The Price-to-Hodl Ratio: A Better Metric for Valuing Bitcoin Mining Stocks

In this article, we introduce the price-to-hodl ratio, a metric for valuing Bitcoin mining stocks based on market cap and bitcoin holdings.

There has been a lot of discussion within the bitcoin investor community regarding the need for a quick “spot check” metric to gauge trends or relative value for public Bitcoin mining stocks. As more companies hodl the bitcoin they mine on their balance sheets, their bottom-line profits experience higher volatility.

So what’s the best way to truly value these companies?

In the traditional investment world, “price-to-earnings” is a common financial ratio for evaluating stock valuations. Investors gravitate towards using a price-to-earnings ratio because it tracks a company’s ability to earn bottom-line profits over time. A lower ratio means companies are generally more undervalued, while a higher P/E ratio means investors are paying more to own those earnings.

Technology stocks historically carry very high P/E ratios because investors are willing to spend more to own a fast growing tech stock. Nvidia is considered a high P/E stock, whereas Intel is considered a low P/E stock within the semiconductor sector. Investors are willing to pay more to receive high earnings growth from Nvidia, whereas they want to pay less to own Intel stock because of its slower earnings growth.

Historically, value investors seek out companies with lower earnings multiples, as those companies may be undervalued or out of favour. Growth investors generally seek higher P/E stocks because they are growing profits at a fast clip.

Only problem with the age-old P/E ratio is that it’s ill-suited for valuing public Bitcoin miners.

Why Are Price-to-Earning Ratios Not Fit for Bitcoin Mining Stocks?

Industries that have large capital expenditures or large volatility in bottom-line profits because of mark-to-market accounting rules typically have distorted P/E ratios, making the metric ineffective for gleaning insights into these companies’ valuations. Bitcoin mining stocks are no exception here as they experience all of the above drawbacks.

Bitfarms and Hut 8, for example, follow IFRS accounting rules, so at the end of every business quarter, they must “mark-to-market” their bitcoin holdings on their balance sheet.

How Do These Accounting Rules Affect the Bottom-Lines of Bitcoin Miners?

Mark-to-market accounting rules affect public Bitcoin miners in three primary ways.

- During large bitcoin price drops, companies will generally show bottom-line losses, even though they are operating profitably.

- During large bitcoin price increases, the bottom-line profits for these companies increase; they can record the dollar gains for their bitcoin holdings as profit without having to sell the asset to realize these gains.

- Mining companies must spend large sums of money to expand mining capacity. These large capital expenditures create massive non-cash depreciation expenses. These large depreciation expenses lower the earnings numbers that companies report to their shareholders.

In essence, Bitcoin’s price volatility, in addition to the high cost of expanding mining operations, distort public miners’ reported earnings. Since the earnings numbers are skewed, P/E ratios are practically useless for evaluating bitcoin mining stocks.

Enter the Price-to-Hodl Ratio

Miners are hodling more bitcoin every day. Bitcoin has become a key asset on public miner balance sheets, and these bitcoin treasuries have become an alternative form of retained earnings for public miners. Many miners are using the newly minted bitcoin on their balance sheets to fund expansion by collateralizing this bitcoin for lines of credit.

If we substitute cash earnings with bitcoin retained on miners’ balance sheets, we can devise a new, bespoke value metric for bitcoin miners.

Benefits of using the price-to-hodl ratio over the traditional P/E ratio for miner valuations:

- A lower ratio means mining companies are likely undervalued compared to their peers based on retained bitcoins and market capitalization.

- A higher ratio means investors are willing to pay more for future growth based on a company’s contracted ASIC pre-orders and/or its plans to expand warehouse space.

- price-to-hodl ratio trends over time can provide insights into a miner’s ability to navigate bull or bear markets. For example, a company with a very low price-to-hodl ratio is likely out of favor with investors as they cannot grow capacity or retain as much bitcoin on their balance sheet due to poor mining economics.

- We can track mining economics and investor sentiment with this ratio, as a high price-to-hodl ratio may reflect investors willingness to pay more to own low-cost producers or pay a large premium for future contracted hashrate.

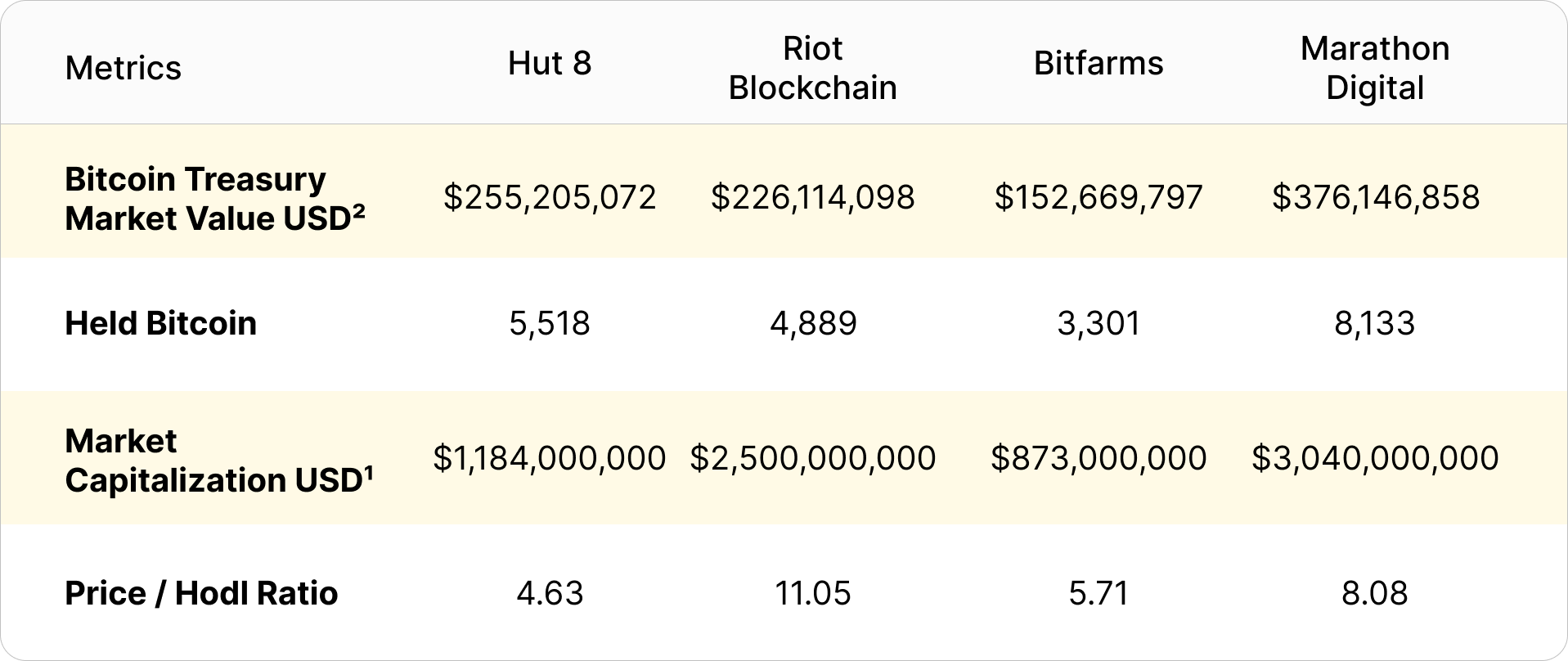

Price-to-Hodl Ratio of Major Public Miners

1 Market Capitalization = Share Price multiplied by shares outstanding

2 Price of Bitcoin as of Jan 1st, 2022 ($46,249.56)

Calculation of Price to Hodl Ratio = Market Cap divided by market value of bitcoin on balance sheet

Drawbacks of the Price-to-Hodl Ratio

Price-to-hodl has a couple of drawbacks:

- Mining companies may buy bitcoin on the spot market with an equity raise or existing cash to inflate their BTC treasuries. If a miner purchases bitcoin on the open market to include on their balance sheet, the company distorts their existing operational efficiencies.

- Price-to-hodl does not take into account the debt on a miners balance sheet. A highly indebted miner has far greater down-market risk than a miner with little or no debt.

What the Price-to-Hodl Ratio Tells Us About Top Public Miners.

Taking a look above at the Price-to-hodl ratio for major public miners, we can get an idea for how investors are valuing specific mining stocks. A few takeaways:

- Hut 8 has the lowest value relative to its peers.

- Riot Blockchain and Marathon Digital have the highest price-to-hodl ratio. Investors are willing to pay a premium today for the massive hashrate expansions these companies have planned for 2022.

- Bitfarms is extremely efficient in their mining operations. The market has likely mispriced their hashrate expansion.

- Marathon Digital is an outlier as they purchased a large quantity of bitcoin in January 2021 after an equity raise. Their actual self-mined bitcoin is much lower than the total bitcoin on their balance sheet.

- Hut 8 was the first public miner to begin hodling production in 2017, a practice that is now standard for most publicly traded miners. In 2021, nearly all public mining firms followed the hodl strategy for their corporate treasuries.

Disclosure: The author is long Hut 8 and Bitfarms.

Header image by Colton Sturgeon on Unsplash

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.