Do the public miners spend too much on administration?

Public bitcoin mining companies have historically spent a higher share of their revenues on administration than firms from comparable sectors. These administrative spending habits have raised concerns from investors experienced in similar but more mature industries like gold mining, tech, or oil and gas.

Like these investors, I struggle with understanding what justifies the high administrative expenses among public miners. Therefore, I wrote this article, which compares the historical administrative spending in the bitcoin mining industry to similar sectors and reveals which public mining companies are the biggest administrative spenders.

What are administrative expenses?

Administrative expenses are costs that do not directly contribute to the functions of production and sales. It is a broad category that includes executive compensation, consulting fees, legal fees, insurance costs, etc. These administrative expenses are put into the category general and administrative (G&A) on the financial statement.

Executive compensation makes up a significant share of the administrative expenses, particularly for public bitcoin mining companies. Since most executive compensation is in the form of shares and not directly paid out as cash, we can split the administrative expenses into cash and non-cash expenses. For the public miners, non-cash share compensation makes up most of their administrative expenses.

Bitcoin miners spend a lot on administration

There are several ways to measure the level of administrative expenses. We can calculate it as a percentage of revenue or cash flow, a portion of the capital raised, or we can directly measure stock compensation as Anthony Power did in his latest article. In this article, we will look at administrative expenses relative to revenue.

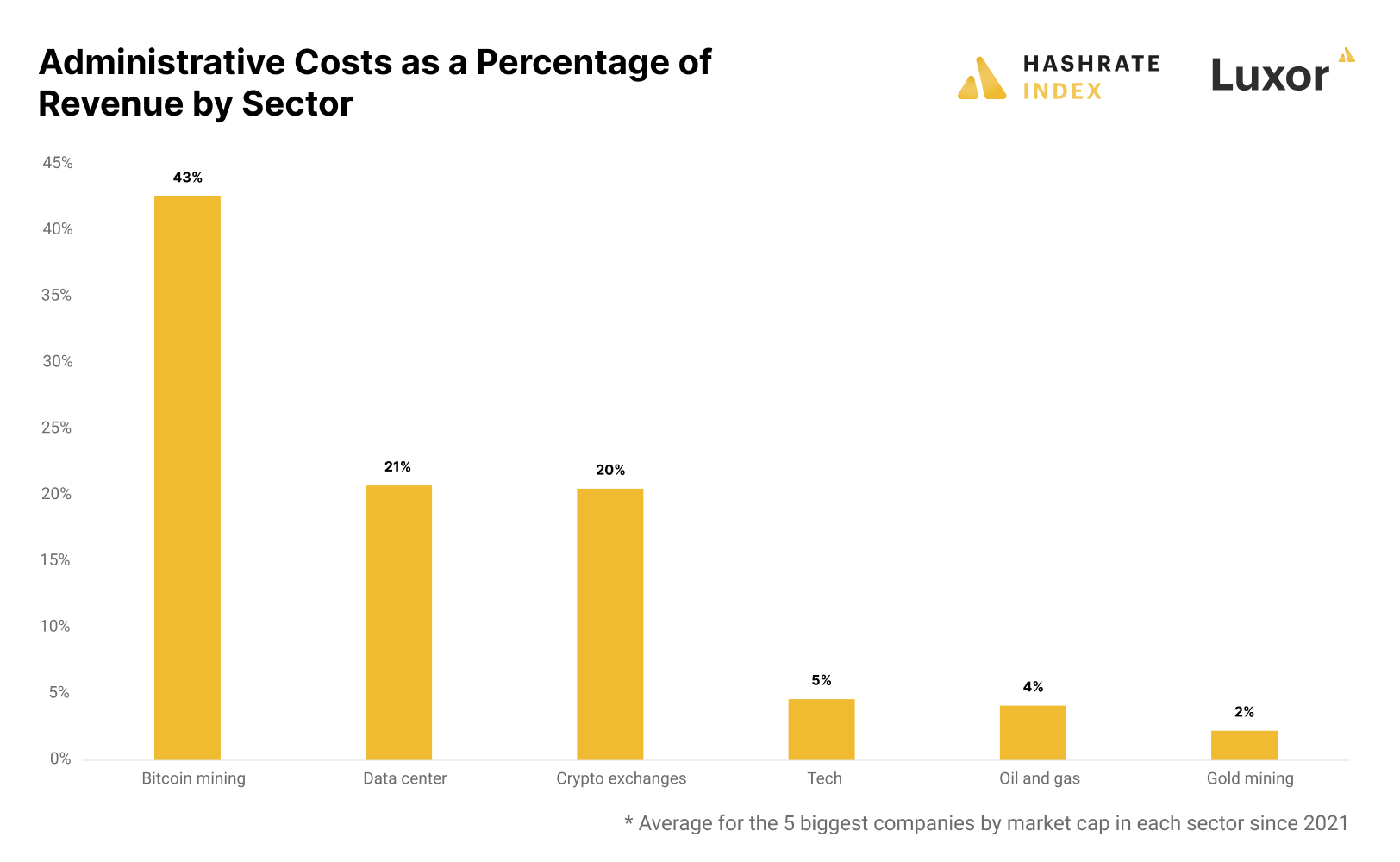

Let’s compare the historical administrative spending between sectors. The chart below shows the average administrative costs as a percentage of revenue since 2021 for different industries that are the most comparable to bitcoin mining.

Since 2021, the bitcoin mining industry has spent 43% of its revenues on administration, dwarfing the comparable sectors. During the same period, the “traditional” data center industry spent 21%, and Coinbase, which makes up the entire crypto exchanges category, spent 20%. The tech giants only spent 5%, oil and gas majors 4%, and the gold miners 2%.

We can see a clear pattern here: the more mature an industry, the lower the administrative spending relative to revenue. As an industry matures, competitive pressures tend to shave away all non-revenue-generating costs. This is particularly true in ultra-competitive industries like gold mining, where minimizing costs is the only way to stay competitive.

There are several reasons why the bitcoin mining industry's administrative expenses are so high. It is a very immature sector, with most companies going public after 2020. Investors have mainly focused on revenue and hashrate growth. I expect competitive pressures to force down administrative expenses over the long term.

In addition, non-cash stock compensation has tended to make up a significantly higher share of executive compensation in the bitcoin mining industry than in comparable sectors. For example, 85% of Marathon’s administrative expenses since 2021 have been non-cash stock compensation. As growth companies, bitcoin miners want to preserve cash for investment purposes and, therefore, to a more considerable degree. Stocks, particularly in volatile sectors, are a more risky payment than cash, and executives will generally demand a volatility premium. VanEck touches on this in their analysis of share compensation in the bitcoin mining industry.

Which public miners have the highest administrative expenses?

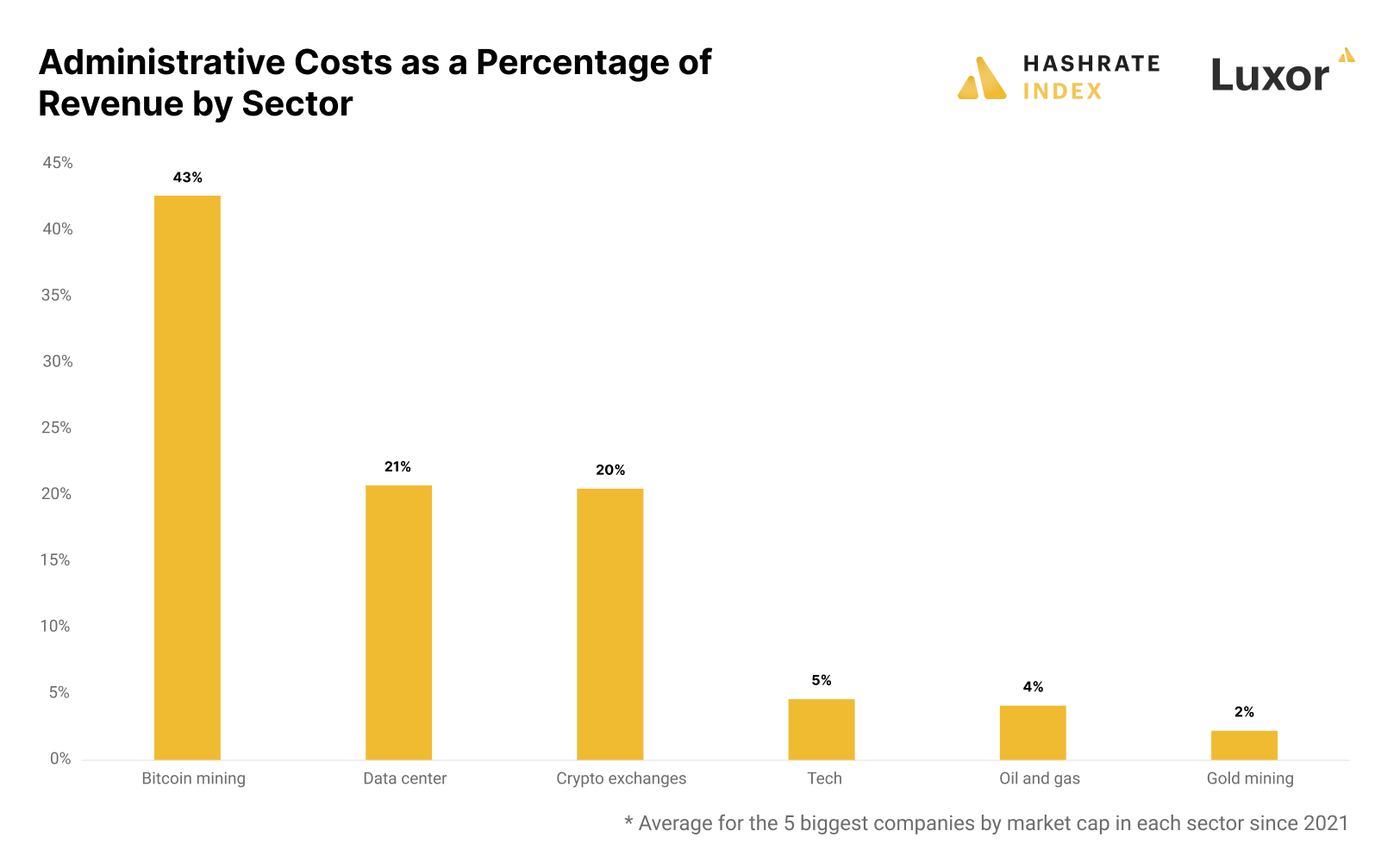

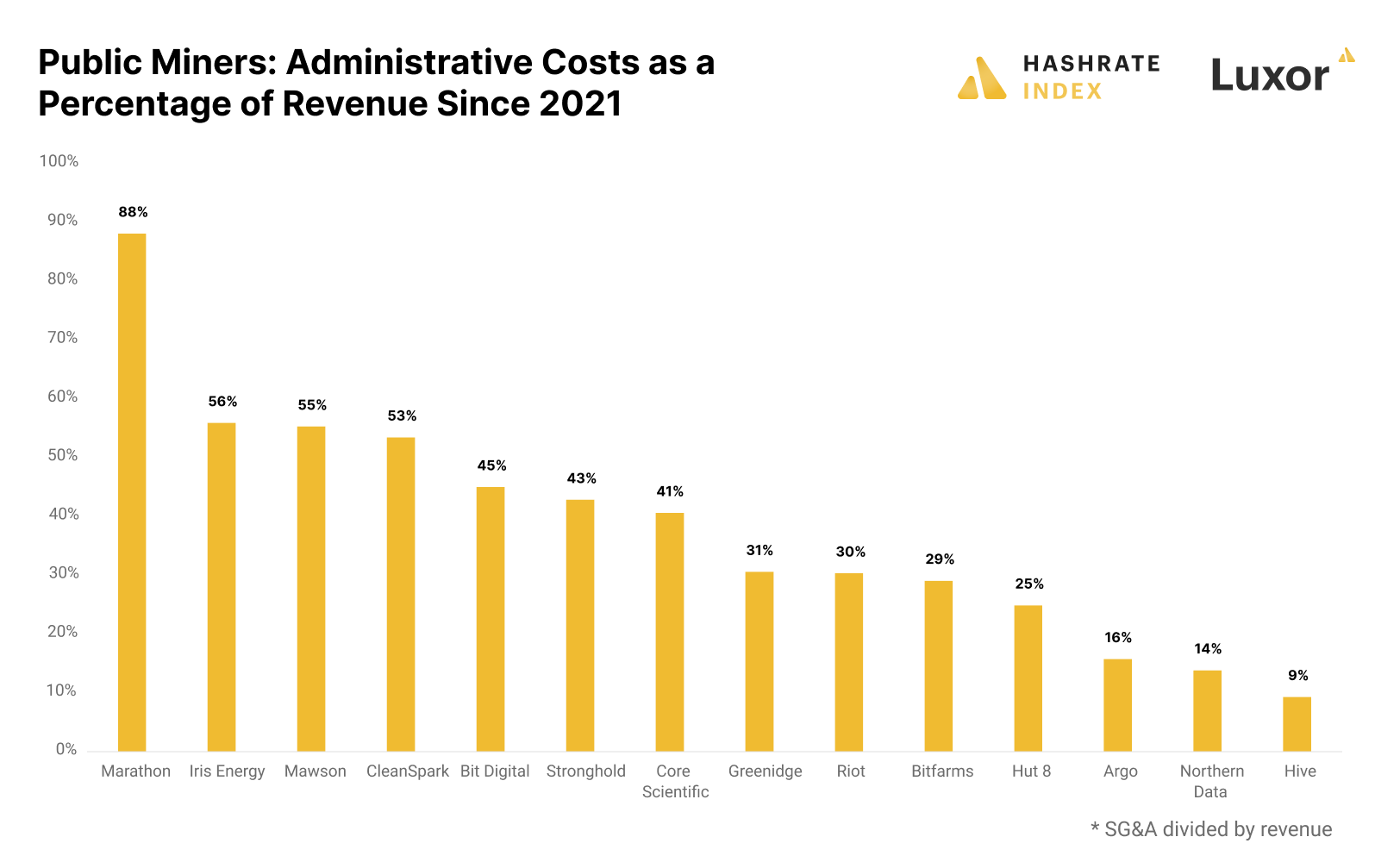

In the previous section, we established that administrative expenses are much higher in the bitcoin mining industry than in comparable sectors. Now we will compare the administrative expenses between individual bitcoin mining companies.

As you can see on the chart, there are significant differences in how much public bitcoin miners spend on administration relative to their revenues. Marathon is the biggest spender, spending 88% of its revenues since 2021 on administration. Most of Marathon’s spending took place in 2021, and the company has since drastically lowered its spending. In the second place, we find Iris Energy, spending 56%, while the third-biggest spender is Mawson, spending 55%.

In contrast, Hive Blockchain has only spent 9% of its revenues on administration since 2021. Other frugal bitcoin miners include Northern Data, Argo, and Hut 8.

Conclusion: Bitcoin miners should lower their administrative expenses

This article compared the administrative costs in the bitcoin mining industry and other sectors. We found that bitcoin miners spend a significantly higher share of their revenues on administration than companies in comparable sectors, like gold mining, oil and gas, tech, crypto exchanges, and data centers.

We also compared the administrative expenses between different bitcoin mining companies, and we found significant differences in the level of spending between the companies. Some miners spend a lot on administration, while others are more frugal.

Most of the administrative expenses are executive compensation. Since the fast-growing companies in the capital-intensive bitcoin mining sector aim to preserve cash for investment purposes, they primarily reward executives with non-cash stock compensation.

Some will claim that cutting non-cash administrative expenses, like stock compensation, is not particularly important since it doesn’t directly affect cash flow. I disagree, as shareholders still have to pay these expenses through dilution. In my old-fashion view, the entire point of a company’s existence is to generate value for its shareholders, and dilution is not value-generating.

The only way to survive and thrive long-term in cutting-throat competitive industries like bitcoin mining is by minimizing all costs, including non-cash administrative expenses. As investors gradually get a better understanding of the bitcoin mining sector, they will be careful to invest in companies with a history of diluting their shares through excessive stock compensation. Therefore, reducing non-cash administrative expenses is a matter of securing a long-term low cost of capital for these companies.

But before Gordon Gekko arrives to cut costs, investors should know that certain public mining companies are bigger spenders than others.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.