Luxor Technologies Launches OTC Bitcoin Mining Derivative

Luxor's hashprice derivative will give miners a much-needed hedging instrument.

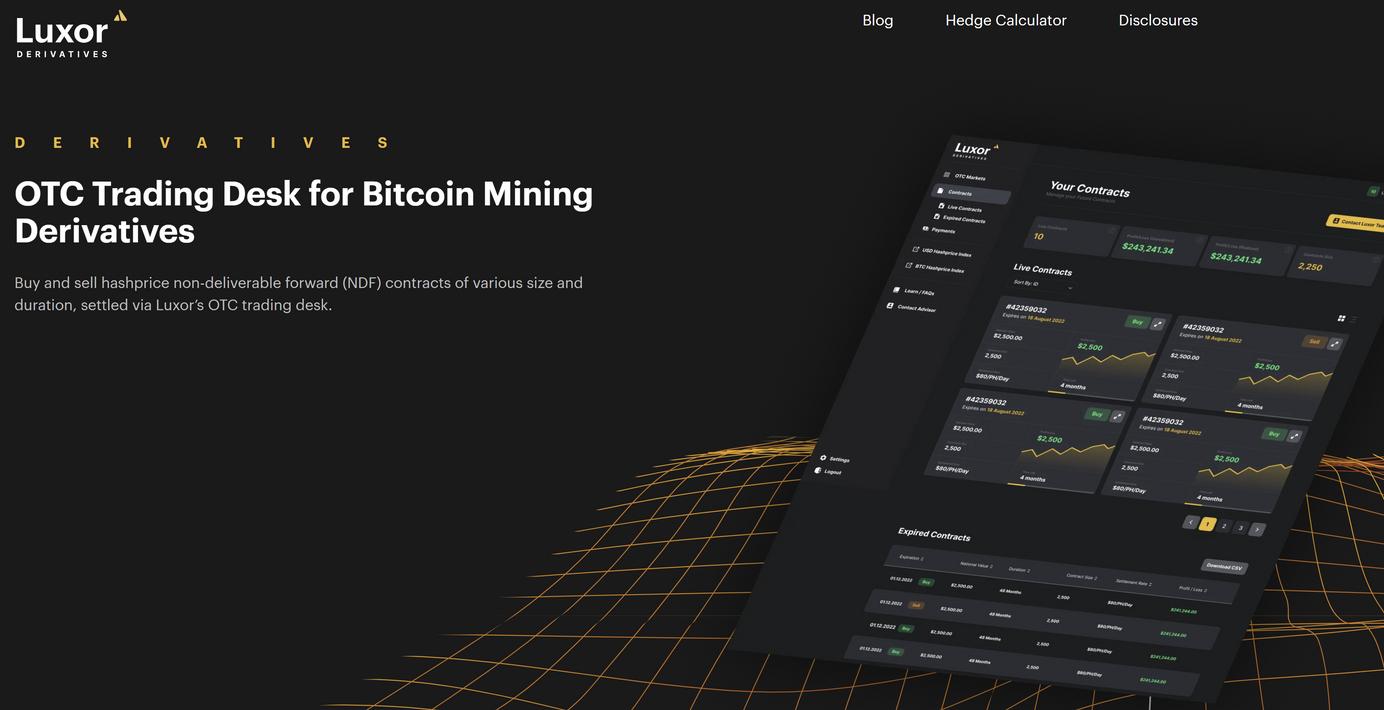

Luxor Technologies has launched the Luxor Hashprice NDF, an Over-the-Counter (OTC) non-deliverable forward contract (NDF) for Bitcoin mining hashprice.

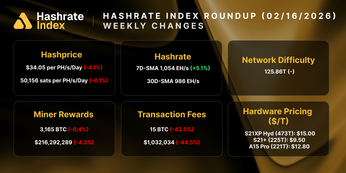

Hashprice, a term Luxor coined, refers to the bitcoin mining revenue miners earn from a unit of hashrate (i.e., compute power) over a specific timeframe.

This derivative product is the first of its kind. With Luxor's Bitcoin Hashprice NDF, contract sellers can lock in bitcoin mining revenue, and contract buyers can participate in potential bitcoin mining upside with non-physical exposure.

Hashprice-based derivatives such as the Luxor Hashprice NDF forward contract will usher in a new era of financial instruments for Bitcoin miners and give them a much-needed tool to hedge their mining operations. Additionally, Luxor’s NDF will provide prop trading firms, hedge funds, and other investment firms with exposure to the Bitcoin mining industry via a novel derivatives product.

“Luxor’s Hashprice NDF is a simple, yet highly effective instrument for Bitcoin miners to hedge their hashrate exposure. While many derivative instruments exist for miners to hedge their Bitcoin price exposure, as well as their power and energy exposure, the space was lacking an instrument to easily hedge their hashrate exposure. This derivative is also a great tool for getting synthetic exposure to hashrate,” Luxor Head of Derivatives Matt Williams said.

The Luxor Hashprice NDF contracts will settle in USD, with Luxor also providing participants the option to reconcile in BTC or USD equivalents. Luxor will act as the principal in these trades by facilitating order matchmaking, managing counterparty risk, and settling the payments using the Bitcoin Hashprice Index as the reference rate for hashrate value.

Sellers will agree to contract terms that are structured according to the following variables: 1) locked-in hashprice, 2) daily hashrate being sold, and 3) duration of the contract. Contract durations will be flexible and bespoke according to counterparty needs.

“These products are a major step in the Luxor roadmap and something we have analyzed deeply since the company’s genesis; hashprice derivatives are the apotheosis of our vision of hashrate as an asset class, something we’ve been pioneering since we introduced hashprice with the launch of Hashrate Index in 2020,”said Nick Hansen, CEO and co-founder of Luxor.

Luxor’s non-deliverable forward contract is the first of many hashrate derivatives Luxor plans to release in the coming year.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.