How the Otherdeed NFT Auction Made ETH Miners Rich for a Day

While DeFi degens aped into Otherdeed NFTs, Ethereum miners raked in record tip volumes from the minting free-for-all.

I don't usually (read: ever) write about Ethereum, but last weekend's Otherdeed's minting was too absurd not to spill a few words. So for today's newsletter, we're going to be talking NFTs: specifically how the Otherdeed NFT mint was a boon for ETH miners.

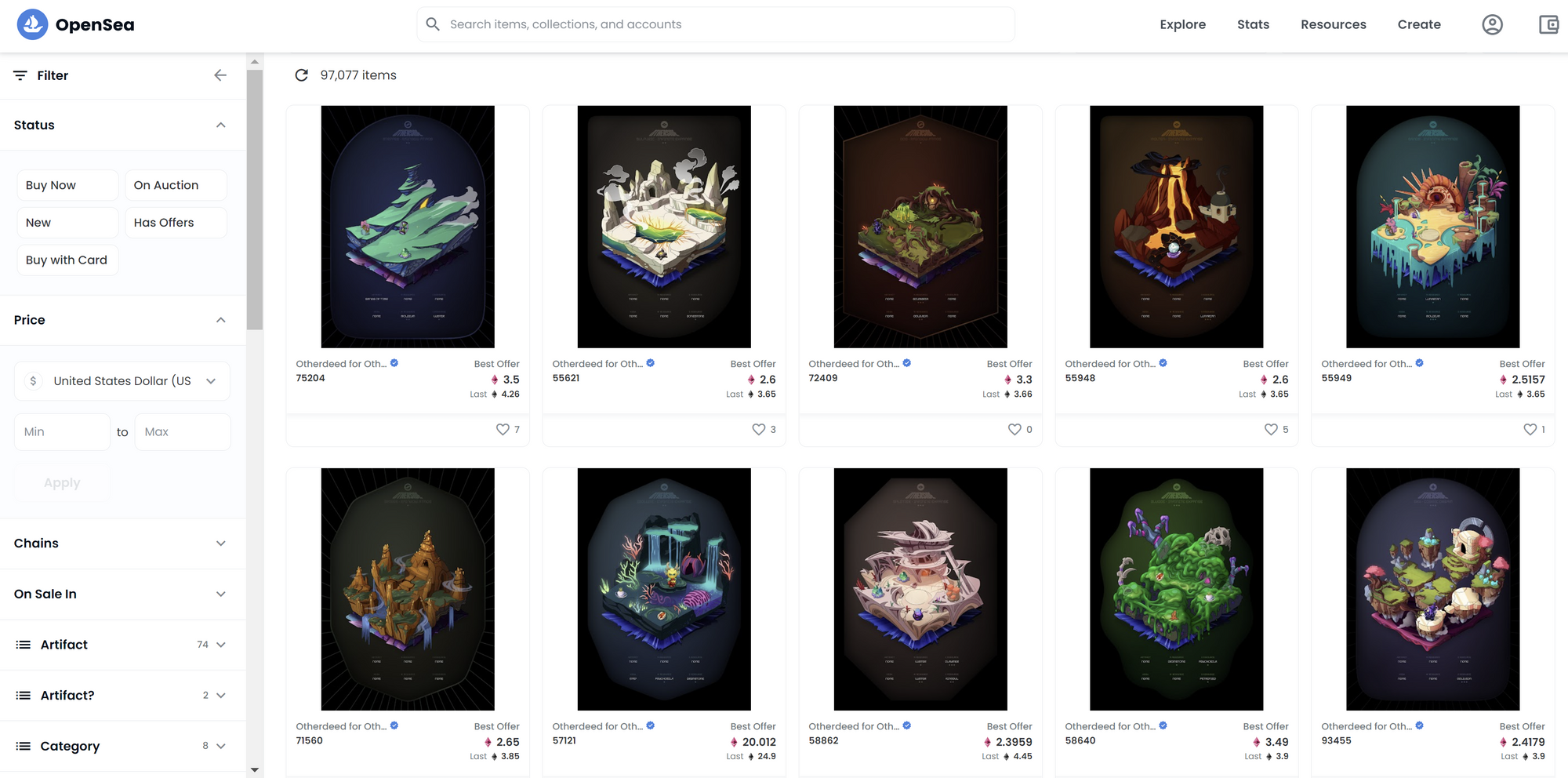

The TLDR: Yuga Labs, the studio behind the Bored Ape Yacht Club, opened up minting for a new NFT series, Otherdeeds, late in the evening on Saturday April 30th, 2022 (May 1st UTC, for folks who like that kinda thing). These Otherdeed NFTs are claims to digital real estate in Yuga Lab's forthcoming Otherside VR world. The activity clogged the Ethereum network, sent fees to the stratosphere, and made ETH miners a lot of money.

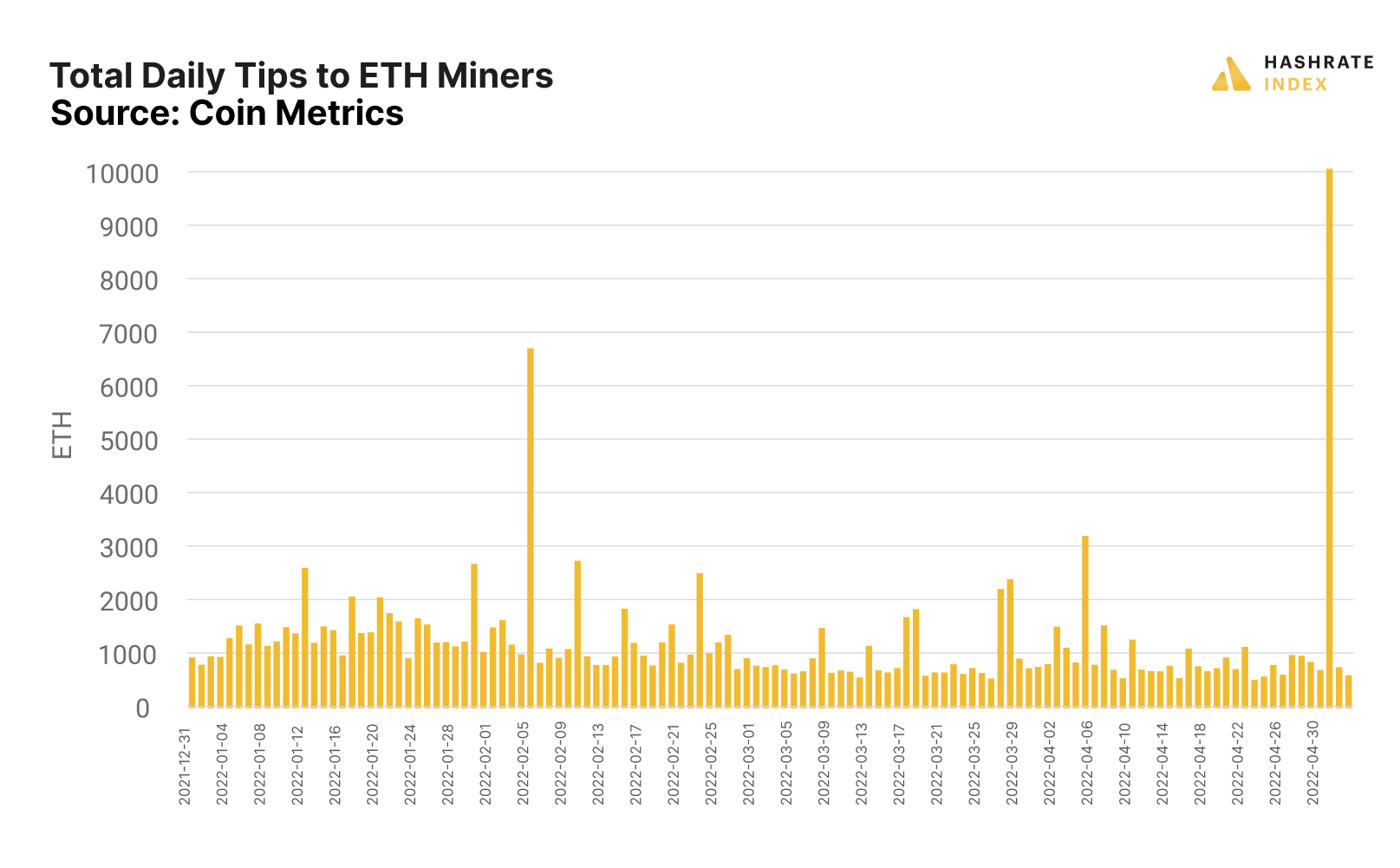

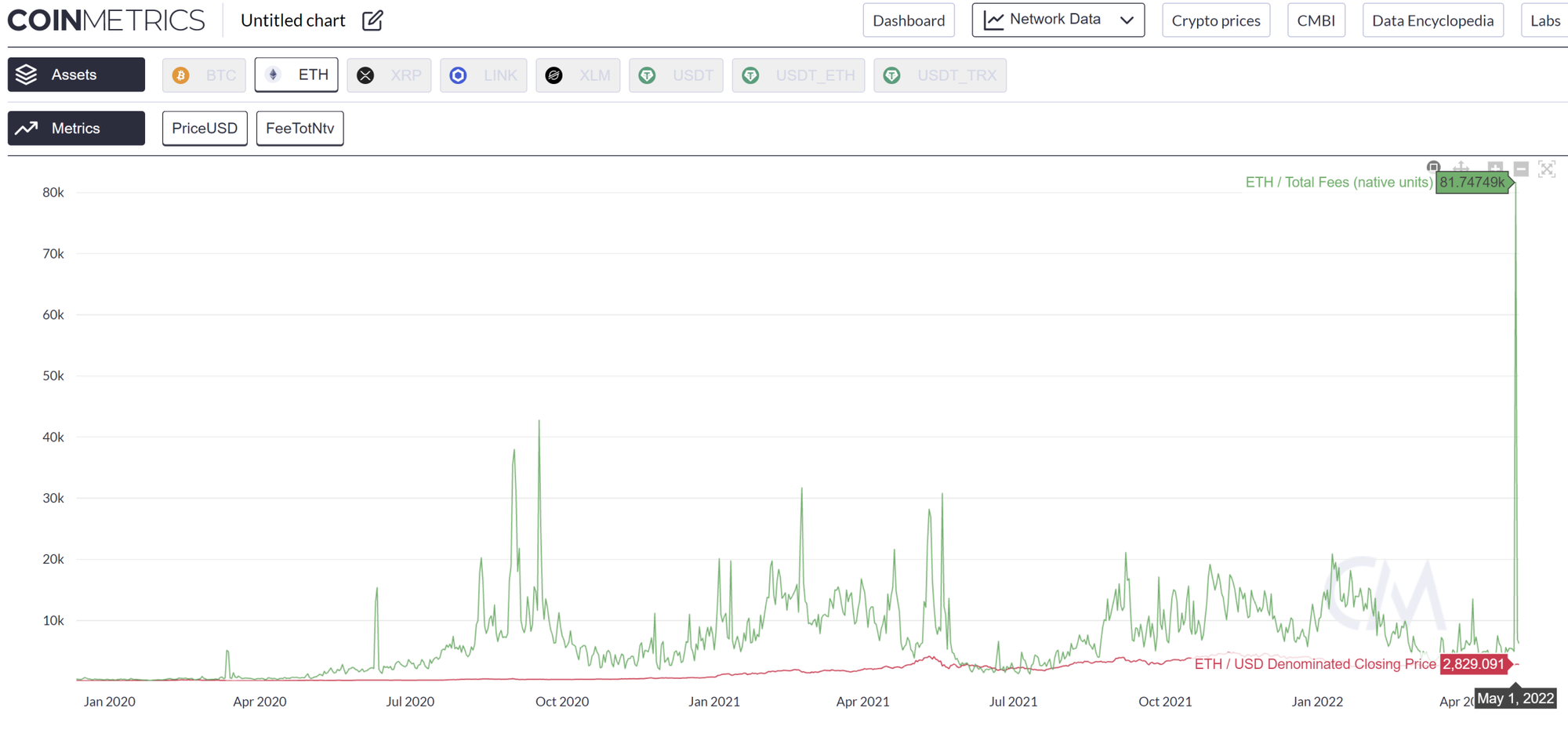

With so many DeFi degens aping into these expensively-minted NFTs, miners raked in serious profits from tips. The minting got so out of hand, in fact, that it led to an all-time high in Ethereum transaction fee volume--and an all-time high in ETH tip volume.

Sponsored by BlockFi

Otherdeed Minters Ape into Fees, Ethereum Miners Rake in Record Tips

So, a quick rundown on ETH mining: blocks are propagated on average every 14ish seconds, each block reward is 2 ETH, miners no longer receive fees (instead they receive a fraction of the actual on-chain fees as optional "tips" from users).

No fees? That's right, with EIP-1559, an Ethereum code change that burns fees instead of paying them to miners (thanks Ethereum Foundation!!!!!), miners no longer earn fees, only tips. But even so, Ethereum mining is still profitable.

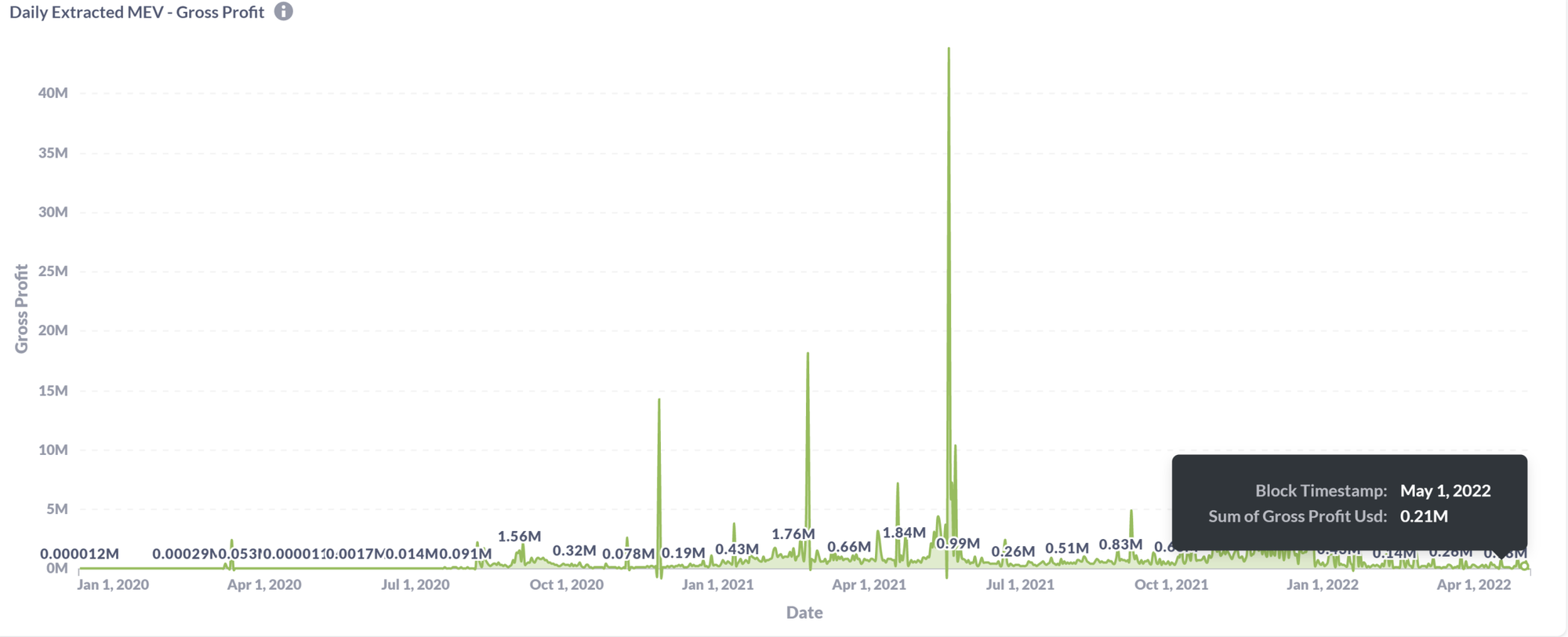

Or better put, MEV is profitable.

Or, at least, it has been in the past. And at first glance, last weekend's haul looked like the product of MEV treasure hunting. Except, it wasn't. The vast majority of miner rewards came from record tipping.

On May 1st, miners pulled in an all-time high 10,029 ETH in tips.

Naturally, Ethereum transaction fees hit an all-time high during this time, as well.

Tips, Not MEV, Pump Up Ethereum Hashprice

So, with all of the above in mind, take a gander at this chart.

That's Ethereum's hashprice (or, how much ETH a miner can expect to earn from 1 GH of hashrate per day).

The average Ethereum hashprice for May 1st (0.0781 ETH/GH/day) was 269% higher than the average for April 30th (0.0212 ETH/GH/day). At the peak of the on-chain activity, Ethereum's hashprice had ballooned by 4,295% to ~0.9 ETH/GH/day from its value at the beginning of April 30th (0.0205 ETH/GH/day).

Amazingly, very little of this increased revenue came not from MEV.

So how did Otherdeed lead to record tip volume, exactly?

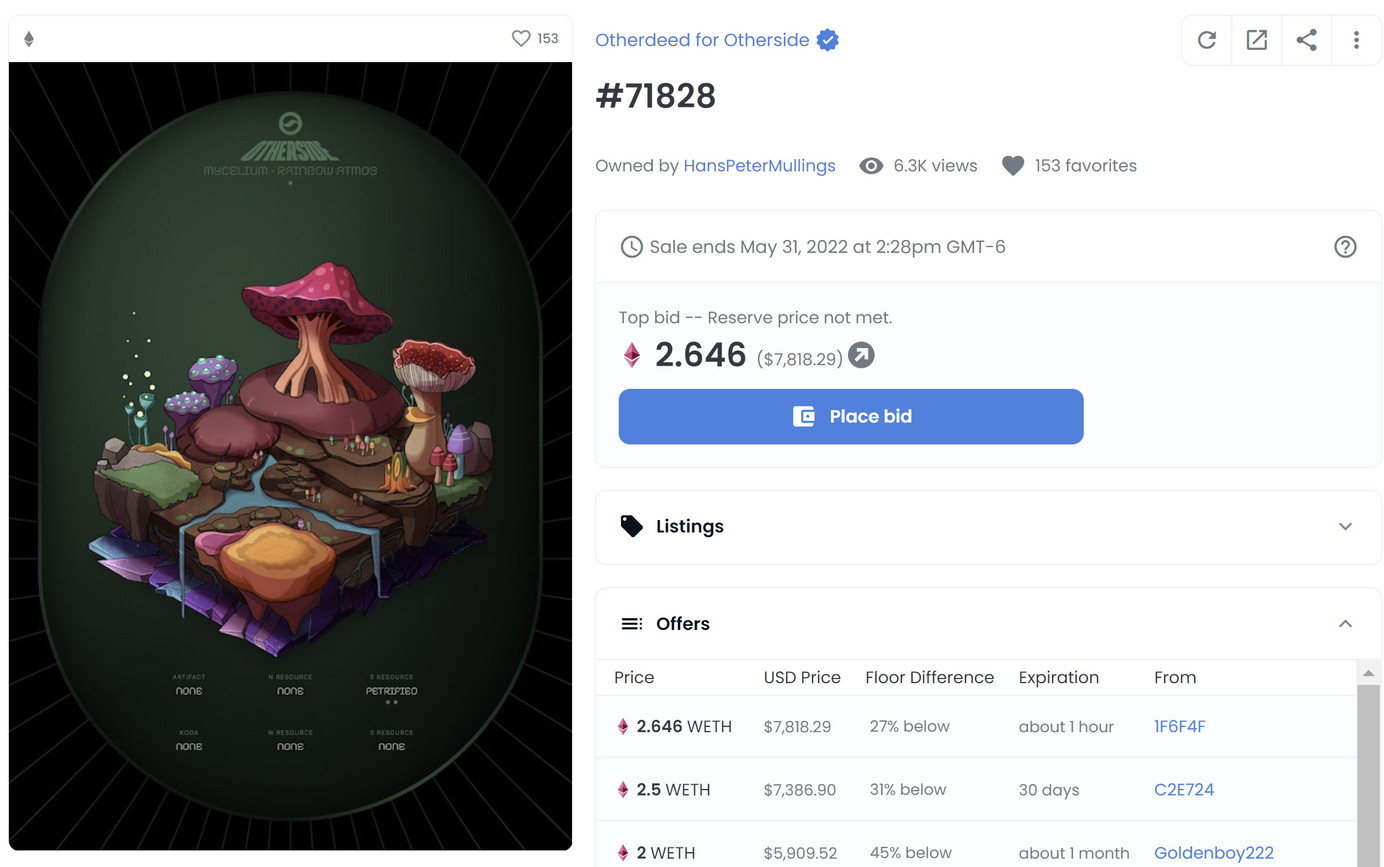

For starters, the Otherdeed NFT event was a minting, meaning traders and Ethereum users could pay to create the NFTs themselves instead of buying them second hand. These transactions are very complex and data heavy, so they already require a lot of blockspace and, naturally, lots of coin to create.

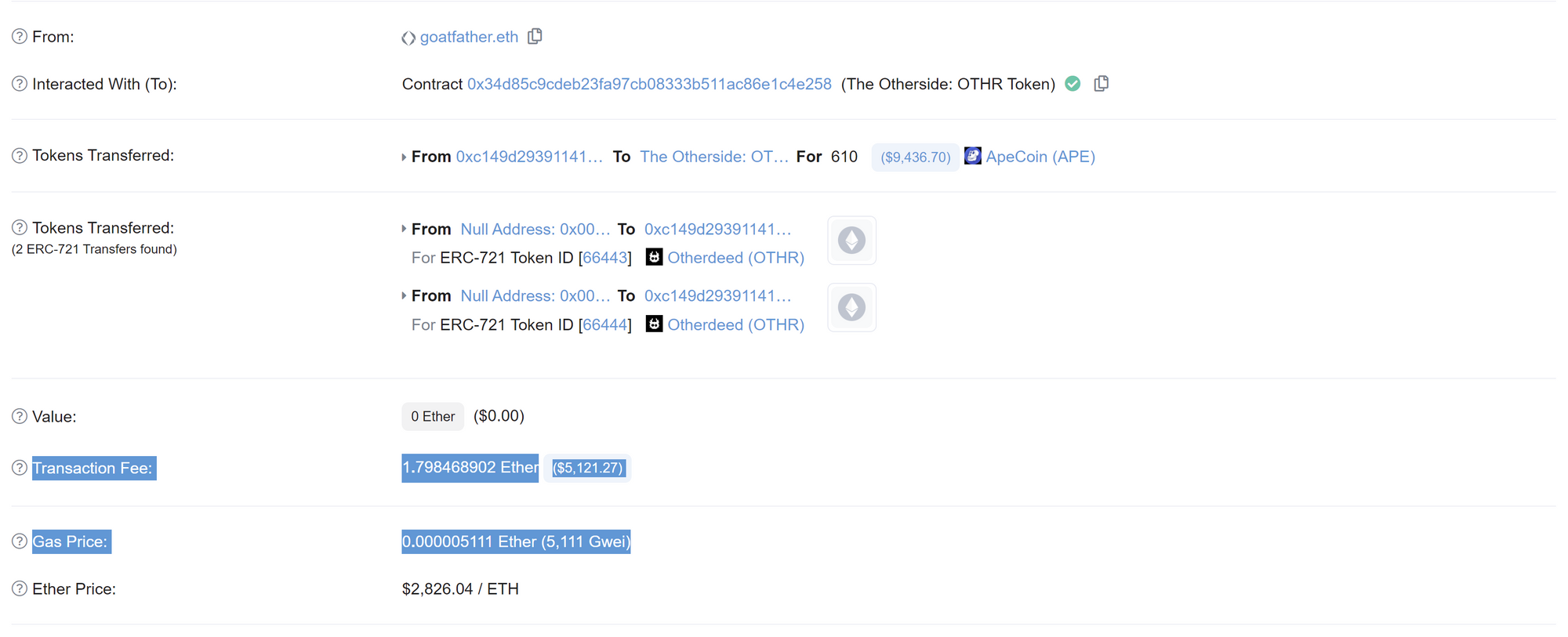

To spin up an Otherdeed, Minters had to pay Yuga Labs in the Bored Ape Club's eponymous token (APE) and pay miners an exorbitant gas fee.

Another thing: this minting was extraordinarily popular. These minting events are like supercharged trading card hunting/collecting. Imagine the thrill of buying a pack of Magic the Gathering or Pokemon cards--except you get to actually generate each card yourself. And just like MTG and Pokemon, everyone is searching for the rarest card. So everyone wants to mint their NFTs as quickly as possible, before everyone else, in hopes of finding a "rare" NFT quickly enough to flip for profit.

And people are willing to pay big bucks to get to the front of the line.

So couple each minter's attempt to front-run the competition with the complexity and cost of these minting transactions, and you have the perfect cocktail for crazy high transaction fees (this transaction, for instance, required $9.6k worth of APE and 1.8 ETH transaction fee ($5k), and that's one of the mellow ones).

So to review: In a bid to expedite their transactions, minters piled on tips as blockspace grew increasingly scarce during the fever pitch of the minting mania. The mania peaked almost immediately after minting opened up, roughly around 12:00-2:00am UTC on May 1st. Ethereum miners made 10,029 ETH in tips on May 1st, a 1268% increase from the prior 7-day average of 733 ETH.

Sometimes, the biz dev team at Luxor gets asked why we spun up an Ethereum pool last year. Reflecting on last weekend's insanity, a two word answer now comes to mind:

Ape season.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.