Share dilution in public bitcoin mining companies – a necessary evil?

Public bitcoin mining companies have tended to fund growth through considerable equity raises, which dilutes existing shareholders. This blog post discusses the impacts of dilution and reveals which public miners have diluted their shareholders the most recently.

The public bitcoin mining companies are not letting the bear market get in their way of expanding operations, adding hashrate like never before. This rapid growth requires these companies to undertake massive investments that must be financed either by:

1) Operating cash flows

2) Debt raises

3) Equity raises

As explained in this article, each means of financing has its pros and cons. Financing operations by operating cash flows alone is only realistic for mature companies with strong cash flows and low growth. Growth companies, particularly capital-intensive bitcoin miners, must make enormous investments that cannot be funded by operating cash flows alone. In addition, most public mining companies aim to hodl as much of their bitcoin production as possible, lowering the viability of funding expansion by operating cash flows.

The fast-growing public bitcoin mining companies must therefore raise external capital to fund growth. They can then choose between raising equity or debt. A company raises equity by issuing new shares, reducing the existing shareholders’ percentage ownership in the company. This phenomenon is called dilution and is the disadvantage of raising equity.

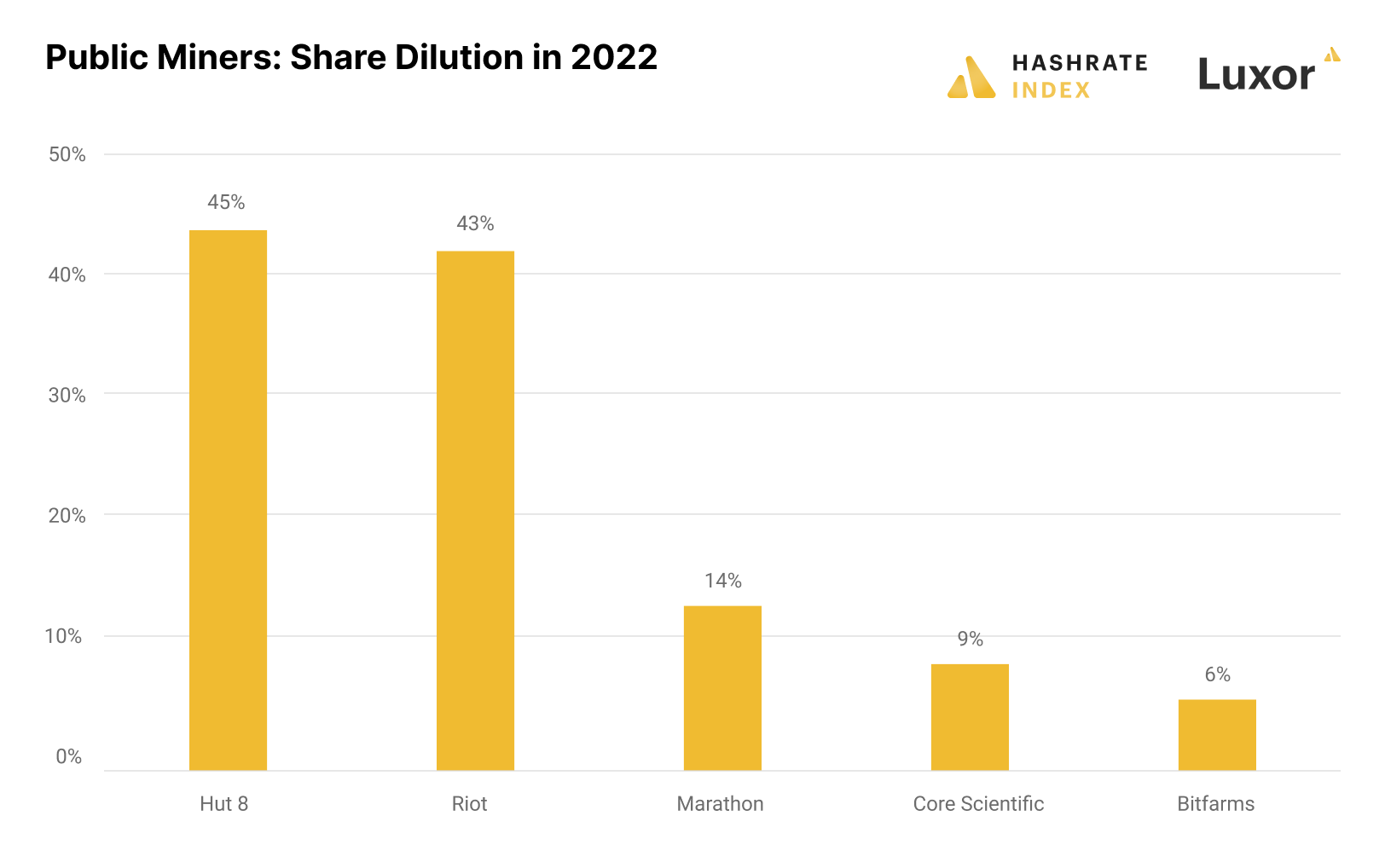

Which public bitcoin miners have diluted their shareholders the most recently?

The chart below shows the share dilution in 2022 of the top five public miners by market cap. Share dilution is the percentage increase in outstanding shares over the period. Investors in Hut 8 have experienced the most dilution, seeing their ownership stake decline by 45% in 2022 alone.

Hut 8 employs a 100% hodl treasury strategy and hasn’t sold a single bitcoin since its inception. The company’s reluctance to sell bitcoin has made them dependent on raising equity and debt to fund hashrate expansion and pay operating expenses like energy. As recently as August, Hut 8 launched an at-the-market (ATM) equity program allowing the company to sell up to $200 million worth of shares. With a market cap of only $377 million, all this dry powder for share printing means that further dilution may be coming.

Riot is second on the list, diluting its shareholders by 43% in 2022. Similarly to Hut 8, Riot aims to hodl as much of its bitcoin production as possible but is a bit more flexible in its treasury strategy as it sells some bitcoin occasionally. Riot launched a $500 million ATM equity program this spring and has since increased its outstanding shares from 117 million to 148 million. This funding has been vital for Riot as it faces enormous investment needs as it finalizes its 700 MW Whinstone facility and is in the early stages of developing its 1 GW Corsicana facility.

The companies diluting their shareholders the least in 2022 are Core Scientific and Bitfarms. While Hut 8 and Riot have historically favored equity over debt, Core Scientific and Bitfarms have mostly taken the debt route.

The only alternative to dilution is taking on debt

A company can either raise equity or debt, and there is a tradeoff between the two. The disadvantage of raising equity is that it dilutes existing shareholders, while the advantage is that equity is a lower-risk form of capital than debt. Public mining companies employ different financing strategies. Some prefer to raise debt to avoid share dilution, while others accept dilution as a tradeoff for acquiring lower-risk equity.

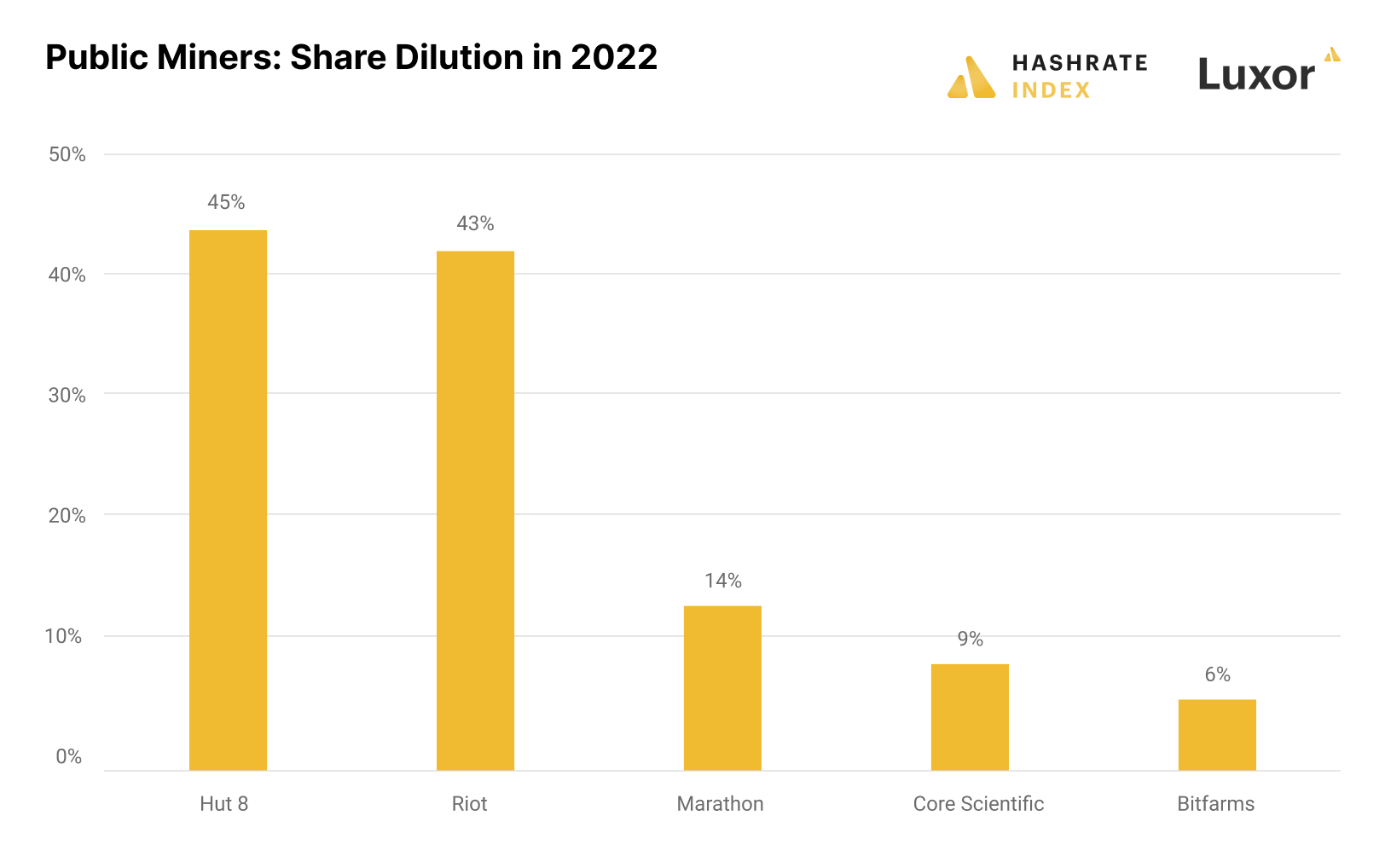

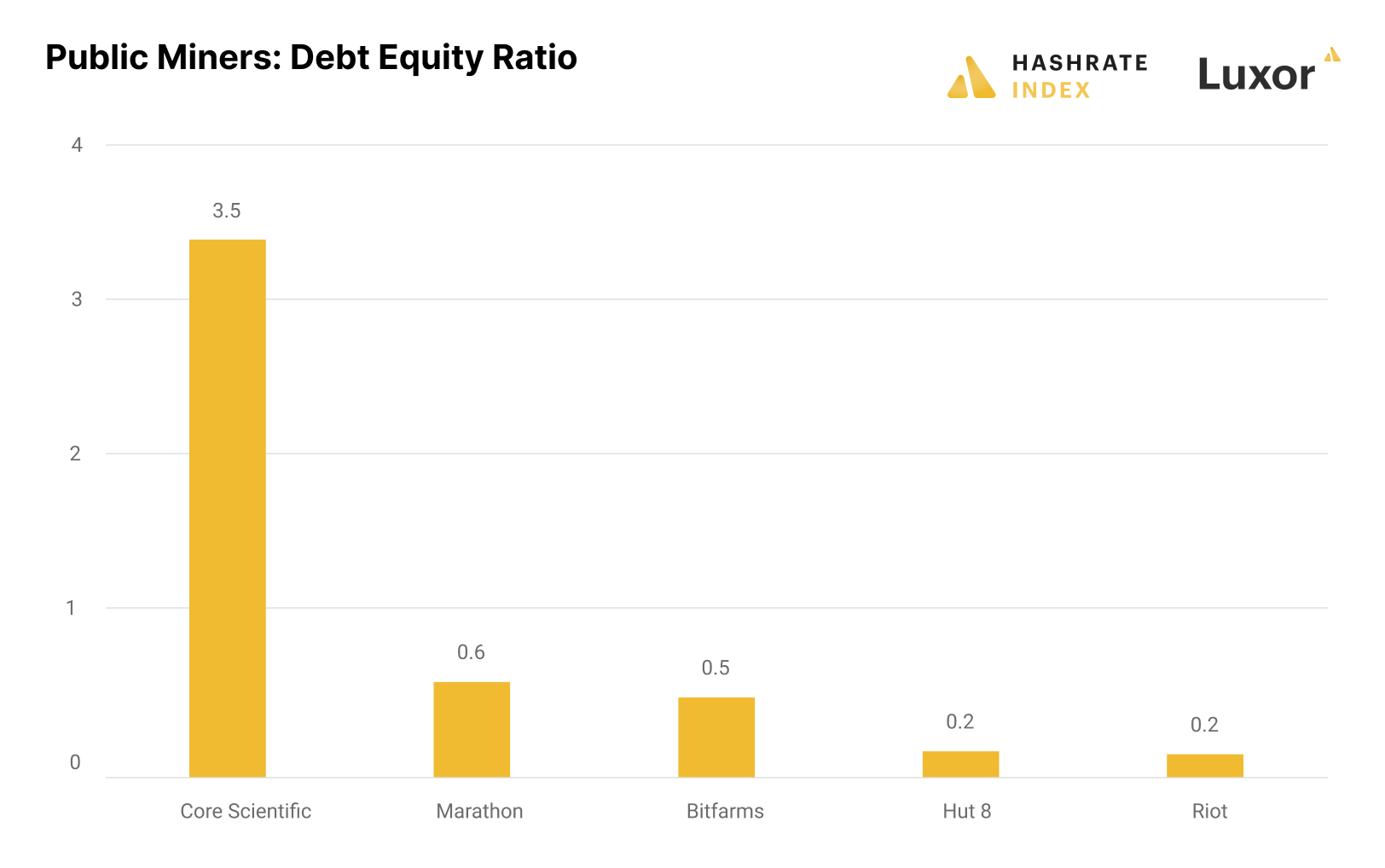

The chart below shows the debt-to-equity ratios of the five biggest public mining companies by market cap. Comparing this chart with the share dilution chart, we notice a strong inverse relationship between a company’s debt-to-equity ratio and its share dilution.

Hut 8 and Riot have very little debt since they have mainly financed their operations with equity, giving them strong balance sheets. Should Hut 8 and Riot need additional financing, they would most likely be able to leverage their strong balance sheets with some debt to avoid further diluting shareholders.

On the other hand, Core Scientific took on enormous amounts of debt during the bull market when the market value of its equity was multiples higher. As its equity value has evaporated in 2022, its debt-to-equity ratio has gone through the roof. The company’s high debt-to-equity ratio means it will likely need to raise significant amounts of equity and start diluting shareholders.

As explained, taking on debt is risky, particularly during a bear market. In addition, as the previous months have shown us, bitcoin mining is an exceptionally volatile industry where market conditions can turn on a dime. In such industries, debt should generally be kept at a low level, forcing investors to be more acceptive of dilution.

Conclusion

Public bitcoin mining companies are expanding like never before. These expansion efforts require significant external capital that can come in the form of equity or debt. Equity is a lower risk means of financing than debt but comes with the disadvantage of diluting shareholders.

Even though raising equity during a bear market at rock-bottom valuations dilutes shareholders, most public miners are doing precisely that. This is mainly caused by them trying to avoid precarious debt during the bear market.

While many investors don’t like the thought of dilution, it’s essential to be aware that not raising equity is, in most cases, worse than the alternative. Without external funding, the public miners will be unable to fulfill their expansion plans. Cash is king during a bear market, and the miners with the best access to capital will thrive. Due to the low-risk nature of equity, investors should appreciate these companies raising equity during this bear market, even when it comes at the expense of diluting shareholders.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.