the bitcoin network will have to be significant enough to have miner revenue and network security rely solely on fees.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.