Luxor Hashrate Lookback Series – December 2025

December 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor’s Monthly Lookback Series is a deep dive into Bitcoin hashrate market activity. In this post, we cover December 2025’s hashrate market and hashprice trends, forward market participation, trading activity and contract performance.

Summary

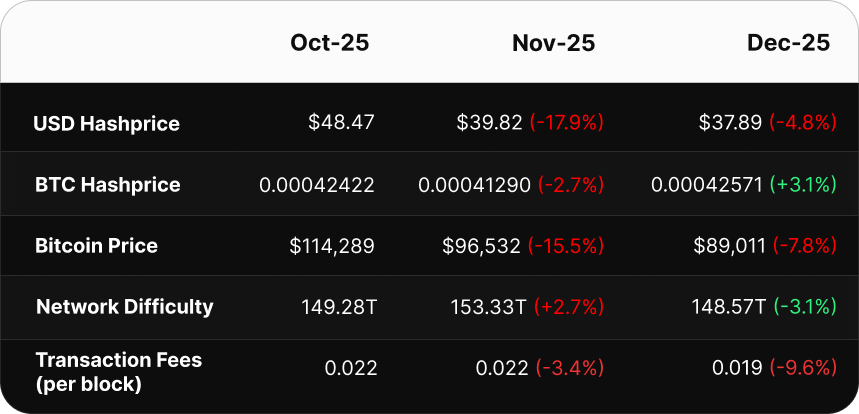

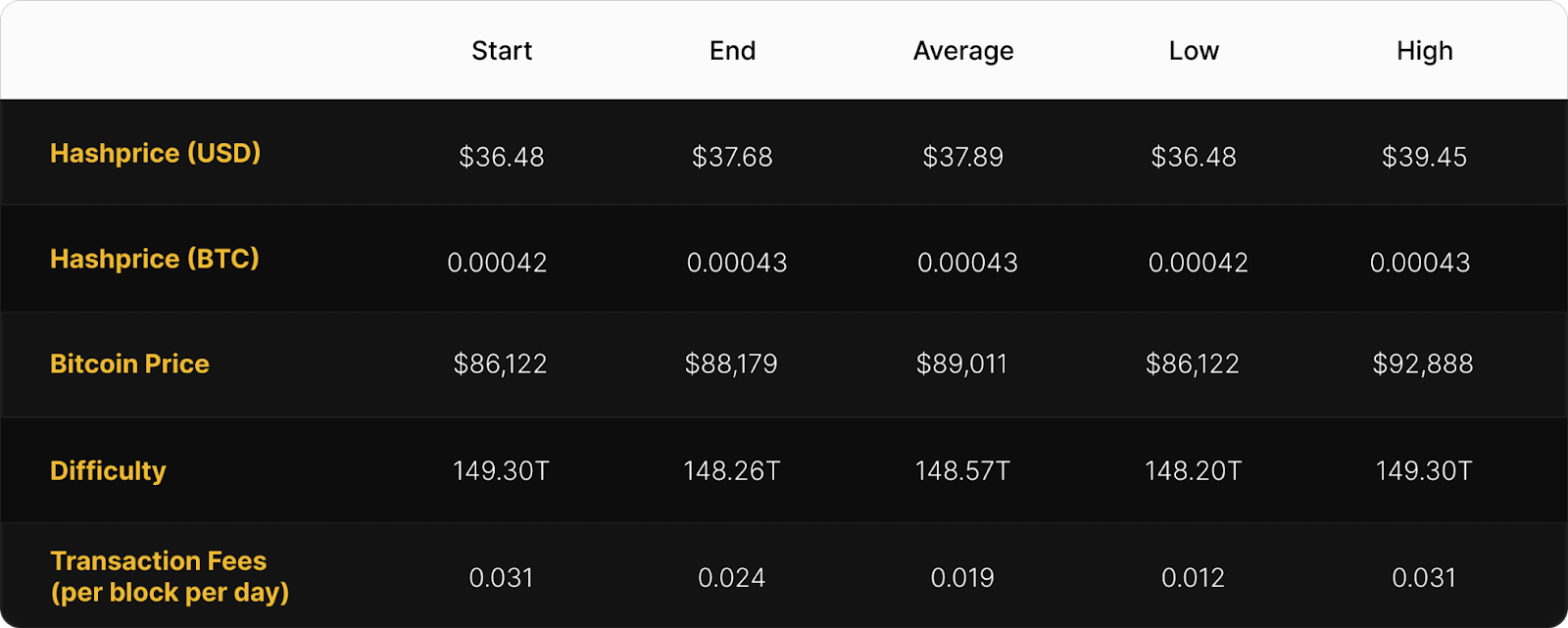

- Hashprice Hit an All-Time Low: BTC price fell 7.8% month-over-month to an average price of $89,011, transaction fees dropped 9.6% to 0.019 BTC per block, and USD hashprice marked an all-time monthly average low of $37.89 per PH/s/day.

- Hashrate & Difficulty Down: The explosive growth in network hashrate since late summer reversed course. The trend was driven by three factors: declining BTC price, rising winter energy costs across North America, and (reportedly) regional enforcement actions in major mining hotspots. Following two consecutive decreases in November, a third downward difficulty adjustment in December pulled monthly average network difficulty down 3.1% to 148.57T.

- Hashrate Growth Expectations Soften: January–May 2026 hashrate forwards moved slightly higher, but the curve remained in backwardation, implying continued near-term downward pressure on hashprice.

- USD Hedges Outperform: Selling forward hashrate contracts denominated in USD outperformed spot by 6–43%, depending on hedge timing. BTC-denominated forwards favoured early hedges, while later hedges underperformed.

December 2025 Spot Hashprice & Its Constituents

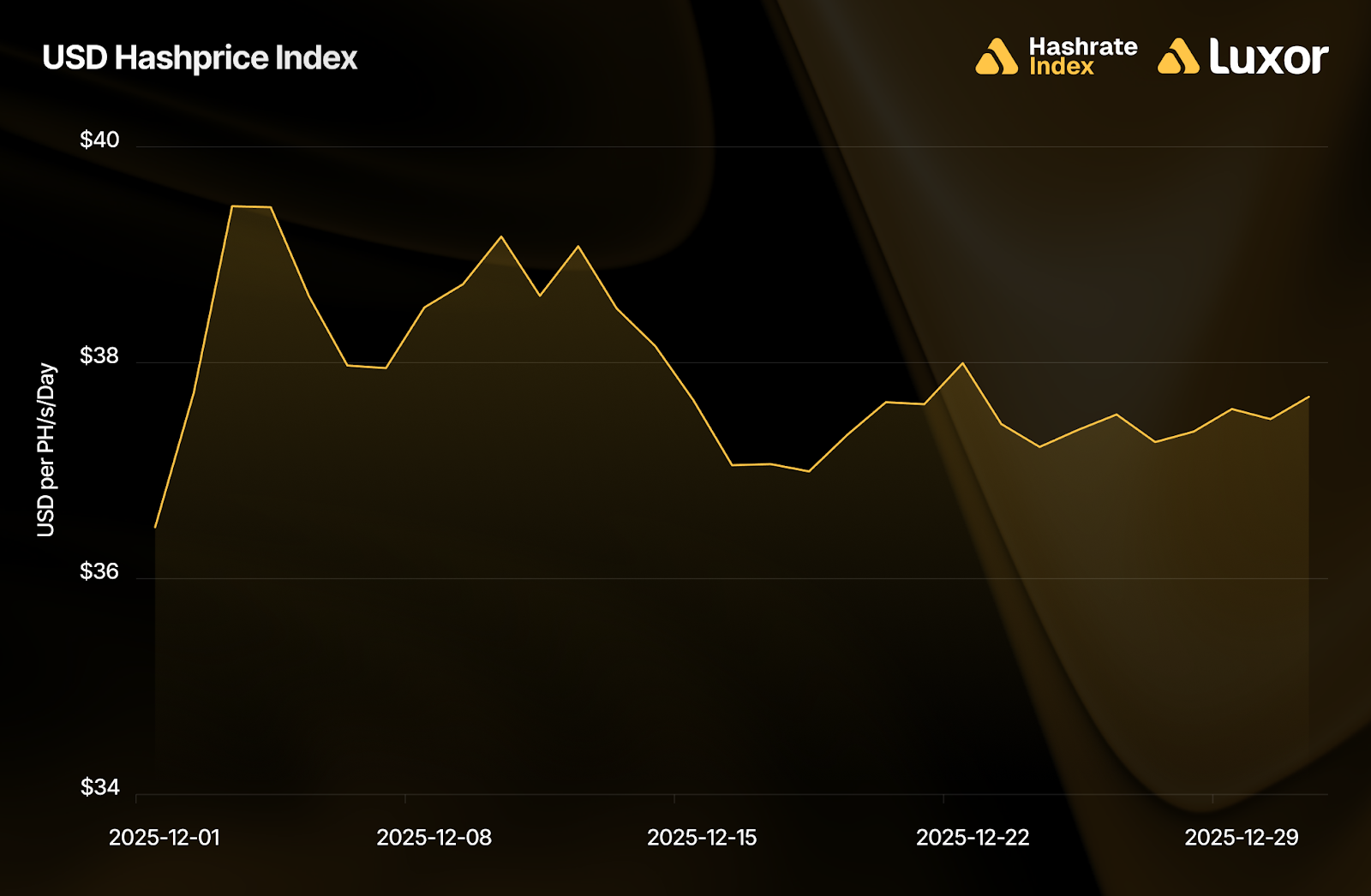

In December, USD-denominated hashprice marked a monthly average of $37.89 per PH/s/day — a new all-time low. This was driven by a 7.8% decline in BTC price and near-record-low transaction fees.

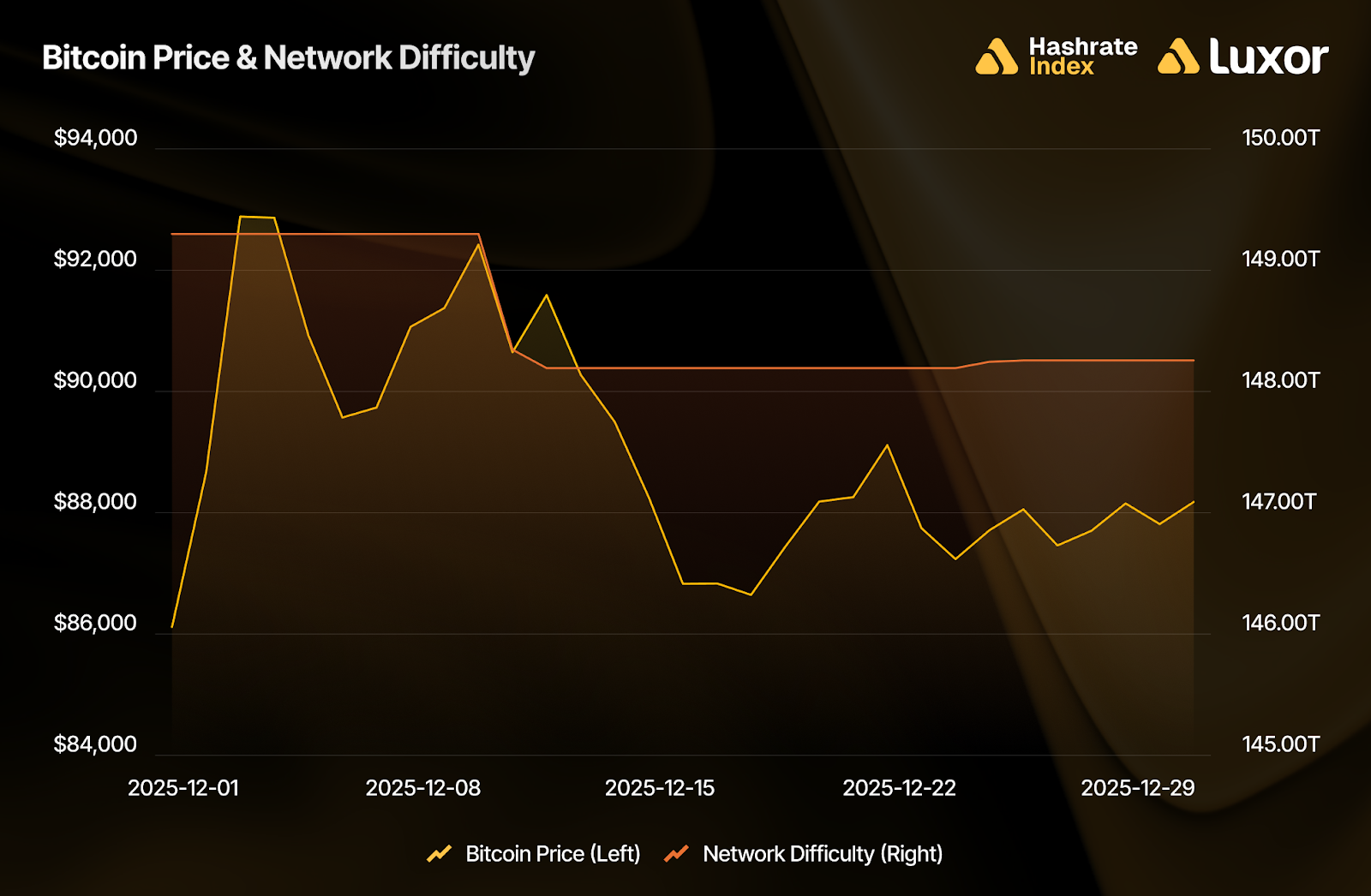

Meanwhile, the explosive growth in hashrate since late summer has officially reversed course. The trend was driven by three factors: declining BTC prices pushing legacy hardware into negative margins, rising winter energy costs triggering seasonal curtailment across North America, and regional enforcement actions removing capacity from major mining regions. As a result, monthly average network difficulty dropped 3.1%.

Despite the weak monthly average, hashprice stabilized and drifted modestly higher over the course of December: it opened at $36.48, traded in a tight $36.48–$39.45 range, and closed at $37.68 per PH/s/day.

After a 15.5% move lower in November, monthly average BTC price fell another 7.8% to $89,011 in December. However, like spot USD hashprice, BTC price stabilized and drifted modestly higher over the course of December—opening at $86,122, closing at $88,179.

On the hashrate side, the explosive growth since late summer reversed course. The dominant driver of falling hashrate was BTC price action. At December’s hashprice level, a meaningful portion of installed hashrate found itself at or below breakeven. Hashrate Index’s latest mining economics projections (Q4-2025) estimated ~90 EH/s of marginal hashrate dropping offline due to the BTC price decline out of the ~100 EH/s decline actually observed since mid-October.

In addition to the decline in BTC price, winter weather increased miners’ costs by driving up electricity demand and tightening power grids across North America.

According to Gridstatus.io, a recent cold snap across the Eastern Interconnection pushed the Southeast and Middle South into synchronized load stress, with several large utilities operating near year-to-date peak demand levels—and some regions nearing their rolling 12-month peak, which is often set in late January.

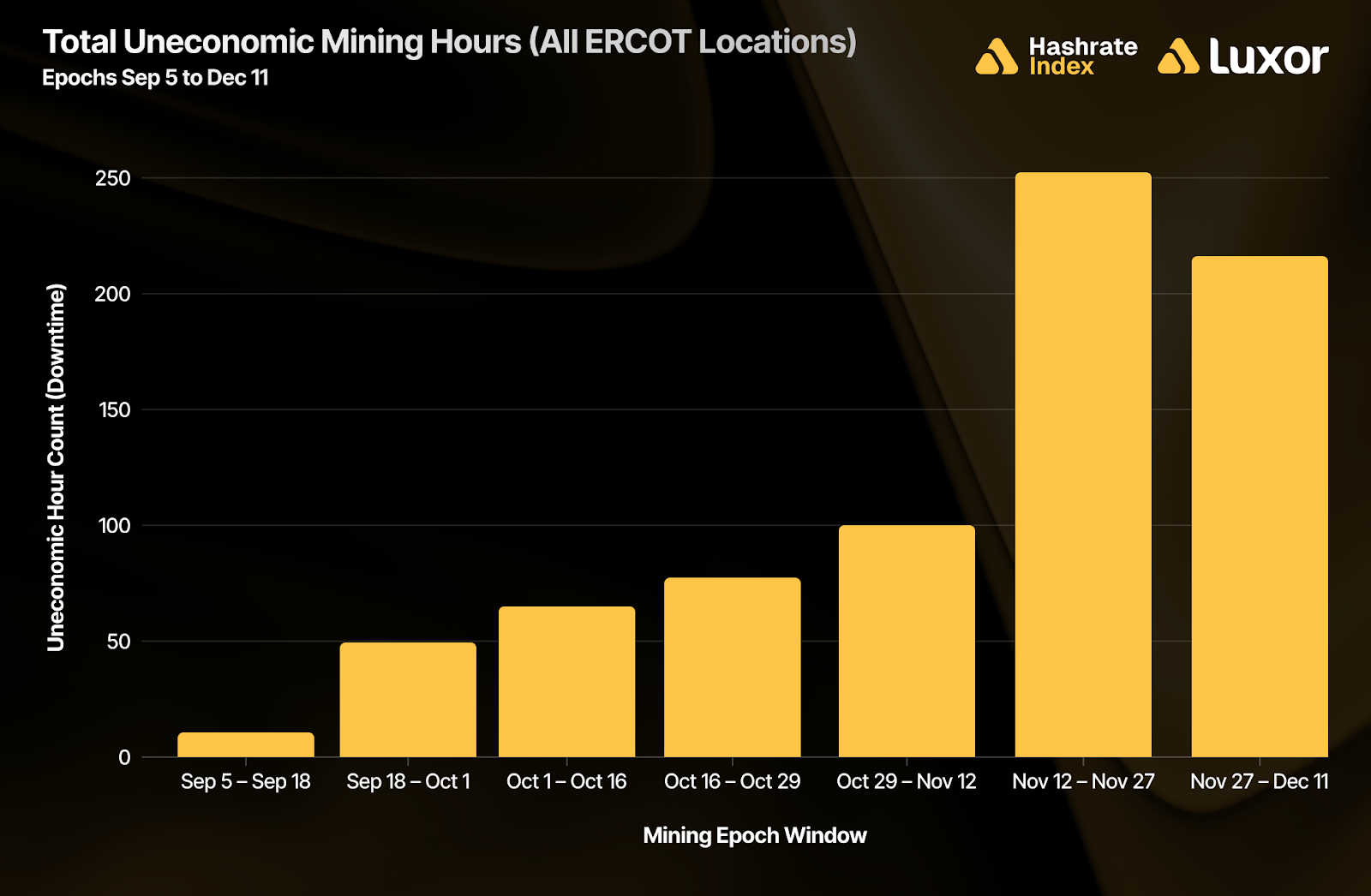

This winter “synchronicity” reduces the regional offsets that typically provide relief in other seasons: electric heating demand rises broadly at the same time, solar output weakens due to shorter daylight hours, interchange capacity tightens, and natural gas demand increases—amplifying power price volatility. For miners, that combination raised marginal power costs and increased curtailment, which showed up clearly in ERCOT data:

As power prices rose above miners’ breakeven thresholds, a sharp escalation in uneconomic mining hours was observed throughout early December, forcing operations to curtail.

Alongside weaker BTC prices and higher power costs, reported regulatory actions added an additional headwind in December. Luxor’s Head of Hardware, Lauren Lin, reported that around December 13, central-government rolling inspections in China triggered broad curtailment across multiple sites. While there were no reports of formal seizure, machines were reportedly either left in place or moved to government-designated warehouses, extending downtime and uncertainty.

Pressure has also reportedly increased in Russia, where authorities have moved to restrict or ban mining in multiple regions amid winter grid constraints during periods of energy stress. So far, the impact appears operational rather than structural: affected hashrate largely remains in-region, with limited evidence of forced liquidation or major hardware displacement, and much of it is controlled by well-capitalized operators—reducing spillover into hardware markets.

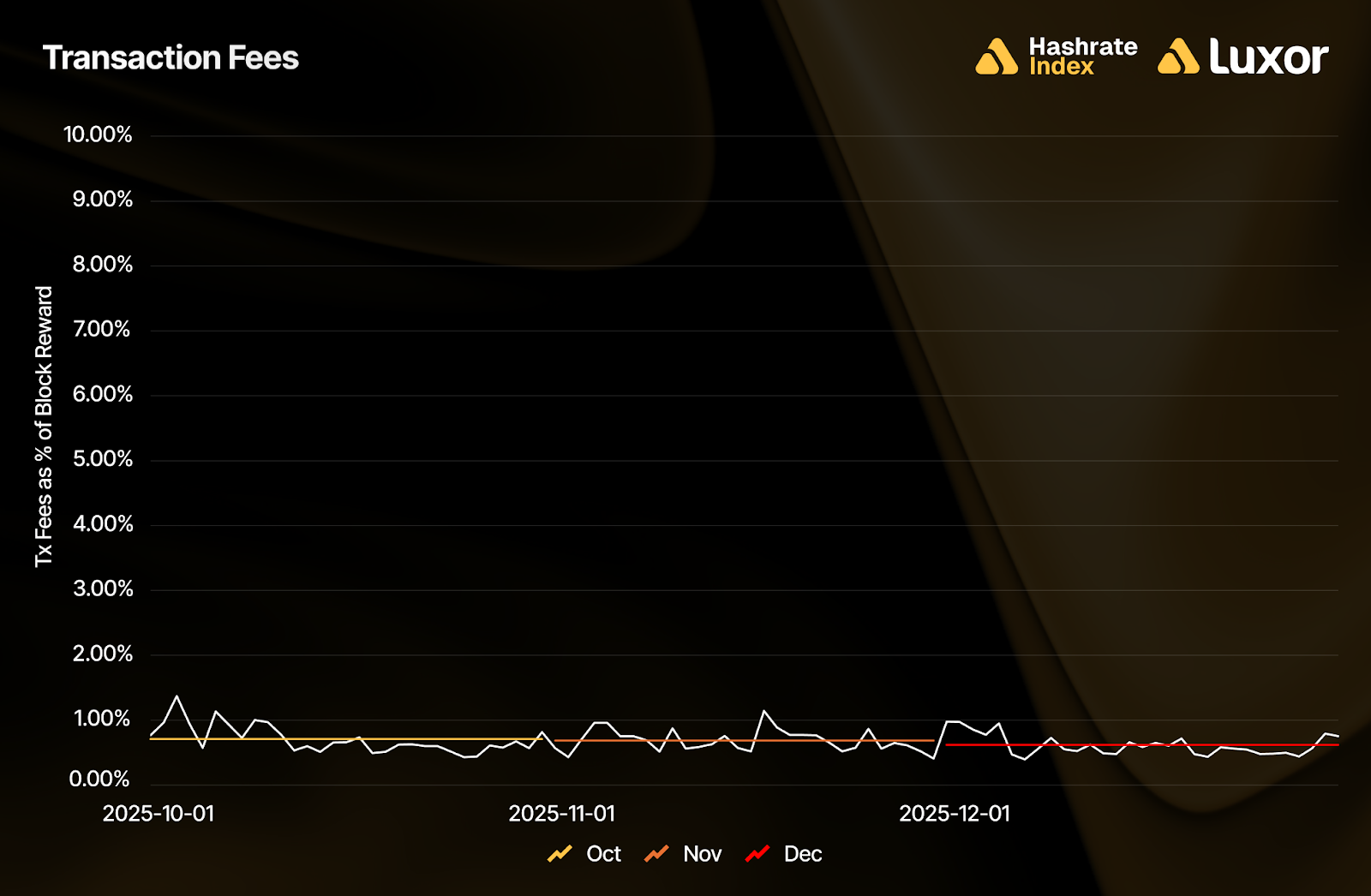

Average fees fell further in December. Fees declined 9.6%, averaging 0.019 BTC per block, pushing BTC-denominated fee levels to their lowest levels since February 2011. In USD terms, average fee revenue per block dropped 16.6% from $2,080 in November to $1,735. As a result, fees accounted for just 0.62% of total block rewards, down from 0.68% the prior month.

December BTC-denominated hashprice remained broadly flat, rising a modest 3.1% to an average of 0.00043 BTC per PH/s/day. Weak on-chain transaction fees provided little lift and kept BTC hashprice down, but a modest easing in difficulty partially offset that drag as marginal hashrate curtailed.

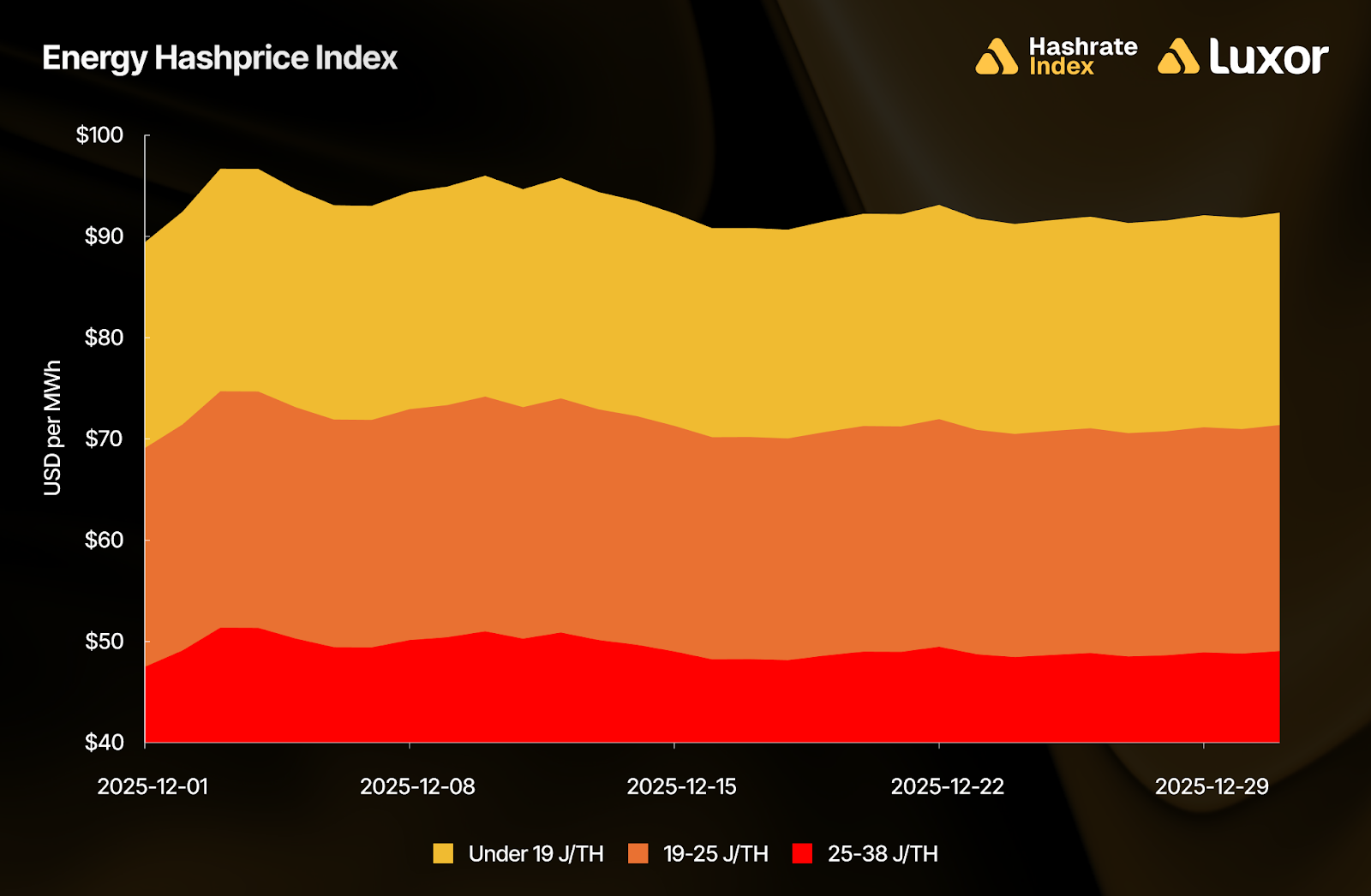

In December, implied mining revenue per unit of electricity consumed was approximately $93/MWh for <19 J/TH fleets, $72/MWh for 19–25 J/TH, and $49/MWh for 25–38 J/TH.

At $49/MWh, the 25–38 J/TH segment is below the estimated average network power cost, putting these rigs at imminent risk of shutdown. On the other hand, since new-generation fleets offer wider operating margins, there is still a strong compute revenue-per-watt incentive for miners to continue deploying those machines.

December 2025 Hashrate Market Activity

Our analysis of the December 2025 hashrate market focuses on two key points: how the December 2025 hashrate contract traded in previous months and how the forward curve shifted in December, based on pricing for forward hashrate during the month.

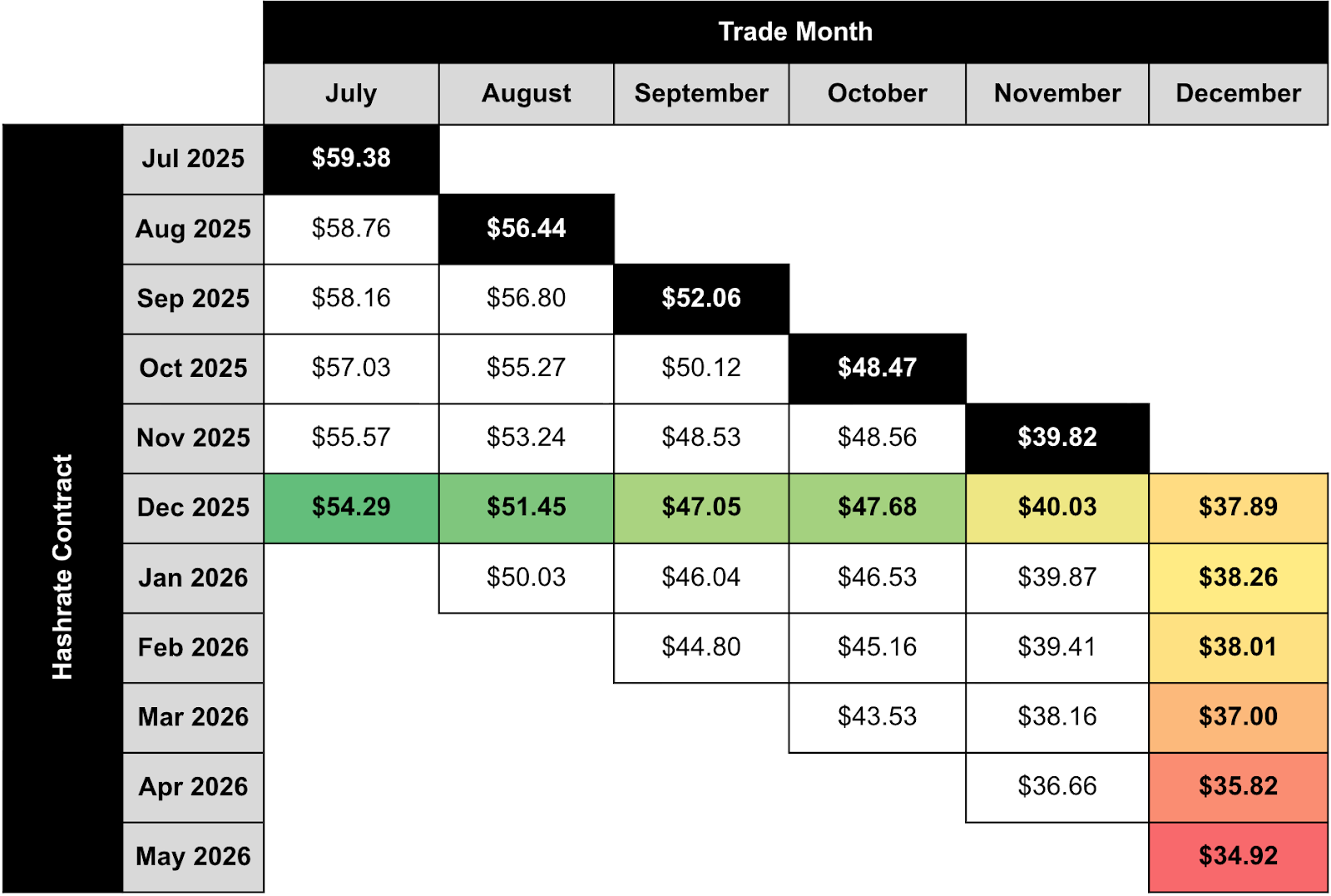

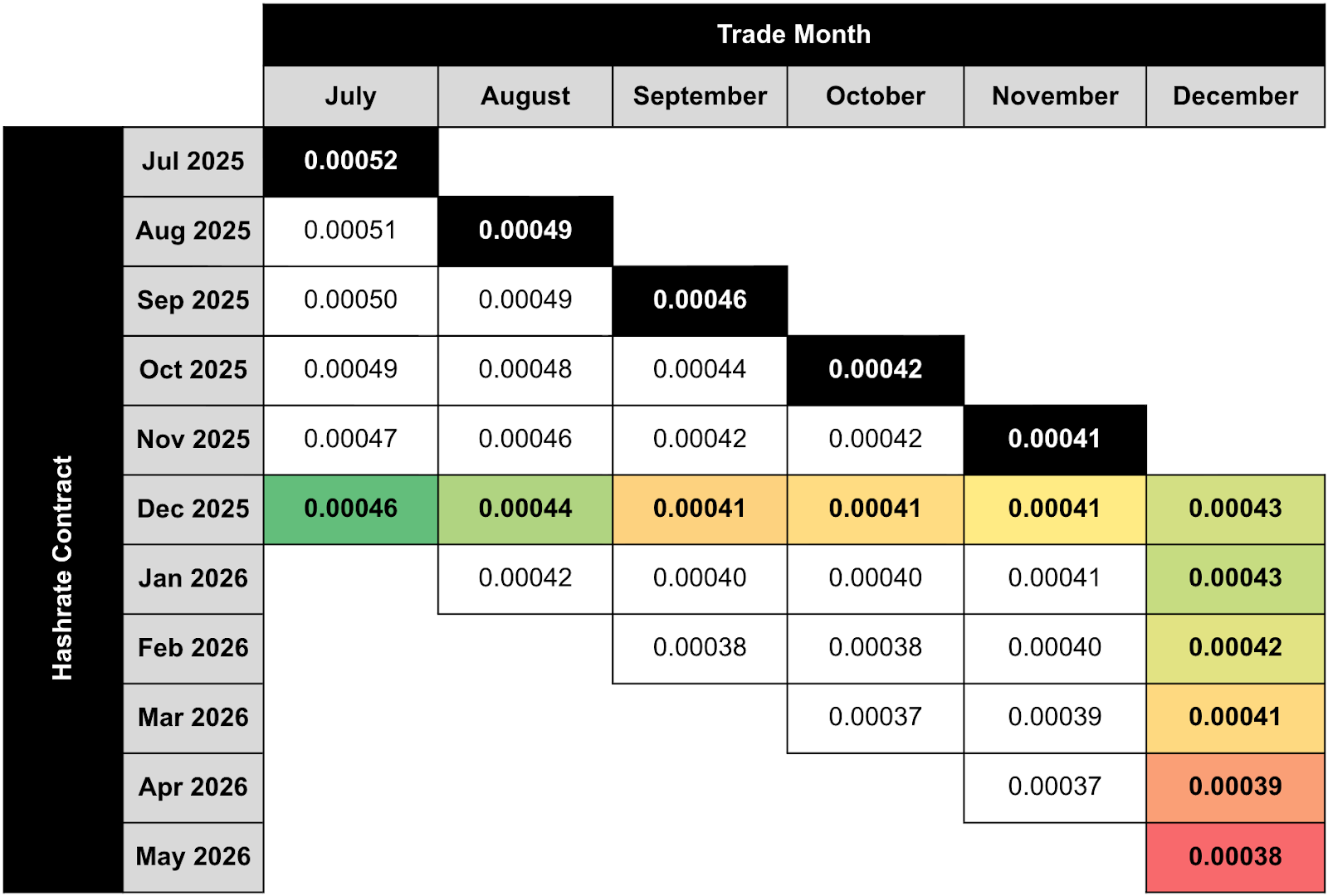

The two tables below show the evolution of Luxor’s USD and BTC-denominated hashrate forward markets from July 2025–December 2025. Rows represent specific monthly contracts, while columns represent each trading month. Cell values indicate the average monthly mid-market hashprice — except for the bold highlighted main diagonal — which shows actual spot hashprice settlement in each month.

This table summarizes both the trading history of the December 2025 USD contract (colored row) and the forward curve in December (colored column).

This table summarizes both the trading history of the December 2025 Bitcoin contract (colored row) and the forward curve in December (colored column).

Note: all values (except for the bold highlighted main diagonal) shown in figures represent mid-market rates, the midpoint of the best bid and ask on Luxor's Non-Deliverable Hashrate Forward market. The bold highlighted main diagonal shows actual spot hashprice settlement in each month, measured by Luxor’s Bitcoin Hashprice Index.

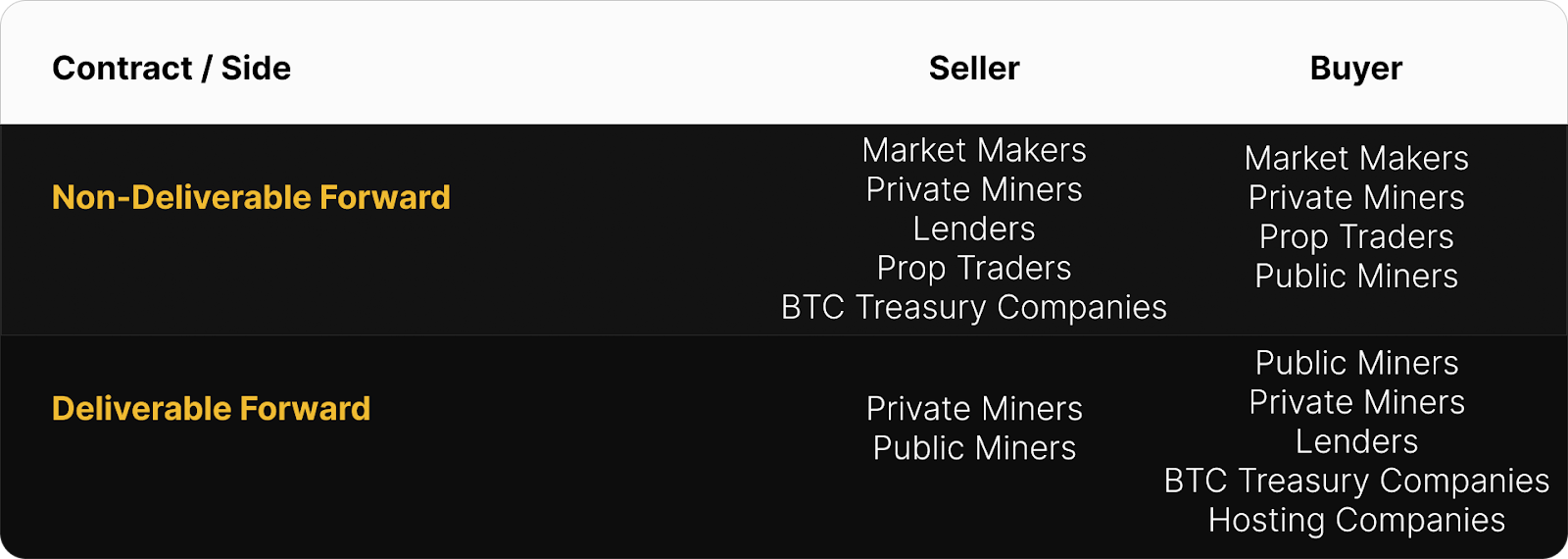

The table below shows the type of market participants on the buy and sell side of Luxor’s deliverable (DF) and non-deliverable hashrate forward (NDF) market. In December, lenders were active on the buy side of the DF market, while public and private miners used the contract to sell forward, receive financing, and expand their fleet.

Since the DF involves upfront payment, it tends to trade at a discount to the NDF, compensating the buyer for the inherent credit risk. We interpret the discount of DFs relative to NDFs as the interest rate in hashrate-based lending markets. Buyers and sellers of the DF with upfront payment can use the NDF to lock-in a fixed yield (cost of capital) instead of having exposure to hashprice uncertainty.

This strategy was used by lenders and Bitcoin treasury companies (Buy DF & Sell NDF) to earn a BTC-denominated return and by miners (Sell DF & Buy NDF) to obtain non-dilutive financing. In December 2025, that yield (cost of capital) was 6–13% annualized.

How December 2025 Hashrate Traded

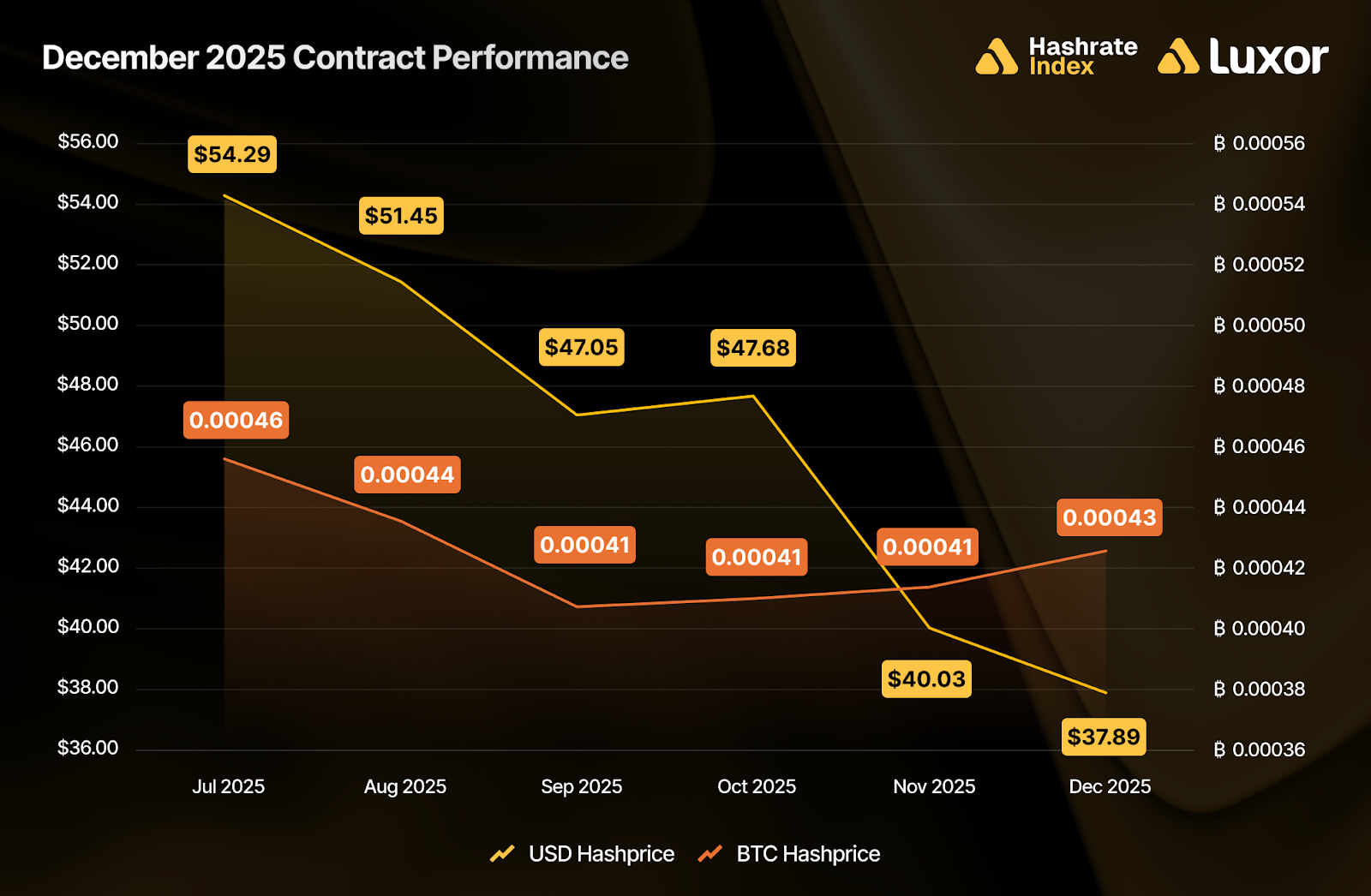

USD-denominated contracts in December favored sellers across the board. Forward sellers outperformed spot FPPS (Full-Pay-Per-Share) mining across all intervals as USD hashprice declined more than expected. USD contracts locked in between $40.03–$54.29 per PH/s/day versus a $37.89 hashprice for spot FPPS miners.

Payoffs in BTC-denominated contracts for December were mixed: early forward sellers outperformed spot mining, whereas miners who hedged later underperformed as network difficulty growth slowed down more than expected. BTC contracts locked in rewards between 0.00041 BTC–0.00046 BTC per PH/s/day compared to spot FPPS hashprice settlement at 0.00043 BTC.

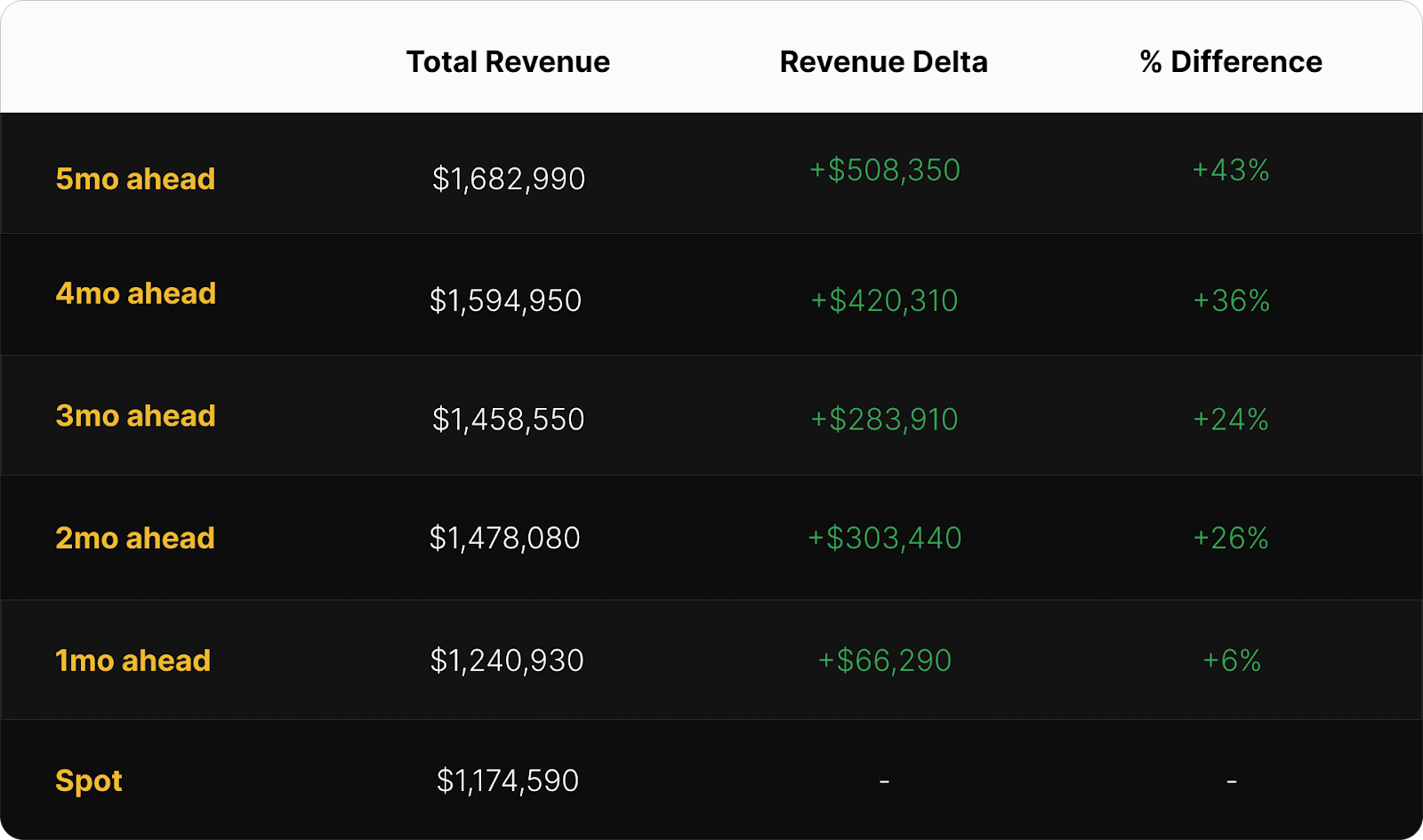

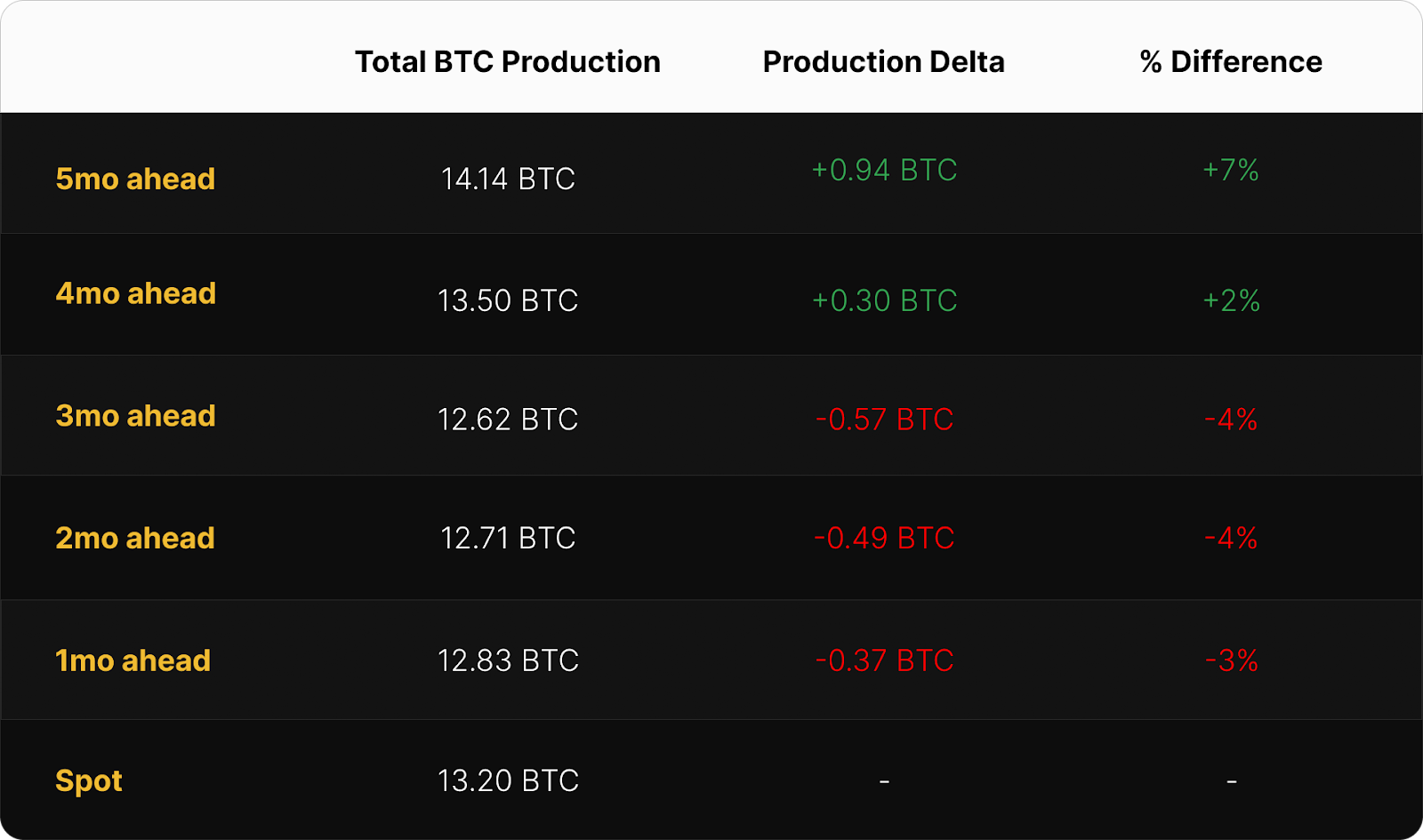

The tables below summarize how a 1 EH/s mining operation would have performed by selling December 2025’s hashrate forward in comparison to spot FPPS mining.

In USD revenue terms, early forward sales (July–October) outperformed spot by 24–43%, whereas later hedges in November locked in a 6% gain. The optimal trade for the USD-denominated December 2025 forward contract would have been to sell five months forward during July (+43%), which would have locked in a hashprice of $54.29 per PH/s/day.

In BTC production terms, early forward sales won, but later hedges lost. Miners who sold December’s hashrate four or more months in advance earned between 2–7% more BTC than spot FPPS miners, with July’s forward sales leading at +7%. Hedges between September–November underperformed by 3–4%.

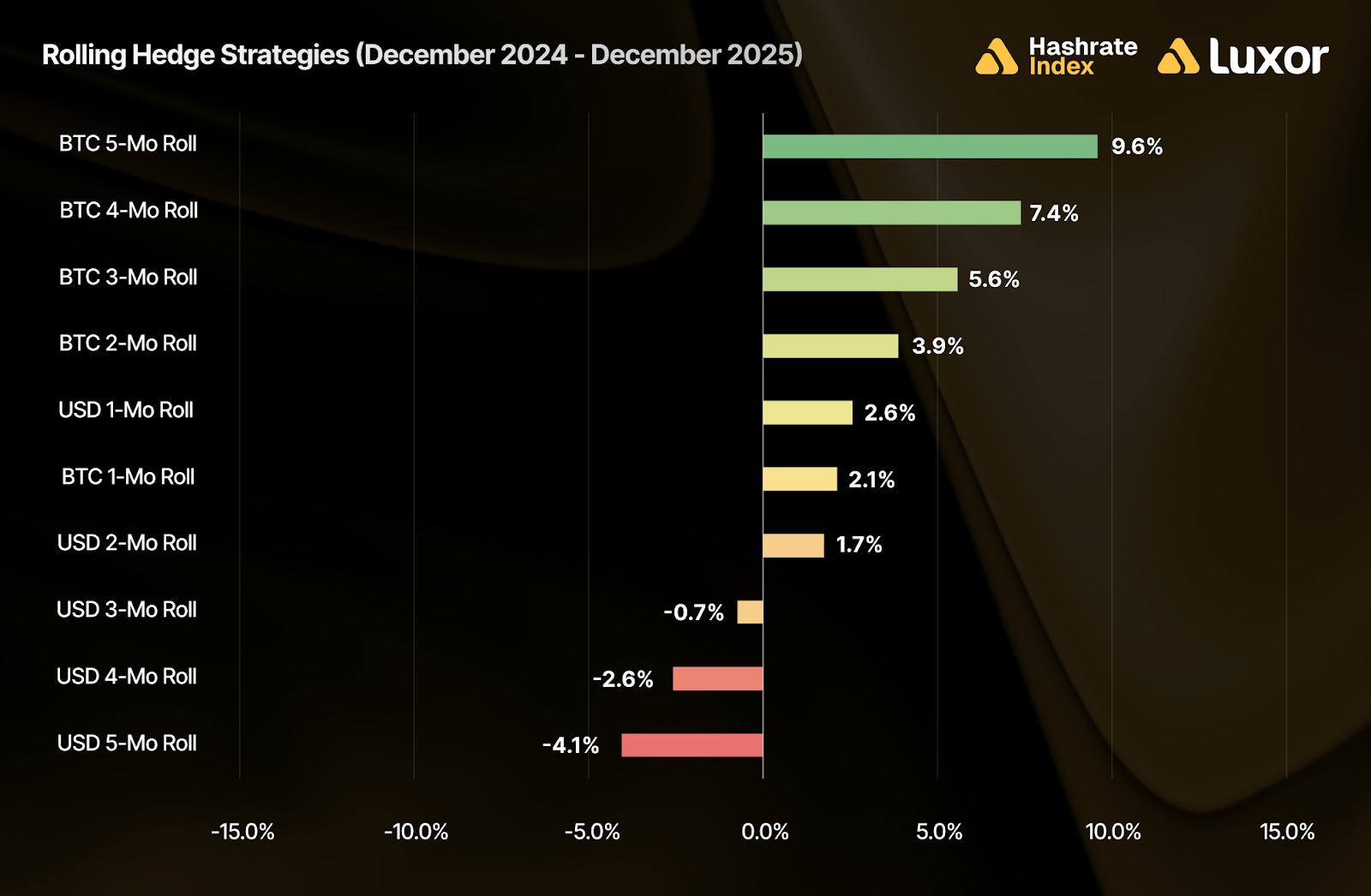

Zooming out, the following chart shows the performance for a range of rolling hedge strategies relative to spot mining, segmented by contract denomination and hedge horizon over the past year, from December 2024–December 2025:

This comparison reveals that rolling BTC-denominated hedging strategies outperformed over the past year, with the strongest results coming from 5-month (+9.6%) and 4-month forward sales (+7.4%). These longer-duration contracts generally benefited from locking in a higher hashprice ahead of rising network difficulty and low fee environments.

In contrast, USD-denominated hedging generally underperformed spot mining by an average of -0.6% because of rising BTC price throughout the past year. However, December 2025 marks a reversal of this trend: USD-denominated hedging results have turned positive given the recent collapse in BTC price.

Note: these figures are strictly for demonstration purposes and exclude fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable during timeframes shown above, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

How Future Hashrate Traded in December 2025

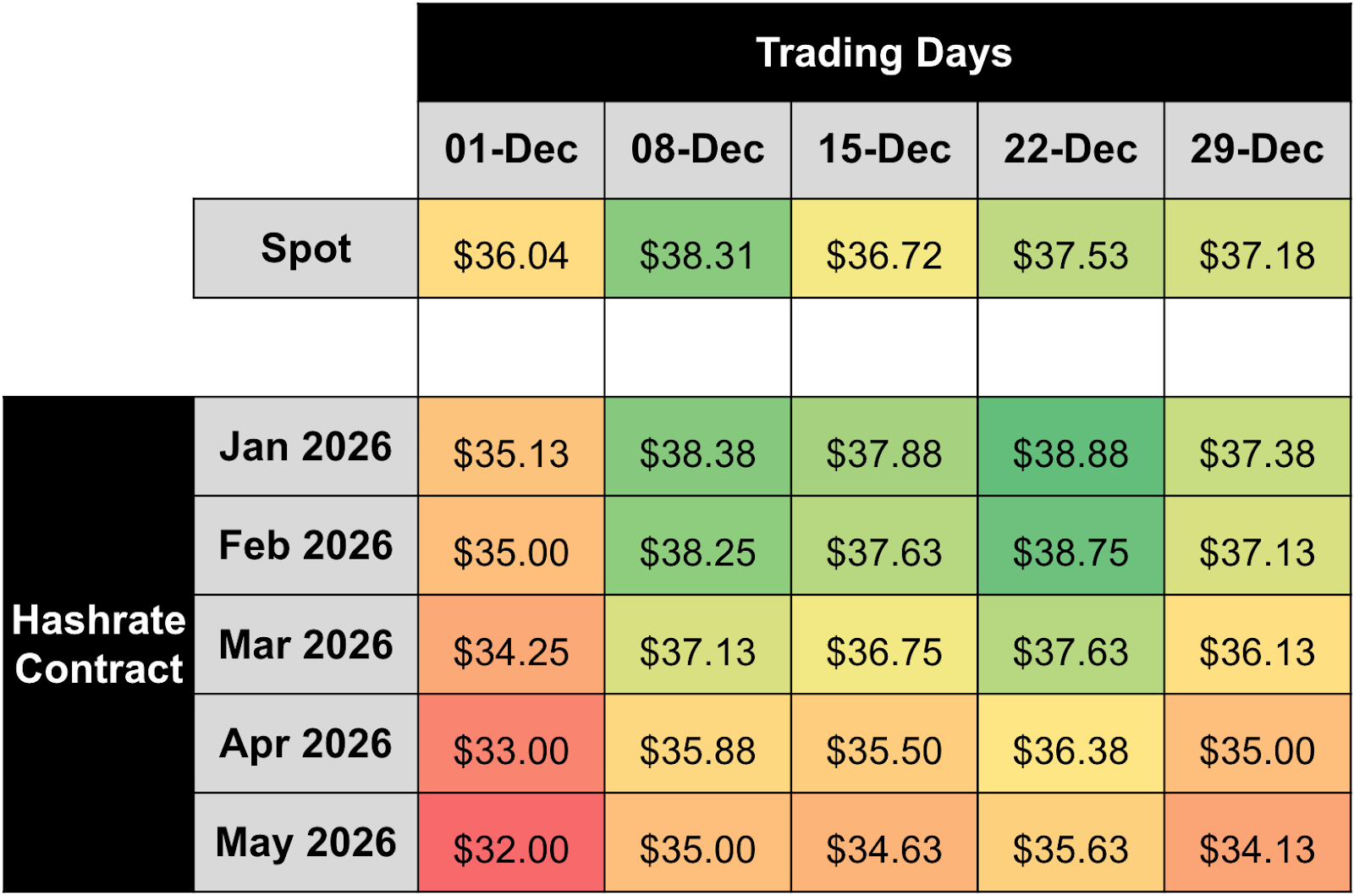

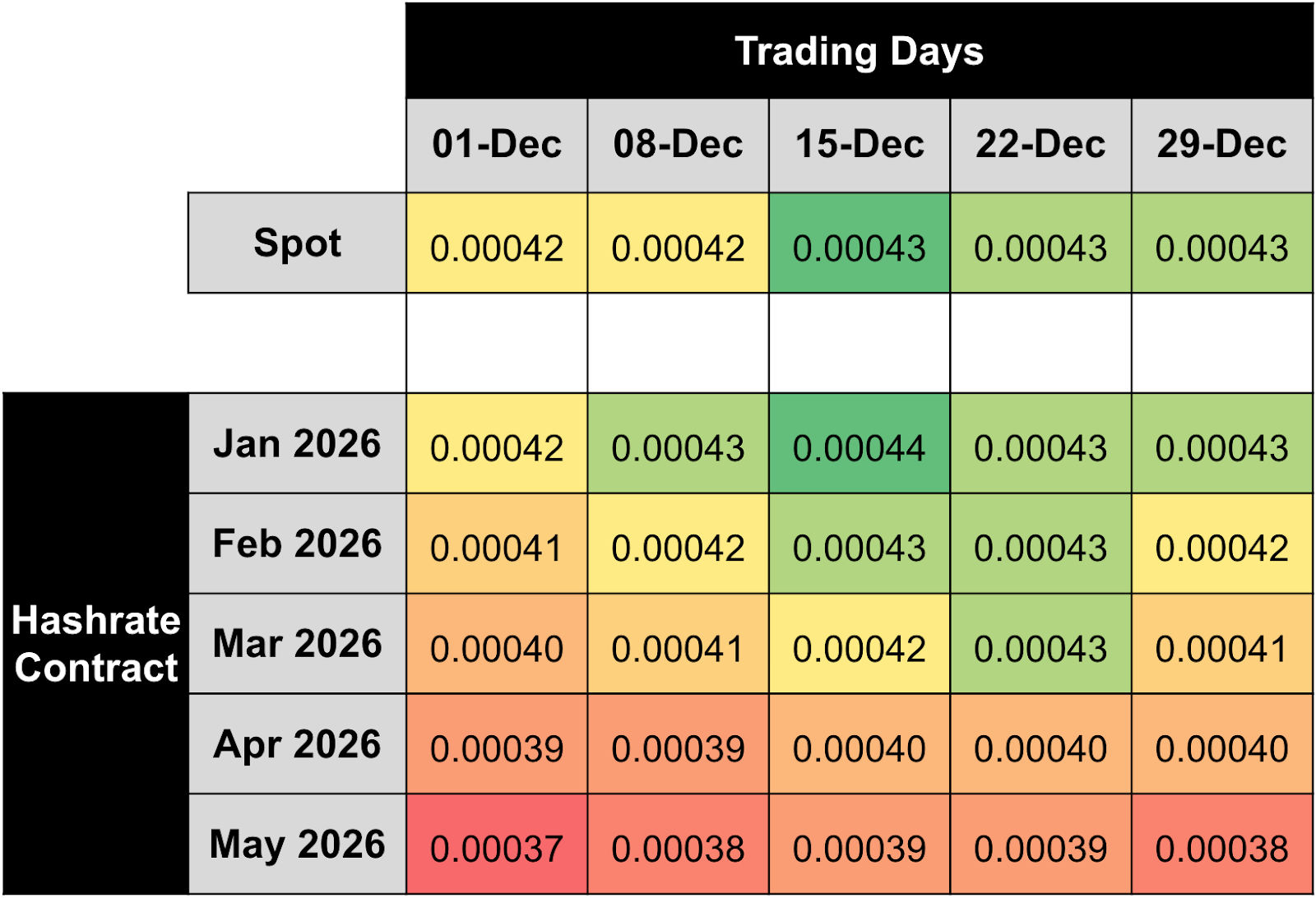

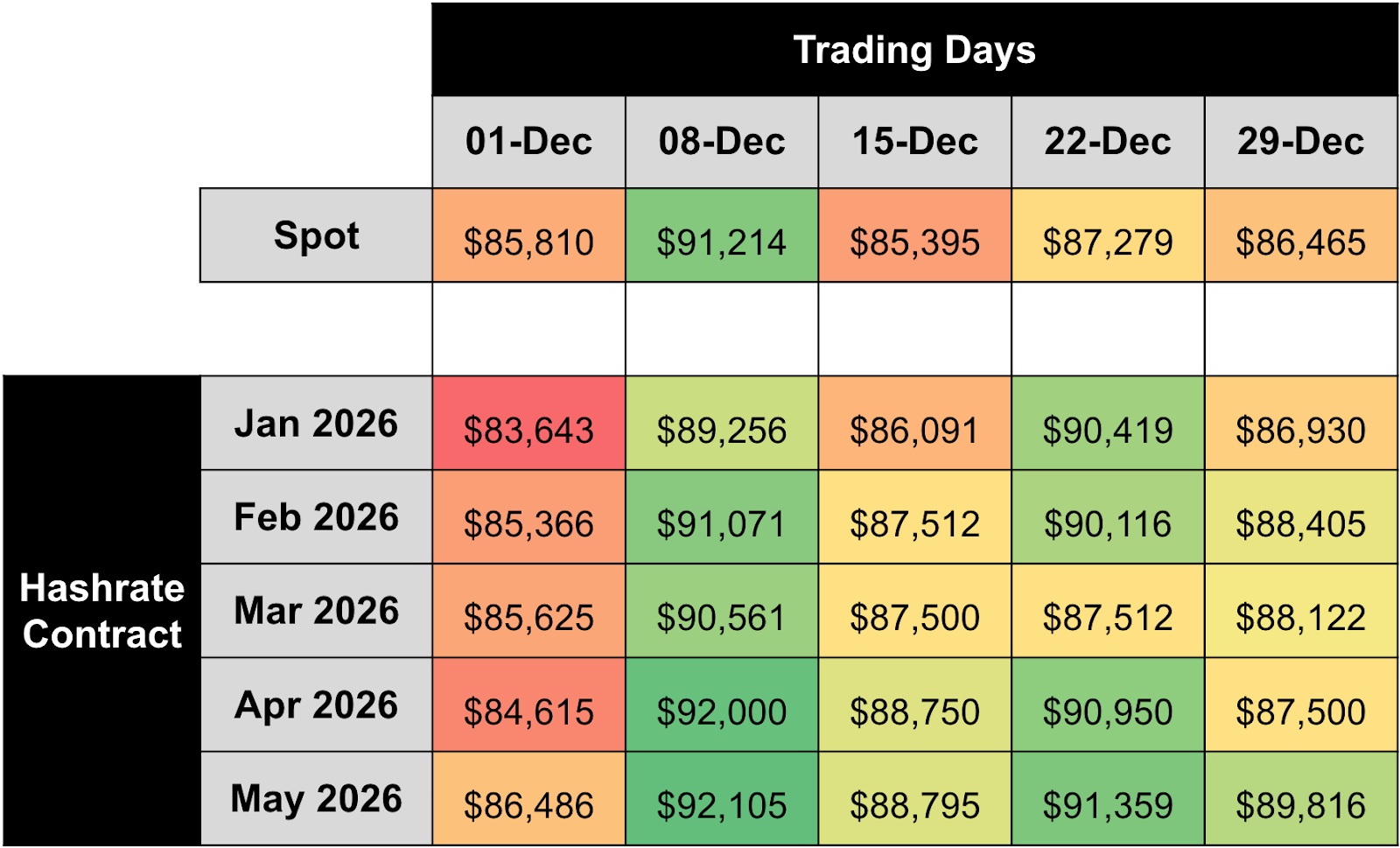

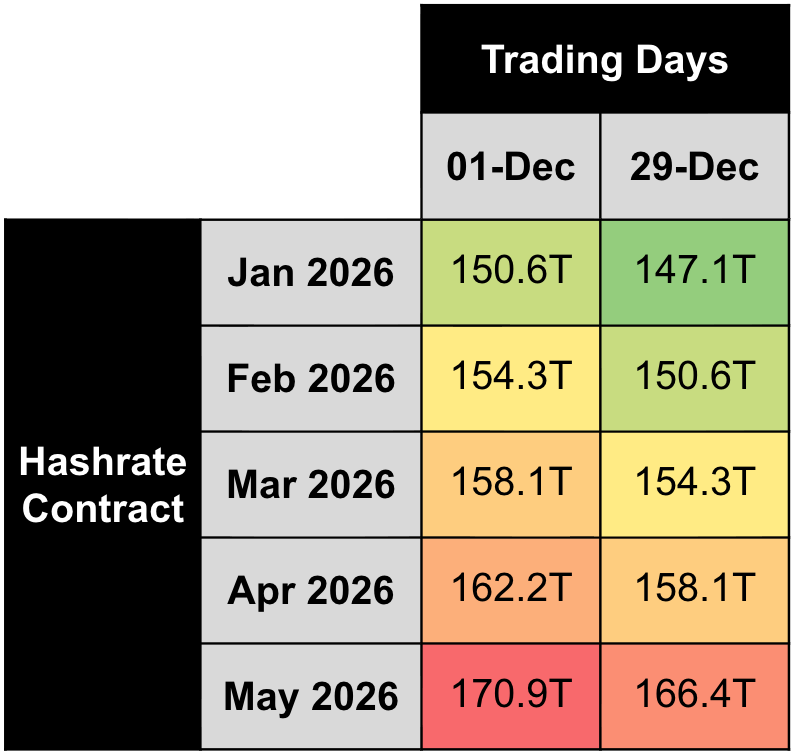

The two tables below summarize the evolution of hashrate forward markets during December 2025, for the subsequent five months from January 2026–May 2026. Rows represent specific monthly hashrate contracts, while columns represent specific trading days. Cell values indicate the average daily mid-market price, except for spot prices.

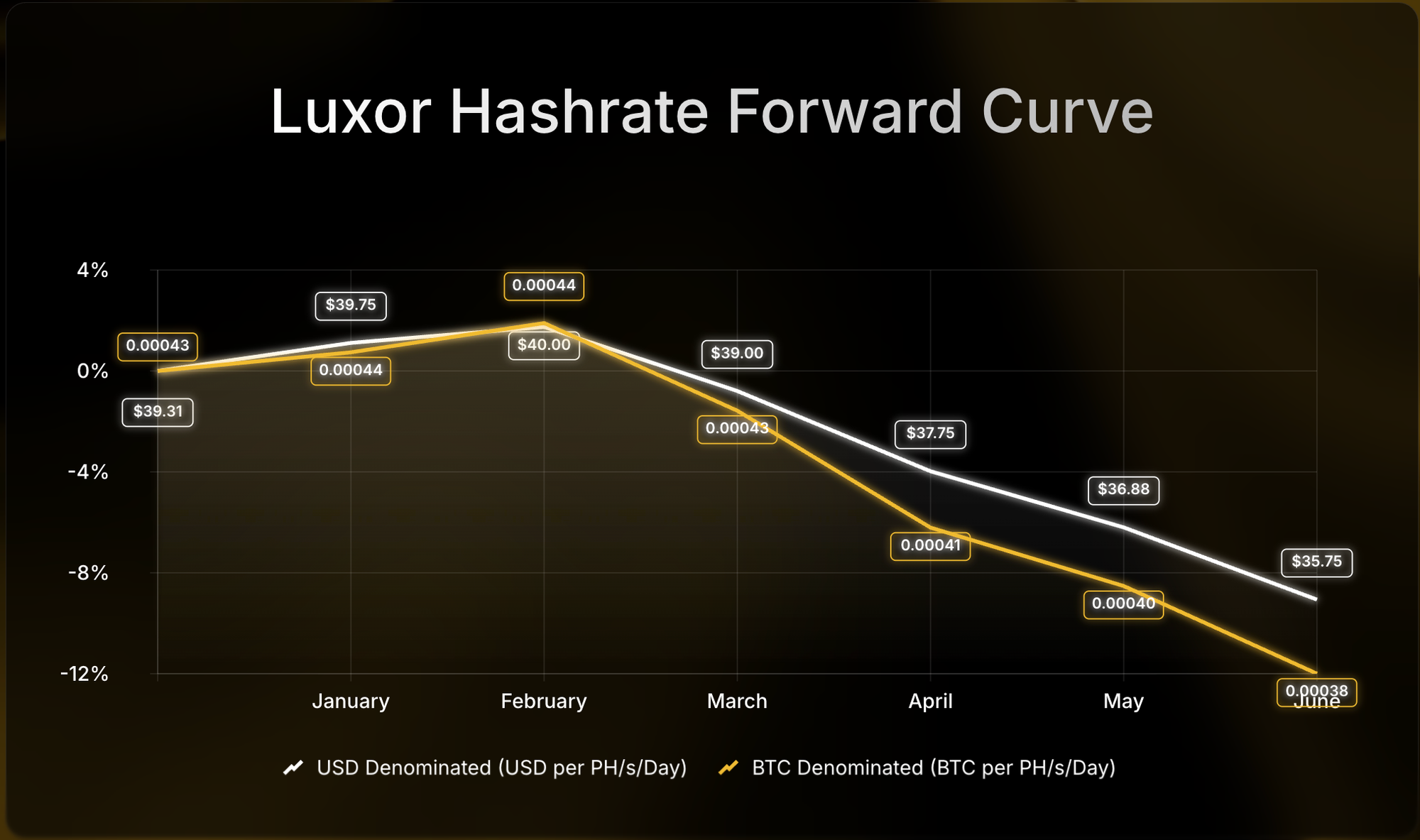

In December, January–May 2026 forwards rose (USD +6.1%, BTC +2.5%), but both curves largely remained in backwardation, with spot prices generally above most forward prices beyond the very front end. The market is pricing brief near-term difficulty relief in January–February followed by a return to steady difficulty growth, keeping medium-term hashprice expectations below spot.

By dividing USD contract hashprice values with BTC contract hashprice values, we can back out implied BTC price expectations expressed by the forward hashrate market. Throughout December, implied BTC price expectations rose by an average of ~3.5%, and generally traded in contango.

If we make an assumption around transaction fees, we can also calculate changes in implied network difficulty and hashrate expectations expressed by the forward hashrate market:

Note: figures assume 0.019 BTC per block transaction fee collection on December 1 and 0.019 BTC per block on December 29, 2025.

Based on this analysis, we estimate that future difficulty and hashrate expectations fell during the month of December, by ~2.5% for the January 2026–May 2026 contracts.

Concluding Thoughts and Looking Ahead

As of January 9, BTC remains hovering around ~$90,000. USD hashprice has moved up from ~$37 to ~$39 per PH/s/day, though it still remains near all-time low territory. The first difficulty adjustment of 2026 has occurred, marking another decrease of 1.20%.

The forward hashrate market is signaling an expectation of slow-to-flat hashrate growth in the near term. Seasonal volatility via winter storm activity (and consequent impacts on power prices) will influence fleet uptime and difficulty adjustments over the coming months.

Looking forward, Luxor’s Hashrate Forward Market is pricing in an average hashprice of $38.32 or 0.00041 BTC per PH/s/day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through June 2026.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a Bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.