2022’s Top Investment Bankers in Bitcoin Mining

With the wave of Bitcoin mining companies going public and a heavy lean to institutional capital, a series of Investment Bankers have planted their flags as the go-to deal men for companies trying to raise capital and do M&A. A handful of boutique investment banks, pushed their advantage of being more nimble than the bulge brackets and got into Bitcoin Mining first, developing an expertise and network that made it hard for even the biggest bankers in the world to compete with. Bitcoin miners value talking to a banker that has a fundamental understanding of the technical, economic and regulatory aspects of their industry, and can help craft a narrative to investors for an often misunderstood industry.

From strong M&A execution, to relentless capital raising these bankers have made a large impact on the industry and helped it grow. When a Bitcoin Mining company has a potential transaction to make, usually they call one of these bankers on the list:

- Adam Sullivan | XMS

He is the Managing Director at XMS Capital Partners, leading the digital investment section of their business. Adam brings a level of public/private sector buy-side experience that has enabled him to bring many of the largest Bitcoin mining deals to market. He is one of the key deal makers for M&A in the Bitcoin mining space. He holds a Financial Economics degree from University of Rochester.

Top Deals:

- Core Scientific $300 million go-public deal via XPDI Spac

- Riot purchase of Whinstone Mining for $651 million in value

- Argo purchase of Helios Texas hosting assets

- Riot $50 million purchase of ESS Metron

2. Christian Lopez | Cohen & Company

He is the Head of Blockchain and Digital Assets at Cohen & Company Capital Markets. Christian has 5+ years experience advising Fintech companies on merger and acquisitions. He brings a depth of knowledge advising Fintech clients on strategic transactions including new capital raises and has been part of some of the largest public offerings in Bitcoin mining. Christian holds an MBA from the Columbia School of Business.

Top Deals:

- Cipher mining $425 million go-public SPAC deal

- Primeblock $1.25 billion go-public SPAC deal

3. Ruben Sahakyan | Stifel GMP

He is a Director of Investment Banking at Stifel Financial Corp. Ruben has been the go to banker for Canadian Bitcoin miners raising capital and advised on a number of strategic transactions. He holds an Honors Bachelor of Commerce degree from the University of Toronto and is a CFA Chartholder.

Top Deals:

- Argo Blockchain sale of Helios site to Galaxy Digital

- Hut 8 Mining acquisition of TeraGo for $30 million

- Argo Blockchain IPO $112 million

- Voyager Digital private placement $146 million gross proceeds

4. Joe Nardini | B. Riley Securities

He is Senior Managing Director at B. Riley Securities. Joe brings over 20 years of investment banking experience. As Head of Cryptocurrency Investment banking, he advises Fintech growth companies on potential strategic or go-public opportunities. Joe and his team have been at the top of the charts for helping American Bitcoin mining companies raise capital. Joe holds an MBA from the American University.

Top Deals:

- Greenidge buy-side advisor merger with Support.com to go-public valued at $2.1 billion

- Greenidge Generation $55.2 million 8.50% Senior unsecured debt note raise

- Core Scientific $75 million debt offering

- Argo Blockchain $40 million 8.75% senior unsecured notes

5. Craig Schwabe | H.C. Wainwright

He is a Managing Director at H.C. Wainwright, who he has been helping lead into blockchain and Bitcoin mining for the past decade. He is another go-to for American mining companies looking to do capital raises and also has raised the most PIPE structures within the Bitcoin mining space.

Top Deals:

- Mawson Infrastructure $45 million go-public offering.

- Cleanspark US $500 million “At-the-market” equity facility

- Canaan US $750 million “At-the-market” equity facility

- Marathon Digital US $650 million 1% convertible note debt raise

6. Jason Partenza | Canaccord

Jason has 20+ years of experience advising leading growth companies and their investors on capital raising and strategic transactions. He has advised a number of Bitcoin mining companies on capital raises. Jason holds a Bachelor of Science in Finance from Georgetown University.

Top Deals:

- Iris Energy IPO funding deal worth $232 million

- Hut 8 private placement equity raise $173 million

- Argo Blockchain IPO funding deal worth $128 million

- Hive Blockchain $100 million “At-the-market” offering

Top Research Analysts Covering the Mining Space:

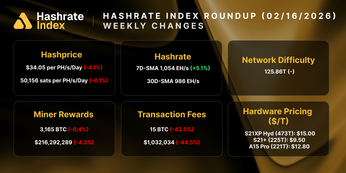

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.