Hashrate Index Roundup (November 20, 2022)

Hashprice is chopping away below $60/PH/day, and new-gen ASIC prices hit an all-time low last week.

Happy Sunday, y'all!

The wider Bitcoin industry is still reeling in the fallout of FTX's collapse. BlockFi could soon file for bankruptcy, Genesis Digital is looking for a billion dollar bailout, and scuttlebutt regarding DCG's Grayscale BTC Trust are percolating through social media.

Meanwhile, Bitcoin mining margins are at their lowest levels ever in the ASIC era. While most Bitcoin miners may not have had exposure to FTX/Alameda, they aren't free from the market contagion; as long as Bitcoin's price and, by extension, hashprice are depressed, more miners run the risk of being washed out or declaring bankruptcy.

We're already starting to see hashrate react to the skin-and-bones market conditions: over the past week, Bitcoin's hashrate has fallen 4%, from 272 EH/s to 261 EH/s.

The bitter realities of the ensuing crypto winter become more real by the day. Are we having fun yet, gang?

Mining Market TLDR

- Hashprice: $57.82/PH/day (+0.2%) | 0.00348661 BTC/PH/day (+0.06%)

- Hashrate: 261 EH/s (-4%)

- Difficulty: 36.76 T (0%)

Sponsored by Luxor

Hashprice Index (November 20, 2022)

Bitcoin's hashprice finished the week basically where it started: just below $60/PH/day.

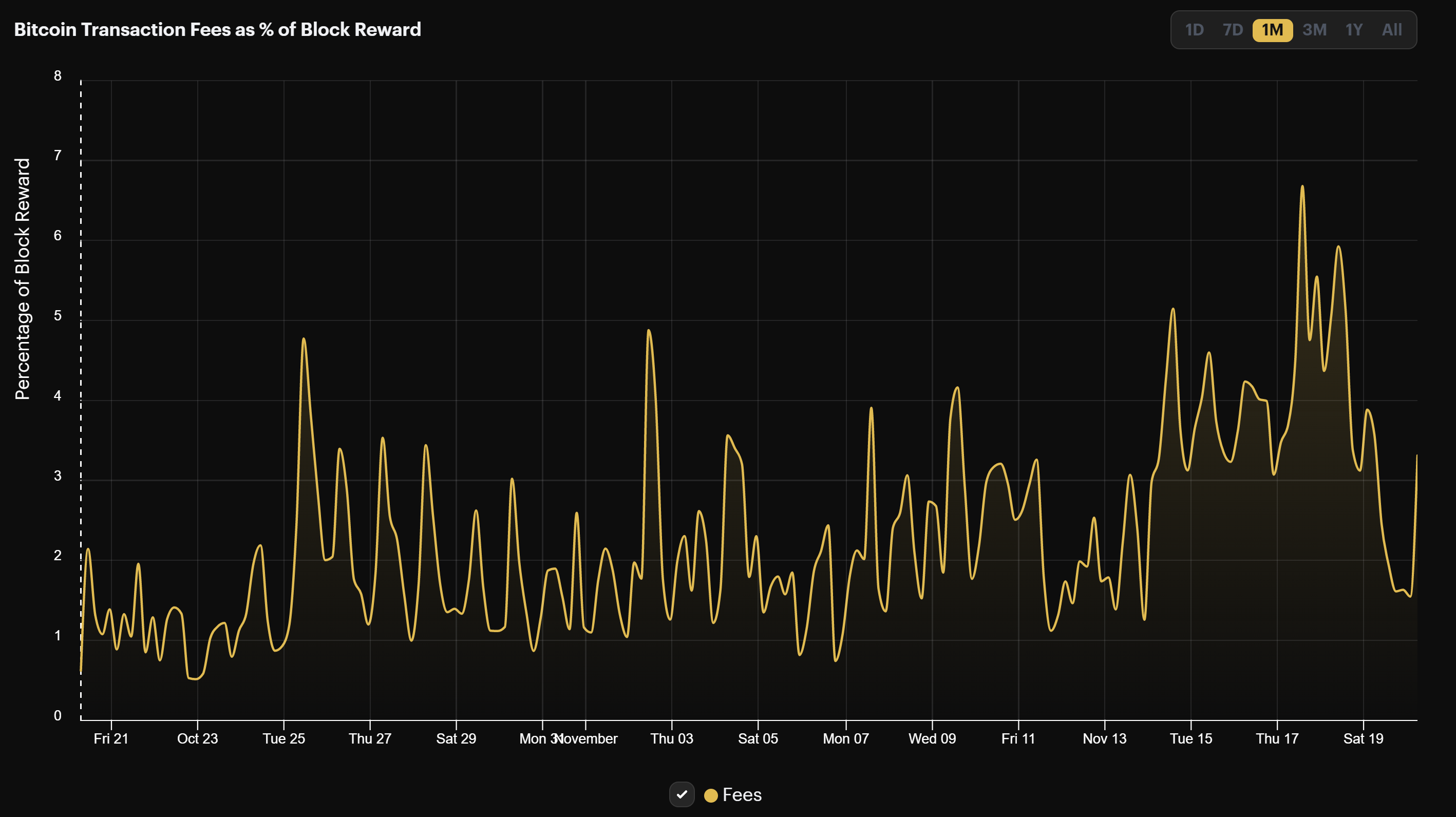

Throughout the week, though, hashprice received a boost from higher-than-usual transaction fees. There was so much transaction traffic that mempools were bloated above the default 300 MB memory usage. This increase came largely from users withdrawing BTC from exchanges, which continue to see substantial outflows in the wake of FTX's insolvency, as well as Binance's consolidating some its own BTC.

At its peak last week, transaction fees made up 6.68% of block rewards.

Bitcoin Mining ASIC Price Index (November 20, 2022)

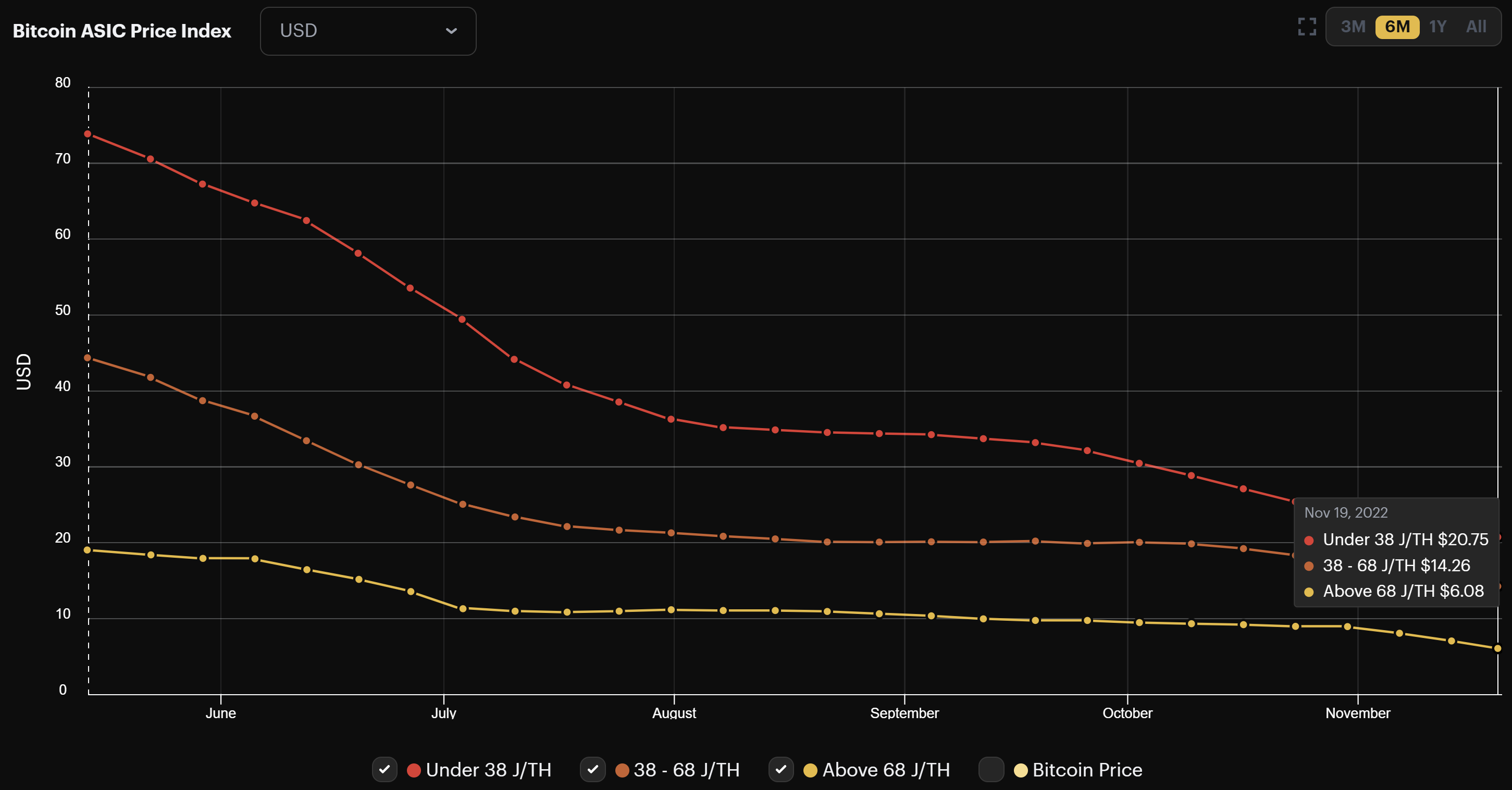

It finally happened last week – the listing price of new-gen ASICs per our ASIC Price Index hit an all-time low.

The average price of new-gen machines on the index fell to $20.75/TH, a 4.2% drop from last week which puts this tier at its lowest position ever. Mid-gen machines likewise fell 4.2% to $14.26/TH and old-gen fell a staggering 15% to $6.08/TH.

When hashing at $0.07/kWh power cost, here are the current bitcoin mining profitability specs for popular mining rigs:

- Antminer S19 XP (140 TH/s): $3.0

- Whatsminer M50 (114 TH/s): $1.0

- Antminer S19j Pro (104 TH/s): $0.9

- Whatsminer M30s++ (112 TH/s): $0.6

- Antminer S19 (95 TH/s): $0.0

- Whatsminer M30s (86 TH/s): -$0.5

- Antminer S17 (56 TH/s): $-1.0

- Whatsminer M20s (68 TH/S): $-1.7

Bitcoin Mining Stocks (November 20, 2022)

Bitcoin mining stocks continued to slide last week as many companies began reporting their Q3 numbers. Our Crypto Mining Stock Index only fell by a whopping 10%.

We've been covering the earnings reports from public miners as they pop up, and this week, we wrote about Hut 8, Bitfarms, and Marathon.

Some takeaways from our coverage:

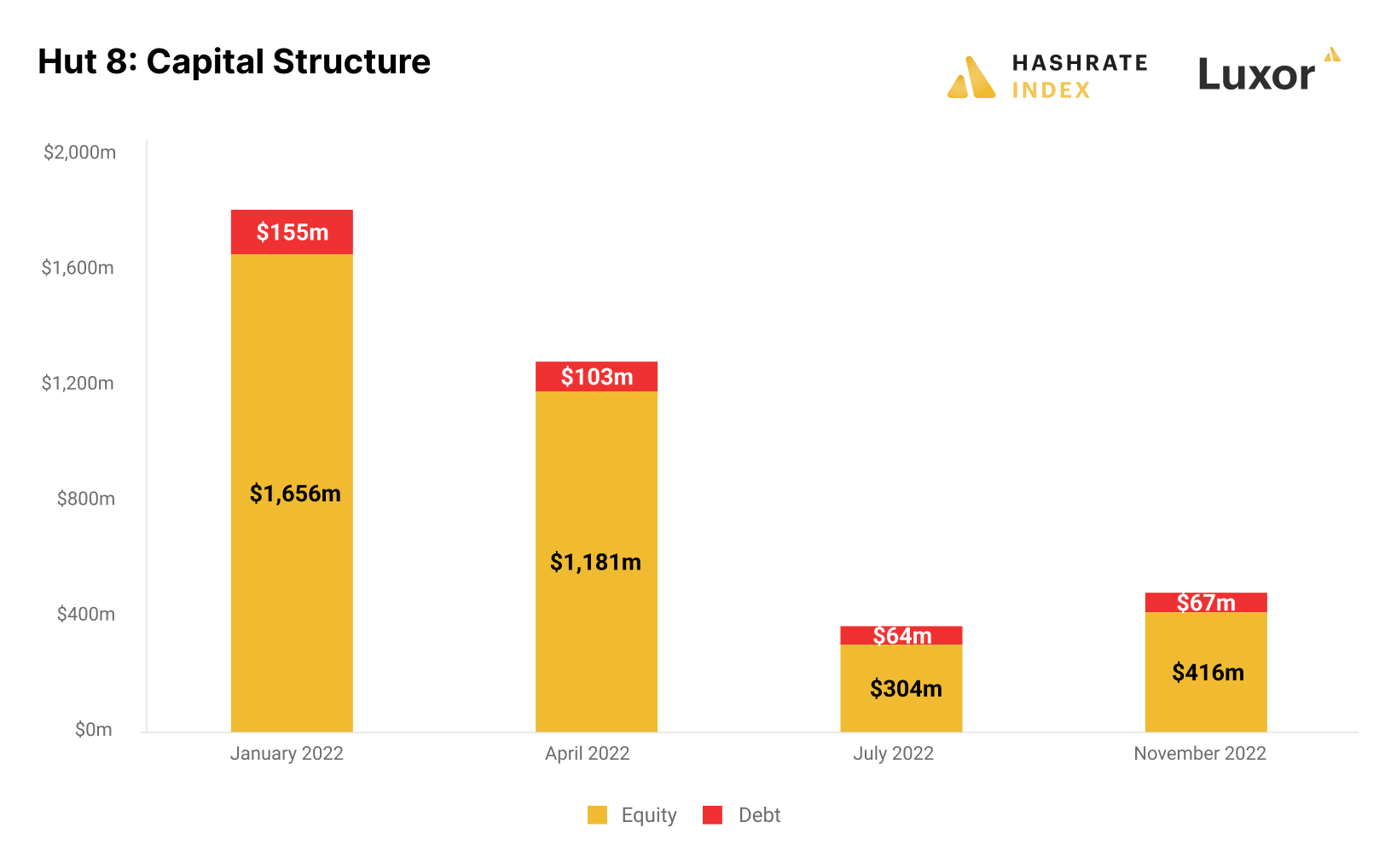

Hut 8 only has $67 million CAD in liabilities, while its equity has a market value of $416 million CAD. This capital structure gives the company a debt-to-equity ratio of only 0.16, among the lowest of the public bitcoin miners.

Additionally, Hut 8 has roughly $227 million CAD worth of liquid assets on its balance sheet ($33 million in cash, and 8,687 BTC), making it one of the most liquid BTC miners.

Hut 8 has maintained this liquidity by diluting its shareholders via equity raises. Since 2021, Hut 8 has raised $398 million CAD, and so far in 2022, it has diluted shareholders by 45%.

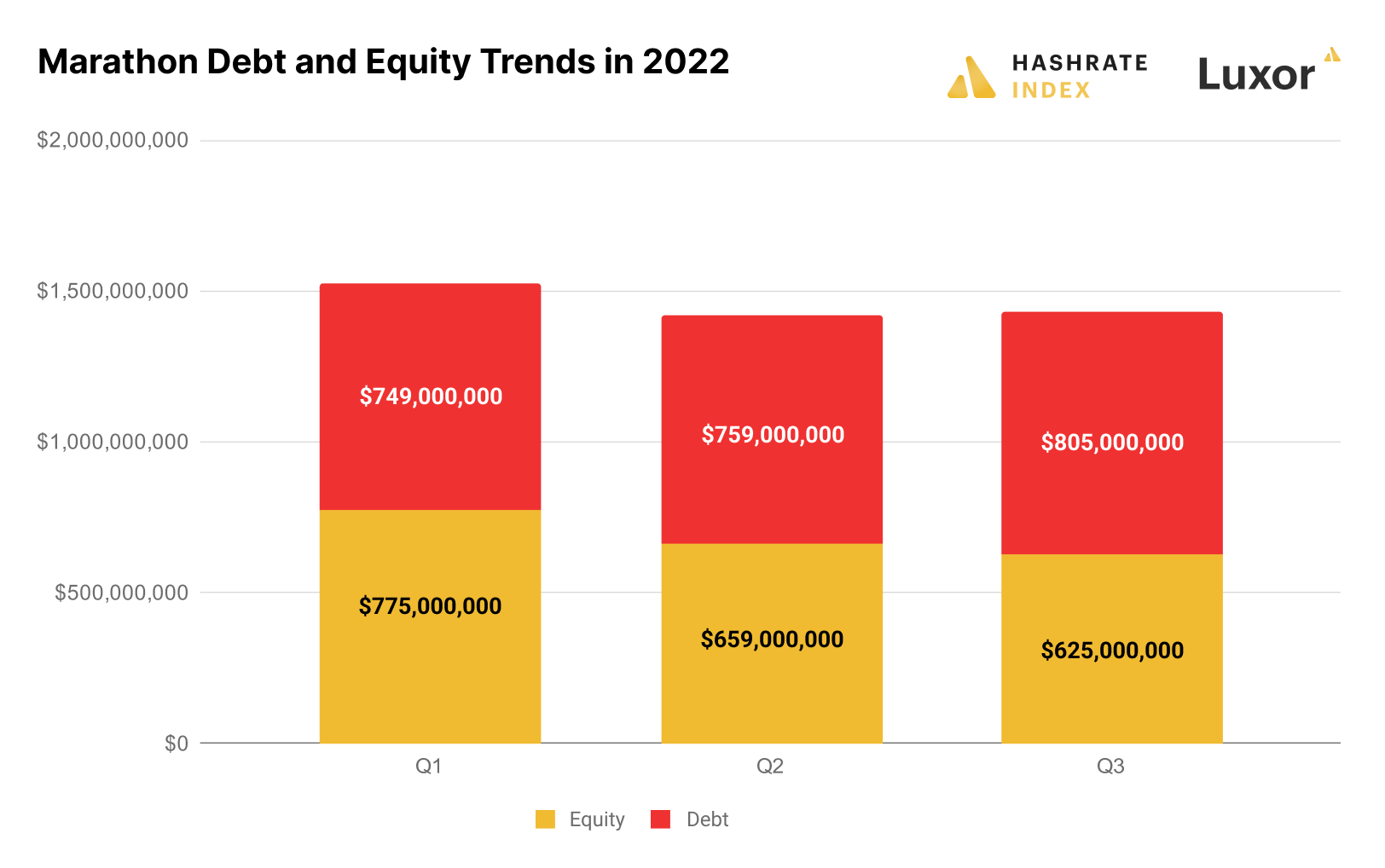

Marathon Digital collateralizes BTC, issues new shares to shore up liquidity

With capital spigots drying up as interest rates rise, Marathon took out a $100 million BTC-collateralized loan from Silvergate in Q3. Marathon has 9,490 BTC (worth about $153 million at the time of the earnings release) out of its total stack of 11,440 BTC tied up in this loan. If BTC goes below $14,000, Marathon would need commit nearly its entire stack of BTC as collateral to keep the loan afloat.

Just like Hut 8, share dilution has been a liquidity solution for Marathon in Q3. Marathon raised $198.7 million from an at-the-market offering in last quarter (the ceiling on this ATM is $750 million).

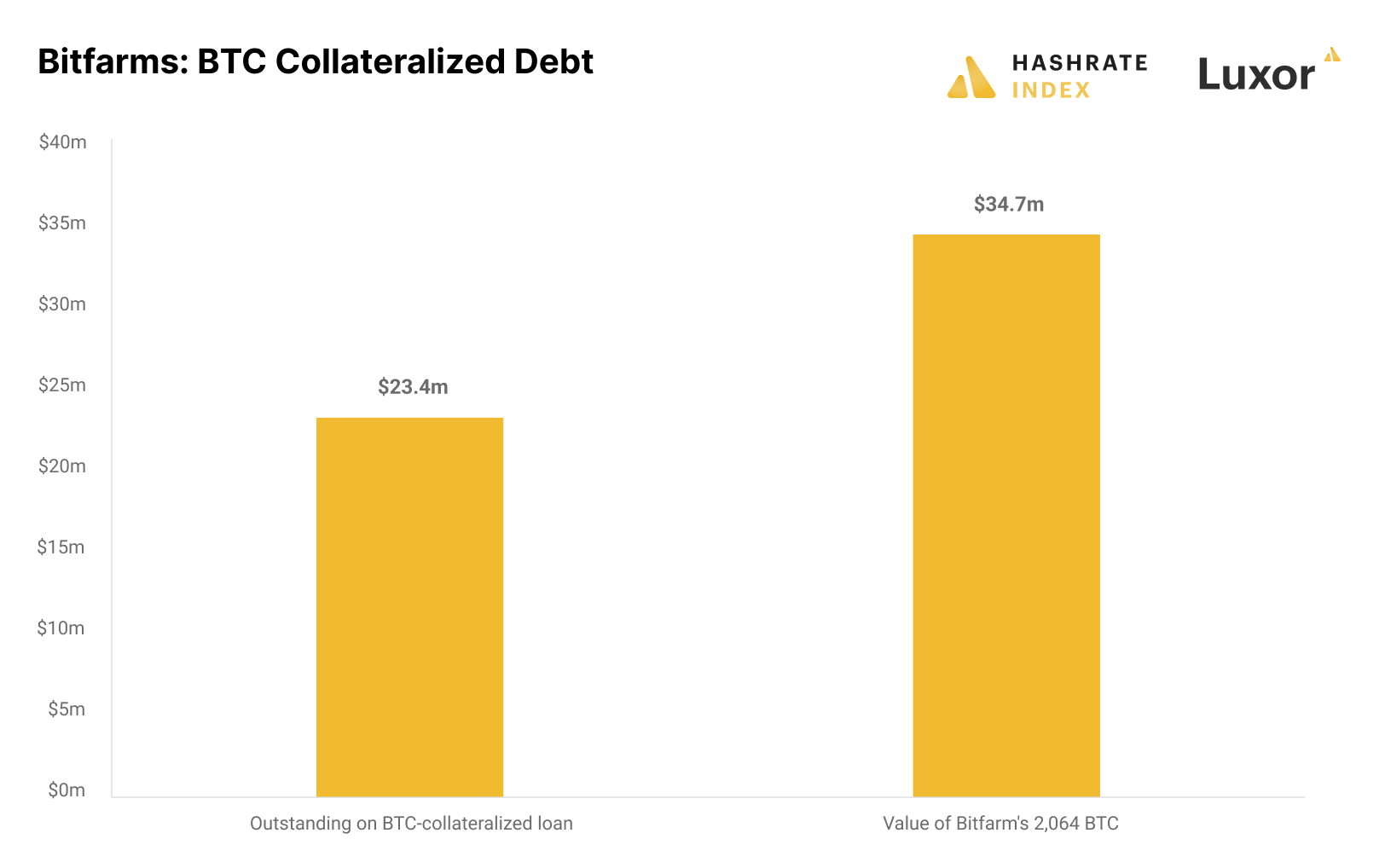

Despite low power costs, BTC and machine-colateralized debt put Bitfarms into a tough spot

Bitfarms has $55 million outstanding in machine-collateralized loans, of which it owes $31.3 million to NYDIG, $22.2 million to BlockFi, and $1.7 million to Foundry. It also has a bitcoin-collateralized loan of $23 million with Galaxy Digital. As I will soon explain, the company’s bitcoin-collateralized loan is at this depressed bitcoin price dangerously close to liquidation. Further, 1,724 BTC out of its total treasury of 2,064 BTC is collateralized in a loan from Galaxy Digital.

Bitfarms might be struggling financially due to its large bitcoin and machine-collateralized debt positions, but the company keeps delivering on the operational front.

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.