Scaling Hashrate Simplified: The Mining Model That Delivered for BitMine

Understand how to leverage predictable Bitcoin mining solutions through BitMine’s partnership with Soluna and Luxor.

Introduction

BitMine Immersion Technologies (OTCQX: BMNR), a growing player in the Bitcoin mining industry, faced a very common industry opportunity & challenge: how to bring hashrate online in the best way possible. The complexities of sourcing energy, power infrastructure, site development, running operations, ASIC procurement, software optimization, and hashrate management require a holistic approach and entail many operational risks.

An experienced capital allocator, BitMine was familiar with these risks owing to deep experience in similar markets prior to founding the company. However, they were open to support. Enter Soluna and Luxor, two industry leaders partnering to provide a complementary solution.

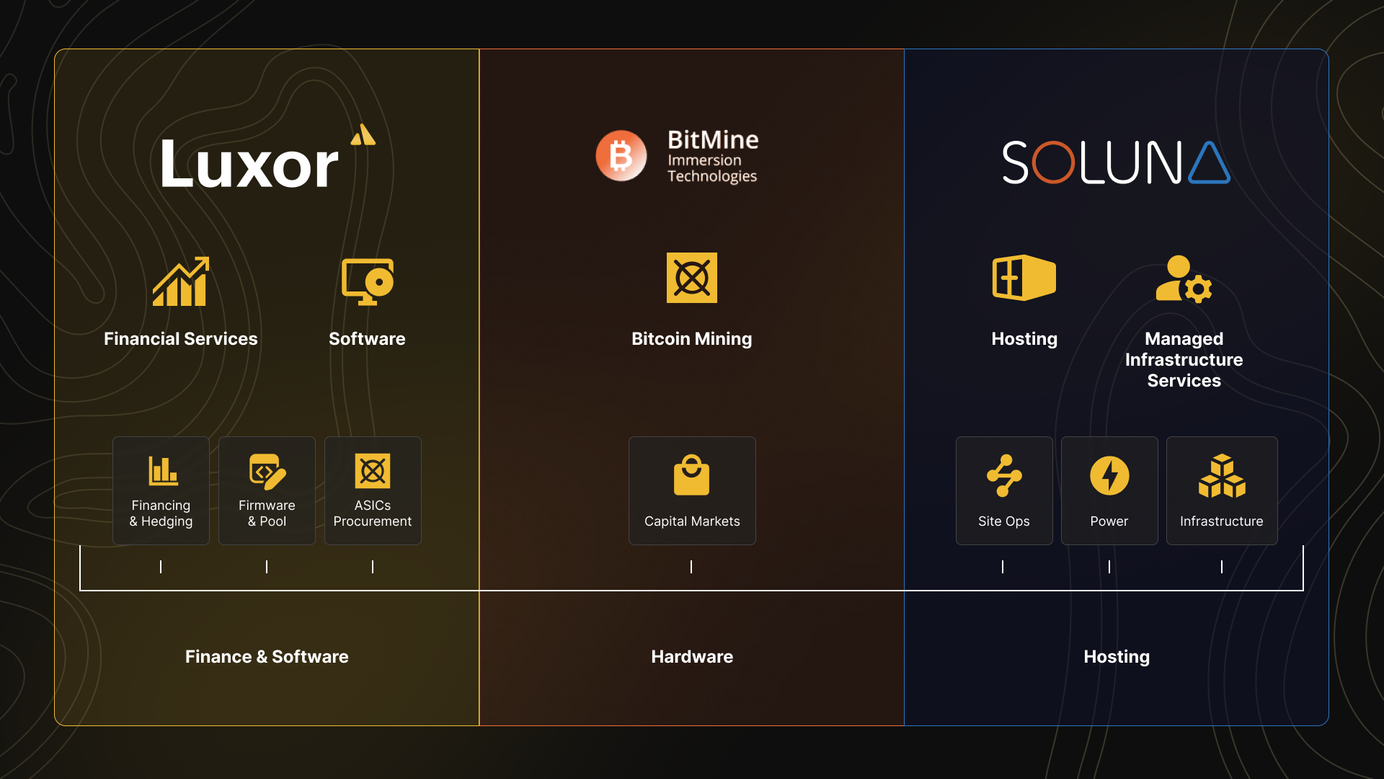

Soluna provided power, infrastructure, and operational expertise. Luxor delivered financing, hedging, procurement, software optimization via LuxOS, and monetization of hashrate via Luxor Pool.

Together, they formed a game-changing partnership that addressed BitMine’s needs, setting a new standard for turnkey mining solutions.

This case study explores how the collaboration between BitMine, Soluna, and Luxor streamlined deployment, mitigated risk, and unlocked new growth opportunities.

BitMine’s Opportunity: Bringing Hashrate Online With Low Operational Risk

BitMine had a clear vision: to scale its mining operations efficiently while minimizing risk. However, they knew the pitfalls associated with deployments. This creates vulnerabilities, especially when deals are structured poorly, for example:

- Power Pricing Pitfalls: Many miners enter long-term hosting agreements with fluctuating rates, or worse, hidden pass-through costs that explode when energy prices spike. Some hosting providers lock clients into contracts that shift all the risk onto the miner.

- Overpaying for Equipment: Without direct industry relationships, miners may buy hardware at retail prices or from intermediaries with significant mark ups. This happened during the 2021 bull run when desperate new entrants paid $10,000–$15,000 per ASIC, only to watch prices crash to $3,000 during the next bear market.

- Inefficient Machine Deployment:

- Delays, customs, DOAs – there are a lot of things that can go wrong in the procurement phase.

- After the machines have arrived, firmware adjustments, cooling, and heat can affect downtime, all resulting in significantly less hashrate and associated declines in returns.

- If uptime and efficiency are poor, larger sites can underperform smaller, well-optimized sites.

- Cash Flow Mismatches: Mining revenue is volatile, fluctuating with network difficulty and Bitcoin price action. Some miners finance their operations with loans assuming steady returns, only to get caught in a bear market where mining rewards drop, electricity bills stay fixed, and debt payments become unmanageable.

This is why partnerships with experienced service providers who understand the nuances of power markets, hardware procurement, optimization, and financial hedging are critical. Those who fail to manage these risks effectively often end up selling distressed assets at the bottom of the cycle, exiting the industry with heavy losses, while more sophisticated players continue to scale.

The Solution: A Turnkey Approach with Soluna & Luxor

Recognizing BitMine’s needs, Soluna and Luxor combined their strengths to offer a comprehensive and predictable end-to-end solution.

Soluna: Reliable Infrastructure & Stable Power

BitMine expanded its relationship with Soluna from ~3 MWs at the Project Sophie data center to adding an additional ~10MW at the new Project Dorothy facility. With Soluna currently providing 13MW hosting capacity, this eliminated uncertainty related to fluctuating energy prices and power interruptions, ensuring BitMine had a dedicated, stable source of power.

Luxor: Financial, Operational, and Strategic Expertise

Luxor played a critical role in enabling BitMine’s expansion by leveraging all aspects of its business:

- Hashrate Forward Contract: Luxor structured a hedging strategy that secured BitMine’s profitability by locking in a fixed hashprice for a 12-month term.

- Capital & Equipment Financing: Luxor facilitated financing for ASIC machine procurement through a forward hashrate sale, ensuring BitMine could scale without facing capital constraints.

- Logistics Support: Luxor managed the entire shipping & logistics process to minimize downtime.

- Fleet Optimization & Management: Luxor firmware was deployed across BitMine’s fleet, unlocking dynamic mining strategies through LuxOS to maximize revenue and efficiency.

Why This Model Stands Out

This partnership redefined the traditional mining setup by integrating infrastructure, software & financial services, and operations management into a turnkey solution. By reducing risk across deployment, price volatility, and operational uncertainty, BitMine was able to scale confidently and predictably while focusing on its core business activities.

Results: Unlocking More Hashrate, More ASICs, and More Efficiency

The collaboration between BitMine, Soluna, and Luxor delivered tangible results:

- Tripled BitMine’s deployed ASIC capacity, significantly boosting its hashrate.

- Secured long-term power stability, mitigating energy price fluctuations.

- Locked in hashprice terms, reducing financial exposure to market volatility.

- Streamlined deployment process, cutting down hardware lead times and ensuring rapid scaling.

- Enhanced operational efficiency, leveraging LuxOS firmware and running around 10% more efficiently than other miners, leading to improved profitability and lower downtime.

This approach provided BitMine with greater financial stability, operational certainty, and a faster growth trajectory, proving the effectiveness of a fully integrated mining solution.

Conclusion: The Future of Integrated Mining Solutions

This partnership between BitMine, Soluna, and Luxor showcases the value of turnkey mining solutions. Each party benefited:

- BitMine: Gained a complete, risk-mitigated mining solution with price certainty, reliable power, and operational efficiency.

- Soluna: Secured a long-term customer for its power capacity, reinforcing its role as a leader in sustainable Bitcoin mining.

- Luxor: Demonstrated the power of its full-service model, proving that its comprehensive approach can drive long-term success for mining companies.

As mining economics continue to evolve, integrated win-win-win solutions like this will become increasingly essential. Soluna and Luxor plan to replicate and scale this model, bringing more miners into a stable, profitable framework.

For mining companies looking for a reliable, end-to-end solution, this case study validates the effectiveness of strategic partnerships in an industry where efficiency and risk management are critical.

Can We Help You?

Given the success of this collaboration, Soluna and Luxor are exploring ways to expand this model. If you're a miner looking for a scalable, turnkey solution, get in touch to learn how this approach can work for you.

About BitMine Immersion Technologies, Inc.

BitMine is a technology company focused on Bitcoin mining using immersion technology, an advanced cooling technique where computers are submerged in specialized oil circulated to keep units operating at optimal ambient temperature. Immersion technology is more environmentally friendly than conventional mining methodologies while lowering operating expenses and increasing yield. BitMine's operations are located in low-cost energy regions in Trinidad, Pecos, Texas, and Murray, Kentucky.

About Soluna Holdings, Inc. (SLNH)

Soluna is on a mission to make renewable energy a global superpower, using computing as a catalyst. The company designs, develops, and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna’s pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications, including Bitcoin Mining, Generative AI, and other compute-intensive applications. Soluna’s proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions and superior returns. To learn more, visit solunacomputing.com. Follow us on X (formerly Twitter) at @SolunaHoldings.

About Luxor Technology Corporation

Luxor Technology Corporation is a Bitcoin mining software and services company that offers a suite of products catered toward the mining and compute power industry. Luxor’s suite of software and services includes an open auction ASIC Marketplace, a Bitcoin mining pool, a Hashrate Derivatives Desk, an Antimer ASIC Firmware, and a Bitcoin mining data platform.

If you are interested in contacting the Luxor Derivatives Desk, please email [email protected].

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.