⚡️Quantifying Q3 and Visualizing China's Mining Ban by the Numbers

Want to visualize how China's ban has affected Bitcoin's mining landscape and its network? Hashrate Index's Q3 report paints this picture with the numbers.

Happy Tuesday, Luxor Mining crew!

We released our Q3 report yesterday, and it’s packed with data from Hashrate Index which illustrates the effects of China’s mining ban on the Bitcoin mining playing field.

In the fallout of China’s ban, we are witnessing an unprecedented restructuring of hashrate across the globe (with the United States being the largest beneficiary so far), as well as a surge in interest in the mining industry from newcomers and seasoned bitcoiners alike.

We’ll be covering some key takeaways from the report in this newsletter, but first, some Hashrate Index data.

Hashrate Index

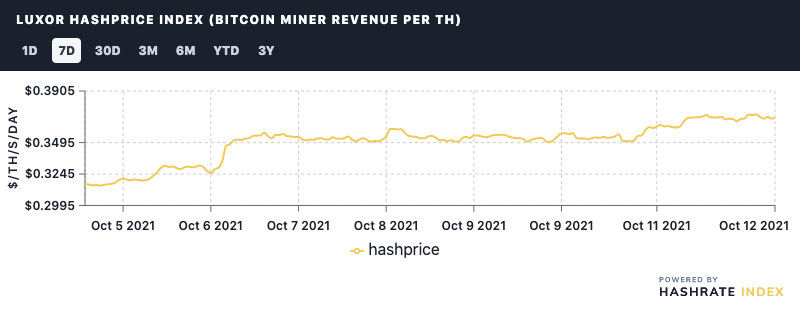

Hashprice: Hashprice is back above $0.35! Thanks to the ongoing bitcoin price pump, mining profitability is up 16.5% over the week to $0.3691/TH.

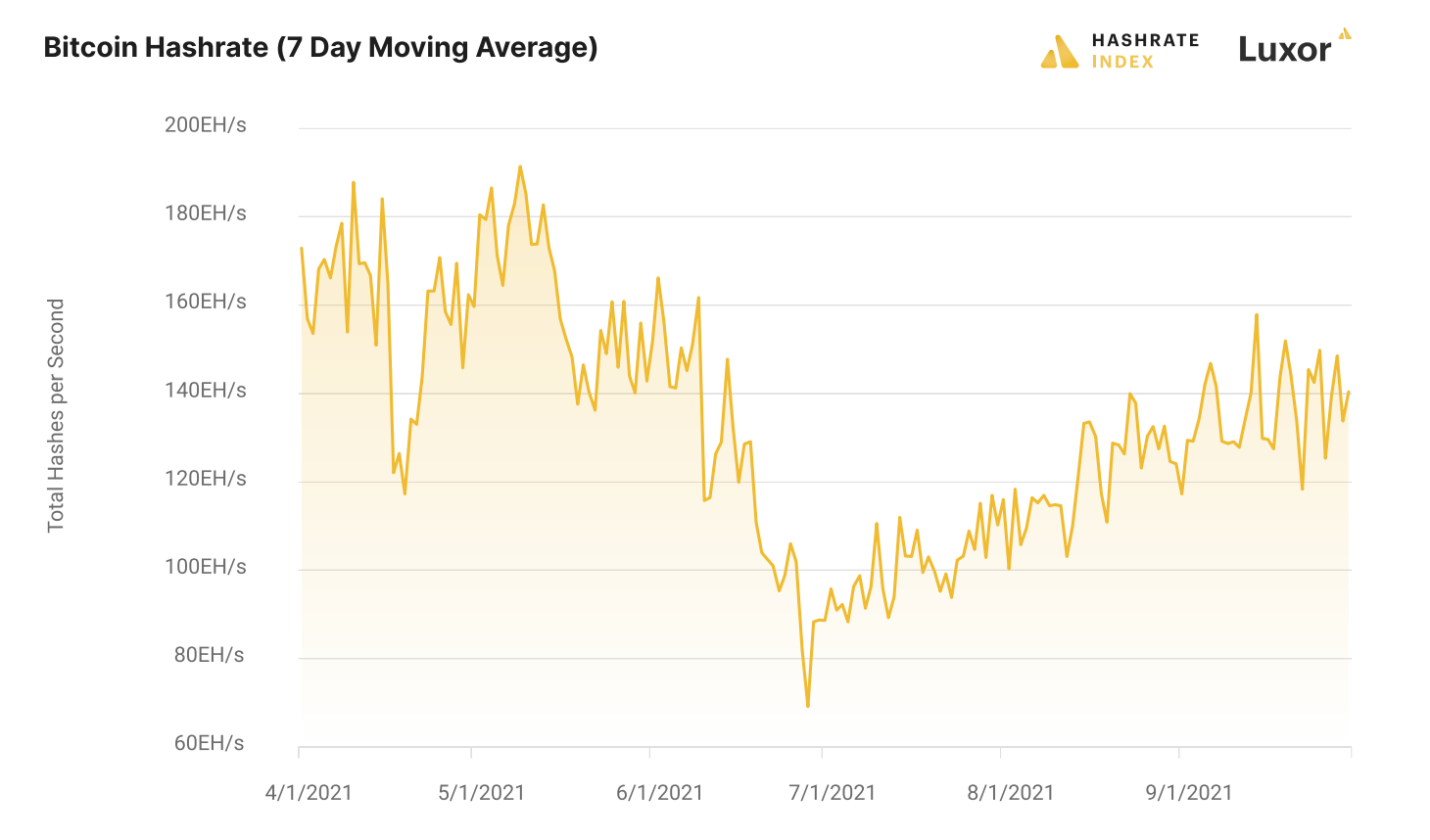

Hashrate: Bitcoin’s hashrate has taken a breather after some explosive growth lately, with the current 7-day moving average showing 140.99 EH/s.

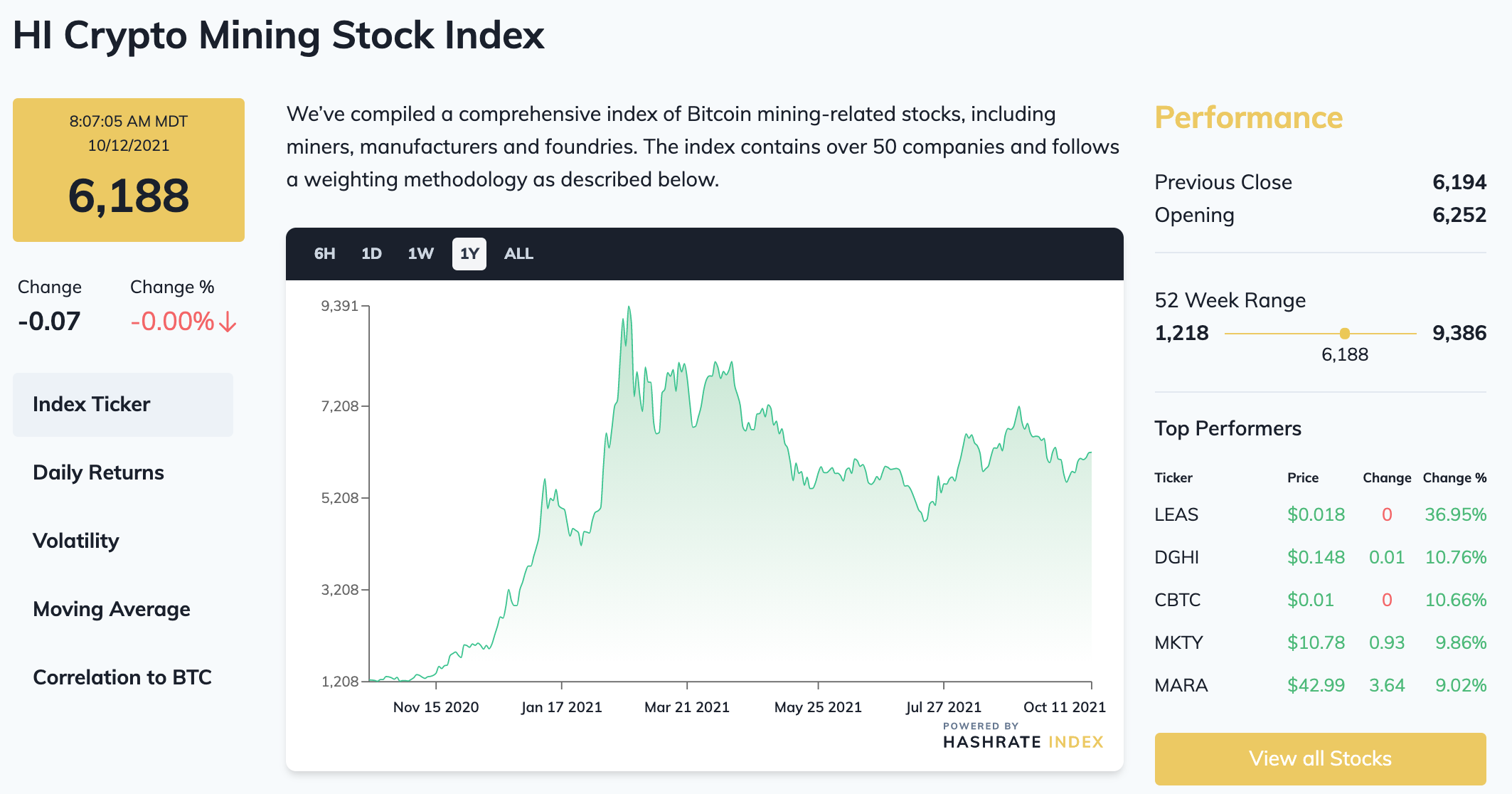

Crypto Mining Stock Index: Mining stocks are on the up-and-up once again after falling for most of September, and our index is up 5% over the past week to $6,188.

Hashrate Index Q3 Report

China’s mining ban created a unique opportunity, something of a reset that leveled the playing field for sidelined investors who never thought it would be possible (or profitable) to enter the industry. In this way, Q3 marked nothing shy of a Renaissance for Bitcoin’s mining industry.

Below are some highlights from our Q3 report which illustrate the massive changes China’s crackdown engendered in the global mining landscape. If you’d like, you can download the full report at the end of the newsletter.

Hashrate Makes Quicker-Than-Expected Recovery

Plenty of folks reckoned we wouldn’t be anywhere close to 150 EH by the end of this year, let alone October. But hashrate has made a herculean recovery following the ban; after being cleft in half, it rose from late-June lows of 69 EH/s to 140 EH/s by the end of Q3, a 103% recovery.

China’s Absence Is a Lucrative Opportunity for Miners Elsewhere

One man’s prohibition is another man’s value proposition, and China’s mining ban has been a huge opportunity for miners everywhere else.

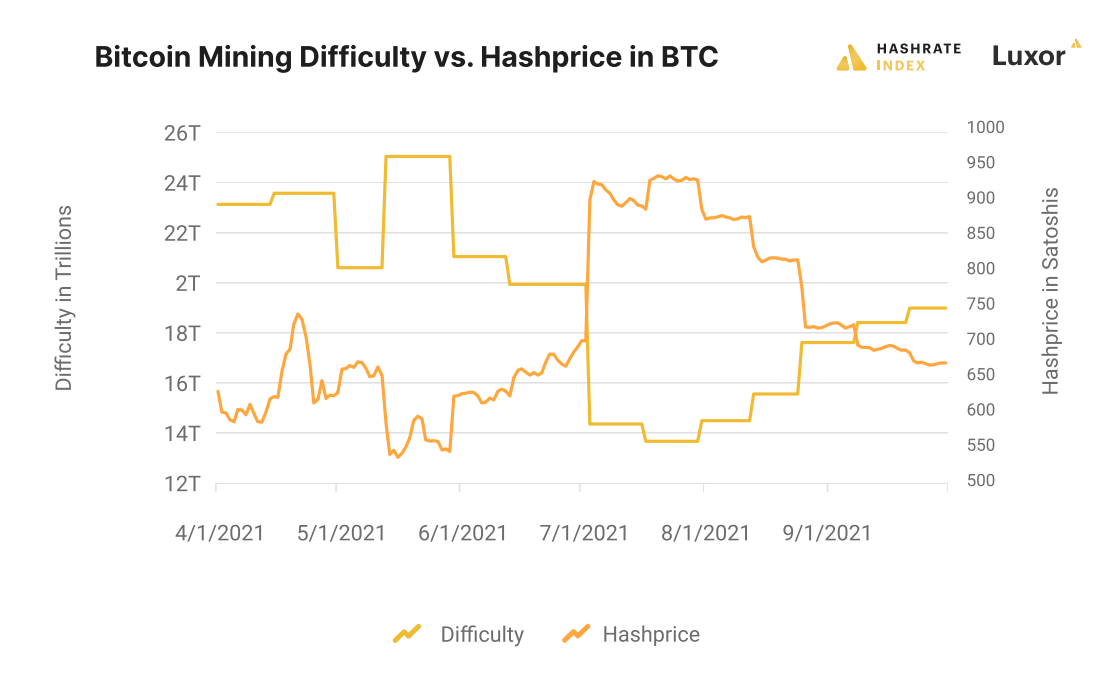

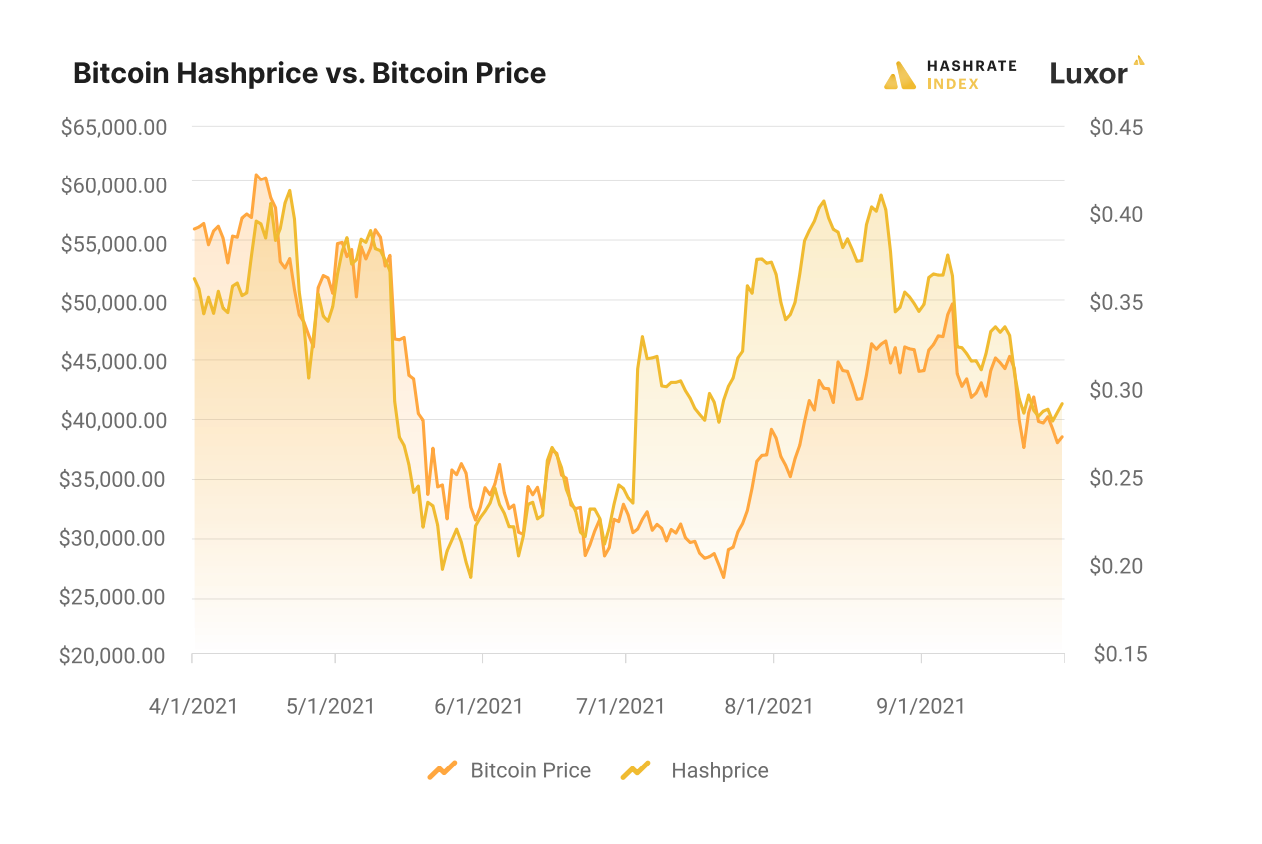

With competition reduced in Q3 and difficulty much lower than pre-ban levels, hashprice in USD more than doubled from its Q2 lows in June to its Q3 highs in August. Hashprice closed out Q3 at $0.29/TH, which was 30% lower than the yearly high set in April. For hashprice in BTC terms, miners saw a 70% increase from the profitability trough in June to its crest in July.

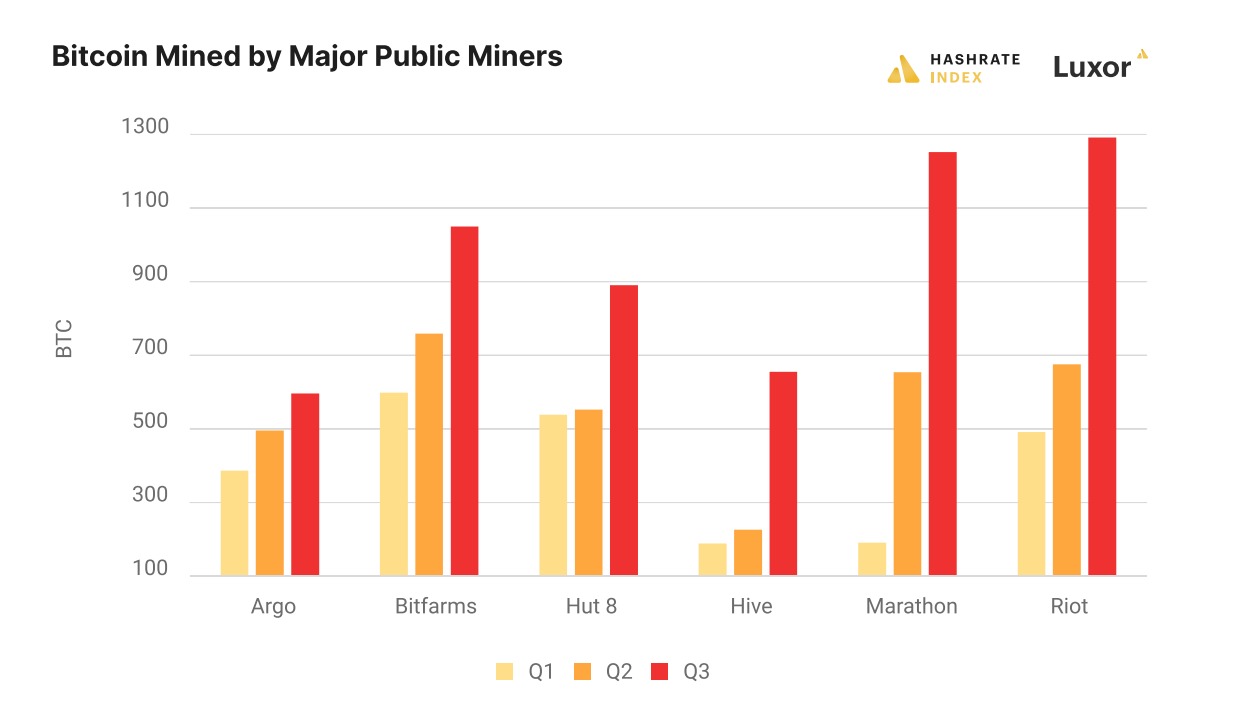

You can clearer see the effects of this golden window of profitability in the mining production of public miners. Collectively in Q3, the largest public North American miners mined 79% more bitcoin than they did in Q2 and 155% more than they mined in Q1.

ASIC Prices Hit Hard but Recover

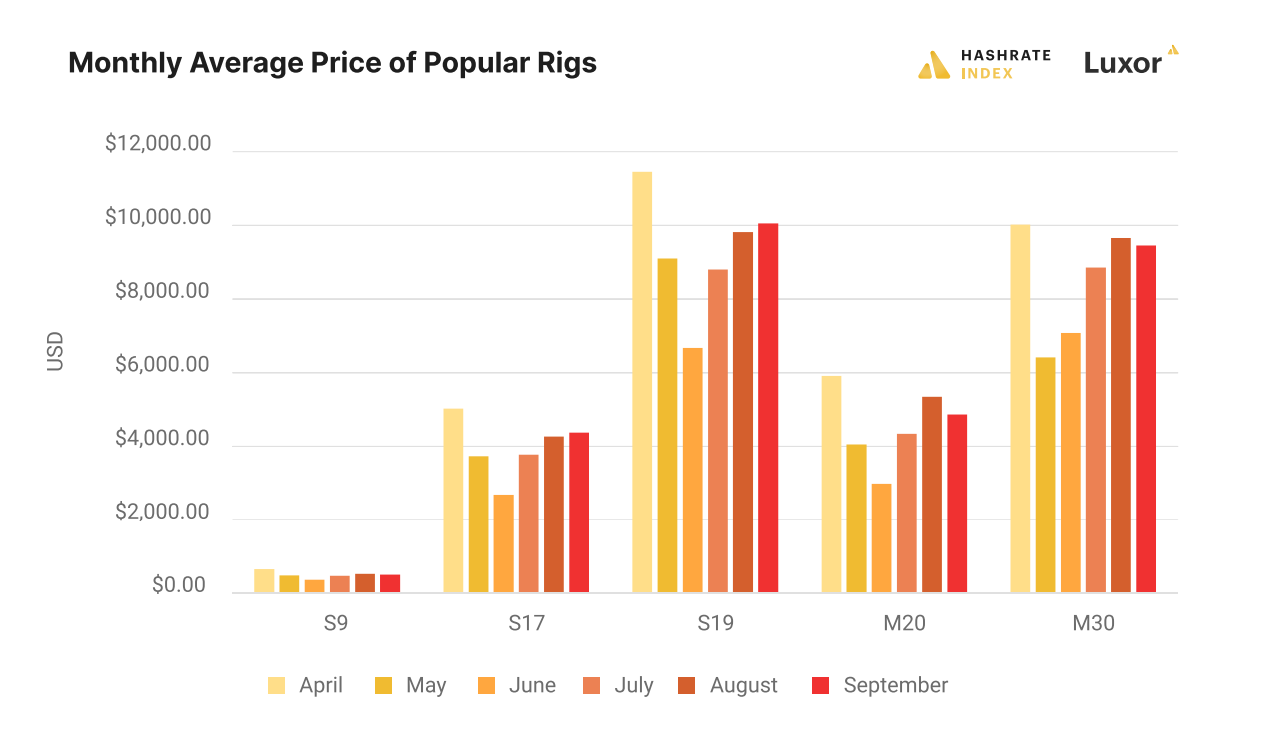

When bitcoin tanked this summer, mining rigs fell with it, something that was exacerbated by frenzied liquidations following China’s mining ban. In the resale market, some Chinese miners opted to sit on their rigs and keep them in storage, while others liquidated.

New generation rigs, for instance, fell 48% throughout the summer, but they recovered from their summer lows by 51% by the end of Q3.

Hashrate Blackout and Recovery Plays With Block Times, Fee Revenue

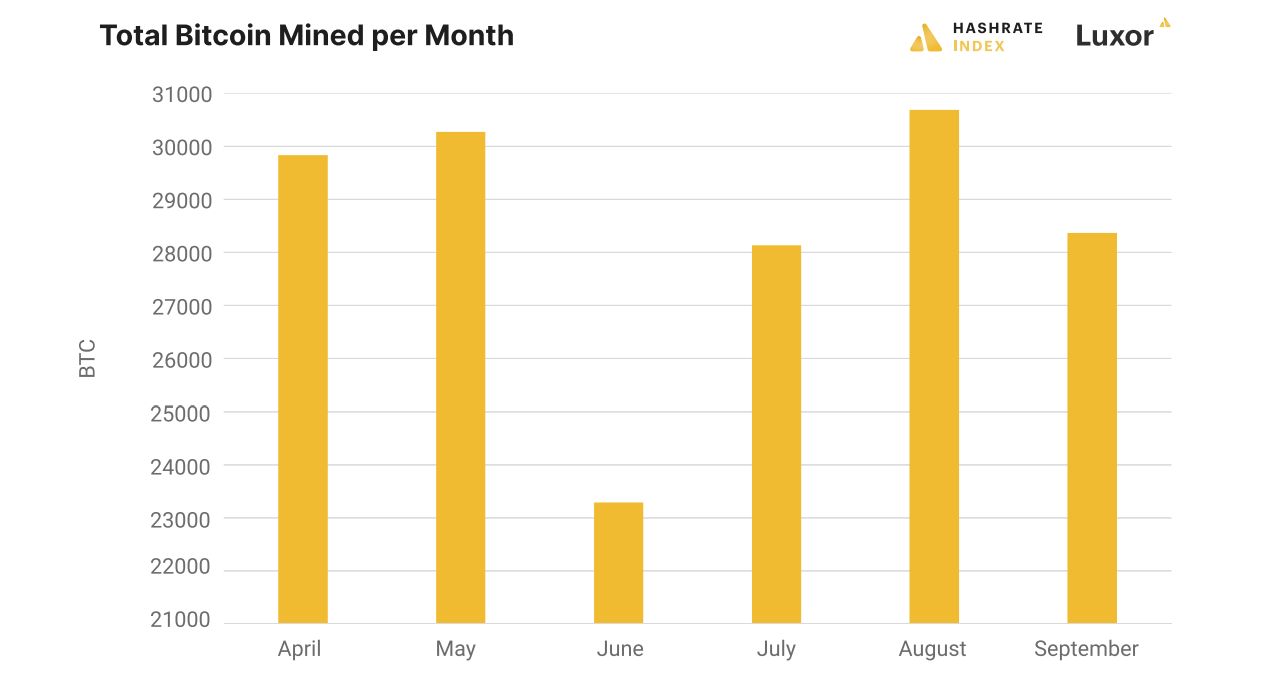

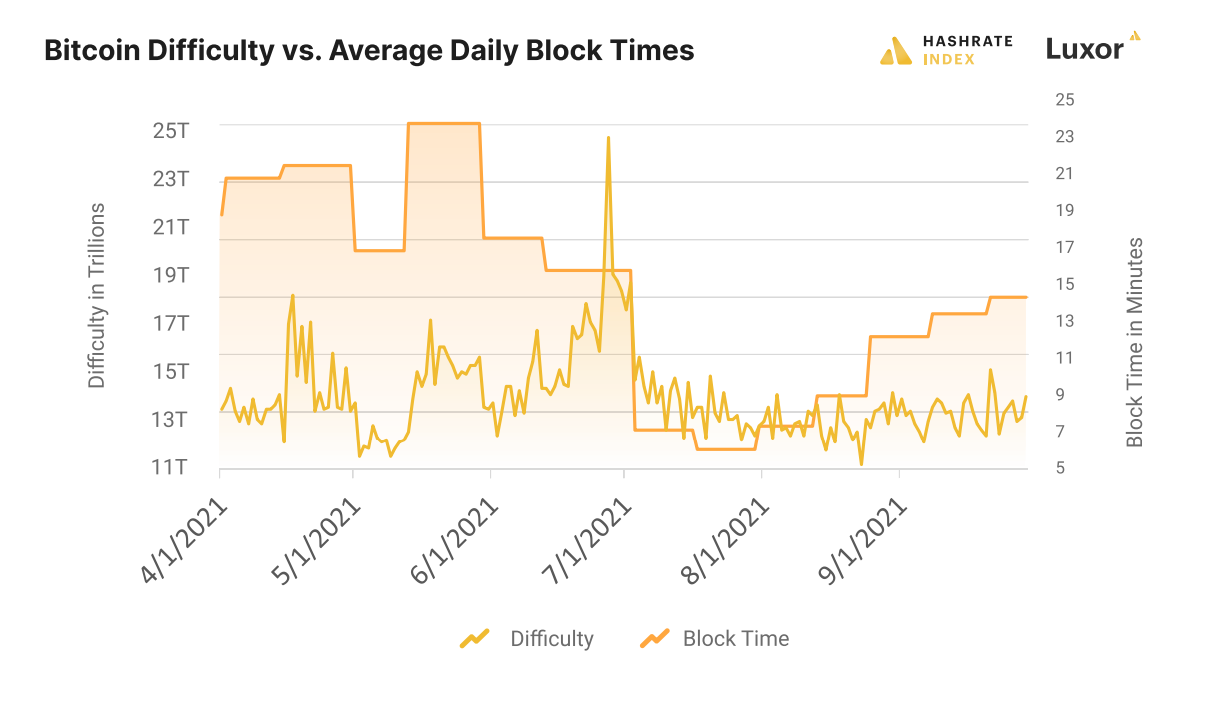

Block times creeped to a sluggish average of 12.6 minutes in June (a 19.93T difficulty kicked in right before China’s mining crackdown, so when half of Bitcoin’s hashrate went dark almost overnight, the network was still hashing under this difficulty until July 3, slowing block production). As a result, miners mined only 23,289 BTC during June--23% less than what they earned in May.

As hashrate began recovering and North American mega-farms booted up fleets of the newest machines, we saw a reversal of this trend in August. With hashrate surging, block production went into overdrive with an average block time of 8.2 minutes, netting them 30,683 BTC.

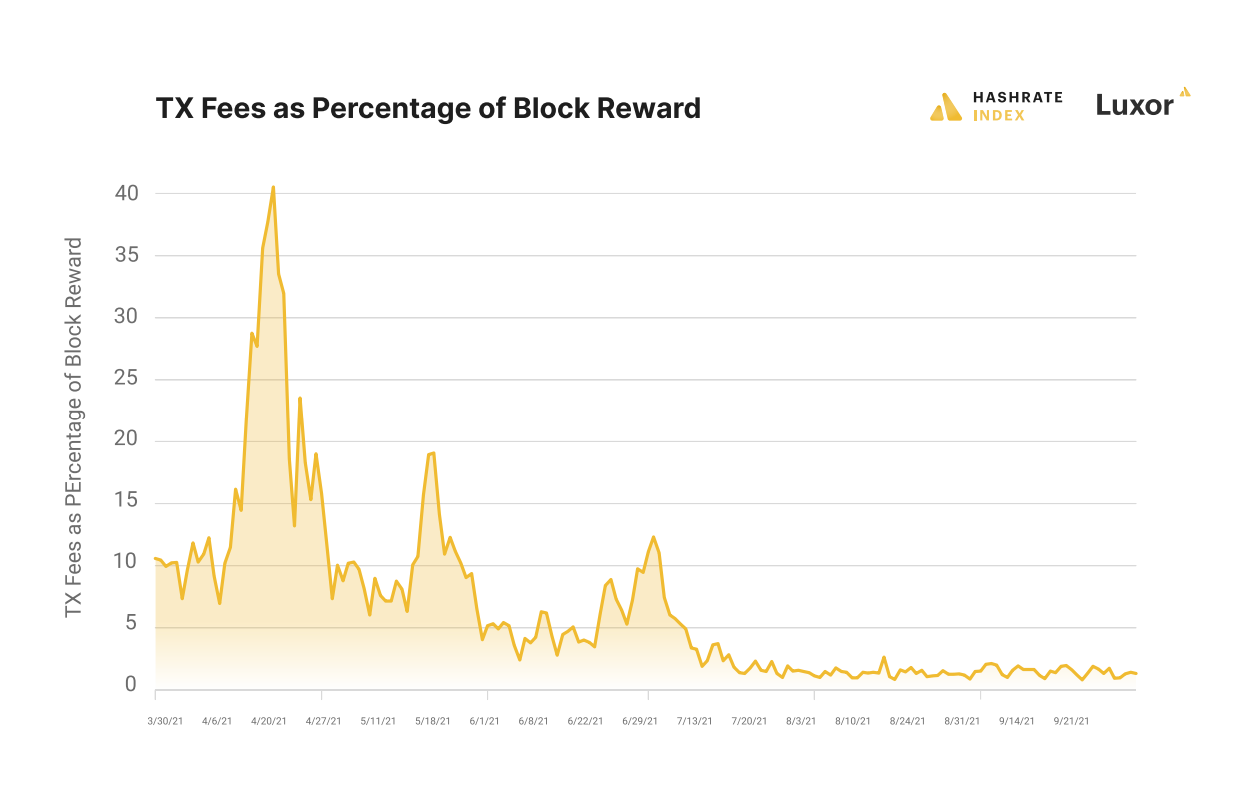

Fees as a percentage of block rewards have plummeted since the event, with the quarterly average for fees as a share of block rewards falling from 11.14% in Q2 to 2.06% in Q3.

Predictions for Q4

- Hashrate will close Q4 near its all-time high range, somewhere in the ballpark of 185 EH/s.

- ASIC prices will exceed the all-time highs they set this Spring.

- Hashprice will transcend its yearly high and close the year above $0.50/TH.

- We will continue to see successive upward difficulty adjustments, though none will be as drastic as the largest positive adjustments we experienced in Q2 and Q3.

- Transaction revenue from fees will at least double.

You can download the full report here (it’s also on our blog).

Have a good week, and Happy Hashing!

-Luxor Team

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.