Top 10 Bitcoin Mining Pools for 2026

The world’s largest and most liquid hashrate markets.

Pooled mining emerged in 2011 as a structural response to exponential hashrate growth. As difficulty rose, solo mining ceased to be economically viable, pushing operators to aggregate hashes to achieve higher reward frequency and lower variance. Pools became the coordination layer that transformed probabilistic block discovery into predictable revenue streams.

Since then, pools have evolved well beyond reward aggregation. Institutional capital forced higher standards around uptime, compliance, and payout certainty, with leading pools achieving SOC 2 certification and enterprise-grade reliability. Innovation in payout methods accelerated this shift. Fixed and upfront pool payouts enabled miners to convert future hashrate production into immediate, predictable cashflow, changing how bitcoin mining is financed and managed.

In 2026, the competitive frontier has moved further up the mining stack. The best pools integrate with firmware, fleet management software, energy optimization systems, and financial markets. Hashrate is increasingly treated as a risk-managed digital (compute) commodity, optimized for in real-time based on power prices, grid conditions, and forward markets. The pools that matter are much more than just endpoints for hashrate, they are coordination & control hubs for mining operations.

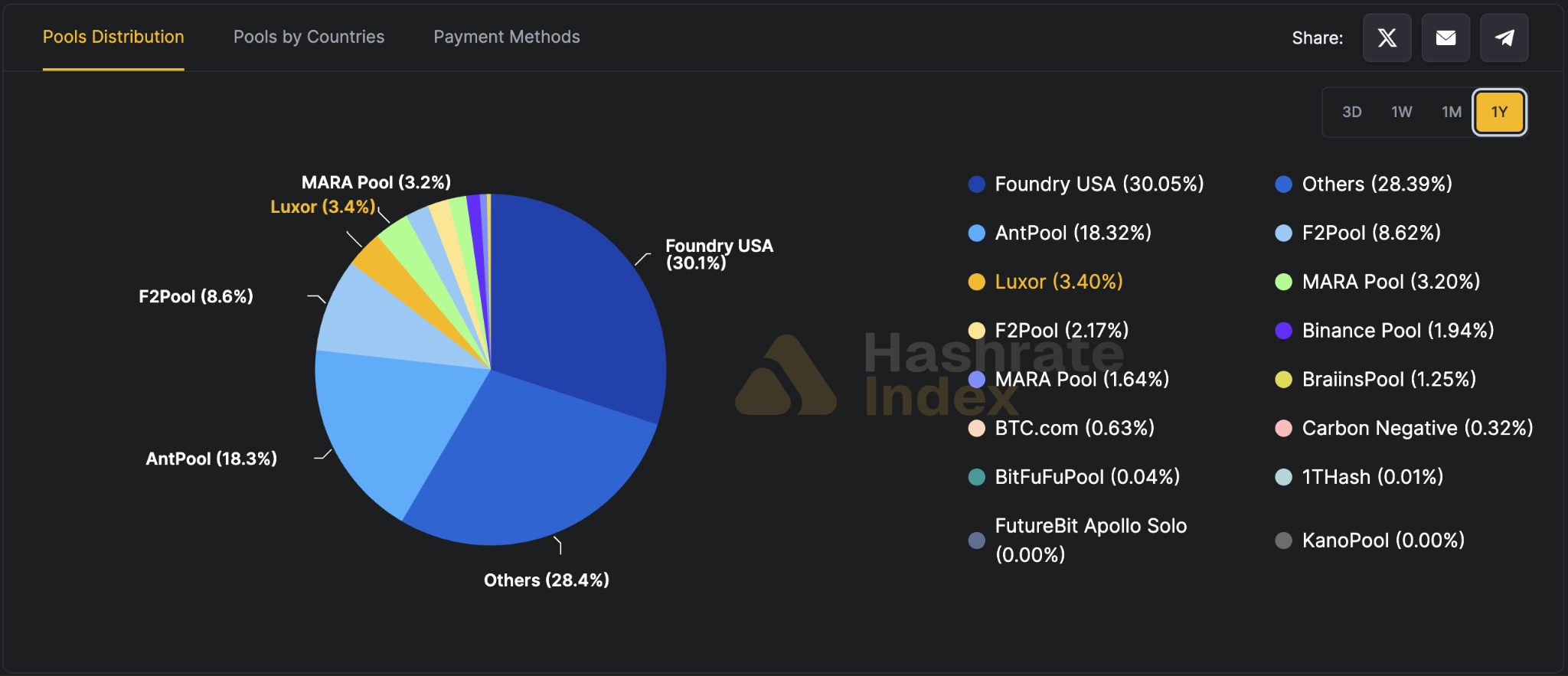

Below are the top Bitcoin mining pools competing for dominance in 2026, ranked by estimated hashrate share. A full dashboard can be found here.

1. Foundry USA (299 EH/s | 30.1%)

Foundry remains the largest mining pool globally, anchored in the United States and backed by Digital Currency Group (DCG). Its dominance is driven by institutional alignment, compliance-first operations, and deep relationships with North American miners and hosting providers. Despite turbulence at the parent-company level, Foundry’s operational focus and regulatory positioning continue to attract scale.

2. AntPool (211 EH/s | 18.3%)

Owned by Bitmain, AntPool benefits from structural alignment with the world’s dominant ASIC manufacturer. It remains the default pool for many Bitmain partners across China and international markets. Hardware distribution, brand recognition, and geographic reach reinforce its position.

3. ViaBTC (145 EH/s | 13.0%)

ViaBTC is one of the most entrenched pools globally, with particular strength in Russia and surrounding regions. Originally supported by Bitmain, ViaBTC has since established itself as an independent operator with strong regional loyalty and stable PPS-style payout offerings.

4. F2Pool (113 EH/s | 10.0%)

One of the earliest mining pools, F2Pool has maintained relevance through technical innovation and early adoption of merge-mining. Its presence remains strong across Central Asia and international markets, supported by long-standing operator trust.

5. SpiderPool (98 EH/s | 8.8%)

SpiderPool has grown rapidly by focusing on performance stability and competitive FPPS payouts. Its rise reflects continued consolidation among large-scale operators seeking payout certainty and scale without heavy ecosystem lock-in.

6. MARA Pool (64 EH/s | 5.7%)

MARA Pool represents the vertical integration of a public mining company into pool infrastructure. While smaller than the top tier, it reflects a strategic move to internalize block production and payout mechanics.

7. SecPool (55 EH/s | 4.9%)

SecPool continues to expand its footprint across Asia, offering FPPS payouts and stable infrastructure. Its growth reflects demand for alternatives outside the dominant US and China-aligned pools.

8. Luxor (38 EH/s | 3.4%)

Luxor is the first US-based mining pool and the most integrated along the mining stack. It pioneered Fixed and Upfront Pool Payouts, enabling miners to lock in revenue before hashrate is delivered. Beyond pooling hashrate, Luxor integrates custom firmware (LuxOS), hashrate derivatives, and energy optimization into a unified platform, positioning the pool as a complete command center for mining operations rather than a standalone service.

9. Binance Pool (26 EH/s | 2.3%)

Binance Pool is the last surviving pool from the exchange-led expansion era. Its relevance stems from integration with Binance’s broader exchange, custody, and financial ecosystem, rather than pure mining innovation.

10. SBI Crypto (15 EH/s | 1.3%)

Owned by Japanese conglomerate SBI, this pool caters to a global miner base with an emphasis on reliability and institutional alignment. While smaller in share, it remains strategically relevant in Asia.

In 2026, mining pools are no longer passive reward distributors. They are liquidity venues, risk managers, and coordination layers that sit at the intersection of hardware, software, energy, and finance. The pools that lead are those that enable miners to respond to real-time power markets and forward pricing signals, turning hashrate into a manageable, financeable asset. The era of full-stack mining has begun.

— Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.