Hardware Review: MicroBT WhatsMiner M70S

The latest air-cooled Bitcoin mining machine aimed at post-halving industrial deployments.

In this post, we cover the physical components, performance testing, and market positioning for the WhatsMiner M70S by MicroBT.

Introduction

Founded in 2016, MicroBT rapidly emerged as one of the world’s leading Bitcoin mining hardware manufacturers through its WhatsMiner product line. The company unveiled the WhatsMiner M70 series at its official launch event on December 8, 2025, in Abu Dhabi, formally introducing its next-generation air-cooled ASIC machines. Rather than competing on marginal efficiency headlines, the M70 series emphasizes operational stability and fleet-level reliability through build quality and predictable performance.

The M70S is a model optimized for industrial-scale deployments where uptime, serviceability, failure rates, and stable power management matter most. This model targets miners operating in thinner-margin environments who prioritize long-duration infrastructure performance over short-term efficiency gains.

TLDR

M70S At A Glance

- Machine Model: WhatsMiner M70S

- Manufacturer: MicroBT

- Release Date: December 2025

- Cooling Option(s): Air

- Target Market: Industrial

Stock Specifications

Performance Parameters

- Hashrate: 226 – 258 TH/s (±5%) | Nameplate: 250 TH/s

- Power Draw: 3,140 – 3,500W (±10%) | Nameplate: 3,375W

- Efficiency: 13.5 J/TH (±5% at 25 °C ) | Nameplate: 13.5 J/TH

Secondary Specs

- Dimensions: 430mm (L) x 135mm (H) x 226mm (W)

- Input Voltage: AC 220V – 240V

- Weight: 11.5 Kg

- Airflow: 350 CFM

- Operating Temperature: -5 °C – 35 °C

- Current Purchase Price: $18.80/TH ($4,700/unit)

Mining Economics

Hardware Components

Bitcoin mining machines consist of four core functional systems that work together to convert electrical power into SHA-256 hashes.

- Power Supply Unit (PSU): converts AC power into regulated DC power that ASIC chips require to work.

- Control Board: serves as the central processor “brain” that coordinates machine operations, firmware management, and network connectivity.

- Hashboards: contain the application-specific integrated circuit (ASIC) chips which perform the work (SHA-256) for earning mining rewards.

- Cooling System: manages thermal load to maintain optimal operating temperatures.

1. Power Supply Unit (PSU)

The M70S from MicroBT has the following PSU specifications:

- Model: WhatsPower P221B / P222B

- Rated Input: AC 220–240V, ≥16A

- Rated Output: DC 12–15V (dynamic voltage range)

- Max Output Power: 3,140 W – 3,500 W

- Connector: Proprietary PSU-to-control board cable (IEC C19), 6-pin board-to-hashboard power leads

2. Control Board

MicroBT designs and manufactures its control boards in-house as part of its vertically integrated ASIC production stack. WhatsMiner control boards run MicroBT’s proprietary firmware and management interface, optimized for stability, low-latency communication with hashboards, and long-duration industrial operation with minimized failure rates.

Control board manufacturing is tightly coupled with MicroBT’s hashboard and system assembly processes, primarily across its Chinese manufacturing footprint, with final integration occurring alongside PSU and chassis assembly. This approach prioritizes electrical symmetry, supply-chain control, and platform-specific optimization over modular interchangeability. At this time of writing, MicroBT has not publicly disclosed control board specifications for the M70S.

3. Hashboards & ASICs

MicroBT designs and manufactures its hashboards in-house for each WhatsMiner generation, pairing them with proprietary SHA-256 ASIC chips. WhatsMiner hashboards are purpose-built to match the machine’s thermal and electrical envelope, with tightly controlled voltage domains, onboard temperature sensors, and power delivery circuits tuned to MicroBT’s stock firmware and management logic. For the M70 series, MicroBT continues its conservative design philosophy, favoring electrical symmetry and thermal headroom over aggressive clocking. At this time of writing, MicroBT has not publicly disclosed hashboard specifications for the M70S.

4. Cooling System

The cooling system manages thermal loads generated by ASIC chips during SHA-256 hashing operations. Most air-cooled machines use dual fans with high cubic feet per minute (CFM) ratings that pull ambient air across aluminum heatsinks attached to each hashboard. Heatsinks transfer heat from ASIC chips to the airflow through finned aluminum designs, with mounting methods varying from soldered to bolt-on configurations.

Effective thermal management is critical for maintaining chip longevity, hashrate stability, and preventing failures that reduce mining profitability.

The M70S from MicroBT has the following cooling system specifications:

- Fan Spec: 1 x Dual 14V fans (one intake + one exhaust)

- Heatsinks: Modular finned blocks (chipside) / single-piece extruded aluminum (backside)

- Notable: each fan operates at around 4,500 RPM, delivering approximately 350 CFM of air volume

Performance Testing

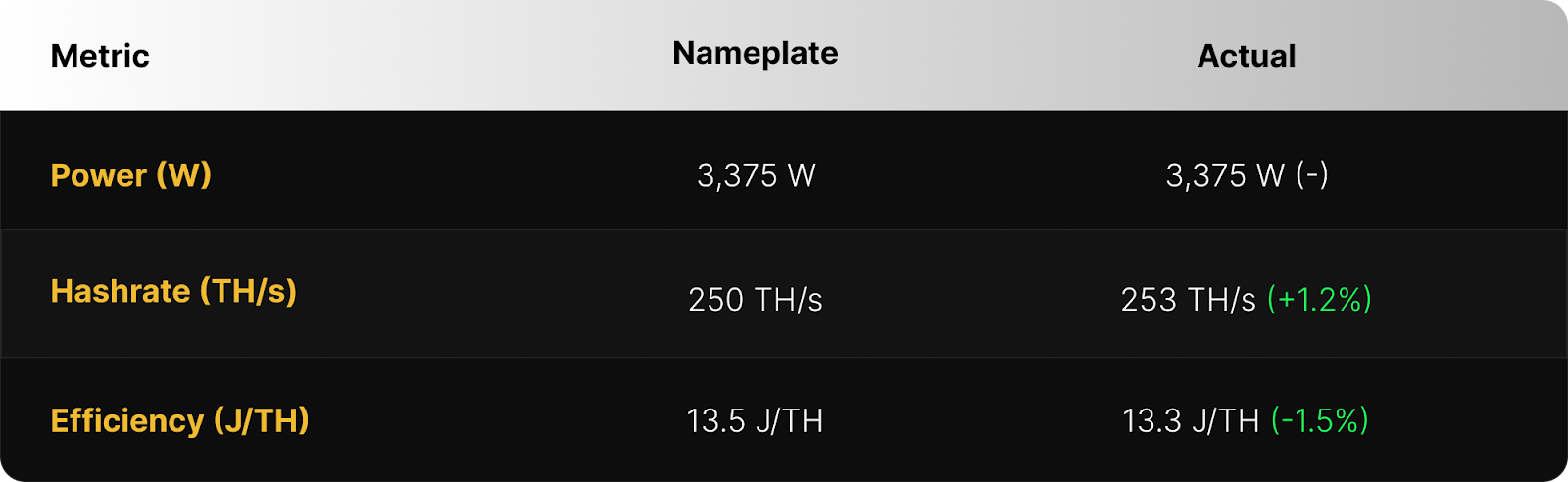

WhatsMiner M70S: Nameplate vs. Actual

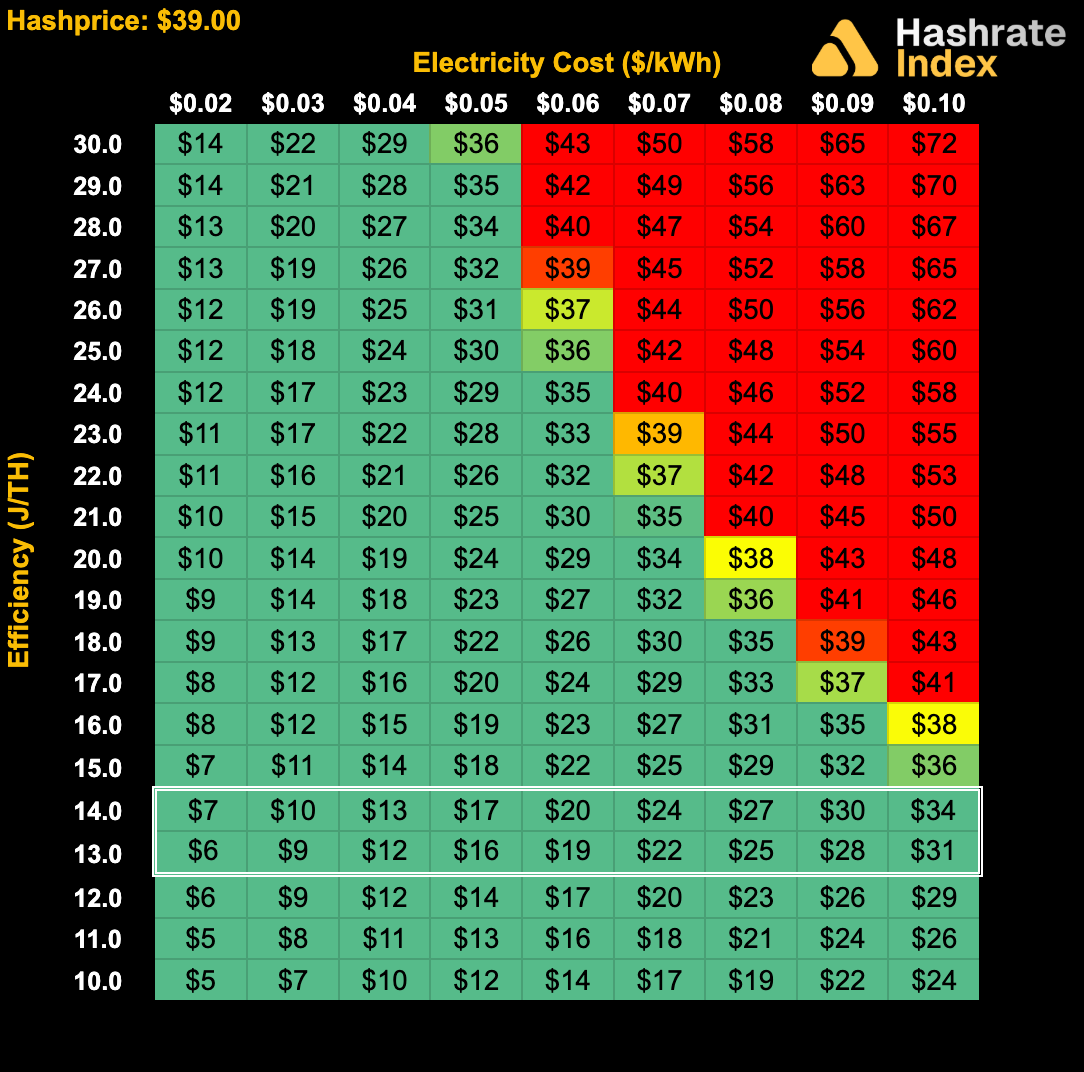

The hashcost curve below shows where the M70S sits relative to the range of fleet efficiency (J/TH) & power price ($/kWh) combinations associated with industrial bitcoin mining operations at current hashprice levels:

Financial Analysis

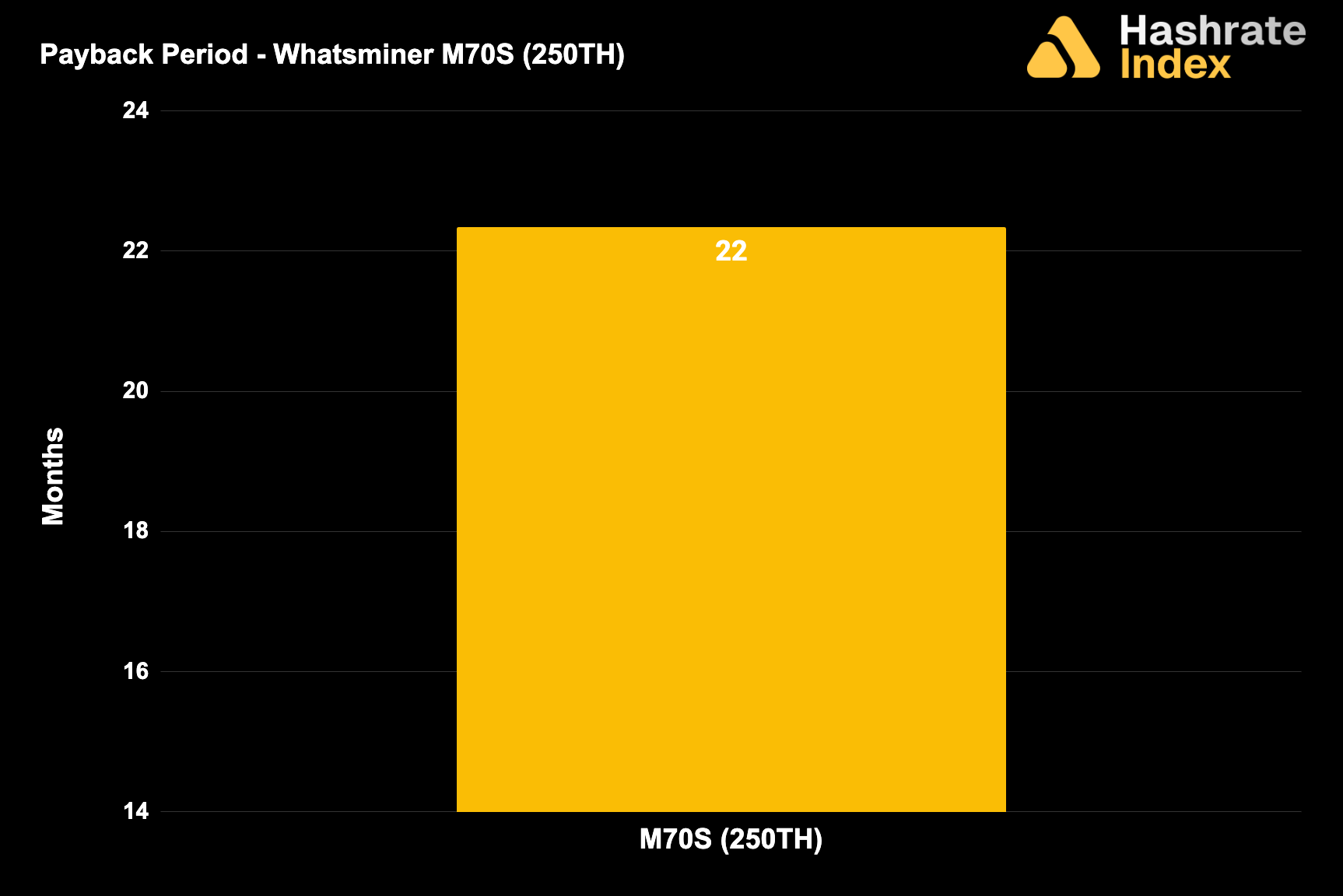

Payback Period

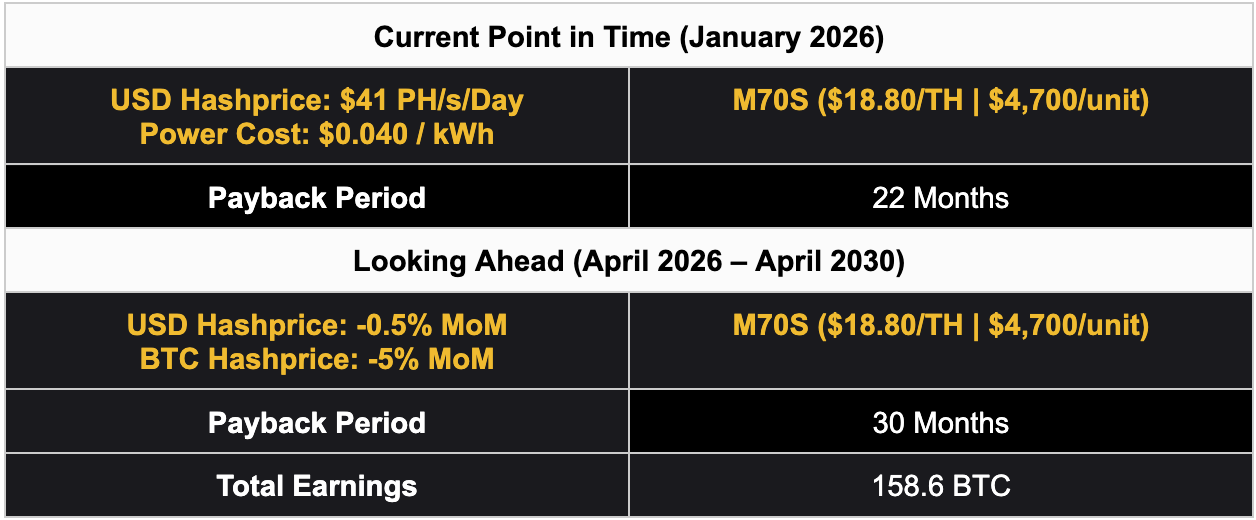

Inputs:

- Hashprice: $41.00 per PH/s/Day

- Power Cost: $0.04/kWh

- Uptime: 100%

- Machine Model: WhatsMiner M70S (250 TH/s | 13.6 J/TH)

- Purchase Price: $18.80/T or $4,700/unit

Projection Scenario

This model evaluates the projected performance and payback period of a 4,000-unit WhatsMiner M70S fleet, representing 1 EH/s of hashrate capacity. Each unit delivers 250 TH/s at 13.5 J/TH, consuming approximately 3.4 kW at the wall. The total capital expenditure is $18.8 million, or $4,700 per unit ($18.80/T). Operations assume 95% uptime and a fixed power cost of $40/MWh ($0.040/kWh).

Inputs:

- Fleet Composition: 4,000 x M70S (250 TH/s | 13.5 J/TH)

- Capital Expenditure: $18,800,000 ($18.80/T or $4,700/unit)

- Power Cost ($/MWh): $40, flat rate

- Uptime: 95%

- Hashprice Scenario(s):

- USD Hashprice Monthly % Change: -0.5%

- Start (April 2026): $39.00 per PH/s/Day

- End (April 2030): $15.41 per PH/s/Day

- BTC Hashprice Monthly % Change: -5%

- Start (April 2026): 0.00032000 BTC per PH/s/Day

- End (April 2030): 0.00001436 BTC per PH/s/Day

- USD Hashprice Monthly % Change: -0.5%

Hashprice trajectories are modeled using empirical month-over-month (MoM) percentage changes derived from historical data on Luxor’s Hashprice Index since 2021. This method provides a simple and realistic framework for projecting long-term mining economics without relying on separate assumptions for BTC price, network difficulty, and transaction fees. Starting hashprice values are derived from the latest Base Case scenario for Hashrate Index Premium’s quarterly Bitcoin Mining Economics Projections Report.

In this model, USD hashprice declines 0.5% per month — from roughly $39 to $15 per PH/s/Day between April 2026 and April 2030 — while BTC hashprice falls 5% per month, reflecting expected compression from network difficulty growth alongside the incoming 2028 halving.

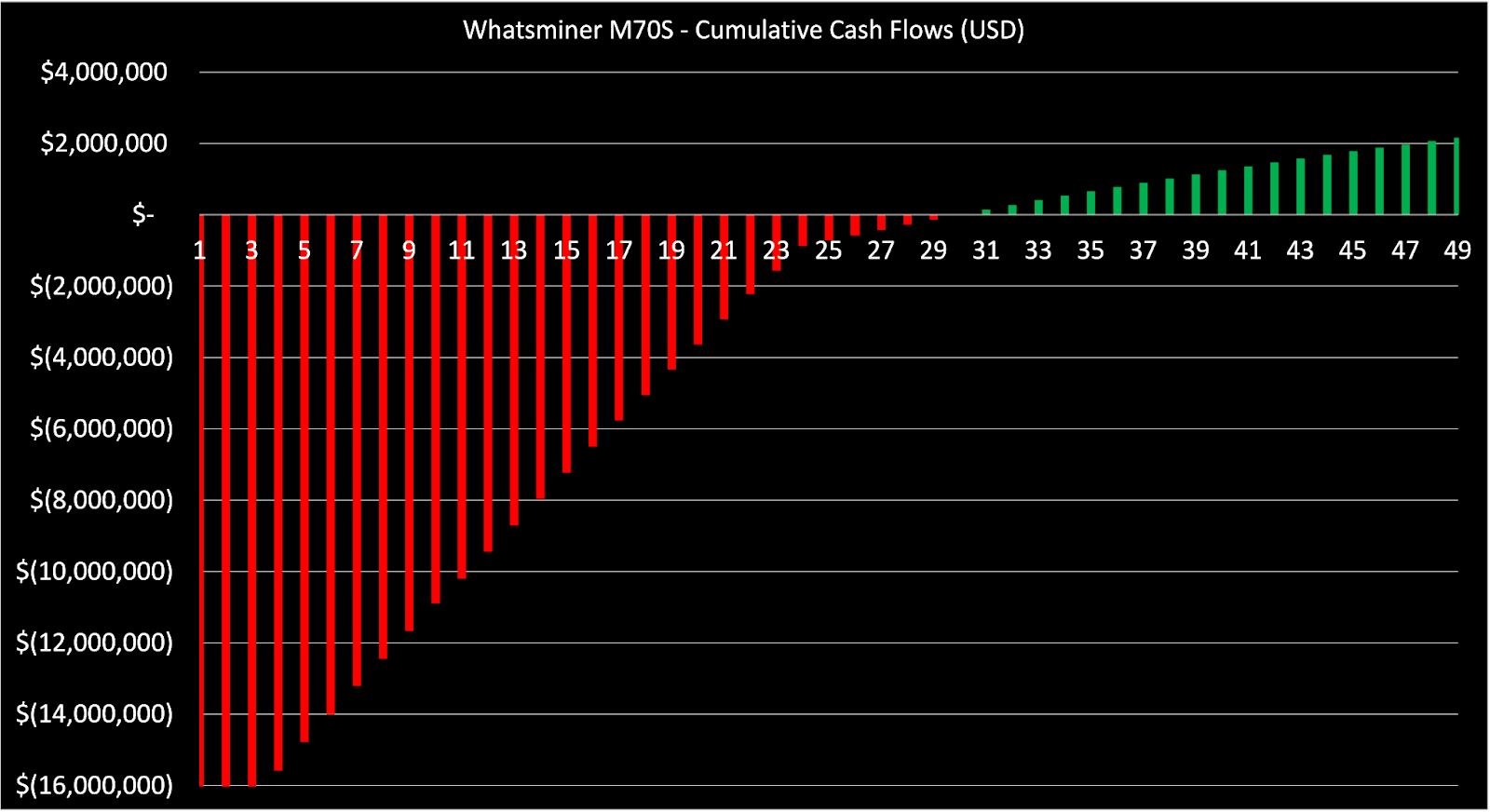

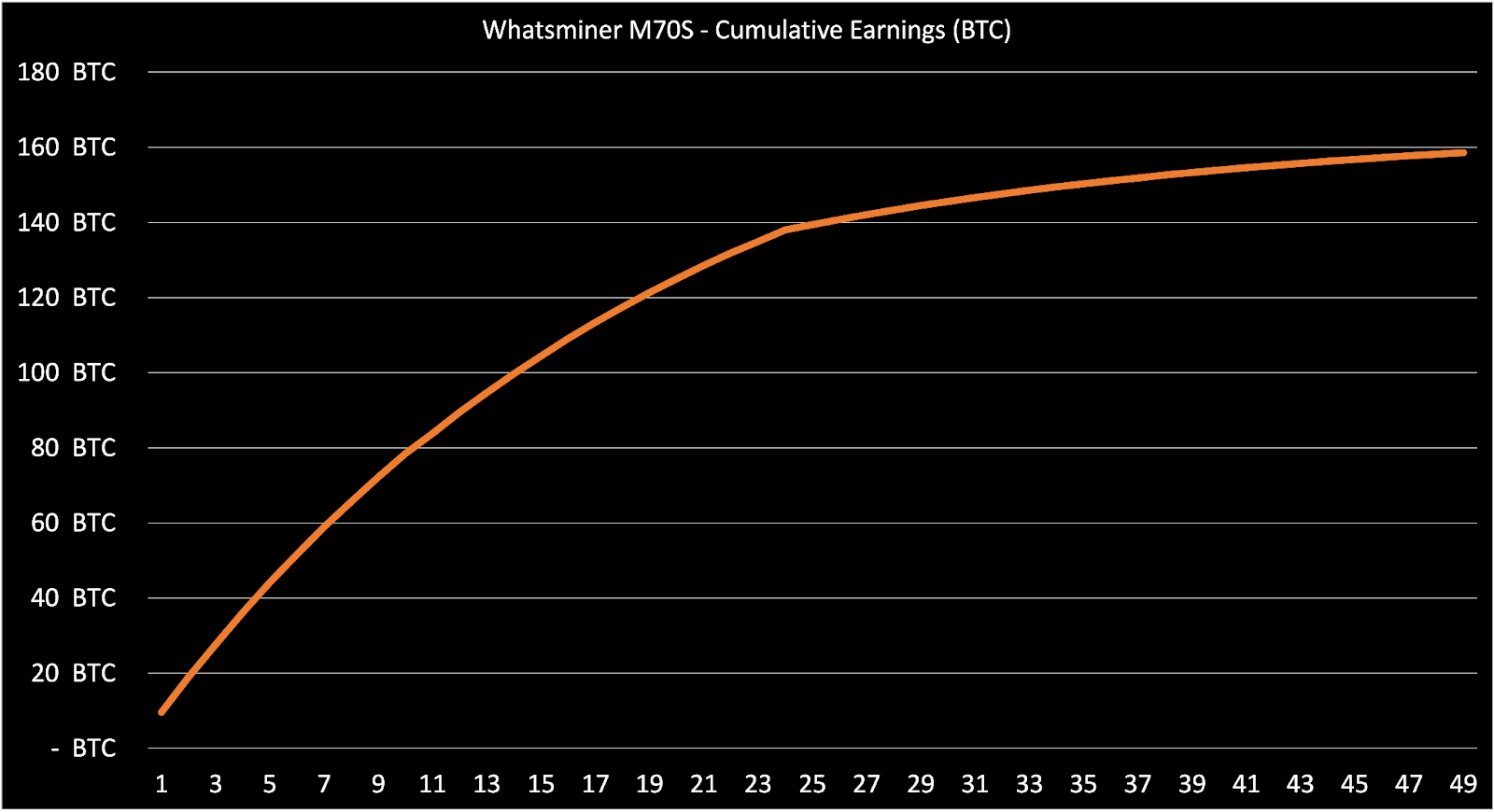

Under these assumptions, the modeled fleet projects the following results:

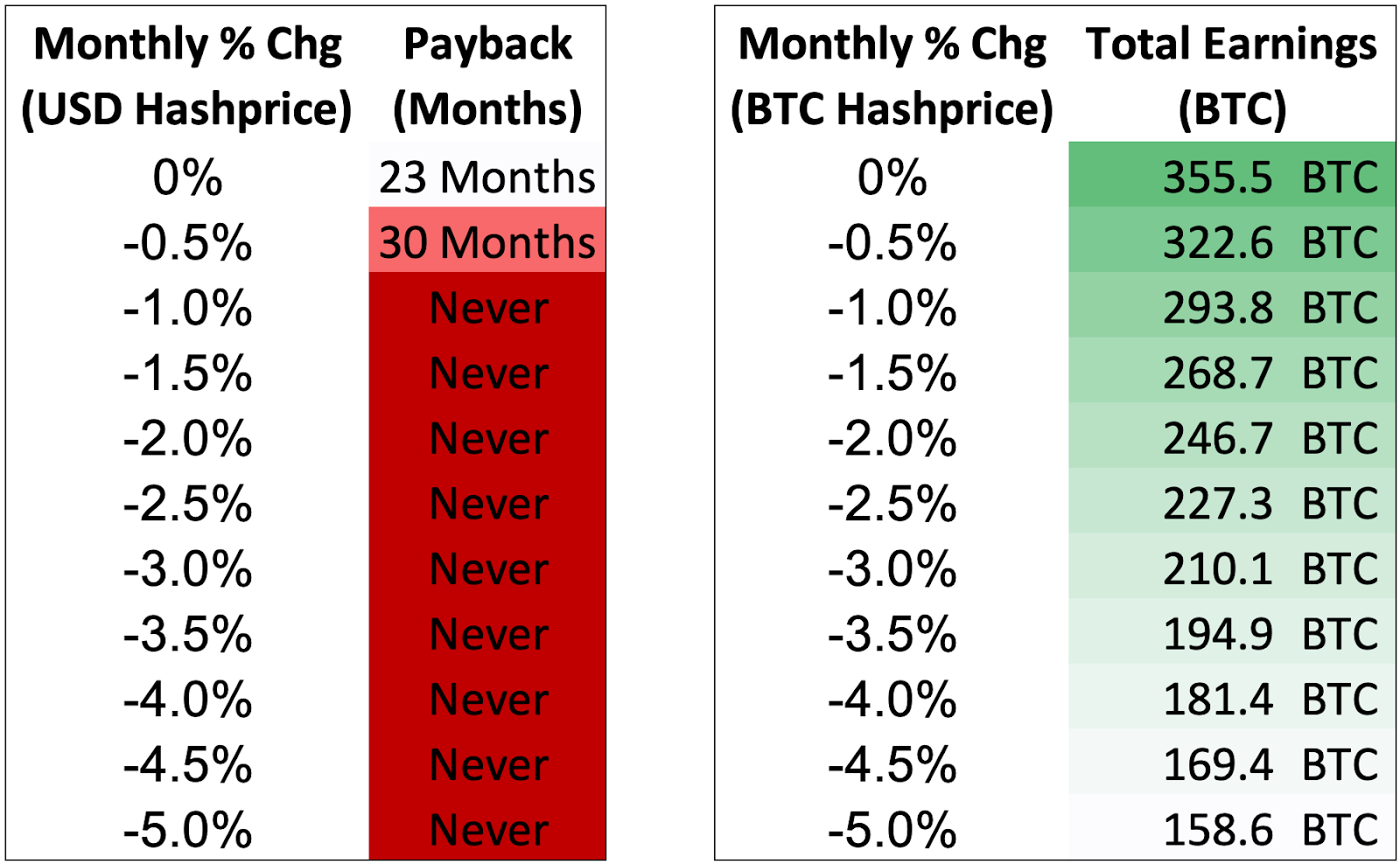

- Payback period: 30 months (October 2028)

- Cumulative earnings: ~158.6 BTC (April 2026 – April 2030)

Cumulative cash flow analysis (USD) shows an initial $18.8M CapEx drawdown, followed by steadily recovering revenues through mid-2027 and full capital recovery by month 30 (October 2028). Despite the projected 2028 halving, an estimated 60% decline in USD hashprice, and an estimated 96% decline in BTC hashprice across the four-year horizon, the WhatsMiner M70S fleet remains profitable through the full projection period, earning a total of 158.6 BTC.

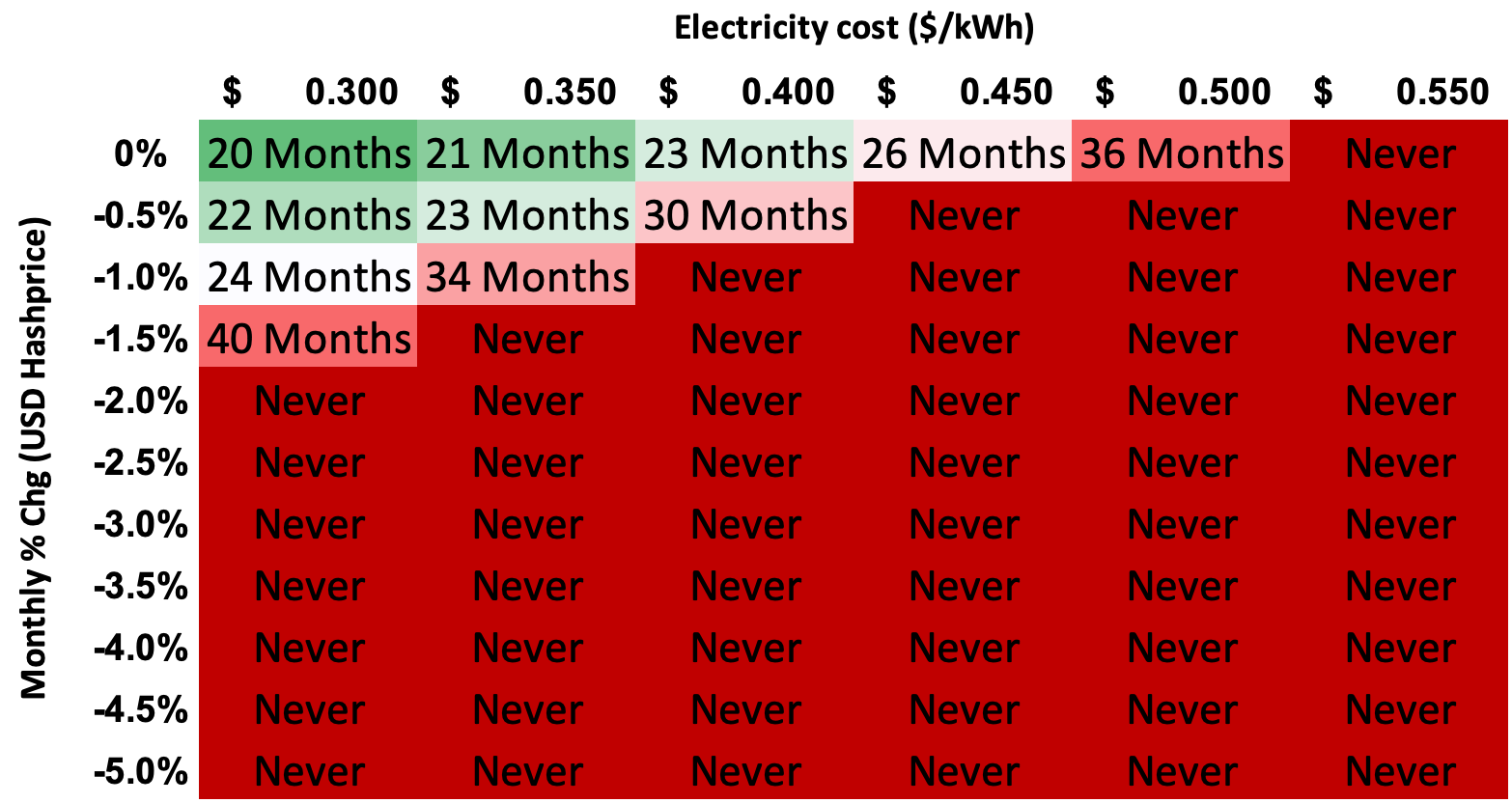

Hashprice sensitivity analysis shows that the WhatsMiner M70S fleet remains resilient under moderate compression, with payback periods ranging from 23–30 months as USD hashprice decay ranges between 0% and -0.5% per month. Beyond this range, capital recovery becomes unviable. In BTC terms, cumulative production varies up to ~355.5 BTC at a flat BTC hashprice, versus ~158.6 BTC at a -5% monthly decay.

In terms of power cost sensitivity, a 25% higher power rate ($0.050/kWh) extends the M70S fleet’s payback period by 13 months (from 23 to 36), underscoring the WhatsMiner M70S’s efficiency in tight-margin environments. However, beyond $0.055/kWh, capital recovery becomes unviable.

Total Cost of Ownership (TCO) and Compatibility Considerations

While machine pricing and electricity costs dominate headline payback calculations, total cost of ownership for the WhatsMiner M70S is meaningfully shaped by operational factors that compound over multi-year deployment horizons. Uptime consistency, failure rates, thermal stability, and maintenance overhead directly affect realized cash flows, particularly in post-halving environments where margins are compressed. MicroBT’s conservative electrical design, stable thermal behavior, and emphasis on platform reliability reduce downtime risk and variance in realized hashrate, improving capital recovery outcomes beyond what nameplate efficiency alone implies.

From an infrastructure perspective, the M70S preserves the external chassis dimensions of prior WhatsMiner generations, ensuring full compatibility with existing racks, containers, and airflow management systems. This cross-generational continuity allows operators to refresh or expand fleets without incurring secondary capital expenditures tied to facility retrofits or layout redesigns. By minimizing deployment friction and avoiding infrastructure re-engineering, the M70S lowers effective upgrade costs and improves fleet-level capital efficiency, reinforcing its competitive positioning from a Total Cost of Ownership (TCO) perspective.

Conclusion

The WhatsMiner M70S represents MicroBT’s most advanced air-cooled ASIC machine series to date, delivering 226–258 TH/s of hashrate at sub-14 J/TH efficiency while maintaining the operational discipline required for post-halving mining economics. Across projection scenarios that incorporate realistic hashprice compression and uptime assumptions, the M70S demonstrates durable cash-flow generation and achieves capital recovery in under two years under competitive power conditions.

More importantly, this machine’s value proposition extends beyond nameplate performance. Its reliability profile, infrastructure compatibility, and predictable operating behavior position it as a low-risk fleet asset rather than a speculative efficiency play. Based on our analysis, the WhatsMiner M70S is best suited for:

- Industrial-scale deployments

- Operations targeting sub-$0.050/kWh power costs

- Operations prioritizing long-term total cost of ownership

If you’d like to learn more about Luxor’s Bitcoin Mining Hardware services, please reach out to [email protected] or visit https://luxor.tech.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.