How to Invest in Bitcoin Mining in 2023

Want to learn how to start mining bitcoin? Here are some ways to gain exposure to bitcoin mining.

Speculation on Bitcoin mining is growing, and Bitcoin mining is very popular in 2023. The current mining industry is progressing into a new stage where it is looking for both scalability and stability. As a large wave of institutional investment enters the market and innovation increases, Bitcoin mining has had increased market segmentation which is broadening investors' ways to get mining exposure. In this article, we are going to talk about four major ways to invest in Bitcoin Mining:

- Purchase mining rigs

- Purchase hashrate tokens

- Invest in publicly-traded mining stocks

- Purchase cloud mining contracts

Purchase Bitcoin Mining ASICs

The first way to invest in Bitcoin mining is by purchasing ASIC miners from manufacturers, brokers, or direct from other miners. Market-wide, the spot price for new-gen mining rigs has reached over 100 USD per TH, and procurement of new-gen mining rigs has been increasingly difficult recently as they are in short supply.

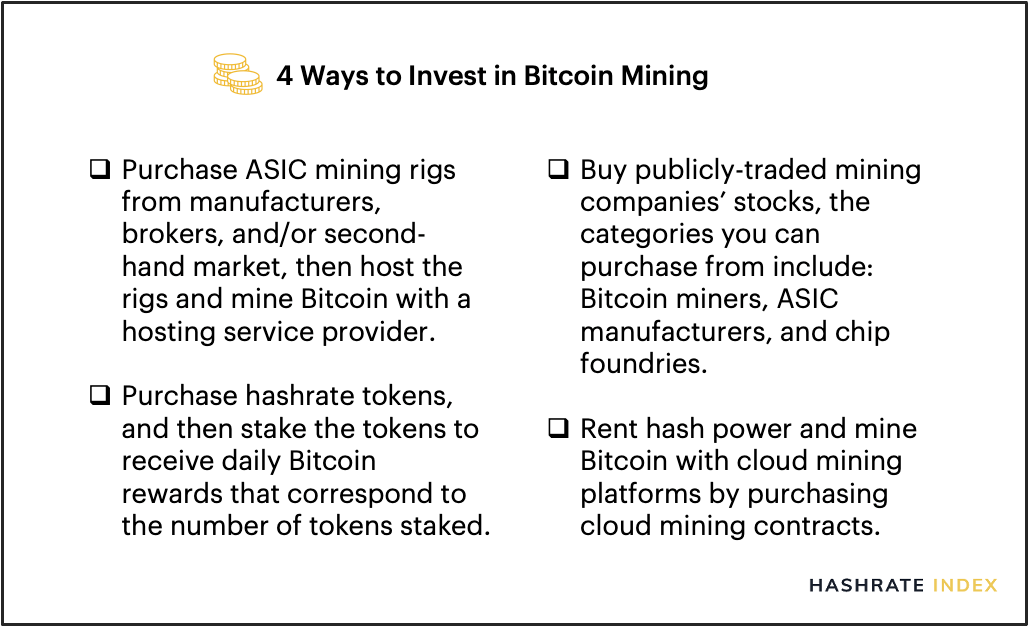

Whether mining by your own rigs is profitable depends on a lot of factors. Below you'll find an image outlining an FPPS mining profit calculation framework (transaction fee not included):

To better gauge your profitability, you can utilize our mining profitability calculator to get an estimate on your revenue, profit, and payback period. From this framework, we can infer that from the revenue side, one can upgrade mining rigs or add more rigs to improve the mining revenue; from the cost side, the purchase cost of a rig is a fixed cost positively correlated with Bitcoin's price, whereas the cost of electricity is a variable cost determined by various factors such as bargaining power. Yet, other costs such as transaction fees, insurance, and firmware costs are not included here, thus to get the net profit from mining activities, investors will need to subtract those cost items from the mining profit as well.

An increase in the Bitcoin price doesn't necessarily mean linear growth in mining profit. When Bitcoin's price increases, the purchase costs of a mining rig will follow. Additionally, as more hashrate joins the network this will increase the mining difficulty level to keep new block generation at a speed of 10 minutes per block. Therefore, in the current market, investors invest in Bitcoin by mining will have more advantages if they have either existing high-performance new-generation rigs purchase orders or a large existing inventory of older rigs on the revenue side, and electricity infrastructure, bargaining power at the top of the supply chain on the cost side.

We have written a comprehensive guide on rig purchasing — ASIC and Bitcoin Mining Purchasing Guide, which will walk you through the entire process from evaluating investments and returns, choosing coins, buying mining rigs from different channels, and in the end selecting a reliable hosting solution.

Purchase Hashrate Tokens

The emergence of hashrate tokens earlier this year is a vital innovation for hashrate financialization. One hashrate token is collateralized with a fixed amount of hashrate and can generate corresponding Bitcoin mining revenues by staking the tokens. It steers clear of the difficult side of Bitcoin mining caused by the overwhelming number of choices and information asymmetry in purchasing rigs or cloud mining contracts. At present, hashrate tokens are trading at a premium given their exchange-level liquidity.

In this in-depth article — Bitcoin Mining Meets Defi, we explained hashrate tokens' mechanisms, valuation frameworks, market adoption, and so forth.

Invest in Bitcoin Mining Stocks Stocks

In the current market, investing in public mining stocks is an even more widely accessible and available option for getting mining exposure compared to the other methods mentioned above. Below are some representative mining stocks in each vertical:

Miner: Marathon Digital Holdings (MARA), Riot Blockchain (RIOT), Bitfarms (BITF), Argo Blockchain (ARB), Hut 8 Mining (HUT), and many more

2021 has been a good year for public miners due to the Bitcoin price increase, the temporarily stagnant total hashrate growth, and new ASIC bottlenecks. New-gen mining rigs procurement has become an arms race and investors need to pay close attention to these companies' rig purchase price and quantity. Miners essentially act as a levered play on Bitcoin, providing investors some torque on the underlying commodity. In bull markets, public miners have generally outperformed Bitcoin, and vice versa in bear markets.

Manufacturer: Canaan (CAN), Ebang International (EBON), NVIDIA(NVDA)

Manufacturers' financial performance will likely lag due to its business model, especially for the first half of 2021. This is because the current mining rigs' chips have an extremely tight supply leading to the delivery lead times of major manufacturers being 3+ months currently. Most bulk rig purchasers choose to pay manufacturers in installments rather than pay in a lump sum, therefore, investors will see a significant revenue increase at a later stage.

Foundry: TSMC (TSM), Samsung

Chip foundries are at the top of the crypto mining food chain, the allocation and evolution of the chips can directly impact the Bitcoin mining industry by determining who can mine and how fast they can mine. The mining rig manufacturers need to work around foundries' schedule and chip availability when it comes to manufacturing as well as designing rigs. In addition to the Bitcoin mining industry, many other industries, such as consumer electronics, are also pushing up demand for chips as well. Therefore, foundry stocks will have a strong financial performance backed by robust sales this year, such as TSMC, its current stock price is almost tripled over the past 12 months. However, it's unclear if the foundries will move mining rig manufacturers up a bit on their priority lists.

Mining Power Leaders

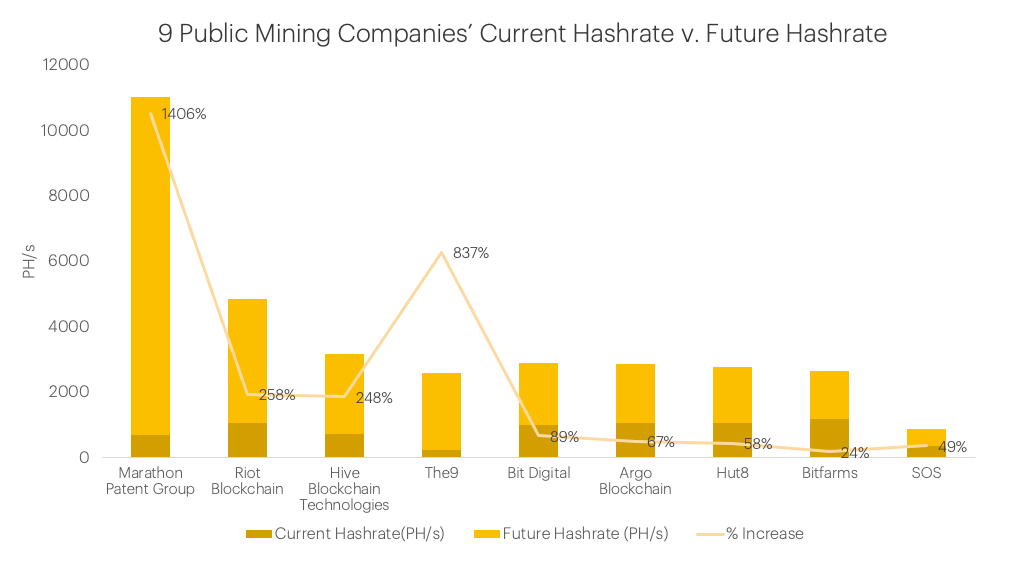

According to our research, 9 public mining companies are generating around 7395 PH/s, which is 4.6% of the total network hashrate (159430 PH/s) at present. The top three public companies, Bitfarms (BITF-CV), Argo Blockchain (ARB.L), and Hut8 (HUT-CT), are leading 45% of the overall 7395 PH/s. All of these 9 companies are listed in either the United States or Canada.

Based on these companies' current mining rigs procurement announcements, by the end of this year, they will be able to produce 25752 PH/s or more, which will be 11% of the total network hashrate (231699 PH/s) assuming the total network hashrate grows at 4.2% per month. Below compares these companies' current hashrate and theoretical future hashrate at the end of 2021.

Purchase Cloud Mining Contracts

The last choice is purchasing cloud mining contracts from cloud mining platforms. Since its debut in 2013, cloud mining has been evolving and integrating industry resources to deliver more liquid mining solutions to investors. Using cloud mining, investors can rent hash power and generate mining revenues without purchasing or operating mining rigs.

Previously, we have produced a detailed guide on Bitcoin cloud mining — Bitcoin Cloud Mining Guide: Scam or Legit, covering its history, common concerns, IRR estimation, legality, and so on.

Bitcoin Mining Market 2023 Outlook

On the market side, the current mining industry is still an incremental market, manufacturers and service providers should aim to keep delivering more refined, innovative, and professional mining products to both individual and institutional investors. For instance, given Canada has approved two Bitcoin ETFs this year, and more players are eyeing the US markets, we can anticipate more financial products being introduced into the secondary market followed by other countries.

On the investor's side, choosing which way to invest in Bitcoin mining depends on each investor's portfolio, risk appetite, and how it's going to evolve in different market segments (ASIC, Defi, public markets, cloud mining) moving forward.

Last but not least, to get subscriber-only updates on the Bitcoin mining market, industry trends, and educational content, sign up for our weekly newsletter: Mining & Hashrate Newsletter.

Disclaimer: content is for informational purposes only, you should not construe any such information as investment advice.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.