Hashrate Index Roundup (June 24, 2024)

Hashrate is dropping like a rock, and more could come offline in the summer heat.

Happy Monday, y'all!

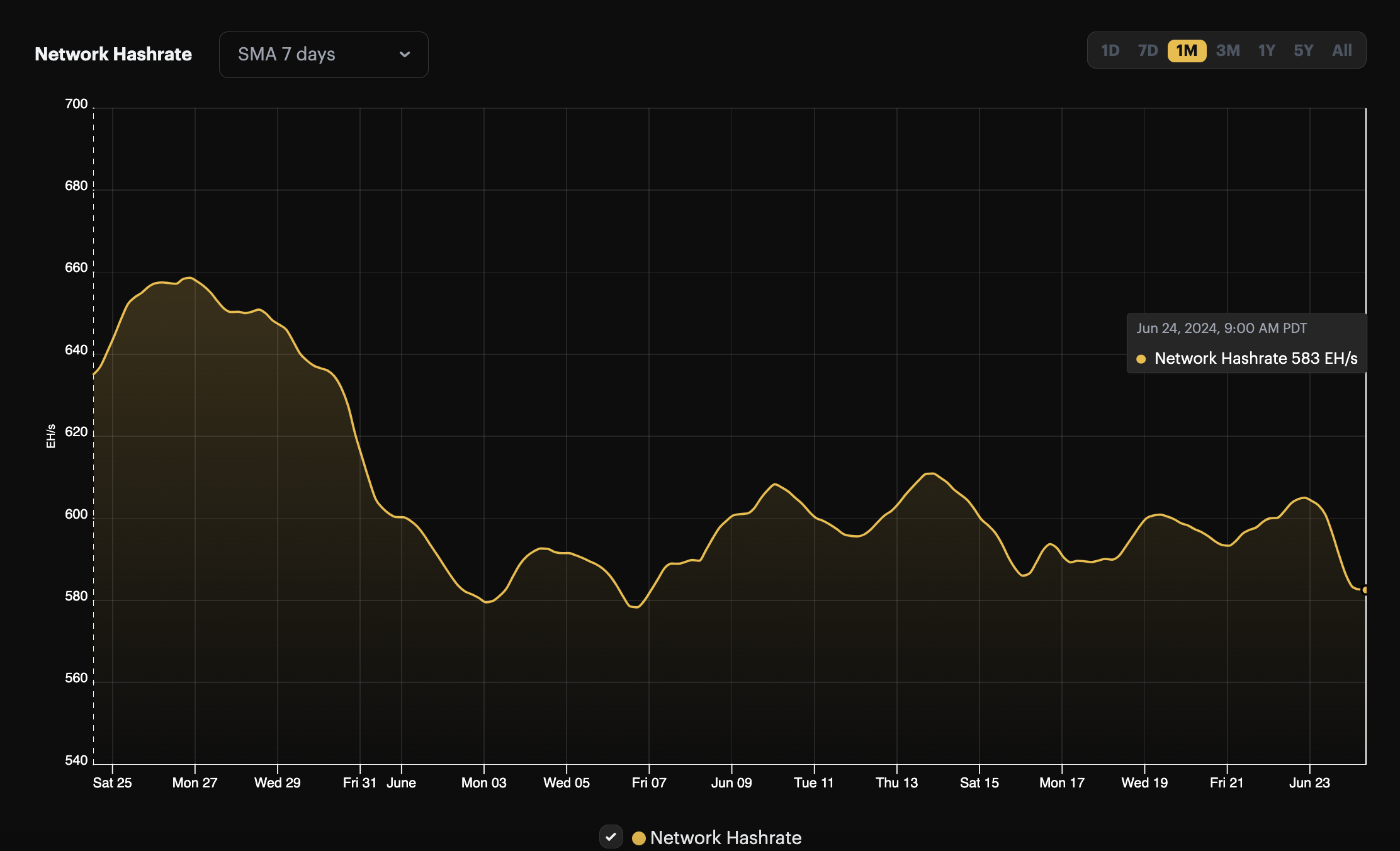

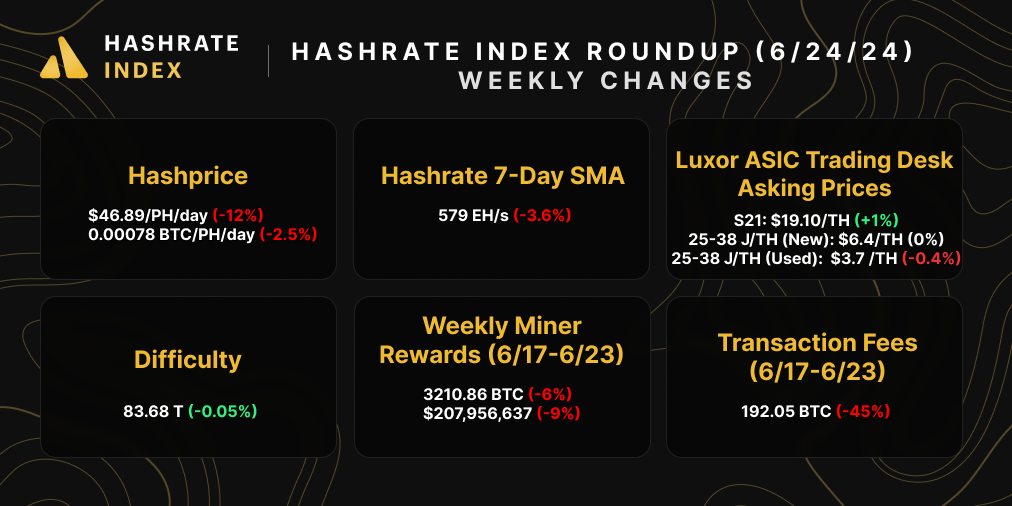

With hashprice treading just above all-time lows, Bitcoin's hashrate continues to decline. Over the last month, Bitcoin's 7-day hashrate has fallen from 635 EH/s to 579 EH/s. At current levels, Bitcoin's hashrate is down 12% from its all-time high

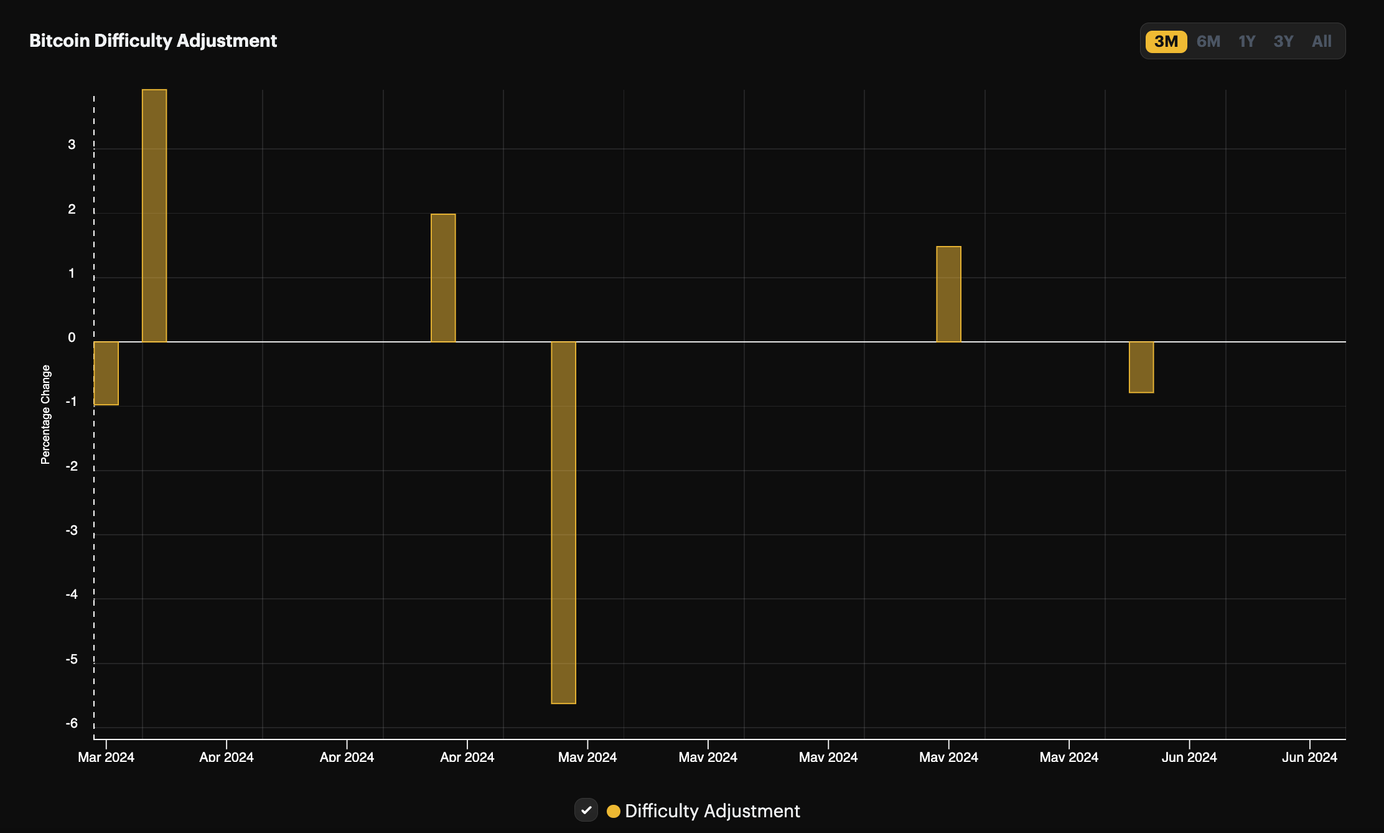

As hashrate has fallen, so too has difficulty – even if just barely, with Bitcoin's difficulty dropping by less than a tenth of a percent last week. Last week's negative adjustment marked the second such adjustment in a row since July 2022, and it could be a three-peat. With blocks coming in at a grindingly-slow 10 minute and 25 second average so far this epoch, our difficulty forecast is currently estimating a -4% decrease.

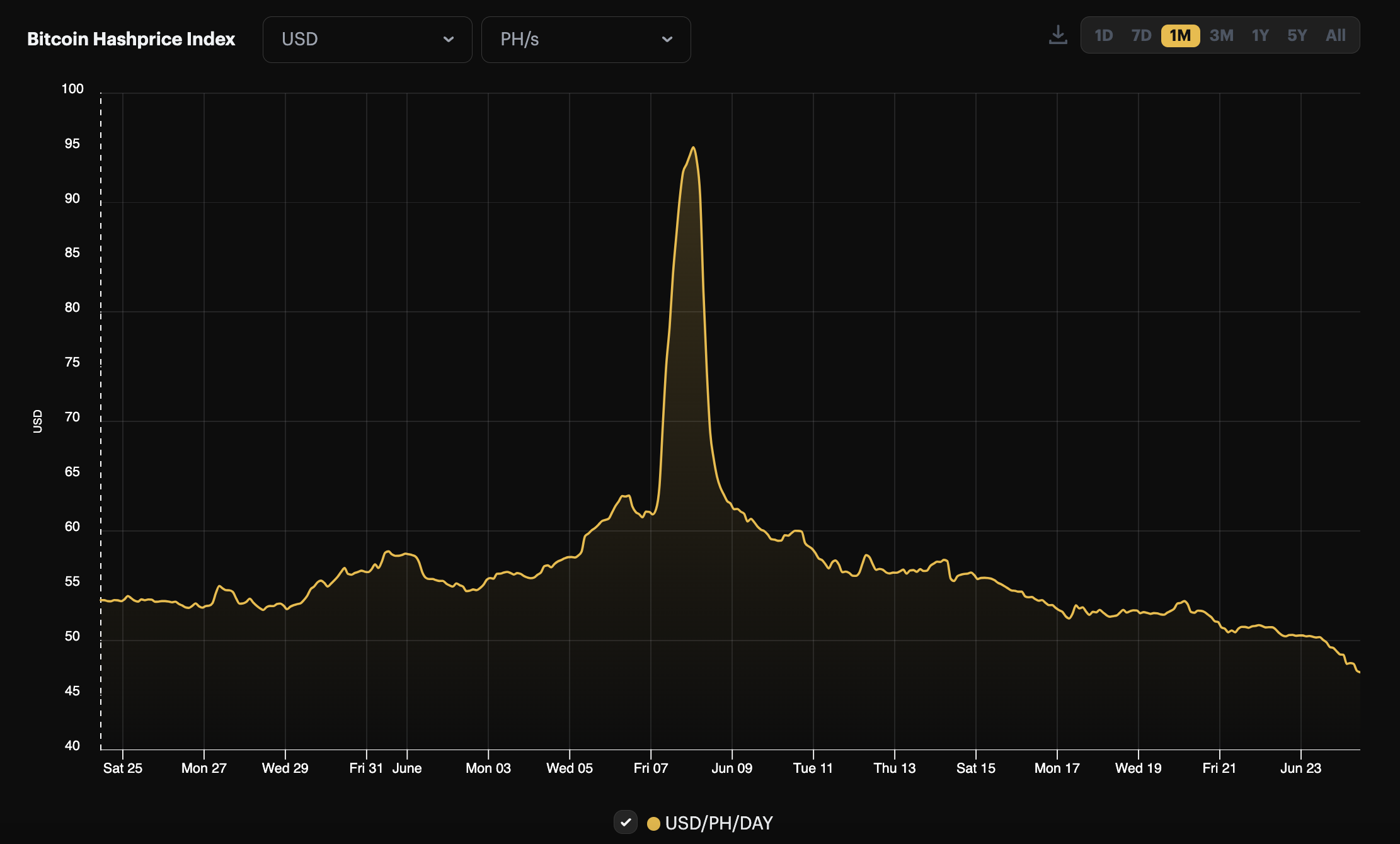

It's too early to say with confidence what the next difficulty adjustment will be, but all the early signs currently point to another downward one. This would be a temporary lifeline to miners who are near or at breakeven, as last week, Bitcoin's hashprice broke below $50/PH/Day for the first time in over a month.

Hashrate has tapered off so far without much influence from the summer climate. The main factor currently impacting it has been the decline in hashprice, but the hottest months of the year in the US – July and August – are right around the corner, so we wouldn't be surprised to see Bitcoin's hashrate range-bound below 600 EH/s over the next two months.

For those miners who are still plugged in (and who won't be affected by the heat and related curtailment), a blazing summer could be the relief they need to weather the current post-Halving hashprice woes.

Sponsored by Luxor Firmware

At $60/PH/Day, hashprice is close to breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

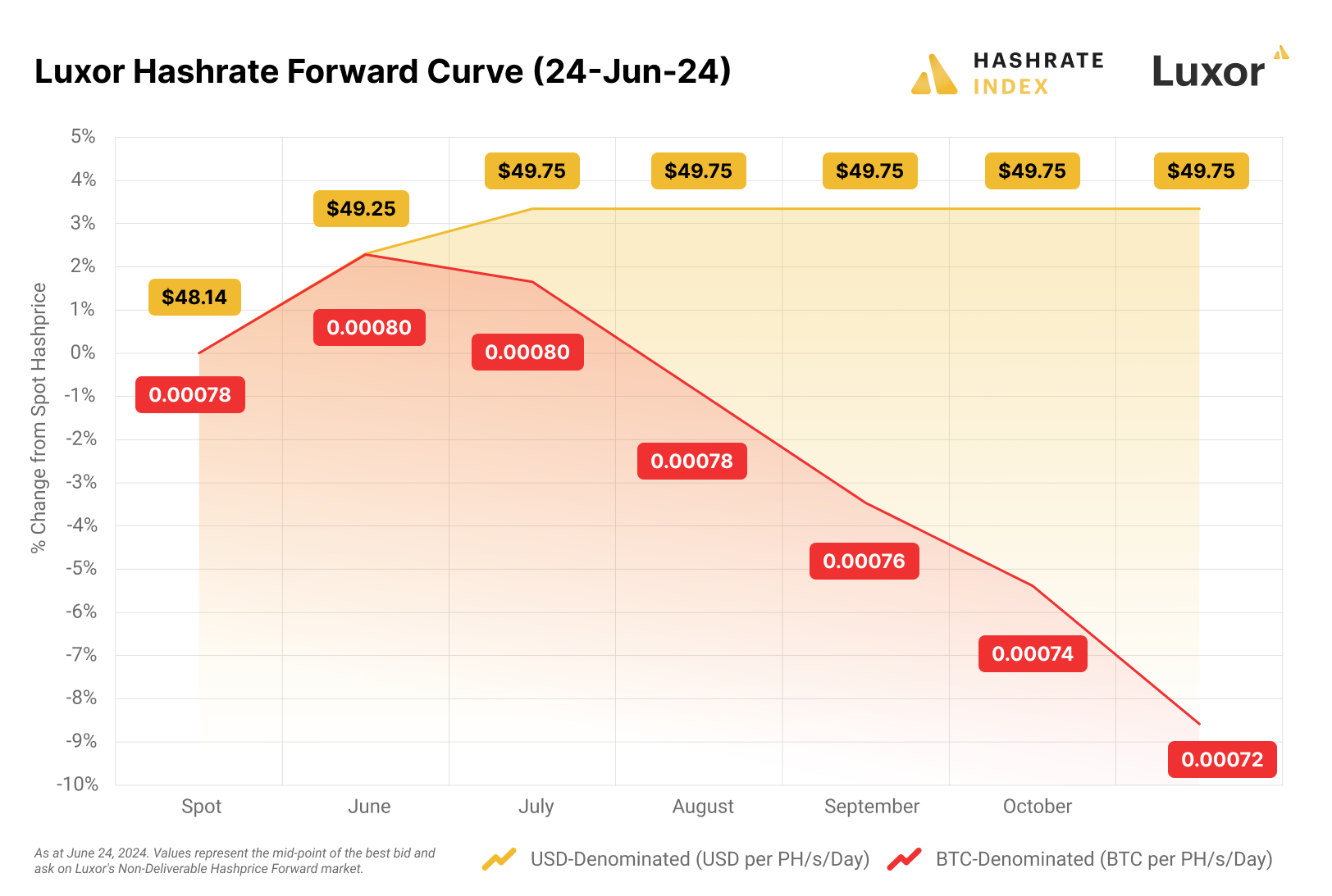

USD-denominated contracts on Luxor's Hashrate Forwards markets are trading in contango (above spot) for the next six contract months. As with last week, this week's forward curve continues to show divergence in USD and BTC-denominated contracts, with BTC contracts for August through November trading in backwardation (below spot).

Bitcoin Mining Market Update

A lot of red for this week's market update. Hashprice is (way) down, transaction fees are (also way) down, and mining rewards are down. But the good news is that hashrate and difficulty are down, too. The ASIC market didn't see any notable changes to pricing last week.

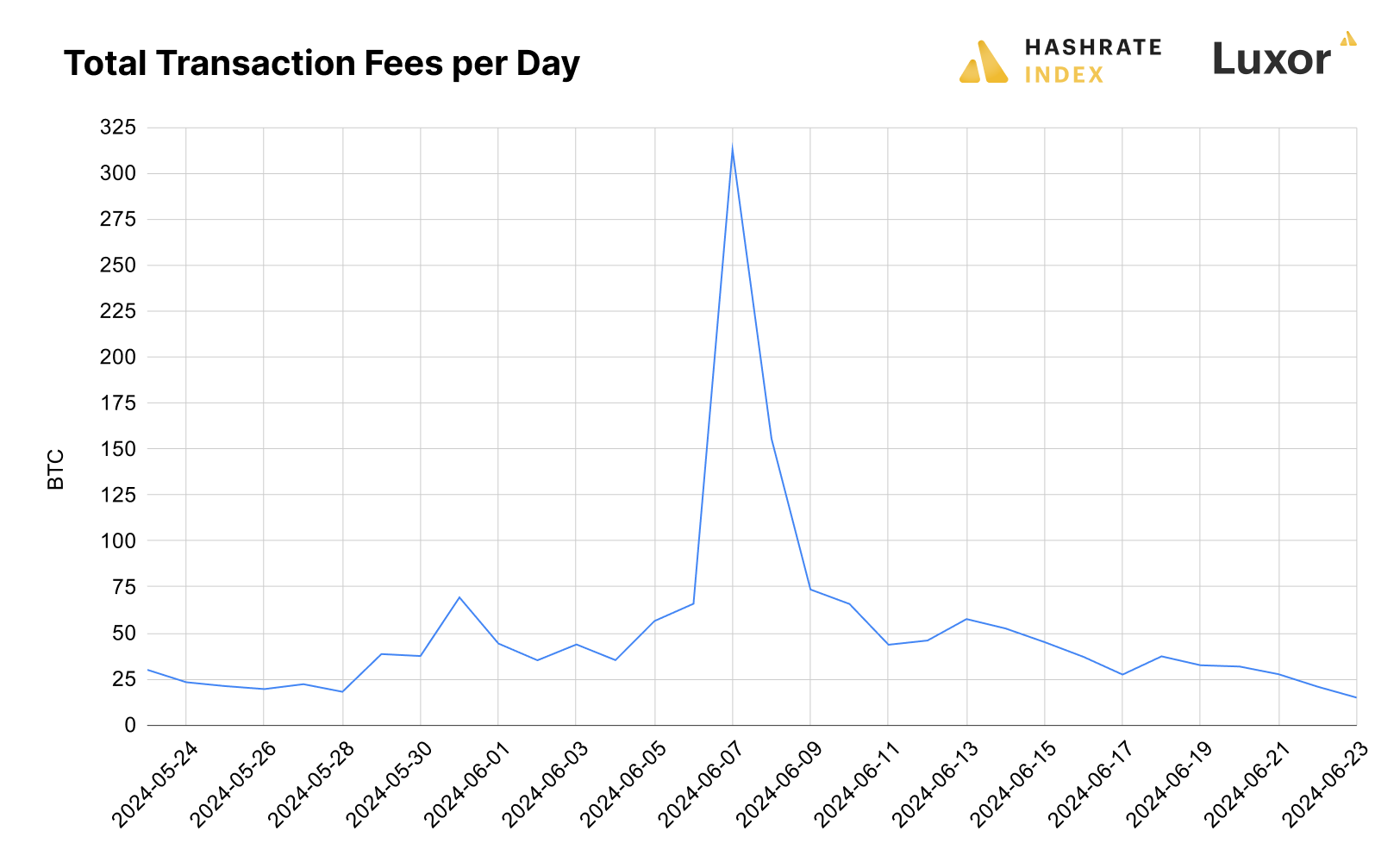

Bitcoin Transaction Fee Update

Transaction fees continued to fall last week, with volumes on Sunday hitting a monthly low. On-chain transaction volume is low currently as the Ordinal, Inscription, and Runes markets cool off and Bitcoin's price falls, as well.

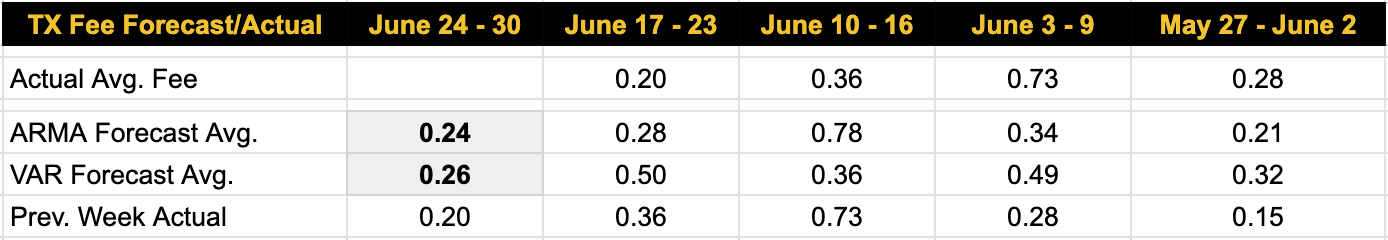

Last week, our VAR model for transaction fee forecasting was off, but our ARMA was close. The VAR model projected a 0.50 BTC per block average, and the actual was 0.20 BTC. Our ARMA model projected 0.28.

For this week, the VAR model forecasts 0.26 BTC per block – the ARMA, 0.24 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Coatue Invests in Bitcoin Miner Hut 8 as Sector Joins AI Race

- Investor interest surges for bitcoin miners following Core Scientific AI hosting deal: JP Morgan

- 'Vulture Contracts' Affecting Bitcoin Mining Development in Paraguay

- Mt. Gox to Begin Repayments in July; BTC Slides Under $61K

Bitcoin Mining Stocks Update

Bitcoin mining stocks are mostly down over the week, with a few exceptions, although they have not fallen as sharply as we might expect given Bitcoin's current selloff. Our Crypto Mining Stock Index is up 3%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $9.21 (-11.44%)

- HUT: $12.53 (+5.09%)

- BITF: $2.68 (-6.94%)

- HIVE: $2.93 (+0.69%)

- MARA: $18.69 (-2.20%)

- CLSK: $16.51 (-5.39%)

- IREN: $12.63 (-2.02%)

- CORZ: $8.73 (-16.30%)

- WULF: $4.22 (+8.76%)

- CIFR: $4.27 (-11.59%)

- BTDR: $9.20 (-5.54%)

- SDIG: $4.58 (+20.53%)

Have a great week, and Happy Hashing!

New From Hashrate Index

The Bitcoin Halving is Behind Us: How Did Luxor’s Predictions Hold Up?

In March, we published a pre-halving report with predictions for how the event would shake up Bitcoin’s hashrate and other network metrics. With the Bitcoin halving now two months behind us, it's time to look back and see how our predictions held up.

2024 Bitcoin Home Mining Guide

It’s been a while since our last Bitcoin Home Mining Guide back in 2021, and a lot has changed in the Bitcoin mining industry since then. The price of Bitcoin has seen its fair share of ups and downs, culminating in a new all time high in 2024. New ASIC miner models such as the Antminer S21 have come to market, providing excellent efficiency gains while pushing Bitcoin’s hashrate to its own all-time high. Most importantly, we have gone through Bitcoin’s fourth halving, which reduced the Bitcoin block subsidy to 3.125 BTC. Given these significant evolutions to the mining ecosystem, we feel it’s a great time to provide an updated Bitcoin Home Mining Guide for 2024.

-Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.