Under a Mountain of Debt: Analyzing Core Scientific’s Current Situation

The once undisputed king of the public bitcoin miners has been dethroned and could soon be forced to declare bankruptcy. This article analyzes the company’s finances and predicts how this situation could unfold.

Core Scientific is by far the biggest public bitcoin miner by hashrate. Therefore it came as a shock for many when the company recently announced it might have to declare bankruptcy. The company’s stock price has plummeted by more than 80% since the announcement as the last bagholders scramble to get out.

Several capital interests, including holders of the company’s remaining equity and owners of various debt instruments, are now battling to control the company’s assets. Equity owners are clinging to the hope that the company will avoid bankruptcy, while debt holders are arguing about who gets paid first.

This article attempts to answer several questions about Core Scientific’s current situation, starting with explaining how the company got into this mess. Then I will show to whom the company owes money, discussing who might be made whole first. The article ends with a discussion of the future of the company’s assets and the potential implications for the broader bitcoin mining ecosystem.

How did Core Scientific get into this mess?

It’s easy to see that Core Scientific developed its business strategy during the bull market of late 2021. At that time, capital markets were wide open for miners and awarded the companies with the most extensive expansion plans.

Core Scientific did as the market told them and expanded as quickly as possible. The company’s mining team was always great at execution and managed to grow its self-mining capacity from 6.6 EH/s in January to 13 EH/s. Even though this massive capacity expansion required hundreds of millions in financing, the company was reluctant to sell any bitcoin before it absolutely had to.

Since Core Scientific saved up all its internally generated capital in bitcoin, it had to acquire external capital to fund its massive growth. External capital comes in two forms: equity or debt. While most other miners prioritized equity, Core Scientific was reluctant to dilute its shareholders and therefore took on debt – a cheaper, but at the same time riskier form of capital.

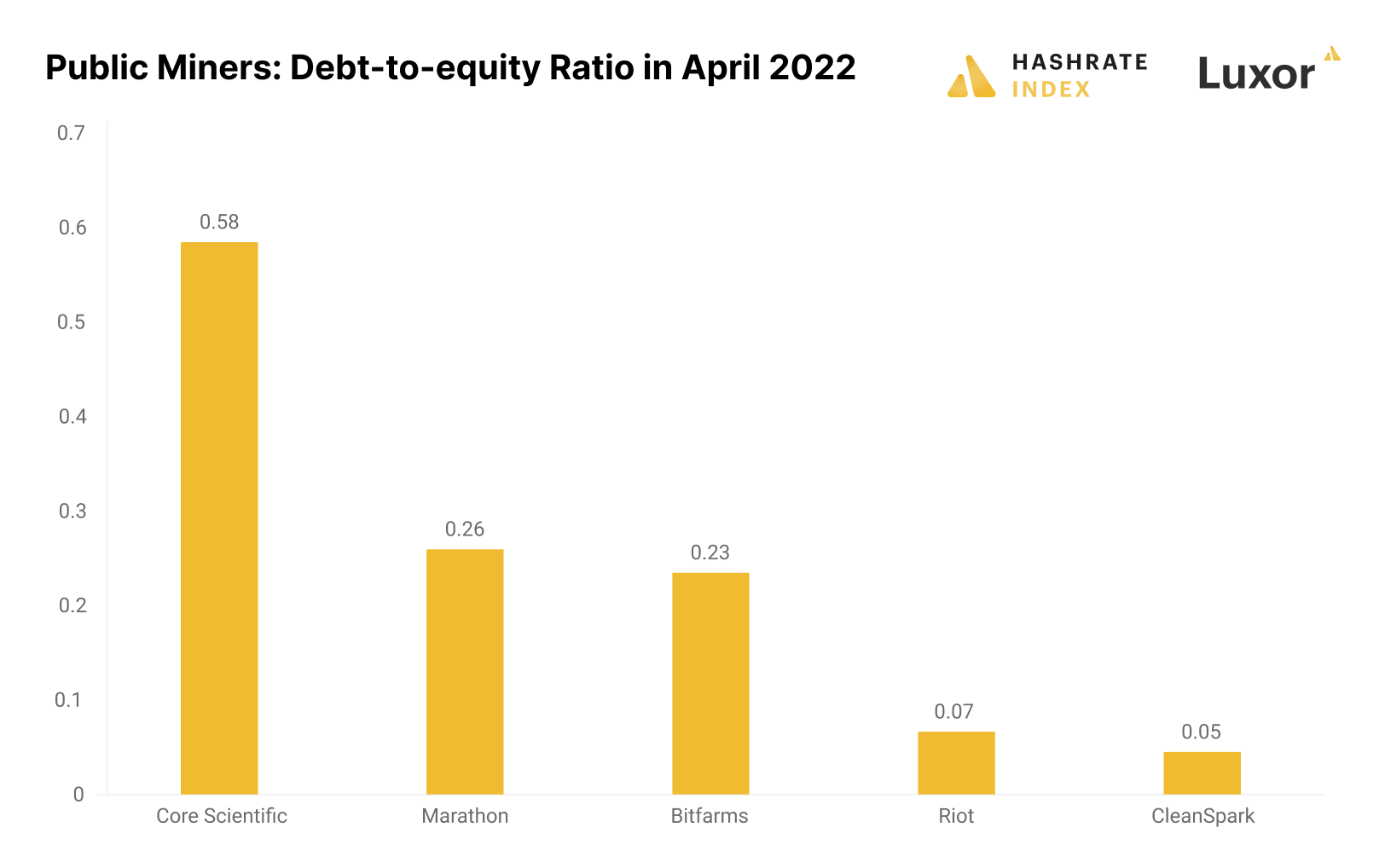

The company loaded up with as much debt as it could get its hands on. This excessive leverage led the company’s debt-to-equity ratio to hit levels far higher than usual in the bitcoin mining industry.

The chart above shows the debt-to-equity ratios of the five biggest public miners by hashrate in April 2022, before this bear market started taking off. With a debt-to-equity ratio of 0.58, Core Scientific was much more leveraged than its competitors. Companies like Marathon and Bitfarms also experimented with debt but kept their debt-to-equity ratio in the more reasonable 0.2 – 0.3 area, while the prudent Riot and CleanSpark barely took on any debt at all.

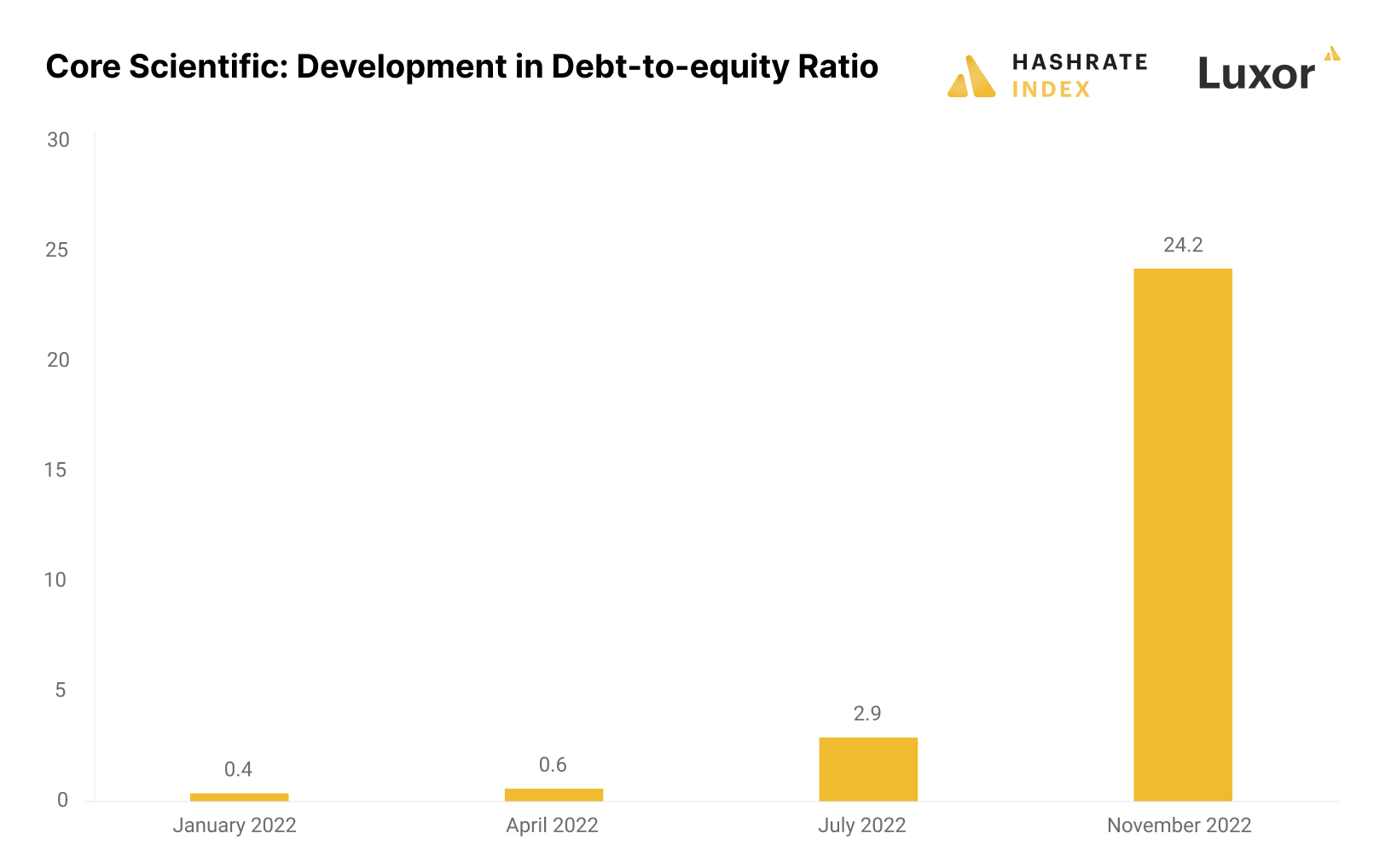

Core Scientific’s April 2022 debt-to-equity ratio of 0.58 is normal in most industries. The problem is that bitcoin mining is not a normal industry. Bitcoin mining is an exceptionally volatile industry with deep bear cycles that can last very long. As the bear market unfolded this summer, Core Scientific’s debt-to-equity ratio skyrocketed due to its plummeting equity value.

In July 2022, the company’s debt-to-equity ratio had already become 2.9, a high figure even in less volatile industries. It kept worsening throughout the summer as its equity value evaporated. Due to its high debt-to-equity ratio, the company couldn’t take on any additional debt and would severely dilute its shareholders if it raised equity. The company’s financial situation suddenly started looking very grim.

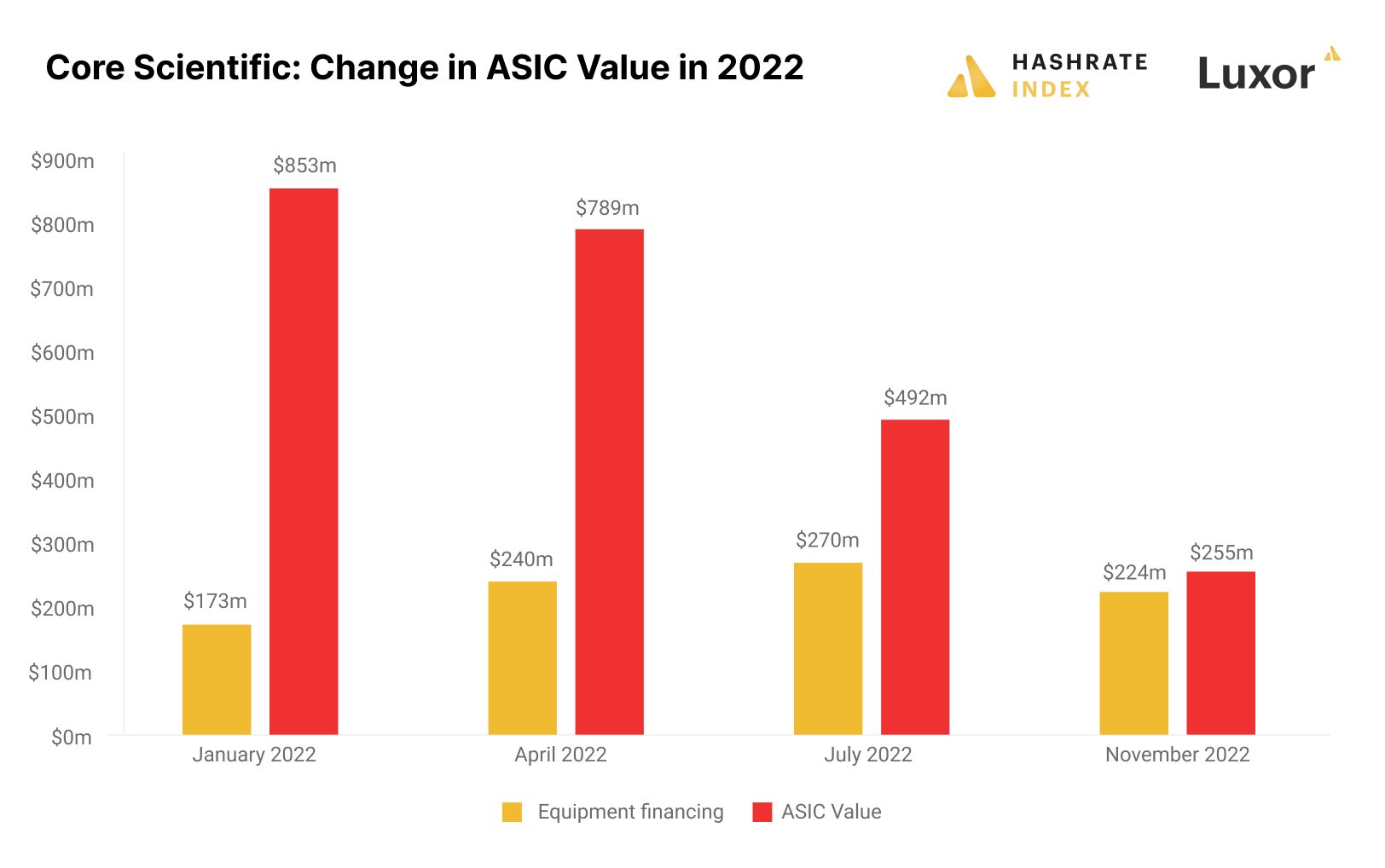

Another way to illustrate the deterioration in Core Scientific’s solidity is to look at the development of the equipment financing balance versus the value of the company’s ASICs. Equipment financing is a form of short-to-medium-term debt used to finance machine purchases, in which the machines are used as collateral for the loan. This scheme became very common in the bitcoin mining industry over the past year, and Core Scientific has been the biggest user of these lending products.

As we can see on the chart, Core Scientific’s equipment financing scheme looked relatively solid at the beginning of 2022, as ASIC prices were much higher than now. As ASIC prices plummeted as the year progressed, the company’s loan-to-value ratio gradually increased. In January 2022, Core Scientific’s ASIC fleet was worth an estimated $850 million, which has now declined to only $255 million. Meanwhile, the equipment financing balance is approximately the same as in January 2022. Due to this high loan-to-value ratio, the company could not take on any additional equipment financing, which is detrimental to its liquidity.

A company’s financial strength is determined by two factors: solidity and liquidity. We have now discussed the solidity of the balance sheet so let’s move on to analyzing the liquidity.

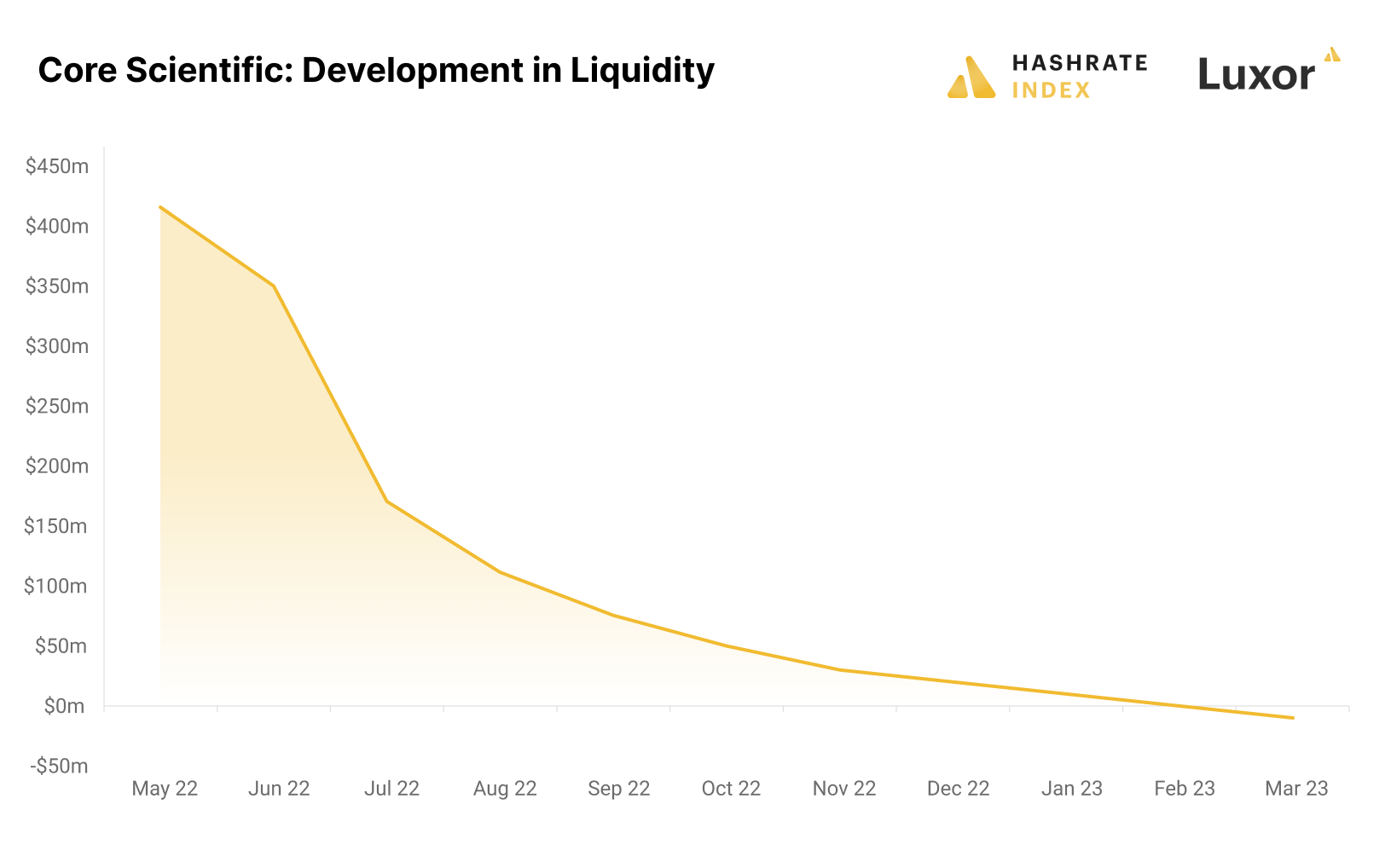

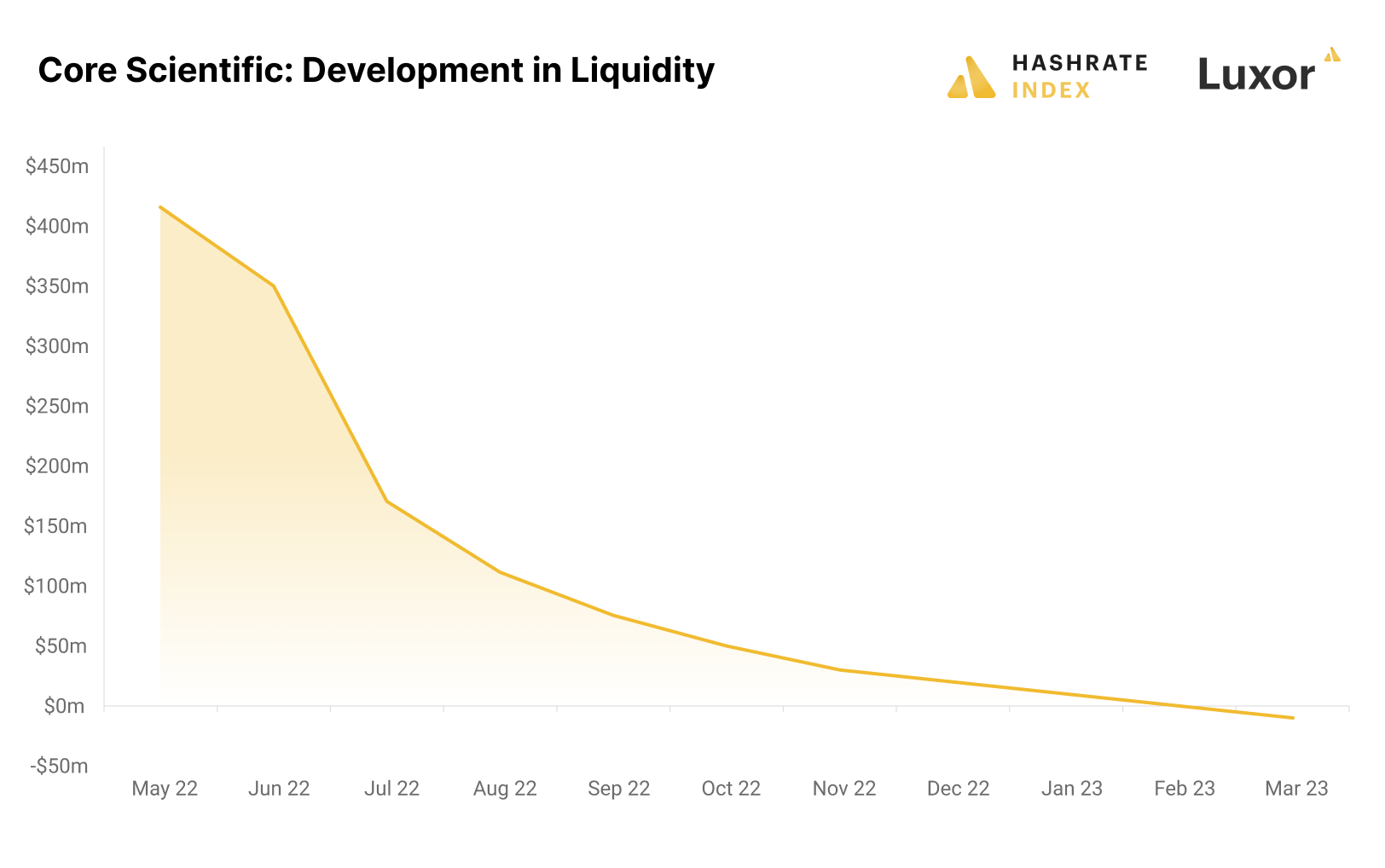

The company had a relatively liquid balance sheet in early May, holding 9,618 bitcoin worth $40k each then. In addition, it held $50 million in cash. Its total liquidity was $415 million, which on paper looked solid and should have been more than enough to cover future debt payments.

The problem was that nearly 90% of this liquidity consisted of bitcoin, and we all know what happened to the bitcoin price in May. One month later, in June, the bitcoin price was suddenly $20k, and the company appears to have realized it was in danger. It started diverging from its previous “hodl-at-any-cost” strategy, dumping 2,698 bitcoin in May and 7,205 in June at fire sale prices. The company has since kept selling and now only has 24 bitcoin left. Even after bitcoin stabilized around $20k, the company’s liquidity position has worsened month after month, as it doesn’t generate enough cash flow from operations to service its debt.

The company now only has $27 million of liquidity. It produces about 1,200 bitcoin per month, equivalent to $25 million. I estimate their gross margin is only 30% due to the company being hit hard by energy price inflation. This gross margin gives the company a monthly cash flow from its self-mining operations of $7 million. The other business units – hosting and equipment sales – don’t generate any cash flow.

Meanwhile, Core Scientific has $17 million in monthly debt payments to make, $10 million more than its cash flow from operations. The company must drain its liquidity by $10 million per month to service debt, and its $27 million cash balance will get wiped out by February 2023.

Still, the company has an equity purchase agreement allowing it to sell shares worth up to $100 million to B. Riley. Until now, the company has only sold shares worth $21 million, meaning that they still have $79 million left of firepower from this facility. Usage of this facility would somewhat improve the company’s liquidity position but, at the same time, heavily dilute existing shareholders as the market cap is only $62 million.

As hopefully became clear from this analysis, the company is in a hopeless position both from a solidity and liquidity perspective. It is therefore forced to either restructure or declare bankruptcy. In the next section, we will discuss the battle for the company’s assets in the event of bankruptcy.

Who does Core Scientific owe money to, and who is the most likely to get their money back in the event of bankruptcy?

Core Scientific’s capital holders are now battling to save what is left of their investments. Equity holders are clinging to their last hopes that the company will not bankrupt, while debt holders are forced to play the game of musical chairs for who gets their money out first.

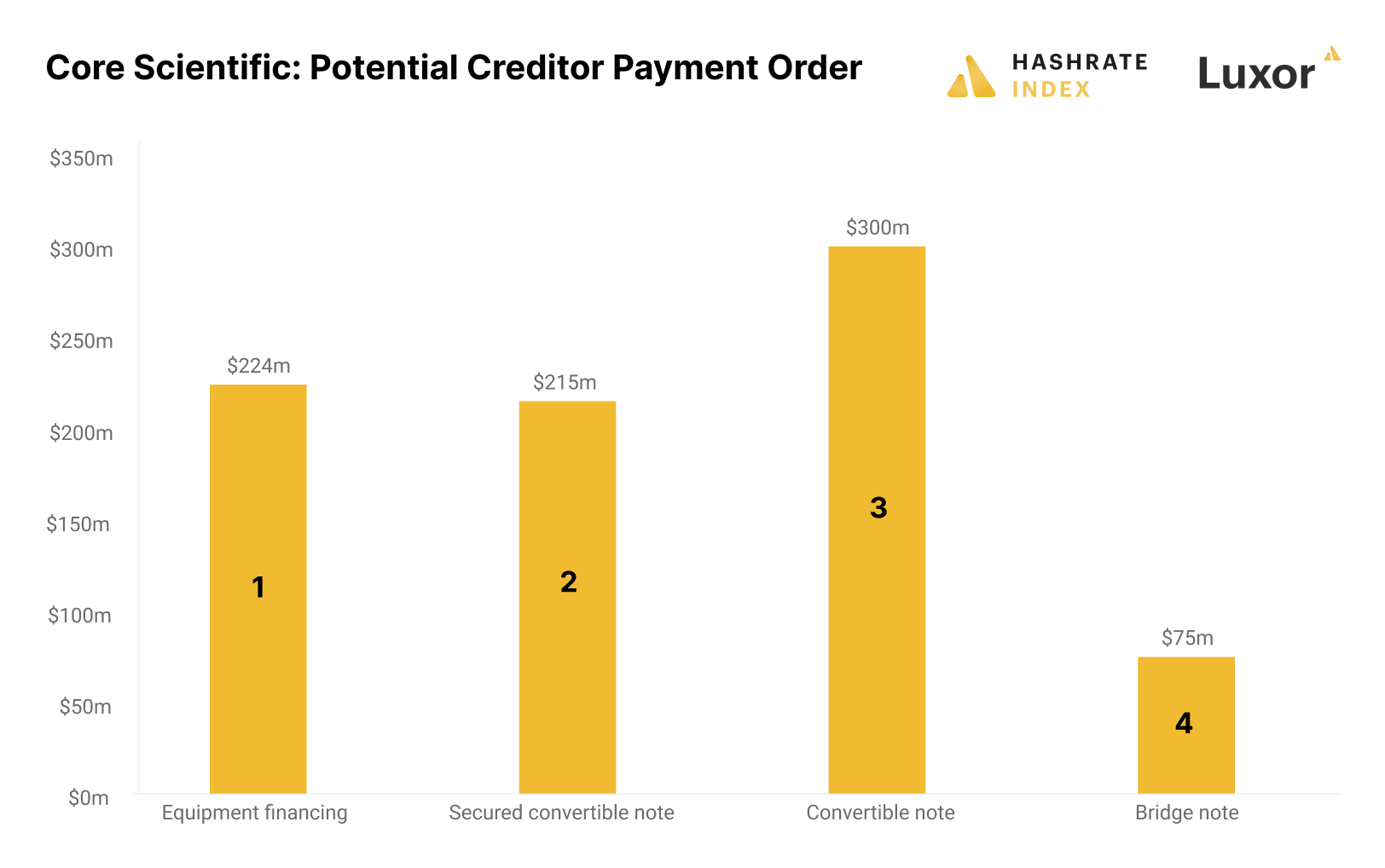

As I mentioned, Core Scientific’s current situation is chaotic, to put it mildly. This could take many ways, including bankruptcy. Bankruptcy is a complicated topic involving many attorneys fighting over possessions in court. Although I don’t consider myself an expert in bankruptcy law, I’ve included a chart showing which lenders I believe will be the most likely to get their money back in the event of bankruptcy.

Core Scientific’s $836 million debt consists of $224 million in equipment financing, $215 million in secured convertible notes, $300 million in convertible notes, and $75 million in bridge notes.

Holders of the convertible notes include Apollo Global Management, Blockfi, and Wolfswood Partners, amongst others. These notes are secured by assets unencumbered by equipment financing. As I will soon show, most of Core Scientific’s machines are tied to equipment financing, meaning the convertible notes are only secured by the facilities, infrastructure, and any equity value that might be left.

The company’s bridge notes are issued by B. Riley, a well-known lender in the bitcoin mining space. Bridge notes are short-term loans used until a company secures permanent financing for a project. These are unsecured notes, and B. Riley will likely book a significant loss. Core Scientific was supposed to make payments on these notes in late October and early November 2022 but decided not to due to its poor liquidity.

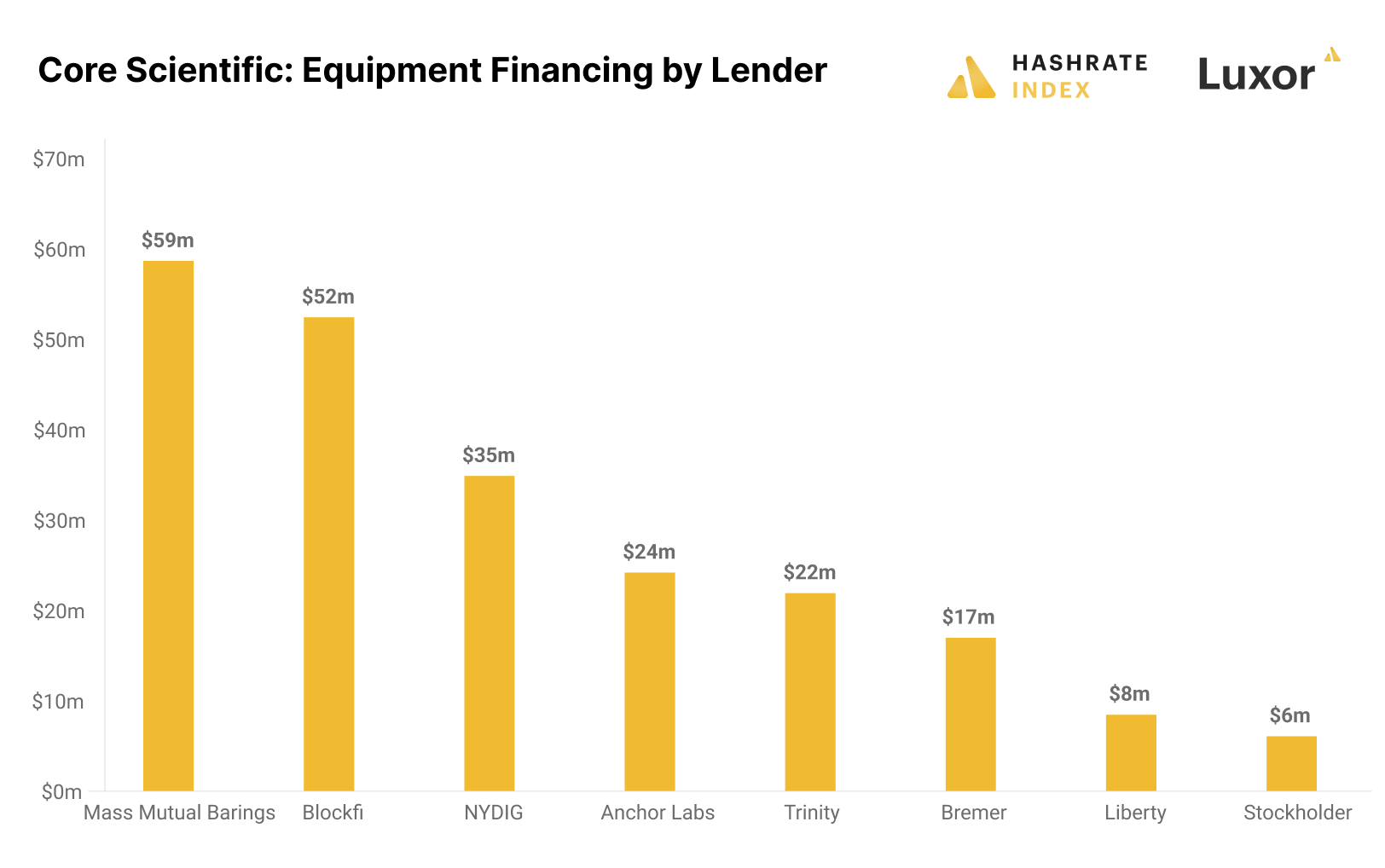

The equipment financing is backed directly by the machines. These lenders are first in the creditor payment order as they could take direct control of the machines. Let’s take a closer look at who these equipment financers are.

Core Scientific’s biggest equipment lender is Mass Mutual Barings, with $59 million outstanding. The crypto lender Blockfi, which already has lost enormous amounts during this bear market, has $52 million outstanding. NYDIG, another well-known lender in the space, has $35 million outstanding. The loans are secured by machines, meaning the loan-to-value ratio determines whether they will get their money back or not.

Let’s estimate the value of Core Scientific’s ASIC fleet to compare it to the equipment financing balance. Core Scientific currently has 13 EH/s of deployed self-mining capacity and awaits delivery of an additional 4 EH/s by the end of the year, giving them a total owned ASIC fleet of 17 EH/s. Our ASIC price index currently prices new-gen rigs at $23 per TH, but Core’s fleet would likely not be worth more than $15 per TH, giving it a total value of $255 million. I showed the development of the company’s ASIC value versus equipment financing balance in a chart in the previous section.

Core Scientific’s ASIC fleet is currently worth about the same as their equipment financing balance, meaning that the equipment financers should be able to get their money back. What I think is most likely is that these creditors take ownership of Core Scientific’s machines and keep hosting the machines at the current facilities. Still, they may want to give these machines new homes, given Core Scientific’s high current hosting rates.

The secured convertible notes are likely the next in line for getting paid. As explained, these notes are secured by assets unencumbered by equipment financing. These assets primarily consist of mining facilities, electrical infrastructure, and equity.

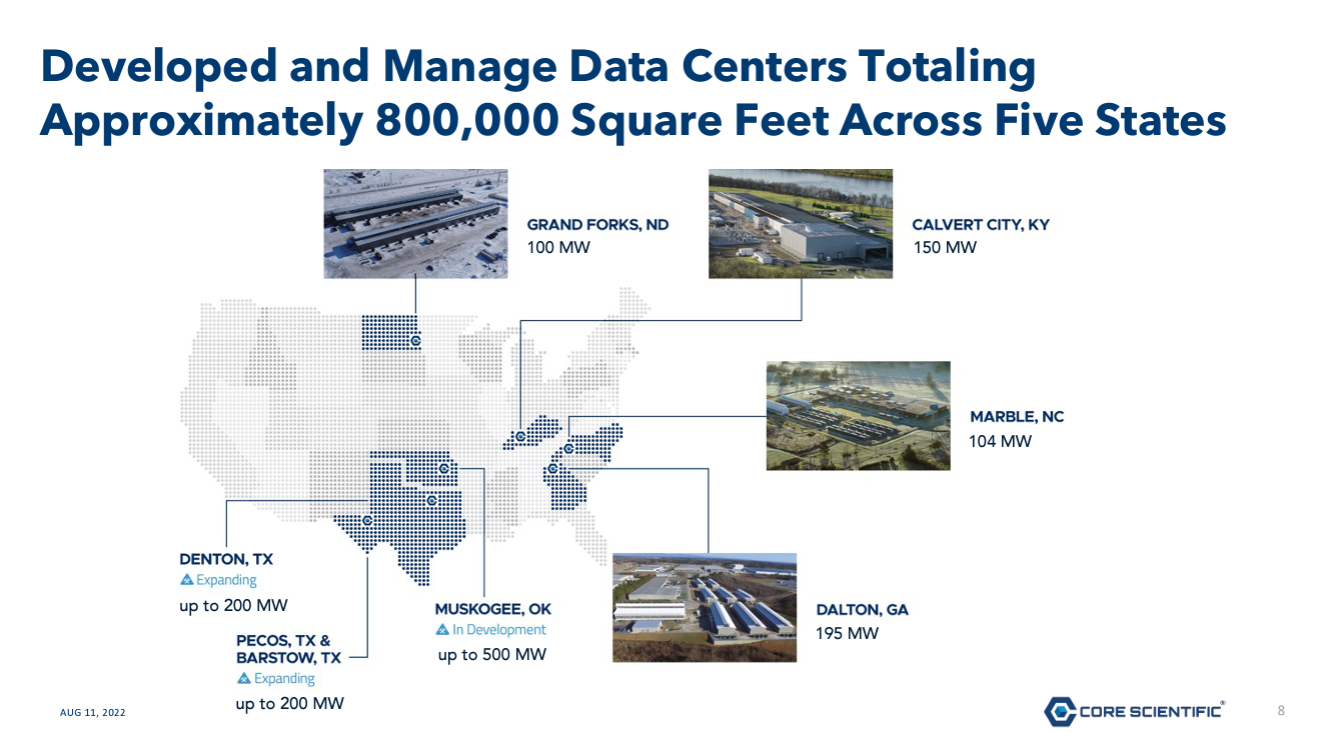

Estimating the value of Core Scientific’s mining facilities is complex. The company currently operates six data centers, of which four are finished with a combined capacity of 549 MW, and two are expanding up to 400 MW. They also have one data center under development with a capacity of 500 MW. In its August investor presentation, the company announced plans to have a total power capacity of 1 GW by year-end.

It’s unclear how much of this capacity is currently developed, but I estimate 800 MW. I estimate the value per MW to be around $400,000, giving us a total facility value of $320 million. The convertible notes outstanding are $515 million, meaning that Core Scientific’s assets will not be sufficient to cover these notes. The holders of convertible notes will likely book a significant loss, and the bridge note owners (B. Riley) will not get paid.

The way forward for Core Scientific

Core Scientific’s finances look grim. The company will soon run out of cash and default on its massive loans. The financiers providing these loans want to protect their investments, but there is not much value left in the company.

The company cannot exist in its current form and will have to go through a restructuring. Such a restructuring involves two main pathways: exchanging its existing debt for equity or going bankrupt. Turning debt into equity involves massive equity dilution, which the stock market currently is pricing in. In bankruptcy, the equity owners will lose it all, and the debt holders will scramble to get what is left of the company’s assets.

The most likely scenario is that the debt will be converted into equity. As I explained in the previous section, convertible note holders will likely lose a significant portion of their investments if the company goes bankrupt and are therefore incentivized to convert their debt to equity. These are powerful interests with more than $500 million of backing. This is also the least bad outcome for the company’s shareholders. This hypothesis is further strengthened by Bloomberg reporting that the convertible note holders are working with restructuring attorneys.

Another possible scenario is that Core Scientific gets acquired by another bitcoin mining company. Who could be interested in buying them, and who would have the financial muscles to do so? Let’s go through a few potential acquirers: Riot Blockchain, Marathon, and CleanSpark.

Riot Blockchain has a solid balance sheet with minimal amounts of debt. Still, I don’t think the company would be interested in acquiring Core Scientific. Riot Blockchain is super-focused on its data center buildout in Texas and would likely not want to deviate from this focus.

CleanSpark has already purchased two mining facilities during this bear market, proving its acquisition willingness. The company has a strong balance sheet and would have little problem raising the necessary capital to buy out Core Scientific. I, therefore, believe CleanSpark could be a potential acquirer.

I believe the most likely acquirer is Marathon. The company has a very liquid balance sheet which it could use to acquire and restructure Core Scientific. At the same time, Marathon has several EH/s of capacity sitting idle. With problems at their primary hosting provider Compute North, they could use some extra space for their machines. Core Scientific’s total 22.5 EH/s capacity is broken down into 13 EH/s of self-mining and 9.5 EH/s of hosting. The hosters are currently unhappy since Core Scientific increased their hosting rate to $0.1 per kWh, which may lead them to move their machines to other facilities. This could potentially provide Marathon with 9.5 EH/s of hosting space, which they need to scale towards their 23 EH/s hashrate target.

Still, restructuring the company where debt is turned into equity is the most viable solution. The restructuring may be combined with an acquisition by Marathon or a similar miner.

How could a bankruptcy affect the wider mining ecosystem?

Although I have explained that bankruptcy is not the most likely scenario, we should still think about how bankruptcy could affect the broader mining ecosystem. The bankruptcy of the once undisputed king of public bitcoin miners will undoubtedly lead to a massive breakdown of trust in the industry. The public bitcoin miners already have a poor reputation in traditional finance due to poor execution and massive executive compensation schemes. Core Scientific’s bankruptcy will be the icing on the cake for the industry’s criticism.

Such evaporating trust in the industry could manifest as a massive sell-off of other bitcoin mining equities, particularly the ones with high net debt. I would avoid such mining stocks as we advance and only invest in those with little debt relative to equity and strong liquidity. Also, falling equity valuations of other miners might render them unable to raise additional life-saving capital, which could lead to a domino effect of several public miners suffering the same bankruptcy fate as Core Scientific.

Bankruptcy could also have implications for the ASIC market. Core Scientific is in a lawsuit with the bankrupt crypto lender and miner Celsius regarding a hosting agreement in which Celsius refuses to pay Core Scientific’s recently increased hosting fees. Celsius currently hosts 26,655 machines at Core Scientific’s facilities hashing at around 2.7 EH/s. Core Scientific going bankrupt might change this lawsuit and force Celsius to liquidate their machines into the ASIC market. This could have a negative effect on the ASIC market. Still, all these lawsuits and bankruptcies are complicated and must be decided in court.

Conclusion

The bear market has claimed its first public miner scalp. Once the poster boy of public bitcoin miners, Core Scientific is now forced to restructure due to its extremely weak financial position. The company got into this mess by taking on too much debt during the bull market while also being too exposed to the bitcoin price, which fell like a rock at the beginning of the summer. In other words, it simply took on too much risk and is now punished.

Capital owners in the company are now battling for the little value left. The most likely path forward for the company is not bankruptcy but a restructuring of its debt in which debt is converted to equity, as this would be the only way for several debt holders to get their money back. At the same time, other public miners could be interested in acquiring the company.

Avoiding bankruptcy would also be the best solution for the rest of the bitcoin mining industry, as bankruptcy would likely lead to a deteriorating trust in the industry and falling share prices among other public miners.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.