Hashrate Index Roundup (September 03, 2024)

Network security grows, mining economics stagnate.

Hello world, happy Tuesday!

Bitcoin trended down throughout the past week, decreasing by 7.62% from $63,000 to a current price of $58,200. Price action is hovering around the mid-point of the previous month's range, between a local peak and trough of $64,100 and $54,250 respectively.

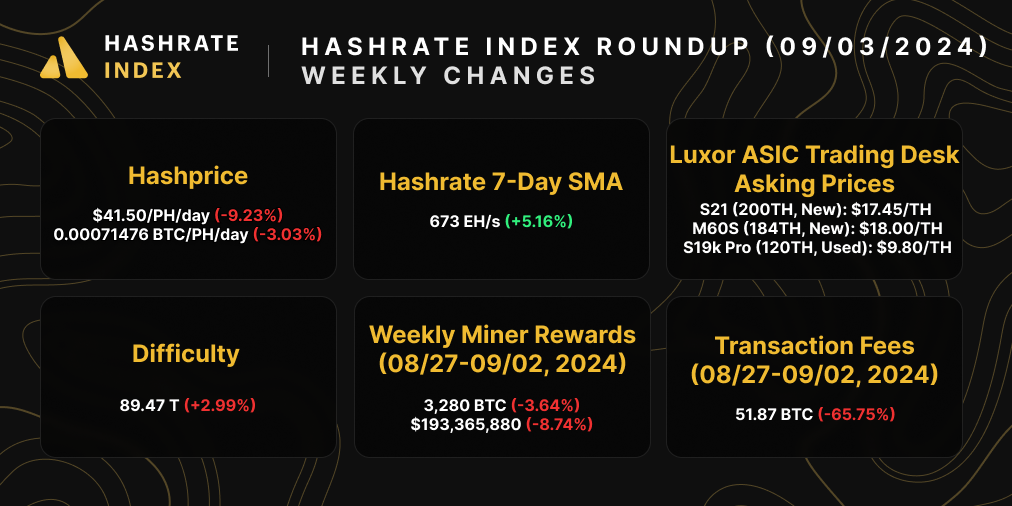

Hashprice also trended down throughout the week, decreasing by ~9.23% from $45.72/PH/Day to $41.50/PH/Day, at the time of writing. An unwelcome squeeze in week-to-week profitability for miners.

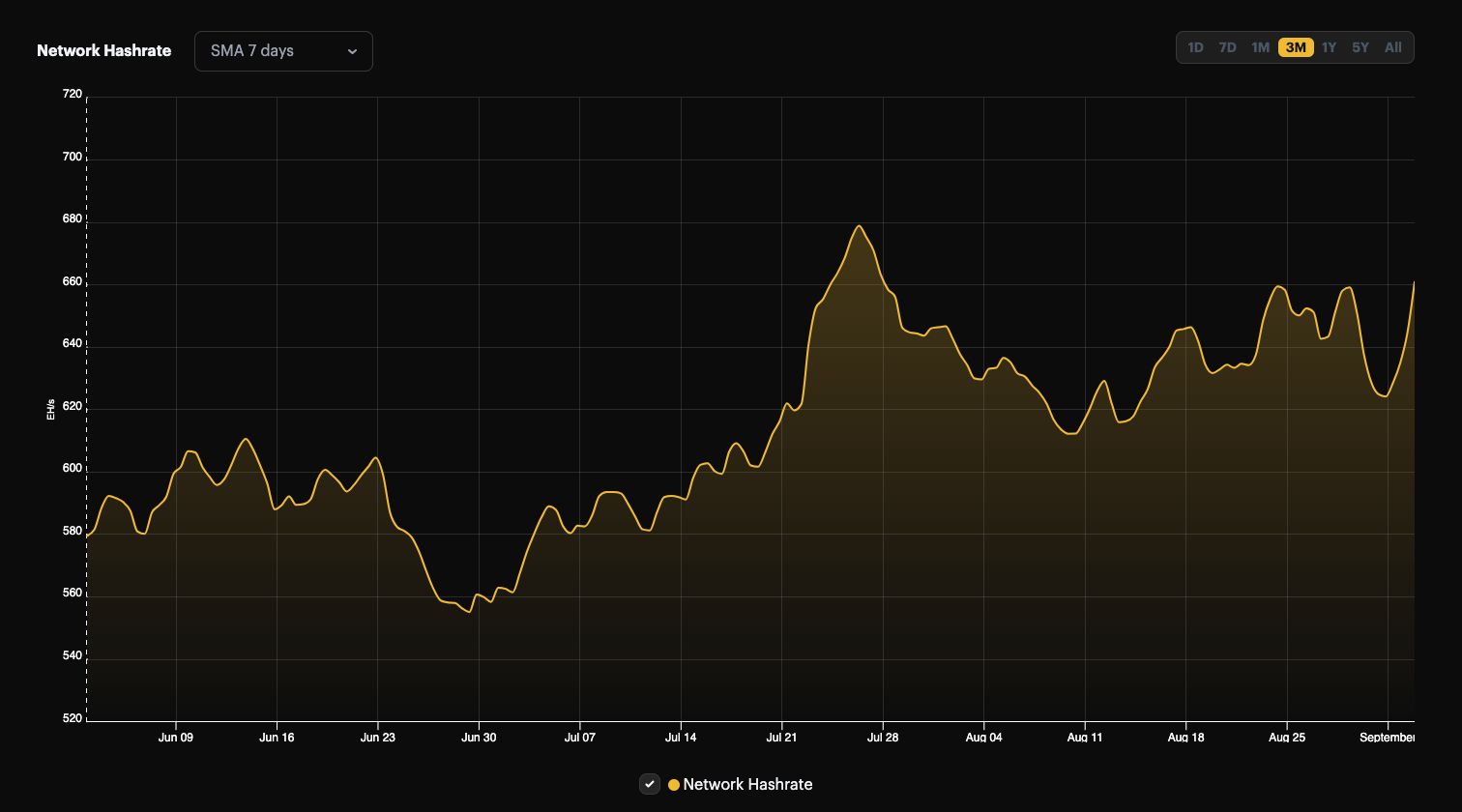

Beyond price action in Bitcoin and hashprice, global network hashrate grew by ~5.16% from 640EH/s to 673EH/s throughout the week. The 7-day simple moving average (SMA) network hashrate is a mere 0.89% below the all-time high of 679 EH/s, recorded on July 26.

Blocks were found at an average time of around 9 minutes 44 seconds throughout the week. We estimate a slight increase in difficulty of ~2.65% for the upcoming adjustment, expected to occur on September 11th.

Sponsored by Luxor Firmware

At $42/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

We are excited to announce that Luxor Derivatives is expanding its range of hashrate forward contracts by introducing contract tenors up to 12 months. This latest addition to Luxor’s hashrate derivative product suite reiterates our commitment to providing the hedging and financing tools from traditional commodity sectors to the Bitcoin mining industry.

Starting September 2024, Luxor will offer both deliverable and non-deliverable hashrate forward contracts with tenors extending up to 12 months. This new offering builds on our history of cautiously and responsibly extending contract tenors, which began with 1-month contracts in October 2022, followed by 3-month contracts in January 2023, and 6-month contracts in July 2023.

Throughout 2024, our OTC derivatives desk has been active, settling an average of 1.4 EH per day and trading a cumulative 326 EH/s/Day.

Our long-term goal is to align hashrate contracts with the typical payback period of an ASIC investment, which averages to around 18 months. We are aiming to achieve this milestone in 2025, ensuring that Bitcoin miners have the tools they need to effectively manage their operations and investments.

Please note that contracts for durations between 6 and 12 months will be available exclusively for bespoke contracts and approved market participants; they will not be listed in Luxor’s Hashrate Forward Order Book.

We are excited about this new chapter and look forward to continuing to support the needs of the Bitcoin mining industry with innovative solutions.

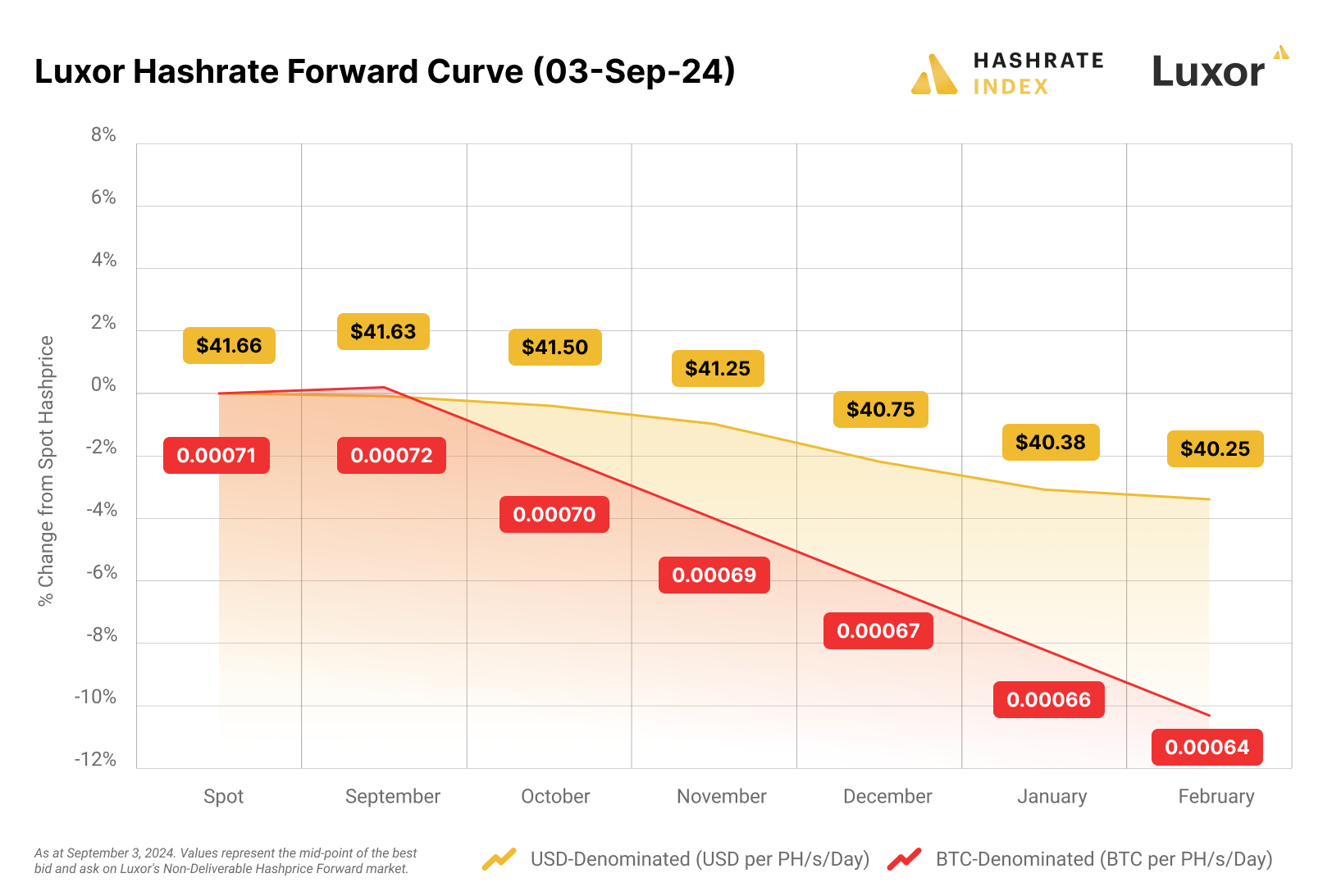

For this week's Hashrate Forwards market update, both USD and BTC contracts are trading in backwardation. Miners can lock in a ~$40.25 hashprice for up to six months into the future.

Bitcoin Mining Market Update

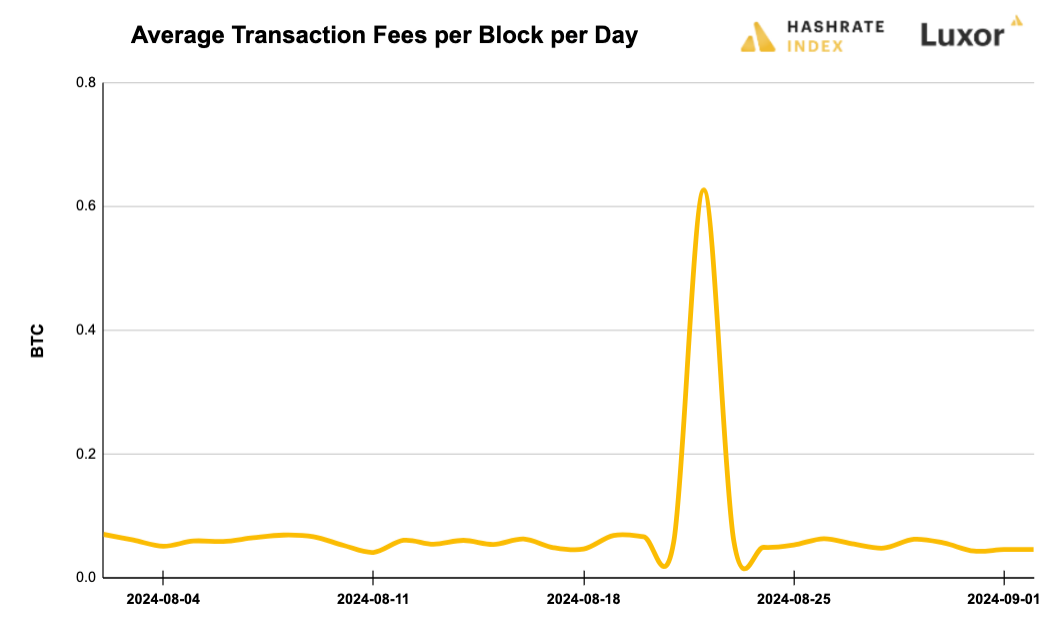

A negative trend for this week's update. Bitcoin and hashprice are down, whereas network difficulty and hashrate are up. Miners collected a total of ~3,280 BTC in rewards, equivalent to ~$193.4 million. Transaction fees were significantly lower as the spike caused by the recent launch of the Babylon staking protocol has calmed down.

Bitcoin Transaction Fee Update

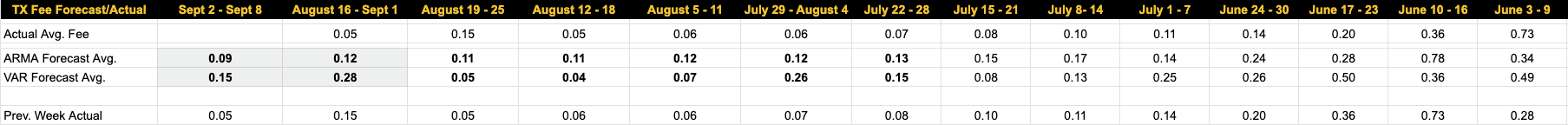

Transaction fees have normalized since the recent launch of the Babylon staking protocol. Over the past week, Bitcoin miners collected an average of 0.0506 BTC per block per day in transaction fees compared to the prior week's 0.15 BTC, a whopping 66.60% decline.

Our transaction fee projection models for this week are somewhat biased to the upside since the effects of the Babylon fee spike linger on in lagging indicator inputs, however we remain relatively bearish as we expect a low-fee, low-volatility environment to persist in the medium term. For this week, our VAR model forecasts 0.15 BTC per block, and the ARMA estimates 0.09 BTC per block.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin miners see worst revenues in 11 months as difficulty climbs

- Galaxy Offers $30M Cash or Bitcoin Loans to Bankrupt Miner Rhodium

- Metalpha Adopts New Bitcoin Mining Index by Antalpha and FTSE Russell

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended down throughout the past week, reflecting a 8.03% decrease in our Crypto Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $7.53 (-11.36%)

- HUT: $10.11 (-19.25%)

- BITF: $2.16 (-11.83%)

- HIVE: $3.12 (-14.05%)

- MARA: $16.70 (-9.44%)

- CLSK: $10.69 (-15.36%)

- IREN: $7.91 (-6.94%)

- CORZ: $10.32 (-1.55%)

- WULF: $4.36 (-12.10%)

- CIFR: $3.51 (-11.36%)

- BTDR: $6.54 (-12.24%)

- SDIG: $4.82 (-12.20%)

- FUFU: $4.51 (+2.50%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.