Bitcoin Mining in Canada: 2023 Recap and Looking Ahead to 2024

Bitcoin miners in Canada faced policy challenges in 2023, but they also adapted to this adversity.

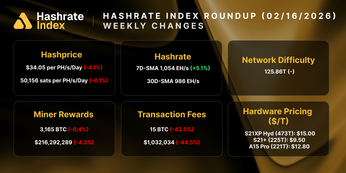

In 2023, the global Bitcoin mining industry recovered from the depths of the previous year’s Crypto Winter. A wide array of economic indicators took a positive turn: Bitcoin price rose by 154%, an index of public Bitcoin mining stocks increased by 246%, and network transaction fees – largely dormant since mid-2021– reemerged as a substantial portion of miner revenue. Additionally, the costs associated with energy, hosting, and hardware all declined to varying degrees.

Yet, in Canada, the Bitcoin mining landscape was more muddled. Harmful government policies, implemented in 2022 to explicitly target and discriminate against the industry, remained in place in 2023 and forced the industry into a defensive posture (Alberta was the noteworthy exception). These actions pushed major players to seek more favorable opportunities abroad. Consequently, we estimate that Canada’s share of Bitcoin’s global network hashrate fell to 4-5% from the 7-8% it held at the close of 2022 – a significant drop from its peak of 13% in 2021.

Economics improved dramatically in 2023, but storm clouds linger over 2024

The global Bitcoin mining industry found relief in 2023 after a tough 2022. Bitcoin price – the metric that attracts most attention – rose by 154% and nearly retraced its entire decline from the year prior.

The real surprise to the upside came from the resurgence of transaction fees on the Bitcoin network. Fuelled by the development of ordinals and inscriptions, new use cases and network activity on Bitcoin dramatically pushed up miner revenue via transaction fees. To put this into perspective, transaction fees constituted 7.6% of block rewards in 2023, compared to 1.5% in 2022.

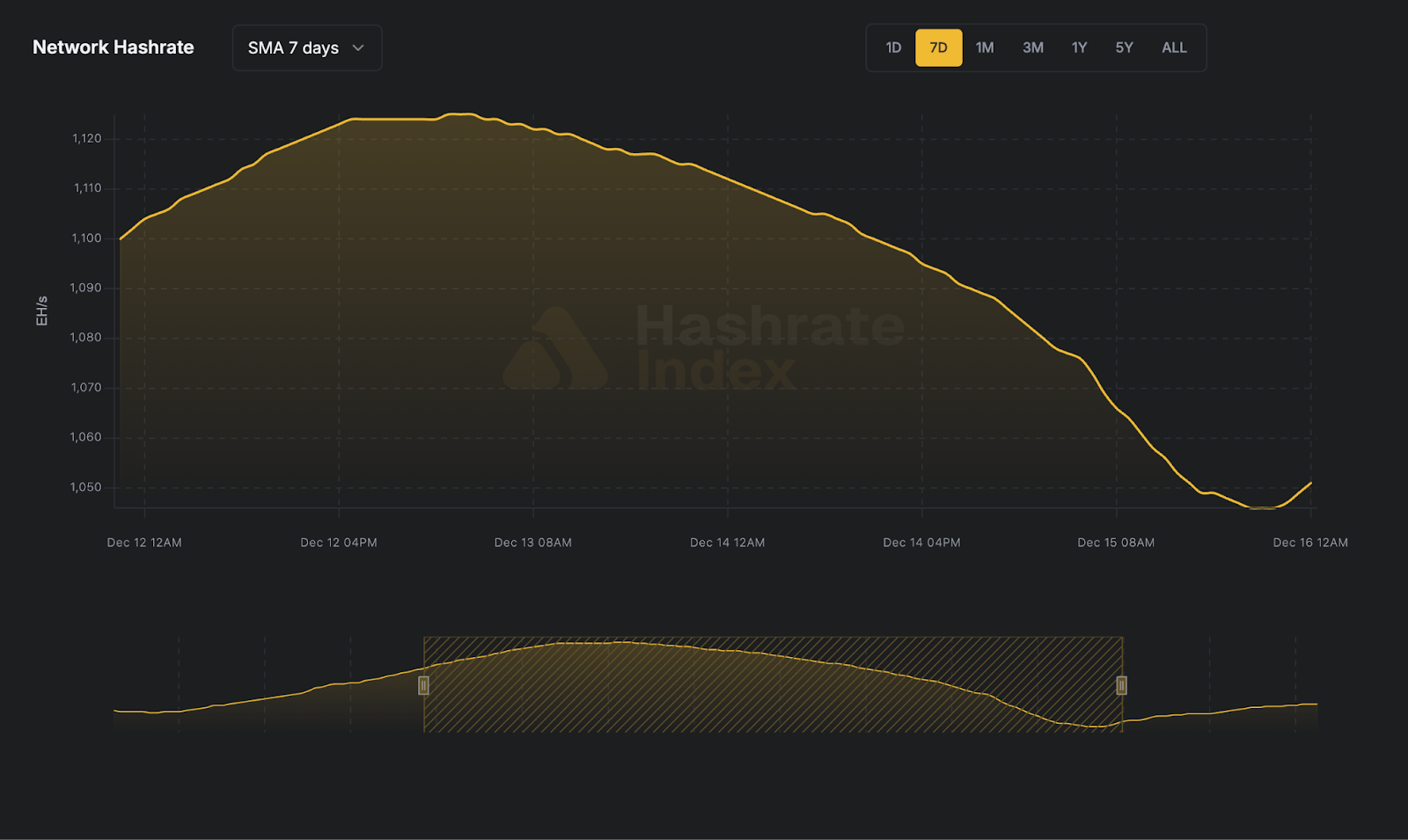

Hashprice, a comprehensive measure of Bitcoin miner revenue per unit of hashrate, increased by 70%, from $59/PH/day to $101/PH/day, with notable spikes in May and December due to transaction fees. 2023’s average hashprice was $75/PH/day.

Despite 2023’s relatively good fortune, there’s a storm cloud on the horizon in 2024: the halving – an event which occurs every 4 years and cuts revenue from the block subsidy in half (i.e, newly created bitcoin, not revenue from transaction fees). The second order impact of this event – on Bitcoin price, network difficulty, and transaction fees – is uncertain and debated. Some argue the halving of Bitcoin’s supply increases its price, while others point to falls in network difficulty from unprofitable miners turning off their operations. If high transaction fees are sustained, as they were during the last halving, that can also offset part of the lost revenue from the 50% reduction of the block subsidy.

The primary impact of the halving, however, is certain. Bitcoin miners will get a significant, negative revenue shock in the short term. It is currently forecast to occur on April 21, give or take a day.

Government policy continues to harm the industry, hamper opportunities and growth across Canada

In 2022, in the aftermath of the trucker protest and at the depths of Crypto Winter, Canadian Bitcoin mining companies were subjected to legislation and regulation that specifically targeted and unfairly discriminated against the sector. In essence, policymakers at different levels of government made the misguided decision to single out digital asset mining computers – from all other types of computers – for a distinct set of taxes, electricity rates, and interconnection regulations. So in 2023, the Canadian mining industry pivoted from a completely defensive position to beginning the work of building serious, permanent, and coordinated advocacy institutions across Canada.

Unfortunately for the Canadian economy, poor public policy cost the country jobs, investment and tax revenue. At the national level, the Canadian Government gave a masterclass in creating uncertainty – killing jobs and investment in the process. In February 2022, without advance notice to the Bitcoin mining industry, the Department of Finance proposed a “clarifying” amendment to the Excise Tax Act which would declare digital asset mining not a “commercial activity” in Canada. The proposal would have made all digital asset mining companies ineligible for the Input Sales Tax credits available to all other exporting businesses. The unprecedented proposal would have created a 5% - 15% hidden tax on the cost of Bitcoin mining in Canada and done irreparable harm to Canadian companies competing in a globally competitive market.

Fortunately, due to the efforts of the newly formed Digital Asset Business Council and member companies like Hut 8, Hive, Bitfarms, Iris Energy, Argo, and DMG, ASIC operators have reason to be optimistic about an acceptable resolution. Though the proposal became law, legislators made amendments that potentially give ASIC operators access to input sales tax credits, provided the CRA determines, on a case-by-case basis, they are selling hashrate to an international pool in the same way a regular data center would sell computing services internationally. This should apply to nearly all industry players in Canada, but we await further updates. With hundreds of millions in tax credits, jobs, and investment hanging in the balance, the industry is still awaiting general CRA guidance and case-by-case decisions on these matters. An update is expected early in 2024.

In British Columbia, Manitoba, Quebec, New Brunswick, and Newfoundland and Labrador, moratoriums on new interconnections from 2022 remain in place. These jurisdictions have some of the cleanest, cheapest and most plentiful electricity in the world and received tremendous interest from around the globe for digital asset mining investment. Instead of capitalizing on this opportunity and undertaking the work required to streamline application evaluations and improve grid system flexibility, these provinces chose to close their doors for business. In all cases, provinces cited concerns about peak electricity usage and ignored, or did not understand, digital asset mining’s inherent flexibility in power usage. None of the moratoria applied to any other type of computing or sector, regardless of its energy usage.

In British Columbia, Conifex Timber, a paper and forest products company looking to make investments into high performance computing, took legal action against the Province and BC Hydro in response to the provincial moratorium. In a publicly released White Paper, Conifex, “outlines the several ways in which the actions of the provincial cabinet contravene the law, interfere with the regulatory system, and in fact work against the government’s own stated economic, carbon mitigation and reconciliation goals.”

In this challenging environment, Alberta was the notable outlier. Elected officials in the province recognize the benefits of the digital asset mining industry – namely high tech jobs, particularly in rural and remote regions, diversification, international market access, and the potential to revolutionize environmental and energy system sustainability. They are actively courting investment and encouraging economic development. In July during Stampede, Premier Danielle Smith and Minister Dale Nally participated in the Canadian Blockchain Consortium’s Bitcoin Mining trade mission, while Minister Nate Glubish spoke about the benefits of mining at the Bitcoin Rodeo. Minister Dale Nally also participated in the Canadian Blockchain Consortium’s second annual Texas trade mission.

In Ontario, the energy department appears to have abandoned plans from 2022 to exclude cryptocurrency miners from participating in the Industrial Conservation Initiative (ICI). The ICI is an electricity conservation program that allows participants to reduce their Global Adjustment costs, based on their ability to reduce demand during five top peak demand hours.

Canadian Bitcoin miners show resilience, expand into new markets

Policy mismanagement could not stop Canadian companies from innovating and expanding into new markets.

Perhaps most notably, in November, Hut 8 completed the largest M&A transaction in the industry’s history, in an all-stock merger of equals with US Bitcoin Corp. The combined company will be domiciled in the United States, and, with access to approximately 825 MW of gross energy, will be one of the largest digital asset mining and high performance computing infrastructure operators in North America.

Other large Canadian headquartered public Bitcoin mining companies with a focus on clean energy – namely, Hive and Bitfarms – expanded operations outside Canada. Bitfarms received permits to power up to 100 MW in Argentina and secured contracts for up to 150 MW of hydropower in Paraguay, while Hive completed the acquisition of a hydro-electric powered data centre in Sweden at the end of the year.

On the hardware side, we saw a couple noteworthy collaborations in 2023. In January, Hive deployed the BuzzMiner powered by Intel’s Blockscale ASIC, after months of planning, engineering development, implementing factory processes, field testing, and global collaboration. Later in the year, Toronto-based ePIC Blockchain announced a collaboration with Chain Reaction to produce ePIC’s next-generation hashing systems for Bitcoin mining.

Bitcoin mining companies diversified into new areas for revenue generation in 2023. DMG expanded its business by venturing into inscriptions and ordinals, establishing itself as a leader in this market. Hut 8 signed an agreement with Interior Health in southern British Columbia to deliver secure colocation services, showcasing their expansion beyond Bitcoin mining. Meanwhile, Iris Energy entered the AI market, demonstrating its commitment to diversify its offerings and expand its high-performance computing data center strategy.

BlockLAB introduced an innovative system, piloted since 2022, to provide an eco-friendly and cost-effective heating solution for greenhouse operations, by harnessing the excess heat generated during the Bitcoin mining process. Additionally, container manufacturers like Upstream Data, CryptoTherm, Bit-Ram, and Intelliflex have maintained their leadership in innovative air-cooled and immersion systems in North America.

In 2024, Bitcoin miners must face challenges and find opportunities

While the rally in Bitcoin price and transaction fees is providing miners with much needed relief, the impending halving will keep industry attention on bottom lines. While the direction of Bitcoin price, network difficulty, and transaction fees remain uncertain, the halving of the block subsidy is a certainty and will be a significant negative revenue shock. To survive, companies need to lower costs, increase efficiencies, and protect margins.

On the policy side, the landscape looks unlikely to improve much outside Alberta. Unfortunately, the federal Liberals see the digital asset industry not as an economic opportunity, but as an opportunity to attack their political opponents. The rebound in Bitcoin price may change the electoral calculus, but trailing in the polls, we believe Justin Trudeau and the Liberals will continue to attack Pierre Poilievre and the Conservatives for their support of the digital asset industry. At the provincial level, bureaucratic inertia will make overturning moratoriums unlikely in 2024. Educating provincial governments and grid operators about the industry's benefits will require significant time and effort.

Despite all this, we believe that building serious, permanent, and coordinated advocacy institutions across Canada is a worthwhile investment. At the end of the day, with access to abundant, low cost, and sustainable energy; a highly skilled workforce; cold climate; underutilized industrial infrastructure (particularly in rural areas); and a relatively stable, secure political environment, Canada is naturally positioned to be a leader in digital asset mining and other power-intensive compute industries.

If polling is any indication, political change is on the horizon in Canada. To capitalize, industry needs to continue making its value known. Digital asset miners create jobs – both upstream and downstream from site operators, including hardware manufacturers, infrastructure providers, and software engineers. They bring investment to their local communities, often in rural or remote areas with limited opportunity and underutilized industrial infrastructure. They improve environmental and energy system efficiency and sustainability by using stranded gas that would otherwise be flared or vented, supporting electrical grid stability through demand response, and enabling the build-out of new renewable generation assets. And perhaps most importantly, they help deliver stranded Canadian energy to international markets without physical transmission lines or pipeline infrastructure, as hashrate is sold over the internet.

Canada’s success in digital asset mining in 2024 and beyond will be dependent on the industry’s ability to lower costs, increase efficiency, and protect margins, as well as to continue to change the narrative and educate the public and policymakers on the benefits of welcoming responsible digital asset mining.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.