The Bullish Case for Bitcoin Mining in Europe

Could rapidly growing renewable energy capacity make Europe a bitcoin mining haven?

Miners have been flocking to the Nordic outposts of Norway, Sweden, Iceland, and Finland while avoiding countries further south in Europe due to elevated electricity prices. Could the future of mining in Europe become more distributed across the continent?

I recently participated in a panel at BTC Prague, discussing European mining with Bob Burnett, Adam Back, and Fabian Weber. This conversation inspired me to write this article, which outlines a scenario in which bitcoin miners will thrive in continental Europe. Let's dive in.

Mining in Europe is infeasible due to elevated electricity prices

European countries like Germany, the Netherlands, France, and the United Kingdom are at the forefront of grassroots Bitcoin adoption. Still, there is barely any bitcoin mining capacity in these countries except for small home setups by hobbyists willing to altruistically run at a loss to secure the network.

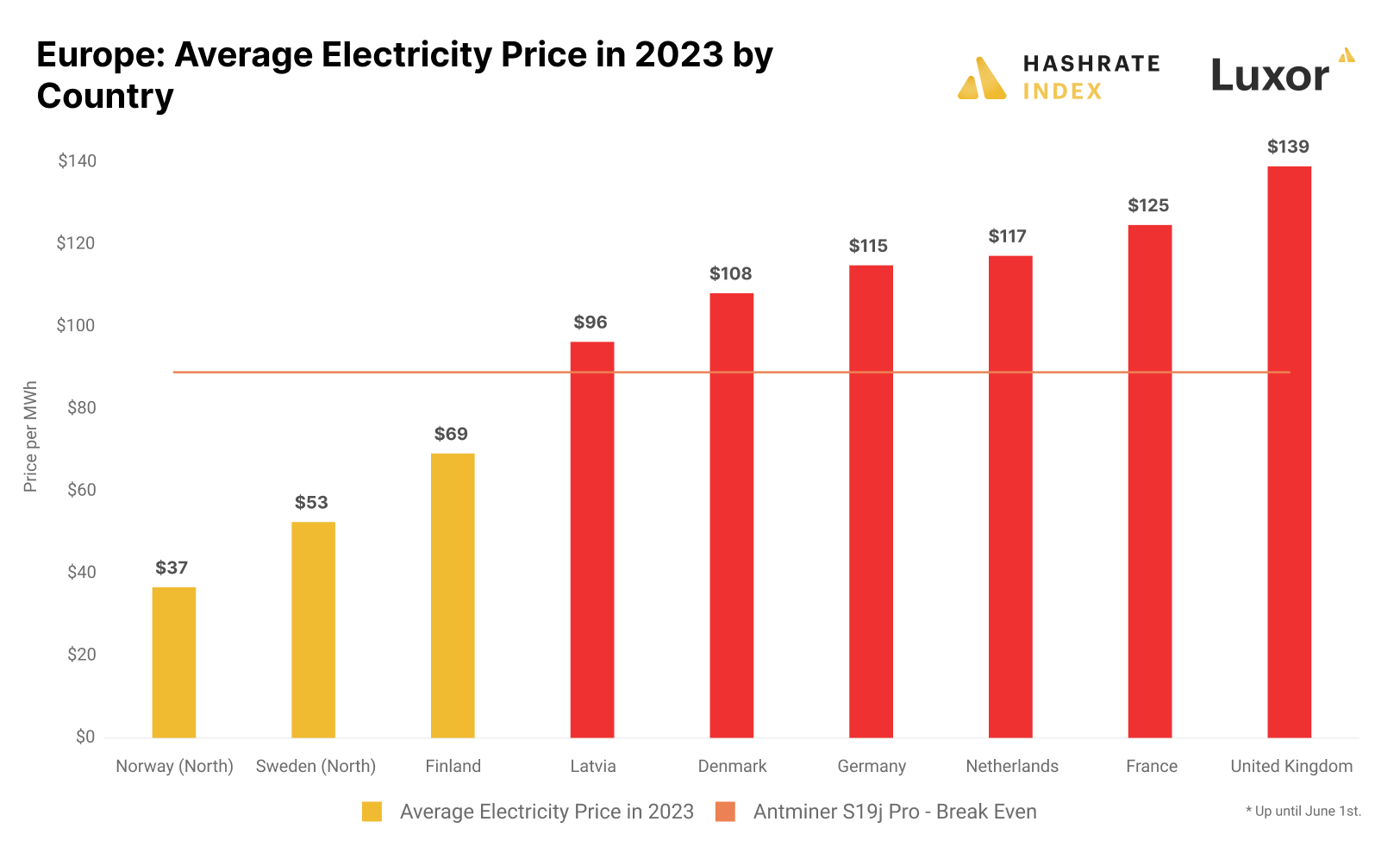

Elevated electricity prices, particularly since the energy crisis hit in late 2021, have made bitcoin mining infeasible on the continent. As you can see on the chart below, electricity prices in most European countries are far too high for profitable mining.

At the current hashprice, the Antminer S19j Pro has a break-even electricity price of $89 per MWh, considerably lower than the average 2023 prices in most European countries. As shown in the chart, the only countries in Europe with spot prices below this level are the Nordic countries.

Interestingly, before the energy crisis, there was some industrial mining going on in places like Latvia and the Netherlands, but these operations have since moved to greener pastures. Simultaneously, Europe has a huge investor demand for mining, with countless mining-as-a-service companies offering investors the opportunity to mine in far-away places like Paraguay and Russia. Still, many investors are willing to pay a premium to mine in the Nordics since they want to keep their assets in nearby jurisdictions.

Could we see a future where the undeniable European mining demand could be satisfied in-house by mining facilities operating on the continent? Let’s analyze.

Could the influx of wind and solar make European mining great again?

In the United States, particularly in Texas, we have seen tremendous mining capacity pop up in places with surplus wind and solar. Given the exceptional interruptibility of their load, miners in these places are able to arbitrage the electricity market, running at full throttle during times of surplus electricity production while turning off their machines during periods of electricity scarcity.

As most bitcoiners know thanks to their advanced understanding of electricity markets, wind and solar are uncontrollable energy sources that periodically will produce significantly more electricity than the market demands. During these hours, electricity prices can fall close to or even below zero. Thus, in volatile electricity markets with lots of wind and solar, miners can significantly lower their average electricity price by curtailing during the most expensive hours. If you want to learn more about the exceptional flexibility of mining, you can read my article in Bitcoin Magazine.

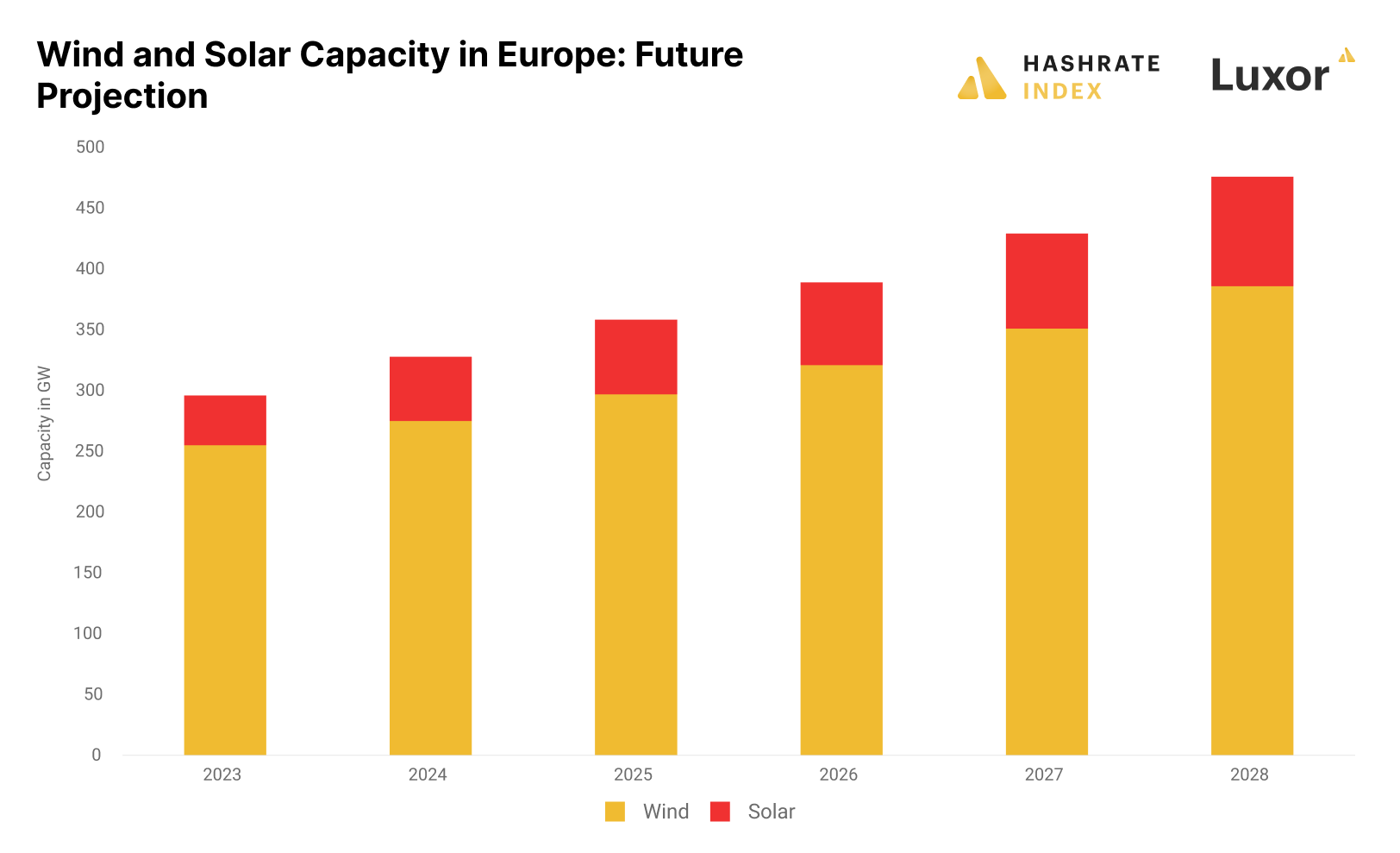

Similarly to Texas, Europe is heavily expanding its wind and solar capacity. The narrative among decision-makers on the continent seems to be that an aggressive buildout of these variable energy sources will make Europe independent of Russian natural gas. Huge wind and solar farms are being built all over the continent. At the same time, small solar installations on roofs are becoming increasingly common, with the EU even drafting a law to make it mandatory on all new buildings from 2029.

The total European wind and solar capacity is expected to grow by 180 GW by 2028. This explosive growth of variable renewable energy sources will likely significantly increase the electricity price volatility in the European electricity market. Having a recent case study from Texas, we know that electricity prices could get exceptionally low during times of high wind and solar production, particularly when coupled with low demand.

This has already started happening in Europe. In May, Europeans witnessed several negatively-priced hours all over the continent, culminating when the Dutch were paid a whopping €740 per MWh to consume electricity. These negative prices were caused by an enormous amount of excess wind and solar production in the Netherlands and neighboring countries.

I expect the frequency of hours with depressed electricity prices to gradually increase in Europe over the next few years as the continent adds more wind and solar. Prices would likely become depressed during times of low demand or high supply, like the weekends and nights, particularly during the summer. Still, Europe will likely continue to see explosive electricity prices during the winter when heating demand is high and solar production low.

In addition, the need for flexible consumers to participate in Europe’s various demand response markets is expected to increase significantly in the coming years. Just like in Texas, European miners will likely be able to considerably lower their effective electricity prices by participating in demand response programs. We already see Nordic miners like Hive Blockchain becoming valuable providers of demand flexibility, and this could become a reality further south in Europe as well.

Still, while the electricity price distribution in Texas is very low for most of the time, prices in Europe are currently very elevated during the majority of hours. Power prices close to zero are nice, but not if a miner can only run 10% of the time. The high capital expenditure of mining infrastructure requires a certain up-time to yield an acceptable return on investment, usually at least 80%, depending on the electricity price. Currently, even with the increasing prevalence of negatively-priced hours, my guesstimate is that European miners will not be able to run their machines profitably for more than 20-30% of the time.

Therefore, for mining to become viable in Europe, the prevalence of hours priced below the breakeven of the Antminer S19j Pro of $90 per MWh must increase considerably so the uptime can increase. In addition, mining equipment must become cheaper to justify a lower uptime. If both these factors play out, we could see some industrial mining facilities pop up in countries like the Netherlands or Germany.

Conclusion

This article outlined a bullish scenario for bitcoin mining in Europe driven by a vast increase in electricity price volatility due to the massive growth of variable renewable energy capacity. Remember that this is merely one of several scenarios for European mining. In the worst case, politicians could ban mining as a scapegoat for the electricity crisis. Then miners will also have to leave Norway, Sweden, Iceland, and Finland, and there will be no mining in Europe.

Such a depressing scenario would have disastrous consequences not only for the miners but also for the European electricity grid. The future grid of Europe, consisting of a large share of variable renewable energy, will require tremendous growth in demand flexibility. Miners can provide this flexibility to the system, sparing ordinary household consumers from running around like headless chickens, timing their laundry to get the best possible electricity price. In addition, by adding miners as consumers of last resort, owners of renewable energy plants could more easily pay down their capital expenditures, relying less on government subsidies.

The actual outcome will likely lie somewhere in the middle between the positive scenario I outlined in this article and the depressing one I just mentioned. The mining industry will likely continue to thrive in the Nordics while being of a more humble size further south in Europe. But remember, I can’t predict the future, so only time will tell what happens.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.