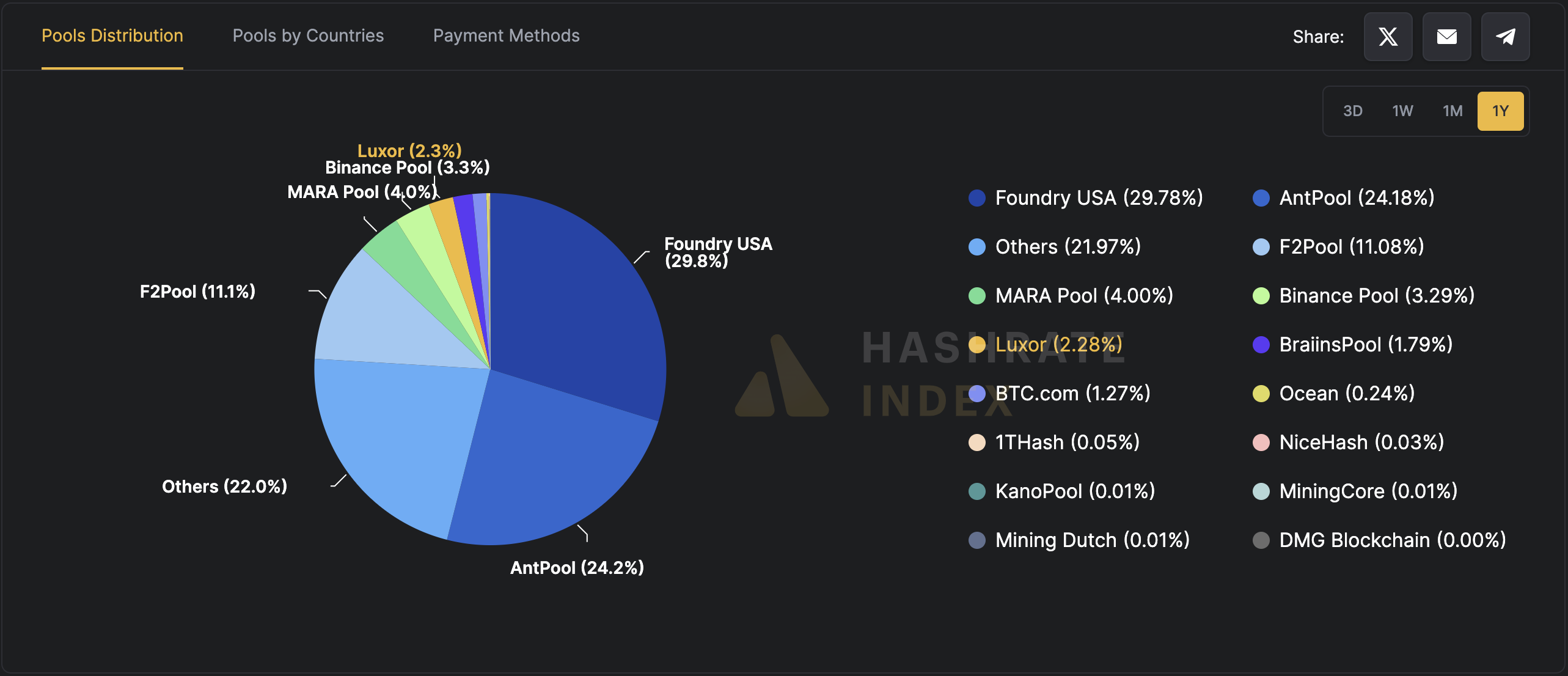

Top 10 Bitcoin Mining Pools of 2025

Here is Hashrate Index’s list for the best Bitcoin mining pools battling it out in 2025.

Since their introduction in 2011, mining pools have been a vital piece of the Bitcoin mining industry as a way to increase the cadence and certainty of receiving mining rewards. This was a direct result of fierce competition: an exponentially increasing global network hashrate forced individual miners to form groups, in an effort to have a greater chance of winning anyone of the 144 blocks appended onto the Bitcoin blockchain every day.

Since then, there has been a lot of innovation in mining pools, ranging from payment methodologies to technical features and enterprise-grade solutions. Major mining pools such as Luxor have achieved SOC2 compliance to keep up with the growing demand from institutional miners, in addition to finding new revenue streams such as ordinals and merge mining. The new frontier for mining pools in 2025 and beyond is around Maximal Extractable Value (MEV), i.e., sequencing transactions in ways that can maximize the collection of transaction fees.

A full dashboard of the current mining pool landscape can be found here.

Here is Hashrate Index’s list for the top Bitcoin mining pools battling it out in 2025.

| # | Mining Pool | Reported Hashrate |

|---|---|---|

| 1 | Foundry USA Pool | 277 EH/s |

| 2 | Antpool | 146 EH/s |

| 3 | Luxor Pool | 24 EH/s |

| 4 | F2Pool | 77 EH/s |

| 5 | Binance Pool | 54 EH/s |

| 6 | Braiins Pool | 13 EH/s |

| 7 | Ocean Pool | 3 EH/s |

| 8 | Via.BTC | 120 EH/s |

| 9 | EMCD Pool | 21 EH/s |

| 10 | SBICrypto Pool | 10 EH/s |

- Foundry USA Pool

Started in 2022 by crypto-native giant Digital Currency Group (DCG), Foundry is the largest Bitcoin mining pool in 2025, holding a significant market share. Foundry’s growth is attributed to its compliance-first approach, catering to institutional miners, particularly in the US. The pool uses FPPS (Full Pay-Per-Share) as its payment method and integrates well with DCG’s broader crypto-native ecosystem. Despite financial turmoil at the parent company level, Foundry’s robust operational model keeps it at the top.

- Antpool

- Owned by Bitmain, Antpool capitalizes on its parent company’s dominance in ASIC manufacturing. The pool holds a significant global market share, particularly among miners using Bitmain hardware. Antpool’s payment methods include PPS+ (Pay-Per-Share Plus), which ensures consistent payouts while sharing transaction fees. Its integration with Bitmain’s ecosystem gives it a natural advantage, particularly in China and abroad.

- Luxor Pool

The first US-based mining pool, Luxor has steadily increased its market share by offering innovative services. Luxor’s products include custom firmware (LuxOS) to optimize ASIC performance and financial instruments to lock in profitability through forward hashrate contracts. The pool uses FPPS for payouts and has positioned itself as a leader in North America, serving both retail and institutional miners.

- F2Pool

One of the earliest mining pools, F2Pool is renowned for its technological innovations, including merge mining support for multiple coins. It has a strong presence in Central Asia and uses PPS (Pay-Per-Share) and PPS+ as payment methods. F2Pool’s adaptability and focus on technology have allowed it to maintain a competitive edge in an evolving market.

- Binance Pool

Launched by the global exchange giant Binance, this mining pool integrates seamlessly with Binance’s broader crypto-native ecosystem. The pool’s FPPS payment method and competitive fee structure attract miners looking for reliability and integration with Binance’s trading platform. Binance Pool’s global presence and institutional focus make it one of the few exchange-backed pools still thriving in 2025.

- Braiins Pool

Formerly known as Slushpool, Braiins is the oldest mining pool in operation, based in the Czech Republic. It transitioned from PPLNS (Pay-Per-Last-N-Shares) to FPPS to better align with miner preferences. Braiins is known for its commitment to transparency and open-source development, including its popular Braiins OS firmware for optimizing mining efficiency.

- Ocean Pool

A newcomer to the scene, Ocean Pool is backed by prominent Bitcoiner's like Jack Dorsey. It’s the only PPLNS pool on this list, appealing to miners who prioritize decentralization and a hard stance against non-standard transactions. Ocean Pool’s unique positioning and support from influential figures have helped it carve out a niche in the competitive mining space.

- Via.BTC

Initially backed by Bitmain, ViaBTC has since established itself as an independent player, dominating the mining landscape in Russia and surrounding regions. The pool offers multiple payment methods, including PPS and FPPS, catering to both small and large-scale miners. ViaBTC’s diversification and focus on local markets ensure its continued relevance.

- EMCD Pool

Competing with ViaBTC in the Russian market, EMCD has rapidly gained significant market share. The pool leverages the region’s growing mining sector and offers attractive payment options, including FPPS. EMCD’s focus on reliability and local partnerships has helped it maintain a competitive position.

- SBICrypto Pool

Owned by the Japanese conglomerate SBI Holdings, this pool serves a global miner base with a strong focus on Asia. SBI Pool’s payment methods include PPS and FPPS, catering to institutional miners. Its integration with SBI’s financial services ecosystem makes it a unique player in the market, combining traditional finance with bitcoin mining.

These top mining pools showcase the diversity and innovation in the Bitcoin mining industry. Their unique strategies, payment methods, and market focuses highlight the dynamic nature of the sector as it continues to evolve.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.