Top Bitcoin Mining Investment Bankers of 2025

The top investment bankers who made deal flow possible.

In 2025, Bitcoin mining deal flow focused on balance sheets, asset consolidation, and compute-adjacent infrastructure rather than greenfield expansion. Riot’s Rockdale facility acquisition from Rhodium set the tone at the asset level, while miners such as CleanSpark, Cipher Mining, Hut 8, and Bitdeer repeatedly accessed convertibles, secured debt, and ATM equity to extend runway or fund power and AI/HPC optionality. Capital raise activity outweighed M&A as miners adapted to compressed margins and rising difficulty.

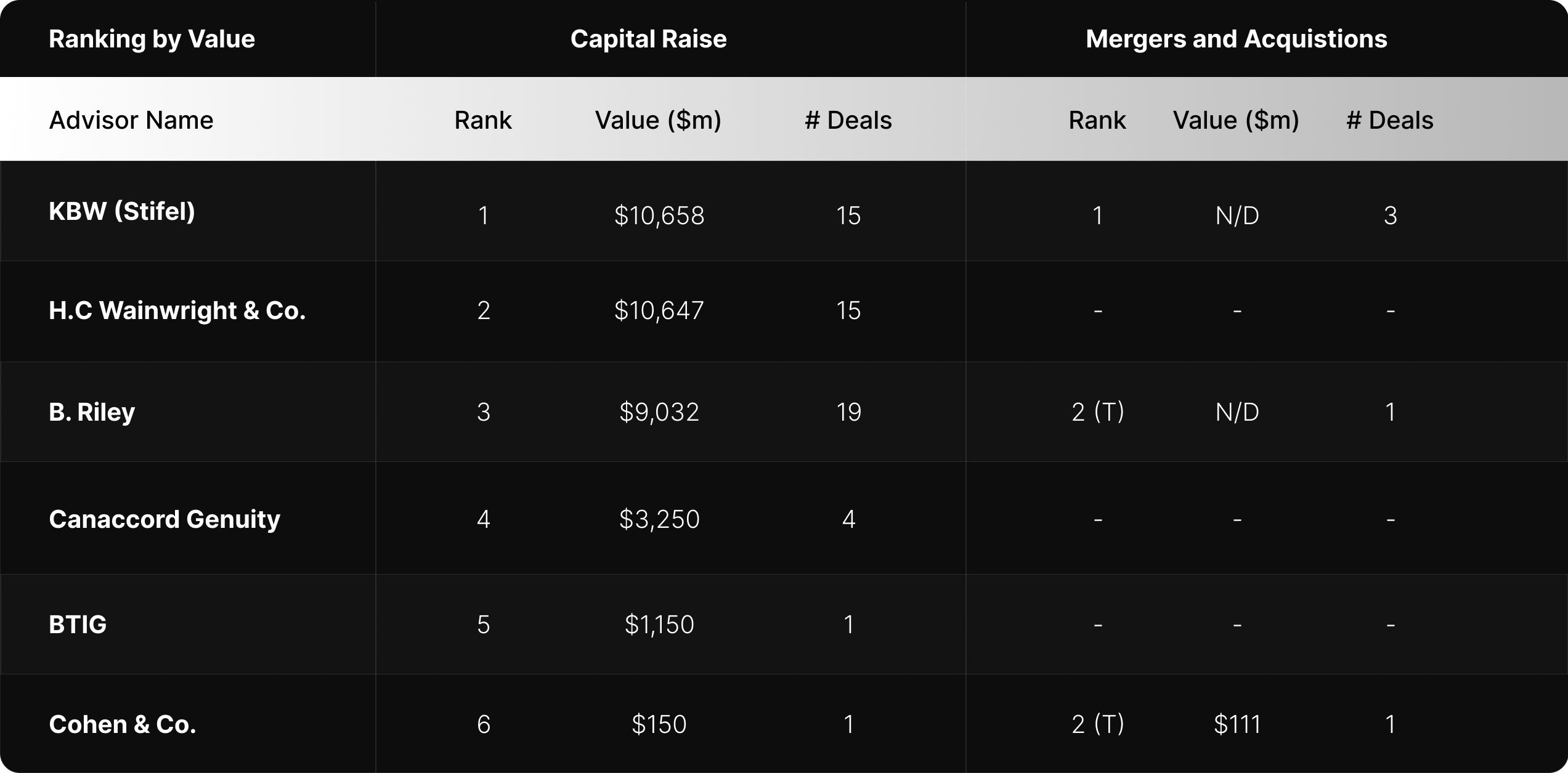

Advisory and underwriting leadership concentrated among a small group of banks. B. Riley and KBW (Stifel) stood out across IPOs, restructurings, and strategic infrastructure acquisitions, including Antalpha’s $49.3M IPO, WhiteFiber’s $183.3M IPO, HIVE’s $85M Yguazu acquisition, multiple Synteq data center transactions, and Argo’s NASDAQ relisting. H.C. Wainwright, Canaccord Genuity, and BTIG drove volume across convertibles and ATMs.

Details of 2025's bitcoin mining deals from the most active investment banks in the industry are shown below.

NB: Values shown reflect participation volume across syndicated transactions, where the same deal may be credited to multiple advisors based on role, and should not be interpreted as net capital raised or exclusive deal ownership.

Investment Banks - Deal Values for Bitcoin Mining Companies

Now, let's take a look at the people behind the deals. For the rest of this article, we recognize the leading investment bankers who helped broker some of the most significant investment banking activity in the Bitcoin mining space during 2025.

1. Ruben Sahakyan | KBW (Stifel)

Ruben Sahakyan is a Managing Director at KBW (Stifel), where he co-leads investment banking coverage across digital assets and infrastructure. Based in New York, he has been a key advisor to U.S. and Canadian Bitcoin miners on capital raises, M&A, and strategic transactions spanning mining, compute, and financial infrastructure. Ruben brings over 15 years of financial services and investment banking experience, with prior roles at TD Bank across risk and asset management. He holds a Bachelor of Commerce from the University of Toronto and is a CFA charterholder.

Deals in 2025:

- American Bitcoin's $2.1B At-The-Market (ATM) Equity Program

- Cipher Mining's $1.4B Senior Secured Notes (7.125%, due 2030)

- Galaxy Digital's $1.3B Exchangeable Senior Notes Offering

Historical Deals:

- Hut 8's acquisition of VPC power generation assets

- Riot Platform's $92.5 million acquisition of Block Mining Inc.

- Galaxy Digital's $402.5 million Exchangeable Senior Note

- Financial Advisor to Hut 8's $595 million merger with US Bitcoin and Validus Power asset purchase

- Riot Platforms $750 million at-the-market offering

- Hive Blockchain $100 million at-the-market offering

- Hive Blockchain amended $90 million at-the-market offering on Nasdaq

- Hive Blockchain $25 million bought deal warrant offering

- Financial Advisors to unsecured creditors in Core Scientific bankruptcy

- Argo Blockchain sale of Helios site to Galaxy Digital

- Hut 8 Mining acquisition of TeraGo for $30 million

- Argo Blockchain IPO for $112 million

- Voyager Digital private placement ($146 million gross proceeds)

2. Craig Schwabe | H.C. Wainwright

Craig Schwabe is a Managing Director at H.C. Wainwright, where he established and leads the firm’s Bitcoin mining and HPC investment banking practice. He has played a central role in building H.C. Wainwright into one of the most active banks in U.S. Bitcoin mining capital markets over the past decade. Schwabe is a primary advisor for American miners pursuing equity, convertible, ATM, and PIPE financings, with particular depth in structured PIPE transactions.

Deals in 2025:

- Bit Digital's $2.5B At-The-Market (ATM) Equity Program

- MARA Holding's $2.0B At-The-Market (ATM) Equity Program

- Soluna Holding's $87.7M At-The-Market (ATM) Equity Program

Historical Deals:

- Bitfarms $127 million at-the-market offering

- Argo Blockchain $6.5 million private placement offering

- CleanSpark $800 million at-the-market offering

- Bitfarms $375 million at-the-market offering

- MARA Holding $1.5 billion at-the-market offering

- CleanSpark $500 million at-the-market offering

- MARA Holding $750 million at-the-market offering

- Bitfarms $60 million private placement offering

- Stronghold Digital Mining $15 million at-the-market offering

- MARA Holding $14 million private placement offering

- Mawson Infrastructure follow-on offering for $5 million

- Advised Cleanspark on $33 million purchase of Mawson's Sanderville site

- Mawson Infrastructure $45 million go-public offering

- Cleanspark $500 million at-the-market equity facility

- Canaan $750 million at-the-market equity facility

- MARA Holding US $650 million 1% convertible note debt raise.

- Joe Nardini | B. Riley Securities

Joe Nardini is a Senior Managing Director at B. Riley Securities and serves as Head of Cryptocurrency Investment Banking. With over two decades of investment banking experience, he has been a leading advisor to U.S. Bitcoin mining and fintech companies across capital raises, strategic transactions, and go-public pathways. Under his leadership, B. Riley has consistently ranked among the most active banks in Bitcoin mining finance. Joe holds an MBA from American University.

Deals in 2025:

- Applied Digital's $2.35B Senior Secured Notes offering

- CleanSpark's $1.15B Convertible Notes offering

- WhiteFiber's $183.3M Initial Public Offering

- Antalpha's $49.3M Initial Public Offering

Historical Deals:

- Bit Digital $46 million acquisition of Enovum

- Terawulf $500 million convertible debt offering

- Core Scientific $400 million convertible debt offering

4. Jason Partenza | Canaccord Genuity

Jason Partenza has over 20 years of experience advising growth-stage and public companies on capital formation and strategic transactions. His work spans fintech, digital assets, internet, and software, with direct advisory experience supporting Bitcoin mining companies across equity, debt, and public market financings. Jason’s background covers M&A, IPOs, valuation, and capital markets execution, grounded in a long-standing focus on positioning companies for scalable growth. He holds a Bachelor of Science in Finance from Georgetown University.

Deals in 2025:

- Cipher Mining's $1.1B Convertible Notes offering

- IREN's $1.0B At-The-Market (ATM) Equity Program

- Galaxy Digital's $600M Upsized Common Stock Offering

Historical Deals:

- IREN $400 million convertible debt offering

- Core Scientific $550 million convertible debt offering

- Galaxy Digital $350 million convertible senior debt offering

- Hive Blockchain $25 million bought deal warrant offering

- Co-agent for Cipher mining's $250 million at-the-market offering

- Hut 8 $100 million at-the-market offering

- Hive Blockchain $90 million at-the-market offering

- Iris Energy IPO funding deal worth $232 million

5. Christian Lopez | Cohen & Company

Christian Lopez is Managing Director and Head of Blockchain and Digital Assets at Cohen & Company Capital Markets. He brings over six years of experience advising fintech and digital asset companies on M&A, capital raises, and public market transactions, including several of the largest Bitcoin mining offerings to date. His coverage spans blockchain infrastructure, DeFi, payments, and next-generation financial services, with a focus on complex strategic and capital markets advisory. Christian holds an MBA from Columbia Business School and a Bachelor of Science in Finance from the University of Illinois Urbana-Champaign.

Deals in 2025:

- Bitfarms' $111 million acquisition of Stronghold Digital

Historical Deals:

- Blockstream $210 million financing

- Peak Mining acquisition of 300 MW data center

Honorable Mentions

Finally, we'd also like to recognize the research analysts that have provided exemplary financial coverage of the Bitcoin mining industry this year. In no particular order, the table below showcases the top Bitcoin mining analysts for investment firms.

— Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.