China Bitcoin Mining Ban Profitability Window Has Closed

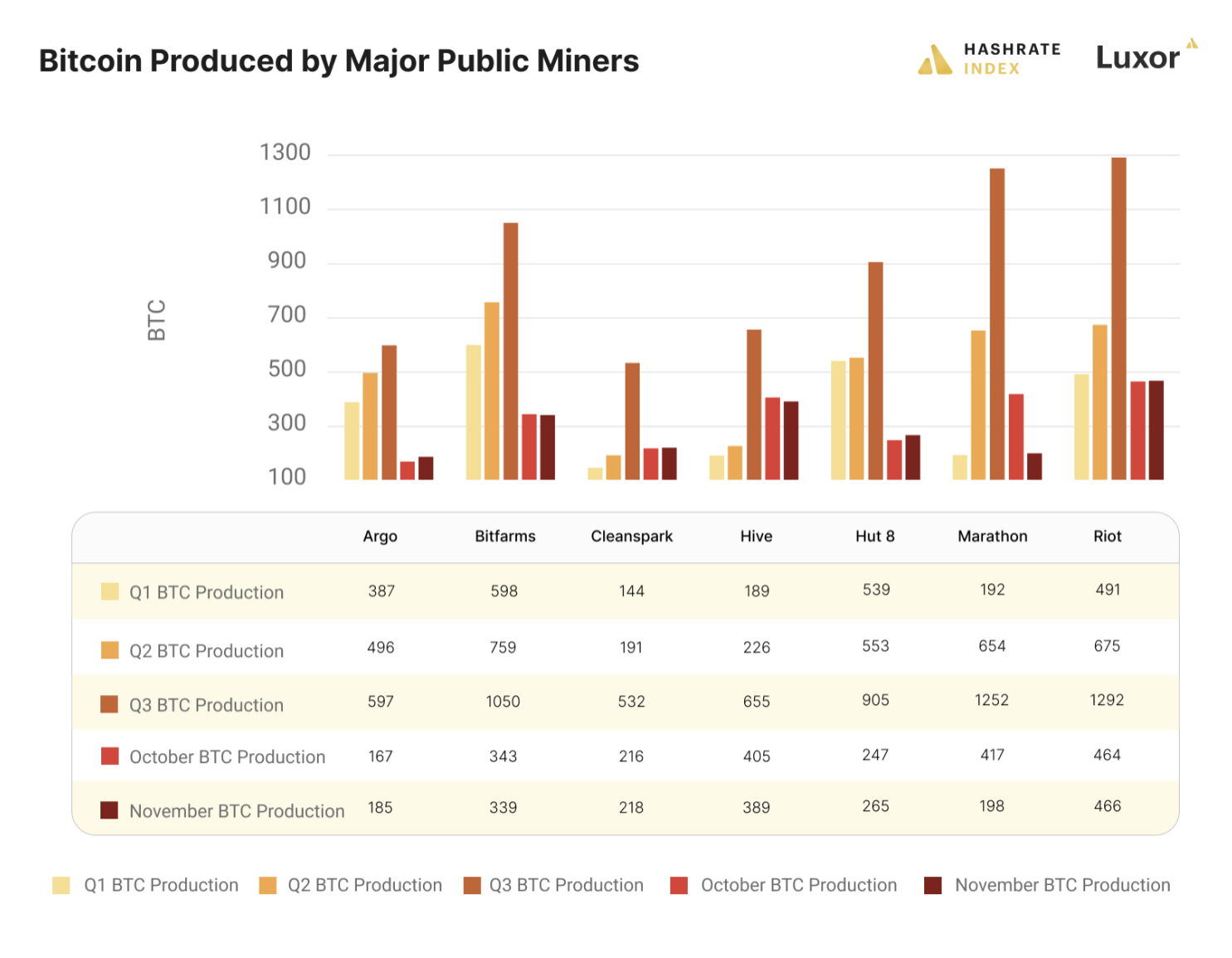

Crypto mining stocks fell after Thanksgiving, but November production reports show that miners are still seeing strong inflows of newly-mined bitcoin.

Crypto mining stocks may have taken a hit recently thanks to Bitcoin dumping the week after Thanksgiving, but public miners are still (mostly) posting strong monthly results.

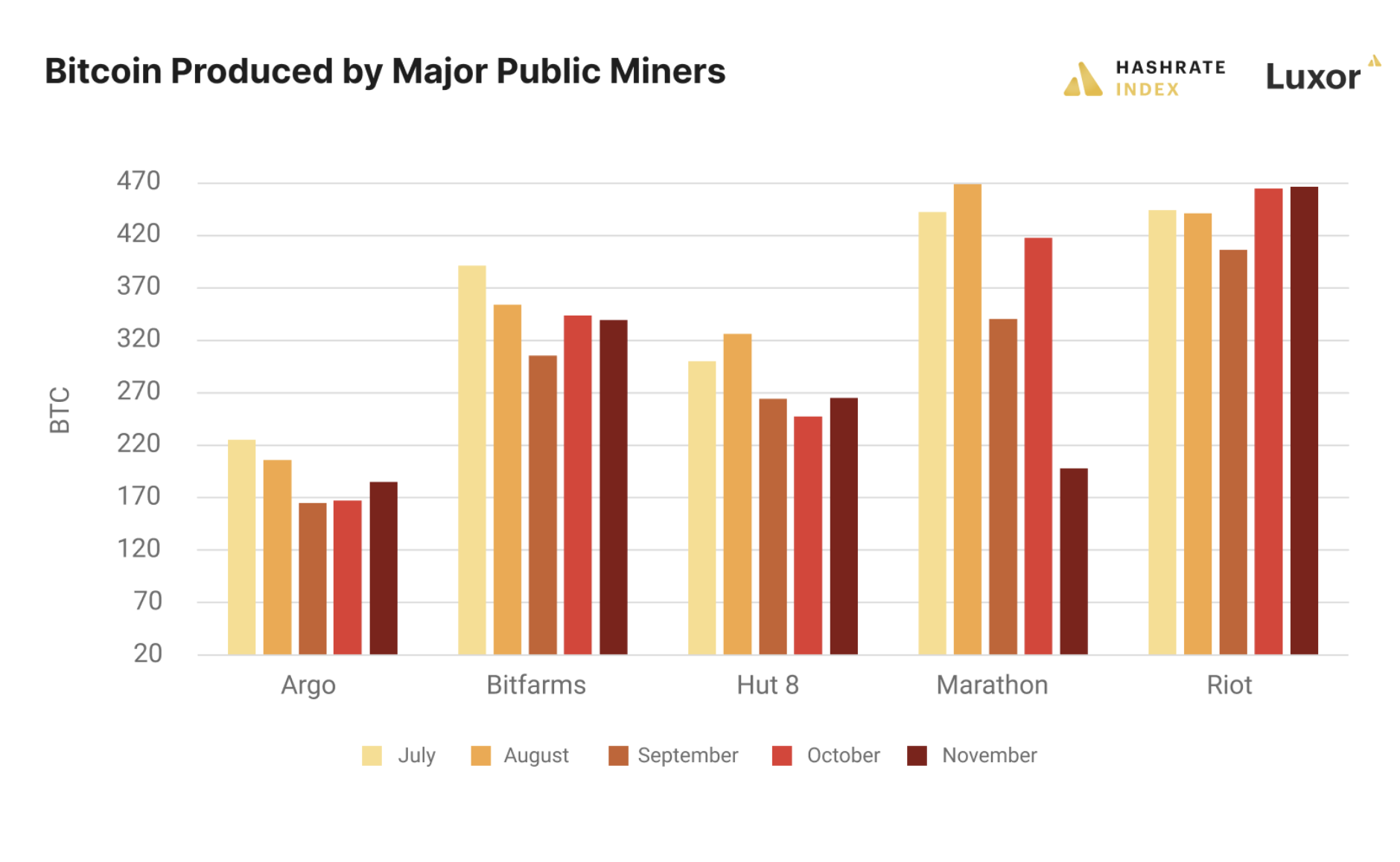

Many of these miners produced more Bitcoin last month than they did in October as they continue to expand their ASIC fleets with the latest machines. That said, these miners (with the exception of Riot) are not producing as much bitcoin as they did in July and August in the immediate aftermath of the China mining ban, a time when competition was reduced and mining profitability in BTC terms was at yearly highs.

When China banned Bitcoin mining and most Chinese miners fled the country, Bitcoin's hashrate was slashed in half and difficulty was significantly knee-capped. Bitcoin's largest ever negative adjustment kicked in on July 3 and dropped mining difficulty 27.94%, and with this adjustment, bitcoin-denominated hashprice immediately increased roughly 69%.

The cavity of competition dug out by China's mining ban led to a couple of lucrative months for active miners, but that profitability window has since closed with hashrate and diffciulty nearing post-China ban highs. For instance, the average BTC reward per terahash was 904 sats/TH in July, 822 sats/TH in August, 693 sats/TH in September, 643 sats/TH in October, and 574 sats/TH in November.

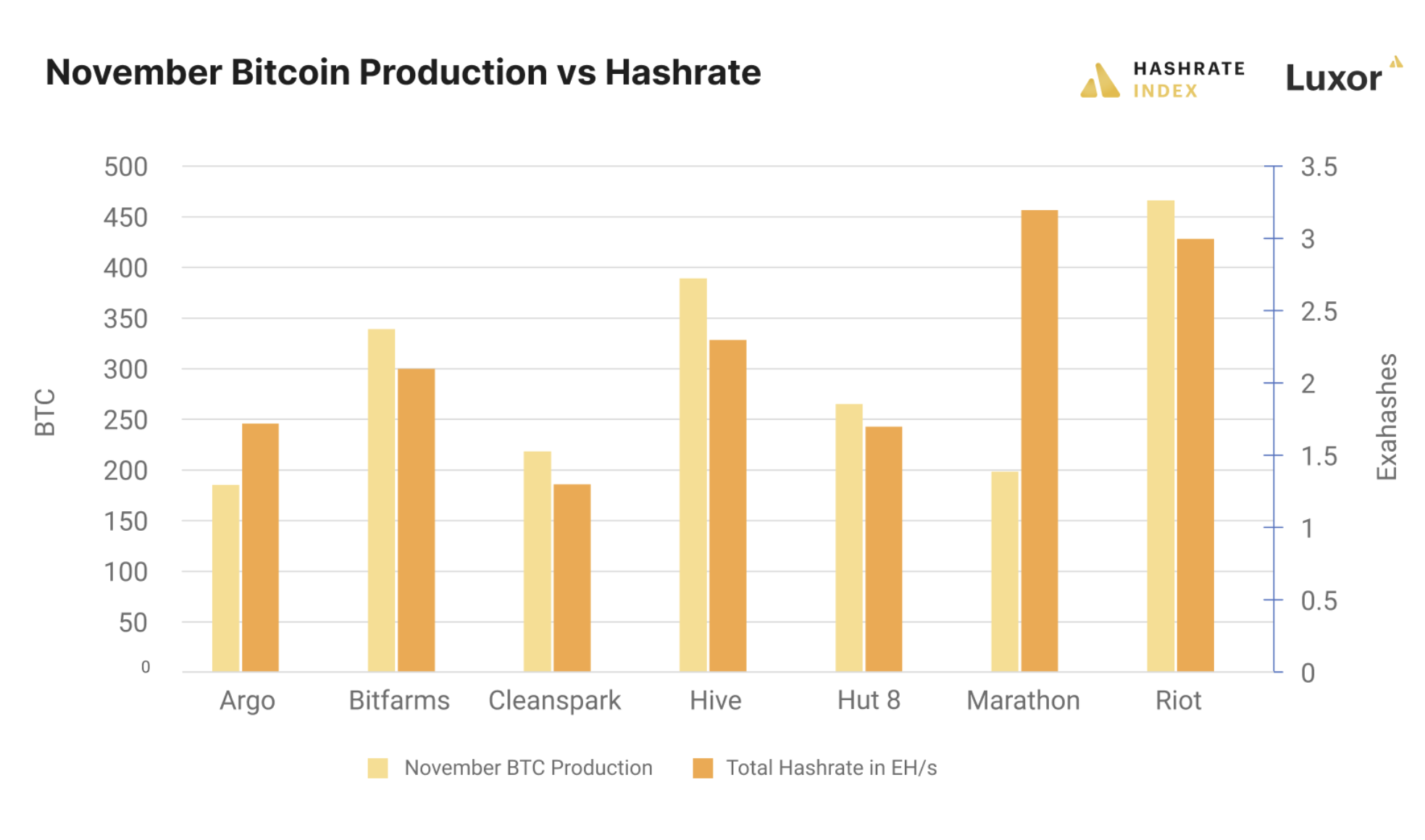

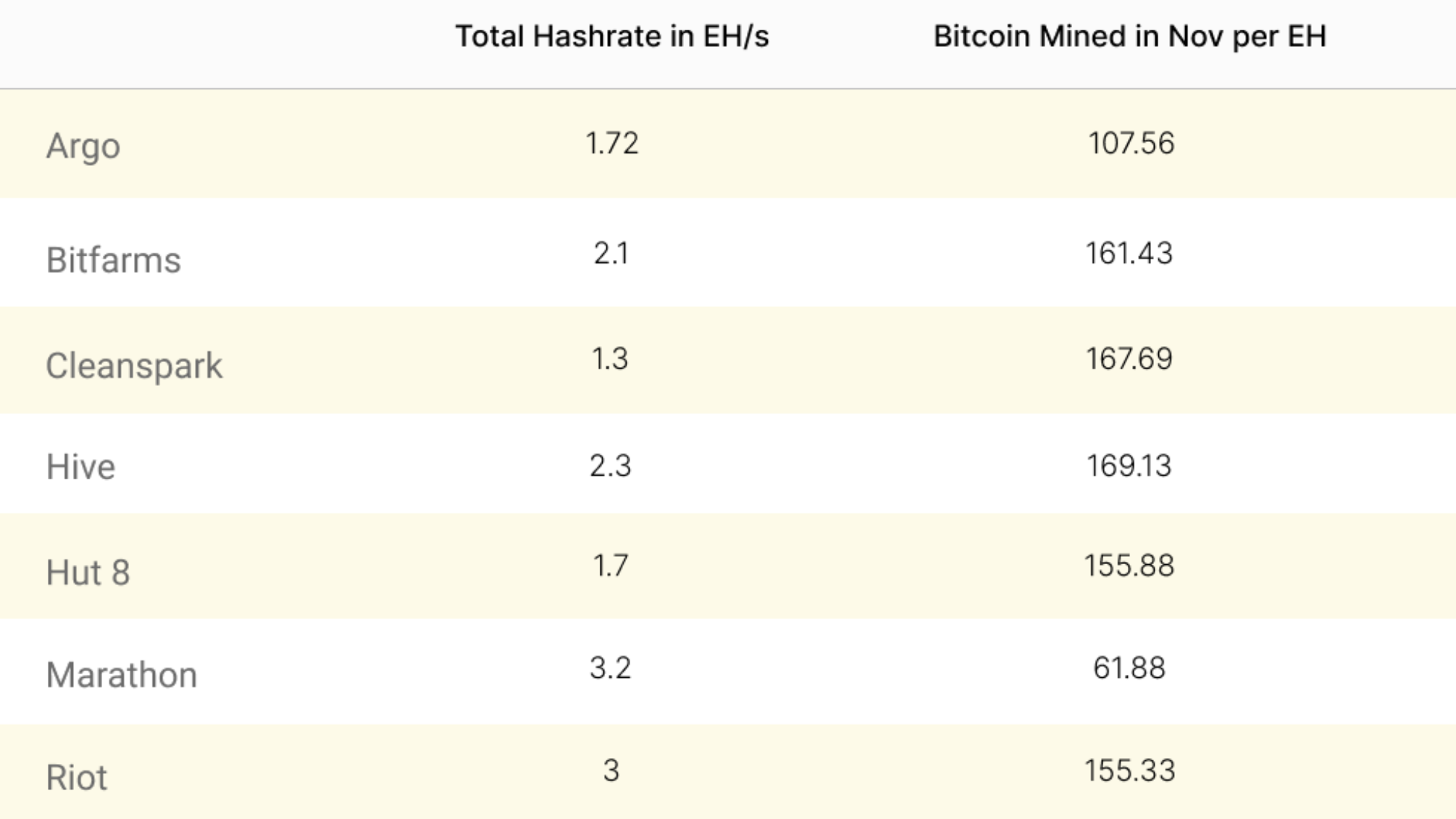

If we look at BTC production alongside total hashrate under management, we get a sense for which miners are running their operations more optimally than others in the pack.

Going a step further, dividing bitcoin production by hashrate gives us a look at how much bitcoin these companies produce per exahash of hashrate. Hive has the best total output per unit of hashrate when we measure BTC production with this metric, likely on account of Hive's including the ETH it mines into BTC production. Hut 8 does this as well, liquidating all ETH it mines into BTC.

Marathon and Argo's output per EH is at the bottom of the bucket. According to Marathon, its November production lagged behind because of maintenance at its primary power provider in Montana, along with on-site maintenance of machines.

As these miners continue to plug in new rigs, we expect their monthly BTC productions to rise. But they will likely not revisit the same profitability (in BTC terms) they experienced over the summer as difficulty continues its upwards march in response to Bitcoin's swelling hashrate.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.