Intelligent Mining — Part I: The Markets That Power Bitcoin Mining

In this blog post, we cover two crucial markets essential for mining: hashrate and energy.

The Intelligent Miner — a new comprehensive guide published by Luxor Technology — introduces a fundamentally different approach to bitcoin mining operations. Download the full guide to learn how your operation can transition from binary to intelligent mining.

In this blog post, we cover two crucial markets essential for mining: hashrate and energy.

Hashrate: Bitcoin’s Compute Commodity

Hashrate is the commodity of Bitcoin mining — a measure of computational work performed per second. It represents the productive capacity miners monetize, just as megawatt-hours (MWh) measure electricity generation. Understanding hashrate is essential because it defines the output that drives mining revenue.

At the foundation of the hashrate market sit mining pools. These over-the-counter (OTC) hubs aggregate global computational power from miners around the world and distribute block rewards based on contribution. The dominant structure today is Full-Pay-Per-Share (FPPS), where miners are paid the theoretical value of their hashrate (based on Bitcoin’s block subsidy, transaction fees, and network difficulty) over a 24-hour window. Pools assume the luck risk in finding actual blocks, and apply a small discount to this value in return.

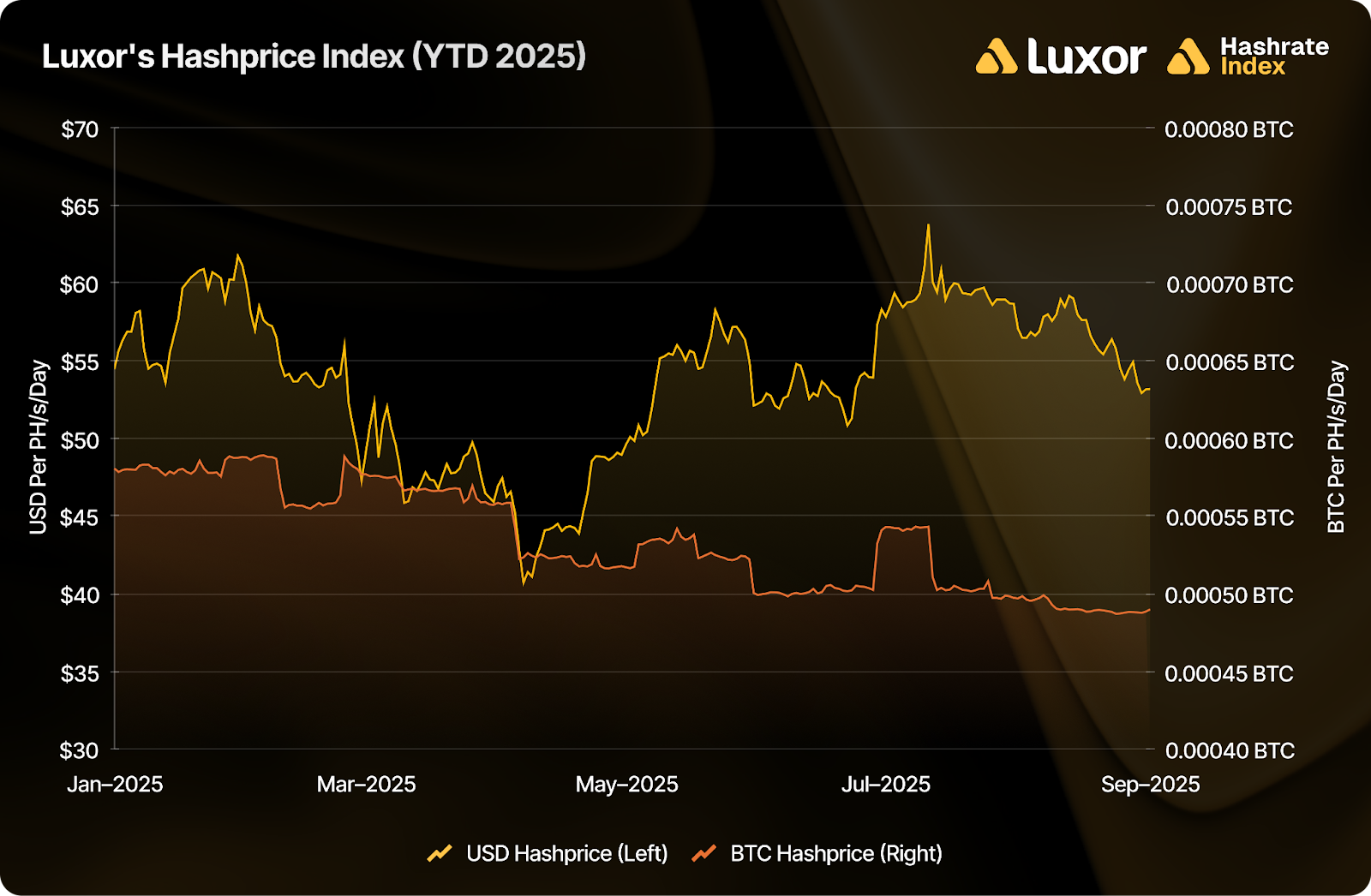

This pricing mechanism gave rise to hashprice — the standardized measure of mining economics introduced by Luxor in 2020.

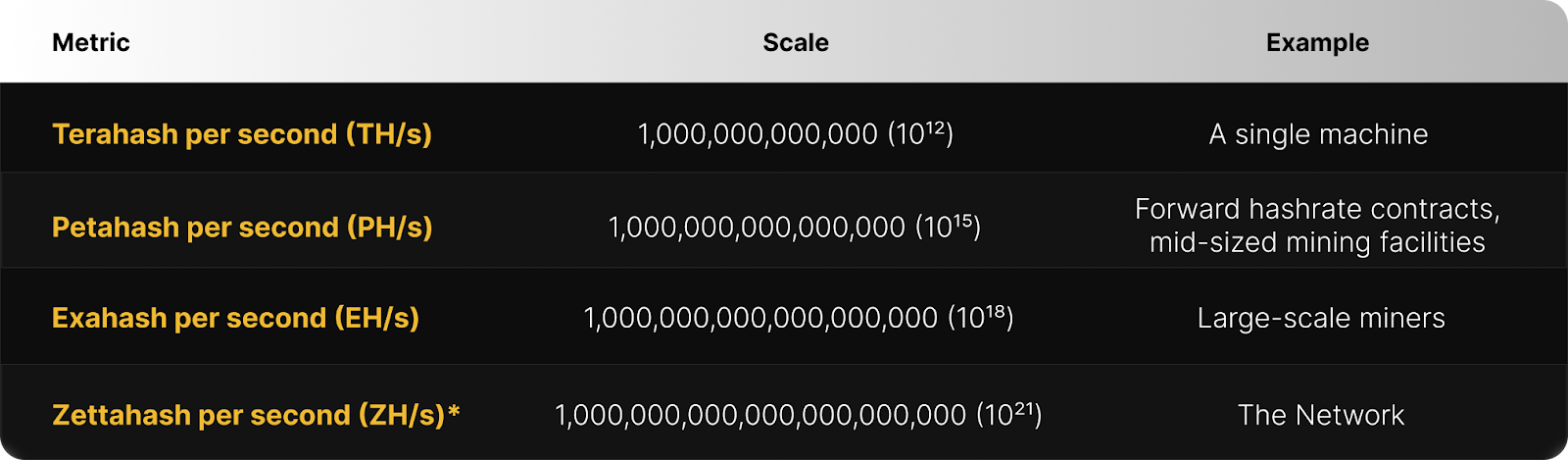

*After Zetta, it’s Yottahash (YH/s = 10^24)

Hashprice: The Revenue Engine

Hashprice expresses how much a miner earns for one petahash per second of hashrate operated over a 24-hour period. It’s quoted in both USD and BTC terms, and integrates all the moving parts of mining economics:

- Block subsidy (currently 3.125 BTC, post-2024 halving)

- Network difficulty (which adjusts every 2,016 blocks)

- Transaction fees (driven by network activity)

- Bitcoin price (for USD-denominated hashprice)

The result is a dynamic, highly volatile metric that can swing 20–30% within a single difficulty epoch.

Luxor’s Bitcoin Hashprice Index standardizes this measure, serving as the benchmark for real-time hashrate valuation, similar to how power markets use $/MWh pricing. Monitoring this index empowers miners to benchmark revenue, manage exposure, and make data-driven operational decisions.

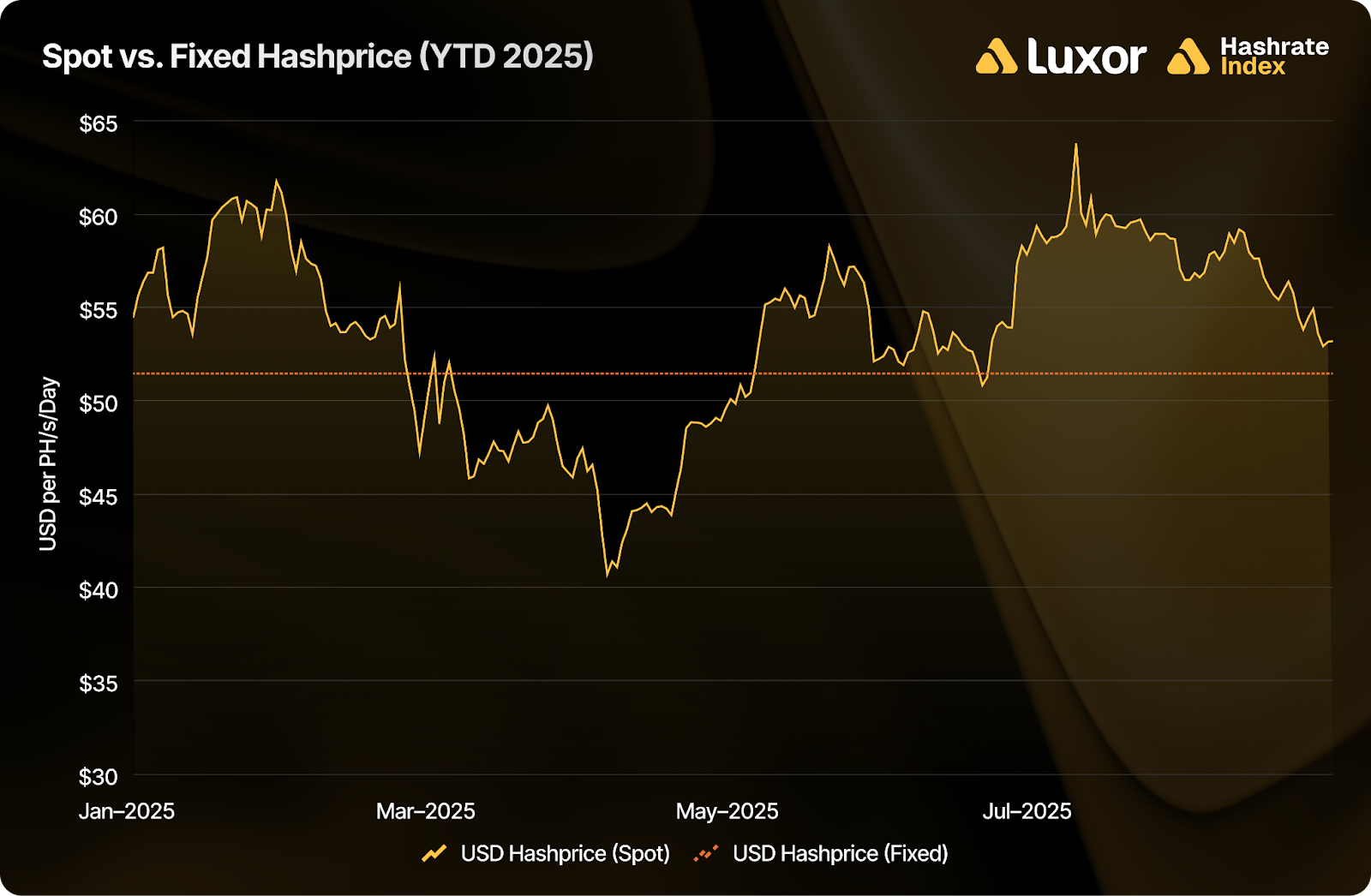

Spot vs. Fixed Hashprice

Hashrate can now be hedged. Through Luxor’s Forward Market, miners can sell or buy hashrate forward — locking in a predetermined hashprice for 1–12 months out into the future.

- Fixed hashprice exposure provides predictable income and improves financing prospects.

- Spot exposure retains upside during rallies but exposes miners to revenue compression when difficulty rises or transaction fees fall.

Most operators adopt a blended approach, hedging part of production to stabilize cash flow while maintaining exposure to favorable market movements.

Note: The fixed hashprice shown is illustrative, and based on the average mid-market rate from forward contracts listed on Luxor’s order book between August 1, 2024 and August 31, 2025 (excluding intra-month contracts).

Energy: The Other Side of the Coin

Electricity is the lifeline of mining, accounting for 60–80% of operating costs. Yet energy markets also represent an emergent source of alpha for miners.

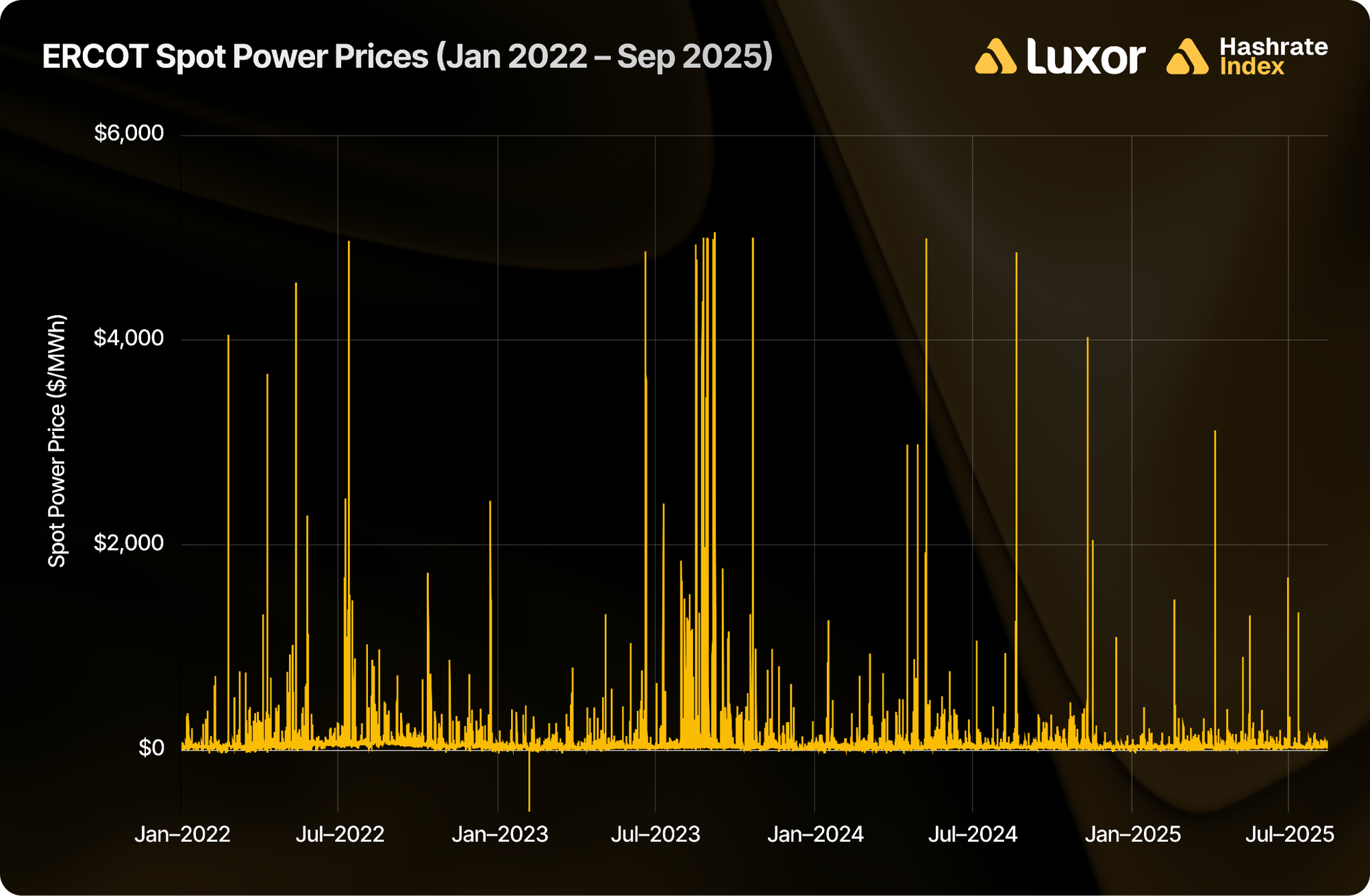

In deregulated grids like ERCOT, miners can source electricity either through fixed-price PPAs or spot index pricing.

- Fixed PPAs enable predictable modeling and financing but limit flexibility.

- Spot pricing introduces volatility, and therefore opportunity. Prices can spike to thousands of dollars per MWh or turn negative when excess supply floods the grid.

Sophisticated miners use this volatility for profit. Instead of simply running machines through high-price intervals, they curtail and sell power back to the grid, often earning more than from mining.

Beyond Consumption: Miners as Grid Participants

Intelligent miners don't just consume energy, they respond to it. Through ancillary services and demand response programs, miners are compensated for stabilizing the grid:

- Frequency regulation rewards rapid load adjustments to maintain grid balance.

- Demand response pays miners to reduce power draw during peak demand or emergencies.

- ERCOT’s 4CP reduces annual transmission costs by curtailing during four key summer peaks.

Platforms like Luxor Energy integrate these programs directly into mining operations, sending automated dispatch signals for miners to monetize their flexibility. During scarcity events, these programs often pay hundreds of dollars per MWh, exceeding mining profits.

Towards Intelligent Energy Consumption

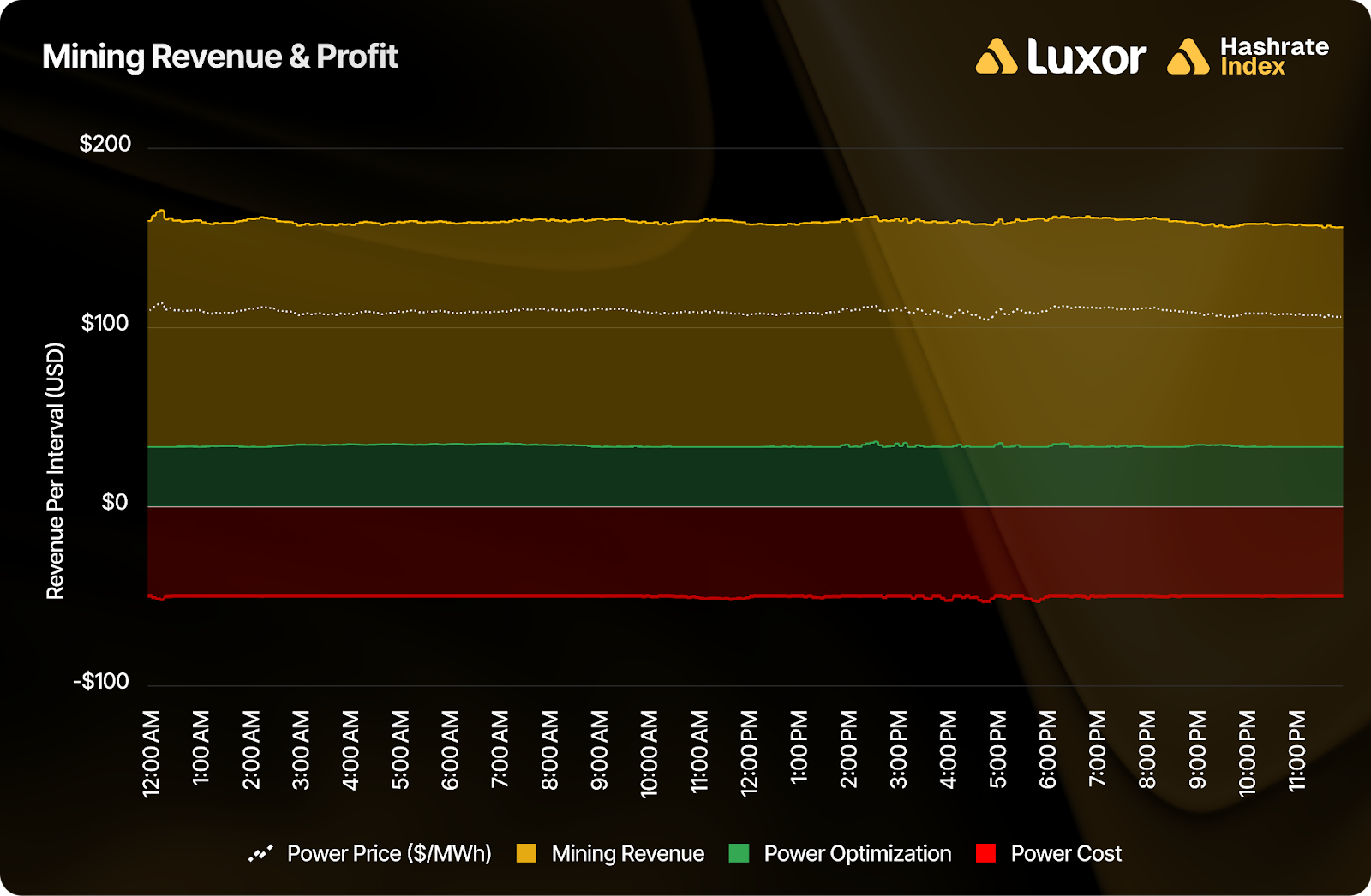

The next phase of mining optimization merges hashrate markets with real-time energy markets. The goal isn’t merely to minimize costs, but rather to orchestrate energy and compute exposure as a portfolio. Instead of relying solely on hashrate production, modern miners are developing multiple income streams which provide a margin of safety.

Profit = (Hashrate × Hashprice) + Power Optimization − (Power Consumption × Power Price)

Intelligent Mining transforms this concept from a static formula into a live system. Automated software layers monitor markets, modulate machine performance, and execute on optimal responses, within seconds. The winners of this game will be those who befriend volatility instead of avoiding it, turning both hashrate and energy into coordinated profit centers.

If you’d like to learn more about how to build your Intelligent Mining operation across Luxor’s full technology stack — including hashrate derivatives, firmware, and energy services — reach out to us at [email protected] or visit https://luxor.tech/energy.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.