Hashrate Index Roundup (October 15, 2024)

Uptober is upon us, hashprice volatility remains an open question.

Hello world, happy Tuesday!

Bitcoin trended up throughout the past week, increasing by 5.73% from ~$63,130 to a current price of ~$66,750. A sudden surge of 10% was observed over the weekend. 1-month price performance stands at +10.93% and 6-month performance at +5.26%.

Hashprice responded similarly with a downtrend throughout the week and subsequent spike of 13.66% over the weekend, moving from $42.62 per PH/s/Day to a local peak of $48.44 per PH/s/Day, currently hovering around $48.15 per PH/s/Day.

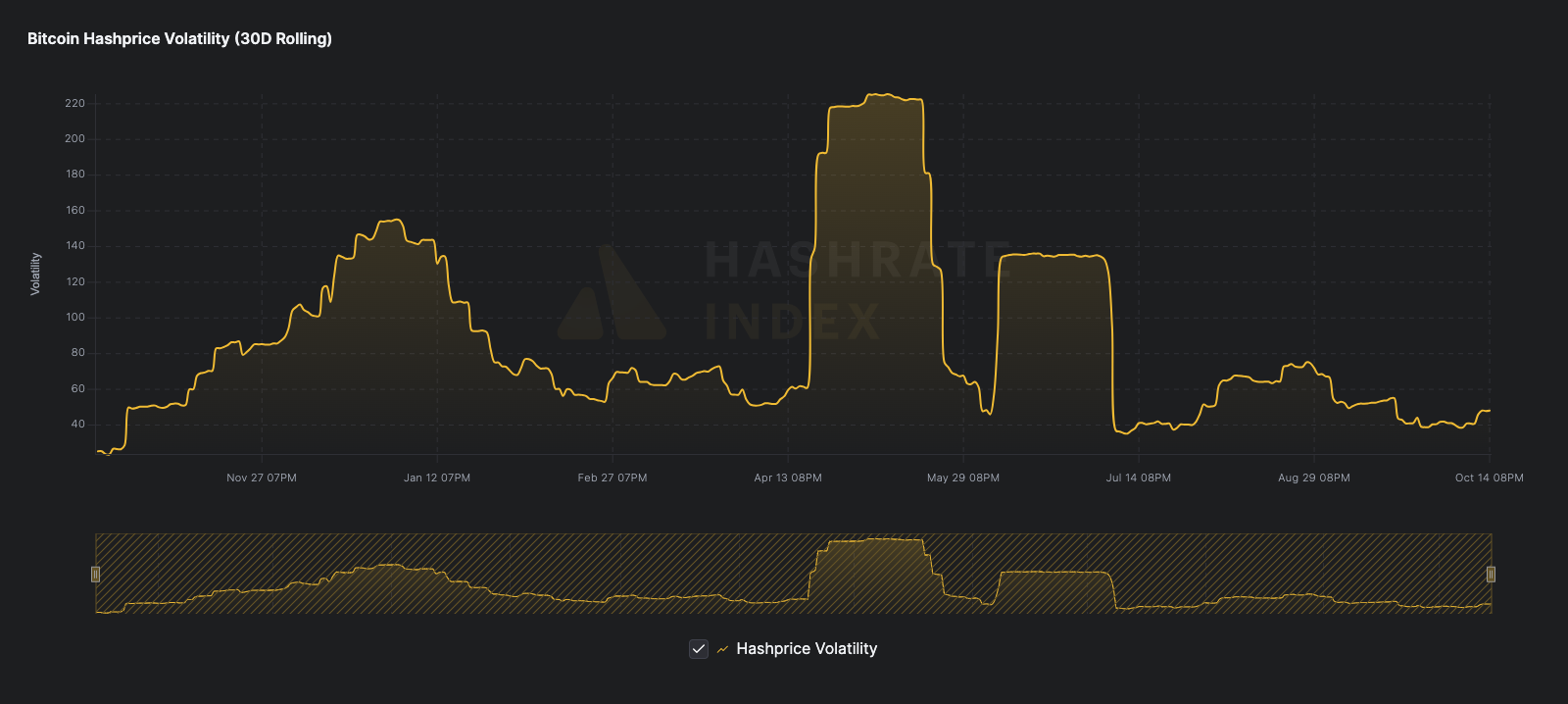

Taking a look at hashprice volatility, three observations stand out: the most recent Halving event in April and Summer of 2024 were two periods of immense volatility, including another gradual episode which began exactly one year ago today and lasted until the end of 2023. Hashprice varied by over 70% throughout these periods, causing uncertainty in mining economics and revenues.

Beyond price action in Bitcoin and hashprice, global network hashrate had a modest decline with the 7-day simple moving average (SMA) decreasing by 3.88% from 696EH/s to 670EH/s throughout the week. Network security is ~6% above the previous month's mark.

Blocks were found at an average time of around 10 minutes 07 seconds throughout the week, a slight slowdown in pace as compared to the week prior at 9 minutes 31 seconds. We estimate a decrease in difficulty of ~0.46% for the upcoming adjustment expected to occur on October 23rd.

Sponsored by Luxor Firmware

At $48/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

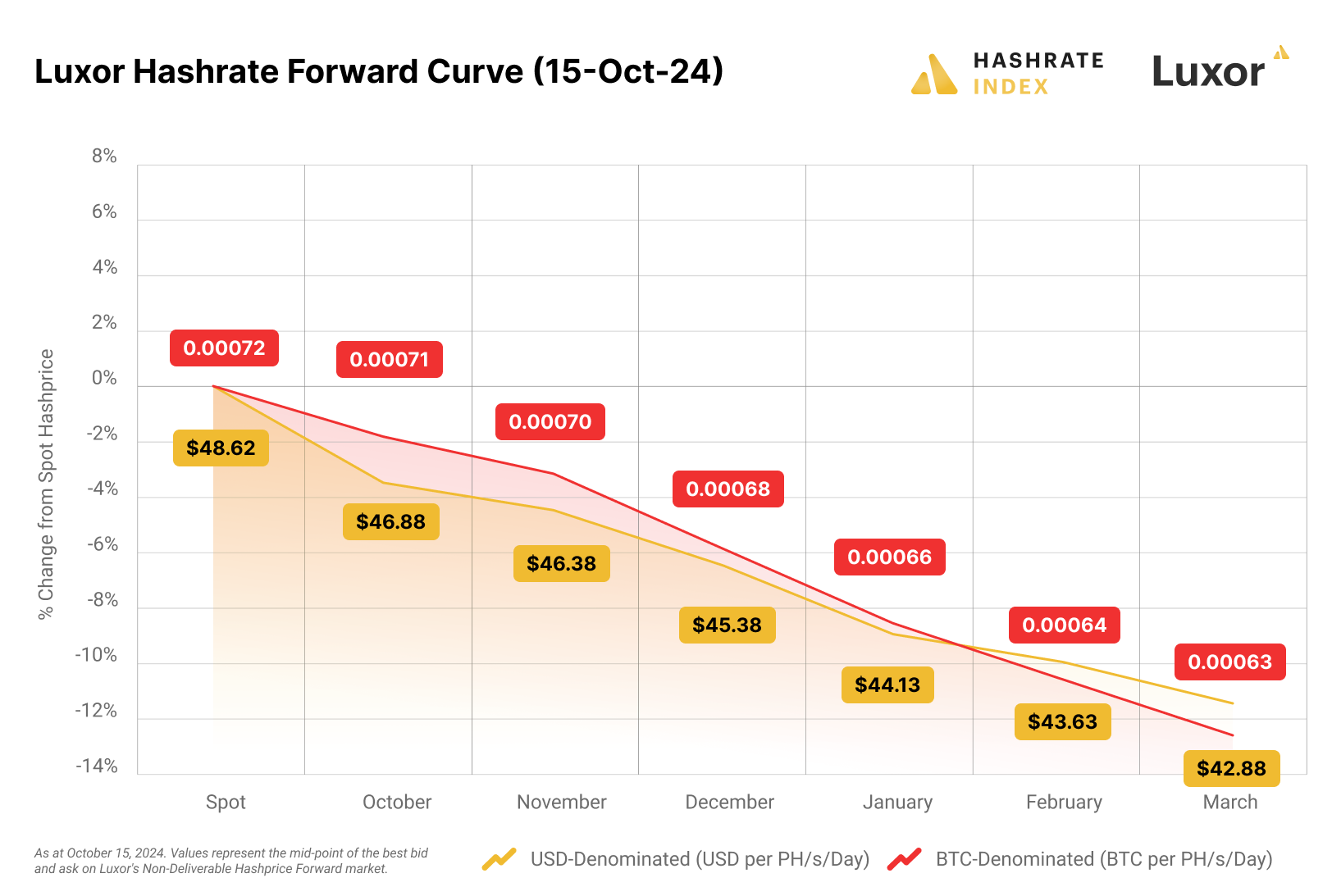

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, both USD and BTC contracts are trading in backwardation. Miners can lock in a ~$44.88 hashprice for up to six months into the future.

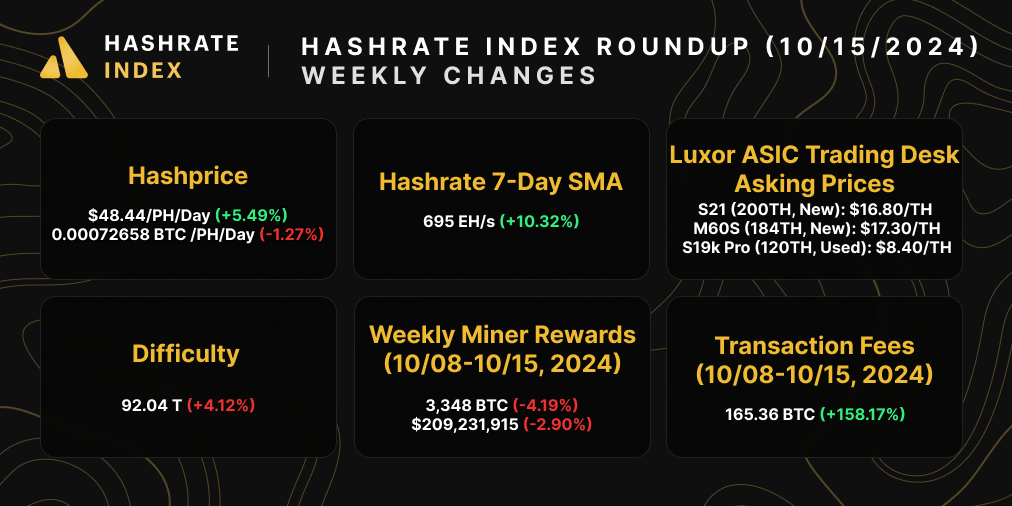

Bitcoin Mining Market Update

A positive trend for this week's update. Hashprice is up, hashrate is steady, network difficulty is expected to decrease. Miners collected a total of ~3,348 BTC in block rewards, equivalent to ~$209.2 million. Transaction fees constituted 5.34% of block rewards totalling 165.36BTC, equivalent to ~$11.07 million.

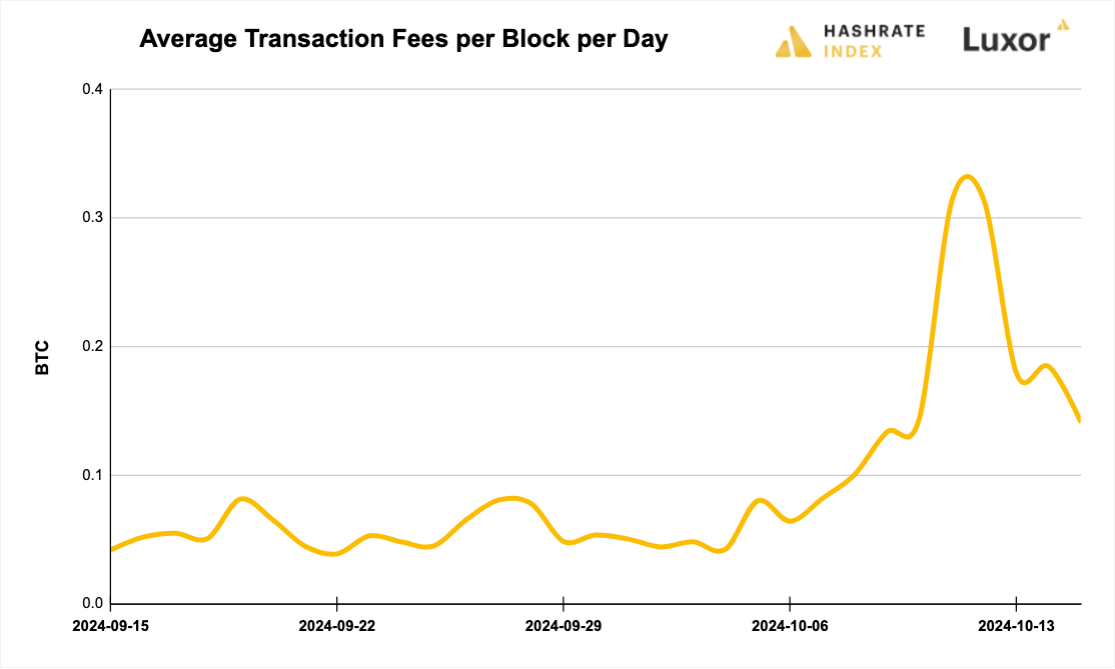

Bitcoin Transaction Fee Update

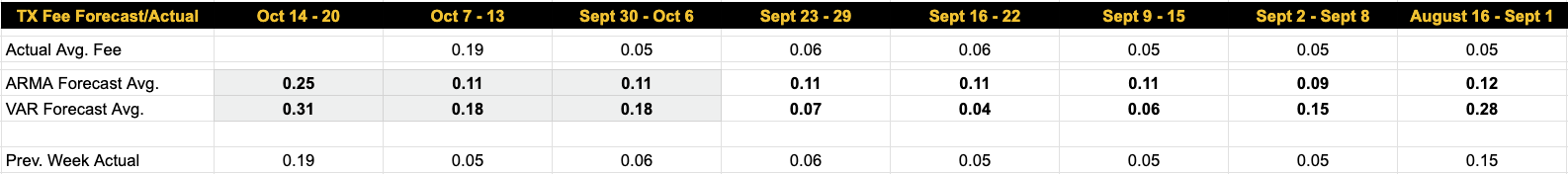

Over the past week, Bitcoin miners collected an average of 0.2012 BTC per block per day in transaction fees compared to the prior week's 0.0660 BTC, a whopping 205.07% increase.

Our transaction fee projection models are becoming relatively more bullish as we expect moderate volatility in the more typical range of fees (i.e., above the summer's all time lows) to continue. For this week, our VAR model forecasts 0.31 BTC per block per day and the ARMA estimates 0.25 BTC per block per day.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bit Digital, Inc. Vertically Integrates, Acquiring Tier 3 HPC Datacenter Company; 280+ MW Pipeline in Major Metropolitan Areas

- Bitcoin miner Riot open to AI opportunities if the right deal comes along: Bernstein

- Texas town residents sue Marathon Digital over crypto mine noise

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended up throughout the past week, reflecting a 4.58% increase in our Bitcoin Mining Stock Index.

5-day changes to Bitcoin mining stocks as of yesterday's market close:

- RIOT: $8.74 (+9.39%) | Mkt Cap: $2.65B

- HUT: $12.18 (+4.10%) | Mkt Cap: $1.11B

- BITF: $1.91 (+0.53%) | Mkt Cap: $0.83B

- HIVE: $3.35 (+7.37%) | Mkt Cap: $0.37B

- MARA: $16.98 (+8.29%) | Mkt Cap: $5.00B

- CLSK: $10.81 (+20.24%) | Mkt Cap: $2.70B

- IREN: $8.53 (+3.77%) | Mkt Cap: $1.62B

- CORZ: $12.97 (+5.45%) | Mkt Cap: $3.35B

- WULF: $4.49 (+12.53%) | Mkt Cap: $1.72B

- CIFR: $4.32 (+8.54%) | Mkt Cap: $1.42B

- BTDR: $8.13 (+15.48%) | Mkt Cap: $1.13B

- FUFU: $4.60 (+20.42%) | Mkt Cap: $0.75B

- CAN: $1.01 (-0.98%) | Mkt Cap: $0.29B

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.