Hashrate Index Roundup (May 28, 2024)

Bitcoin's hashrate is back with a vengance.

Happy Monday, y'all!

Before we hop into the data for today's roundup, a big announcement.

The Luxor team is thrilled to share that Luxor's Hashrate Futures are now trading on Bitnomial under the ticker $HUP! You can find more information on our Hashrate Futures on Luxor's website and on our latest article on Hashrate Index.

These regulated derivatives contracts are the next evolution of Luxor’s Hashrate Forwards, an over-the-counter Bitcoin mining derivative that Luxor launched at the end of 2022. The Hashrate Futures are exchange-traded and fully-regulated by the CFTC, and they will provide market participants with greater market transparency, deeper liquidity, and reduced counterparty risk.

To get started with Luxor and Bitnomial’s Hashrate Futures, please head over the Luxor’s Derivatives Desk website, where Luxor’s Introducing Broker business can help you onboard with a qualifying Futures Commission Merchant (FCM). If you already have an FCM account, please let them know that you are interested in trading Hashrate Derivatives on Bitnomial.

And now to your weekly dose of Bitcoin mining data.

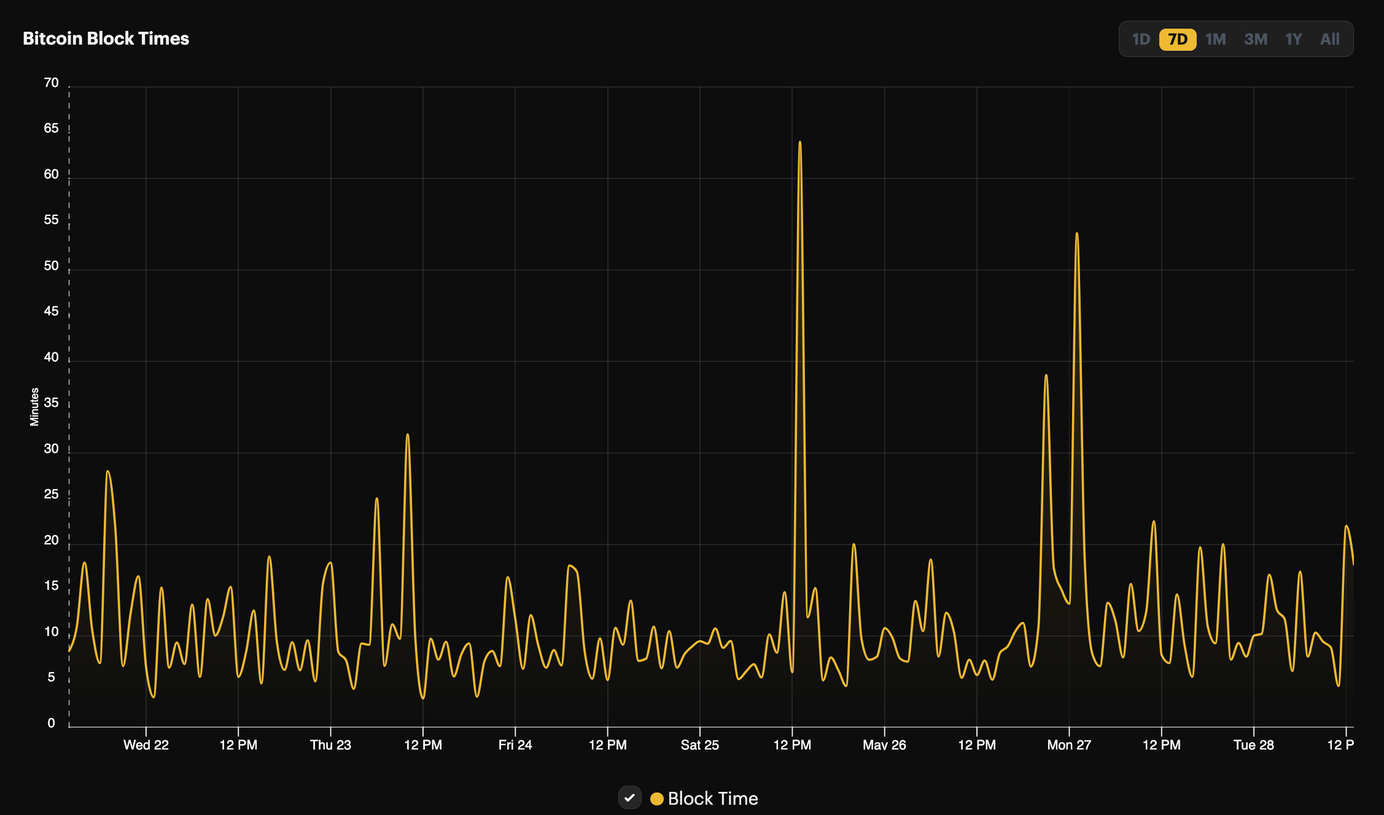

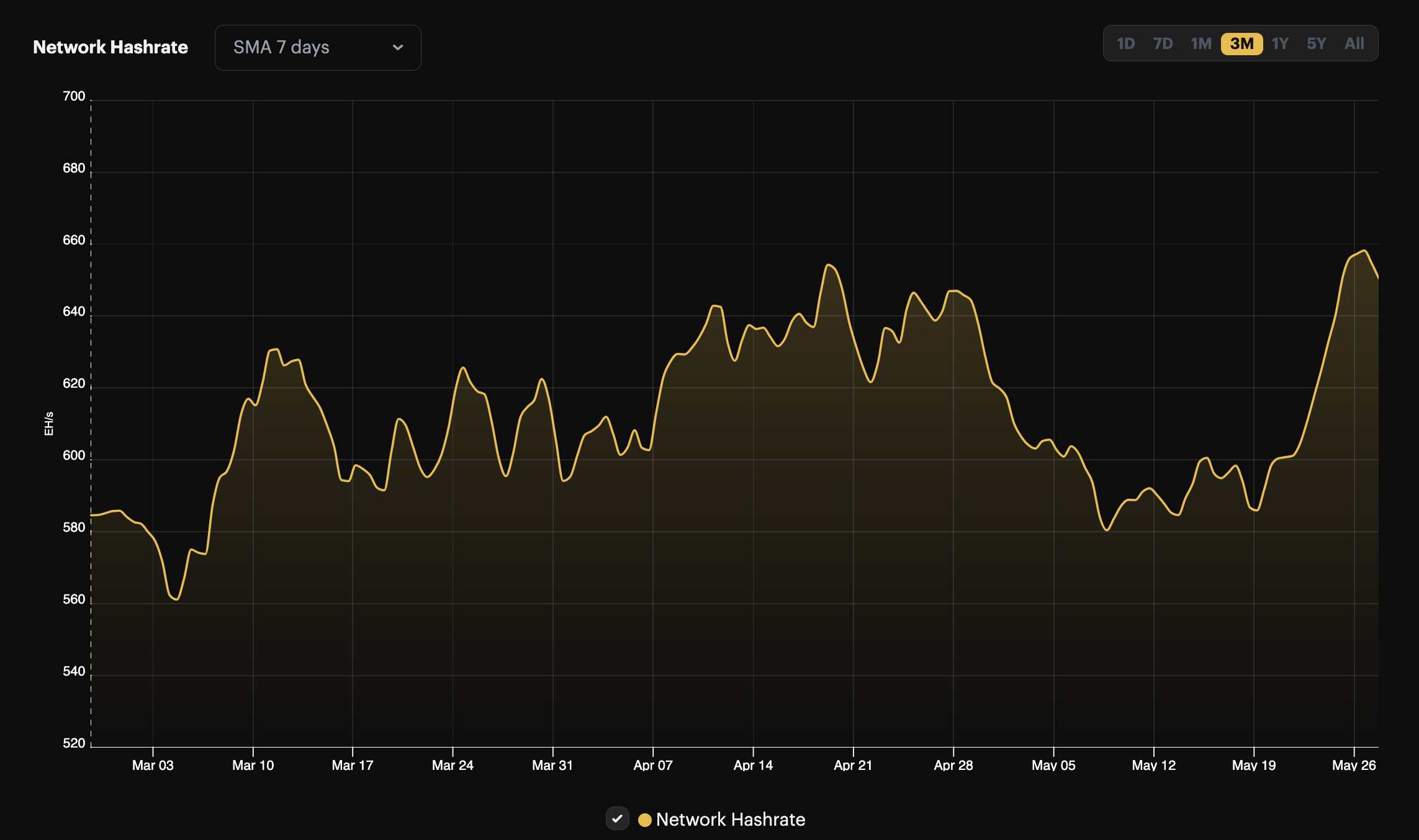

Hashrate is on an absolute tear right now. On May 27, Bitcoin's 7-day average hashrate hit an all-time high of 659 EH/s, a 13.6% increase from its post-halving low of 580 EH/s. The current average block time is a blistering 9 minutes and 26 seconds.

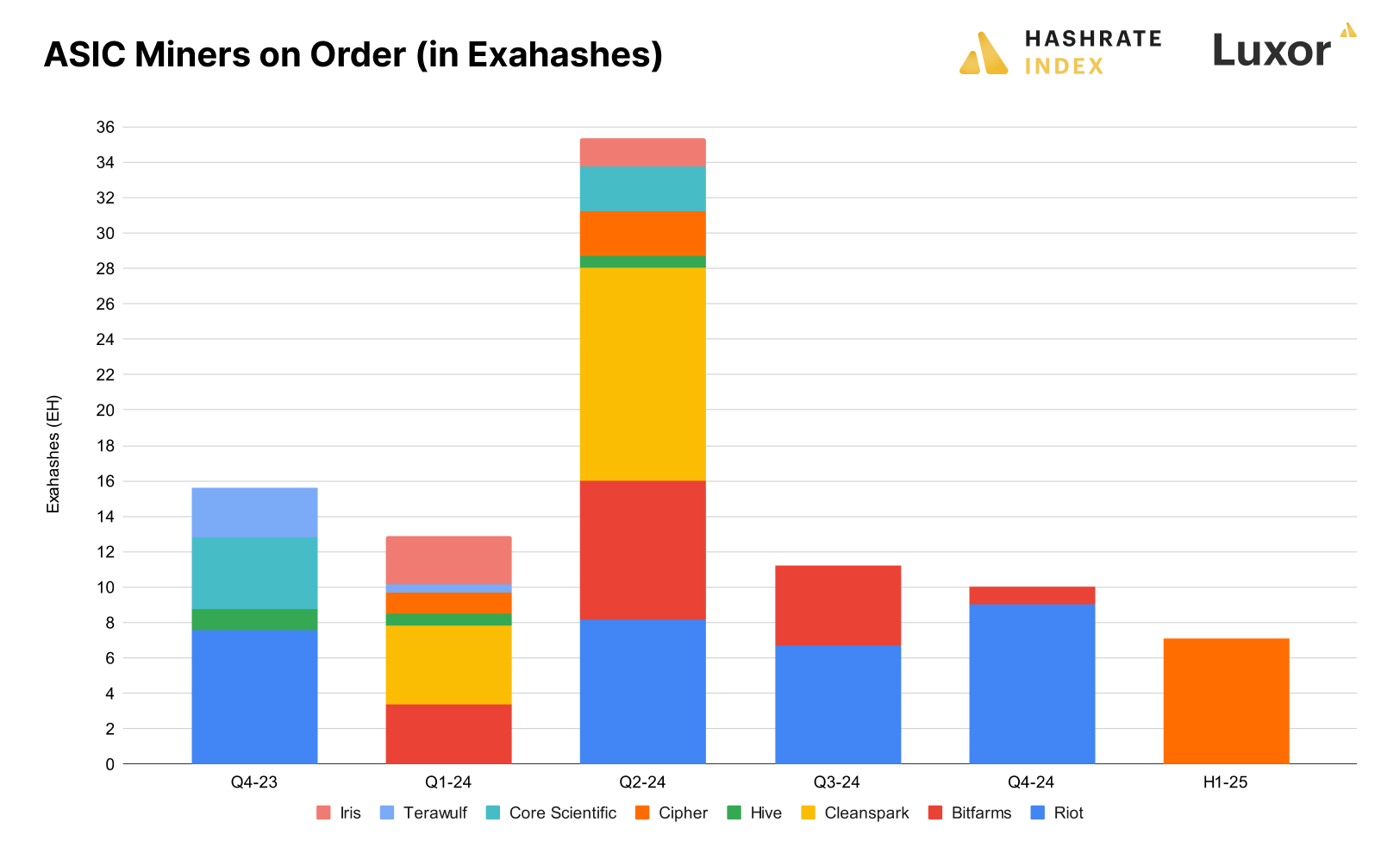

This hashrate growth could indicate that public Bitcoin miners are energizing their ASIC orders on schedule. The top public miners have had 76.6 EH/s worth of equipment on order for 2024, 12.9 EH/s of which should have been delivered in Q1 and nearly 36 EH/s of which should be delivered in Q2 (assuming delivery timelines stayed on track). Of course, the hashrate coming online could also be coming from private miners around the world.

Regardless of where it's coming from, the current surge in hashrate is going to smack miners with a hefty upward difficulty adjustment in about 8 days. It's too early to say how large the adjustment will be for sure, but our estimate right now puts it at +5.97%. If Bitcoin's price stays steady, the next adjustment will likely drive hashprice back below $50/PH/Day.

Sponsored by Luxor Firmware

At $53/PH/Day, hashprice is close to breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

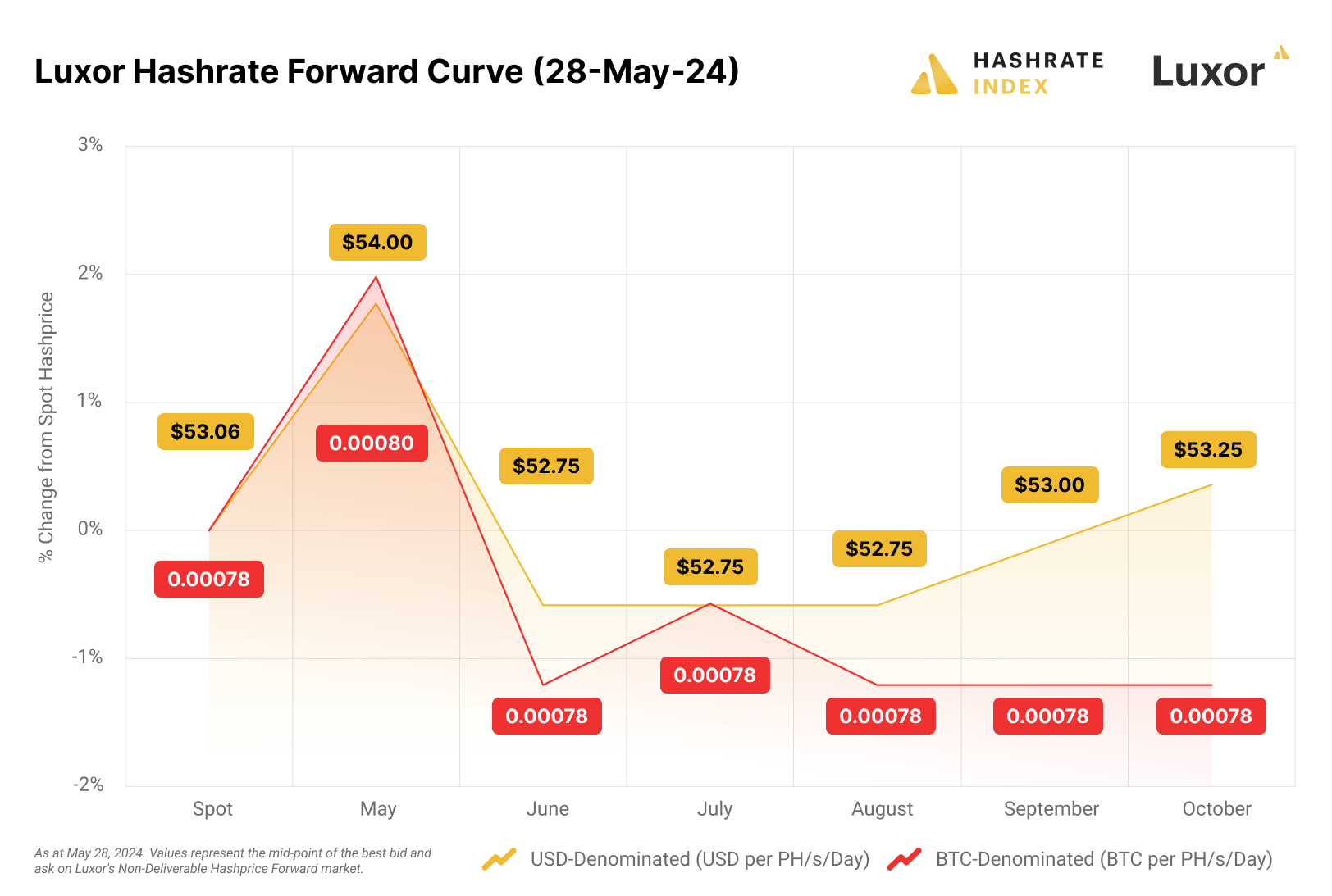

In the month after the Halving, Luxor's Hashrate Forwards markets for each contract month were trading in contango, which means that the future quotes for hashprice were trading above spot price. That changed for this week's update.

Now, the Hashrate Forward Curve shows contracts trading in contango for May and October, but June, July, August, and September are trading in backwardation (which means that the future price is below spot).

Bitcoin Mining Market Update

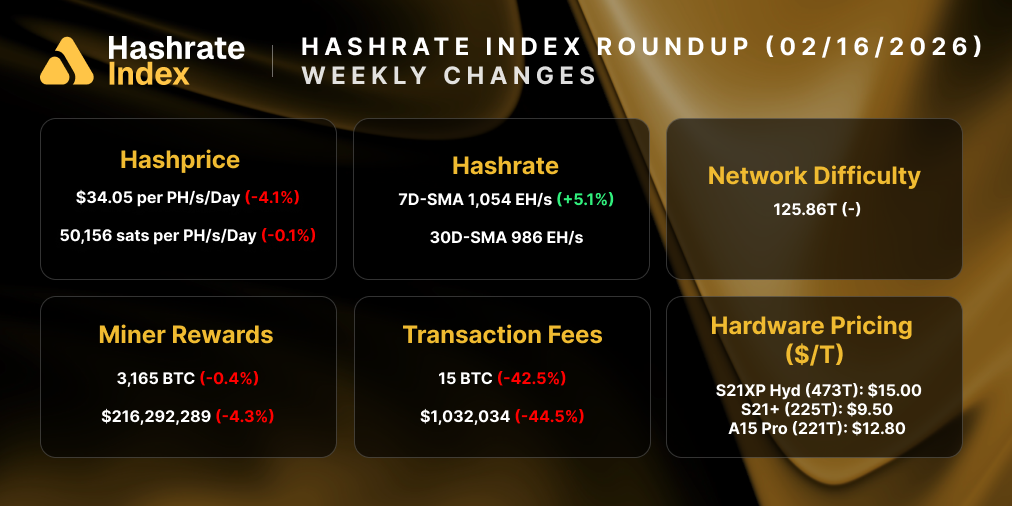

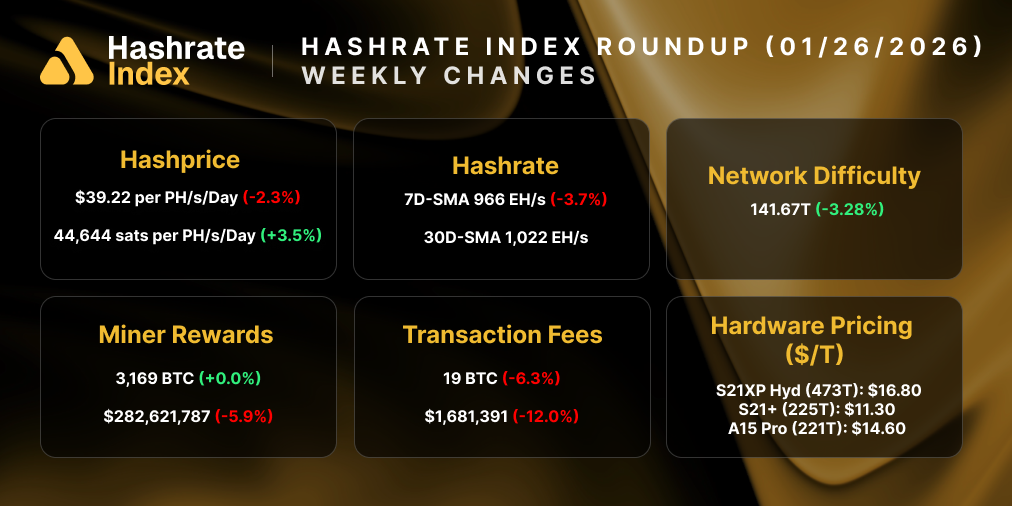

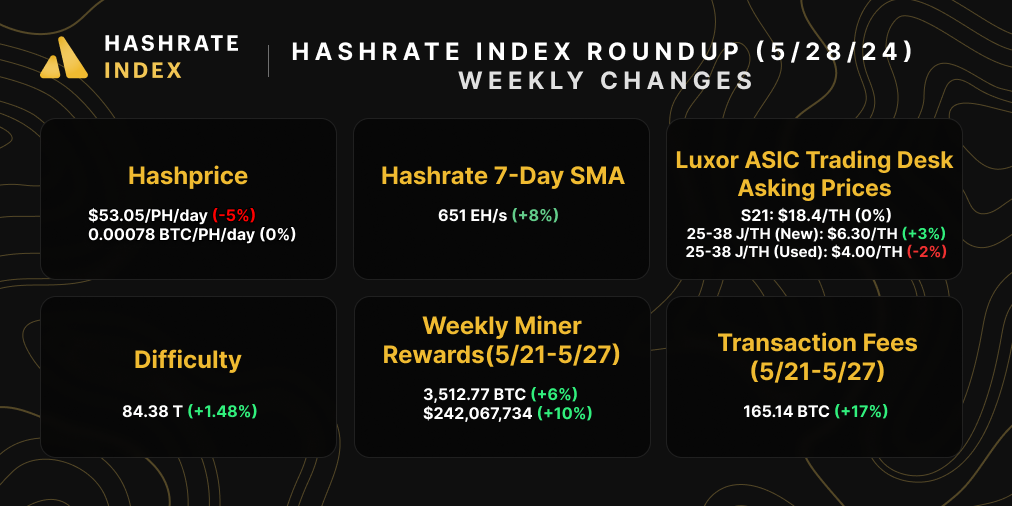

For this week's market update, hashprice is down, hashrate is up, and transaction fees are on the rise. Mining rewards in BTC are up over the week since block times are speeding up with the rise in hashrate.

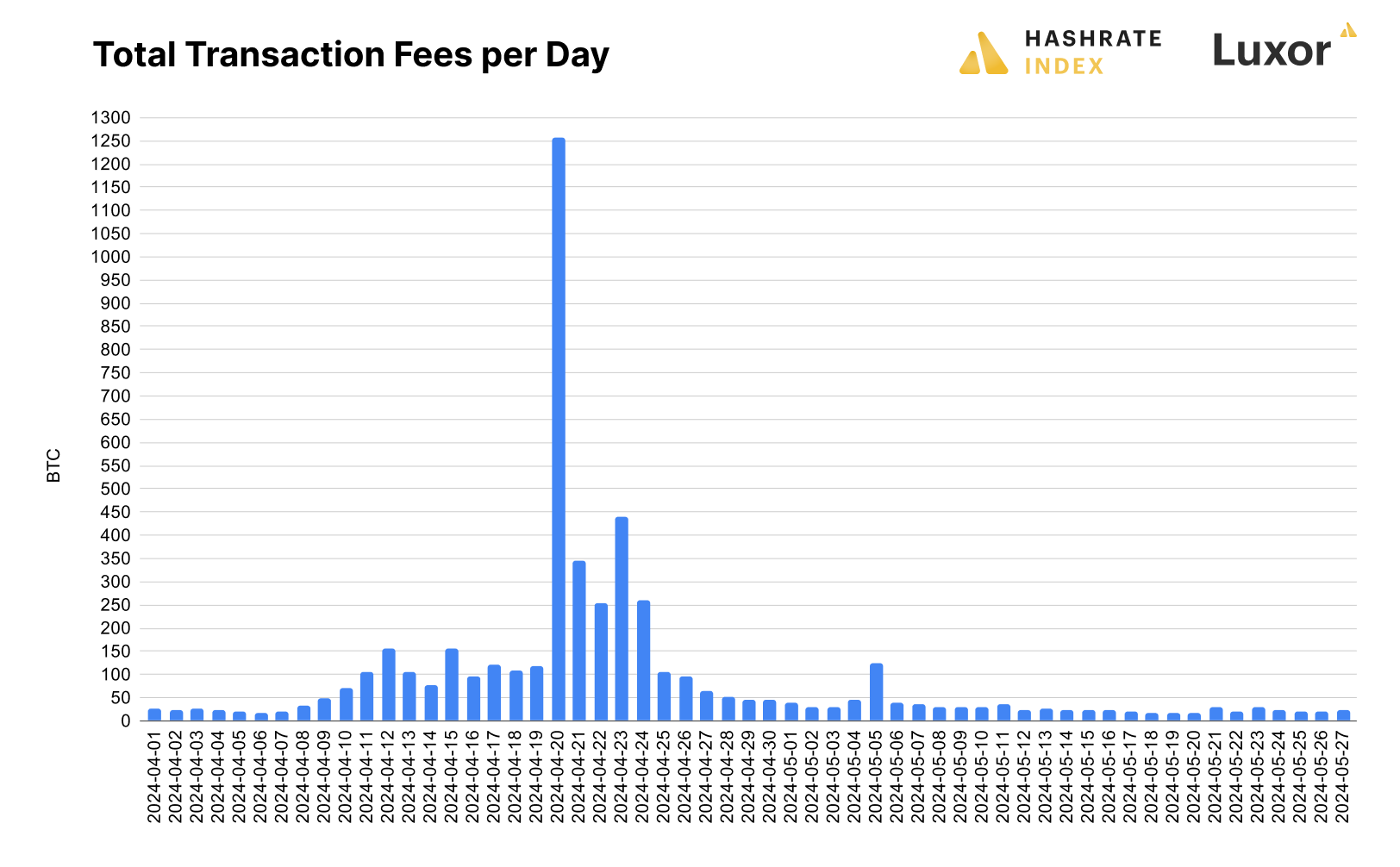

Bitcoin Transaction Fee Update

Transaction fee volumes have completely deflated since the Halving. In the week leading up to the event, inscription and ordinal trading was popping off in anticipation of the Runes fungible token standard which launched at the Halving. Runes trading then dominated the mempool for the days after the Halving and generated substantial fee revenue for Bitcoin miners.

But now, this trading has petered out, and transaction fees have subsided to normal levels.

Last week (from May 20 - 26), the average transaction fee per block was 0.15 BTC. Using our autoregressive moving-average model (ARMA) for transaction fee forecasting, we estimate that the current week's average transaction fee per block will be 0.21 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Luxor Bitcoin Hashrate Futures Now Live On Bitnomial After Regulatory Approval

- Cryptoverse: Miners trudge through post-halving world

- Riot Platforms Proposes to Acquire Rival Bitcoin Miner Bitfarms

Bitcoin Mining Stocks Update

It's a mixed bag for our stock update this week, with some stocks up by double digits while others are down. Our Crypto Mining Stock Index is up 5%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.34 (-5.48%)

- HUT: $9.20 (-6.12%)

- BITF: $2.21 (+20.77%)

- HIVE: $2.63 (-1.50%)

- MARA: $20.73 (-6.50%)

- CLSK: $17.69 (-4.15%)

- IREN: $7.89 (+23.28%)

- CORZ: $4.96 (+27.84%)

- WULF: $2.07 (-5.48%)

- CIFR: $4.00 (+1.78%)

- BTDR: $6.11 (+2.35%)

- SDIG: $3.06 (+3.73%)

New From Hashrate Index

Bitcoin Mining Hashrate Futures: What They Are, Why They Matter, How to Trade Them

In partnership with Bitnomial, a CFTC-regulated Bitcoin and derivatives exchange, Luxor Technology Corporation has launched the first ever Bitcoin Mining Hashrate Futures.

From corn to crude oil, futures are crucial financial instruments that allow commodity producers to hedge their income and plan for the future. Luxor and Bitnomial’s Hashrate Futures provide the most robust hedging tool on the market for Bitcoin miners to hedge their (often volatile) revenue, while also offering institutional investors exposure to the Bitcoin mining market.

In our latest on Hashrate Index, we give a quick breakdown of what Hashrate Futures are, why they matter, and how accredited investors can trade them.

Hashrate Index Q1-2024 Report: The Specter and Fallout of the Halving

Our Q1-2024 report is here, and in light of the Fourth Bitcoin Halving, we decided to shake things up for this report by running the numbers for Q1 while also diagnosing the immediate impact of the Halving.

In this report, we provide a recap of Q1-2024 through the lens of the Fourth Bitcoin Halving, and we include data through April and the first week of May where applicable to show the immediate impact of the event on network data, hashprice, ASIC prices, Bitcoin mining stocks, and other aspects of the mining industry. You can download the full report below:

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.