Hashrate Index Roundup (May 13, 2024)

Hashprice hit an all-time low last week, and Bitcoin's hashrate is on the decline.

Happy Monday, y'all!

The dust is starting to settle from the Fourth Halving, so we're getting a clearer picture for how the event has impacted Bitcoin's hashprice and hashrate in the near term.

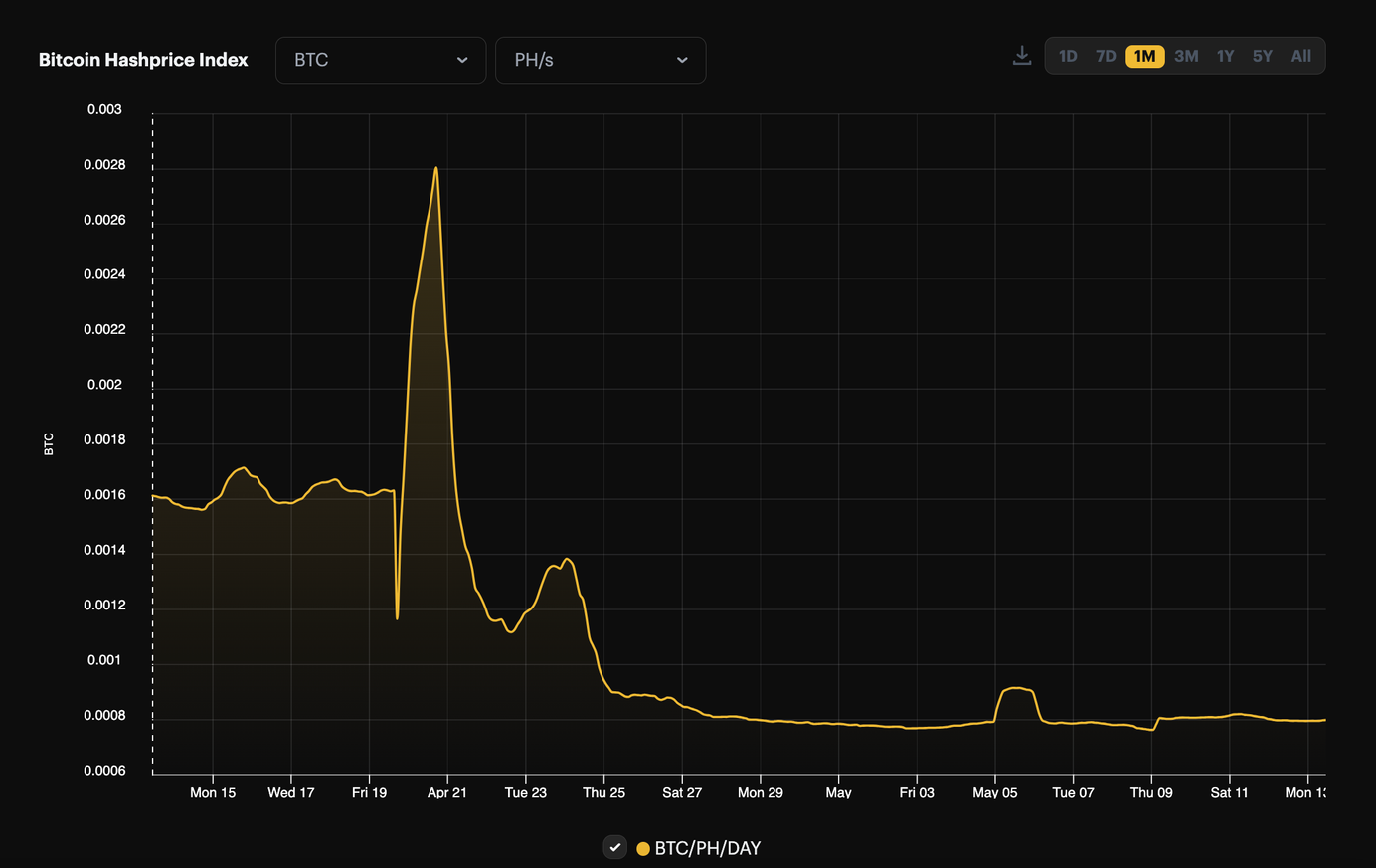

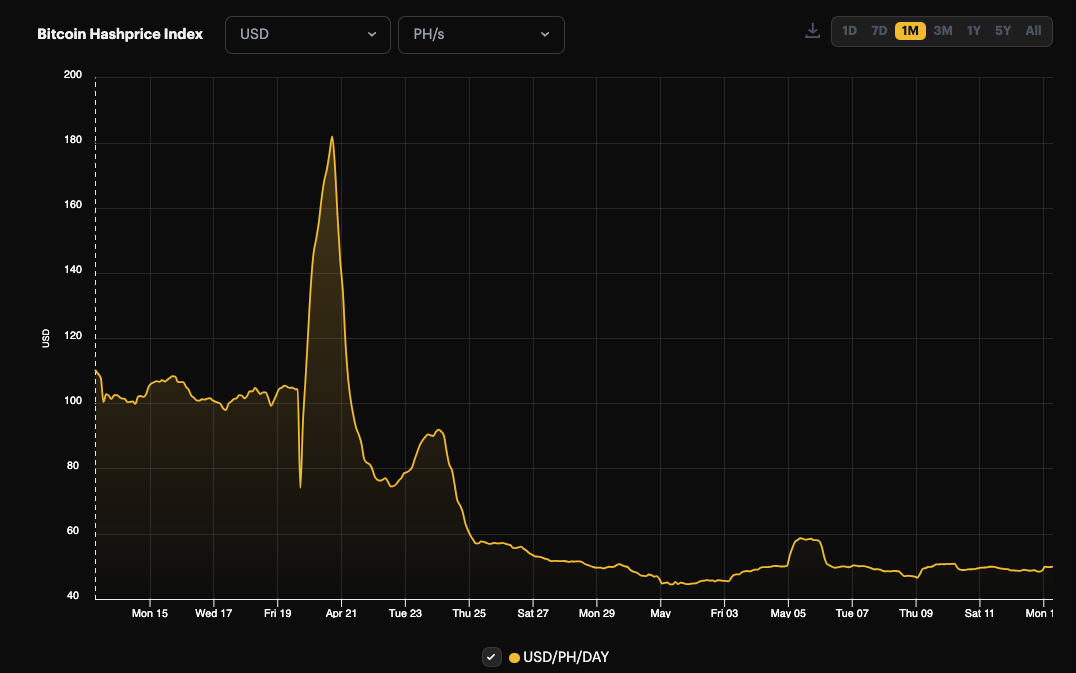

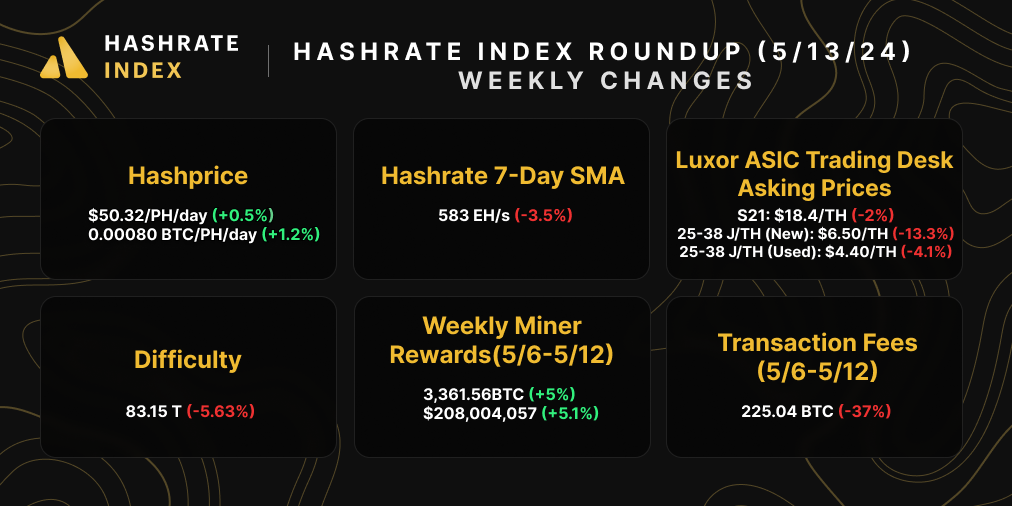

For starters, hashprice is in the gutter. Runes (and inscriptions/ordinals writ large) are constituting far fewer fees than regular transactions compared to the week preceding and succeeding the Halving. As a result, the mempool is cleared out, transaction fees per day have dropped below Q1-2024's average of 64.39 BTC, and hashprice is coming down from its short-lived Runes high.

On May 9, hashprice hit an all-time low of $46.69/PH/day, but thanks to a fat -5.63% difficulty adjustment on the same day (the largest negative adjustment since December 2022) hashprice has since snapped back to $50/PH/day. Still not great, but it's a bit like the difference between blowing out your knee and getting a low ankle sprain – it still hurts, but at the current hashprice, many miners can at least hobble along.

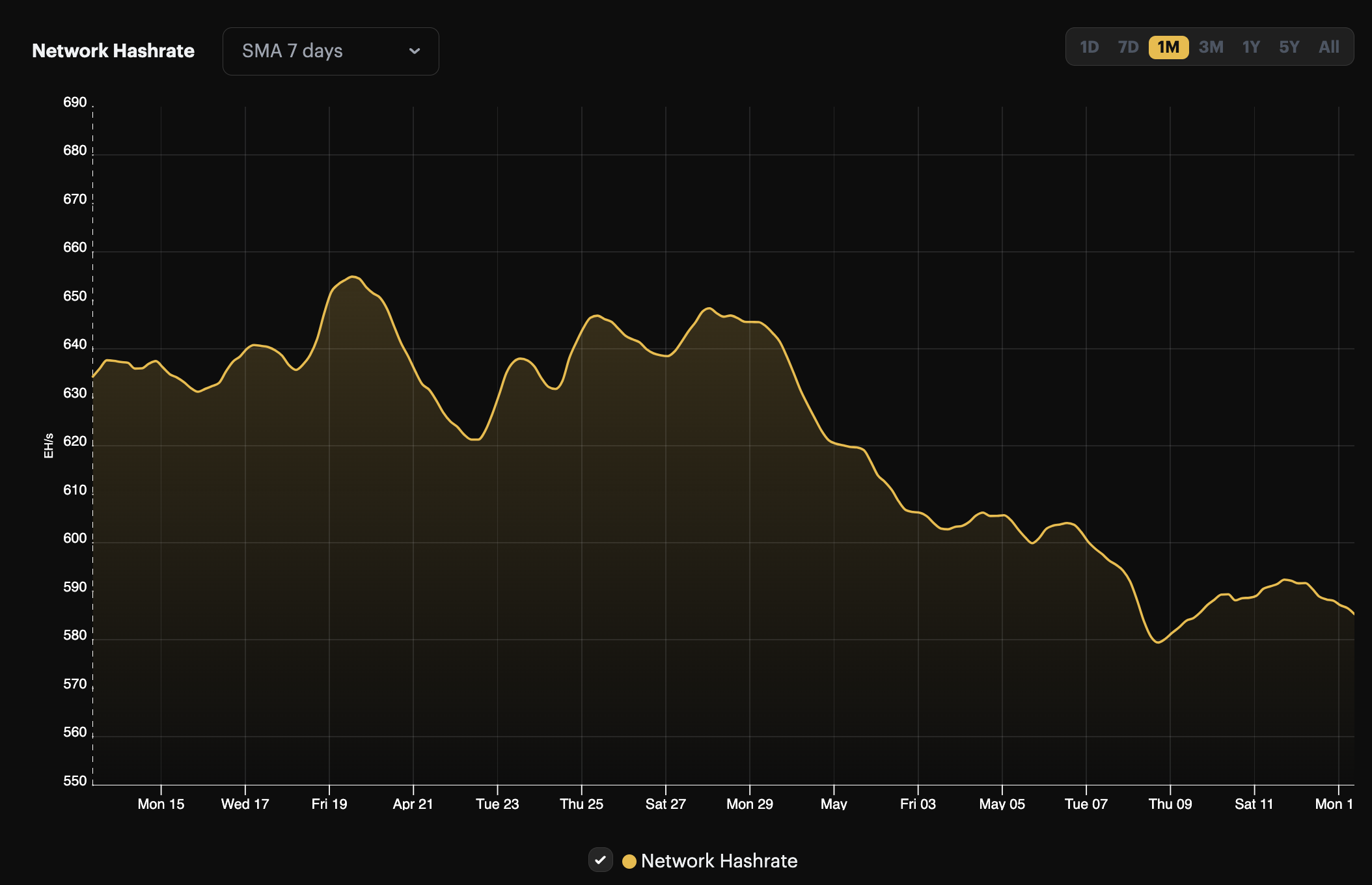

Some are hobbling better than others, though, as evidenced by the fact that Bitcoin's hashrate has been noticeably knocked down a peg. At 583 EH/s on the 7-day average, Bitcoin's hashrate has fallen 11% from its all-time high of 655 EH/s on the eve of the Halving, a reduction that prompted May 9's negative difficulty adjustment.

Mining margins are highly compressed, summer is firing up, and heatwaves are on the way, so it's likely that hashrate growth will be stunted for the foreseeable future. Miners could even see additional downward adjustments in the coming months if the weather in mining hot spots like Texas necessitates curtailment from industrial scale mining operations.

At the very least, the current hashprice environment will restrict growth from certain corners of the mining market, and miners will want to optimize their energy efficiencies with after-market firmware and/or upgrade to next-generation ASICs to shore up revenues.

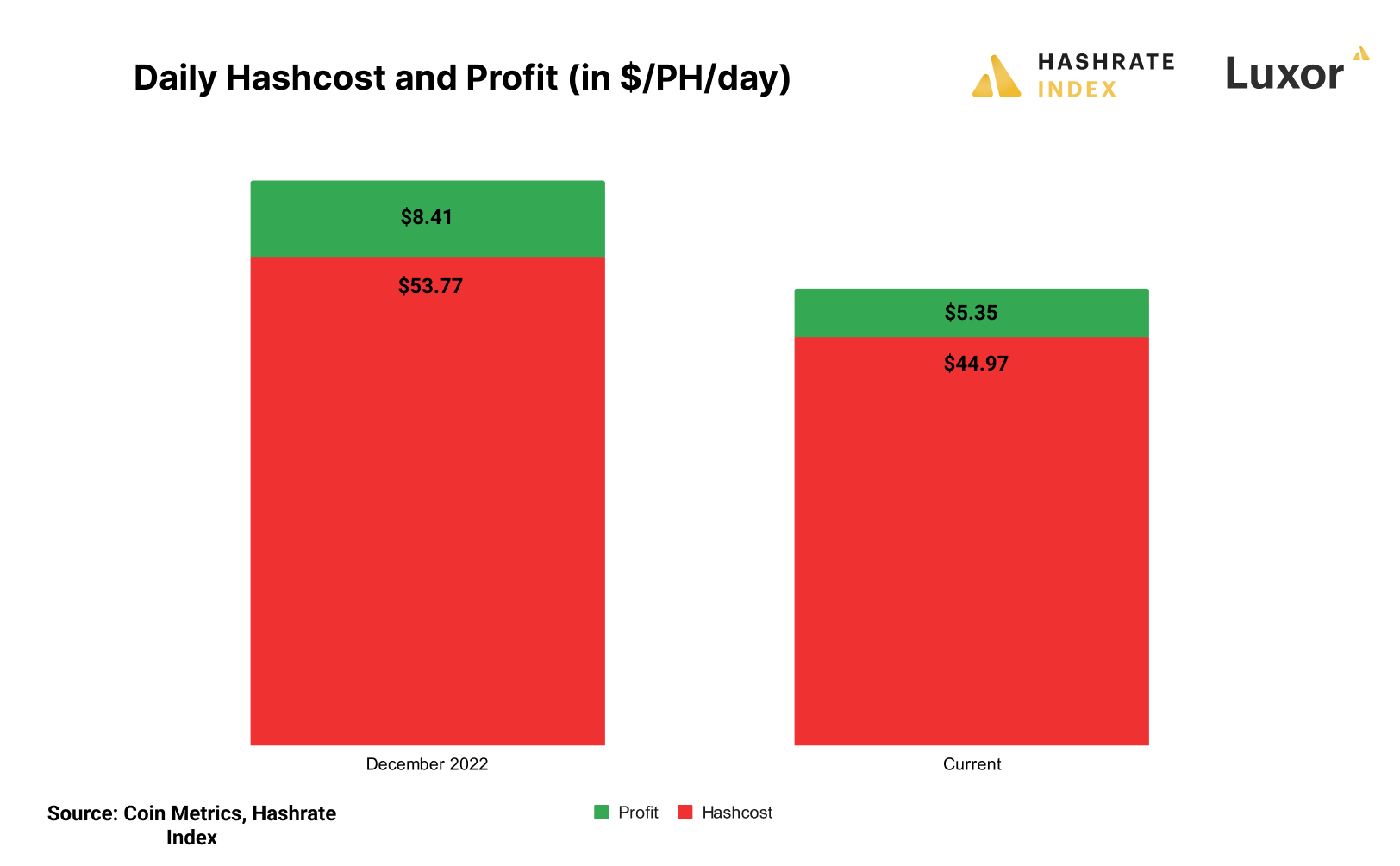

To visualize how tight margins are currently, let's compare a hypothetical miner's margin today to their margin in December 2022, another time when all-time low hashprice was jeopardizing mining profits. The chart below compares the hypothetical miner's daily hashcost (in other words, operating cost) and daily profit in December 2022 vs today. For this analysis, we use Estimated Bitcoin Network Efficiency averages from Coin Metrics, a $0.06/kWh power cost, a $62.18/PH/day average hashprice for December 2022, and the current hashprice of $50.32/PH/day. Daily profit and hashcost are represented in terms of dollars per petahash per day ($/PH/day).

Under this hypothetical, the profit margin for this miner in December 2022 was 13.5% versus 10.6% today. Not a huge delta, but a delta all the same.

Sponsored by Luxor Firmware

The Fourth Halving has come to pass, so it's never been more prudent for miners to optimize their operations. LuxOS, Luxor's Antminer firmware, can help miners get the best bang for their hash by increasing energy efficiency when necessary and increasing hashrate when opportune. Plus, when running LuxOS, Bitcoin miners who use Luxor's Bitcoin mining pool can access 0% fees. Start supercharging your fleet with LuxOS today.

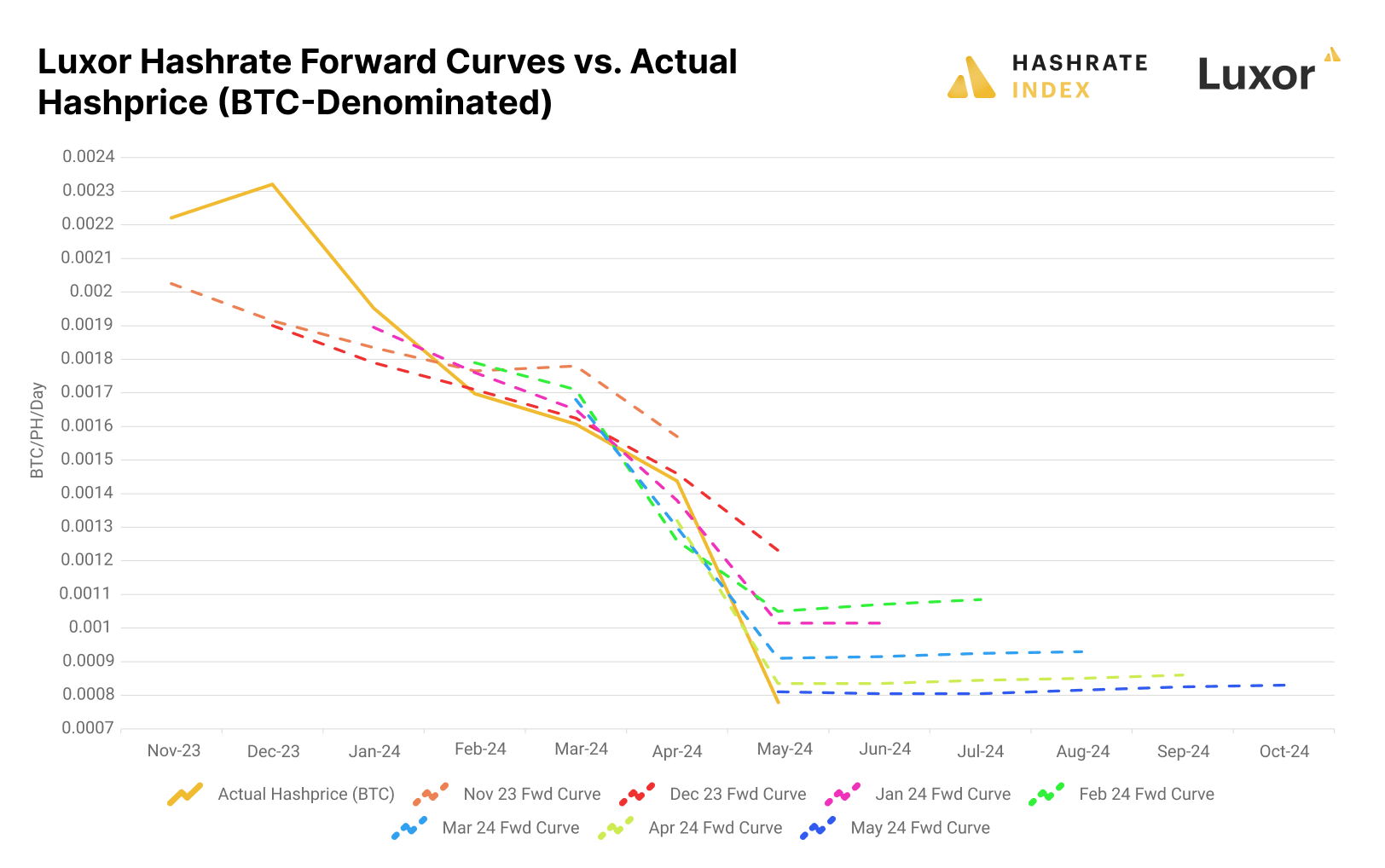

Luxor Hashrate Forwards Market Update

A notable trend in Luxor's Hashrate Forwards markets post Halving is that hashprice is trading in contango, which means that the future quotes for hashprice are trading above spot price.

Indeed, Hashrate Forward contracts for every month from May to October are trading above spot. The chart below shows the BTC-denominated curve for Luxor Hashrate Derivatives contracts from November 2023 to May 2024.

We derive this forward curve by taking an average of the lowest ask and highest bid on Luxor’s Hashrate Forward order book on the first trading week of each calendar month for each Forward contract month. So for example, for the November data point, we take the ask-bid average for forward contracts in the first week of November for November, December, January, February, March, and April forward contracts. We then compare these forward prices to monthly average spot prices for hashprice.

There are a few takeaways we can derive from this. To start, we see the spot price (the black line) rise sharply above forward pricing in November and December. In USD terms, transaction fees were at their highest levels since 2017 for these months thanks to inscriptions trading, and fees stayed elevated for the longest period since 2020/2021’s bull market. As a result, hashprice surged during this period.

As such, forward buyers for these months made a pretty penny. Conversely, though, buyers were overconfident that the transaction fee gold rush would last longer than it did, so traders overbid for hashprice in January, February, and March. As such, miners and hashrate sellers who locked in forward prices for these months earned more than they would have if they had mined spot hashprice.

Going forward, we plan on publishing an updated version of this chart on the first week of each month, so be on the lookout for another one in June.

Bitcoin Mining Market Update

As we mentioned earlier, transaction fees have fallen significantly, but hashprice is up (oh so slightly) thanks to last week's difficulty drop. ASIC prices are still falling, with new-gen (25-38 J/TH) rigs taking another significant haircut over the week.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- PRESIDENT BIDEN BLOCKS CHINESE-BACKED BITCOIN MINING FIRM FROM OWNING LAND NEAR A WYOMING NUCLEAR MISSILE BASE

- Canaan unveils new bitcoin-mining machine in Hong Kong

- Bitcoin Mining Difficulty Slumped Last Week in Biggest Decline Since Crypto Winter: Bernstein

- Bitcoin Miner Bitfarms Fires Interim CEO Early After Exec Files $27 Million Lawsuit

- New Arkansas laws regulate cryptocurrency mining

Bitcoin Mining Stocks Update

All the Bitcoin mining stocks in our update fell (with the exception of Core Scientific) last week, and our benchmark Crypto Mining Stock Index is down 4.3%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $9.50 (-10.38%)

- HUT: $7.87 (-9.71%)

- BITF: $1.59 (-16.75%)

- HIVE: $2.33 (-4.20%)

- MARA: $17.26 (-13.96%)

- CLSK: $15.55 (-10.01%)

- IREN: $4.85 (-7.09%)

- CORZ: $3.64 (+6.29%)

- WULF: $2.24 (-6.28%)

- CIFR: $3.72 (-14.48%)

- BTDR: $5.45 (-6.84%)

- SDIG: $2.81 (-10.22%)

New From Hashrate Index

Hashrate Index Q1-2024 Report: The Specter and Fallout of the Halving

Our Q1-2024 report is here, and in light of the Fourth Bitcoin Halving, we decided to shake things up for this report by running the numbers for Q1 while also diagnosing the immediate impact of the Halving.

Bitcoin’s Fourth Halving has come and gone, and the event will go down as the most impactful Halving yet for a number of reasons. For one, the Bitcoin mining industry has never been larger nor has there ever been so much at stake. Further, Bitcoin has attained a mainstream acceptance that it never enjoyed in past Halvings, something that is best exemplified by the Bitcoin ETFs that launched in January of this year. And activity on the Bitcoin network has never been higher, including from alternative, non-financial use cases (namely, Inscriptions/Ordinals and Runes) that are boosting transaction fees when miners need them most.

In this report, we provide a recap of Q1-2024 through the lens of the Fourth Bitcoin Halving, and we include data through April and the first week of May where applicable to show the immediate impact of the event on network data, hashprice, ASIC prices, Bitcoin mining stocks, and other aspects of the mining industry. You can download the full report below:

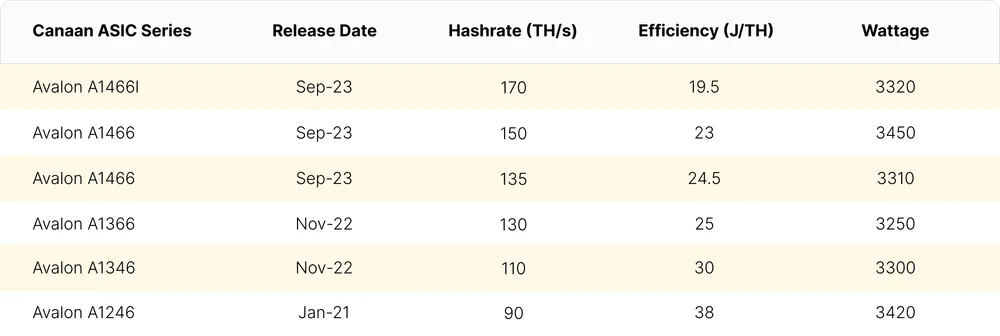

Canaan A1466 Review and Testing

Canaan unveiled one of its latest ASIC miner model, the Avalon A14 series, at its 10th Anniversary conference in Singapore in September 2023.

Canaan's anticipated A14 series underscores the company's commitment to energy-efficient mining technology. The series comprises three models designed to suit various operational preferences. The A1466I, an immersion miner, is a highly efficient rig with a hashrate of 170TH/s and an efficiency of 19.5 J/TH.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.