Is Bitcoin Cloud Mining Legit or a Scam?

What is cloud mining in Bitcoin and how can you avoid cloud mining scams?

Cloud mining is often portrayed by industry insiders as a scam and to outsiders as a way to get rich quick. Although there have been countless of unethical & illegal players in the cloud mining space, they continue to flourish. There are a few platforms today that play an important role in the ecosystem so we figured it was time to do a deep dive on it.

We cover:

- Cloud Mining History

- Concerns about Cloud Mining

- Notable Cloud Mining Platforms

- How to Estimate Cloud Mining IRR

- Difference from Hashrate Marketplaces

- Difference from Hashrate Futures & Forwards

- Legality of Cloud Mining

- Future of Cloud Mining

Cloud Mining History

Cloud mining platforms are almost as old as Mining Pools. It was first introduced by CEX.IO exchange in 2013. Since then it has evolved with dozens of scams and the creation of a few mining giants.

Cloud mining is a term to describe companies that offer contracts of compute power (“hashrate”) to mine Bitcoin and other PoW coins. Instead of investing in mining hardware directly, buyers can purchase a cloud mining contract and rent the hashrate produced from a machine. The buyer pays some form of currency (usually Bitcoin) in return for a set amount of hashrate (i.e. 20 TH/s) for a set time period (i.e. 30 months). The buyer pays a fixed rate at the start with the hopes that their contract returns more than they originally put in, or some IRR.

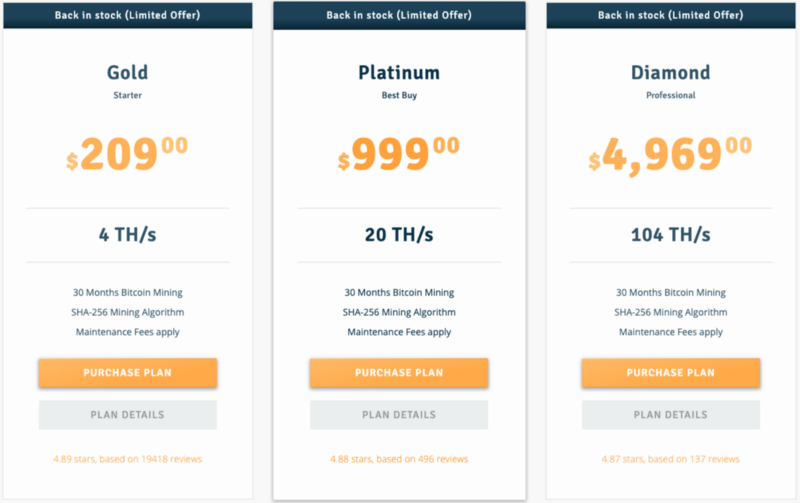

Below is an example of three mining contracts offered by Genesis Mining. In the Platinum contract a user puts in $999 USD and a maintenance fee of $0.03 per TH/s per day to receive 20 TH/s of hashing power for 30 months.

A large difference between cloud mining and regular mining is about who owns the hardware. In cloud mining the company offering the contract owns the actual hardware, and the buyer merely owns a claim to a period of its hashrate output.

Cloud mining be attractive for people wanting to get into mining without the technical or financial ability to purchase their own machines, send it to a colocation or host in their own home. What has really made cloud mining so successful is the simple UX of being able to start “mining” without any of the hassle and capital expenditure required with traditional mining.

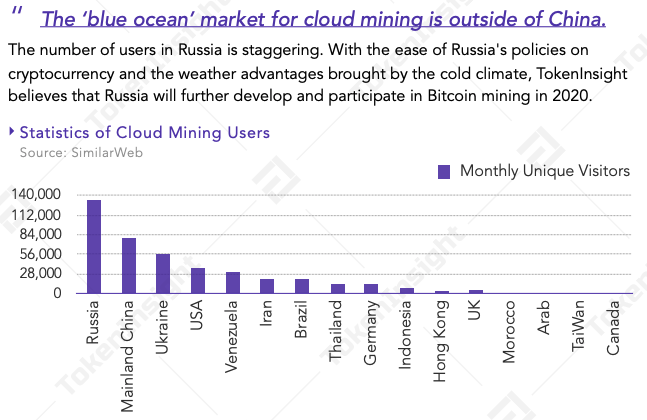

According to TokenInsight buyers in Russia, China and the Ukraine make up the majority of cloud mining volume.

Concerns about Cloud Mining

There are a few main concerns with cloud mining; (1) the platform could be a straight up scam and Ponzi scheme (2) the platform might pray on uneducated retail investors who don’t understand the risks associated (3) there is no market based pricing.

Scam Platforms

Over the past 7 years there have been dozens of “cloud mining” platforms that turned out to be a scam. Most often these platforms did not actually have the hashrate that they promised to deliver to buyers. So buyers ended up putting money in and getting nothing in return.

A few of the more public ones were HashOcean, Bitcoin Cloud Services, GAW, BitClub.

It is extremely important for buyers to do their own due diligence before putting money into a cloud mining contract and only put in what they are willing to lose.

Deceptive Marketing

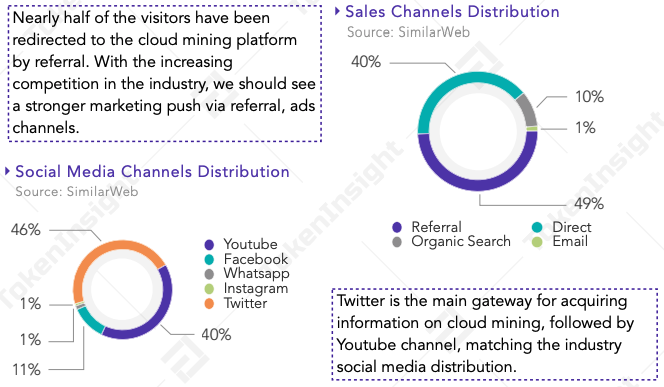

Part of the reason why cloud mining has been so successful is because of the marketing tactics they employ. It is very common for a cloud mining platform (even if legit) to promise a large percentage return on investment. Often times they indicate that the contract will make 50%+ in return.

Below is an unsolicited email I received from Hotbit a few months ago. In the email it showed a theoretical return of 100%.

This is a big red flag in any investment. No one can predict the future (especially a cloud mining company) so it is unethical to put out an aggressive return profile. Just like public CEO’s shouldn’t put out a share price target, cloud mining companies shouldn’t put out an expected IRR.

Mining can be a great investment but it is also very hard to do properly. The individuals that make a good return in mining are industry insiders who understand the market dynamics. Retail buyers who are just learning about mining are not well placed to make any investment decision. Focusing marketing on retail buyers is unethical, which is the clear target market for a large percentage of cloud mining platforms.

Opaque Pricing

Cloud mining platforms set the price for their contracts, rather than allowing an open marketplace to set it. This results in a situation where the buyer is usually at a disadvantage. It is sort of like playing a card game against the casino, but the casino sets the odds. Usually it won’t be in your favor…

A really interesting project is HoneyLemon which aggregates mining contracts so people can compare their specifications. Hopefully, this type of platform will bring more transparency (and competition) to the pricing of cloud mining contracts.

Notable Cloud Mining Platforms

While there are varying opinions on the popular cloud mining companies, there is no doubt that they play a large role in the mining ecosystem.

Genesis Mining is one of the oldest and largest cloud mining companies. They offer contracts for SHA-256 (Bitcoin) and a few other algorithms. Based in Europe they own all of their own mining equipment. This is what I would use as an example of a traditional and legitimate cloud mining company.

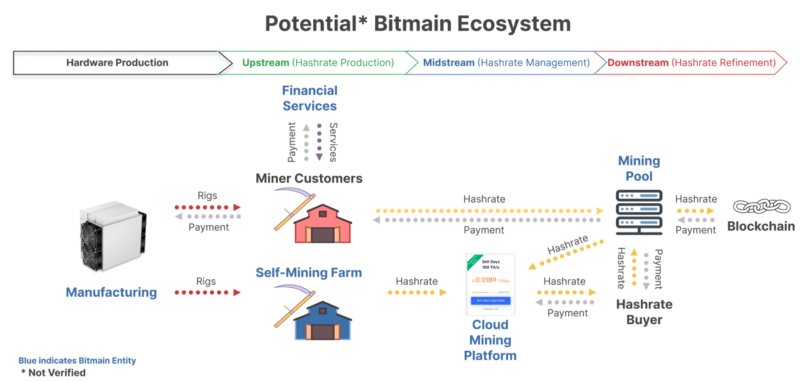

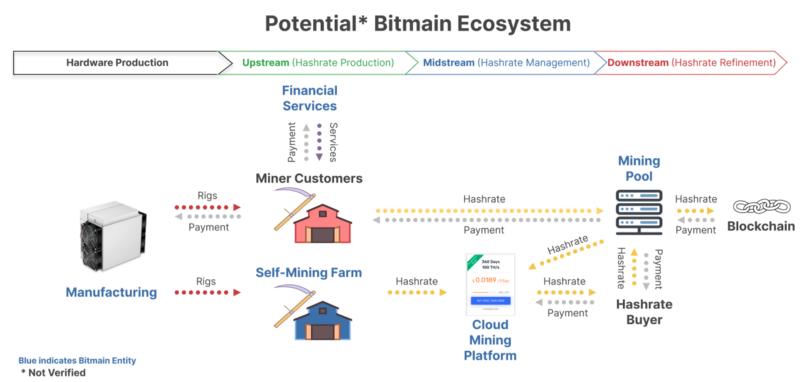

Bitdeer is one of the most interesting companies in mining. As a Bitmain subsidiary it sits at the center of many mining products including Bitmain (manufacturer + farms), Antpool, BTC.com, Via.BTC, Matrixport etc. It is also interesting because it has allowed us to reimagine the way in which hashrate can be traded between farms, pools, cloud mining platforms and buyers. Hashrate could theoretically change hands multiple times before it used to actually mine on the network. Below is a potential ecosystem that could exist today.

I expect that these platforms, especially Bitdeer, to continue to grow moving forward.

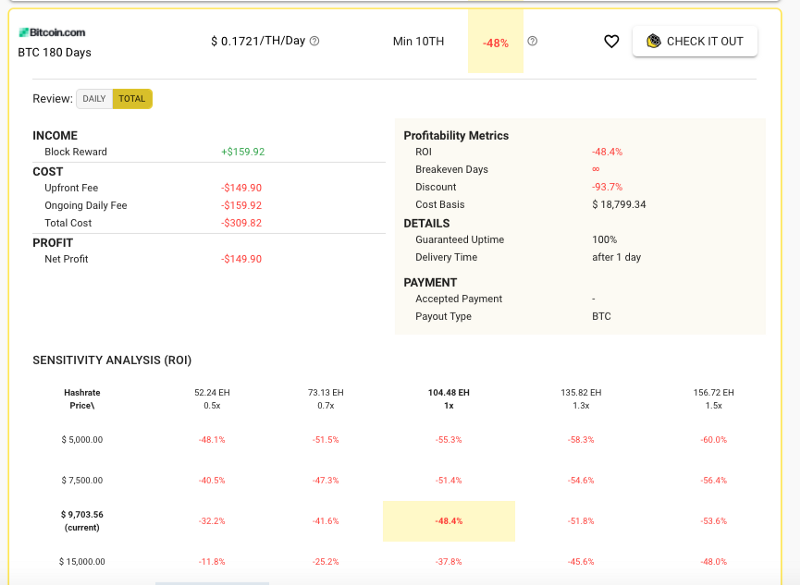

How to Estimate Cloud Mining IRR

You can calculate the current profitability of mining with any calculator like MinerStat or Whattomine.

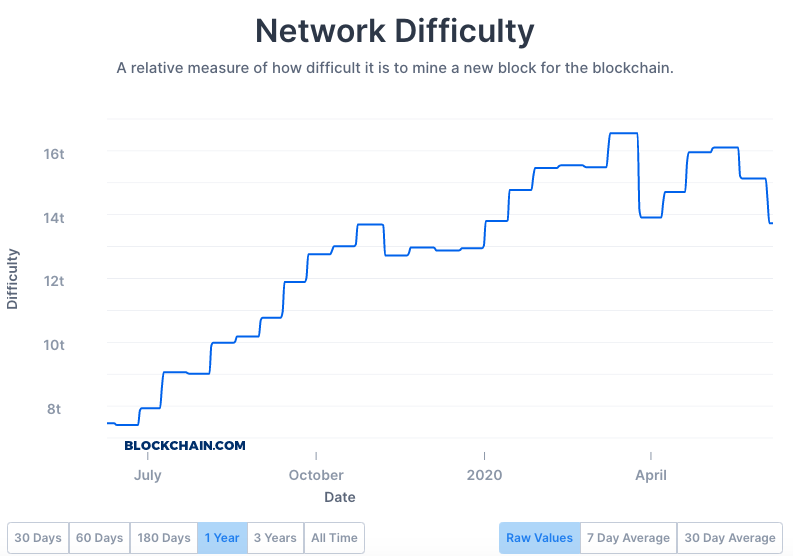

A key is to make sure that you factor in that Network Difficulty will change during the contract. Historically it has increased, leading to a decrease in revenue.

Another aspect not often talked about is determining your personal opportunity cost (or cost of capital). Mining is a risky venture and returns can be very volatile. So make sure that your expected return makes sense given the risk profile and your other investment opportunities.

Would recommend using a metric that takes this into consideration such as [IRR](https://www.investopedia.com/terms/i/irr.asp#:~:text=The internal rate of return,particular project equal to zero.) instead of ROI when making investment decisions.

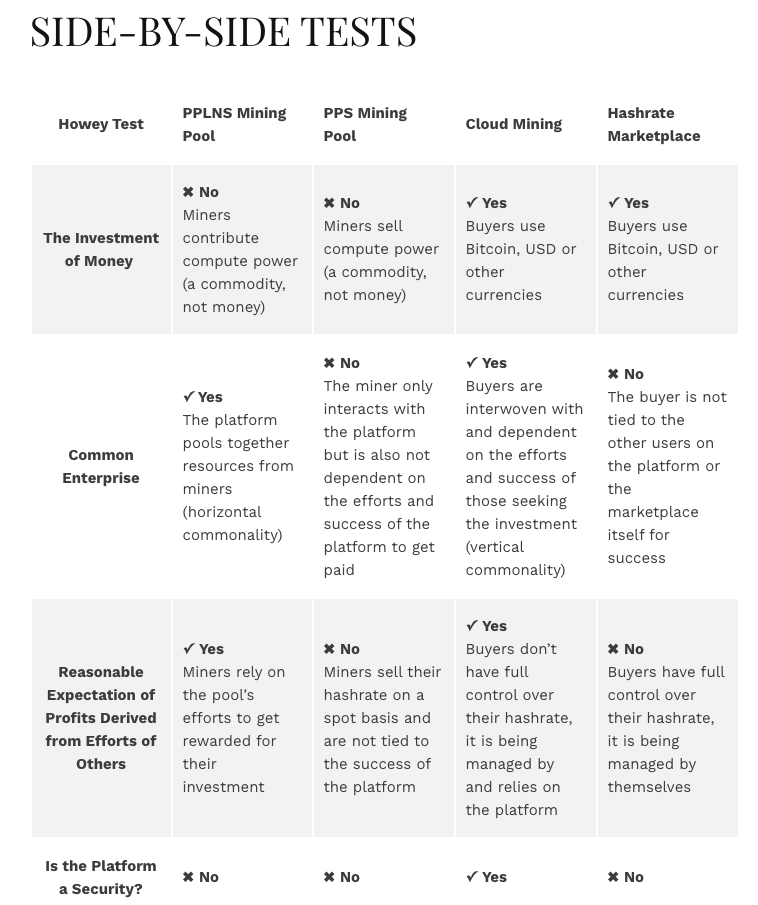

Difference from Hashrate Marketplaces

Often times Nicehash, a hashrate marketplace gets classified as a cloud mining company. However, there are a few clear distinctions between cloud mining and a hashrate marketplace.

Hardware Owners - Cloud mining companies own the hardware that is used to produce the hashrate sold on the platform. This is different than hashrate marketplaces where independent miners connect their hardware to the market.

Market Pricing - In cloud mining the platform sets the price and buyers must accept it or leave it. In the hashrate marketplace the price is set by the supply and demand of hashrate.

Buyer Freedom - On cloud mining platforms, often the buyer has limited or no ability to choose which coin they mine, which pool to use or generally which stratum enabled endpoint to send their hashrate. Hashrate marketplaces have complete flexibility for the buyer to use their acquired hashrate as they please.

Difference from Hashrate Futures & Forwards

In April 2020, Greenidge sold 30% of their hashrate to a buyer. This was a physically-delivered contract. At face value this might look like a cloud mining contract. However there are some clear distinctions.

Purchaser Type - The majority of buyers on cloud mining platforms are retail. This is different than hashrate forwards that are targeted at institutional investors such as hedgefunds or family offices. These investors typically can put more resources into making the investment decision.

OTC Pricing - Even though this contract was traded OTC there was still some better pricing mechanism than the seller of hashrate setting the price such as in cloud mining. There was an intermediary (BitOoda) that sat in between the two parties.

Legality of Cloud Mining

In America, the go-to test to determine if a transaction between a platform and a user qualifies as an investment contract (“Security”) is the Howey Test.

Under the Howey Test, a transaction is a security if:

- It is an investment of money, and;

- The investment of money is in a common enterprise, and;

- Reasonable expectation of profits derived from efforts of others

their present form cloud mining contracts are securities. Which means to operate in the US the platform needs to be properly licensed.

To my understanding in countries such as China & Russia there is no specific law against cloud mining.

Future of Cloud Mining

Personally I think that models that don’t target retail and have market pricing forces are better for the ecosystem. However, it is clear that cloud mining platforms have found a niche of easy UX that retail really enjoys (at first?) participating in.

Expecting these platforms to continue to grow in China, Russia & Ukraine. I also expect other platforms like hashrate marketplaces to grow in the North America.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.