Hashrate Index Roundup (August 27, 2024)

Dovish monetary policy, bullish Bitcoin? Transaction fees explode due to meta-protocol.

Hello world, happy Tuesday!

Bitcoin trended up throughout the past week, increasing by a healthy 6.50% from $58,500 to a current price of $62,300. Price action is close to a recovery from its recent ~18% downturn as spot prices are now back on par with the previous month. Year-to-date performance stands at 43.44%.

Contrary to the recent slump, macroeconomic conditions are now having an inverse effect on risk assets across financial markets. During the recently held Economic Policy Symposium in Jackson Hole, Wyoming, from August 22-24, Federal Reserve Chair Jerome Powell announced that the FED will begin easing its monetary policy through interest rate cuts. This announcement aligns with other major central banks around the globe which have already started cutting rates. Powell highlighted worsening U.S. labour market conditions as a key reason, indicating that the employment side of the FED’s dual mandate is now becoming a focus area relative to inflation. Markets are expecting a series of rate cuts starting in September with additional cuts likely in November and December.

Although the FED’s move to cut rates was already priced in based on signals from treasury markets and the yield curve, what could this mean for Bitcoin? A low interest rate environment combined with certainty regarding rate cuts may increase liquidity and suppress bond volatility, supporting higher prices in risk assets. However, despite this potential tailwind, unexpected events may always occur. If anything, the recent series of exogenous shocks impacting Bitcoin's price has demonstrated the power of a Dollar-Cost-Average (DCA) or Time-Weighted Average Price (TWAP) strategy for retail and institutional investors, which smoothes out price volatility over time. Under the right conditions, participating in proof-of-work through mining would go one step further by enabling bitcoin accumulation at a discount to spot prices (subject to your cost to mine).

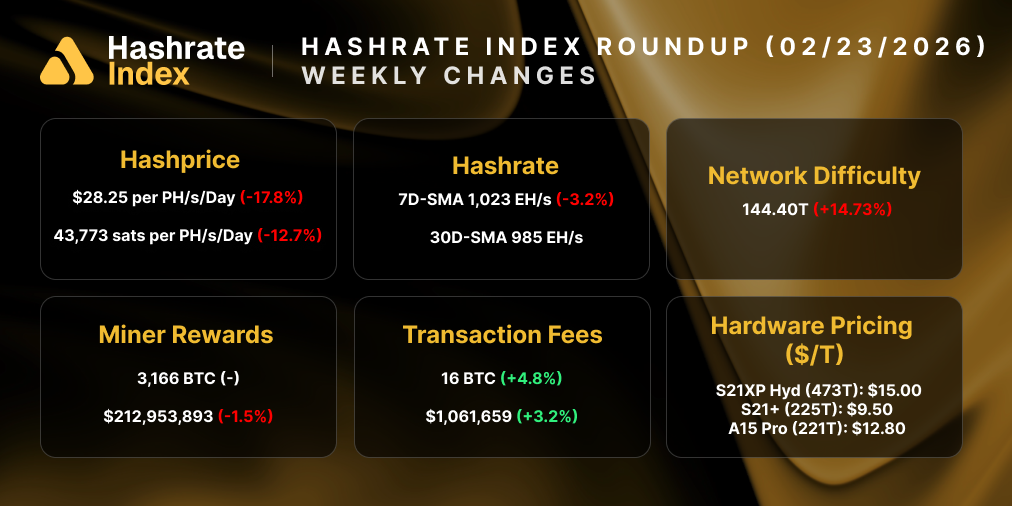

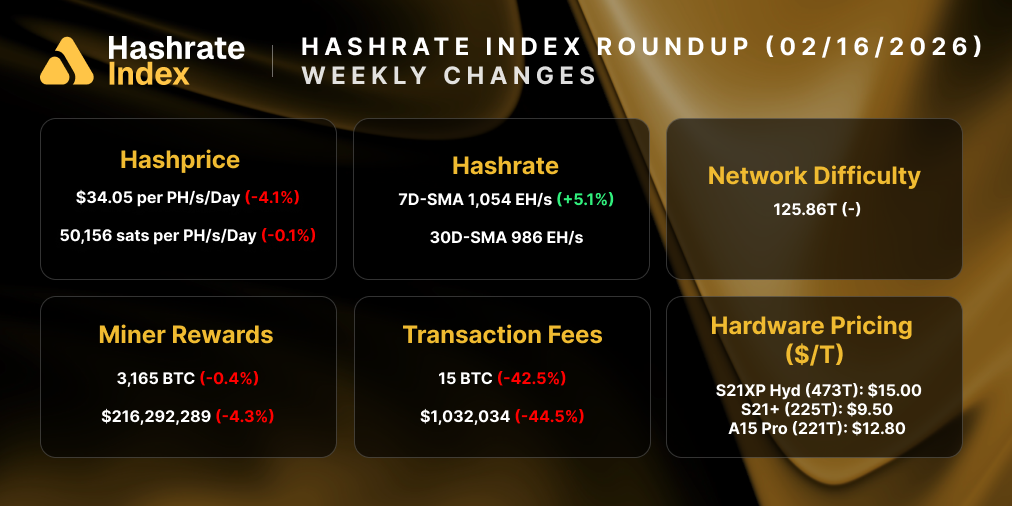

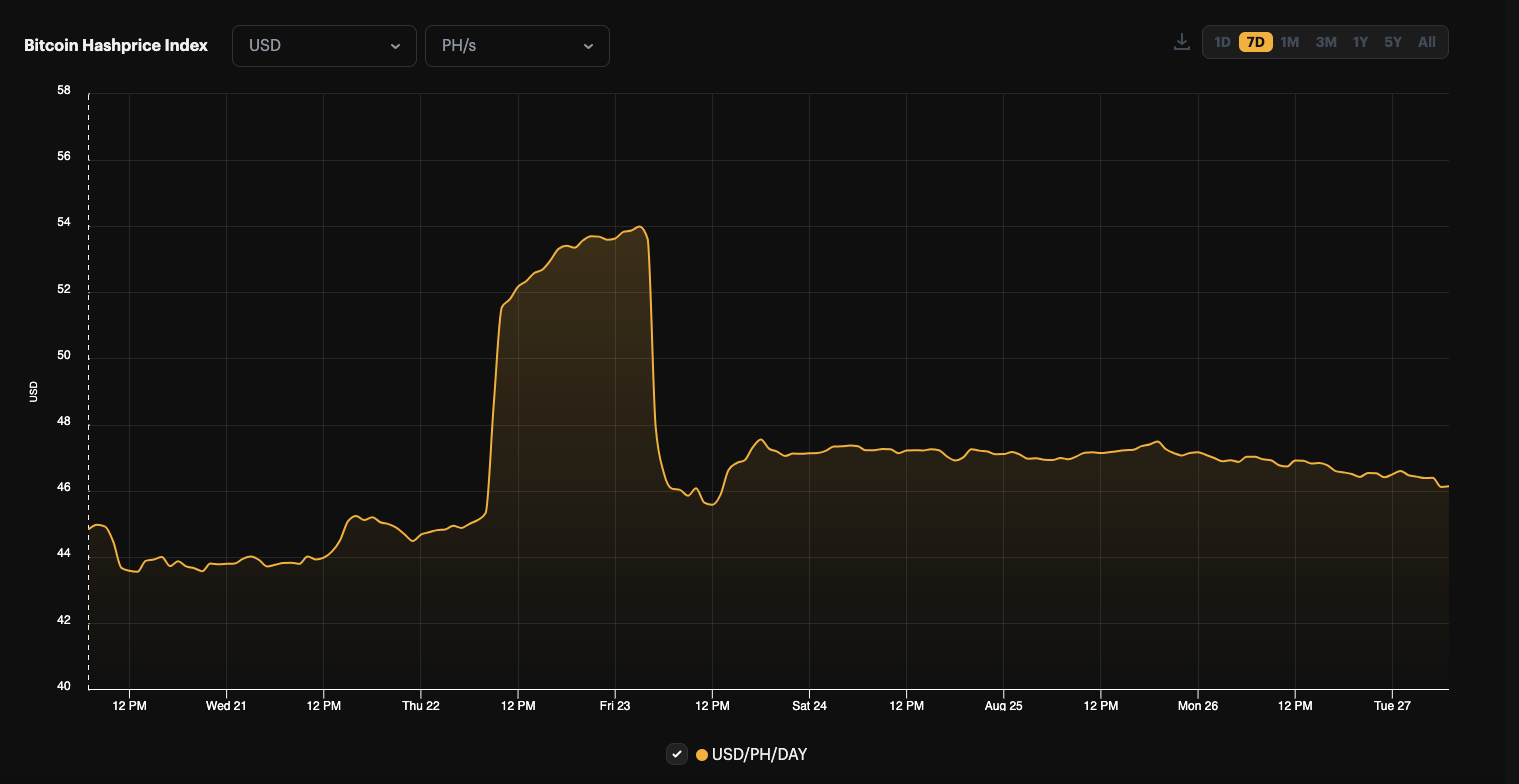

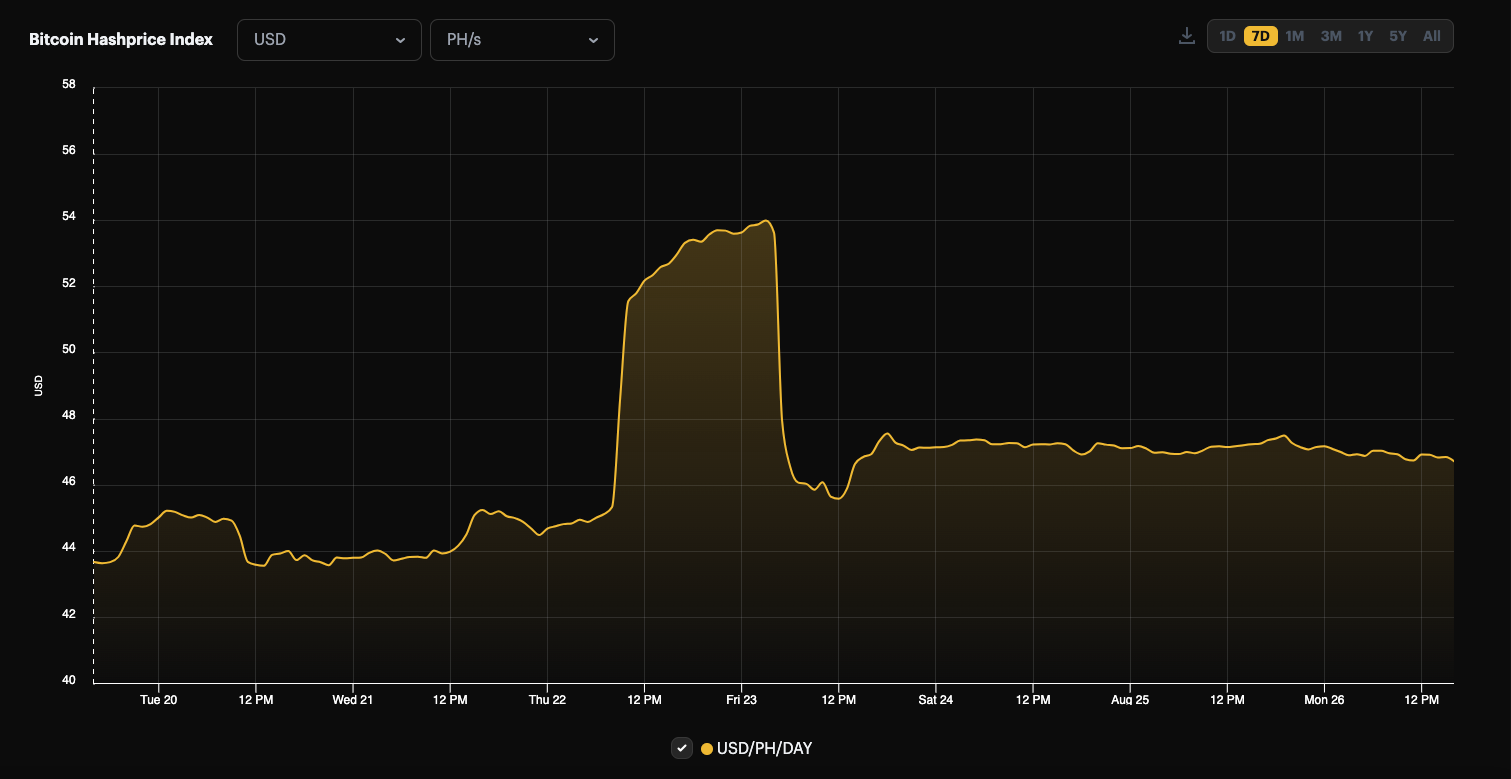

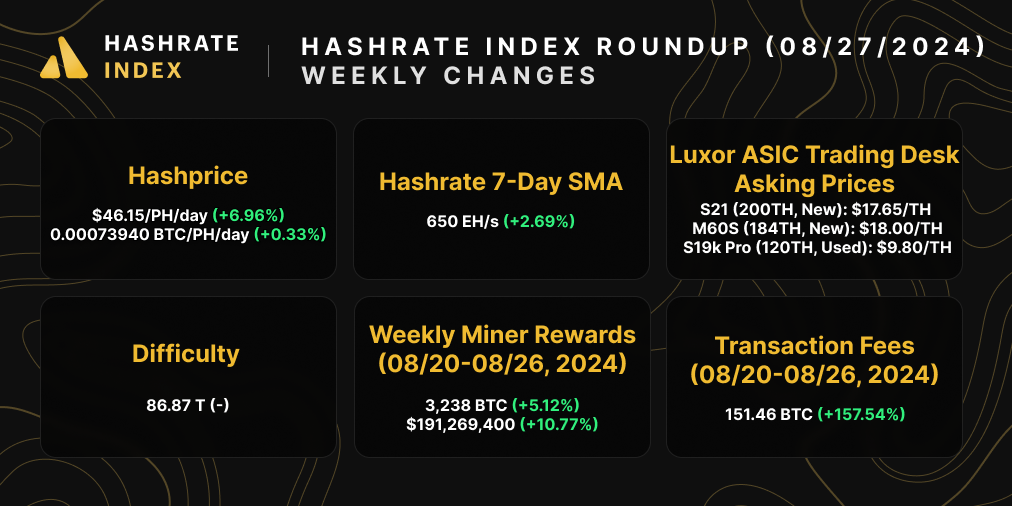

Hashprice also trended up throughout the week, increasing by ~6.96% from $43.68/PH/Day to $46.15/PH/Day, at the time of writing. A modest improvement in week-to-week profitability, amplified by the launch of the Babylon Protocol which surged hashprice up to a local peak of ~$54.00/PH/Day. Although a short-lived boon, this was a welcome surprise for miners.

Beyond price action in Bitcoin and hashprice, global network hashrate oscillated between 633EH/s and 650EH/s throughout the week. The 7-day simple moving average (SMA) network hashrate is currently ~4.50% below the all-time high of 679 EH/s, recorded a month ago on July 26.

Blocks were found at an average time of around 9 minutes 37 seconds throughout the week. We estimate a slight increase in difficulty of ~1.80% for the upcoming adjustment, expected to occur tomorrow, on August 28th.

Sponsored by Luxor Firmware

At $46/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

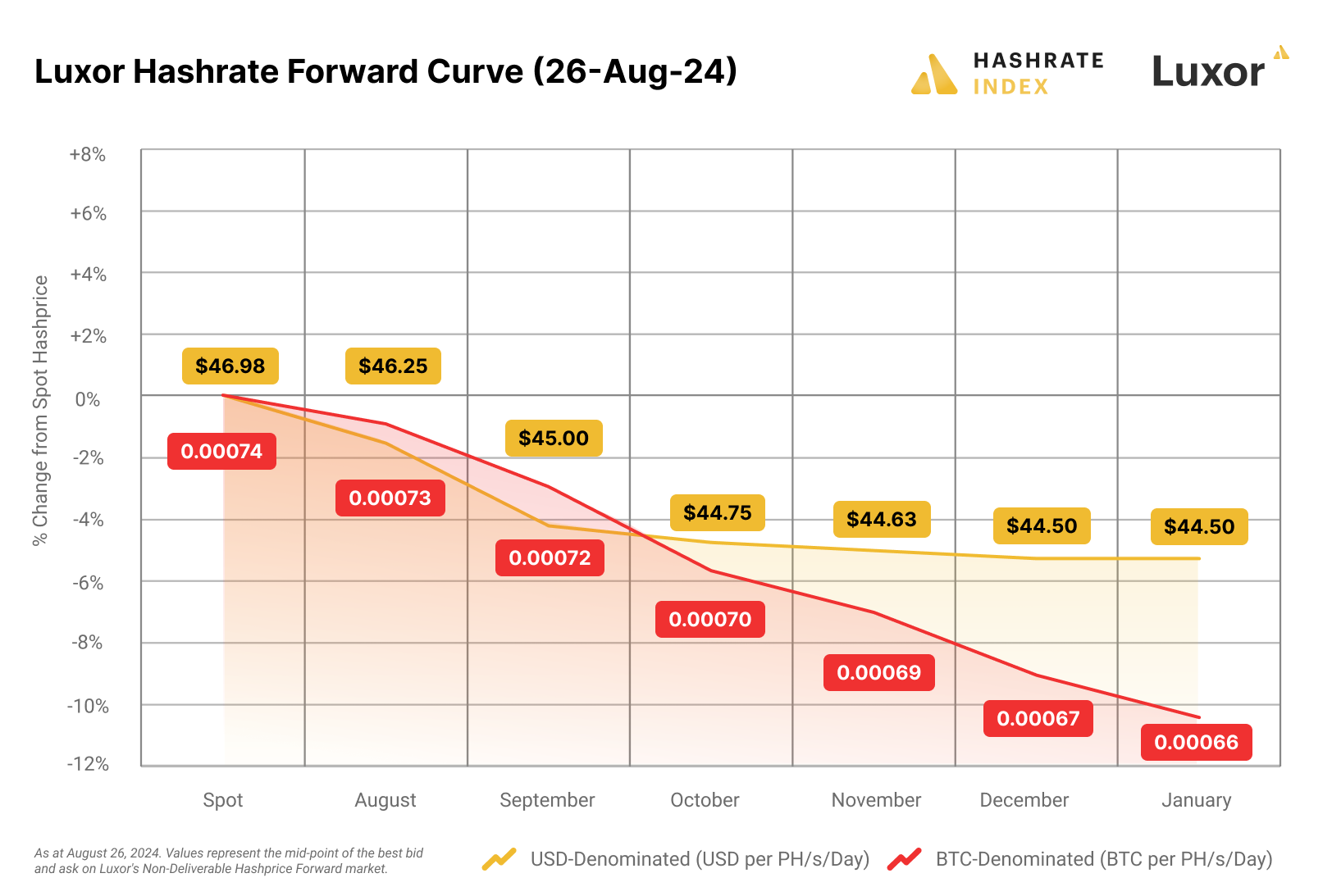

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, both USD and BTC contracts are trading in backwardation. Miners can lock in a ~$44.50 hashprice for up to six months into the future.

Bitcoin Mining Market Update

A positive trend for this week's update. Bitcoin, hashprice, and hashrate all had a healthy uptick. Miners collected a total of ~3,238 BTC in rewards, equivalent to ~$191.3 million. Transaction fees were significantly higher due to launch of the Babylon staking protocol.

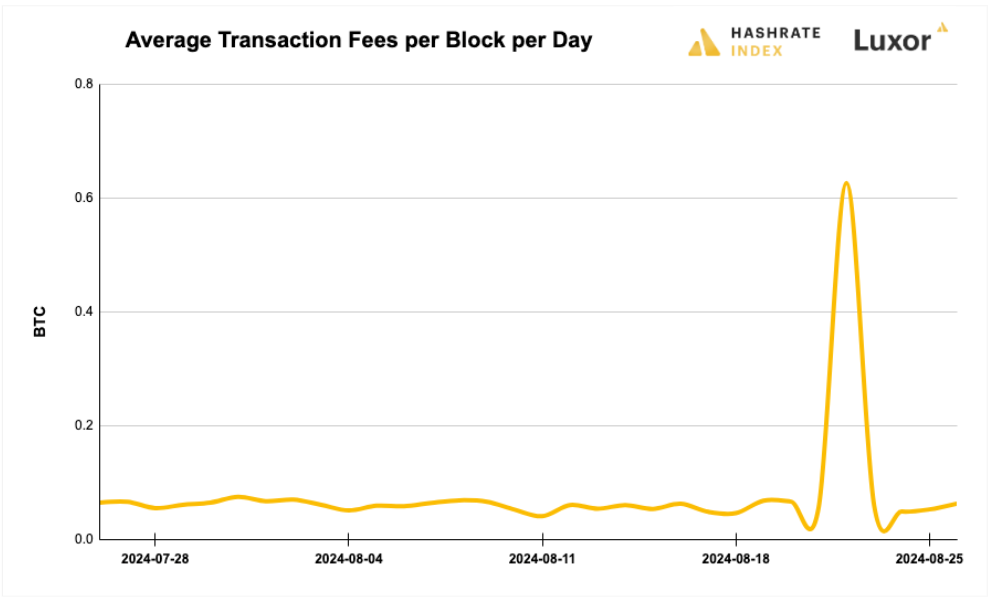

Bitcoin Transaction Fee Update

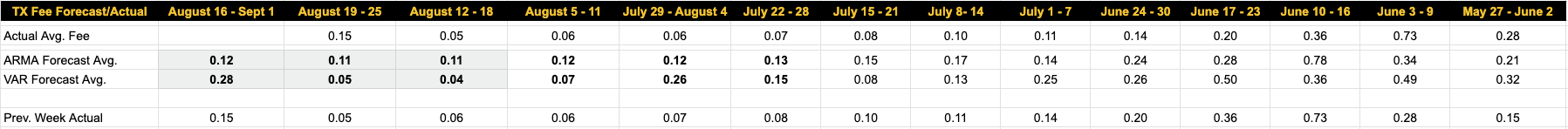

Transaction fees exploded throughout the launch of the Babylon staking protocol, with blocks reaching up to 15BTC in rewards. Over the past week, Bitcoin miners collected an average of 0.14 BTC per block per day in transaction fees compared to the prior week's 0.06 BTC.

Our transaction fee projection models are relatively bullish due to the isolated Babylon event, however, we would't be surprised if actual fees for this week underperform relative to our quantitative forecast as we expect a low-fee, low-volatility environment to persist beyond this meta-protocol boon. For this week, our VAR model forecasts 0.28 BTC per block, and the ARMA estimates 0.12 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Greenidge Generation sues NY regulator over mining permit renewal

- Bitfarms to Acquire Stronghold Digital Mining

- Rhodium Files Chapter 11 for Bitcoin Mining Subsidiaries

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended up throughout the past week, reflecting a 8.11% increase in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $8.50 (+5.99%)

- HUT: $12.57 (+8.27%)

- BITF: $2.44 (+2.95%)

- HIVE: $3.63 (+19.08%)

- MARA: $18.69 (+14.17%)

- CLSK: $12.61 (+5.79%)

- IREN: $8.62 (+6.55%)

- CORZ: $10.76 (+6.11%)

- WULF: $4.93 (+19.66%)

- CIFR: $4.00 (+2.56%)

- BTDR: $7.54 (+15.11%)

- SDIG: $5.42 (+108.46%)

- FUFU: $4.35 (-10.68%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.