How hedging strategies can help Bitcoin miners lower their cost of capital

Bitcoin miners can hedge their cash flow risks and lower their capital costs with mining derivatives.

Bitcoin mining is a capital-intensive business where having access to low-cost capital is critical for the success of an operation. Unfortunately, bitcoin miners’ cost of capital is significantly higher than that of companies from comparable sectors. This high cost of capital limits miners’ growth prospects and eats into their net incomes.

Luckily, not all hope is lost for capital-hungry bitcoin miners. This article analyzes the high cost of capital in the bitcoin mining industry and explains how cash flow hedging with derivatives can open up new capital-raising opportunities for these companies.

The cost of capital is exceptionally high in the bitcoin mining industry

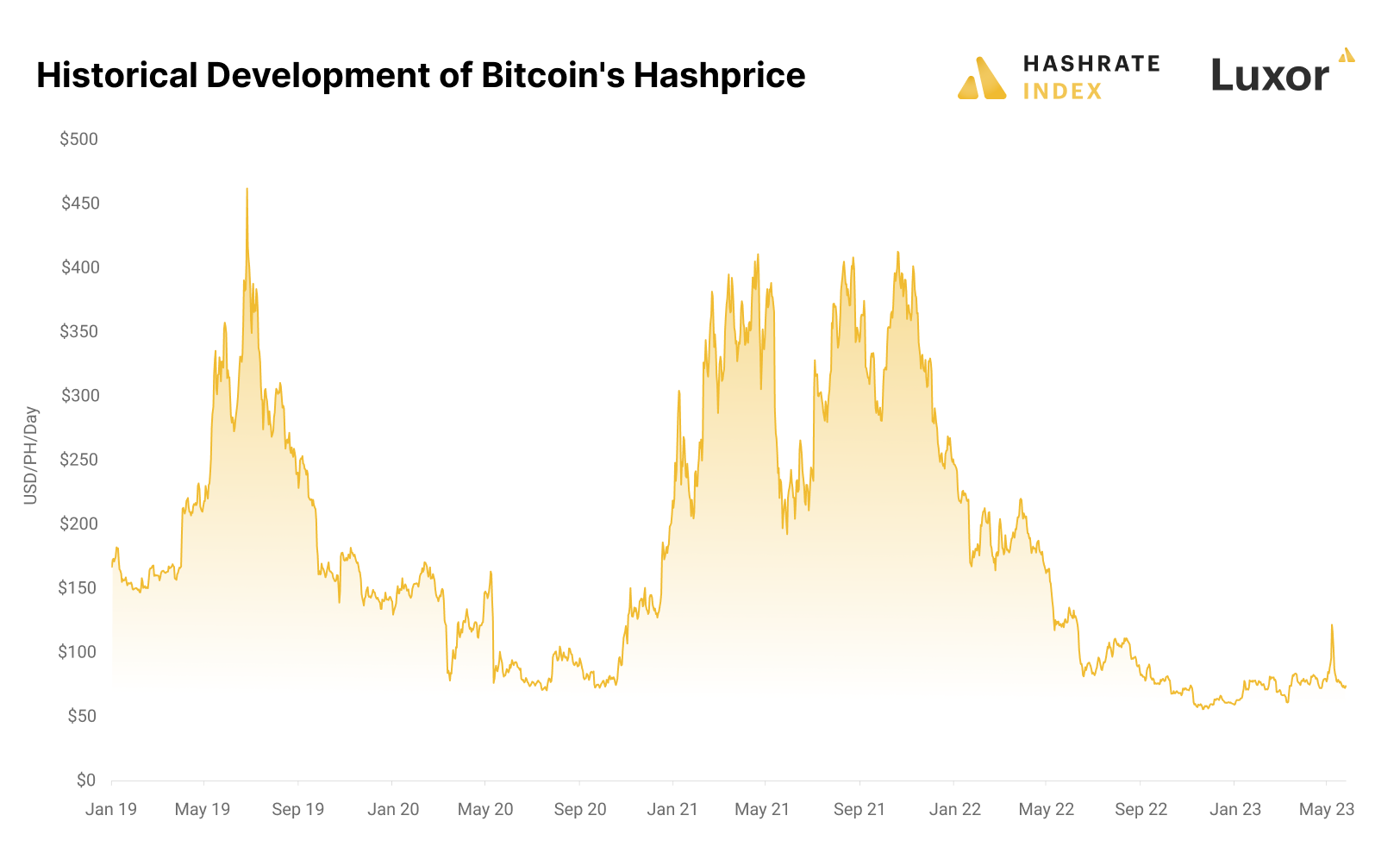

Bitcoin miners have struggled under a high cost of capital regime since the inception of the industry. Let’s compare the cost of capital in the bitcoin mining industry with that of similar industries. As you can see in the chart below, bitcoin miners have significantly higher costs of both equity and debt than companies in more mature commodity industries like precious metals, power, and oil & gas production.

For example, bitcoin miners' 21% cost of equity is almost twice as high as the average in the precious metals sector. Equity investors are plowing money into physical gold production while avoiding digital gold producers like the plague.

Debt investors are also highly reluctant to invest in bitcoin mining companies. If miners can get ahold of any debt at all, it will likely be an ASIC-backed loan at a predatory interest rate between 9% and 15%, corresponding to an average interest rate of 12%. Meanwhile, gold producers can get similar equipment-backed loans at around 7% interest rates.

The high cost of capital has severely negative effects on bitcoin mining companies

The high cost of capital has two main negative effects on bitcoin mining companies. Firstly, by limiting the amount of capital raised, the high cost of capital prevents miners from reaching their full growth potential. I have met many great operators who struggle to scale their operations because they cannot raise sufficient capital.

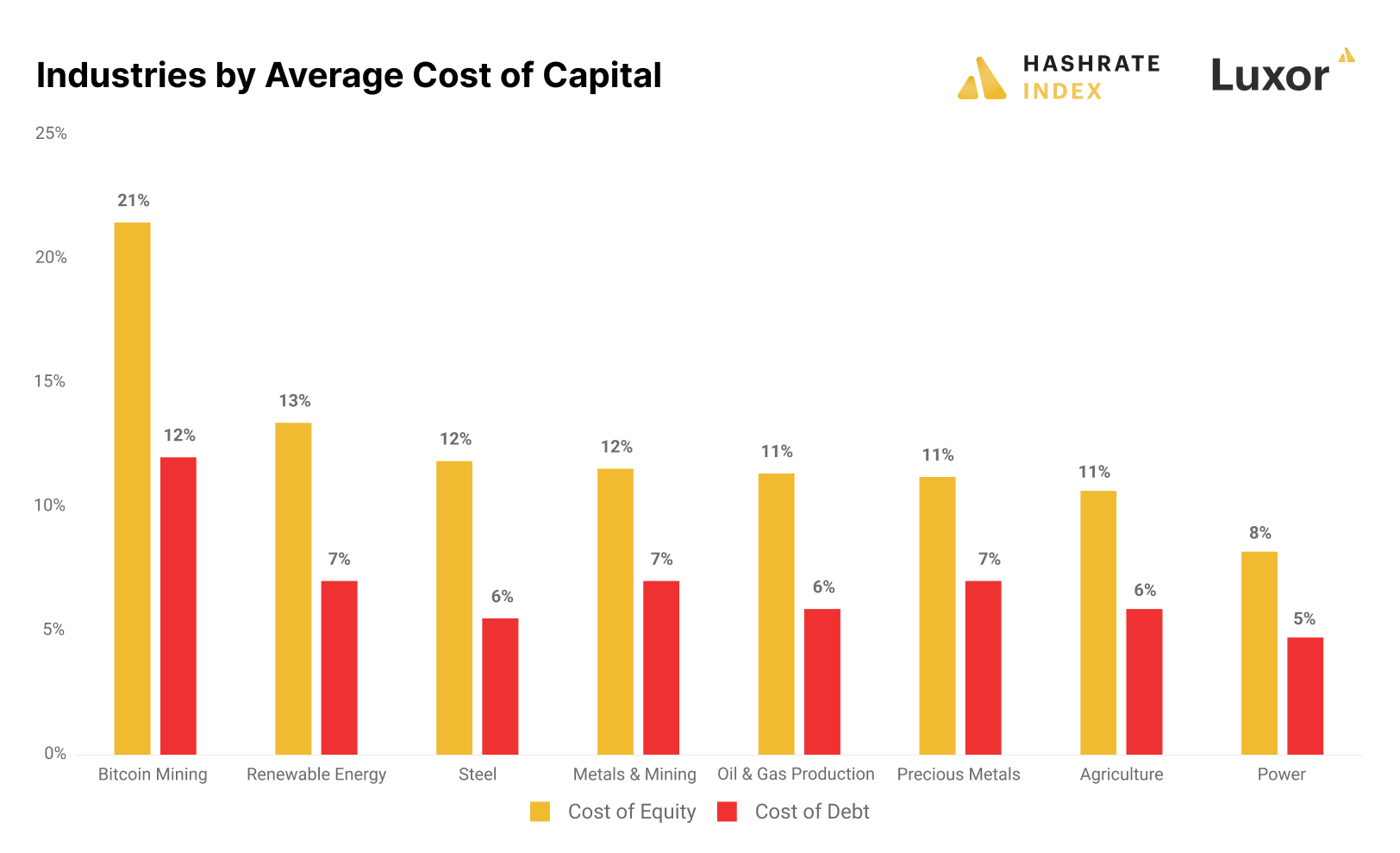

The severity of this problem becomes obvious when looking at the numbers. Public miners raised $1.7 billion in 2022, comprising $1.2 billion of equity and $440 million of debt. Assuming bitcoin miners had a similarly low cost of capital as gold miners, they should have been able to raise an additional $1.5 billion, almost twice as much. This massive additional capital would have given the miners a vital boost to get through the bear market.

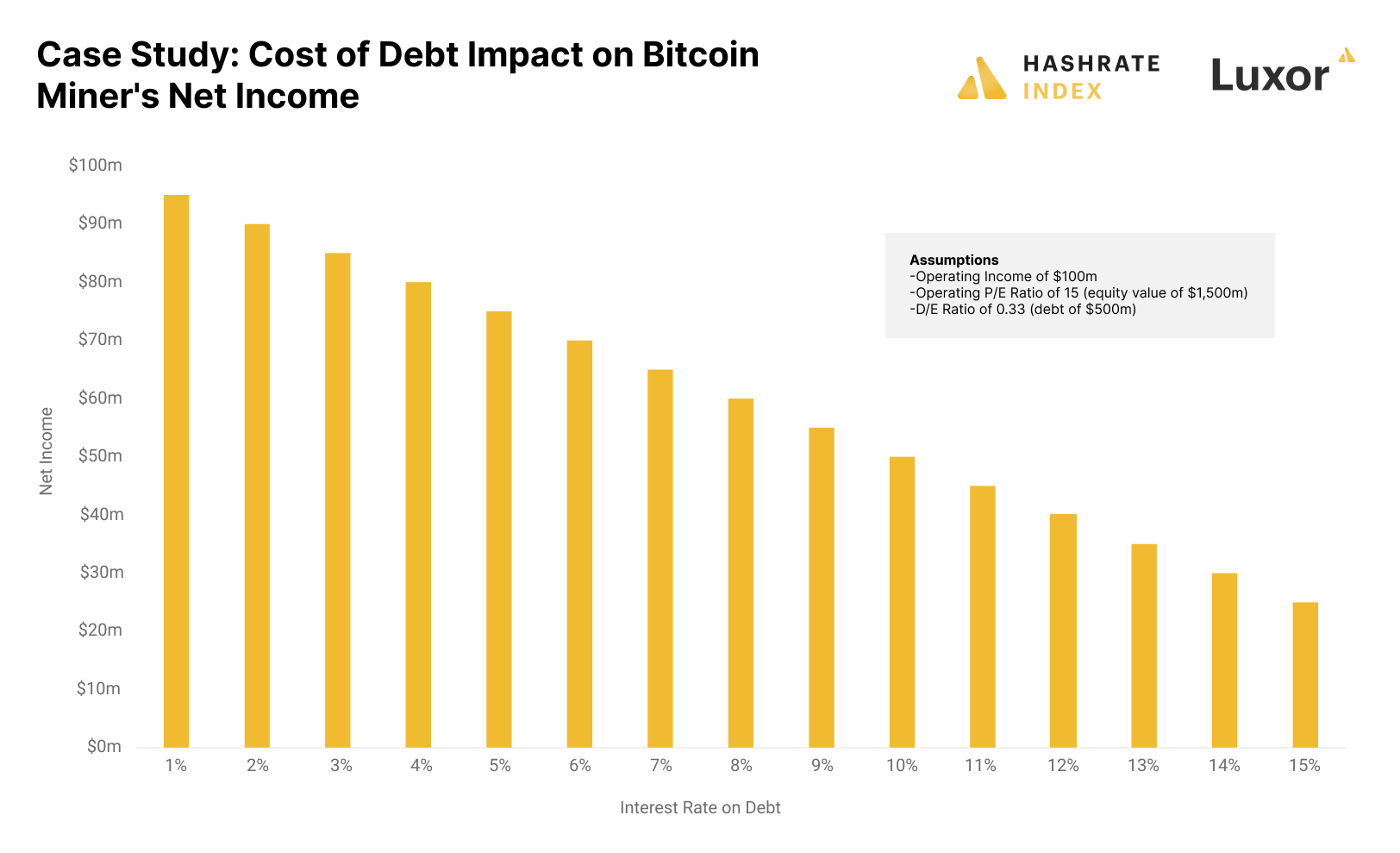

The second problem of the bitcoin miners’ high cost of capital is that their predatory interest rate payments eat up large portions of their net income. Shareholders are thus losing out massively by paying such high interest rates.

The chart above shows the interest rate’s impact on the net income. Shareholders in a mining company with a typical balance sheet and a $100 million operating income paying a 12% interest rate on its debt would only be left with $40 million after interest payments. Comparatively, if the bitcoin miner paid a similar interest rate as gold miners of 7%, its net income would have been $65 million. Thus, the bitcoin mining company’s shareholders are losing $25 million annually, or 63% of the entire operating income, by paying this higher interest rate.

To summarize, the high cost of capital in the bitcoin mining industry limits miners’ ability to expand and optimize their operations and reduce their net incomes.

Why is the cost of capital so high in the bitcoin mining sector?

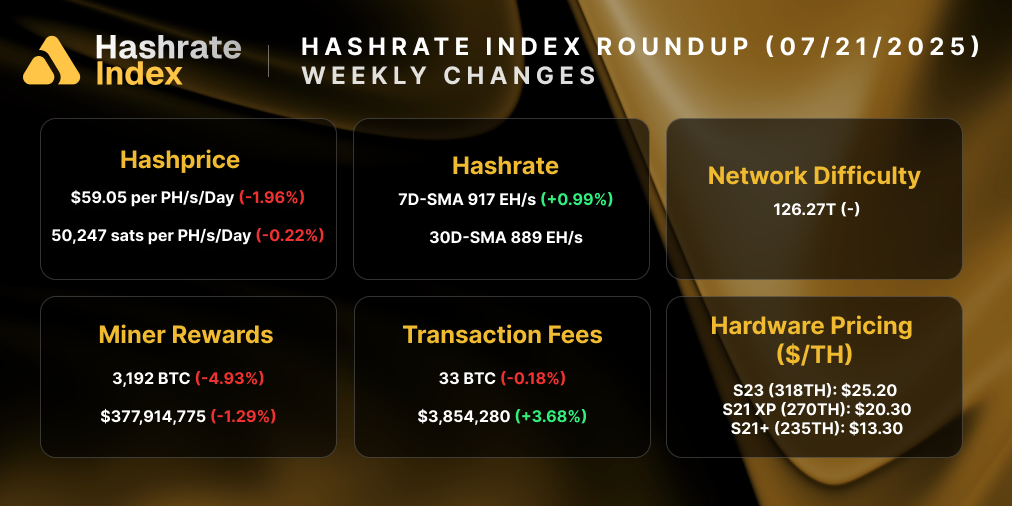

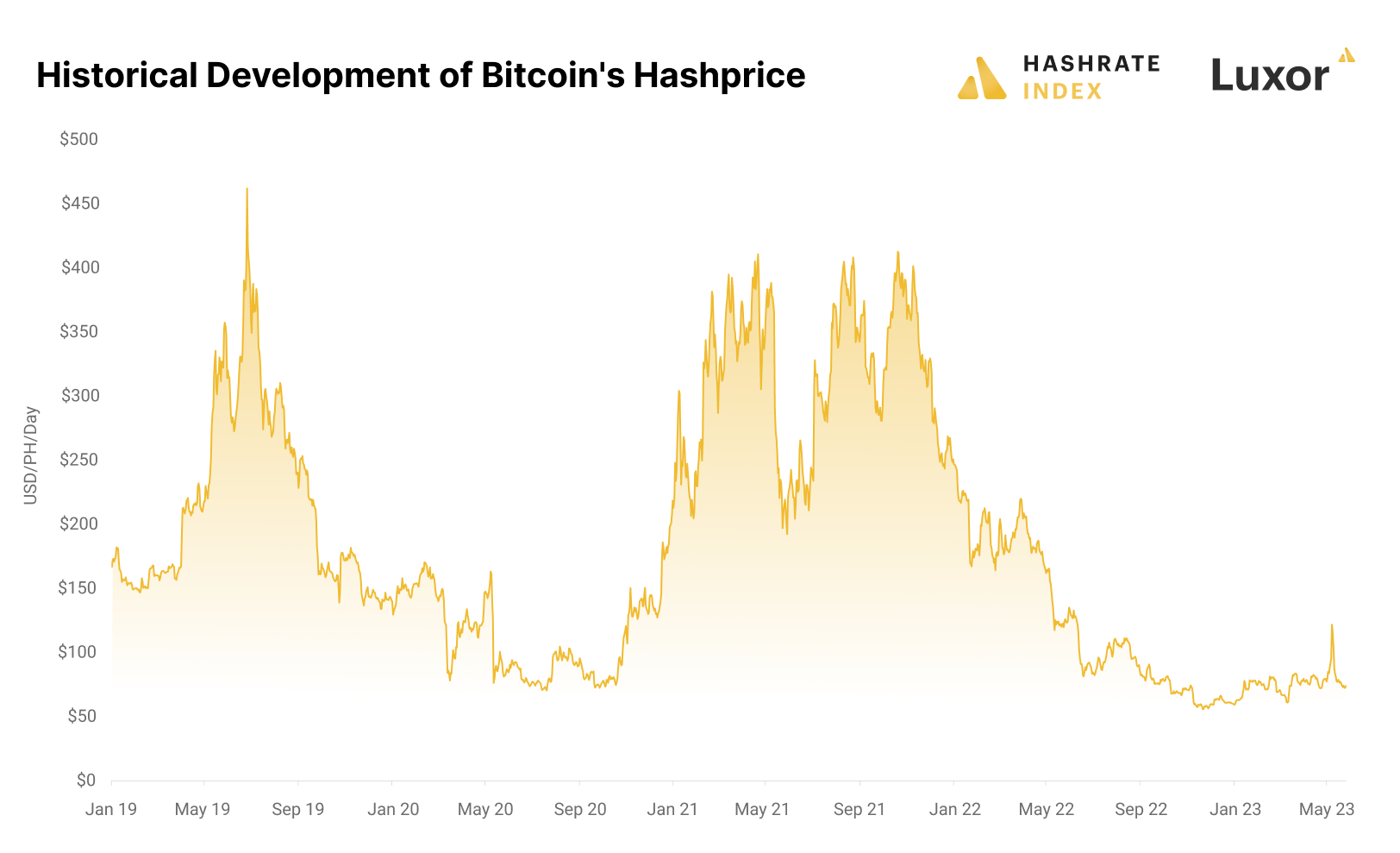

The primary reason the cost of capital is so high in the bitcoin mining sector is elevated cash flow uncertainty caused primarily by fluctuations in revenues. The hashprice is the daily expected revenue per PH of mining capacity, and it has tended to be highly volatile, wildly fluctuating with changes in the bitcoin price, mining difficulty, transaction fees, and block rewards.

Historically, the bitcoin price and mining difficulty have been the most significant sources of hashprice volatility, but we have recently seen examples of extreme fluctuations in hashprice due to unpredictable changes in the transaction fees.

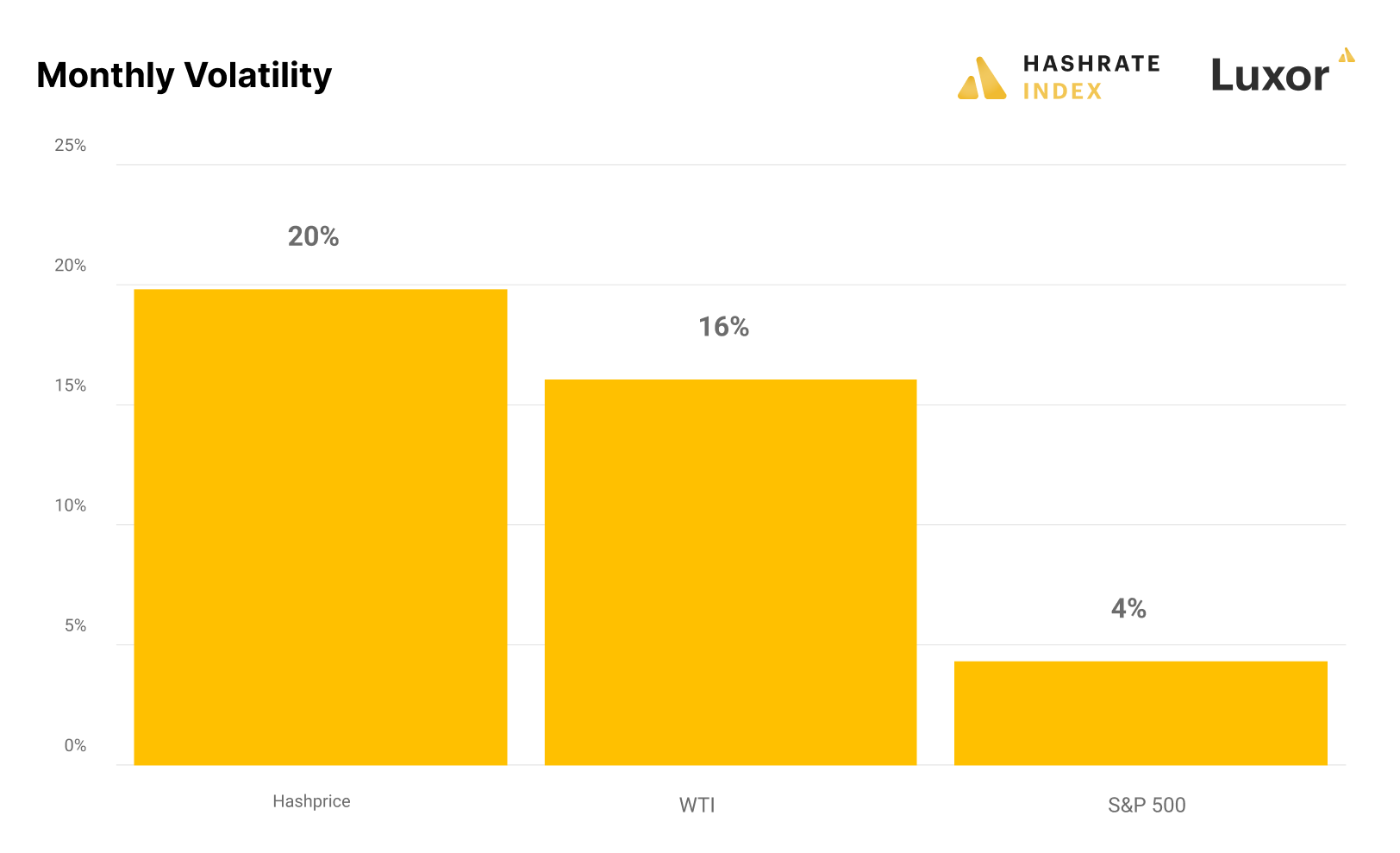

As you can see on the chart above, the hashprice has fluctuated between $56 and $462 per PH during the period since January 2019. These fluctuations correspond to an elevated monthly volatility of 20%, compared to 16% for the oil price and only 4% for the S&P 500.

This elevated revenue volatility in bitcoin mining is the core reason investors shy away from the industry. Risk-averse investors prefer to allocate their capital to businesses where it is possible to project future cash flows with at least a little bit of certainty. Unhedged bitcoin miners have not been able to make such projections and thus struggled to raise debt and equity.

Hedging with derivatives can lower miners’ cost of capital

We just explained that the enormous cash flow risk has been bitcoin mining companies’ biggest barrier to attracting investors. Luckily, there is a way for them to reduce this cash flow risk and become more attractive to investors.

Bitcoin miners have a lot to learn in terms of risk management from companies in more mature commodity industries like oil and gas, precious metals, and farming. Most companies in these industries use derivatives to hedge cash flows, allowing them to operate with more certainty and ultimately achieve a lower cost of capital. Most important is the hedging of revenues, as it makes up the most significant part of cash flow volatility. Commodity producers generally hedge their revenues by utilizing derivatives products like futures and forwards.

Numerous academic studies are confirming the negative relationship between companies’ usage of derivatives for hedging and their costs of capital. For example, one study found that companies hedging with derivatives achieved an average of 109 basis point reduction in the industry-adjusted cost of equity than their non-derivative using competitors.

Even more interestingly, the same study, along with another study, also found the reduction in the cost of capital to be the largest for smaller firms. This is promising for bitcoin mining firms, which all are relatively small in the grand scheme of things.

So, according to both logic and several studies, bitcoin miners would be able to significantly lower their cost of capital by hedging revenues using derivatives.

Specifically, miners can hedge their revenues using Luxor’s Hashprice Forward contract. By selling this contract, miners can lock in the value of their hashrate for a set duration, and thus dramatically reduce their cash flow risk. With the resulting lower cash flow variability, miners can better manage internal financial operations and raise funds in the capital markets with a lower cost of capital.

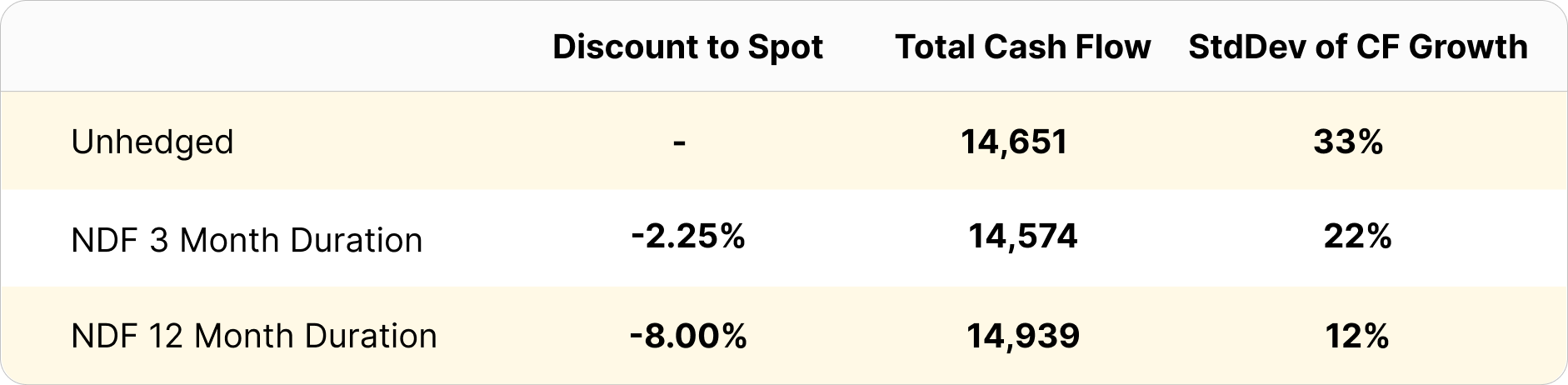

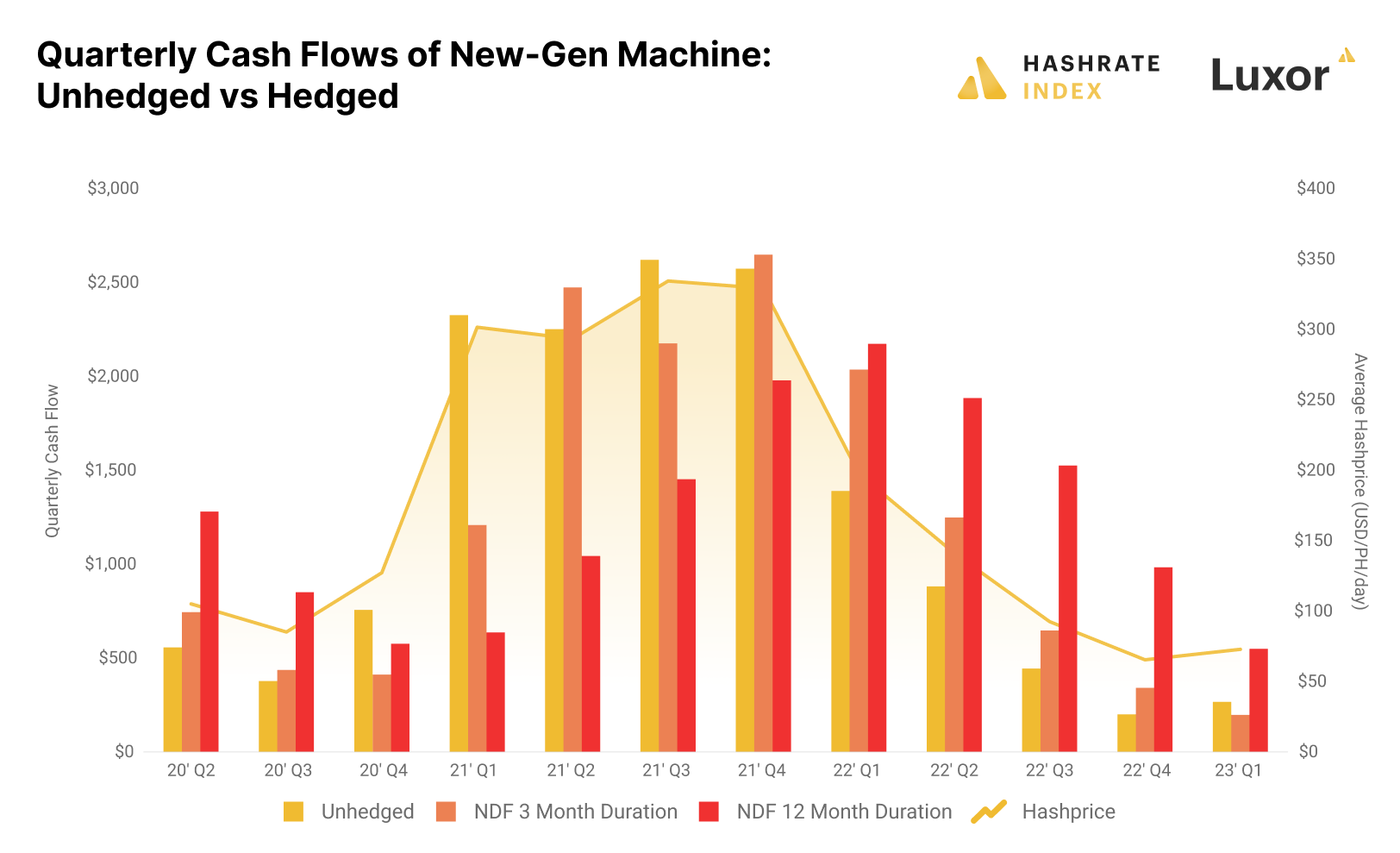

Let’s look at how usage of this derivatives product reduces the volatility of mining cash flows. In our case study below, we compare the cash flows of an unhedged miner with those of miners hedging revenues using 3 and 12-month durations of Luxor’s Hashprice Forward contract. The case study assumes that the miners used a single new-gen machine with $0.06/kWh power over the previous 12 quarters.

As you can see in the table above, the cumulative cash flow was nearly the same in all scenarios; however, cash flow volatility decreased significantly as longer-duration contracts were utilized. We see that a miner hedging using the 12-month contract achieved a 64% reduction in cash flow volatility over the 3-year period. This is massive.

On the chart above, the unhedged miners are directly receiving the hashprice as their daily revenue, while hedged miners are able to lock in hashprice using different durations of Luxor’s Hashprice Forward contract. As you can see on the chart, miners locking in future revenues are exposed to significantly lower cash flow volatility.

The increased cash flow predictability achieved by utilizing Luxor’s Hashprice Forward contract should make equity investors and lenders more certain of the long-term viability of a mining operation, ultimately lowering the operation’s cost of capital.

Therefore, we encourage miners to consider hedging their revenues using this derivatives instrument. The Luxor's derivatives team is always ready to onboarded new miners.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.